Global Cannabidiol Market Size, Share, And Business Environment Analysis By Product (CBD Oil, CBD Isolates, Others), By Nature (Non-organic, Organic), By Source (Dietary Supplements, Pharmaceutical, Topicals, Tincture, Food, Beverages, Others), By Application (Marijuana, Hemp, Others), By End User (Pharmaceuticals, Food and Beverages, Personal Care Products, Nutraceuticals and Dietary Supplements, Others), By Distribution Channel (Hospital Pharmacies, Online Stores, Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 32147

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

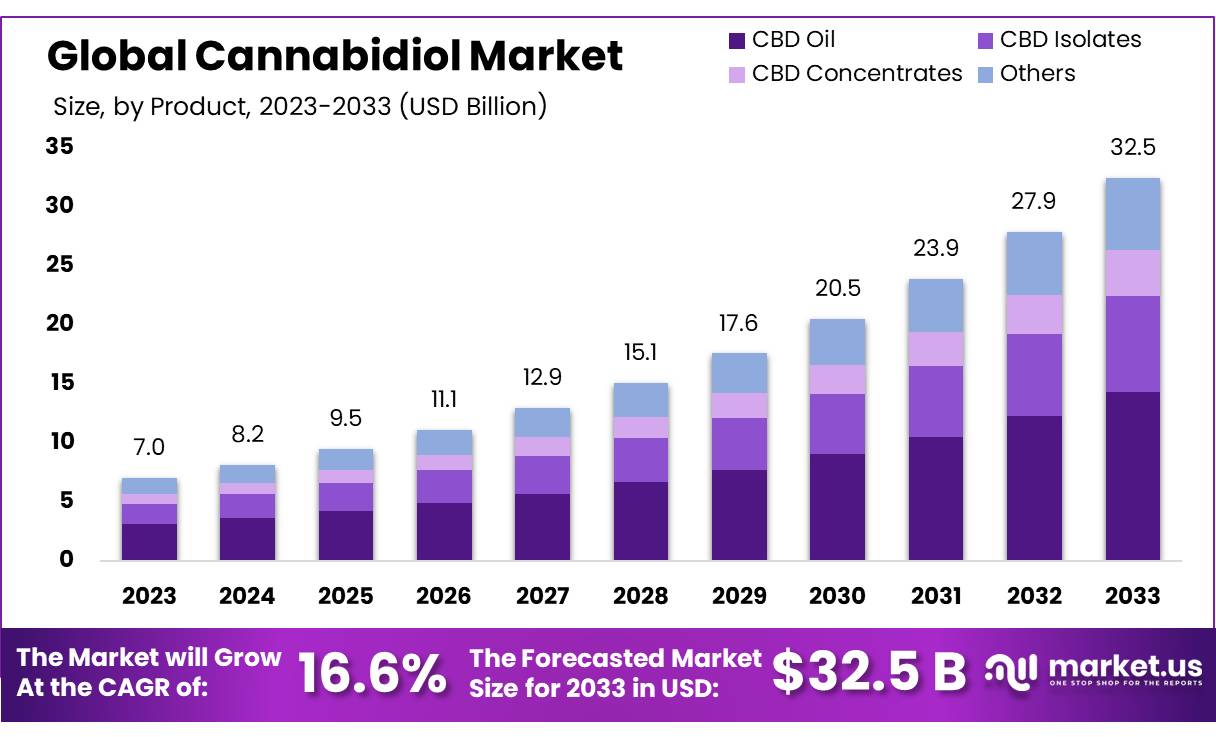

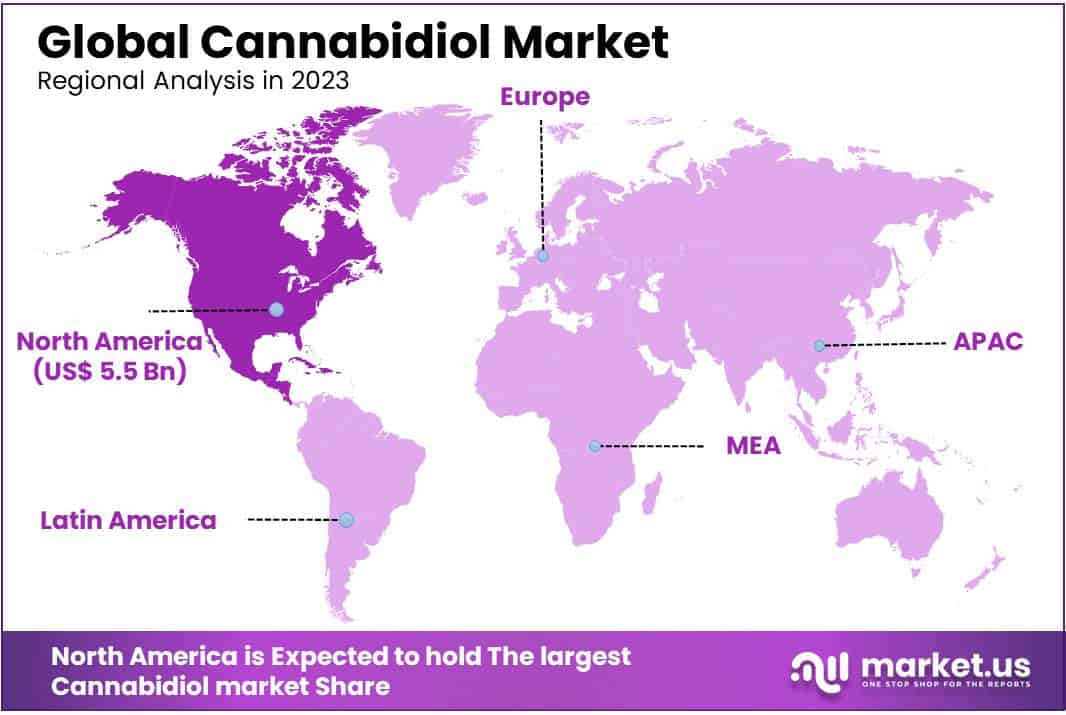

The Global Cannabidiol Market size is expected to be worth around USD 32.5 Bn by 2033, from USD 7.0 Bn in 2023, growing at a CAGR of 16.6% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 53.2% share and holding USD 4.1 billion in revenue.

The cannabidiol (CBD) market has experienced substantial growth in recent years, emerging as a critical component of the wellness, pharmaceutical, and personal care industries. CBD is a non-psychoactive compound derived from the cannabis plant, known for its potential therapeutic benefits, including relief from anxiety, chronic pain, and inflammation. Its incorporation into various consumer and healthcare products has propelled its popularity across global markets.

CBD’s industrial applications span multiple sectors. The pharmaceutical industry leads the charge, with CBD-based medications like Epidiolex addressing severe epilepsy cases. Additionally, the personal care segment is witnessing robust growth, with CBD being infused into skincare products for its anti-inflammatory and antioxidant properties. The food and beverage industry has also embraced CBD, with infused snacks, beverages, and dietary supplements gaining popularity.

The increasing prevalence of chronic illnesses and mental health conditions is a significant driver of CBD adoption. In 2023, more than 30% of CBD products were utilized for managing anxiety and stress, highlighting the compound’s role in mental wellness. The aging population in developed economies has further spurred demand, as older adults seek natural remedies for arthritis, insomnia, and pain management.

Regulatory support has been instrumental in shaping the market. The legalization of hemp cultivation through the U.S. Farm Bill of 2018 marked a turning point, enabling large-scale production and commercialization. Similar initiatives in Europe, Latin America, and parts of Asia have created opportunities for cross-border trade and investment.

The CBD market is characterized by rapid innovation and diversification. Edible CBD products, including gummies, chocolates, and infused beverages, accounted for over 25% of total revenue in 2023. These formats appeal to health-conscious consumers seeking convenient and enjoyable ways to integrate CBD into their daily routines. Topical applications, such as creams and balms, have also seen significant growth, particularly among athletes and individuals with localized pain.

Technological advancements, such as nanoencapsulation, have improved CBD’s bioavailability, enhancing its efficacy in smaller doses. E-commerce has emerged as a vital distribution channel, contributing nearly 30% of sales in 2023, as consumers increasingly turn to online platforms for product variety and convenience.

Emerging economies in Asia-Pacific and Latin America present untapped opportunities, supported by increasing cultivation and processing capabilities. Research into CBD’s broader therapeutic potential, including its role in cancer treatment and neurodegenerative diseases, could unlock new avenues for growth.

Key Takeaways

- Cannabidiol Market size is expected to be worth around USD 32.5 Bn by 2033, from USD 7.0 Bn in 2023, growing at a CAGR of 16.6%.

- CBD Oil held a dominant market position, capturing more than a 44.5% share. This substantial market share.

- Non-organic CBD held a dominant market position, capturing more than a 68.5% share.

- Dietary Supplements held a dominant market position in the cannabidiol (CBD) sector, capturing more than a 29.2% share.

- Marijuana held a dominant market position in the cannabidiol (CBD) sector, capturing more than a 58.6% share.

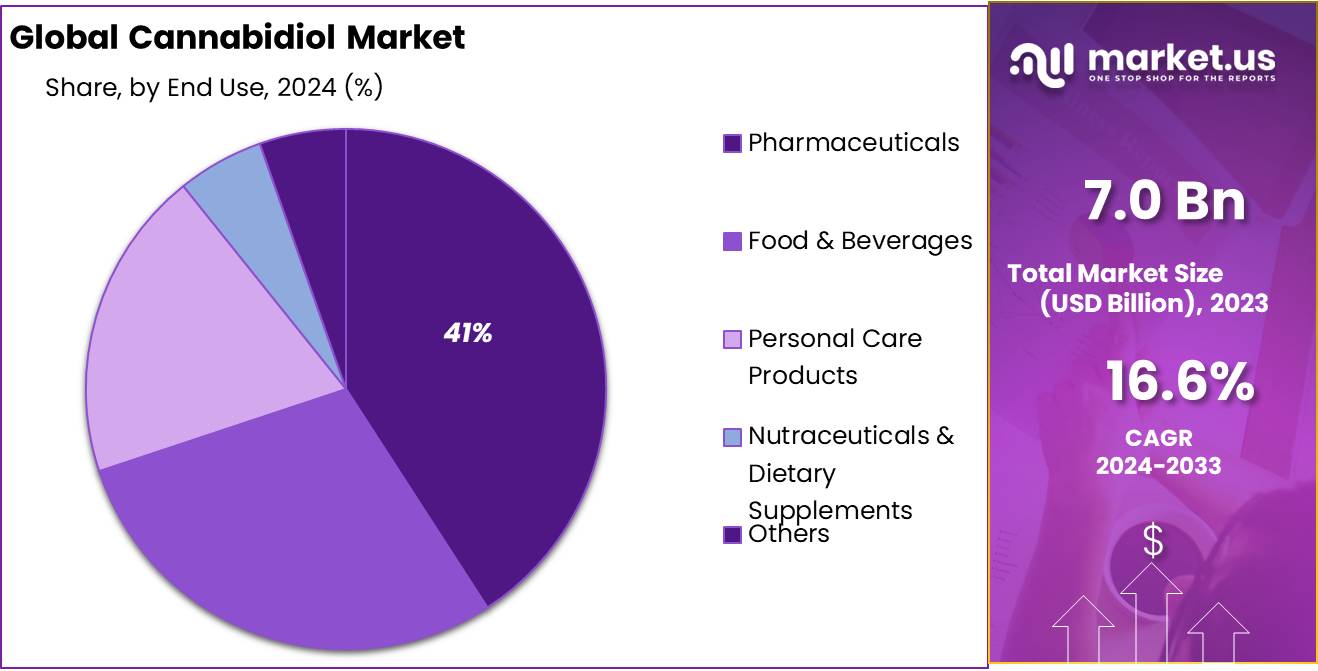

- Pharmaceuticals held a dominant market position in the cannabidiol (CBD) sector, capturing more than a 38.2% share.

- Hospital Pharmacies held a dominant market position in the distribution of cannabidiol (CBD) products, capturing more than a 39.7% share.

- North America leading at a dominating 53.2% market share, translating to a revenue of USD 4.1 billion.

Cannabidiol Business Environment Analysis

The business environment for cannabidiol (CBD) is evolving rapidly, driven by a combination of regulatory developments, consumer demand, and technological advancements. The industry, though promising, operates within a complex framework influenced by varying legal, economic, and competitive factors across global markets. Here’s an analysis of the key dimensions shaping the CBD business environment:

The regulatory environment is one of the most significant factors impacting the CBD business. In regions like North America and Europe, regulatory bodies such as the U.S. FDA and the European Commission have begun clarifying their positions on CBD usage in pharmaceuticals, food, beverages, and cosmetics. Similarly, Europe is grappling with standardizing CBD regulations across member states, creating opportunities and challenges for market entry.

In emerging markets, such as Latin America and Asia-Pacific, governments are gradually embracing the medicinal and economic potential of CBD, with countries like Brazil and Australia taking the lead. However, in regions where cannabis is still stigmatized or illegal, CBD businesses face barriers to growth, limiting international trade and product innovation.

The rising consumer preference for natural and wellness-oriented products is a significant driver of the CBD market. Increasing awareness of CBD’s therapeutic benefits—such as pain relief, anxiety reduction, and anti-inflammatory properties—has boosted demand across various industries, including pharmaceuticals, nutraceuticals, personal care, and food and beverages.

CBD-infused edibles, beverages, and skincare products are particularly gaining traction among millennials and health-conscious consumers. Moreover, the pet care industry is emerging as a niche market for CBD products, driven by pet owners seeking natural remedies for anxiety and joint pain.

The CBD market is highly fragmented, with numerous players competing for market share. Key players like Canopy Growth Corporation, Charlotte’s Web, and Aurora Cannabis are leading the industry with significant investments in research and development, product diversification, and global expansion. Simultaneously, smaller players and startups are focusing on innovation, such as developing water-soluble CBD and targeted delivery mechanisms, to differentiate themselves.

The CBD industry is projected to grow significantly, with global revenues expected to exceed $20 billion by 2030. The economic potential of CBD lies not only in consumer products but also in industrial applications, such as textiles and biofuels derived from hemp. Additionally, the legalization of cannabis in various regions is unlocking investment opportunities, with venture capital and private equity firms showing interest in the sector.

By Product

In 2023, CBD Oil held a dominant market position, capturing more than a 44.5% share. This substantial market share is attributed to the versatility and widespread acceptance of CBD oil across various consumer segments. CBD oil is extensively used due to its ease of application, ranging from direct consumption as a health supplement to its incorporation in skincare and therapeutic products.

Its popularity is further supported by the direct marketing efforts of manufacturers who highlight its benefits, such as stress reduction, anti-inflammatory properties, and pain relief. The familiarity of oil as a form also plays a crucial role in its dominance, as consumers are often more comfortable integrating new health products in familiar forms into their routines.

CBD Isolates are another significant segment within the cannabidiol market. In 2023, these products appealed particularly to consumers looking for the purest form of CBD, free from other cannabinoids, terpenes, and compounds found in the hemp plant.

This purity makes isolates ideal for individuals with sensitivities or those who require high doses of CBD for medical purposes without the effects of other plant molecules. The market for CBD isolates has been growing as advancements in extraction and processing technologies improve yield and purity, making these products more accessible and appealing.

By Nature

In 2023, non-organic CBD held a dominant market position, capturing more than a 68.5% share. This segment’s strong performance is largely due to its more affordable pricing and wider availability compared to its organic counterpart. Non-organic CBD is derived from conventional farming methods where pesticides and non-organic fertilizers are utilized.

These products are prevalent in regions where organic certification standards are either less stringent or less commonly pursued by farmers due to the high costs and complex certification processes associated with organic farming. As a result, non-organic CBD products are more accessible to a broader range of consumers, particularly in price-sensitive markets.

The organic CBD segment has been steadily gaining traction, fueled by a growing consumer preference for products that are perceived as healthier, safer, and environmentally friendly. Organic CBD is produced from hemp plants grown without the use of synthetic chemicals, in an environment that adheres to strict organic farming standards.

Although organic CBD products typically command higher prices, they appeal to health-conscious consumers who are willing to pay a premium for products that align with their lifestyle choices and personal values concerning sustainability and ecological welfare. This segment’s growth is also supported by the expanding availability of these products in mainstream retail channels and specialized health stores, along with an increase in consumer education regarding the benefits of organic products.

By Source

In 2023, dietary supplements held a dominant market position in the cannabidiol (CBD) sector, capturing more than a 29.2% share. This segment’s strong performance can be attributed to the growing consumer demand for health and wellness products that offer natural alternatives to conventional medicine. CBD dietary supplements are favored for their ability to provide relief from a range of conditions such as anxiety, inflammation, and chronic pain without the side effects often associated with pharmaceutical drugs. The ease of integrating these supplements into daily routines also contributes to their popularity, with products available in forms like capsules, soft gels, and gummies.

The pharmaceutical segment also plays a critical role in the CBD market, leveraging the compound’s therapeutic properties to offer more targeted and regulated therapeutic options. In 2023, this segment continued to expand, driven by ongoing clinical research and the approval of CBD-based medications for medical conditions such as epilepsy and multiple sclerosis. These developments have helped establish CBD’s credibility in the pharmaceutical space and have led to broader acceptance among healthcare professionals and patients alike.

CBD topicals, including creams, balms, and lotions, have become increasingly popular for their localized pain relief and skin care benefits. These products are particularly appealing to consumers looking for non-invasive relief from muscle aches, joint pain, and skin conditions such as eczema and acne. The ease of use and the absence of systemic effects make topicals a favored choice for both new and experienced CBD users.

Tinctures are another significant segment within the CBD market, appreciated for their versatility and efficacy. These liquid extracts offer rapid absorption and easy dosage customization, making them attractive to both seasoned CBD users and newcomers. Tinctures are typically administered sublingually, allowing for quick onset of effects, which is essential for those seeking immediate relief.

The food and beverage segment has also seen considerable growth, with CBD increasingly being incorporated into a variety of edible products such as chocolates, baked goods, and even savory snacks. This integration meets the growing consumer interest in functional foods that not only taste good but also provide health benefits. Similarly, CBD-infused beverages, including teas, coffees, and non-alcoholic spirits, are gaining traction among consumers seeking refreshing, wellness-oriented drink options.

By Application

In 2023, Marijuana held a dominant market position in the cannabidiol (CBD) sector, capturing more than a 58.6% share. This dominance is largely due to the high CBD content typically found in marijuana strains compared to hemp. Marijuana-derived CBD is particularly prevalent in regions where cannabis is legalized for medicinal or recreational use, as it allows for comprehensive utilization of the plant’s therapeutic potential.

Consumers and medical patients opt for marijuana-derived CBD products for their potent effects and rapid relief from conditions such as chronic pain, severe anxiety, and sleep disorders. This segment’s growth is supported by an expanding dispensary network and an increasing number of states and countries adopting cannabis-friendly legislation.

On the other hand, hemp-derived CBD has carved out a significant niche in the market, particularly in countries with strict regulations against marijuana. In 2023, hemp was particularly favored for its low THC content, making it legal in many regions where marijuana is not.

Hemp-derived CBD is commonly used in a wide array of products, including dietary supplements, topicals, and cosmetics, appealing to consumers seeking health benefits without the psychoactive effects. This segment benefits from the 2018 Farm Bill in the United States, which legalized hemp cultivation and created a boom in the CBD market, driving innovations and product availability.

By End User

By Distribution Channel

In 2023, Hospital Pharmacies held a dominant market position in the distribution of cannabidiol (CBD) products, capturing more than a 39.7% share. This segment’s prominence is largely due to the critical role hospital pharmacies play in distributing FDA-approved CBD-based medications, particularly for conditions such as epilepsy and multiple sclerosis. The trust and credibility associated with hospital pharmacies ensure that patients receive high-quality, regulated CBD products under medical supervision, which is crucial for therapeutic uses.

Online Stores have also become a vital channel for the distribution of CBD products, driven by the convenience and anonymity they offer. In 2023, consumers increasingly turned to online platforms to purchase a variety of CBD products, from dietary supplements to personal care items. The growth of this segment has been bolstered by the improvement in e-commerce technology, broader acceptance of CBD, and the extensive range of products available online. These platforms also provide consumers with valuable information, reviews, and competitive pricing, which are significant factors in the decision-making process.

Retail Stores, including health food stores and wellness boutiques, represent another key distribution channel. These stores provide consumers with the ability to physically evaluate products before purchase, which can enhance consumer trust and comfort. In 2023, retail stores were particularly effective in catering to new CBD users, who benefit from in-person guidance and recommendations. The tactile shopping experience, coupled with the ability of staff to provide immediate answers and reassurance, has supported the growth of this segment.

Key Market Segments

By Product

- CBD Oil

- CBD Isolates

- Others

By Nature

- Non-organic

- Organic

By Source

- Dietary Supplements

- Pharmaceutical

- Topicals

- Tincture

- Food

- Beverages

- Others

By Application

- Marijuana

- Hemp

- Others

By End User

- Pharmaceuticals

- Food & Beverages

- Personal Care Products

- Nutraceuticals & Dietary Supplements

- Others

By Distribution Channel

- Hospital Pharmacies

- Online Stores

- Retail Stores

- Others

Drivers

Government Initiatives and Regulatory Frameworks

A primary driver of the cannabidiol (CBD) market’s expansion in 2023 has been the systematic establishment of regulatory frameworks by various governments. These regulations are crucial as they dictate the cultivation, processing, sale, and research of cannabis, thereby enabling a structured and legal market environment. For instance, the Government of Canada mandates licenses for multiple cannabis-related activities, which has facilitated a controlled yet thriving market for CBD products, ranging from wellness items to pharmaceuticals.

In the United States, the approval of the U.S. Farm Bill in 2020 played a significant role in shaping the market. This legislation not only legalized hemp, a major source of CBD, but also opened doors for extensive cultivation and commercialization, contributing to a booming market for both therapeutic and wellness products. The Farm Bill effectively removed hemp-derived CBD from the controlled substances list, thereby increasing its accessibility and use across a multitude of sectors.

Moreover, the legal recognition of CBD’s health benefits has encouraged substantial investment in the sector, supporting the development of a wide range of CBD-based products. This has been evident in North America, where there’s a high concentration of health-conscious consumers and a growing acceptance of CBD’s therapeutic properties. These factors collectively enhance consumer confidence and drive demand, making regulatory actions a cornerstone of market growth.

The synergy between government regulations and market response is clear. With each regulatory approval, there’s a noticeable uplift in market activities, ranging from increased product availability to more extensive research and development efforts in the pharmaceutical and wellness industries. This regulatory landscape is expected to continue playing a critical role in the market’s trajectory, providing a stable foundation for the growth of the cannabidiol industry well into the future.

Restraints

Regulatory Complexity

One of the most significant challenges impeding the growth of the cannabidiol (CBD) market is the complexity of regulatory frameworks across different regions. Despite the increasing popularity and acceptance of CBD products, particularly in North America, the varying legal landscapes make it difficult for companies to navigate compliance, market entry, and operational expansion. Each state may impose its own regulations that can differ significantly, affecting everything from CBD production to distribution and sales.

Moreover, the classification of CBD products in the pharmaceutical and dietary supplement sectors introduces additional layers of regulatory requirements. For instance, while hemp-derived CBD is largely recognized and regulated as a supplement, the inclusion of CBD in foods and beverages still encounters regulatory hurdles, particularly with the FDA’s cautious stance on adding CBD to food products without comprehensive scientific reviews. This results in a marketplace where many potential CBD innovations are stalled or limited to specific categories or regions, thus restraining market growth.

Another major challenge is the high cost of CBD products, which can be prohibitive for many consumers and limit market expansion. The costs associated with ensuring product safety, quality assurance, and regulatory compliance contribute significantly to the final retail price, making CBD products less accessible to a broader audience. Additionally, inconsistent consumer awareness and understanding of CBD’s benefits and potential side effects also pose challenges for market growth. Misinformation and the selling of unapproved CBD products further complicate the public’s perception and trust in CBD as a viable health supplement or medical treatment.

Collectively, these factors create a restrictive environment for the growth of the CBD market, despite its recognized potential in health and wellness sectors. The market’s expansion is contingent not only on legislative progress and standardization but also on broad consumer education and the establishment of clear, consistent regulatory guidelines that can harmonize the legal landscape for CBD products.

Opportunity

Expansion into Emerging Markets

A significant growth opportunity for the cannabidiol (CBD) market lies in the expansion into emerging markets, particularly in regions like Asia-Pacific and Latin America. This growth is supported by increasing legalization, growing consumer awareness of CBD’s health benefits, and the continuous development of new CBD-based products.

One of the driving factors behind this opportunity is the rising awareness and acceptance of CBD’s therapeutic benefits, which include pain relief, anxiety reduction, and the potential to improve sleep quality. In regions like North America and Europe, where CBD is more established, the market has seen substantial growth due to these recognized benefits. However, in Asia-Pacific and Latin America, CBD is still a relatively new concept, offering vast potential for market penetration as regulatory environments evolve and consumer awareness increases.

The Asia-Pacific region, in particular, is expected to record significant growth in the CBD market over the forecast period. Factors contributing to this growth include increasing public acceptance and the gradual legalization of CBD products. Countries like Australia, Japan, and South Korea are witnessing growing consumer interest in CBD-infused products, particularly for their potential therapeutic benefits.

In Latin America, progressive changes in cannabis regulation are gradually opening the market for CBD products. Countries such as Uruguay and Brazil have been pioneers in cannabis reform in the region, which is likely to lead to increased market size and a stronger consumer base for CBD products.

Moreover, the increasing sophistication of distribution channels, such as online sales and e-commerce, which allow for broader global reach and easier consumer access to CBD products, are crucial for tapping into these emerging markets. The online sales channel, in particular, has been instrumental in driving the growth of the CBD market by enabling direct-to-consumer shipping and a wider array of product offerings.

Trends

Rising Demand for CBD-infused Products to Augment Market Growth.

The global market for cannabidiol (CBD) is experiencing significant growth, driven primarily by the rising demand for CBD-infused products across various consumer segments. As awareness of CBD’s potential health benefits increases, consumers are increasingly drawn to its diverse applications in health, wellness, beauty, and even pet care products. This surge in demand is not only reshaping the consumer goods landscape but also encouraging manufacturers to innovate and expand their product ranges.

CBD’s appeal lies in its versatility and perceived health benefits, which include pain relief, anxiety reduction, and anti-inflammatory properties. This has led to its incorporation into a wide array of products such as oils, tinctures, capsules, edibles, and topical creams. The beauty and skincare industry, in particular, has seen a rapid increase in CBD-infused products, with consumers eager for natural and therapeutic ingredients. Products ranging from anti-aging creams to therapeutic balms are being infused with CBD, driving consumer interest and sales.

The food and beverage sector is also capitalizing on this trend, with an increase in CBD-infused beverages and edible products. From CBD-infused coffee and tea to chocolates and gummies, the market is expanding to include a broad range of consumables. This trend is supported by a growing body of research that suggests CBD can provide various health benefits without the psychoactive effects associated with THC, the other main chemical compound found in cannabis.

Regulatory changes have played a pivotal role in facilitating this growth. In regions like North America and Europe, where regulatory bodies have started to provide clearer guidelines and more consistent enforcement around CBD, there has been a significant increase in the production and sale of CBD products. This regulatory clarity has helped reduce consumer hesitancy and has encouraged more businesses to enter the CBD market.

Regional Analysis

North America Holds the Largest Market Share in Cannabidiol Market

In 2023, the Cannabidiol (CBD) market has shown significant growth across various regions, with North America leading at a dominating 53.2% market share, translating to a revenue of USD 4.1 billion. This dominance is largely due to progressive legalization and a well-established commercial infrastructure for CBD products in the U.S. and Canada, coupled with high consumer awareness and acceptance.

Europe follows as a major player in the market, where the demand for CBD is driven by increasing consumer preference for natural and wellness products, particularly in countries like Germany, the UK, and Switzerland. Regulatory advancements and an expanding retail presence have also significantly contributed to the growth of the CBD market in this region.

The Asia Pacific region is experiencing rapid growth in the CBD market, attributed to changing regulations, particularly in countries like Australia and Japan. The region benefits from an increasing number of government approvals for CBD products, rising awareness of CBD’s health benefits, and growing middle-class disposable income.

The Middle East & Africa, while still in the nascent stages, is beginning to witness growth in the CBD market, primarily driven by gradual regulatory changes. South Africa leads the market in this region, with Israel also showing potential due to its advanced medical cannabis research and technologies.

Latin America shows promising growth with gradual regulatory easing, especially in countries like Uruguay and Mexico, which are pioneering the legal cannabis space. The region shows potential for significant market expansion as more countries continue to explore and adjust CBD regulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Cannabidiol (CBD) market features a dynamic landscape of key players who have significantly shaped its growth and development. Companies like Canopy Growth Corporation, Aurora Cannabis, and GW Pharmaceuticals Plc are major contributors, known for their innovative product lines and substantial market reach. Canopy Growth Corporation, in particular, stands out for its extensive portfolio and strategic partnerships, which enhance its distribution capabilities across global markets.

Other notable companies like Medical Marijuana, Inc. and Elixinol are recognized for their focus on quality and consumer education, which are crucial for navigating the regulatory environments and consumer perceptions associated with CBD products. Medical Marijuana, Inc., for example, is one of the pioneers in the industry, with a strong focus on medicinal products and a broad international presence.

Emerging players such as NuLeaf Naturals, LLC, and Pharmahemp D.O.O. also make significant impacts by specializing in high-quality, organic CBD oils, catering to a niche market that values natural and pure products. These companies, along with others like Aphria, Inc. and Endoca, leverage advancements in extraction and production technology to enhance their product offerings and meet the stringent standards demanded by consumers and regulatory bodies. This competitive environment not only drives innovation but also ensures a diverse range of products for consumers, fostering growth and accessibility in the global CBD market.

Market Key Players

- Abcann Medicinals, Inc.

- Aphria, Inc.

- Aurora Cannabis

- Cannoid, LLC

- Canopy Growth Corporation

- Elixinol

- ENDOCA

- Endoca

- Folium Biosciences

- GW Pharmaceuticals Plc

- Isodiol International, Inc.

- Maricann, Inc. (Wayland Group Corporation)

- Medical Marijuana, Inc.

- Nuleaf Naturals, LLC

- Organigram Holding Inc.

- Pharmahemp D.O.O.

- The Cronos Group

- Tikun Olam

Recent Developments

In 2023, Aphria reported cannabis sales of CAD 220 million, with a notable portion attributed to CBD products.

In 2024, Aurora reinforced its financial health by achieving a net cash position of over $200 million and repaying all convertible senior notes, setting a firm foundation for future financial stability.

Report Scope

Report Features Description Market Value (2023) USD 7.0 Bn Forecast Revenue (2033) USD 32.5 Bn CAGR (2024-2033) 16.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (CBD Oil, CBD Isolates, Others), By Nature (Non-organic, Organic), By Source (Dietary Supplements, Pharmaceutical, Topicals, Tincture, Food, Beverages, Others), By Application (Marijuana, Hemp, Others), By End User (Pharmaceuticals, Food and Beverages, Personal Care Products, Nutraceuticals and Dietary Supplements, Others), By Distribution Channel (Hospital Pharmacies, Online Stores, Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abcann Medicinals, Inc., Aphria, Inc., Aurora Cannabis, Cannoid, LLC, Canopy Growth Corporation, Elixinol, ENDOCA, Endoca, Folium Biosciences, GW Pharmaceuticals Plc, Isodiol International, Inc., Maricann, Inc. (Wayland Group Corporation), Medical Marijuana, Inc., Nuleaf Naturals, LLC, Organigram Holding Inc., Pharmahemp D.O.O., The Cronos Group, Tikun Olam Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abcann Medicinals, Inc.

- Aphria, Inc.

- Aurora Cannabis

- Cannoid, LLC

- Canopy Growth Corporation

- Elixinol

- ENDOCA

- Endoca

- Folium Biosciences

- GW Pharmaceuticals Plc

- Isodiol International, Inc.

- Maricann, Inc. (Wayland Group Corporation)

- Medical Marijuana, Inc.

- Nuleaf Naturals, LLC

- Organigram Holding Inc.

- Pharmahemp D.O.O.

- The Cronos Group

- Tikun Olam