Global Industrial Alcohol Market By Product (Ethyl Alcohol, Methyl Alcohol, Isopropyl Alcohol, Isobutyl Alcohol, Others), By Source (Sugar and Molasses, Grains, Corn, Fossil Fuels, Others), By Application (Personal Care, Chemical Intermediates, Food Industry, Pharmaceutical, Fuels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134649

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global industrial alcohol market is expected to be worth around USD 277.0 billion by 2033, up from USD 131.9 billion in 2023, and grow at a CAGR of 7.7% from 2024 to 2033.

Industrial alcohol refers to alcohols that are produced for industrial use rather than for human consumption. These typically include ethanol, methanol, and isopropyl alcohol, which are used in a variety of applications such as manufacturing, pharmaceuticals, and automotive industries.

The industrial alcohol market is a sector that encompasses the production, distribution, and consumption of these alcohols. It serves industries like chemicals, fuel, food & beverages, and pharmaceuticals, among others.

The increasing demand for biofuels and the expanding pharmaceutical industry are major drivers, as industrial alcohol is a key ingredient in both. The rise in manufacturing activities and demand for sanitization products boosts the demand for industrial alcohol. Growing environmental concerns and the push for renewable energy sources create significant opportunities for bio-based alcohols, driving innovation in production processes.

The industrial alcohol market is experiencing steady growth, driven by increasing demand across various sectors, including pharmaceuticals, automotive, and beverages. The rising consumption of alcoholic beverages, particularly in emerging markets, and ongoing industrial applications are expected to support market expansion. India, for example, has seen a notable surge in alcoholic beverage exports, with projections indicating a 15-20% growth in exports for the 2024–25 period.

This increase is expected to boost demand for industrial alcohol, particularly ethanol, which is widely used in the production of spirits and alcoholic drinks. According to Bajajbroking, India’s alcoholic beverage exports are set to rise from $389 million to over $450 million, underscoring the growing demand on a global scale.

Furthermore, the alcohol industry faces significant scrutiny due to its health implications. According to the World Health Organization, alcohol consumption was responsible for around 2.6 million deaths globally in 2019, with a disproportionate impact on men.

This raises concerns about the market’s sustainability, especially in countries with stringent health policies. In response, governments are ramping up health initiatives. The UK’s Department of Health and Social Care has committed substantial investments, including £154.3 million in 2024-25 to improve public health services related to alcohol consumption and further funding of £266.7 million in 2025 to address alcohol-related health issues.

Despite these challenges, the industrial alcohol market remains poised for growth, underpinned by robust demand in key sectors and expanding export opportunities, even as governments push for more responsible consumption and better public health management.

Key Takeaways

- The Global industrial alcohol market is expected to be worth around USD 277.0 billion by 2033, up from USD 131.9 billion in 2023, and grow at a CAGR of 7.7% from 2024 to 2033.

- Ethyl alcohol accounts for 58.5% of the industrial alcohol market due to its versatility.

- Sugar and molasses contribute 37.3% of industrial alcohol production, serving as key feedstocks.

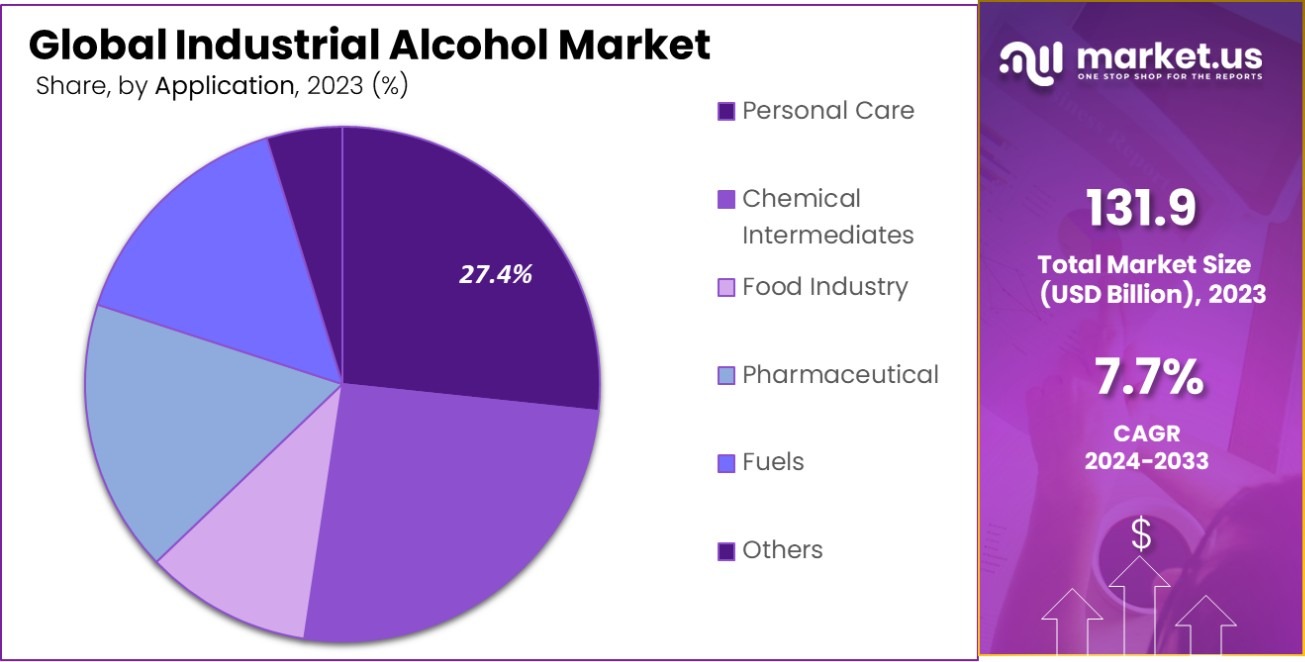

- Personal care applications dominate industrial alcohol use, representing 27.4% of total market demand.

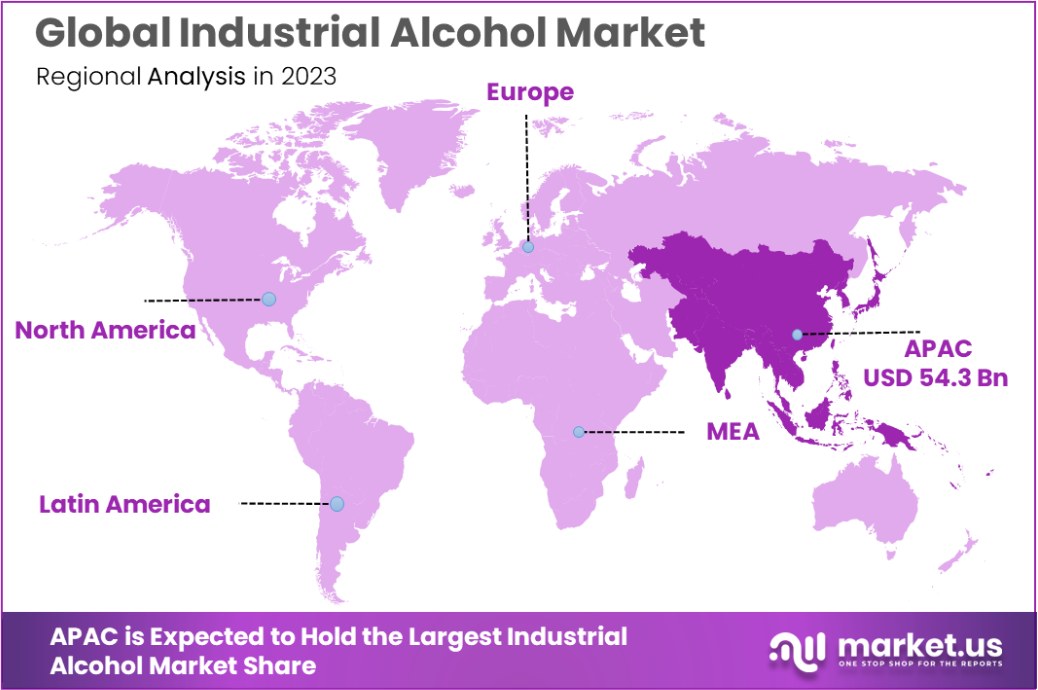

- The Asia-Pacific region holds 41.6% of the industrial alcohol market, valued at USD 54.3 billion.

By Product Analysis

Ethyl alcohol holds a dominant share of 58.5% in the industrial alcohol market due to widespread use.

In 2023, ethyl alcohol held a dominant market position in the by-product segment of the industrial alcohol market, capturing a 58.5% share. Methyl Alcohol followed with a 22.8% market share, while isopropyl Alcohol and isobutyl Alcohol accounted for 12.2% and 6.5% shares, respectively.

The substantial market share of ethyl alcohol can be attributed to its extensive application across various industries, including pharmaceuticals, personal care, and fuel additives. The demand for ethyl alcohol is primarily driven by its use as a solvent and in sanitization products, which saw a significant increase due to heightened hygiene awareness amidst global health challenges.

Methyl alcohol’s usage in the production of formaldehyde and acetic acid, which are essential in automotive and construction industries, supports its market position. Meanwhile, isopropyl alcohol’s demand stems largely from its role in the manufacture of cosmetics and personal care products, buoyed by consumer preferences for sanitizing solutions. Isobutyl alcohol, though holding the smallest share, finds niche applications in the food and beverage industry, contributing to flavors and extracts.

The distribution of market shares across these alcohols indicates a robust dependency on industrial applications and the critical role they play in meeting consumer and industrial needs. The growth trajectories of these segments are expected to be influenced by technological advancements and regulatory frameworks aimed at environmental sustainability.

By Source Analysis

Sugar and molasses contribute 37.3% to the industrial alcohol market, highlighting their key role in production.

In 2023, Sugar & Molasses held a dominant market position in the By Source segment of the Industrial Alcohol Market, with a 37.3% share. This was closely followed by grains and corn, which accounted for 26.4% and 21.8% of the market, respectively, while fossil fuels trailed with a 14.5% share.

The predominance of sugar & molasses as a source can be attributed to its renewable nature and widespread availability, particularly in regions with extensive sugarcane and sugar beet cultivation. This source is preferred for the production of bioethanol, which is increasingly used as a biofuel and in various industrial applications due to its lower environmental impact compared to fossil-based alternatives.

Grains, including wheat and barley, are primarily utilized in the beverage industry, especially for the production of ethyl alcohol used in spirits and beers. Corn, a major feedstock for ethanol in the United States, supports the demand in biofuel sectors, bolstered by governmental biofuel blending mandates and subsidies. Fossil fuels, despite their declining market share, continue to be significant in regions with less developed biomass processing infrastructure.

The market dynamics within the By Source segment reflect a shifting preference towards more sustainable and environmentally friendly raw materials, a trend that is expected to continue influencing market growth and development strategies.

By Application Analysis

Personal care products account for 27.4% of industrial alcohol market demand, driven by increasing cosmetic use.

In 2023, Personal Care held a dominant market position in the By Application segment of the Industrial Alcohol Market, with a 27.4% share. Chemical intermediates followed with a 22.1% share, while the Food Industry, Pharmaceutical, and Fuels segments captured 19.7%, 17.8%, and 13.0%, respectively.

The leadership of the personal care segment can be largely attributed to the extensive use of alcohol as a solvents and antiseptic agent in products such as skin creams, lotions, and sanitizers. The increased consumer focus on hygiene and wellness, especially in the wake of global health events, has propelled demand in this sector.

Chemical intermediates utilize industrial alcohols in the synthesis of various chemicals and materials, indicating robust industrial activity and innovation. The food industry’s use of alcohol pertains mostly to preservatives and flavoring agents, reflecting growing consumer preferences for quality and longevity in food products.

The pharmaceutical sector relies on industrial alcohol for the manufacture of medicines and sanitization products, a need that has remained critical and stable. Lastly, the Fuels segment, driven by the demand for biofuels and sustainable energy solutions, continues to harness ethanol’s potential as a cleaner alternative to conventional fossil fuels.

This segmentation highlights the diverse applications of industrial alcohols and underscores their integral role across multiple industries, driven by evolving consumer preferences and regulatory standards.

Key Market Segments

By Product

- Ethyl Alcohol

- Methyl Alcohol

- Isopropyl Alcohol

- Isobutyl Alcohol

- Others

By Source

- Sugar & Molasses

- Grains

- Corn

- Fossil Fuels

- Others

By Application

- Personal Care

- Chemical Intermediates

- Food Industry

- Pharmaceutical

- Fuels

- Others

Driving Factors

Rising Demand for Bio-based Industrial Alcohols

The growing focus on sustainability and environmental concerns drives the shift towards bio-based industrial alcohols. Bioethanol, produced from renewable sources like corn and sugarcane, is gaining popularity due to its eco-friendly production process compared to petroleum-based alcohols.

This shift is further boosted by government regulations and policies that promote green alternatives. The demand for bio-based alcohol is also rising in industries like automotive, chemicals, and pharmaceuticals, which prefer renewable options for manufacturing, helping reduce their carbon footprints and reliance on fossil fuels.

Expanding Applications Across Multiple Industries

Industrial alcohols are widely used in various industries, including pharmaceuticals, automotive, food, and personal care, contributing to the market’s rapid growth. Their versatility makes them essential for the production of solvents, disinfectants, and other chemicals.

The pharmaceutical sector, for example, uses industrial alcohols for manufacturing medicines and vaccines. In the automotive sector, alcohols are used as fuel additives and as solvents in coatings. As industries continue to diversify, the demand for industrial alcohols in innovative applications, such as cleaning products and biofuels, will continue to rise.

Government Regulations and Support for Sustainable Practices

Government initiatives promoting sustainable and environmentally friendly manufacturing processes are significantly influencing the industrial alcohol market. Many countries are implementing stricter environmental regulations and setting renewable energy and carbon reduction targets. These regulations encourage companies to shift from traditional petroleum-based products to bio-based alcohols.

Additionally, subsidies and incentives for biofuel production and usage are making bio-based industrial alcohols more economically viable, driving their adoption across various sectors. This shift toward sustainable practices is expected to remain a strong growth driver for the industrial alcohol market.

Restraining Factors

High Production Costs of Bio-based Alcohols

The production cost of bio-based industrial alcohols remains a significant barrier to widespread adoption. While bioethanol and other bio-based alcohols are considered more sustainable, they require complex production processes, including fermentation and distillation, which can be costly.

The high prices of raw materials like corn and sugarcane, combined with energy-intensive production methods, make bio-based alcohols more expensive compared to their petroleum-based counterparts.

Fluctuating Raw Material Prices and Availability

The industrial alcohol market is highly dependent on raw materials, such as corn, sugarcane, and petroleum, whose prices and availability fluctuate frequently. These fluctuations are caused by factors like climate change, supply chain disruptions, and geopolitical issues, making it difficult for manufacturers to predict costs and maintain a stable supply.

For example, unexpected weather conditions or harvest shortages can drive up the prices of bio-based feedstocks, increasing the overall production costs of industrial alcohol. This uncertainty affects the stability and profitability of companies in the market.

Strict Regulatory Challenges and Compliance Costs

The industrial alcohol market faces several regulatory hurdles that limit its growth, especially for bio-based alcohols. Regulatory requirements regarding safety, health standards, and environmental impacts are stringent, especially in the pharmaceutical and food industries. Compliance with these regulations requires significant investment in research, development, and testing.

For smaller manufacturers or new entrants, the costs associated with meeting these regulations can be prohibitively high. Additionally, evolving government policies around environmental standards and industrial waste management create further challenges for alcohol producers looking to innovate and scale their operations.

Growth Opportunity

Growth of Renewable Energy and Biofuel Applications

The increasing global shift towards renewable energy and biofuels presents a major growth opportunity for the industrial alcohol market. Bioethanol, a key industrial alcohol, is widely used as an alternative fuel source in the automotive sector and for blending with gasoline to reduce carbon emissions.

With governments worldwide promoting cleaner energy alternatives through subsidies and regulatory incentives, the demand for biofuels is expected to rise. This trend will significantly boost the need for industrial alcohols, especially in energy-intensive sectors such as transportation and power generation.

Rising Demand for Sustainable Packaging Solutions

The growing consumer demand for sustainable products and packaging is a key growth opportunity for the industrial alcohol market. Industrial alcohols are used in the production of biodegradable and recyclable materials, particularly in the packaging industry. With an increasing focus on reducing plastic waste, manufacturers are turning to bio-based alternatives for packaging, labeling, and coatings.

This growing trend toward eco-friendly packaging provides a significant opportunity for industrial alcohols, as companies seek renewable solutions to meet sustainability goals and align with consumer preferences for environmentally conscious products.

Expansion in Emerging Markets and New Applications

Emerging markets, particularly in Asia-Pacific, Latin America, and Africa, offer significant growth potential for the industrial alcohol market. These regions are experiencing rapid industrialization and urbanization, driving demand for industrial alcohols across sectors like automotive, chemicals, and food & beverages.

Additionally, there is increasing interest in new applications for industrial alcohols, such as in the production of biodegradable plastics, adhesives, and disinfectants. As industries in these regions adopt more sustainable and advanced technologies, the demand for industrial alcohol is expected to grow, creating new revenue streams for market players.

Latest Trends

Increased Focus on Green and Bio-based Solutions

The industrial alcohol market is increasingly shifting towards greener, bio-based alternatives due to rising environmental concerns. Bioethanol, produced from renewable sources like corn, sugarcane, and other agricultural products, is gaining traction as a sustainable replacement for fossil-fuel-based alcohols.

This trend is driven by both consumer demand for environmentally friendly products and government incentives promoting sustainability. Companies are investing in innovative production technologies to reduce the carbon footprint of industrial alcohols and improve the efficiency of bio-based alcohol manufacturing processes, further accelerating this green trend.

Technological Advancements in Alcohol Production Processes

The industrial alcohol market is witnessing rapid advancements in production technologies, particularly in the development of more efficient fermentation and distillation processes. New innovations, such as enzyme-based processes and synthetic biology, are helping manufacturers increase yields while reducing energy consumption.

Additionally, new extraction methods are being explored to lower costs and improve the overall sustainability of alcohol production. These technological advancements not only make production more cost-effective but also support the growing demand for renewable and bio-based alcohols across various industries like automotive, pharmaceuticals, and packaging.

Expanding Use of Industrial Alcohols in Personal Care Products

The application of industrial alcohol in personal care and cosmetic products is on the rise. Alcohols are widely used in the formulation of products such as hand sanitizers, perfumes, lotions, and hair care products due to their solvent properties and antibacterial effects.

With increased consumer focus on hygiene, especially following the COVID-19 pandemic, demand for alcohol-based personal care products has surged. This trend is expected to continue, driven by growing awareness of cleanliness and personal care, presenting a significant opportunity for industrial alcohol.

Regional Analysis

The Asia-Pacific region holds 41.6% of the industrial alcohol market, valued at USD 54.3 billion.

The Industrial Alcohol Market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia-Pacific dominates the market, accounting for 41.6% of the global market share, valued at USD 54.3 billion. This region’s leadership is driven by robust industrialization, rising demand for biofuels, and government incentives for renewable energy sources. Major countries like China, India, and Japan are significant consumers of industrial alcohols, particularly in bioethanol and industrial chemicals.

North America follows as a key market, driven by the U.S. and Canada’s strong demand for bioethanol and the growing adoption of sustainable practices in the automotive and energy sectors. The market in North America is valued at approximately USD 32.1 billion and is projected to continue expanding due to increasing regulations on greenhouse gas emissions and rising investments in renewable energy.

Europe holds a significant portion of the market, with demand driven by the stringent environmental regulations and the EU’s push towards sustainability. The market in Europe is valued at USD 24.5 billion and is expected to grow as governments emphasize green alternatives in transportation and industry.

Middle East & Africa and Latin America contribute smaller shares, but the demand for industrial alcohol is growing due to increased industrial activity and biofuel adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Industrial Alcohol Market in 2023 is characterized by intense competition, with major players focusing on both strategic expansions and innovation to meet the increasing demand for sustainable and bio-based alcohols.

Key companies such as Archer-Daniels-Midland (ADM), Cargill, ExxonMobil, and Royal Dutch Shell dominate the market through their extensive distribution networks, diverse product portfolios, and strong investments in green technologies.

These players benefit from their established presence in bioethanol production and renewable energy sectors, aligning with the growing trend toward sustainable solutions in multiple industries, including automotive, chemicals, and pharmaceuticals.

ADM and Cargill remain pivotal in driving innovation, particularly in bioethanol and other bio-based alcohols, with significant manufacturing capabilities and global reach. Meanwhile, companies like Green Plains Inc. and Greenfield Specialty Alcohols focus on expanding renewable biofuels, which positions them favorably as governments worldwide push for stricter environmental regulations.

Companies such as Dow Chemical and Eastman Chemical also leverage their expertise in chemical production, integrating industrial alcohols into a broad range of applications, from solvents to additives.

LyondellBasell Industries, ExxonMobil, and Raizen Energia are heavily involved in the production of industrial alcohols derived from fossil fuels but are gradually increasing their bio-based alcohol offerings to cater to sustainability demands. Smaller players like MGP Ingredients and Flint Hills Resources also play a significant role by providing specialized alcohol products for niche markets.

Top Key Players in the Market

- Archer-Daniels-Midland Company

- Cargill Inc

- Cristalco SAS

- Dow Chemical Company

- Eastman Chemical Company

- Exxon Mobil Corporation

- Flint Hills Resources

- Grain Millers Inc.

- Grain processing Corporation

- Green Plains Inc.

- Greenfield Specialty Alcohols

- LyondellBasell Industries

- MGP Ingredients Incorporated

- Raizen Energia

- Royal Dutch Shell Plc.

- Sigma Aldrich

- The Andersons Inc.

- Wilmar International

Recent Developments

- In 2024, LyondellBasell focused on advancing sustainable solutions, reporting substantial earnings, and leveraging advanced technologies to enhance their low carbon and circular economy initiatives. They also announced the development of the Cyclyx Circularity Center, set for a 2024 start-up, to increase U.S. recycling rates and meet demand for circular products, reflecting their commitment to sustainability and innovative industry leadership.

- In 2023, Greenfield Global Inc. completed a major expansion at its Johnstown distillery, significantly boosting its high-purity alcohol production capacity by 30 million gallons. This development aims to meet increasing demand across industries like life sciences and food, enhancing their global supply chain efficiency.

- In 2021, (ADM) announced 2021 plans to build a $350 million soybean crushing plant and refinery in North Dakota to meet the growing demand for renewable products like renewable diesel. The facility is designed to process 150,000 bushels of soybeans per day.

- In 2020, Cargill Inc expanded its operations by acquiring ADM’s global chocolate business for $440 million. This acquisition includes transferring 700 employees and several facilities across North America and Europe, which will enhance Cargill’s productivity and extend its market reach.

Report Scope

Report Features Description Market Value (2023) USD 131.9 Billion Forecast Revenue (2033) USD 277.0 Billion CAGR (2024-2033) 7.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Ethyl Alcohol, Methyl Alcohol, Isopropyl Alcohol, Isobutyl Alcohol, Others), By Source (Sugar and Molasses, Grains, Corn, Fossil Fuels, Others), By Application (Personal Care, Chemical Intermediates, Food Industry, Pharmaceutical, Fuels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Archer-Daniels-Midland Company, Cargill Inc, Cristalco SAS, Dow Chemical Company, Eastman Chemical Company, Exxon Mobil Corporation, Flint Hills Resources, Grain Millers Inc., Grain Processing Corporation, Green Plains Inc., Greenfield Specialty Alcohols, LyondellBasell Industries, MGP Ingredients Incorporated, Raizen Energia, Royal Dutch Shell Plc., Sigma Aldrich, The Andersons Inc., Wilmar International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Alcohol MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Alcohol MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer-Daniels-Midland Company

- Cargill Inc

- Cristalco SAS

- Dow Chemical Company

- Eastman Chemical Company

- Exxon Mobil Corporation

- Flint Hills Resources

- Grain Millers Inc.

- Grain processing Corporation

- Green Plains Inc.

- Greenfield Specialty Alcohols

- LyondellBasell Industries

- MGP Ingredients Incorporated

- Raizen Energia

- Royal Dutch Shell Plc.

- Sigma Aldrich

- The Andersons Inc.

- Wilmar International