Global Vapour Barrier Market By Material (Polymers, Glass, Metal, Drywall, Others), By Application (Insulation, Waterproofing, Corrosion resistance, Others), By Installation (Membranes, Coatings, Cementitious waterproofing, Stacking and Filling, Others), By End Use (Construction, Packaging, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134691

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Vapour Barrier Market is expected to be worth around USD 19.9 Billion by 2033, up from USD 12.2 Billion in 2023, and grow at a CAGR of 5.0% from 2024 to 2033.

A Vapour Barrier is a material designed to prevent the passage of water vapour through building structures. It is commonly used in construction to protect walls, floors, and ceilings from moisture that can cause damage like mold, mildew, and corrosion. Vapor barriers are typically made of plastic films, foils, or other impermeable materials.

The Vapour Barrier Market is driven by the increasing demand for energy-efficient buildings and the growing awareness of moisture-related issues in construction. Growth factors include stricter building codes, rising construction activities, and the push for sustainable architecture.

Demand for vapour barriers is rising as more consumers and builders prioritize energy efficiency and building longevity. Moisture management is crucial for maintaining building integrity.

Opportunities exist in emerging markets, where rapid urbanization and infrastructure development drive construction activities. Growing green technology building initiatives also create a demand for innovative vapour control solutions.

The vapor barrier market is experiencing significant transformations driven by evolving environmental standards and construction practices. As the construction industry continues to prioritize sustainability and efficiency, the demand for advanced vapor intrusion solutions is escalating.

A pivotal advantage in this sector is held by Land Science, a firm with extensive experience in vapor intrusion mitigation and environmental remediation. Their involvement in over 26,000 projects across more than 27 countries positions them distinctively against other providers, suggesting a profound competitive edge grounded in both scope and depth of experience.

Further influencing market dynamics is the need for effective moisture management within building envelopes, as evidenced by various studies. Research by the Air Infiltration and Ventilation Centre highlights the impact of temperature variations on water behavior within systems, noting a potential increase in water temperature by 2° to 4°C. This variation crucially affects the effectiveness of vapor barriers in preventing ice formation during the bleed cycles in colder climates.

Empirical data underscores the significance of material choice and placement in vapor barriers. Studies have shown that a single stud wall with horizontal strapping and a polyethylene vapor barrier experiences substantial moisture accumulation, peaking at about 42% before declining to approximately 30% by day 160.

In contrast, walls without a vapor barrier have recorded persistently high moisture levels, with a peak of around 42% by day 150. The strategic placement of polyethylene on the warm side of the base plate has demonstrated moisture content below 10% throughout the monitoring period, while the cold side reached a high of 36%.

These findings underline the critical role of vapor barriers in managing moisture within buildings, thereby influencing market trends and material innovations. As the market advances, the integration of robust data analytics and environmental considerations will likely guide product development and strategic positioning within the industry.

Key Takeaways

- The Global Vapour Barrier Market is expected to be worth around USD 19.9 Billion by 2033, up from USD 12.2 Billion in 2023, and grow at a CAGR of 5.0% from 2024 to 2033.

- Polymers dominate the vapor barrier market, comprising 47.4% of materials used globally.

- Insulation applications account for 39.3% of vapor barrier usage, reflecting significant market demand.

- Membranes are the preferred installation method, representing 39.5% of the vapor barrier installations.

- The construction sector is the largest end-user, utilizing 54.7% of vapor barriers produced.

- In Asia-Pacific, the Vapor Barrier Market holds 39.4%, valued at USD 4.7 billion.

By Material Analysis

Polymers dominate the vapor barrier market, comprising 47.4% of materials used globally.

In 2023, Polymers held a dominant market position in the “By Material” segment of the Vapor Barrier Market, with a 47.4% share. The segmentation by material also includes Glass, Metal, and Drywall. This prominent standing can largely be attributed to the versatility and cost-effectiveness of polymer-based solutions in moisture control applications.

Glass followed with a 23.6% market share, benefiting from its permeability properties and durability which make it an ideal choice in stringent environmental conditions. Metal barriers accounted for 18.7% of the market, preferred in applications demanding robust moisture control and longevity. Drywall, capturing a 10.3% share, is favored in residential construction due to its ease of installation and cost efficiency.

These materials collectively define the landscape of the Vapor Barrier Market, each serving specific sectoral needs that dictate their adoption. The polymer segment, in particular, is projected to maintain its lead due to ongoing innovations in polymer chemistry that enhance its properties and sustainability, thereby broadening its applicability across various industries.

By Application Analysis

Insulation applications account for 39.3% of the vapor barrier market, reflecting significant demand.

In 2023, Insulation held a dominant market position in the “By Application” segment of the Vapor Barrier Market, with a 39.3% share. Additional segments within this category include Waterproofing and Corrosion Resistance.

The significant share held by Insulation can be ascribed to the increasing demand for energy-efficient building solutions, where vapor barriers play a critical role in minimizing heat transfer and enhancing the overall energy performance of buildings.

Waterproofing accounted for 33.2% of the market, driven by the need to protect buildings and structures from water ingress and associated damages, particularly in regions prone to heavy rainfall or flooding.

Corrosion resistance, with a 27.5% share, highlights the importance of vapor barriers in industrial and infrastructure projects to prevent the deterioration of metal components and structures exposed to moisture-laden environments.

These applications underscore the diverse functionalities of vapor barriers across various sectors, illustrating their pivotal role in extending the longevity and durability of construction and infrastructure projects.

The insulation segment is anticipated to witness sustained growth, fueled by global initiatives aimed at reducing energy consumption and greenhouse gas emissions in the building sector. This trend is expected to propel further innovations and adoption in the vapor barrier market.

By Installation Analysis

Membrane installations represent 39.5% of the vapor barrier installation methods preferred.

In 2023, Membranes held a dominant market position in the “By Installation” segment of the Vapor Barrier Market, with a 39.5% share. The other categories in this segment include Coatings, Cementitious Waterproofing, and Stacking and Filling. Membranes’ leading position is primarily due to their high efficiency in moisture control and ease of installation in a variety of construction settings. They are particularly favored in both residential and commercial buildings for their durability and flexibility.

Coatings, capturing 26.2% of the market, are applied to protect surfaces from moisture penetration and are preferred for their quick application and cost-effectiveness. Cementitious waterproofing, holding a 20.8% share, is widely utilized underground and water-exposed.

Structures like tunnels and sewage systems are appreciated for their robust and long-lasting protective qualities. Lastly, Stacking and Filling methods accounted for 13.5% of the market, employed in specialized applications requiring detailed moisture barrier solutions in complex constructions.

Overall, the varied applications of these installation techniques highlight their critical roles across different environmental conditions and construction requirements. Membranes are expected to maintain their market superiority, driven by continuous advancements in material technology and growing demand for sustainable building practices.

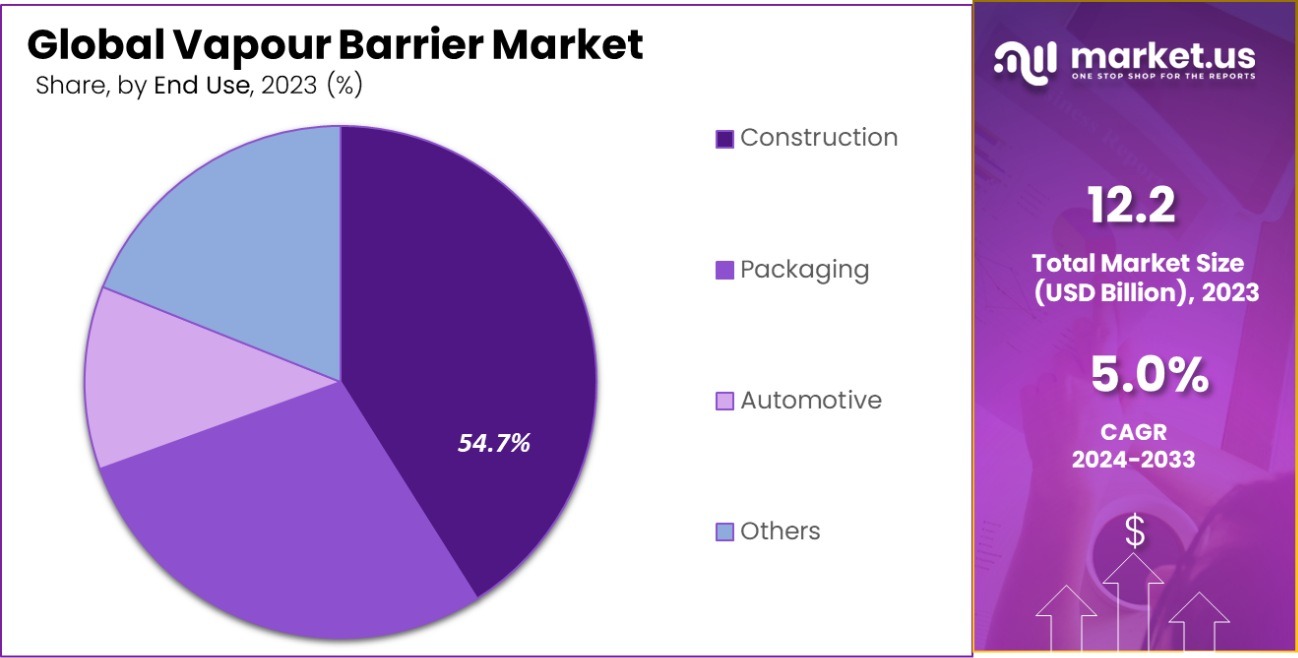

By End Use Analysis

In the vapor barrier market, construction end-use claims the largest share at 54.7%.

In 2023, Construction held a dominant market position in the “By End Use” segment of the Vapor Barrier Market, with a 54.7% share. This segment also includes Packaging and Automotive.

The construction industry’s substantial share is attributed to the critical need for effective moisture control systems that prevent structural damage and enhance building longevity, which are essential in modern construction practices. The use of vapor barriers in construction is driven by stringent regulations and standards aiming to improve building energy efficiency and inhabitant comfort.

Packaging followed with a 28.6% market share, where vapor barriers are integral in protecting goods from moisture, particularly in the food and pharmaceutical sectors, to ensure product integrity and longevity. The Automotive sector accounted for 16.7% of the market, utilizing vapor barriers to prevent corrosion and ensure the longevity of vehicle components exposed to various environmental conditions.

The data indicate that the construction sector will continue to be a major driver of demand within the vapor barrier market, propelled by ongoing urbanization and increased investments in infrastructure. Moreover, advancements in materials and technology are likely to further enhance the effectiveness and application range of vapor barriers, supporting sustained growth in this segment.

Key Market Segments

By Material

- Polymers

- Glass

- Metal

- Drywall

- Others

By Application

- Insulation

- Waterproofing

- Corrosion resistance

- Others

By Installation

- Membranes

- Coatings

- Cementitious waterproofing

- Stacking and Filling

- Others

By End Use

- Construction

- Packaging

- Automotive

- Others

Driving Factors

Increasing Construction Activities Globally

The global increase in construction activities, especially in developing regions, serves as a primary driver for the Vapor Barrier Market. As urbanization continues to rise, there is a heightened demand for building projects that incorporate advanced materials to ensure durability and energy efficiency.

Vapor barriers are essential in these projects for moisture control, which is crucial to maintaining the structural integrity and longevity of buildings. This trend is expected to persist as more nations invest in residential and commercial infrastructure, further propelling the market growth.

Stringent Building Regulations and Standards

Governments worldwide are implementing stricter building codes and standards focused on energy conservation and sustainability. These regulations mandate the use of efficient insulation materials, including vapor barriers, to minimize energy losses and reduce the environmental impact of buildings.

Compliance with these standards is crucial for construction projects, driving the adoption of high-performance vapor barriers. This regulatory push is particularly influential in developing markets where energy efficiency is a major focus in building practices.

Technological Advancements in Barrier Materials

The Vapor Barrier Market is benefiting significantly from technological advancements in material science. Innovations in polymer chemistry and manufacturing processes have led to the development of more effective, durable, and environmentally friendly vapor barrier products.

These advancements enhance the properties of vapor barriers, such as increased resistance to punctures, tears, and water permeability, making them more appealing for a wide range of applications. The continuous improvement in product performance is a key factor that encourages broader adoption and growth within the market.

Restraining Factors

High Installation and Material Costs

The significant costs associated with the installation and materials of vapor barriers pose a major restraining factor for the market. High-quality vapor barriers, especially those designed for specific or extreme conditions, demand premium prices, which can deter budget-conscious builders and homeowners.

Additionally, the need for professional installation to ensure optimal performance adds further to the overall costs. This can limit the adoption of vapor barriers in cost-sensitive markets and among individuals who prioritize upfront savings over long-term benefits.

Availability of Alternative Technologies

The development and availability of alternative moisture control technologies challenge the growth of the Vapor Barrier Market. Innovations such as enhanced building techniques and alternative waterproofing materials that offer similar benefits at a lower cost or with greater ease of application can sway consumers away from traditional vapor barriers.

These alternatives are becoming increasingly popular as they are often easier to install and may offer more flexible usage scenarios, which can restrain the demand for traditional vapor barrier solutions.

Environmental Concerns and Regulatory Challenges

Environmental concerns related to the production and disposal of vapor barriers, particularly those made from non-recyclable materials, pose significant challenges. The impact of these materials on the environment can lead to stricter regulations and increased scrutiny from both governments and consumers.

This scrutiny can result in reduced market penetration or demand shifts towards more eco-friendly alternatives. Additionally, meeting diverse regulatory standards across different regions can complicate production and distribution strategies for manufacturers, further restraining market growth.

Growth Opportunity

Expansion into Emerging Markets

Emerging markets present significant growth opportunities for the Vapor Barrier Market due to rapid urbanization and industrialization. Countries in Asia, Africa, and South America are experiencing substantial increases in construction activities, both in residential and commercial sectors. As these regions continue to develop, the demand for advanced building materials, including vapor barriers, is expected to rise.

Market players can capitalize on this growth by establishing local manufacturing units, forming partnerships, and tailoring products to meet regional needs and standards, thereby enhancing their market penetration and revenue potential.

Innovations in Eco-Friendly Vapor Barriers

As environmental sustainability becomes a global priority, there is a growing opportunity for innovation in eco-friendly vapor barriers. Developing products that are both effective in moisture control and environmentally benign can cater to the increasing consumer and regulatory demands for sustainable construction materials.

Companies that invest in research and development of recyclable, biodegradable, or less environmentally damaging vapor barriers could gain a competitive edge. This shift not only aligns with global sustainability trends but also opens up new markets and customer segments focused on green building practices.

Integration with Smart Building Technologies

The integration of vapor barriers with smart building technologies represents a notable growth opportunity within the market. As buildings become more intelligent, incorporating sensors and IoT devices into vapor barriers can provide real-time data on humidity and moisture levels, enhancing building management systems.

This technology can significantly improve the preventive maintenance of structures, extend their lifespan, and reduce repair costs. Manufacturers who innovate in this space by developing smart vapor barrier solutions can lead the market, attracting tech-savvy consumers and projects that prioritize advanced construction technologies.

Latest Trends

Rising Demand for Energy-Efficient Building Solutions

The increasing focus on energy efficiency in buildings is a prominent trend in the Vapor Barrier Market. As energy costs rise and environmental awareness grows, builders and homeowners are seeking ways to reduce energy consumption and minimize heat losses.

Vapor barriers play a crucial role in this by improving insulation and reducing the need for heating and cooling. This trend is driving the development of new materials and installation techniques that enhance the effectiveness of vapor barriers, contributing to their growing adoption in both new constructions and renovations.

Adoption of Advanced Installation Technologies

The adoption of advanced installation technologies for vapor barriers is reshaping the market. Techniques such as automated installation and the use of robotics are becoming more common, reducing labor costs and improving the precision and speed of installations.

This trend is particularly influential in large-scale commercial projects, where efficiency and consistency are paramount. As these technologies become more accessible and cost-effective, their adoption is expected to increase, further driving the efficiency and growth of the vapor barrier market.

Increased Focus on Indoor Air Quality

There is a growing trend towards prioritizing indoor air quality in construction, influencing the development and use of vapor barriers. Modern vapor barriers are designed not only to protect structures from moisture but also to contribute to a healthier indoor environment by preventing the growth of mold and mildew.

This aspect is increasingly important in residential, commercial, and healthcare settings, where air quality directly impacts occupant health. The demand for vapor barriers that offer these dual benefits is expected to rise, spurred by health-conscious consumers and tighter building regulations.

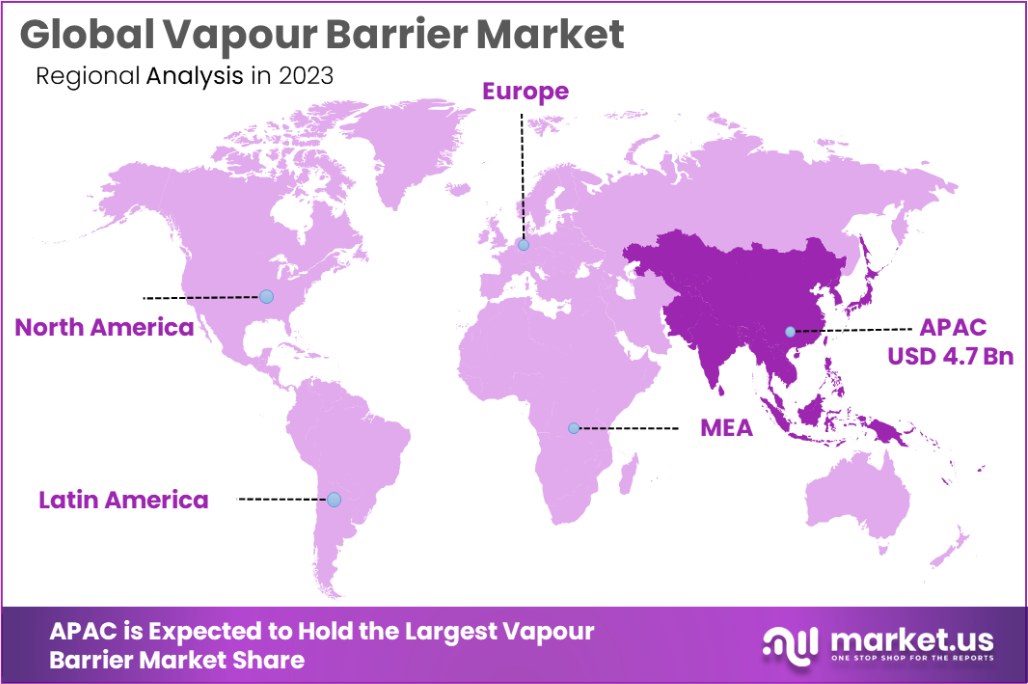

Regional Analysis

In 2023, the Asia-Pacific Vapor Barrier Market held a 39.4% share, valued at USD 4.7 billion.

The Vapor Barrier Market is segmented across several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia-Pacific is the dominating region, holding 39.4% of the market share, which translates to a valuation of USD 4.7 billion.

This dominance is driven by rapid urbanization, significant infrastructure investments, and the increasing adoption of advanced building technologies in countries like China, India, and Japan.

In North America, the market is propelled by stringent building codes and a high standard of construction practices, with a strong focus on energy efficiency and sustainable building materials. Europe follows a similar pattern, with additional impetus from government initiatives promoting energy-efficient buildings across the European Union.

The Middle East & Africa region is experiencing growth due to increasing infrastructure projects and urban development, particularly in the Gulf Cooperation Council (GCC) countries, which are investing heavily in diversifying their economies away from oil dependency.

Latin America, though smaller in market size compared to other regions, shows potential for growth through increasing awareness and adoption of moisture control systems in construction to improve building longevity and efficiency.

Overall, while Asia-Pacific leads the market, other regions are also showing significant activity and growth potential, driven by a combination of regulatory frameworks, technological advancements, and environmental concerns.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Vapor Barrier Market is significantly shaped by the activities of major companies such as 3M Company, BASF SE, and DuPont de Nemours, Inc., among others. These key players are pivotal in driving innovation, technological advancements, and market strategies that address both current needs and future demands.

3M Company continues to be a leader in the market, leveraging its robust R&D capabilities to innovate more effective and sustainable vapor barrier solutions. Their focus on integrating smart technology into their products allows for enhanced performance metrics, appealing to a tech-savvy market segment and reinforcing their market position.

BASF SE distinguishes itself through its commitment to environmental sustainability, producing vapor barriers that contribute to the energy efficiency of buildings. Their products are designed to meet stringent international standards for green building, which positions them favorably in regions with aggressive climate goals.

DuPont de Nemours, Inc. focuses on the development of high-performance building materials that provide superior moisture control. Their Tyvek® brand, for example, is highly regarded for its durability and effectiveness, making it a preferred choice for both residential and commercial constructions.

Additionally, companies like Carlisle Coatings & Waterproofing Inc. and Johns Manville capitalize on their extensive industry experience to offer tailored solutions that meet specific regional and application-specific requirements, thus enhancing their customer base and market reach.

Emerging players such as Stego Industries, LLC and UFP Industries, Inc. are also making significant inroads into the market by offering innovative and cost-effective solutions, challenging the established market leaders.

The market is also witnessing a shift towards more eco-friendly products, with companies like BASF SE and Compagnie de Saint-Gobain S.A. at the forefront, promoting vapor barriers that align with global sustainability trends. This not only helps in complying with environmental regulations but also caters to the growing consumer demand for green building materials.

Overall, the competitive dynamics within the Vapor Barrier Market are characterized by a blend of innovation, sustainability, and customization, with key players continuously evolving to meet the changing preferences and regulations of the construction industry worldwide.

Top Key Players in the Market

- 3M Company

- BASF SE

- BMI Icopal

- Bostik (Arkema S.A.)

- British Polythene Limited (Berry Global Inc.)

- Carlisle Coatings & Waterproofing Inc. (Carlisle Construction Materials LLC)

- Compagnie de Saint-Gobain S.A.

- DuPont de Nemours, Inc.

- Johns Manville (Berkshire Hathaway Inc.)

- Layfield Group Limited

- Reef Industries Inc.

- Reflectix, Inc

- RPM International Inc.

- Stego Industries, LLC

- UFP Industries, Inc.

- Visqueen Building Products

- W.R. Meadows, Inc.

Recent Developments

- In 2023, 3M announced the completion of the spin-off of its healthcare business, which is now an independent company named Solventum. This strategic move allows 3M to focus more intently on its core businesses, including the vapor barrier market, aiming to drive long-term shareholder value and concentrate on innovation in material science

- In April 2023, Saint-Gobain acquired the Bailey Group Companies, significantly strengthening its position in the North American light construction market. This acquisition is aligned with its strategy to enhance light and sustainable construction offerings, promoting a broader reach in interior and exterior building solutions in Canada.

Report Scope

Report Features Description Market Value (2023) USD 12.2 Billion Forecast Revenue (2033) USD 19.9 Billion CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polymers, Glass, Metal, Drywall, Others), By Application (Insulation, Waterproofing, Corrosion resistance, Others), By Installation (Membranes, Coatings, Cementitious waterproofing, Stacking and Filling, Others), By End Use (Construction, Packaging, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Company, BASF SE, BMI Icopal, Bostik (Arkema S.A.), British Polythene Limited (Berry Global Inc.), Carlisle Coatings & Waterproofing Inc. (Carlisle Construction Materials LLC), Compagnie de Saint-Gobain S.A., DuPont de Nemours, Inc., Johns Manville (Berkshire Hathaway Inc.), Layfield Group Limited, Reef Industries Inc., Reflectix, Inc, RPM International Inc., Stego Industries, LLC, UFP Industries, Inc., Visqueen Building Products, W.R. Meadows, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- BASF SE

- BMI Icopal

- Bostik (Arkema S.A.)

- British Polythene Limited (Berry Global Inc.)

- Carlisle Coatings & Waterproofing Inc. (Carlisle Construction Materials LLC)

- Compagnie de Saint-Gobain S.A.

- DuPont de Nemours, Inc.

- Johns Manville (Berkshire Hathaway Inc.)

- Layfield Group Limited

- Reef Industries Inc.

- Reflectix, Inc

- RPM International Inc.

- Stego Industries, LLC

- UFP Industries, Inc.

- Visqueen Building Products

- W.R. Meadows, Inc.