Global Dimethyl Terephthalate Market By Form (Solid, Liquid), By Application (Polyester Fibers, Polyester Film, PET Resins, Polybutylene Terephthalate, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 123939

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

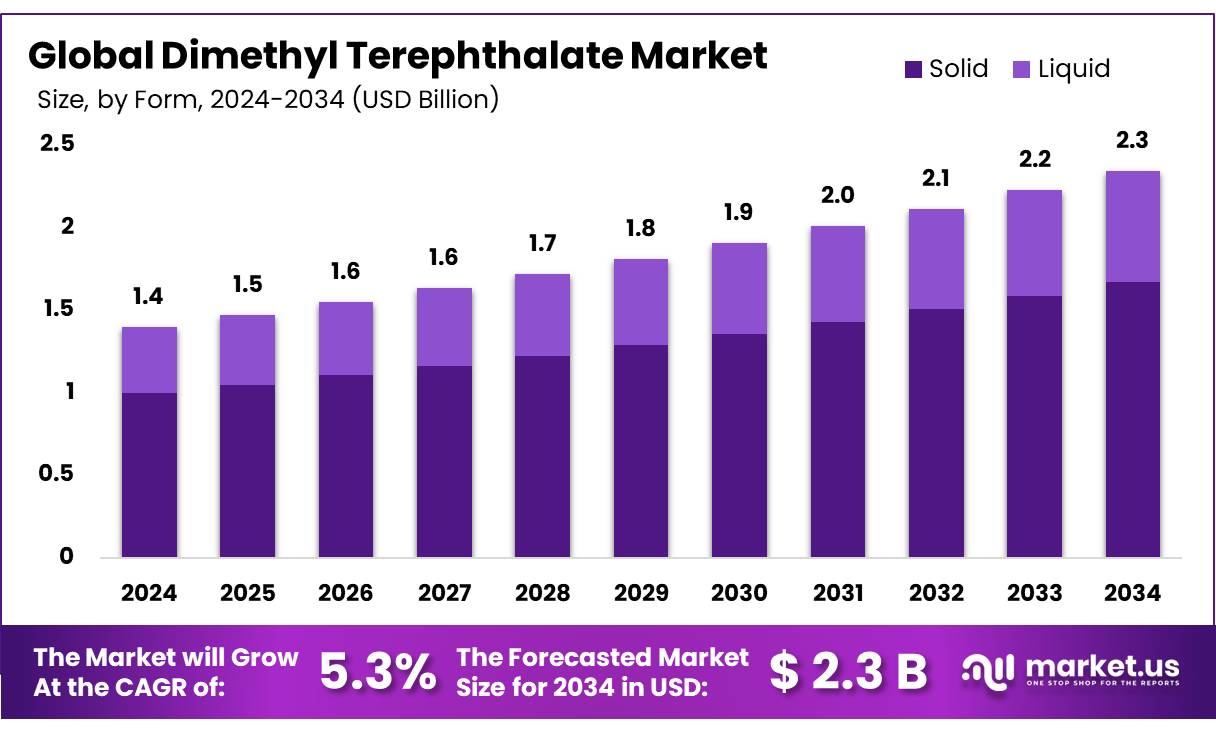

The Global Dimethyl Terephthalate Market size is expected to be worth around USD 2.3 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Dimethyl Terephthalate (DMT) is an organic chemical compound primarily used as an intermediate in the production of polyesters. It is typically manufactured through the oxidation and esterification of paraxylene and is available in both molten (liquid) and flake (solid) forms. DMT plays a critical role in the chemical industry due to its versatility and stability under normal conditions, though it poses a dust explosion hazard in powdered form. It is widely utilized to produce esters that serve as plasticizers and intermediates in various applications.

Owing to its volatility, DMT is also used as an intermediate in recycling processes, particularly in the chemical recycling of polyethylene terephthalate (PET) from plastic waste. DMT is extensively used in the production of polyester resins, fibers, and films. It serves as a key raw material in manufacturing industrial plastics such as PET, polybutylene terephthalate (PBT), and polytrimethylene terephthalate (PTT). These polyesters are essential in the textile industry for making synthetic fibers, in the packaging industry for producing PET bottles, and in electronics and photography for polyester films used in X-ray films, computer components, and audio-visual equipment.

Additionally, DMT is employed in the synthesis of dyes, pigments, anhydrides, and insect repellents. The global DMT market is expected to grow steadily, driven by increasing demand for PET packaging, the expansion of textile manufacturing in emerging economies, and growing interest in sustainable recycling pathways for plastics.

Key Takeaways

- The global Dimethyl Terephthalate market was valued at USD 1.4 Billion in 2024.

- The global Dimethyl Terephthalate market is projected to grow at a CAGR of 5.3 % and is estimated to reach USD 2.3 Billion by 2034.

- Among forms, solid accounted for the largest market share of 71.2%. Due to its superior handling, storage stability, and widespread use in fiber and resin manufacturing.

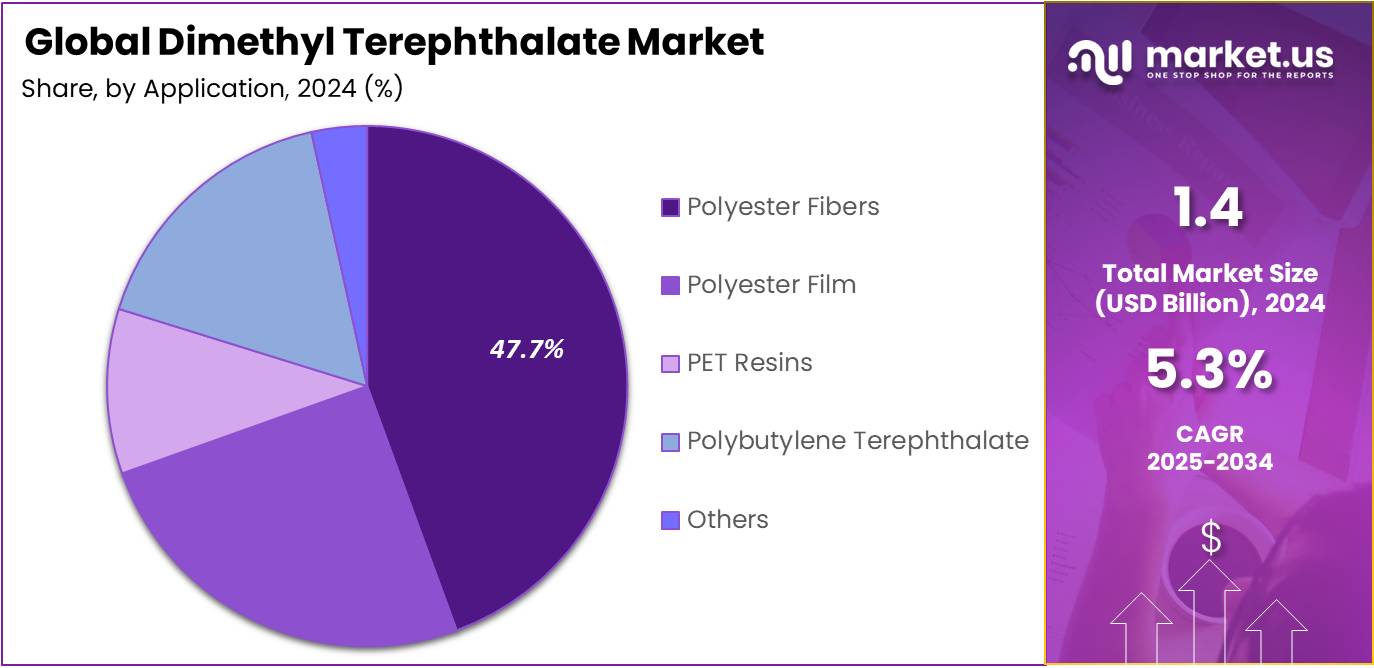

- Among applications, polyester fibers accounted for the majority of the market share at 47.7%. Driven by high demand in textiles, home furnishings, and industrial fabric applications.

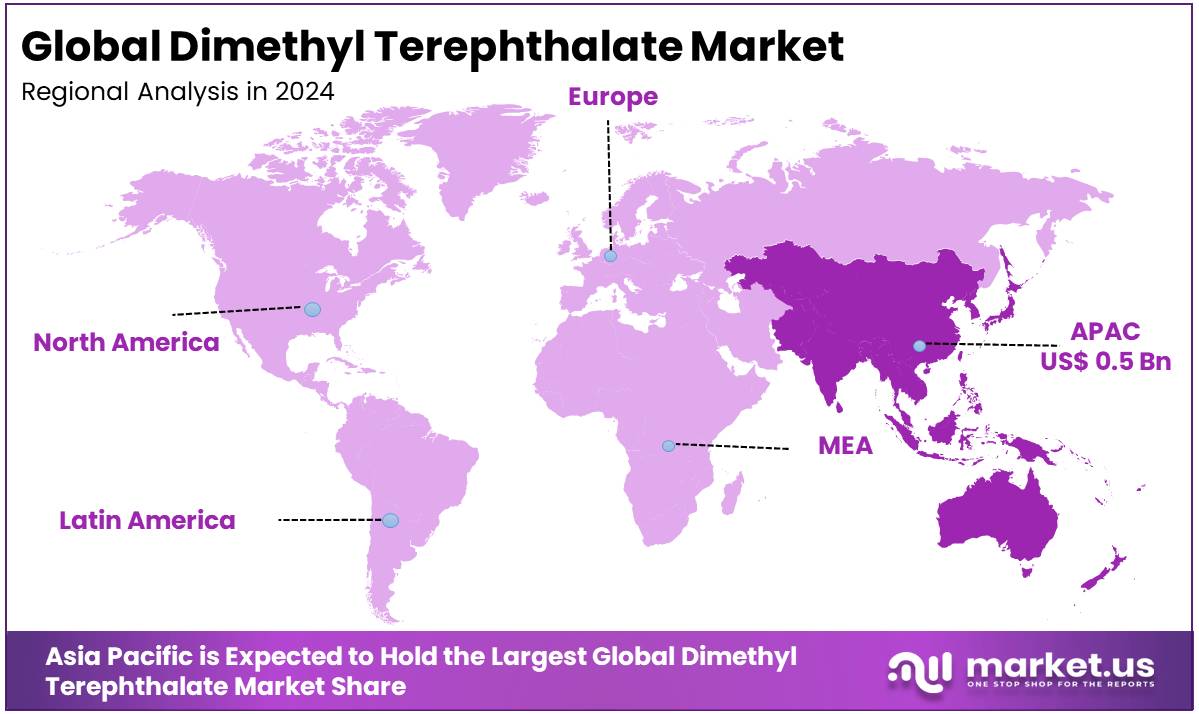

- Asia Pacific is estimated as the largest market for Dimethyl Terephthalate with a share of 37.4% of the market share. Driven by the rapid expansion of key end-use industries such as textiles, packaging, automotive, and electronics.

Form Analysis

Solid Form of Dimethyl Terephthalate Held A Dominant Market Share Due To Its Superior Handling, Storage Stability, And Widespread Use In Fiber And Resin Manufacturing.

The Dimethyl Terephthalate market is segmented based on form into solid and liquid. In 2024, the solid terephthalate segment held a significant revenue share of 71.2%. Due to its widespread industrial use, better ease of transport and storage, and higher stability compared to the liquid form. Solid DMT is the preferred choice for bulk production of polyethylene terephthalate (PET) resins, polyester fibers, and films key materials used across textiles, packaging, and automotive industries further driving its dominance in the global market.

Application Analysis

Polyester Fibers Led The Application Segment Share In 2024, Driven By High Demand In Textiles, Home Furnishings, And Industrial Fabric Applications.

Based on application, the market is further divided into polyester fibers, polyester film, pet resins, polybutylene terephthalate, and others. The predominance of the polyester fibers, commanding a substantial 47.7% market share in 2024 due to their extensive use in the textile and apparel industries. The surge in demand for lightweight, durable, and cost-effective fabrics—especially in emerging economies such as China, India, and Southeast Asia—has significantly driven the consumption of DMT in fiber production. Additionally, the rise of fast fashion and increased usage in home furnishings and industrial textiles have reinforced polyester fibers as the leading application segment.

Key Market Segments

By Form

- Solid

- Liquid

By Application

- Polyester Fibers

- Polyester Film

- PET Resins

- Polybutylene Terephthalate

- Others

Drivers

Growing Demand for Plastic in Industrial Sectors.

The growing demand for plastics across various industries is a key driver of the global Dimethyl Terephthalate (DMT) market growth. Industries are increasingly adopting plastics due to their convenience, cost-effectiveness, and the rising emphasis on sustainability practices and recycling initiatives. As a versatile material used in many sectors, plastic production relies heavily on Dimethyl Terephthalate as a crucial raw material.

- The global plastics market was valued at $570 billion in 2019 and is expected to grow at 5% every year.

Furthermore, the industrial and commercial sectors play a pivotal role in driving plastic demand. Industries like automotive are seeking lightweight plastic components to enhance fuel efficiency. As the automotive industry shifts toward electric vehicles (EVs), the demand for advanced plastic materials like PET resin has risen. Since Dimethyl Terephthalate is a key intermediate in processing these plastics, its importance is growing as EV manufacturers seek lighter, more energy-efficient components. Similarly, the construction industry relies heavily on plastics for products such as pipes, insulation, and wiring, highlighting their significance in modern infrastructure.

Moreover, the packaging sector is a major consumer of plastics, driving the growth of Dimethyl Terephthalate (DMT) through the extensive use of plastics in food and beverage packaging. These plastics help preserve products, extend shelf life, and facilitate transportation. The expansion of e-commerce has further accelerated the demand for plastic packaging as more products are shipped directly to consumers. Beyond packaging, plastics are essential in consumer goods industries such as electronics and textiles. The rising global demand for smartphones, computers, and home appliances has increased the use of plastics in electronics for housing, wiring, and insulation.

- According to Environmental Pollution and Management, more than 2 million plastic bottles and bags are currently being consumed by the packaging industry every day.

Restraints

High Production Cost

The high cost of production is one of the major constraints affecting the growth of the dimethyl terephthalate market. The most important factor is the increased volatility in raw material prices, which directly impacts the overall cost of manufacturing. In addition, raw materials sourcing for dimethyl terephthalate production can be more complex and expensive, leading to higher production costs.

Moreover, the development of dimethyl terephthalate faces challenges due to the high investment requirements associated with its production and the limited awareness in some markets about its applications and benefits. These factors make it more difficult for companies to form large-scale investments, especially in regions with less familiarity with the compound. In addition, the combination of high production costs, raw material price fluctuations, and limited market knowledge creates significant barriers to expanding the dimethyl terephthalate market.

Furthermore, regulatory pressure on producing plastics further complicates its market growth. The stringent regulations governing the production and use of plastics contain compounds, and due to their negative environmental impact, these regulations can lead to delays in production and higher operational costs. A combination of regulatory pressures, technical challenges, and financial limitations creates a challenging environment for the widespread adoption and growth of the dimethyl terephthalate market.

Opportunity

Rising Use Of Biobased Dimethyl Terephthalate

The increasing demand for bio-based dimethyl terephthalate (DMT) presents a significant growth opportunity for the global DMT market. Driven by rising environmental awareness and sustainability initiatives implemented by governments worldwide major manufacturing companies used biobased material in plastics production. This bio-based DMT is produced using natural ingredients and can degrade naturally, making it an attractive alternative to conventional, petroleum-based DMT.

- The European Union’s Green Deal, which aims for a circular economy by 2050, mandates higher recycled content in plastic products, pushing industries to innovate in polypropylene recycling.

- The Bio Preferred Program, managed by the USDA, promotes biobased products by offering federal purchasing requirements and voluntary labeling. Products with the bio Preferred label encourage adoption by government and private sector buyers focused on sustainability.

Furthermore, bio-based DMT, produced using natural ingredients, their a biodegradable nature making it a promising environmentally friendly alternative to conventional, petroleum-based DMT. One of the key benefits of bio-based materials is their reduced environmental footprint. Compared to traditional plastics, bio-based alternatives generate lower carbon emissions, consume less energy during production, and are derived from renewable resources. These characteristics contribute to reduced environmental impact, decreased white pollution, and a lesser dependency on fossil fuels.

Additionally, companies across the globe are now emphasizing the development and manufacturing of bio-based DMT, recognizing its potential to align with sustainability goals. Bio-DMT retains similar performance characteristics to conventional DMT, making it suitable for a wide range of applications without compromising quality or functionality.

Moreover, bio-based DMT and bio-based polyesters can be derived from biomass sources containing terpenes or terpenoids—such as limonene—further broadening the scope for sustainable material innovation. The rising use of bio-based DMT is expected to significantly contribute to the growth of the global DMT market in the coming years.

Trends

Integration in Consumer Electronics materials

The integration of dimethyl terephthalate in electronics materials is emerging as a significant trend driving growth in the global dimethyl terephthalate market. These advanced materials used intermediate or plasticizers to produce a sustainable alternative to traditional plastics, with properties like flexibility, durability, and lightweight nature that make them ideal for electronic applications such as device casings, insulation, and wearables components. As the electronics industry becomes more eco-conscious, Bio-DMT aligns with sustainability goals while offering high performance.

Furthermore, their core ingredients such as PET resins, polyester film, and fibers thermal or moisture sensitivity, are opening new opportunities for innovative electronic products. These materials can be used in temperature-sensitive components or as coatings for devices requiring specific environmental conditions. As demand for both high-tech and sustainable electronics grows, this trend towards electronic material manufacturing is poised to open new opportunities for manufacturers to cater to the growing demand for both high-tech and eco-conscious electronics.

Geopolitical Impact Analysis

Geopolitical tensions and trade tariffs are significantly disrupting the global dimethyl terephthalate (DMT) market by increasing costs, straining supply chains, and impacting a wide range of industries.

Geopolitical factors have an intense influence on the global dimethyl terephthalate market. Trade policies and tariffs between major economies, such as the recent trade-tariff war between China and the European Union, can increase costs for manufacturers and disrupt global supply chains, affecting the price and availability of raw materials needed for dimethyl terephthalate. In addition, restrictions imposed by specific countries can affect the pricing and availability of raw materials critical to DMT production.

- For instance, on April 2, 2025, the United States announced a broad set of trade tariffs on imported goods, prompting reciprocal tariffs from over 60 countries. Currently, the U.S. has implemented additional tariffs of 10% on imports from most countries, while imports from China are subject to a total tariff rate of 145%. In retaliation, China has imposed a 125% tariff on the majority of U.S. imports.

These tariff measures are impacting a wide array of materials—including chemicals, electronics, and industrial components. Within the chemical sector, actions such as the expansion of Section 232 tariffs and the introduction of “reciprocal tariffs” have intensified challenges for manufacturers. The US-China tariff war has disrupted chemical supply chains, forcing US companies to seek new suppliers and implement reshoring efforts.

- According to UN trade data, in 2023, the European Union exported €523 billion worth of chemicals and related products while importing €325 billion, maintaining a significant trade surplus. The United States was the largest importer, with €340 billion in chemical imports, and the second-largest exporter, at €279 billion. Meanwhile, China ranked as the third-largest importer (€218 billion) and third-largest exporter (€240 billion) of chemical products. This global trade data underscores the high level of dependence among major economies in the chemical sector. The DMT industry, which heavily relies on the import and export of raw materials and intermediate chemicals, is especially sensitive to these trade flows.

The DMT industry is especially vulnerable to such geopolitical and trade disruptions due to its reliance on international supply chains and imported raw materials. Tariffs significantly increase the cost of these imports, placing immediate financial pressure on chemical manufacturers. Smaller companies, in particular, may struggle to absorb the added expenses and could be forced to raise prices, reduce production, or turn to costlier suppliers each of which negatively impacts operational stability and profit margins. Moreover, the broader impact of these disruptions extends beyond the chemical industry. Since DMT is a key input in sectors such as pharmaceuticals, electronics, agriculture, and automotive manufacturing, increased costs and supply delays can ripple through the global economy, affecting a wide range of industries and consumers.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Dimethyl Terephthalate Market

In 2024, Asia Pacific dominated the global Dimethyl Terephthalate market, accounting for 37.4 % of the total market share, Driven by the rapid expansion of key end-use industries such as textiles, packaging, automotive, and electronics. Countries such as China and India are leading both production and consumption due to their large-scale manufacturing capabilities, growing domestic demand, and strategic investments in petrochemical infrastructure.

China, in particular, dominates the regional landscape with its cost-competitive production, while India is experiencing rising demand supported by government initiatives such as the Production-Linked Incentive (PLI) scheme aimed at boosting textile and manufacturing sectors. Additionally, Southeast Asian nations are emerging as alternative manufacturing hubs as global companies seek to diversify supply chains in response to geopolitical tensions and rising production costs in China. The region’s cost-effectiveness, abundant labor, and supportive policy frameworks make it an attractive base for DMT production.

Furthermore, there is growing interest in sustainable and bio-based alternatives to petroleum-derived DMT, especially in developed markets like Japan and South Korea, where innovation in green chemistry and environmental compliance are driving change. As a result, the Asia-Pacific region is expected to remain a critical growth engine for the global DMT market, supported by structural demand, investment inflows, and evolving environmental priorities.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the Dimethyl Terephthalate market dominate the market through strategic innovation, premium positioning, and global reach.

In 2024, the global Dimethyl Terephthalate (DMT) market was dominated by key players such as Eastman Chemical Company, SK Chemicals, and Kishida Chemical Co., Ltd. These companies maintain market leadership through large-scale manufacturing capabilities, continuous innovation, and a strong regional presence, particularly in Asia-Pacific and Europe. Eastman Chemical Company is a major global producer of DMT, supplying it primarily for the production of polyethylene terephthalate (PET) used in fibers, films, and container plastics. SK Chemicals is another leading producer, marketing its DMT under the brand name SKYDMT. In addition to conventional DMT production, SK Chemicals is actively investing in sustainable and circular economy initiatives.

Key Players in the Industry

- Eastman Chemical Company

- SK chemicals

- OXXYNOVA GmbH

- SASA

- OAO Mogilevkhimvolokno

- Fiber Intermediate Products Company

- Connect Chemicals

- KANTO CHEMICAL CO., INC.

- Kishida Chemical Co., Ltd

- Sarna Chemicals PVT. LTD

- Other Key Players

Recent Development

- In August 2024 – Ester Industries Ltd. and Loop Industries Inc. formed a joint venture to establish a ₹1,385 crore recycling facility in India that will produce recycled dimethyl terephthalate (rDMT) using Infinite Loop technology, targeting the rising demand for sustainable polymers across multiple industries including electronics, automotive, and packaging.

- In January 2023 – The SK Geo Centric subsidiary of SK Chemical partnered with UK-based Plastic Energy to build Asia’s largest pyrolysis plant in Ulsan, South Korea, as part of the Ulsan Advanced Recycling Cluster (ARC). The project, which includes collaboration with Loop Industries and PureCycle Technologies, will use advanced recycling technologies to convert unrecyclable plastics into high-purity monomers such as DMT and MEG, enhancing SK’s position in the circular plastic economy across Asia.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Bn Forecast Revenue (2034) US$ 2.3 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid), By Application (Polyester Fibers, Polyester Film, PET Resins, Polybutylene Terephthalate, Others), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Eastman Chemical Company, SK Chemicals, OXXYNOVA GmbH, SASA, OAO Mogilevkhimvolokno, Fiber Intermediate Products Company, Connect Chemicals, Kanto Chemical Co., Inc., Kishida Chemical Co., Ltd, Sarna Chemicals Pvt. Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dimethyl Terephthalate MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Dimethyl Terephthalate MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eastman Chemical Company

- SK chemicals

- OXXYNOVA GmbH

- SASA

- OAO Mogilevkhimvolokno

- Fiber Intermediate Products Company

- Connect Chemicals

- KANTO CHEMICAL CO., INC.

- Kishida Chemical Co., Ltd

- Sarna Chemicals PVT. LTD

- Other Key Players