Global Polymer Plaster Market By Product (Acrylic Polymer Plaster, Silicone Polymer Plaster, Polyurethane Polymer Plaster, Vinyl Polymer Plaster, Epoxy Polymer Plaster), By Application (Tiling and Flooring, Mortar and Cement, Plastering and Gypsum, Insulation System, Others) , By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147988

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

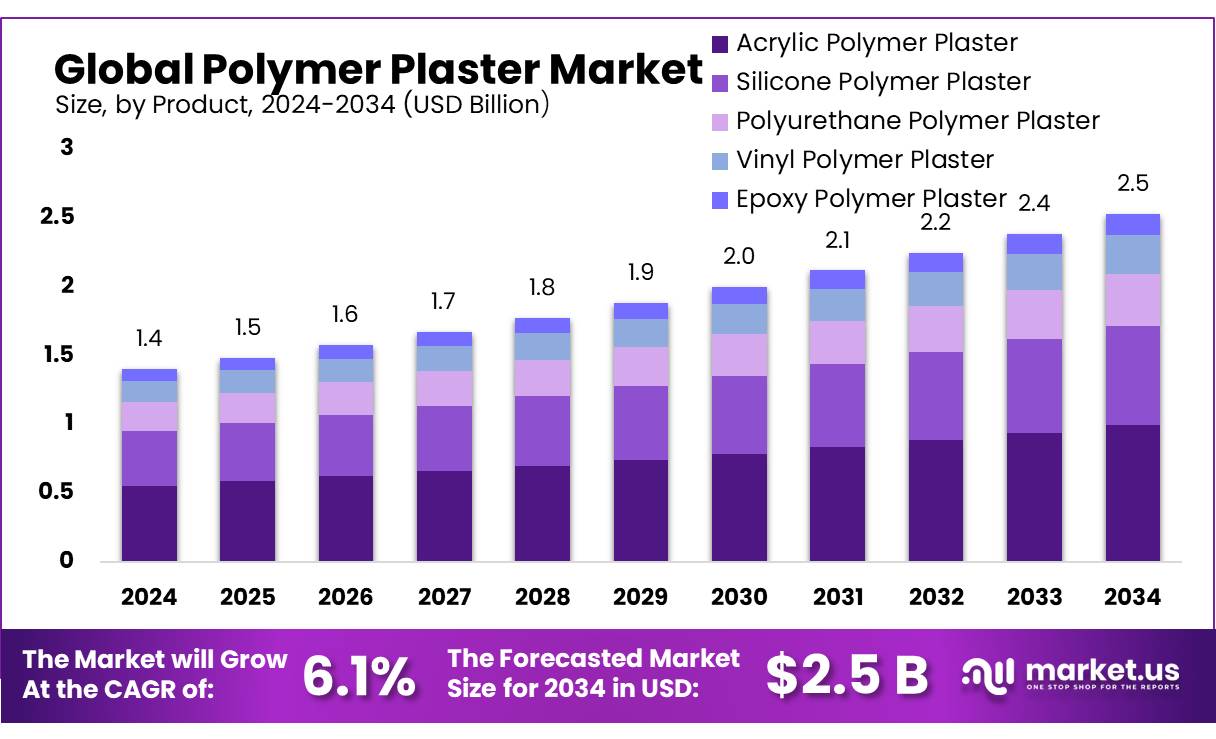

The Global Polymer Plaster Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

Polymer plaster, a composite material integrating polymers into traditional plaster formulations, has emerged as a pivotal innovation in the construction sector. This amalgamation enhances properties such as adhesion, flexibility, and resistance to environmental factors, making it suitable for diverse applications including residential, commercial, and industrial structures. The incorporation of polymers not only improves the mechanical properties of plaster but also contributes to sustainability by extending the lifespan of building components.

Government initiatives are also playing a crucial role in promoting the use of advanced construction materials like polymer plaster. For instance, the U.S. Department of Energy announced a $25 million investment in polymer upcycling research, aiming to develop new technologies for reusing discarded plastics in valuable products, thereby reducing plastic waste. Such initiatives not only address environmental concerns but also encourage the development and adoption of sustainable building materials.

In India, the government’s focus on sustainable and energy-efficient construction practices is evident through various programs and policies. The Bureau of Energy Efficiency (BEE) and the Energy Efficiency Services Limited (EESL) are actively promoting energy-efficient building materials and practices. These efforts are expected to create a favorable environment for the growth of the polymer plaster market in the region.

Key Takeaways

- Polymer Plaster Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 6.1%.

- Polymer Plaster held a dominant market position, capturing more than a 39.4% share.

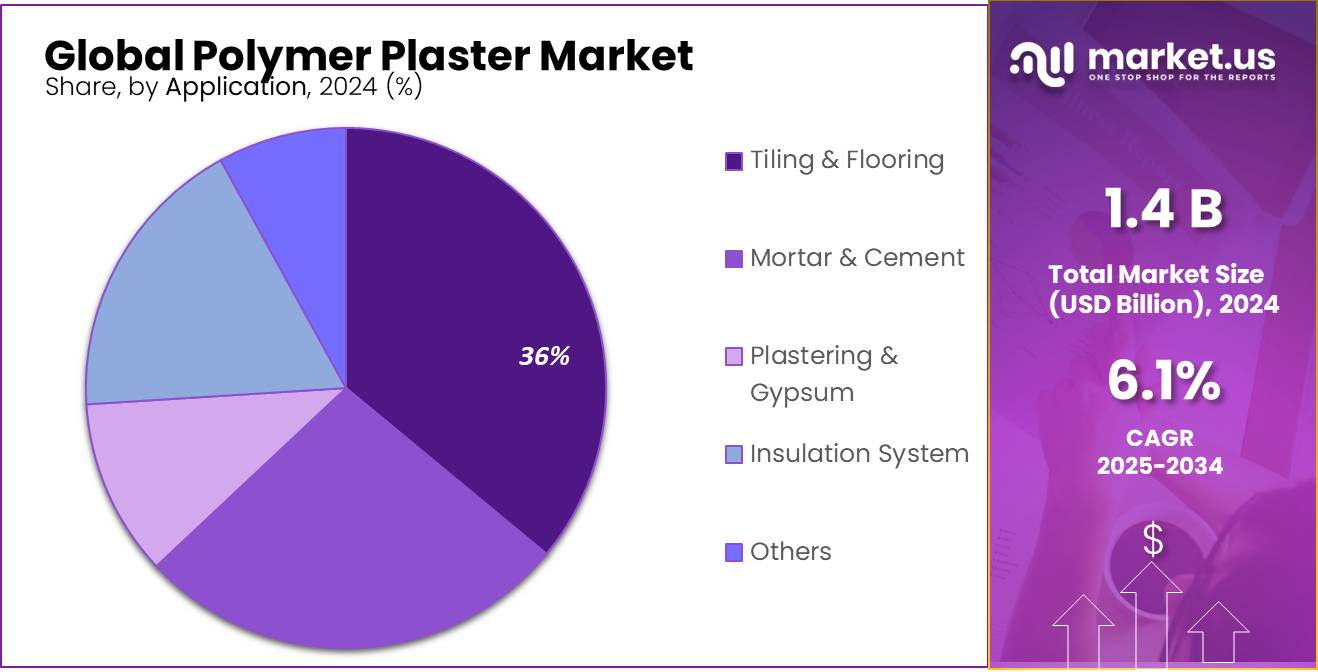

- Tiling & Flooring held a dominant market position, capturing more than a 36.7% share in the Polymer Plaster market.

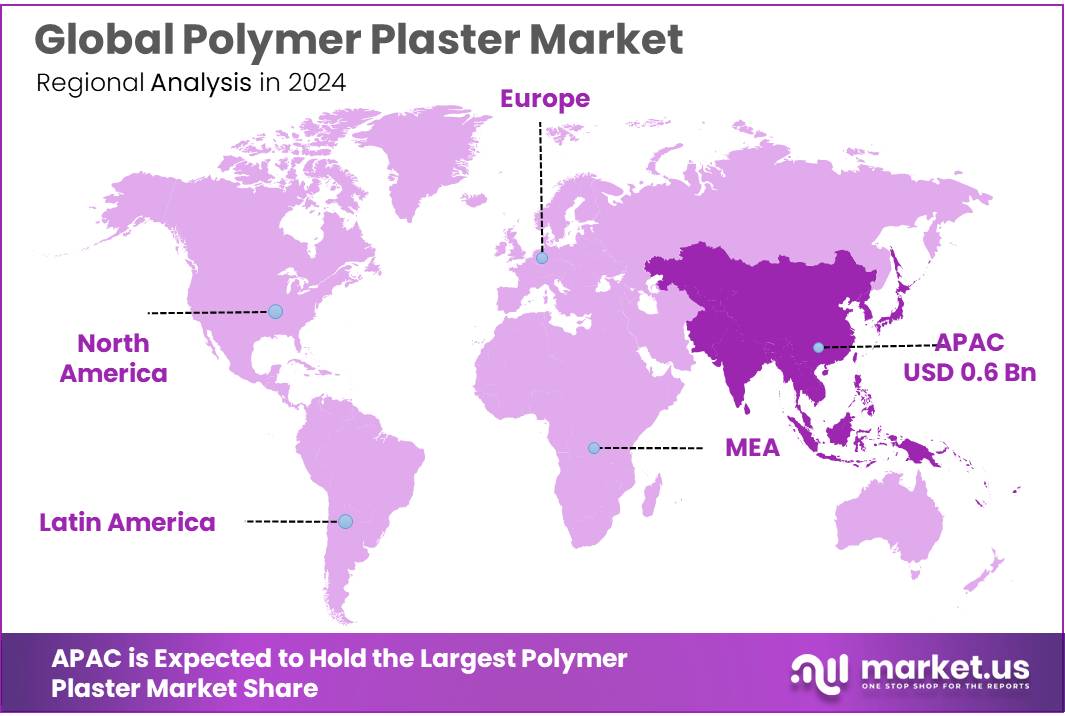

- Asia-Pacific (APAC) region emerged as the dominant market for polymer plaster, capturing a substantial 45.9% share and generating approximately USD 0.6 billion in revenue.

By Product

Polymer Plaster dominates with 39.4% due to superior durability and thermal resistance.

In 2024, Polymer Plaster held a dominant market position, capturing more than a 39.4% share in the global market. Its widespread adoption is primarily attributed to its enhanced properties, such as improved adhesion, flexibility, and resistance to environmental factors, making it a preferred choice for construction projects in regions experiencing extreme weather conditions.

The material’s ability to provide superior insulation and quick curing times has further driven its demand in both residential and commercial sectors. Additionally, government initiatives promoting sustainable construction materials have further boosted its market share, positioning Polymer Plaster as a key segment in the broader construction materials market. The continued emphasis on durable and cost-effective building solutions is expected to maintain its dominance through 2025.

By Application

Tiling & Flooring dominates with 36.7% due to robust demand in construction projects.

In 2024, Tiling & Flooring held a dominant market position, capturing more than a 36.7% share in the Polymer Plaster market. The segment’s stronghold is driven by its extensive use in residential and commercial construction projects, where its superior adhesion, durability, and moisture resistance make it a preferred choice.

The surge in urban infrastructure development and renovation activities has further fueled demand for polymer plaster in tiling and flooring applications, particularly in regions with high construction activity. Additionally, the material’s quick setting time and compatibility with various surfaces have contributed to its widespread adoption. As construction projects continue to emphasize cost-effective and durable building materials, the Tiling & Flooring segment is expected to maintain its market position through 2025.

Key Market Segments

By Product

- Acrylic Polymer Plaster

- Silicone Polymer Plaster

- Polyurethane Polymer Plaster

- Vinyl Polymer Plaster

- Epoxy Polymer Plaster

By Application

- Tiling & Flooring

- Mortar & Cement

- Plastering & Gypsum

- Insulation System

- Others

Drivers

Government-Led Green Building Initiatives Driving Polymer Plaster Market Growth

One of the major driving factors for the polymer plaster market is the increasing emphasis on sustainable construction practices, propelled by government initiatives worldwide. Governments are actively promoting the use of eco-friendly and energy-efficient building materials to reduce carbon footprints and enhance building performance. Polymer plasters, known for their durability, thermal insulation properties, and reduced environmental impact, align well with these sustainability goals.

For instance, the European Union’s Green Deal aims to make Europe climate-neutral by 2050, encouraging the construction industry to adopt sustainable materials and practices. Similarly, India’s Energy Conservation Building Code (ECBC) mandates energy efficiency standards for new commercial buildings, promoting the use of materials that contribute to thermal efficiency. These regulations are creating a favorable environment for the adoption of polymer plasters in construction projects.

In addition to regulatory support, financial incentives and subsidies are being offered to encourage the use of green building materials. For example, the U.S. Department of Energy provides grants and tax incentives for energy-efficient building practices, which include the use of advanced materials like polymer plasters. These incentives lower the cost barriers for builders and developers, making sustainable materials more accessible and attractive.

Restraints

High Initial Costs Limit Polymer Plaster Adoption in Budget-Conscious Markets

One of the major challenges facing the polymer plaster market is its relatively high initial cost compared to traditional plastering materials. While polymer plasters offer benefits like enhanced durability, flexibility, and resistance to environmental factors, their upfront expenses can be prohibitive, especially in regions with budget constraints.

For instance, the production of redispersible polymer powders, a key component in polymer plasters, is energy-intensive, with energy costs accounting for nearly 15% of overall production expenses. This high production cost translates to higher market prices, making polymer plasters less accessible in developing economies.

Moreover, the lack of awareness about the long-term benefits of polymer plasters further exacerbates the issue. In many emerging markets, traditional cement-based plasters remain the default choice due to their lower initial costs and widespread familiarity among builders and contractors. This preference persists despite the higher maintenance and repair costs associated with traditional materials over time.

Government initiatives aimed at promoting sustainable and energy-efficient construction practices could play a pivotal role in mitigating this challenge. By offering subsidies or incentives for the adoption of advanced building materials like polymer plasters, authorities can help offset the initial cost barrier. Additionally, educational campaigns highlighting the long-term cost savings and environmental benefits of polymer plasters can foster greater acceptance among stakeholders.

Opportunity

Rising Demand for Energy-Efficient Buildings Fuels Polymer Plaster Market Growth

One of the significant growth opportunities for the polymer plaster market lies in the increasing global emphasis on energy-efficient and sustainable construction practices. As governments and industries strive to reduce carbon footprints and enhance building performance, materials like polymer plaster, known for their superior insulation properties and durability, are gaining traction.

Government initiatives are playing a pivotal role in this market expansion. For instance, the European Union’s Green Deal aims to make Europe climate-neutral by 2050, encouraging the construction industry to adopt sustainable materials and practices. Similarly, India’s Energy Conservation Building Code (ECBC) mandates energy efficiency standards for new commercial buildings, promoting the use of materials that contribute to thermal efficiency. These regulations are creating a favorable environment for the adoption of polymer plasters in construction projects.

Trends

Eco-Friendly Formulations and Sustainable Construction Drive Polymer Plaster Market Trends

A significant trend shaping the polymer plaster market is the shift towards eco-friendly formulations and sustainable construction practices. As environmental concerns intensify, there’s a growing demand for building materials that minimize ecological impact without compromising performance. Polymer plasters, known for their durability and thermal insulation properties, are being reformulated to incorporate bio-based polymers and recycled materials, aligning with global sustainability goals.

Governments worldwide are implementing policies to promote green building materials. For instance, the European Union’s Green Deal aims to make Europe climate-neutral by 2050, encouraging the construction industry to adopt sustainable materials and practices. Similarly, India’s Energy Conservation Building Code (ECBC) mandates energy efficiency standards for new commercial buildings, promoting the use of materials that contribute to thermal efficiency. These regulations are creating a favorable environment for the adoption of polymer plasters in construction projects.

The market is also witnessing technological advancements that enhance the eco-friendliness of polymer plasters. Innovations such as the incorporation of nanomaterials and the development of low-VOC (volatile organic compounds) formulations are making polymer plasters more sustainable and safer for indoor environments. These advancements not only reduce the environmental footprint but also improve the health and safety aspects of buildings.

Regional Analysis

APAC Dominates Polymer Plaster Market with 45.9% Share, Valued at USD 0.6 Billion

In 2024, the Asia-Pacific (APAC) region emerged as the dominant market for polymer plaster, capturing a substantial 45.9% share and generating approximately USD 0.6 billion in revenue. The region’s dominance can be attributed to rapid urbanization, expanding construction activities, and increasing infrastructure development in countries like China, India, and Japan. China, being the largest construction market globally, continues to drive demand for advanced building materials, including polymer plaster, to meet the rising demand for energy-efficient and durable structures.

India, on the other hand, is witnessing a surge in construction projects, particularly in the commercial and residential sectors, fueled by government initiatives such as the Smart Cities Mission and Pradhan Mantri Awas Yojana. These programs are promoting sustainable building materials, creating lucrative opportunities for polymer plaster manufacturers. Additionally, Japan’s stringent building codes focused on thermal insulation and earthquake-resistant structures further boost the adoption of polymer plaster as a preferred construction material.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ardex Group is a leading global player in the construction materials sector, specializing in high-performance building solutions, including polymer plaster. The company focuses on delivering durable and sustainable products for tiling, flooring, and waterproofing applications. Ardex’s advanced polymer plaster formulations are known for their quick-drying capabilities and superior adhesion, making them ideal for large-scale construction projects. The company’s strong presence in Europe and Asia positions it as a key player in the global polymer plaster market.

BASF SE, a major chemical manufacturer, has a strong footprint in the construction sector through its innovative polymer plaster solutions. The company leverages its expertise in chemical formulations to develop high-performance, environmentally friendly plasters that enhance thermal insulation and structural integrity. BASF’s construction materials division, particularly in Asia-Pacific and Europe, has witnessed substantial growth due to rising demand for sustainable building materials. The firm continues to invest in R&D to expand its polymer plaster product portfolio.

Cementos CAPA specializes in producing high-quality cementitious and polymer-modified plasters, targeting both residential and commercial construction sectors. The company’s products are known for their exceptional bonding strength, water resistance, and quick-setting properties, making them ideal for tiling and flooring applications. With a strong distribution network in Latin America and Europe, Cementos CAPA is capitalizing on the growing demand for durable and cost-effective building materials, positioning itself as a key regional player in the polymer plaster market.

Top Key Players in the Market

- Ardex Group

- BASF SE

- Cementos CAPA

- Drymix S.A.E.

- Fosroc

- Japan Coating Resin Corporation

- LafargeHolcim

- Mapei SpA

- MYK Laticrete

- Quikrete

- Saint-Gobain Weber

- Sika AG

- Wacker Chemie AG

Recent Developments

In 2024, BASF’s commitment to innovation is evident in its €2.1 billion investment in research and development in 2024, with approximately 45% of its 1,159 patent applications focusing on sustainability.

In 2024, Cementos CAPA reinforced its position in the polymer plaster market by expanding its global reach and introducing eco-friendly, high-performance products. As one of Europe’s top ten special mortar manufacturers, CAPA operates advanced facilities in Spain and maintains a distribution network spanning over 80 countries.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Acrylic Polymer Plaster, Silicone Polymer Plaster, Polyurethane Polymer Plaster, Vinyl Polymer Plaster, Epoxy Polymer Plaster), By Application (Tiling and Flooring, Mortar and Cement, Plastering and Gypsum, Insulation System, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ardex Group, BASF SE, Cementos CAPA, Drymix S.A.E., Fosroc, Japan Coating Resin Corporation, LafargeHolcim, Mapei SpA, MYK Laticrete, Quikrete, Saint-Gobain Weber, Sika AG, Wacker Chemie AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ardex Group

- BASF SE

- Cementos CAPA

- Drymix S.A.E.

- Fosroc

- Japan Coating Resin Corporation

- LafargeHolcim

- Mapei SpA

- MYK Laticrete

- Quikrete

- Saint-Gobain Weber

- Sika AG

- Wacker Chemie AG