Global Pelargonic Acid Market Size, Share, And Business Benefits By Source Type (Plant-based, Animal-based), By Grade Type (Technical Grade, Reagent Grade), By Purity Type (Greater than 95%, 90% to 95%), By Application Type (Agrochemicals, Cleaning and Homecare, Personal Care and Cosmetics, Food and Beverage, Pharmaceuticals, Plastics, Paints and Coatings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145961

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

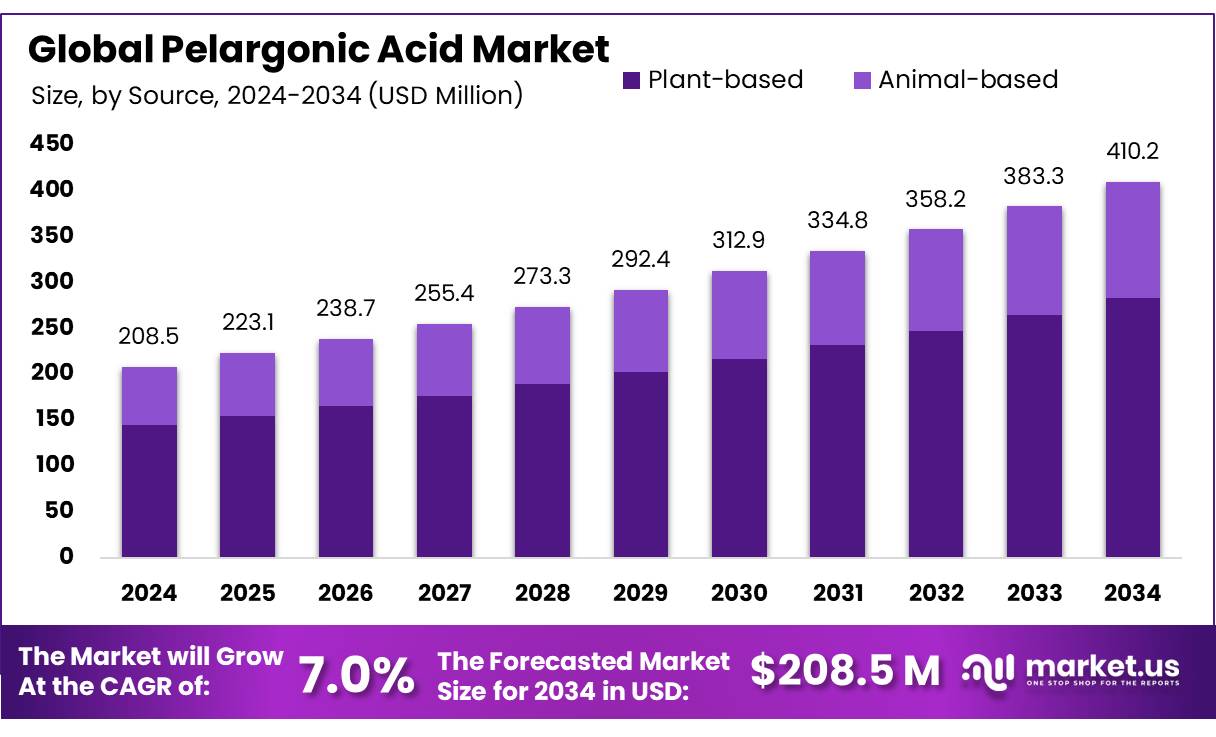

The Global Pelargonic Acid Market size is expected to be worth around USD 410.2 million by 2034, from USD 208.5 million in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034.

The pelargonic acid market has gained significant traction due to its versatile applications across agrochemicals, personal care, food & beverages, and industrial cleaning. Pelargonic acid, a naturally occurring fatty acid (nonanoic acid), is primarily derived from plant and animal sources. Its biodegradability and effectiveness as a herbicide, antimicrobial agent, and flavoring ingredient have positioned it as a preferred choice in multiple industries.

Pelargonic acid is present in many plants. It is used as an herbicide to prevent the growth of weeds both indoors and outdoors and as a blossom thinner for apple and pear trees. The U.S. Food and Drug Administration (FDA) has approved this substance for use in food. No risks to humans or the environment are expected when pesticide products containing pelargonic acid are used according to the label directions.

Pelargonic acid is present in many plants. It is used as an herbicide to prevent the growth of weeds both indoors and outdoors and as a blossom thinner for apple and pear trees. The U.S. Food and Drug Administration (FDA) has approved this substance for use in food. No risks to humans or the environment are expected when pesticide products containing pelargonic acid are used according to the label directions.Pelargonic acid is a chemical substance that is found in almost all species of animals and plants. Because it contains nine carbon atoms, it is also called nonanoic acid. It is found at low levels in many of the common foods we eat. It is readily broken down in the environment. Pelargonic acid occurs naturally in many plants, including food plants, so most people are regularly exposed to small amounts of this chemical.

The use of pelargonic acid as an herbicide or blossom thinner on food crops is not expected to increase human exposure or risk. Furthermore, tests indicate that ingesting or inhaling pelargonic acid in small amounts has no known toxic effects. Pelargonic acid is a skin and eye irritant, and product labels describe precautions that users should follow to prevent the products from getting in their eyes or on their skin.

Key Takeaways

- The global Pelargonic Acid Market is projected to grow from USD 208.5 million in 2024 to USD 410.2 million by 2034, at a 7.0% CAGR.

- Plant-based pelargonic acid holds a 69.20% market share due to rising demand for eco-friendly products in agriculture, food, and personal care.

- Technical-grade pelargonic acid leads with a 75.40% share, favored for cost-effective industrial and agricultural applications.

- Pelargonic acid with >95% purity dominates (74.30% share), preferred for high-performance agrochemicals like herbicides.

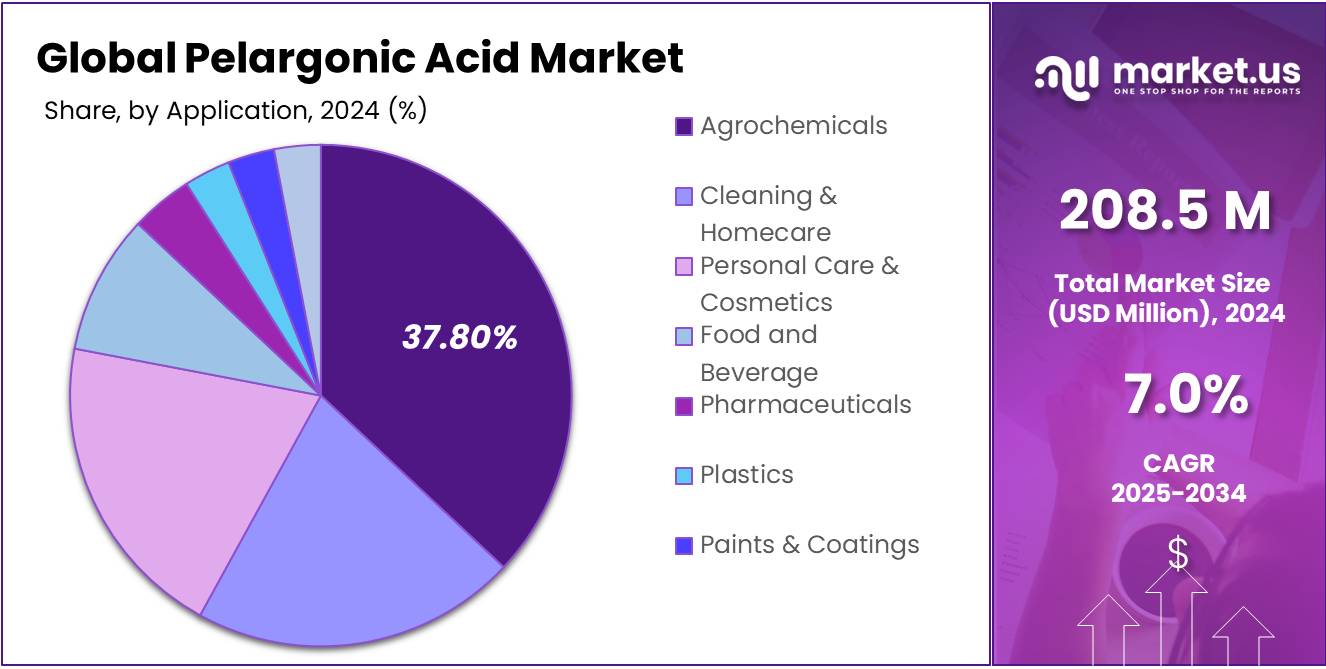

- The agrochemicals sector holds a 37.80% market share, driven by pelargonic acid in organic and sustainable farming.

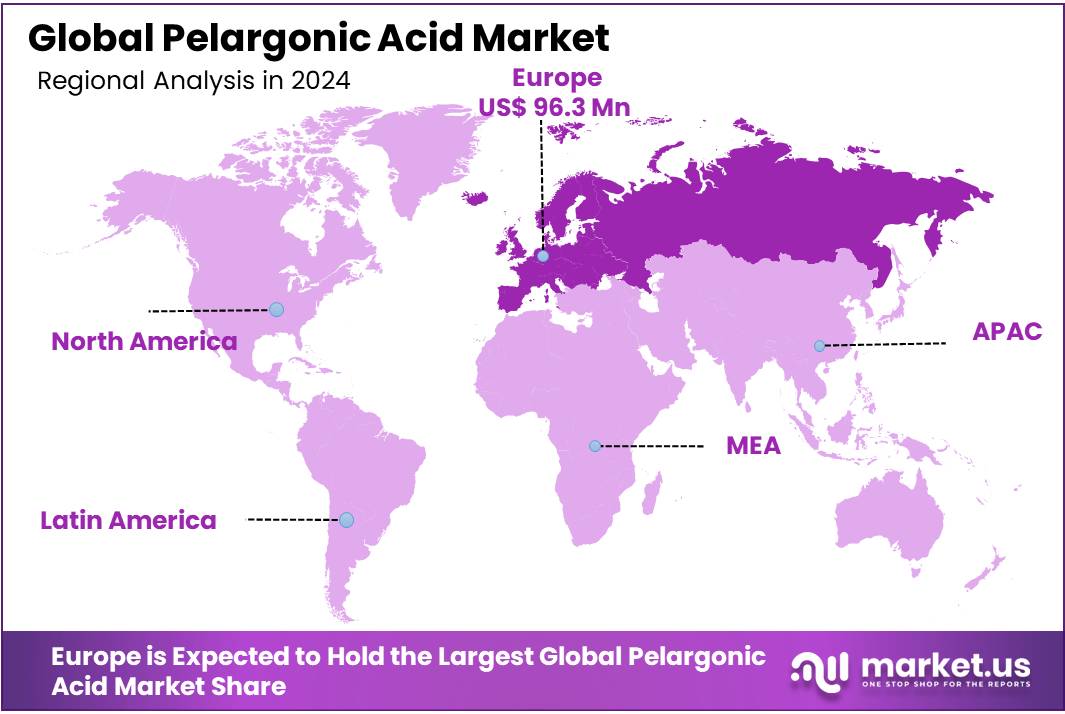

- Europe leads with 46.20% market share (USD 96.3 million), supported by strong demand for bio-based and sustainable products.

By Source Type

Plant-Based Pelargonic Acid held a dominant market position, capturing more than a 69.20% share. This strong lead comes from the rising demand for eco-friendly and sustainable products across industries like agriculture, food, and personal care.

Consumers and manufacturers are increasingly choosing plant-based options over synthetic alternatives due to their lower environmental impact and compliance with strict regulations on chemical use. The shift toward natural ingredients has boosted the adoption of plant-derived pelargonic acid, especially in organic herbicides and bio-based cleaning products.

Compared to other sources, such as animal-based or synthetic pelargonic acid, the plant-based segment benefits from wider acceptance and easier regulatory approvals. As sustainability trends grow, this segment is likely to expand further, reinforcing its position as the preferred choice in the pelargonic acid market.

By Grade Type

Technical-Grade Pelargonic Acid held a dominant market position, capturing more than a 75.40% share. This strong demand comes from its wide use in industrial and agricultural applications, where high efficiency and cost-effectiveness matter more than ultra-purity. Farmers and manufacturers prefer technical-grade pelargonic acid because it works well in herbicides, pesticides, and other agrochemical formulations without needing expensive refinement.

The segment’s growth is also driven by the rising need for weed-control solutions in large-scale farming. Unlike food-grade or pharmaceutical-grade pelargonic acid, technical-grade is more affordable and readily available, making it the top choice for commercial use. Industries like textiles and cleaning products also rely on it for its strong degreasing and antimicrobial properties.

By Purity Type

Greater than 95% purity pelargonic acid dominated the market, holding more than a 74.30% share. This high-purity segment is the go-to choice for industries that need strong, reliable performance—especially in agriculture, where it’s a key ingredient in premium herbicides and desiccants.

Farmers and agrochemical companies prefer it because it works faster and more effectively than lower-purity alternatives, giving better weed control and crop management results. Beyond farming, this high-purity grade is also popular in specialty chemicals, pharmaceuticals, and lab applications where consistency matters.

Since impurities can affect performance in sensitive formulations, manufacturers are willing to pay a bit more for the >95% pure version. Even with slightly higher costs, demand keeps growing because end-users see the value in its efficiency.

By Application Type

The Agrochemicals sector dominated the pelargonic acid market, capturing more than a 37.80% share. This strong position comes from the acid’s widespread use as a natural herbicide and desiccant, especially in organic and sustainable farming. With strict regulations limiting synthetic chemicals, farmers are turning to pelargonic acid-based weed killers because they’re effective, fast-acting, and environmentally friendly.

The demand is particularly high in North America and Europe, where organic farming and eco-conscious policies are growing. Pelargonic acid works by breaking down plant cell membranes, making it a popular choice for pre-harvest crop drying and weed control in fields, orchards, and vineyards. Compared to other applications like personal care or food additives, agrochemicals remain the biggest driver simply because there’s no equally effective natural alternative for weed management.

Key Market Segments

By Source Type

- Plant-based

- Animal-based

By Grade Type

- Technical Grade

- Reagent Grade

By Purity Type

- Greater than 95%

- 90% to 95%

By Application Type

- Agrochemicals

- Cleaning and Homecare

- Personal Care and Cosmetics

- Food and Beverage

- Pharmaceuticals

- Plastics

- Paints and Coatings

- Others

Drivers

Rising Demand for Bio-based Herbicides Drives Pelargonic Acid Growth

One of the key driving forces behind the growing demand for pelargonic acid is its increasing adoption in bio-based herbicide formulations, especially as agriculture transitions toward sustainable practices. Pelargonic acid, a naturally occurring fatty acid, has gained popularity as a non-selective, contact herbicide. It offers rapid weed control without leaving long-term residues in the soil, making it ideal for organic farming.

According to BASF, a global chemical company involved in bio-based crop protection products, their investment in research for pelargonic acid-based solutions has intensified in recent years. BASF’s report on sustainability in agriculture emphasizes support in environmental impact from crop protection.

Pelargonic acid is also supported under the European Chemicals Agency (ECHA) regulations, which classify it as low toxicity and approved for use under biopesticide frameworks. This regulatory backing gives producers confidence to invest further in pelargonic acid-based products.

Restraints

High Production Costs Limit Widespread Use of Pelargonic Acid

One major restraint in the pelargonic acid market is its high production cost, which often limits its use compared to synthetic alternatives. While pelargonic acid is favored for being bio-based and environmentally friendly, the expense involved in producing it at scale makes it less attractive for large-scale agricultural operations, especially in developing countries.

Pelargonic acid is mainly produced through the oxidation of oleic acid, a process that requires significant energy input and specialized catalytic systems. The European Commission has acknowledged this challenge in its circular economy reports, stating that bio-based chemicals face cost disadvantages due to less mature technologies and economies of scale.

The FAO (Food and Agriculture Organization) notes that economic constraints in rural agricultural communities remain a barrier to adopting eco-friendly crop protection solutions. Unless policy support or subsidies are increased, the higher upfront cost of pelargonic acid could prevent its broad-scale implementation.

Opportunity

Regulatory Support for Eco-Friendly Herbicides Boosts Pelargonic Acid Demand

A major growth factor for pelargonic acid is the increasing regulatory support for eco-friendly herbicides from governments and environmental bodies across the world. With mounting concerns over soil degradation, water contamination, and health hazards caused by synthetic herbicides like glyphosate, authorities are now turning toward safer, biodegradable alternatives, giving pelargonic acid a strong edge.

In the European Union, the European Chemicals Agency (ECHA) has approved pelargonic acid for use under its Biocidal Products Regulation (BPR) framework. It is categorized as a low-risk active substance, making it suitable for use in both residential and agricultural settings. This regulatory green light encourages more manufacturers to develop pelargonic acid-based products.

In the U.S., the Environmental Protection Agency (EPA) has registered pelargonic acid as a biopesticide, classifying it under “reduced risk” herbicide categories. This simplifies the approval process for new formulations and reduces the compliance burden for manufacturers.

Trends

Shift Toward Organic Home Gardening Fuels Pelargonic Acid Adoption

An emerging factor driving the use of pelargonic acid is the growing popularity of organic home gardening and lawn care, particularly in urban and suburban households. As more people become conscious of the chemicals they use around their homes, there’s a noticeable shift toward natural herbicide alternatives, with pelargonic acid gaining attention for its safety and effectiveness.

In the U.S., the National Gardening Association reported that American households engaged in some form of gardening. Among these, a large portion preferred organic methods. Pelargonic acid, which acts quickly on weeds and breaks them down rapidly without harming the soil or groundwater, fits this growing demand. It’s already being used in ready-to-use spray bottles sold for home use, offering consumers a reliable and eco-friendly choice.

Government agencies are also encouraging safe yard care. The U.S. Environmental Protection Agency (EPA) promotes the Safer Choice program, which guides consumers to products with ingredients that meet high safety standards. Pelargonic acid qualifies under many of these criteria due to its low toxicity and biodegradability.

Regional Analysis

Europe Leads Global Pelargonic Acid Market with 46.20% Share

Europe dominates the global pelargonic acid market, commanding a substantial 46.20% share, with a market value of USD 96.3 million. This leadership is driven by robust demand across agriculture, cosmetics, and industrial sectors, fueled by the region’s strong emphasis on sustainable and bio-based products.

The European Union’s stringent regulations on chemical usage have accelerated the adoption of pelargonic acid as a biodegradable herbicide, particularly in organic farming, where it serves as an eco-friendly alternative to synthetic pesticides. Countries like Germany, France, and the Netherlands are key contributors, with Germany alone accounting for approximately of the regional market due to its advanced agricultural practices and chemical manufacturing base.

The cosmetics sector also plays a significant role, with pelargonic acid’s use in skin and hair care products gaining traction amid rising consumer preference for natural ingredients. Industrial applications, such as lubricants and detergents, are expanding, supported by innovations from major players like Croda International and OQ Chemicals.

The Nordic countries are also emerging as high-growth markets due to their strong focus on sustainable agriculture. Europe’s robust distribution network of agrochemical suppliers and the presence of key manufacturers like BASF and Evonik further solidify its leading position in the pelargonic acid market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- BASF SE is a leading global chemical company actively engaged in bio-based solutions, including pelargonic acid. With a focus on sustainable agriculture, BASF has integrated pelargonic acid into its eco-friendly herbicide product line. BASF’s strong distribution network across Europe and North America further strengthens its presence in the pelargonic acid market, driving adoption in both commercial farming and home gardening sectors.

- Fengchen Group Co. Ltd, based in China, is a prominent supplier of high-purity pelargonic acid used in pharmaceuticals and agrochemicals. The company focuses on supplying cost-effective, quality-certified ingredients to global clients. Fengchen has expanded its exports across Asia, Europe, and North America, catering to the rising demand for natural and biodegradable herbicides.

- Emery Oleochemicals, headquartered in Malaysia, is a major player in the pelargonic acid segment, focusing on bio-based oleochemicals. The company utilizes advanced green chemistry processes to produce high-performance fatty acids, including C9 pelargonic acid. Emery serves sectors such as agriculture, industrial cleaning, and personal care.

Top Key Players in the Market

- BASF SE

- Fengchen Group Co. Ltd

- Emery Oleochemicals

- Matrìca S.p.A.

- Croda Sipo (Sichuan) Co. Ltd.

- Cayman Chemical

- Merck KGaA

- PRODASYNTH

- BERJÉ INC

- Ernesto Ventós S.A.

- Spectrum Chemical Mfg. Corp.

- OQ Chemicals GmbH

Recent Developments

- In 2024, BASF, a global leader in chemical production, has been active in the pelargonic acid sector, particularly through its focus on sustainable agricultural solutions. In recent years, BASF has emphasized bio-based herbicides to meet regulatory demands for eco-friendly products in Europe.

- In 2024, Fengchen Group, a Chinese chemical supplier, produced pelargonic acid primarily for industrial and agricultural applications. Recent developments are scarce on government or company websites, but Fengchen’s product catalog lists pelargonic acid with expanded grades for cosmetics and lubricants, indicating minor portfolio diversification.

Report Scope

Report Features Description Market Value (2024) USD 208.5 Million Forecast Revenue (2034) USD 410.2 Million CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source Type (Plant-based, Animal-based), By Grade Type (Technical Grade, Reagent Grade), By Purity Type (Greater than 95%, 90% to 95%), By Application Type (Agrochemicals, Cleaning and Homecare, Personal Care and Cosmetics, Food and Beverage, Pharmaceuticals, Plastics, Paints and Coatings, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Fengchen Group Co. Ltd, Emery Oleochemicals, Matrìca S.p.A., Croda Sipo (Sichuan) Co. Ltd., Cayman Chemical, Merck KGaA, Prodasynth, Berjé Inc, Ernesto Ventós S.A., Spectrum Chemical Mfg. Corp., OQ Chemicals GmbH, Kunshan Odowell CO. LTD Customization Scope Customization for segments at, regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF SE

- Fengchen Group Co. Ltd

- Emery Oleochemicals

- Matrìca S.p.A.

- Croda Sipo (Sichuan) Co. Ltd.

- Cayman Chemical

- Merck KGaA

- PRODASYNTH

- BERJÉ INC

- Ernesto Ventós S.A.

- Spectrum Chemical Mfg. Corp.

- OQ Chemicals GmbH