Global Liquid Nitrogen Market Size, Share, And Business Benefits By Production Process (Cryogenic Distillation, Pressure Swing Adsorption), By Storage Type (Tonnage, Cylinders and Packaged Gas, Merchant Liquid/ Bulk, Others), By Application (Coolant, Refrigerant), By End-use (Chemicals and Pharmaceuticals, Healthcare, Food and Beverages, Metal Manufacturing and Construction, Rubber and Plastic, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145878

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

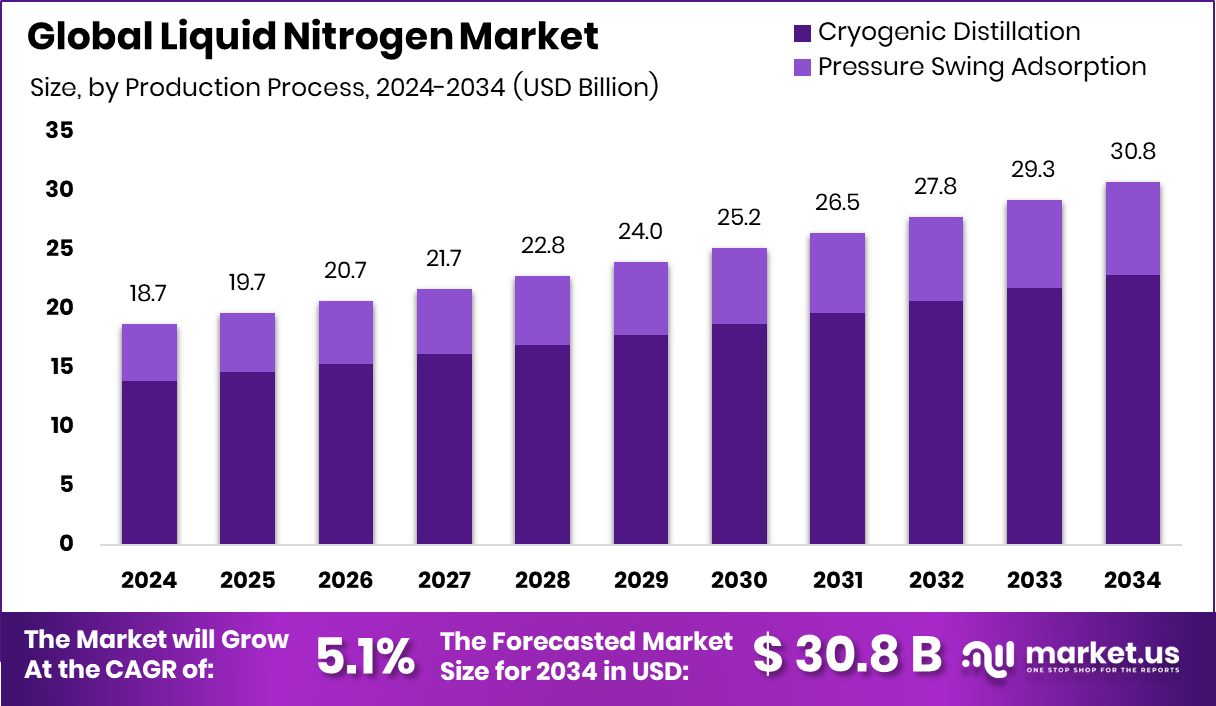

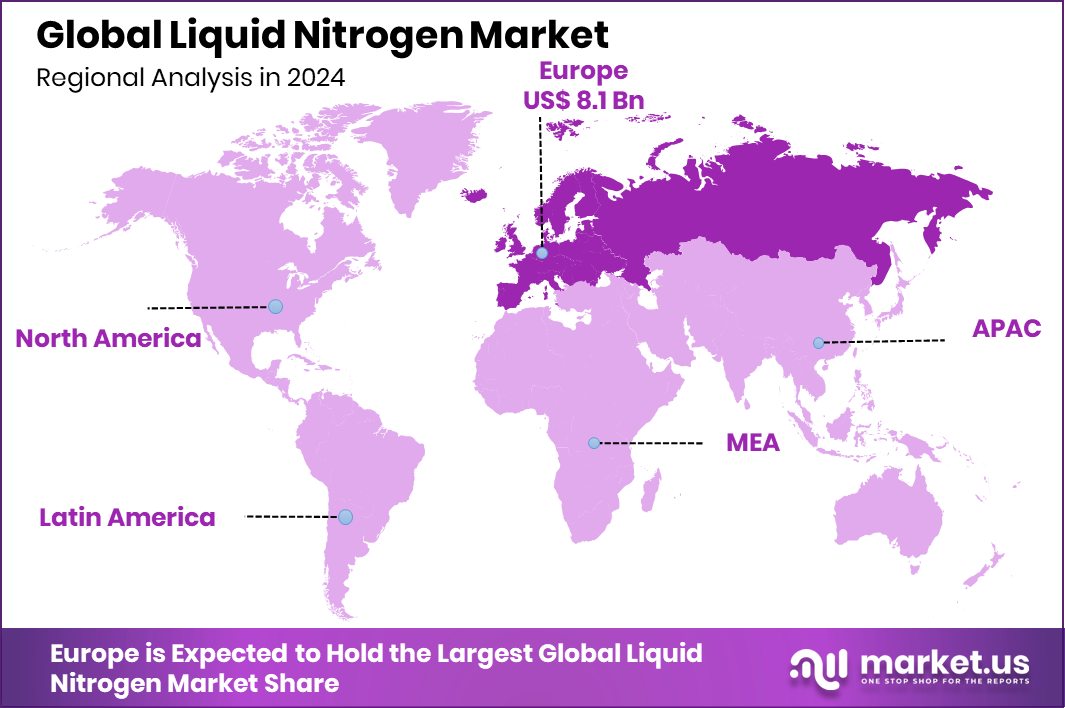

The Global Liquid Nitrogen Market is expected to be worth around USD 30.8 billion by 2034, up from USD 18.7 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034. With USD 8.1 billion, Europe leads the global liquid nitrogen consumption rate.

Liquid nitrogen is a colorless, odorless cryogenic liquid that is extremely cold, with a boiling point of – 196°C. It is produced through the fractional distillation of liquid air and is widely used in various industries due to its cooling and freezing capabilities. Its ability to rapidly lower temperatures makes it ideal for applications ranging from medical preservation and cryosurgery to food processing, electronics, and scientific research.

The liquid nitrogen market is primarily driven by its growing use in medical and healthcare applications. It is commonly used for the cryopreservation of biological samples, vaccines and in dermatological treatments. The rising demand for advanced medical technologies and the expanding pharmaceutical industry contribute to steady market growth. In addition, hospitals and diagnostic centers increasingly rely on cryogenic solutions, further pushing the demand for liquid nitrogen.

Growth in the food and beverage industry is another significant factor. Liquid nitrogen is used in flash freezing and food packaging to preserve freshness and extend shelf life. With increasing consumer demand for frozen and ready-to-eat foods, especially in urban areas, the requirement for liquid nitrogen continues to grow, creating consistent market momentum.

Opportunities also lie in industrial manufacturing and electronics, where liquid nitrogen is used to cool and shrink-fit mechanical parts. As high-precision industries expand, especially in developing economies, liquid nitrogen’s role as a cooling agent will become even more critical. This presents a promising outlook for market expansion across new sectors and geographies.

Key Takeaways

- The Global Liquid Nitrogen Market is expected to be worth around USD 30.8 billion by 2034, up from USD 18.7 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034.

- Cryogenic distillation dominates the liquid nitrogen market, accounting for 74.40% due to high purity yields.

- Tonnage storage systems lead with 43.40%, meeting rising demand in industrial-scale liquid nitrogen applications.

- Liquid nitrogen’s coolant application dominates the market, representing 67.30% due to thermal control demand.

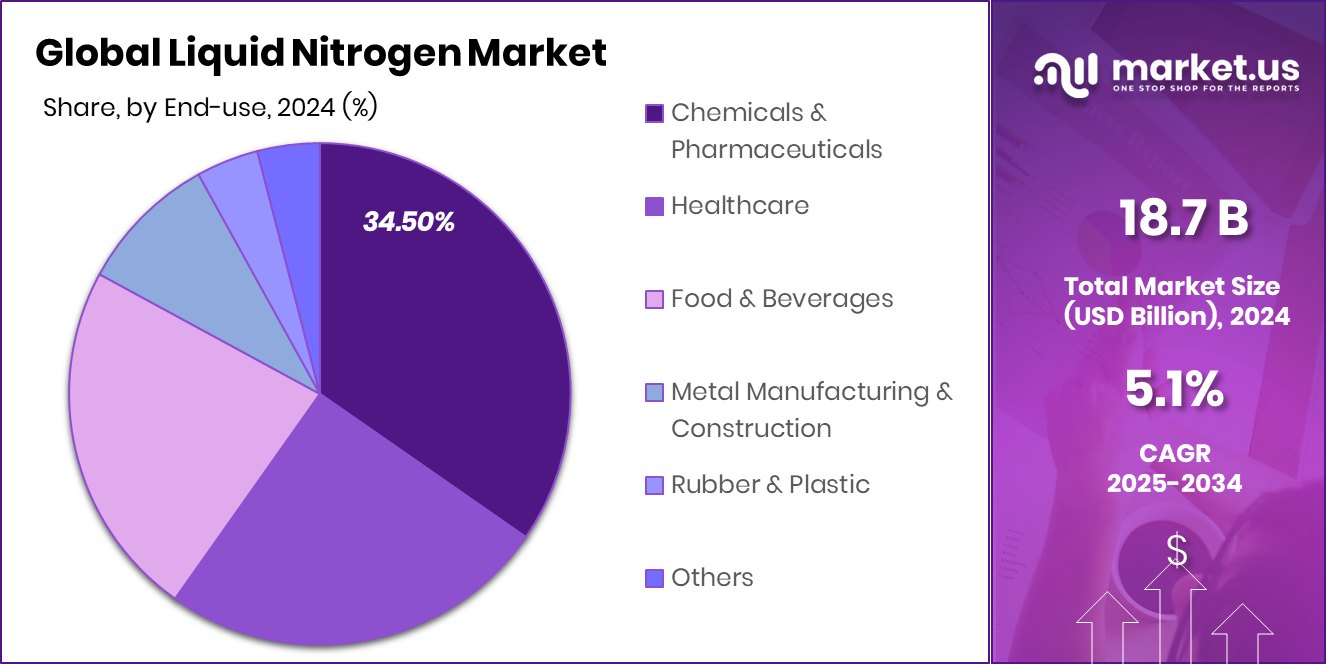

- Chemicals and pharmaceuticals represent 34.50% end-use share, driving steady growth in the liquid nitrogen market.

- The market in Europe is valued at USD 8.1 billion in 2024.

By Production Process Analysis

Cryogenic distillation dominates Liquid Nitrogen production with a 74.40% market share.

In 2024, Cryogenic Distillation held a dominant market position in the By-Production-Process segment of the Liquid Nitrogen Market, with a 74.40% share. This method remains the most widely used due to its high efficiency and capability to produce large volumes of highly pure liquid nitrogen.

Industrial gas companies continue to prefer cryogenic distillation, especially in sectors like electronics, healthcare, and food processing, where purity standards are non-negotiable. The method’s scalability also supports growing demand across multiple geographies, especially in developed economies with established industrial infrastructure.

Moreover, cryogenic distillation plants are increasingly being integrated with air separation units (ASUs), making them more energy-efficient and cost-effective in large-scale operations. Regions such as North America and Europe have seen a surge in demand for liquid nitrogen in metal fabrication, healthcare (for cryotherapy), and chemical processing, further reinforcing the dominance of this process.

While alternative production methods like pressure swing adsorption or membrane separation are gaining attention in niche applications, their market penetration remains limited due to cost, scale, and purity constraints.

By Storage Type Analysis

Tonnage storage leads Liquid Nitrogen demand with a 43.40% global share.

In 2024, Tonnage held a dominant market position in the By Storage Type segment of the Liquid Nitrogen Market, with a 43.40% share. This large share is mainly driven by high-volume end-use industries, such as chemicals, metallurgy, and energy, that require bulk storage and continuous supply.

Tonnage systems are typically installed on-site and connected directly to production facilities, enabling uninterrupted operations and reducing the need for frequent transportation or refilling. The reliability and efficiency of tonnage storage make it the preferred choice for industries where liquid nitrogen is used around the clock.

Industries such as steel manufacturing, electronics, and pharmaceuticals have shown consistent demand for tonnage systems due to their cost-effectiveness in large-scale usage. The integration of automated monitoring and control systems in modern tonnage setups has further improved operational safety and reduced wastage.

Moreover, growing adoption in emerging economies, particularly in the Asia Pacific, where industrial activity is expanding rapidly, has contributed to the segment’s strong position. Compared to smaller storage options like cylinders and microbulk systems, tonnage installations provide better economies of scale, especially in centralized production facilities.

By Application Analysis

Liquid Nitrogen is widely used as a coolant, holding a 67.30% share.

In 2024, Coolant held a dominant market position in the By Application segment of the Liquid Nitrogen Market, with a 67.30% share. The widespread use of liquid nitrogen as a coolant across various industries has firmly positioned it as the leading application.

Its ability to achieve extremely low temperatures quickly makes it ideal for thermal management in electronics manufacturing, metal processing, food preservation, and healthcare equipment. The food industry, in particular, has significantly contributed to this dominance due to the growing adoption of cryogenic freezing to enhance shelf life and preserve nutritional quality.

In the healthcare sector, liquid nitrogen is commonly used in cryosurgery and biological sample storage, further driving demand. The electronics sector also relies on its cooling properties for chip manufacturing and superconductor applications. The high efficiency, non-flammable nature, and inert characteristics of liquid nitrogen make it a reliable and safe coolant, especially in sensitive environments.

Additionally, the rise of advanced technologies requiring precise temperature control has fueled demand for liquid nitrogen cooling systems globally. With industrial operations expanding and requiring more robust cooling solutions, the coolant segment is expected to retain its leading role, supported by both technological integration and increased consumption across diverse verticals.

By End-use Analysis

Chemical and pharmaceutical industries use 34.50% of Liquid Nitrogen output.

In 2024, Chemicals and Pharmaceuticals held a dominant market position in the By End-use segment of the Liquid Nitrogen Market, with a 34.50% share. This leadership is primarily attributed to the critical role liquid nitrogen plays in chemical synthesis, reaction control, and pharmaceutical preservation processes.

In the chemical industry, it is widely used for temperature-sensitive reactions, cryogenic grinding, and inerting volatile compounds to ensure operational safety. In pharmaceuticals, liquid nitrogen is indispensable for preserving biological samples, vaccines, and active pharmaceutical ingredients (APIs), especially under stringent storage regulations.

The demand surged further with the growth in biotechnology and research labs, where maintaining extremely low temperatures is vital for handling cell cultures and genetic materials. As the pharmaceutical industry continues to expand, especially with increased production of biologics and temperature-sensitive medications, the need for liquid nitrogen-based systems has grown significantly.

Moreover, the global push for advanced drug discovery and vaccine development has created additional demand for reliable cryopreservation techniques. The chemical sector’s focus on efficient and safe production processes also supports the continuous use of liquid nitrogen.

Key Market Segments

By Production Process

- Cryogenic Distillation

- Pressure Swing Adsorption

By Storage Type

- Tonnage

- Cylinders and Packaged Gas

- Merchant Liquid/ Bulk

- Others

By Application

- Coolant

- Refrigerant

By End-use

- Chemicals and Pharmaceuticals

- Healthcare

- Food and Beverages

- Metal Manufacturing and Construction

- Rubber and Plastic

- Others

Driving Factors

Rising Demand in Healthcare and Food Sector

One of the biggest driving factors for the Liquid Nitrogen Market is the growing demand in the healthcare and food industries. In healthcare, liquid nitrogen is widely used for cryopreservation, cryosurgery, and storage of biological samples like blood, vaccines, and tissues. Its ability to reach extremely low temperatures makes it ideal for these sensitive uses.

Meanwhile, in the food sector, it helps with flash-freezing, which keeps food fresh and safe during long storage or transport. As global populations grow and focus more on health and food safety, industries are using more liquid nitrogen to meet those needs. This demand is expected to keep rising, helping push the market forward in the coming years.

Restraining Factors

High Production and Storage Costs Limit Growth

One major factor holding back the growth of the Liquid Nitrogen Market is the high cost of production and storage. Creating liquid nitrogen requires a lot of energy, especially during the cryogenic distillation process.

This makes it expensive to produce, particularly in regions where energy prices are high. Additionally, storing and transporting liquid nitrogen safely involves specialized insulated tanks and handling systems to keep it at extremely low temperatures.

These systems are costly to set up and maintain. Smaller businesses, especially in developing countries, often find it difficult to afford these expenses. As a result, despite the strong demand, the high costs involved act as a barrier to wider adoption and slow down market expansion.

Growth Opportunity

Expansion in Emerging Markets Boosts Demand

A major growth opportunity for the Liquid Nitrogen Market lies in the rapid industrial expansion across emerging markets. Countries in Asia-Pacific, Latin America, and parts of Africa are seeing strong growth in sectors like food processing, healthcare, electronics, and chemicals.

These industries increasingly require liquid nitrogen for cooling, freezing, and storage purposes. As infrastructure improves and industrialization picks up pace, demand for reliable and efficient cooling solutions is rising fast.

Additionally, governments in these regions are investing in the medical and pharmaceutical sectors, which depend heavily on cryogenic technologies. With growing awareness, better logistics, and more accessible technology, these developing economies are expected to drive future market growth and create long-term opportunities for liquid nitrogen suppliers globally.

Latest Trends

Integration of Liquid Nitrogen in Semiconductor Manufacturing

A significant trend in the liquid nitrogen market is its increasing integration into semiconductor manufacturing processes. As semiconductor devices become more compact and powerful, they generate substantial heat during operation. Liquid nitrogen, with its extremely low boiling point of -196°C, is employed to cool these devices efficiently, ensuring optimal performance and longevity.

In the production of semiconductors, maintaining a controlled environment is crucial. Liquid nitrogen is used to purge contaminants and moisture from manufacturing chambers, creating an inert atmosphere that prevents oxidation and other unwanted reactions. This application is vital for achieving the high purity levels required in semiconductor fabrication.

Furthermore, the rise of advanced technologies such as artificial intelligence, 5G, and the Internet of Things (IoT) has led to increased demand for high-performance semiconductors. This surge necessitates enhanced cooling solutions, positioning liquid nitrogen as an essential component in the semiconductor industry’s growth.

Regional Analysis

Europe holds a dominant 43.60% share in the liquid nitrogen market value.

In 2024, Europe dominated the global liquid nitrogen market with a significant share of 43.60%, valued at USD 8.1 billion. Europe’s leading position is driven by the robust demand from the healthcare and food industries, with applications in cryopreservation and food freezing being particularly prominent.

North America also showcased substantial market activities, driven by advancements in the pharmaceutical sector and growing industrial uses, including metal manufacturing and chemical processing. In the Asia Pacific region, liquid nitrogen demand continues to rise significantly, driven by expanding industrialization, particularly in China and India, where rapid growth in electronics manufacturing and healthcare sectors is notable.

The Middle East & Africa market, though smaller in comparison, displays steady growth, driven by increasing adoption in the oil and gas sector for pipeline purging and maintenance applications. Latin America exhibits gradual market development, primarily influenced by the food processing and agricultural sectors, where liquid nitrogen is increasingly used in food preservation and transportation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Air Products and Chemicals, Inc. maintained a strong position in the global liquid nitrogen market by capitalizing on its extensive production infrastructure and strategic supply chain. The company continued to expand its onsite and merchant gas offerings, especially for food freezing, metal processing, and semiconductor manufacturing. With robust investment in cryogenic technologies and a focus on energy-efficient plants, Air Products solidified its leadership in both developed and emerging markets.

Linde plc demonstrated a commanding influence through its widespread global presence and technological expertise in cryogenic and low-temperature applications. The company’s focus on innovation in healthcare-related liquid nitrogen usage—such as cryopreservation and medical sample storage—helped it capture a sizable market share. In 2024, Linde’s integration of digital monitoring systems and automation in its gas supply chain enabled better cost efficiency and delivery responsiveness, boosting its competitiveness across Europe, North America, and Asia.

Nexair LLC played a significant role in the U.S. regional market, especially in the southeastern states, by offering customized gas solutions to healthcare, food, and industrial clients. Though smaller in scale compared to global giants, Nexair’s strength lies in its customer-focused distribution strategy and agile supply chain. In 2024, the company enhanced its distribution networks and focused on niche markets like small medical clinics and local food processors, reinforcing its regional leadership.

Top Key Players in the Market

- Air Products and Chemicals, Inc.

- Linde plc

- Nexair LLC

- Praxair Inc.

- Matheson Tri-Gas, Inc.

- Gulf Cryo

- Southern Industrial Gas Berhad

- Messer Group

- Nippon Sanso Holdings Corporation

- Bluefors Oy

- AOC México

- Air Liquide S.A.

- CalOx Inc.

- Norco Inc.

- Dakota Gasification Company

- Other Key Players

Recent Developments

- In September 2024, Air Products completed the sale of its liquefied natural gas (LNG) process technology and equipment business to Honeywell for $1.81 billion. This strategic move allows Air Products to focus more on its core industrial gases, including liquid nitrogen and clean hydrogen initiatives.

- In January 2023, Linde Gas & Equipment Inc., a subsidiary of Linde plc, completed the acquisition of the remaining 77.2% stake in NexAir LLC, making it a wholly owned subsidiary. Before this, Linde held a minority interest in NexAir since 2012. This move strengthened Linde’s packaged gas business and expanded its footprint in the southeastern United States.

Report Scope

Report Features Description Market Value (2024) USD 18.7 Billion Forecast Revenue (2034) USD 30.8 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Production Process (Cryogenic Distillation, Pressure Swing Adsorption), By Storage Type (Tonnage, Cylinders and Packaged Gas, Merchant Liquid/ Bulk, Others), By Application (Coolant, Refrigerant), By End-use (Chemicals and Pharmaceuticals, Healthcare, Food and Beverages, Metal Manufacturing and Construction, Rubber and Plastic, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Products and Chemicals, Inc., Linde plc, Nexair LLC, Praxair Inc., Matheson Tri-Gas, Inc., Gulf Cryo, Southern Industrial Gas Berhad, Messer Group, Nippon Sanso Holdings Corporation, Bluefors Oy, AOC México, Air Liquide S.A., CalOx Inc., Norco Inc., Dakota Gasification Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Products and Chemicals, Inc.

- Linde plc

- Nexair LLC

- Praxair Inc.

- Matheson Tri-Gas, Inc.

- Gulf Cryo

- Southern Industrial Gas Berhad

- Messer Group

- Nippon Sanso Holdings Corporation

- Bluefors Oy

- AOC México

- Air Liquide S.A.

- CalOx Inc.

- Norco Inc.

- Dakota Gasification Company

- Other Key Players