Global 1,3-butylene Glycol (CAS 107-88-0) Market By Purity (Purity Greater than or Equal to 99%, Purity Greater than or Equal to98%), By Function (Flavoring Agent, Antioxidant, Intermediate in Chemical Synthesis, Preservative, Others), By Application (Pharmaceutical Intermediates, Flavors and Fragrances, Others), By Distribution Channel (Online Sales, Offline Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140489

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

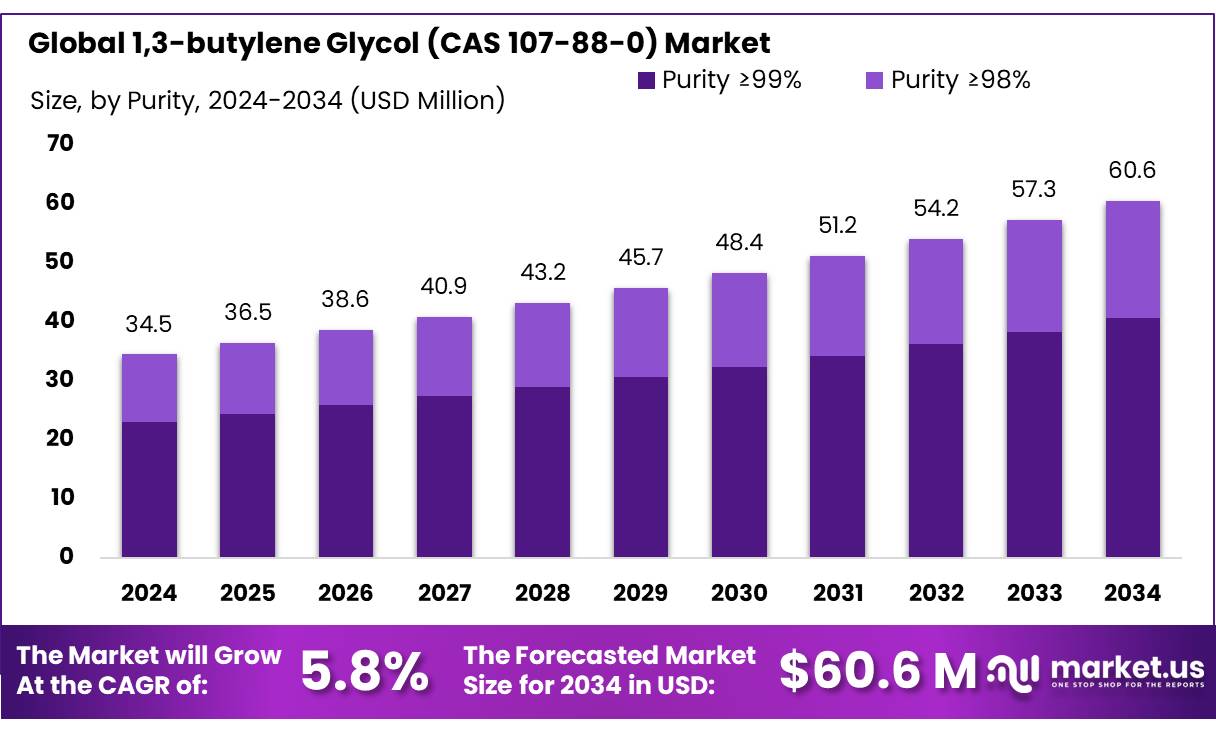

The Global 1,3-butylene Glycol (CAS 107-88-0) Market size is expected to be worth around USD 60.6 Mn by 2034, from USD 34.5 Mn in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

1,3-Butylene glycol (CAS 107-88-0) is a clear, colorless, and odorless liquid widely used as a solvent, plasticizer, and humectant in various industrial applications, including personal care, pharmaceuticals, and food products. Its chemical structure, a diol, makes it a versatile ingredient, valued for its hygroscopic nature and ability to retain moisture. Over recent years, the market for 1,3-butylene glycol has witnessed steady growth, driven by increasing demand in the cosmetics and personal care sectors, as well as its expanding applications in the pharmaceutical and food industries.

In the food and beverage industry, 1,3-butylene glycol finds application as a stabilizer, humectant, and flavor enhancer. It is commonly used in low-calorie foods, bakery items, and beverages, contributing to the growing demand for sugar substitutes and low-sugar alternatives. As the global trend towards healthier diets and functional foods continues to rise, the demand for 1,3-butylene glycol is expected to increase further.

Driving factors for the 1,3-butylene glycol market include the rapid growth of the global cosmetics and personal care industry, where it is used in products such as skin creams, hair conditioners, and deodorants due to its moisturizing and stabilizing properties. Additionally, the expanding pharmaceutical sector, where the compound serves as a solvent and stabilizing agent for oral and injectable formulations, continues to fuel demand. Increasing awareness of the importance of skin hydration and the growing trend of clean-label, non-toxic formulations have spurred the use of 1,3-butylene glycol in these markets.

Future growth opportunities for the 1,3-butylene glycol market lie in the increasing shift toward bio-based and sustainable products. This growth is driven by a combination of innovations in production technology, increasing demand for natural ingredients, and evolving consumer preferences for environmentally friendly solutions. Additionally, the expansion of end-use industries in emerging economies, particularly in Asia-Pacific, will further bolster demand for this versatile chemical.

Key Takeaways

- 1,3-butylene glycol (CAS 107-88-0) is projected to grow from USD 34.5 million in 2024 to USD 60.6 million by 2034.

- This growth reflects a (CAGR) of 5.8% from 2025 to 2034.

- In 2024, Purity ≥99% captured more than a 67.5% share of the 1,3-butylene glycol market.

- Intermediate in Chemical Synthesis held a 38.2% market share in 2024.

- Pharmaceutical Intermediates accounted for over 47.2% of the market in 2024.

- Offline sales dominated the distribution channels with a 78.3% share in 2024.

- The Asia Pacific region held approximately 36.8% of the global market share in 2024.

By Purity

In 2024, Purity ≥99% held a dominant market position, capturing more than a 67.5% share of the 1,3-butylene glycol market. This high-purity segment is widely used in applications requiring precise formulations, such as in the cosmetic, pharmaceutical, and chemical industries, where stringent purity levels are a key requirement. The strong demand in these sectors has driven the growth of Purity ≥99%, with a notable rise in its consumption year on year.

As the demand for high-quality ingredients in personal care and healthcare products continues to rise, the Purity ≥99% segment is expected to remain dominant in 2025. This trend is supported by ongoing developments in the chemical manufacturing process, allowing for the consistent production of 1,3-butylene glycol with higher purity levels. Furthermore, regulatory pressure for cleaner, safer, and more effective raw materials in various industries is likely to continue fueling the market share of Purity ≥99%.

By Function

In 2024, Intermediate in Chemical Synthesis held a dominant market position, capturing more than a 38.2% share of the 1,3-butylene glycol market. This segment is crucial for the production of various chemicals, including plasticizers, resins, and solvents, where 1,3-butylene glycol serves as a key building block. The versatility of 1,3-butylene glycol in chemical synthesis processes has driven its widespread adoption in industries ranging from automotive to construction, contributing significantly to the overall market share.

The demand for 1,3-butylene glycol as an intermediate in chemical synthesis is expected to remain strong. The growing need for sustainable and more efficient chemical processes, alongside an increasing focus on eco-friendly products, will likely continue to boost its use in manufacturing processes. The segment is anticipated to retain its dominant position, with a steady rise in applications across various industrial sectors, further solidifying its role as a critical intermediate in chemical production.

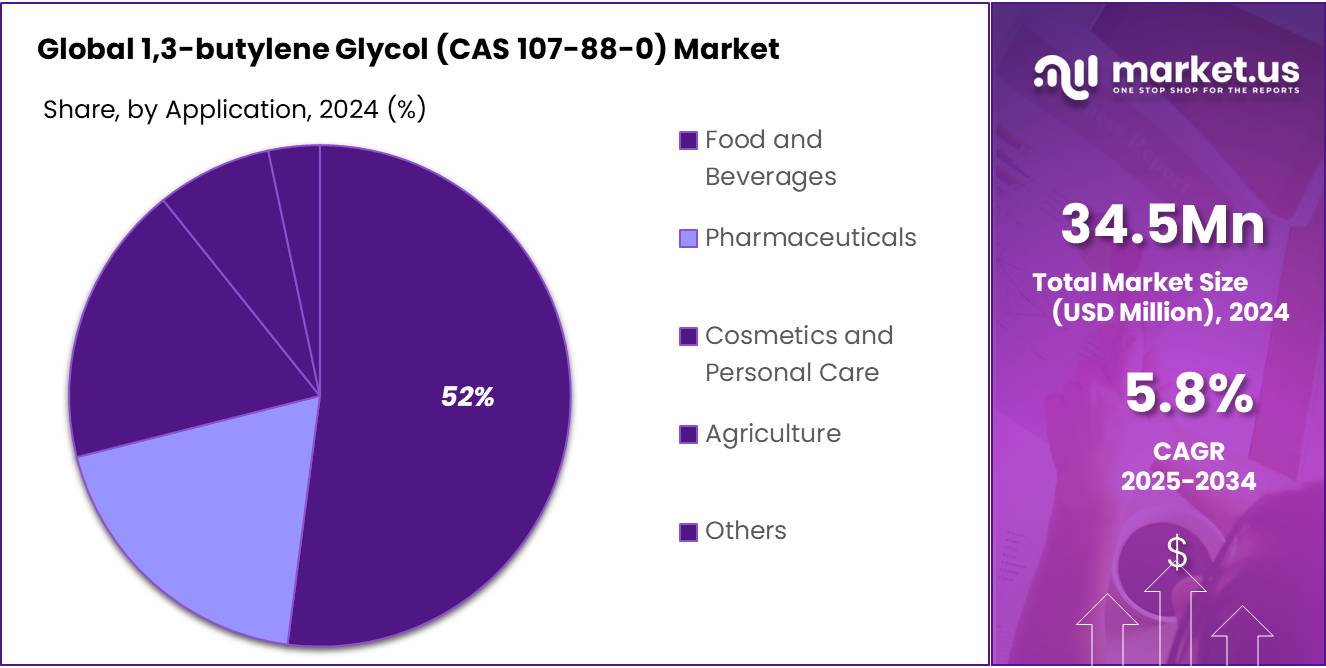

By Application

In 2024, Pharmaceutical Intermediates held a dominant market position, capturing more than a 47.2% share of the 1,3-butylene glycol market. This segment is driven by the critical role 1,3-butylene glycol plays in the synthesis of various pharmaceutical products, including active pharmaceutical ingredients (APIs) and excipients. Its use in drug formulations ensures the stability, efficacy, and safety of medicines, making it a vital component in the pharmaceutical industry.

The pharmaceutical sector is expected to continue relying heavily on 1,3-butylene glycol for the development of new drugs and treatments, especially as the demand for more sophisticated and targeted therapies increases. The segment’s strong growth is further supported by increasing regulatory requirements for high-quality pharmaceutical products, which boosts the need for high-purity intermediates.

By Distribution Channel

In 2024, Offline Sales held a dominant market position, capturing more than a 78.3% share of the 1,3-butylene glycol market. This strong presence can be attributed to the traditional supply chain structure, where manufacturers and distributors rely on physical distribution channels to reach industries such as pharmaceuticals, cosmetics, and chemicals. Offline sales channels, including direct sales and through intermediaries, remain the preferred method for businesses due to their long-established reliability and the need for personalized service, particularly when dealing with bulk or specialized orders.

This trend is expected to continue as businesses still prioritize the security and personal interaction offered by offline transactions. Even with the growing influence of online platforms, many customers in industries that require precise specifications and high-quality standards for products like 1,3-butylene glycol are more inclined to conduct business offline. Therefore, the Offline Sales segment is projected to retain its dominant position in 2025, maintaining its significant share of the market.

Key Market Segments

By Purity

- Purity ≥99%

- Purity ≥98%

By Function

- Flavoring Agent

- Antioxidant

- Intermediate in Chemical Synthesis

- Preservative

- Others

By Application

- Pharmaceutical Intermediates

- Flavors & Fragrances

- Others

By Distribution Channel

- Online Sales

- Offline Sales

Drivers

Growing Demand in the Food and Beverage Industry

One of the key driving factors behind the increased demand for 1,3-butylene glycol (CAS 107-88-0) is its expanding application in the food and beverage industry, where it serves as a stabilizer, humectant, and flavor enhancer in various products. With the rise in consumer demand for processed and convenience foods, the use of food-grade 1,3-butylene glycol has grown significantly. It helps improve the texture and shelf-life of products, making it an essential ingredient in a range of foods like baked goods, beverages, and confectionery.

According to the U.S. Food and Drug Administration (FDA), 1,3-butylene glycol is generally recognized as safe (GRAS) for use in food products, which has further bolstered its adoption across the industry. The FDA’s approval and recognition of 1,3-butylene glycol as a safe ingredient for consumption have played a pivotal role in expanding its usage in food applications. As global food consumption continues to rise, especially in developing markets, this has triggered a surge in demand for 1,3-butylene glycol as a key food ingredient.

Additionally, global trends toward healthier, more sustainable food processing have pushed companies to seek out high-quality and safe additives. The food and beverage industry is estimated to grow significantly in the coming years. This growth provides a solid foundation for increased use of functional ingredients like 1,3-butylene glycol.

The growing focus on enhancing the safety and quality of processed food is expected to further drive demand for high-purity 1,3-butylene glycol, making it a vital ingredient for manufacturers looking to meet the needs of today’s health-conscious consumers.

Restraints

Environmental Concerns and Regulatory Pressures

A major restraining factor for the growth of the 1,3-butylene glycol market is the increasing scrutiny over environmental sustainability and the growing pressure for greener production methods. As the global community becomes more aware of the environmental impact of chemicals, industries that produce or rely on chemical intermediates like 1,3-butylene glycol are facing heightened regulatory challenges. This includes concerns about the carbon footprint associated with its production and the potential environmental hazards linked to its use in certain applications.

Governments and environmental organizations are increasingly pushing for more sustainable and eco-friendly practices in the chemical industry. For example, in the European Union, the European Chemicals Agency (ECHA) has been actively promoting the adoption of more sustainable chemicals and has made efforts to regulate the environmental impact of substances used in food and pharmaceuticals. According to the European Commission’s “Zero Pollution Action Plan,” which aims to reduce pollution in the EU by 2030, there is a growing focus on the reduction of chemical use that harms both human health and the environment.

Additionally, the U.S. Environmental Protection Agency (EPA) has been tightening regulations on chemicals used in food and consumer products, which could limit the use of 1,3-butylene glycol if its production methods are not aligned with new environmental standards. While 1,3-butylene glycol is considered safe for use in food products, its production process still involves petrochemical-derived feedstocks, which contribute to environmental concerns.

As consumers become more environmentally conscious, there is also increasing demand for bio-based and naturally derived alternatives. This presents a challenge for the 1,3-butylene glycol market, as it faces competition from greener substitutes that promise less environmental impact.

Opportunity

Rise of Bio-based Alternatives and Sustainable Production

One of the major growth opportunities for 1,3-butylene glycol lies in the increasing demand for bio-based alternatives, driven by the global shift toward sustainability. As industries, particularly the food and beverage sector, seek to minimize their environmental impact, the demand for renewable, bio-based raw materials is growing. 1,3-butylene glycol produced from renewable sources such as corn or sugarcane, rather than traditional petrochemical-based feedstocks, presents a significant opportunity to align with this trend.

Government initiatives and regulatory frameworks are also pushing industries toward adopting greener and more sustainable practices. For example, the U.S. Department of Energy’s Bioenergy Technologies Office (BETO) is actively supporting the development of bio-based chemicals to reduce reliance on fossil fuels. BETO’s initiatives have led to substantial investments in the production of bio-based 1,3-butylene glycol, which could help reduce greenhouse gas emissions and offer a more sustainable alternative to the petroleum-based version.

This transition to bio-based 1,3-butylene glycol is particularly significant in the food industry, which is one of the largest consumers of the chemical. The growing preference for organic, clean-label, and sustainable products is reshaping consumer behavior. According to the Organic Trade Association, the U.S. organic food market was valued at $61.9 billion in 2021 and is projected to grow by 10% annually. As the organic food sector expands, the need for more sustainable and eco-friendly additives like bio-based 1,3-butylene glycol is expected to increase.

Trends

Shift Toward Clean Label and Natural Ingredients in Food Products

A significant trend driving the demand for 1,3-butylene glycol is the growing shift toward clean label and natural ingredients, particularly in the food and beverage industry. Consumers are increasingly looking for products with fewer artificial additives, and this trend is pushing manufacturers to adopt ingredients that are both effective and perceived as natural. As 1,3-butylene glycol is commonly used in food processing for its moisture-retaining and stabilizing properties, it is finding itself in the spotlight as manufacturers seek to replace synthetic additives with more natural or sustainable alternatives.

This trend is closely linked to the rising popularity of organic and “clean-label” foods. According to the Organic Trade Association, the U.S. organic food market reached $61.9 billion in 2021 and is expected to continue growing by around 10% annually. As more consumers demand transparency and simplicity in food ingredients, manufacturers are under pressure to reformulate their products with cleaner, more naturally sourced components.

Governments are also playing a role in this movement. The European Union, through its “Farm to Fork” strategy, is committed to making food systems fair, healthy, and environmentally-friendly by promoting the use of sustainable ingredients in food production. This regulatory push is encouraging companies to embrace more natural and bio-based substances, further driving the demand for 1,3-butylene glycol, especially in applications where it can serve as a functional, safe, and stable ingredient without compromising product transparency.

Moreover, with growing awareness around the environmental impact of synthetic chemicals, many food companies are focusing on reducing the use of petrochemical-derived ingredients. This has resulted in an increasing interest in bio-based alternatives to traditional 1,3-butylene glycol, as it can be derived from renewable resources, making it a preferable option for clean-label products.

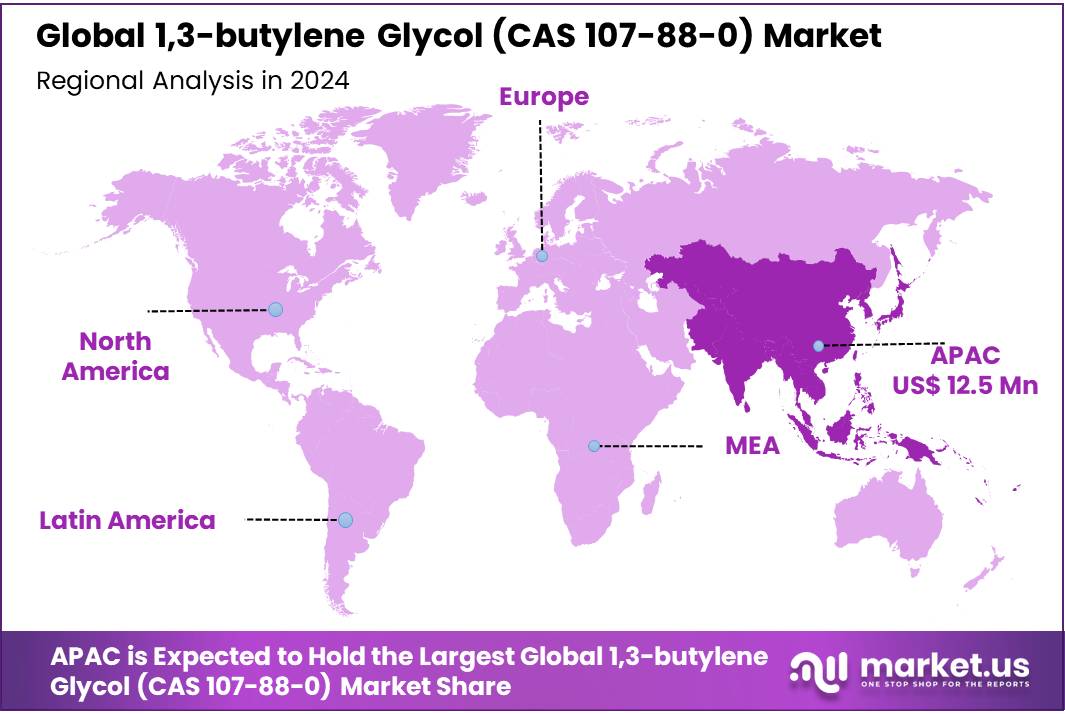

Regional Analysis

In 2024, the Asia Pacific (APAC) region emerged as the dominant market for 1,3-butylene glycol, capturing a significant share of approximately 36.8% of the global market, valued at approximately USD 12.5 million. This region’s stronghold can be attributed to its vast industrial base, including key sectors such as chemicals, pharmaceuticals, and food & beverages, all of which rely heavily on high-purity 1,3-butylene glycol.

China, in particular, plays a crucial role in this market, as it is not only the largest consumer of chemicals but also a major producer of 1,3-butylene glycol, which supports both domestic demand and export growth. The government’s favorable policies supporting manufacturing and technological advancements have also stimulated the growth of the chemical industry in the region, creating an ideal environment for the expansion of 1,3-butylene glycol.

Moreover, as the demand for clean-label and sustainable food products rises, the APAC region is seeing increasing use of bio-based 1,3-butylene glycol, especially in countries like Japan and South Korea. This trend is supported by government incentives promoting sustainability, further boosting the market’s growth prospects. Given the rapid industrial growth and increased consumer demand for functional ingredients in food and personal care products, APAC is expected to maintain its leadership in the coming years, driving the global 1,3-butylene glycol market forward.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Solvay is a leading player in the global 1,3-butylene glycol market, known for its commitment to sustainable and innovative chemical solutions. The company produces high-quality 1,3-butylene glycol used in various applications, including personal care, food, and chemicals. With a focus on sustainable production and environmental responsibility, Solvay leverages advanced technology to meet the growing demand for eco-friendly solutions, maintaining a strong foothold in key markets across Europe, North America, and Asia.

Donglian Nankai Flavor is a key Chinese manufacturer in the 1,3-butylene glycol industry, specializing in the production of flavoring agents and food additives. The company supplies high-purity 1,3-butylene glycol for use in the food and beverage sector, where it is valued for its stabilizing and humectant properties. Donglian Nankai Flavor has a solid presence in the APAC region, backed by strong production capabilities and a reputation for quality, meeting both domestic and international market demands.

Quzhou Mingfeng Chemical is an established player in the 1,3-butylene glycol market, focusing on its application in chemical synthesis and industrial processes. The company manufactures 1,3-butylene glycol primarily for use in polymers, solvents, and plasticizers. With a strong presence in China, Quzhou Mingfeng Chemical benefits from the country’s rapid industrial growth and extensive chemical production network, positioning itself as a significant contributor to both regional and global 1,3-butylene glycol markets.

Top Key Players

- Solvay

- Donglian Nankai FlavorDlflavor

- Quzhou Mingfeng Chemical

Recent Developments

In 2024, Solvay continued to strengthen its position, focusing on environmentally friendly production methods to meet the rising demand for clean-label and sustainable products.

In 2024 Donglian Nankai Flavor, the company has seen consistent growth due to the increasing demand for 1,3-butylene glycol in the food and beverage industries, where it is used as a humectant and stabilizer.

Report Scope

Report Features Description Market Value (2024) USD 34.5 Mn Forecast Revenue (2034) USD 60.6 Mn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Purity Greater than or Equal to 99%, Purity Greater than or Equal to98%), By Function (Flavoring Agent, Antioxidant, Intermediate in Chemical Synthesis, Preservative, Others), By Application (Pharmaceutical Intermediates, Flavors and Fragrances, Others), By Distribution Channel (Online Sales, Offline Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Solvay, Donglian Nankai FlavorDlflavor, Quzhou Mingfeng Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  1,3-butylene Glycol (CAS 107-88-0) MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

1,3-butylene Glycol (CAS 107-88-0) MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Solvay

- Donglian Nankai FlavorDlflavor

- Quzhou Mingfeng Chemical