Global Marine Omega-3 Market Size, Share, And Business Benefits By Type (Docosahexaenoic acid (DHA), Eicosapentaenoic acid (EPA), Alpha-linolenic acid (ALA), Docosapentaenoic acid (DPA), Others), By Form (Liquid, Powder, Softgel, Others), By Application (Supplements and Functional Foods, Pharmaceuticals, Infant Formula, Animal Feed and Pet Food, Others), By Distribution Channel (Supermarkets and Hypermarkets, Pharmacies and Drug Stores, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2025

- Report ID: 138056

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Marine Omega-3 Market

- By Type Analysis

- By Form Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

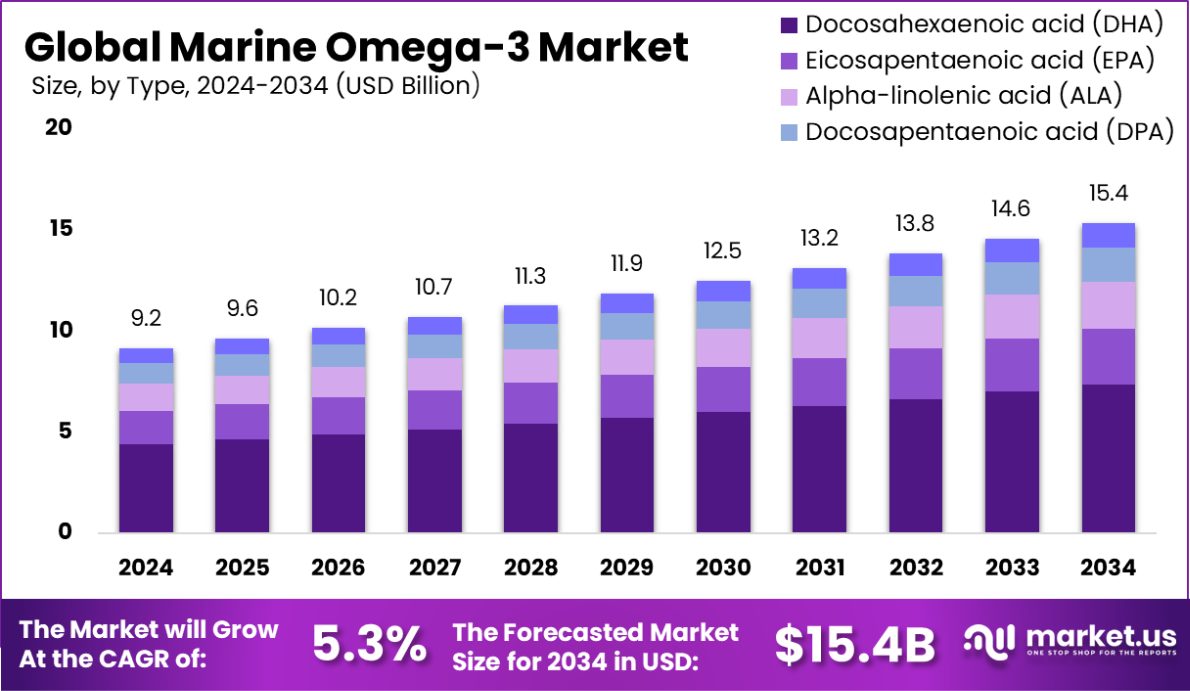

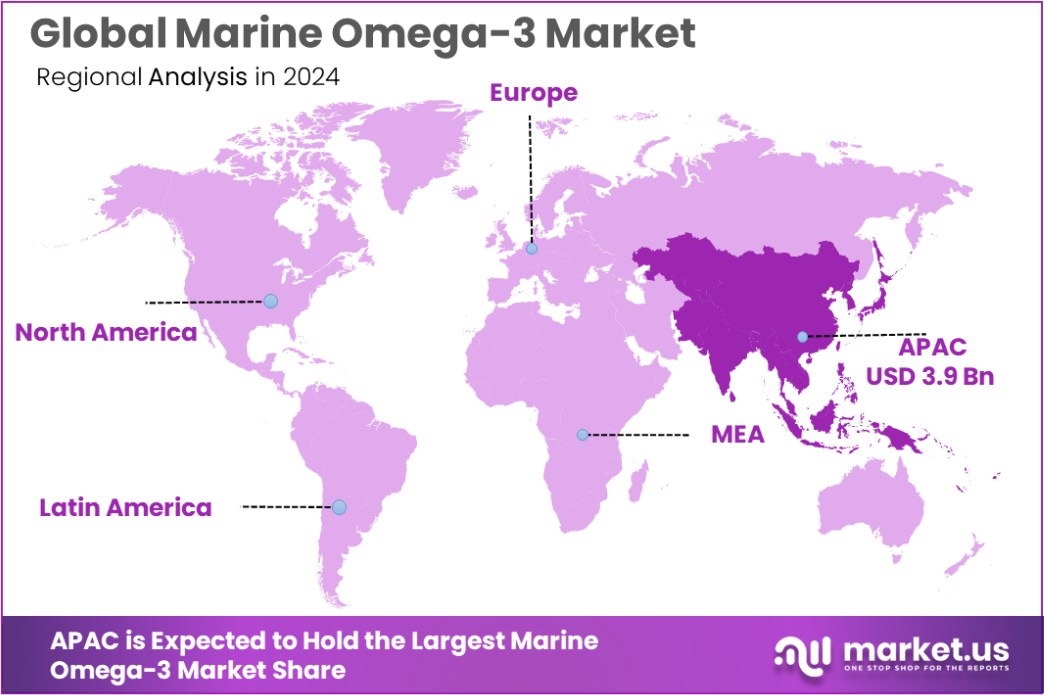

The Global Marine Omega-3 Market is expected to be worth around USD 15.4 Billion by 2034, up from USD 9.2 Billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034. Asia-Pacific holds 45.4% of the Marine Omega-3 Market, USD 3.9 Bn.

The Marine Omega-3 market continues to exhibit robust growth, driven by increasing consumer awareness of its health benefits, particularly in cardiovascular health. Omega-3 fatty acids, primarily derived from marine sources like fish oil, are known for their vital role in reducing inflammation, improving heart health, and enhancing cognitive function.

The industrial scenario is underscored by significant investments in both research and development. For instance, in 2022, the National Institutes of Health (NIH) awarded a grant of $244,974 to explore sustainable feed alternatives and improve market acceptance of marine fish production. This initiative is part of a broader push towards ensuring sustainable sourcing of omega-3-rich marine products, crucial for meeting global demand while addressing environmental concerns.

Key driving factors of this market include rising awareness about chronic diseases, including cardiovascular conditions, and growing consumer preference for natural health solutions. Marine omega-3 supplements have gained prominence due to their proven health benefits.

The VITAL trial, involving 25,871 adults in the US, demonstrated that omega-3 supplementation reduced myocardial infarction rates by 28%. This finding is especially significant for African American populations, where the same trial reported a 77% reduction in myocardial infarction rates with omega-3 supplementation.

Additionally, marine omega-3 products are subject to specific taxation policies, as highlighted by the Mississippi Department of Revenue, which collected $28,318,315 in beer and wine severance tax, including taxes on some marine omega-3 products in fiscal year 2022. This regulatory landscape further influences market dynamics.

Looking ahead, the future growth of the marine omega-3 market is promising, with opportunities for product innovation, including plant-based alternatives and fortified foods. Increasing research on the health benefits of marine omega-3, alongside expanding production and sustainable sourcing, will continue to propel market growth in the coming years.

Key Takeaways

- The Global Marine Omega-3 Market is expected to be worth around USD 15.4 Billion by 2034, up from USD 9.2 Billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034.

- The Marine Omega-3 market shows significant growth in DHA, which constitutes 48.2% of consumption.

- Liquid forms of Omega-3 dominate, accounting for 45.2% of the overall market share.

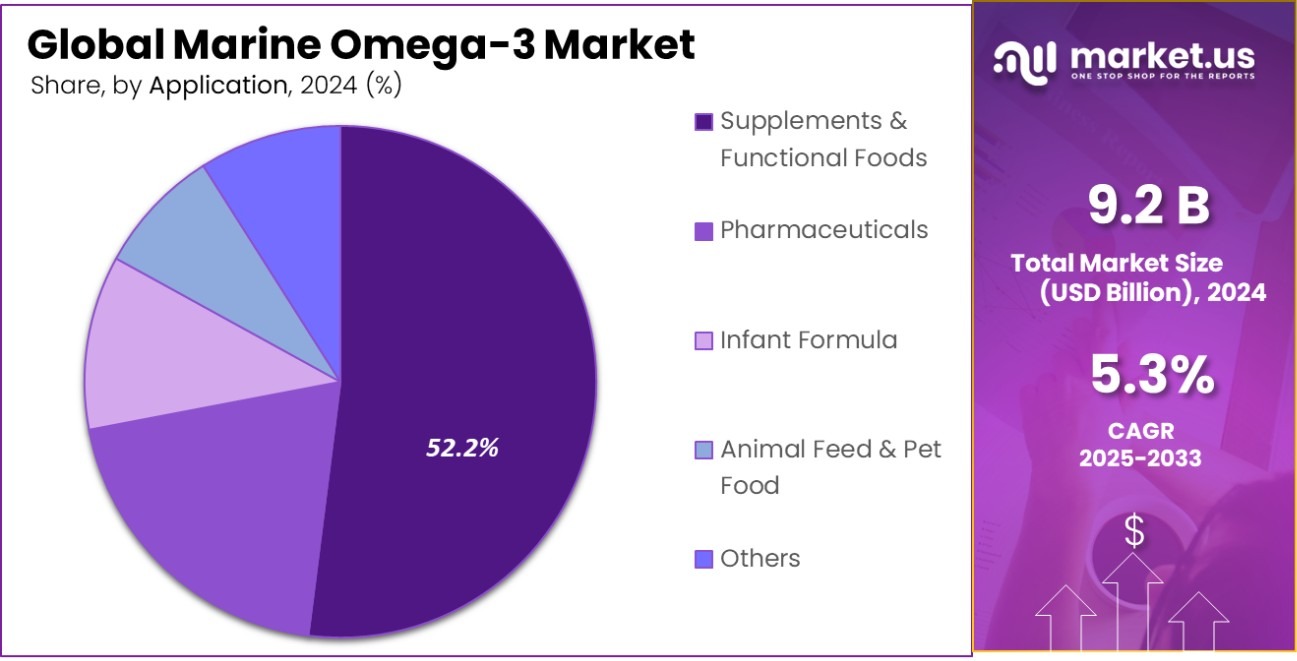

- Supplements and functional foods represent 52.2% of the Marine Omega-3 market’s application segment.

- Supermarkets and hypermarkets lead the distribution channels, capturing 35.1% of the market share.

- In 2023, Asia-Pacific dominated the Marine Omega-3 Market with a 45.4% share, USD 3.9 Bn.

Business Benefits of Marine Omega-3 Market

Marine omega-3 products offer substantial business benefits, primarily due to their growing demand across multiple sectors. For instance, dietary supplementation with DHA, a key marine omega-3 fatty acid, is widely recommended to support cognitive development and visual health. In infant nutrition, guidelines typically suggest that at least 0.32% of total fatty acids in formulas be DHA, highlighting the compound’s critical role in early life health.

Another advantage lies in the ongoing advancements in technology and research. The U.S. Defense Health Agency (DHA) demonstrates a significant commitment to research and development. In fiscal year 2022, DHA allocated $2.2 billion in total RDT&E funds, with nearly 80% ($1.724 billion) directed toward advanced technology development.

This substantial investment not only spurs innovation in marine omega-3 extraction and production but also facilitates the creation of high-quality products for diverse applications such as functional foods, pharmaceuticals, and medical nutrition.

With its scientifically backed health benefits, the marine omega-3 market continues to provide strong commercial opportunities, fostering innovation and maintaining relevance in health and wellness industries.

By Type Analysis

The Marine Omega-3 Market sees DHA dominating at 48.2% by type.

In 2023, Docosahexaenoic acid (DHA) held a dominant position in the By Type segment of the Marine Omega-3 Market, capturing 48.2% of the market share. DHA is critical for cognitive health and is predominantly sourced from fish oil, algae, and krill. Its high bioavailability makes it a preferred choice for dietary supplements and functional foods.

Eicosapentaenoic acid (EPA) accounted for 31.7% of the Marine Omega-3 Market in 2023. EPA is known for its anti-inflammatory properties, promoting cardiovascular health and reducing triglyceride levels. Derived from fish and algae, EPA is often combined with DHA in supplements to enhance therapeutic efficacy, especially for joint and heart-related conditions.

Alpha-linolenic acid (ALA) held a 14.3% share in the By Type segment of the Marine Omega-3 Market in 2023. ALA is a plant-based omega-3 fatty acid found in flaxseed, chia, and walnuts. Though less potent than DHA and EPA, ALA serves as a crucial source of omega-3 for vegetarians and vegans, contributing to overall health.

Docosapentaenoic acid (DPA) represented 5.8% of the Marine Omega-3 Market in 2023. Although less studied than DHA and EPA, DPA is gaining attention for its potential cardiovascular and anti-inflammatory benefits. It is mainly sourced from fish oil and krill oil, and its presence in omega-3 supplements is increasing as research highlights its unique health benefits.

By Form Analysis

Liquid form leads the Marine Omega-3 Market, accounting for a 45.2% share.

In 2023, Liquid Form held a dominant market position in the By Form segment of the Marine Omega-3 Market, with a 45.2% share. Liquid omega-3 products are preferred for their high bioavailability and ease of consumption, particularly in functional foods and beverages. They are also favored for their versatility in dosage and for applications in both dietary supplements and clinical nutrition.

Powder form captured 34.1% of the Marine Omega-3 Market in 2023. Powdered omega-3 products offer convenient storage and longer shelf life compared to liquids. The form is ideal for inclusion in smoothies, snack bars, and other functional food products. Additionally, powdered omega-3 has gained popularity in dietary supplements, especially for consumers seeking an alternative to liquid formats.

Softgel omega-3 products represented 20.7% of the market share in 2023. Softgels are popular for their convenience and easy consumption, particularly in dietary supplements. This format is favored for its ability to mask the strong taste of omega-3 oils while providing precise dosing. The soft gel segment remains a staple in the consumer market for marine-based omega-3 supplements.

By Application Analysis

Supplements and functional foods are the key applications, dominating with 52.2%.

In 2023, Supplements and Functional Foods dominated the By Application segment of the Marine Omega-3 Market, with a 52.2% share. This category includes omega-3-rich supplements and fortified foods that cater to a growing consumer demand for preventive health and wellness products. The segment continues to benefit from rising awareness of omega-3’s role in heart health, cognitive function, and inflammation.

The Pharmaceuticals application held 29.5% of the market in 2023. Marine omega-3 is widely used in the pharmaceutical industry for its therapeutic benefits, particularly in treating cardiovascular diseases, lowering triglycerides, and managing chronic conditions such as rheumatoid arthritis. Ongoing clinical research into omega-3’s potential in other therapeutic areas is further driving growth in this application.

In 2023, Infant Formula accounted for 11.8% of the Marine Omega-3 Market. DHA and EPA are essential for infant brain development, and their inclusion in infant formula is a growing trend. As more parents opt for formula feeding, the demand for omega-3-enriched products continues to rise, particularly in regions where exclusive breastfeeding rates are lower.

The Animal Feed and Pet Food segment represented 6.5% of the market in 2023. Omega-3 fatty acids, particularly EPA and DHA, are increasingly added to animal feed to improve the health and quality of livestock, as well as pet food to support skin, coat, and joint health. The segment is expanding with the growing trend of premium pet food products.

By Distribution Channel Analysis

Supermarkets and hypermarkets hold the largest distribution channel share at 35.1%.

In 2023, Supermarkets and Hypermarkets held a dominant position in the By Distribution Channel segment of the Marine Omega-3 Market, with a 35.1% share. These retail formats remain highly popular due to their widespread availability, large foot traffic, and a broad selection of omega-3 supplements and fortified foods. Consumer convenience and competitive pricing continue to drive growth in this channel.

Pharmacies and Drug Stores captured 30.4% of the Marine Omega-3 Market in 2023. This channel is preferred for its trusted healthcare environment, where consumers seek medical advice and OTC omega-3 products for specific health concerns. The convenience of locating trusted brands, along with professional guidance, continues to support the steady growth of omega-3 sales in pharmacies.

Online Retailers accounted for 34.5% of the market share in 2023. The increasing shift toward e-commerce has boosted the online distribution of omega-3 products, offering consumers access to a wide variety of brands and competitive pricing. The convenience of home delivery, along with the growing trend of online health product shopping, has been a key growth driver in this segment.

Key Market Segments

By Type

- Docosahexaenoic acid (DHA)

- Eicosapentaenoic acid (EPA)

- Alpha-linolenic acid (ALA)

- Docosapentaenoic acid (DPA)

- Others

By Form

- Liquid

- Powder

- Softgel

- Others

By Application

- Supplements and Functional Foods

- Pharmaceuticals

- Infant Formula

- Animal Feed and Pet Food

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- Online Retailers

- Others

Driving Factors

Growing Awareness of Health Benefits Drives Demand

The increasing consumer awareness of the health benefits of omega-3 fatty acids, particularly in heart health, cognitive function, and inflammation management, is a key driver of market growth. Omega-3 supplements, rich in DHA and EPA, are becoming essential in preventative healthcare regimens.

With rising awareness, consumers are actively seeking out omega-3-enriched products in their daily diets, leading to higher demand for both supplements and functional foods. The educational push by health organizations, coupled with scientific research, is accelerating this demand, especially among health-conscious individuals and aging populations.

Expansion of Omega-3 Applications Across Industries

The growing incorporation of omega-3s into a variety of products beyond dietary supplements is significantly fueling market growth. Omega-3 is increasingly used in pharmaceuticals for cardiovascular health, in infant formulas for brain development, and in animal feed for improved pet and livestock health.

The versatility of omega-3 has expanded its application into functional foods, beverages, and even cosmetics. As industries recognize its health benefits, demand for omega-3 is diversifying across different sectors, ensuring consistent growth and a broad consumer base.

Rising Demand for Natural and Plant-Based Products

Consumer demand for natural, sustainable, and plant-based products is steadily increasing, with a notable shift toward plant-based omega-3 sources like algae. This growing interest in plant-based diets, driven by health, ethical, and environmental concerns, is encouraging the development of algae-derived omega-3 products.

Additionally, consumers are increasingly seeking clean-label products free from additives, making plant-based omega-3 options more attractive. The trend toward sustainable and natural food options is expanding the market, especially among vegans, vegetarians, and eco-conscious consumers.

Restraining Factors

High Production Costs Limit Market Accessibility

The production of marine omega-3, especially from high-quality fish oil and algae, is expensive due to sourcing, extraction, and processing costs. This high cost of raw materials impacts the overall pricing of omega-3 supplements and functional foods, limiting their accessibility to budget-conscious consumers.

Additionally, the cost of sustainable sourcing and ensuring high purity levels further drives up prices, restricting the market’s reach in developing regions and among lower-income demographics. These factors prevent widespread adoption, limiting the growth potential in price-sensitive markets.

Challenges in Maintaining Sustainability of Fish Sources

Sustainability concerns surrounding overfishing and environmental impact are major challenges facing the marine omega-3 market. As demand increases, there is heightened pressure on fish populations to supply omega-3, raising concerns about ecosystem damage and resource depletion.

This issue is particularly relevant for omega-3 derived from fish oils, as unsustainable fishing practices contribute to biodiversity loss. The market is responding by focusing on sustainable practices, but the cost of certified sustainable omega-3 sources can limit its availability and growth, especially in price-sensitive markets.

Limited Awareness in Emerging Markets Hampers Growth

In emerging markets, awareness of the health benefits of omega-3 remains relatively low compared to developed regions. Despite growing interest in preventive healthcare, many consumers are unfamiliar with the specific benefits of omega-3 fatty acids, limiting their willingness to invest in supplements and omega-3-enriched products.

Furthermore, cultural dietary habits and lack of education on the importance of omega-3 in maintaining health can hinder market penetration. To overcome this, increased awareness campaigns and targeted education are essential to stimulate demand in these regions.

Growth Opportunity

Rising Demand for Plant-Based Omega-3 Sources

With increasing consumer interest in plant-based diets, there is a significant growth opportunity for omega-3 derived from algae and other plant sources. These alternatives appeal to vegans, vegetarians, and environmentally conscious consumers seeking sustainable, cruelty-free options.

As awareness of the health benefits of omega-3 continues to rise, plant-based omega-3 products, which offer the same cognitive and cardiovascular benefits, are poised to gain traction. The expansion of plant-based omega-3 products can also tap into emerging markets where vegan and vegetarian diets are gaining popularity.

Expanding Omega-3 Use in Functional Foods & Beverages

The growing trend of functional foods and beverages presents a significant opportunity for the marine omega-3 market. Consumers are increasingly seeking food and drink products that provide health benefits beyond basic nutrition.

By adding omega-3 to beverages, snack bars, and dairy products, brands can cater to health-conscious consumers looking to enhance their diets with minimal effort. This expansion into mainstream food products helps omega-3 reach a broader audience, driving market growth while capitalizing on the booming functional food sector.

Increasing Popularity of Omega-3 for Skin & Beauty

There is an emerging opportunity in the beauty and personal care industry, where omega-3 is gaining recognition for its skin health benefits. Omega-3 fatty acids, particularly DHA and EPA, have been shown to reduce inflammation, promote skin hydration, and combat signs of aging.

As consumers continue to prioritize natural, wellness-oriented beauty products, incorporating omega-3 into skincare formulations opens up new markets. The growing demand for anti-aging, moisturizing, and anti-inflammatory skincare products presents a promising growth avenue for omega-3 producers.

Latest Trends

Shift Towards Algae-Based Omega-3 Alternatives

One of the latest trends in the marine omega-3 market is the growing preference for algae-based omega-3 supplements. As more consumers opt for plant-based and sustainable alternatives, algae-derived omega-3, which provides DHA and EPA, is gaining popularity.

Algae-based products are seen as a more sustainable option compared to fish-derived omega-3, addressing environmental concerns around overfishing. This trend is especially significant in the vegan and vegetarian sectors, where plant-based ingredients are highly sought after, allowing brands to tap into a broader, more eco-conscious consumer base.

Personalized Omega-3 Supplements for Targeted Health Benefits

The trend of personalized nutrition is making its way into the marine omega-3 market. Brands are now offering tailored omega-3 supplements based on individual health needs and genetic profiles. These products are designed to provide specific health benefits, such as heart health, cognitive function, or inflammation reduction, based on consumer preferences and conditions.

With increasing demand for customized health solutions, the personalized omega-3 segment is seeing rapid growth. Consumers are willing to invest in products that cater to their unique health needs, driving market innovation.

Sustainable Sourcing and Eco-Friendly Packaging Innovations

Sustainability is becoming a key focus in the marine omega-3 market. Consumers are increasingly concerned about the environmental impact of their purchases, driving brands to adopt sustainable sourcing practices, such as using responsibly harvested fish or algae. Additionally, eco-friendly packaging, including biodegradable and recyclable materials, is gaining popularity.

This trend not only meets the growing demand for sustainable products but also aligns with consumer values of reducing waste and supporting environmental protection. As sustainability becomes a priority, brands are integrating these practices into their products to attract eco-conscious consumers.

Regional Analysis

In 2023, the Asia-Pacific region held 45.4% of the Marine Omega-3 Market, valued at USD 3.9 Bn.

In 2023, the Marine Omega-3 Market exhibited significant regional variations, with Asia-Pacific holding the largest market share. Asia-Pacific dominated the market with a 45.4% share, valued at USD 3.9 billion.

The region’s growth is largely driven by the increasing health-consciousness among consumers, rising awareness of omega-3 benefits, and a growing middle-class population. Countries like China, India, and Japan are seeing a surge in demand for omega-3 supplements, particularly due to their growing emphasis on preventive healthcare and wellness.

North America followed closely, accounting for 30.2% of the market. The demand for omega-3 is primarily driven by the U.S. and Canada, where omega-3 fatty acids are widely used in dietary supplements, functional foods, and pharmaceuticals. Rising awareness of cardiovascular health and cognitive benefits has boosted market penetration in this region.

Europe held 17.6% of the market in 2023. The region is witnessing strong demand for omega-3, particularly in Scandinavian countries where fish consumption is high. Increasing adoption of omega-3 in the food and beverage sector, alongside growing interest in plant-based alternatives, contributes to the market’s steady growth.

Middle East & Africa and Latin America collectively accounted for the remaining 6.8%, with slow but consistent growth driven by emerging health trends. As awareness increases, both regions are expected to experience rising demand for omega-3 products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Marine Omega-3 market remains highly competitive, with several key players driving innovation, sustainability, and market expansion. Companies like Aker Biomarine Antarctic AS and Omega Protein Corporation are major contributors to the market, leveraging their strong research and development capabilities, particularly in the extraction of omega-3 from sustainable marine sources.

Aker Biomarine’s focus on krill oil is a prime example of the increasing trend toward sustainable, high-quality omega-3 sources, aligning with consumer demand for eco-friendly and traceable products.

BASF SE and Koninklijke DSM N.V. are leading players in the pharmaceutical-grade omega-3 segment. Both companies are utilizing advanced technology to deliver high-purity omega-3 products, meeting growing consumer demand for premium supplements with proven health benefits. BASF, in particular, is focusing on expanding its production capacity for plant-based omega-3, reflecting the growing consumer shift toward plant-derived alternatives.

Cargill, Inc. and Croda International Plc are also making notable strides, especially in expanding their functional food and beverage portfolios. These companies have invested heavily in the development of omega-3-fortified products, which is in line with the increasing consumer interest in functional foods as a means of enhancing daily nutrition.

Emerging companies such as Nuseed Global and BioProcess Algae, LLC are tapping into the growing plant-based omega-3 segment, capitalizing on the shift toward algae-sourced products. As sustainability becomes more critical, these players are positioning themselves to meet the rising demand for plant-based omega-3 oils, especially in the vegan and eco-conscious consumer segments.

Top Key Players in the Market

- Aker Biomarine Antarctic AS

- BASF SE

- BioProcess Algae, LLC

- Cargill, Inc.

- Croda International Plc

- Epax,Nuseed Global

- FMC Corporation

- GC Reiber Oils

- Koninklijke DSM N.V.

- Lonza

- LUHUA BIOMARINE (SHADONG) CO., LTD.

- Olvea Fish Oils

- Omega Protein Corporation

- Orkla Health

- Pharma Marine AS

- Polaris.

- Royal DSM

Recent Developments

- In 2023, Aker BioMarine Antarctic AS specializes in producing sustainable Omega-3 oils from Antarctic krill, focusing on human health and animal nutrition. Also, they advanced eco-friendly harvesting techniques, increasing production capacity and innovating new high-quality products.

- In 2023, BASF SE will focus on sustainable omega-3 ingredients for health applications. Also, they advanced omega-3 production methods, enhancing bioavailability and sustainability. Their efforts target improving health through high-quality, marine-derived omega-3 products for supplements and functional foods.

Report Scope

Report Features Description Market Value (2024) USD 9.2 Billion Forecast Revenue (2034) USD 15.4 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Docosahexaenoic acid (DHA), Eicosapentaenoic acid (EPA), Alpha-linolenic acid (ALA), Docosapentaenoic acid (DPA), Others), By Form (Liquid, Powder, Softgel, Others), By Application (Supplements and Functional Foods, Pharmaceuticals, Infant Formula, Animal Feed and Pet Food, Others), By Distribution Channel (Supermarkets and Hypermarkets, Pharmacies and Drug Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aker Biomarine Antarctic AS, BASF SE, BioProcess Algae, LLC, Cargill, Inc., Croda International Plc, Epax,Nuseed Global, FMC Corporation, GC Reiber Oils, Koninklijke DSM N.V., Lonza, LUHUA BIOMARINE (SHADONG) CO., LTD., Olvea Fish Oils, Omega Protein Corporation, Orkla Health, Pharma Marine AS, Polaris., Royal DSM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aker Biomarine Antarctic AS

- BASF SE

- BioProcess Algae, LLC

- Cargill, Inc.

- Croda International Plc

- Epax,Nuseed Global

- FMC Corporation

- GC Reiber Oils

- Koninklijke DSM N.V.

- Lonza

- LUHUA BIOMARINE (SHADONG) CO., LTD.

- Olvea Fish Oils

- Omega Protein Corporation

- Orkla Health

- Pharma Marine AS

- Polaris.

- Royal DSM