Global Dried Kiwi Fruit Market By Type (Sun Dry, Freeze Dry), By Application (Bakery, Confectionery, Snacks, Smoothies, Others), By Nature (Organic, Conventional), By Form (Whole, Sliced, Diced, Powder), By Packaging (Bulk, Retail, Private Label), By End-User (Household Consumers, Food Service Industry, Food Manufacturers, Others), By Distribution Channel (Supermarkets, Specialty Retailers, Convenience Stores, E-Commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132524

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Application Analysis

- By Nature Analysis

- By Form Analysis

- By Packaging Analysis

- By End-User Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

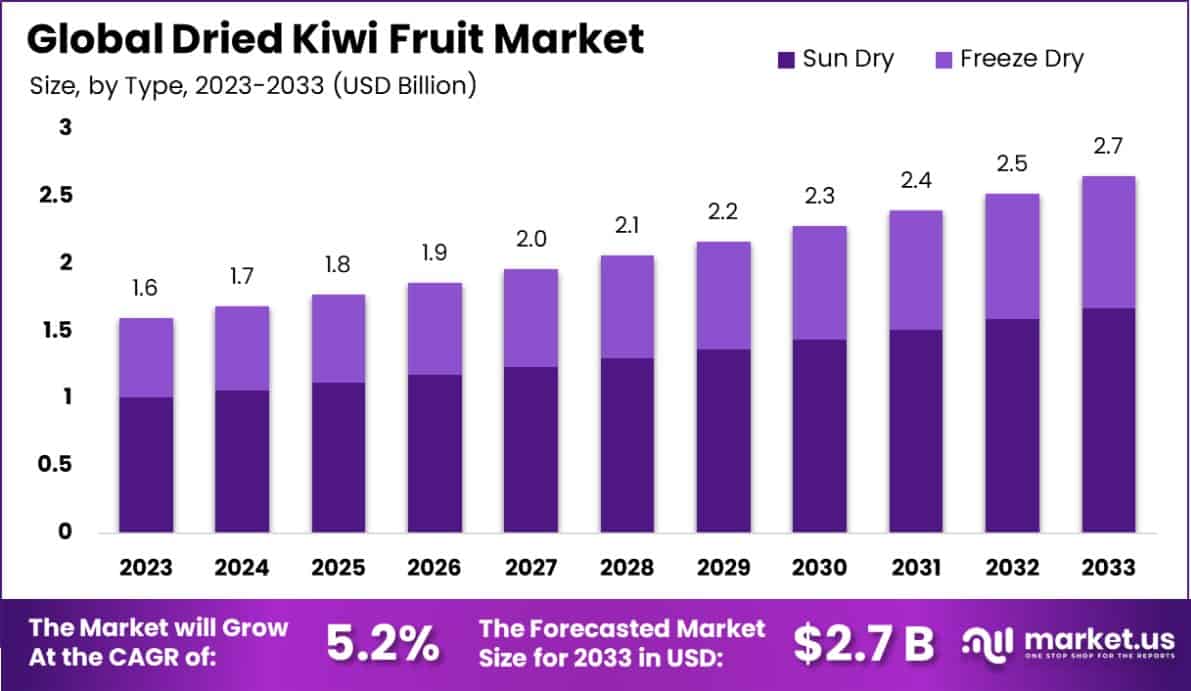

The Global Dried Kiwi Fruit Market is expected to be worth around USD 2.7 billion by 2033, up from USD 1.6 billion in 2023, and grow at a CAGR of 5.2% from 2024 to 2033.

Dried kiwi fruit is a dehydrated form of the fresh kiwi, retaining most of its sweet-tart flavor, nutrients, and green color. This process extends the shelf life of the fruit, making it a convenient and healthy snack option packed with vitamins, antioxidants, and fiber.

The dried kiwi fruit market refers to the commercial space concerned with the production, distribution, and sale of dried kiwi. This niche is part of the broader dried fruit industry and caters to consumer demand for nutritious, portable, and non-perishable food items.

The dried kiwi fruit market presents a dynamic segment within the global dried fruit industry, characterized by significant contributions from key exporting nations and expanding organic production. According to volza.com, China leads as the largest exporter of dried kiwi, accounting for approximately 932 shipments globally, underscoring its pivotal role in the supply chain.

This is closely followed by emerging contributors like India and Ukraine, each playing a crucial role in diversifying the market’s geographic outreach. Furthermore, Greece’s commitment to organic kiwi production is notable, with over 5 farms adhering to stringent EU regulations, as per apps.fas.usda.gov.

This commitment not only meets the growing consumer demand for organic products but also sets a sustainable standard within the agricultural practices in Europe.

New Zealand remains a formidable player, with kiwifruit exports valued at around $2.7 billion during the fiscal year 2020/2021, marking it as the country’s top export crop, according to tupu.nz. This financial performance emphasizes kiwifruit’s economic importance and potential for further market penetration.

As these trends converge, the market is poised for robust growth, driven by increasing health consciousness among consumers and a shift towards more sustainable farming practices.

Companies positioned to leverage these trends through innovative distribution strategies and expanded organic offerings are likely to capture significant market share and achieve sustained growth in the coming years.

The market is growing due to increasing awareness of health and wellness, which promotes the consumption of foods rich in nutrients and antioxidants, like dried kiwi.

Demand for dried kiwi fruit is driven by its use in various dietary routines, as well as in culinary applications such as baking, cooking, and as a topping in cereals and salads.

Opportunities in the dried kiwi market include expanding into new geographical areas, incorporating organic and non-GMO kiwi options, and leveraging online platforms for direct-to-consumer sales strategies.

Key Takeaways

- The Global Dried Kiwi Fruit Market is expected to be worth around USD 2.7 billion by 2033, up from USD 1.6 billion in 2023, and grow at a CAGR of 5.2% from 2024 to 2033.

- The dried kiwi fruit market shows a dominance of sun-dried types, accounting for 63.4%.

- Snacks lead in applications, constituting 37.5% of dried kiwi fruit usage.

- Organic variants prevail, representing 58.5% of the market, reflecting consumer preference for natural products.

- Sliced forms of dried kiwi are favored by 29.3% of the market.

- Bulk packaging is the most common, utilized by 44.3% of the dried kiwi market.

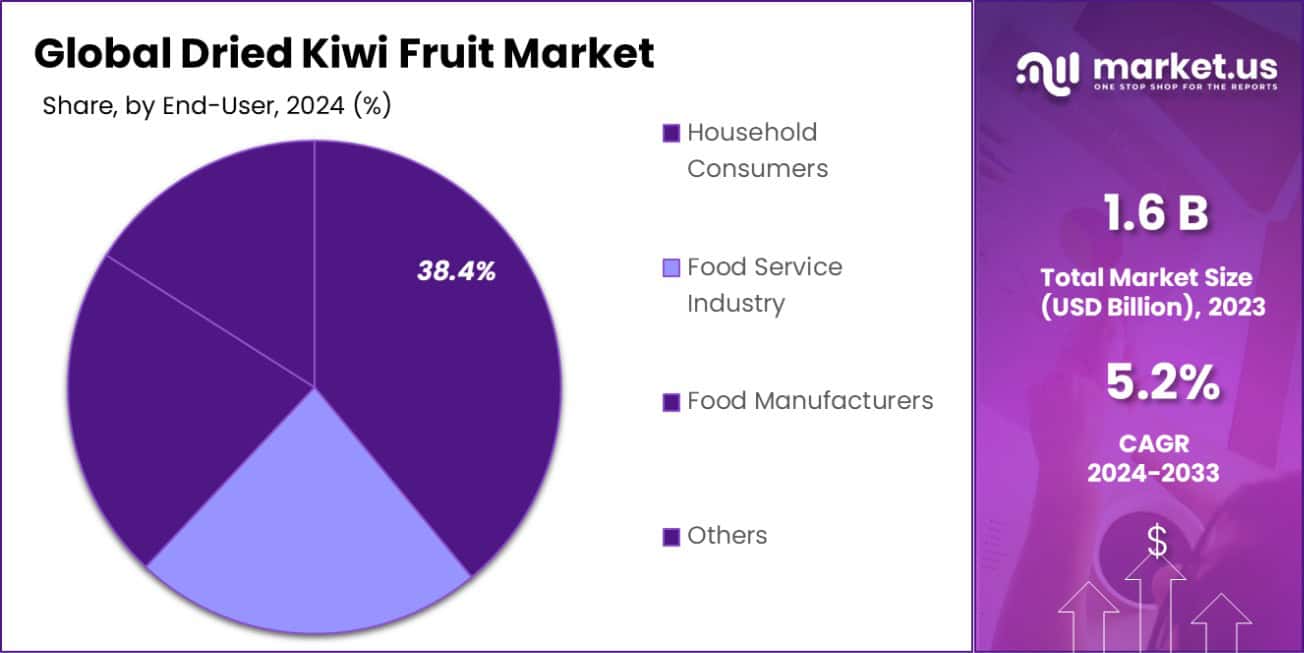

- Household consumers are significant end-users, comprising 38.4% of market demand.

- Supermarkets are the leading distribution channel, capturing 37.3% of dried kiwi sales.

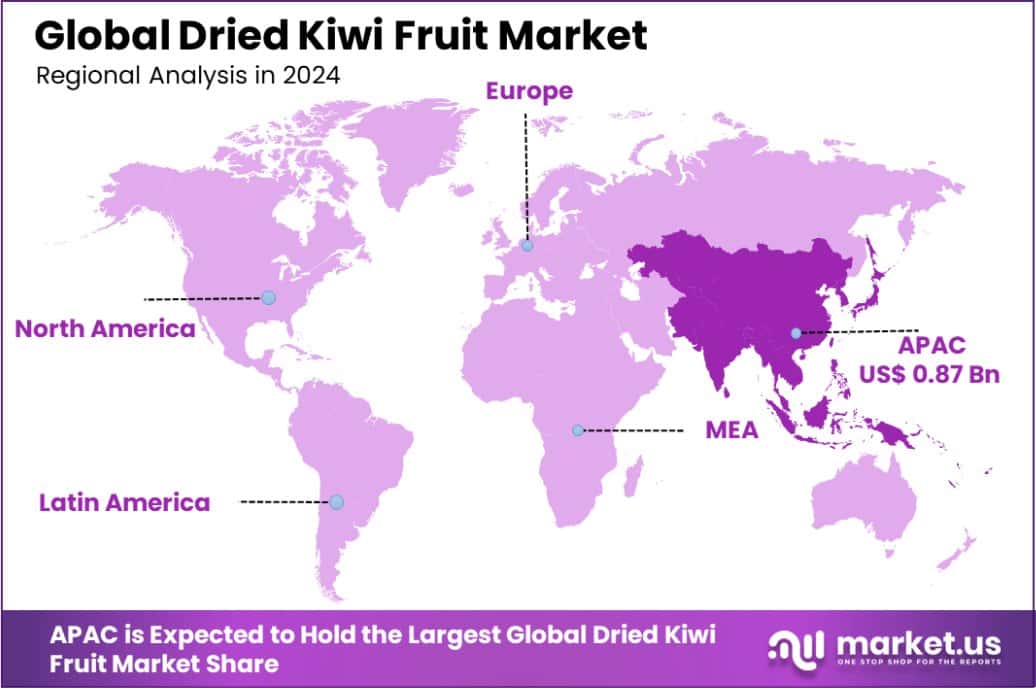

- The Asia Pacific Dried Kiwi Fruit Market holds 51.6%, valued at USD 0.87 billion.

By Type Analysis

Sun-dried kiwi dominates the market, capturing 63.4% of sales.

In 2023, Sun Dry held a dominant market position in the “By Type” segment of the Dried Kiwi Fruit Market, with a 63.4% share. This method, preferred for its ability to preserve the natural flavor and nutritional content, significantly outpaced its nearest competitor, Freeze Dry, which captured a market share of 36.6%.

The substantial preference for Sun Dry can be attributed to its cost-effectiveness and minimal processing requirements, which resonate well with consumer trends toward natural and wholesome food products.

Moreover, the sun-dry method benefits from a lower energy consumption compared to freeze-dry, aligning with growing environmental concerns and the push for sustainability in food processing. This method’s ability to maintain a high level of antioxidants and vitamins in kiwi fruits makes it particularly attractive in markets focused on health and wellness.

As consumers increasingly seek out snacks that offer health benefits without compromising on taste, the Sun Dry segment is poised for continued growth, supported by its strong market share and alignment with consumer preferences.

This trend is further bolstered by advancements in drying technology that promise improved efficiency and product quality, securing its leading position in the market.

By Application Analysis

Snack applications hold a significant share at 37.5% of the market.

In 2023, Snacks held a dominant market position in the “By Application” segment of the Dried Kiwi Fruit Market, with a 37.5% share. This segment outperformed others, including Bakery, Confectionery, and Smoothies, which accounted for 20%, 22.5%, and 20% of the market share respectively.

The prominence of Snacks is largely driven by the growing consumer demand for healthy, portable snack options that offer both convenience and nutritional benefits. Dried kiwi, known for its high Vitamin C and dietary fiber content, has become a popular choice in the snack category, appealing to health-conscious consumers seeking alternatives to traditional snack options.

The versatility of dried kiwi also enhances its appeal in the snack segment, as it can be easily incorporated into various snack formulations, including trail mixes, granola bars, and standalone snack packs.

Manufacturers have capitalized on this by expanding their snack offerings to include dried kiwi as a key ingredient, which has helped in maintaining the high market share.

Continued innovation in flavor and packaging, coupled with strategic marketing campaigns promoting the health benefits of dried kiwi, are expected to sustain the growth and dominance of this segment in the foreseeable future.

By Nature Analysis

Organic dried kiwi is preferred by 58.5% of consumers.

In 2023, Organic held a dominant market position in the “By Nature” segment of the Dried Kiwi Fruit Market, with a 58.5% share, overshadowing its counterpart, Conventional, which held a 41.5% market share.

This notable preference for organic dried kiwi fruit is indicative of a broader consumer shift towards organic products, driven by increasing health awareness and concerns over the use of pesticides and artificial substances in food production.

The organic segment’s growth is fueled by consumers’ growing preference for clean-label products, which are perceived as healthier and safer.

The organic dried kiwi fruit’s market dominance is further supported by the strengthening of distribution channels, including online platforms and health food stores, which have made these products more accessible to health-conscious consumers worldwide.

Moreover, manufacturers are increasingly leveraging the premium that consumers are willing to pay for organic products by enhancing their product offerings with unique packaging and certified organic labels, thereby reinforcing the value proposition of organic dried kiwi fruit.

As the market continues to evolve, the demand for organic dried kiwi is expected to sustain its growth trajectory, driven by ongoing consumer education about the benefits of organic eating and the expansion of global organic farming practices.

By Form Analysis

Sliced kiwi is a popular form, representing 29.3% of sales.

In 2023, Sliced held a dominant market position in the “By Form” segment of the Dried Kiwi Fruit Market, with a 29.3% share, leading over other forms such as Whole (26.2%), Diced (24.0%), and Powder (20.5%).

The sliced form of dried kiwi has gained prominence due to its convenience and versatility, making it a favored choice among consumers and manufacturers alike. Sliced dried kiwi is particularly popular in consumer markets where ease of use and ready-to-eat formats are highly valued, contributing to its leading position.

This preference for sliced kiwi can be attributed to its broad applicability in various culinary applications, from being a ready-to-eat snack to its use as a garnish in desserts and salads. Moreover, the aesthetic appeal of sliced dried kiwi enhances the visual presentation of food products, which is a significant factor in consumer purchase decisions.

Food manufacturers are capitalizing on this trend by incorporating sliced dried kiwi into snack mixes, cereals, and health bars, thus driving its demand.

As the market continues to expand, the sliced segment is expected to maintain its market leadership, supported by ongoing innovations in food processing technologies that improve the texture and flavor preservation of dried fruit products, ensuring sustained consumer interest and market growth.

By Packaging Analysis

Bulk packaging is the most common, accounting for 44.3% of purchases.

In 2023, Bulk held a dominant market position in the “By Packaging” segment of the Dried Kiwi Fruit Market, with a 44.3% share, surpassing Retail (35.2%) and Private Label (20.5%). This predominance of bulk packaging is primarily driven by the significant cost advantages it offers both retailers and consumers, facilitating larger purchases at reduced prices.

Bulk packaging’s efficiency and sustainability aspects also align well with the increasing environmental consciousness among consumers and businesses striving to reduce packaging waste.

The bulk segment’s appeal is further enhanced in settings such as supermarkets and health food stores, where consumers can purchase the exact quantities they need, thus minimizing food waste and personalizing their shopping experience.

Additionally, the growing trend of zero-waste shopping and the popularity of bulk bins in stores support the continued growth of this packaging form.

Manufacturers are responding to this demand by optimizing supply chain efficiencies and investing in durable, yet minimal packaging solutions that cater to bulk purchasers. These strategies not only meet consumer preferences for sustainability but also reduce logistical costs, thereby supporting the economic advantages of bulk sales.

As the market evolves, the bulk packaging segment is expected to retain its leading position, propelled by ongoing trends toward cost-effective and eco-friendly purchasing options.

By End-User Analysis

Household consumers are major buyers, comprising 38.4% of the market.

In 2023, Household Consumers held a dominant market position in the “By End-User” segment of the Dried Kiwi Fruit Market, with a 38.4% share, leading ahead of the Food Service Industry (32.1%) and Food Manufacturers (29.5%).

This segment’s prominence is underscored by the growing trend of healthy snacking and increased consumer inclination towards nutrient-rich options like dried kiwi.

Household consumers are particularly drawn to dried kiwi for its convenience, long shelf life, and nutritional benefits, including high vitamin C and dietary fiber content, which suit busy lifestyles and health-conscious eating habits.

The preference among household consumers is also driven by the versatility of dried kiwi in various culinary applications. It is commonly used in homemade trail mixes, flavoured yogurts, smoothies, and as a topping for cereals and salads, making it a staple in health-oriented kitchen pantries.

The increasing availability of dried kiwi in retail outlets in both bulk and packaged forms has further facilitated its adoption among this segment.

As health trends continue to influence food choices, the demand from household consumers is expected to grow, supported by marketing efforts that highlight the health benefits of dried kiwi.

Manufacturers are likely to continue developing innovative product offerings that cater to this demographic, ensuring the segment maintains its market dominance.

By Distribution Channel Analysis

Supermarkets are the leading distribution channel, with a 37.3% market share.

In 2023, Supermarkets held a dominant market position in the “By Distribution Channel” segment of the Dried Kiwi Fruit Market, with a 37.3% share, outperforming Specialty Retailers (26.7%), Convenience Stores (18.5%), and E-Commerce (17.5%).

Supermarkets’ leading role is largely attributed to their ability to offer a wide variety of products under one roof, providing convenience and accessibility to consumers. This channel’s strength is further bolstered by the strategic placement of healthy snack options like dried kiwi in prominent locations within stores to attract health-conscious shoppers.

Supermarkets’ dominance is also supported by their extensive geographic reach and established supply chains, which ensure consistent product availability and variety, factors highly valued by consumers.

Moreover, the tactile shopping experience allows consumers to select from bulk and pre-packaged options, catering to diverse consumer preferences and driving higher sales volumes.

As consumer trends continue to evolve towards healthier and more convenient food choices, supermarkets are likely to retain their prominence by enhancing their product assortments, especially in the health and wellness segment.

The increasing consumer preference for shopping in a single location for all household needs will further support the dominance of supermarkets in the distribution of dried kiwi fruit.

Key Market Segments

By Type

- Sun Dry

- Freeze Dry

By Application

- Bakery

- Confectionery

- Snacks

- Smoothies

- Others

By Nature

- Organic

- Conventional

By Form

- Whole

- Sliced

- Diced

- Powder

By Packaging

- Bulk

- Retail

- Private Label

By End-User

- Household Consumers

- Food Service Industry

- Food Manufacturers

- Others

By Distribution Channel

- Supermarkets

- Specialty Retailers

- Convenience Stores,

- E-Commerce

- Others

Driving Factors

Health Benefits Propel Dried Kiwi Market Growth

One primary driving factor for the growth of the Dried Kiwi Fruit Market is the increasing consumer awareness of the health benefits associated with dried kiwi.

Rich in vitamins, antioxidants, and dietary fiber, dried kiwi supports digestive health, boosts the immune system, and contributes to overall well-being.

As health-conscious consumers seek nutritious snack options, the demand for dried kiwi continues to surge, making it a popular choice in the health food sector.

Surge in Demand for Convenient Healthy Snacks

The rising popularity of convenient and healthy snack options significantly drives the Dried Kiwi Fruit Market. Dried kiwi offers a convenient way to enjoy the benefits of fresh fruit in a portable, non-perishable form.

This convenience appeals to busy consumers, including working professionals and parents looking for quick, nutritious options for themselves and their families.

The demand is further supported by the global trend towards healthier eating habits and the increasing pace of modern lifestyles.

Expansion of Organic and Natural Food Markets

The expansion of organic and natural food markets worldwide is another crucial factor fueling the Dried Kiwi Fruit Market’s growth.

With an escalating number of consumers opting for organic and natural products due to concerns about pesticides and additives, organic dried kiwi has seen a significant uptick in sales.

Retailers and manufacturers are responding by expanding their offerings, further propelling the market’s growth as these products become more accessible to a broader audience.

Restraining Factors

High Costs Limit Dried Kiwi Market Expansion

A significant restraint in the Dried Kiwi Fruit Market is the high cost of production and retail pricing. Drying kiwi requires specialized equipment and considerable energy, leading to higher production costs compared to many other dried fruits.

Additionally, kiwi fruits are often imported from countries where they are more commonly grown, adding to transportation and import costs. These factors contribute to a higher retail price, which can deter budget-conscious consumers from purchasing dried kiwi, thereby limiting market growth.

Allergy Concerns Reduce Consumer Base

Allergies to kiwi are relatively common and can pose serious health risks, including severe allergic reactions. This health concern acts as a notable barrier to the market growth of dried kiwi fruits.

Consumers who are allergic to fresh kiwi are likely to avoid the dried form as well, significantly reducing the potential consumer base. The presence of allergens thus restricts the market’s expansion, as potential buyers opt for safer fruit alternatives.

Competition from Other Dried Fruits

Intense competition from other dried fruits like mangoes, apricots, and dates also restrains the growth of the Dried Kiwi Fruit Market. These fruits are often available at lower prices and are already well-established in the diets of many consumers globally.

Additionally, some consumers prefer the taste and variety offered by other dried fruits. This competition can divert potential sales from dried kiwi, impacting its market share and growth opportunities in the crowded dried fruit market segment.

Growth Opportunity

Expanding Global Reach through E-commerce Platforms

The growth of e-commerce presents a significant opportunity for the Dried Kiwi Fruit Market. Online retail platforms offer a broader reach to a global customer base, making it easier for suppliers to sell their products beyond local markets.

This digital expansion allows for direct consumer engagement and personalized marketing strategies, potentially increasing sales and brand loyalty. Additionally, the convenience of online shopping appeals to a wider audience, including younger consumers who prefer shopping online.

Innovative Packaging and Flavor Variations

Innovation in packaging and the introduction of new flavor combinations can serve as major growth opportunities for the Dried Kiwi Fruit Market. Attractive, convenient, and sustainable packaging can appeal to environmentally conscious consumers and enhance the product’s shelf appeal.

Furthermore, combining dried kiwi with other fruits or introducing flavors like honey or chili can cater to diverse taste preferences and spur curiosity and trial among new customers. These innovations can differentiate products in a competitive market, attracting more consumers.

Health Trend Alignment and Marketing

Aligning with global health trends offers a substantial growth opportunity for the Dried Kiwi Fruit Market. By marketing dried kiwi as a superfood rich in vitamins, antioxidants, and fiber, producers can tap into the health-conscious consumer segment.

Promotional campaigns that highlight the health benefits of dried kiwi, such as supporting digestive health and boosting immunity, can resonate well with health-focused audiences. Collaborations with health influencers and participation in wellness events can further amplify reach and consumer interest in dried kiwi.

Latest Trends

Organic and Non-GMO Dried Kiwi Gains Popularity

There is a growing trend towards organic and non-GMO dried kiwi in response to increasing health and environmental concerns. Consumers are more mindful of the sourcing and processing of their food, preferring products that are free from genetic modifications and harmful chemicals.

This shift is prompting manufacturers to obtain organic certifications and highlight the purity and safety of their dried kiwi products, catering to a market segment that values sustainability and health.

Snack-Sized Packaging for On-the-Go Consumption

The demand for convenient snack options has led to a trend in snack-sized packaging for dried kiwi. These smaller, easy-to-carry packages are perfect for busy lifestyles, allowing consumers to enjoy a healthy snack while commuting, working, or traveling.

Manufacturers are capitalizing on this trend by offering single-serving packs that fit easily into purses, backpacks, and lunch boxes, meeting the needs of consumers seeking both convenience and portion control.

Enhanced Flavor Profiles and Mixes

Enhancing the appeal of dried kiwi through diverse flavor profiles and mixes is a noticeable trend in the market. Manufacturers are experimenting with adding spices, combining kiwi with other dried fruits, or dipping it in chocolate or yogurt to create appealing new products.

These innovations cater to consumers’ evolving palates and interest in exotic and varied flavors, helping to differentiate dried kiwi in a competitive market and attract a broader audience.

Regional Analysis

The Asia Pacific Dried Kiwi Fruit Market dominates with a 51.6% share, valued at USD 0.87 billion.

The Dried Kiwi Fruit Market showcases diverse regional dynamics, with Asia Pacific leading the charge, commanding a significant 51.6% market share and valued at USD 0.87 billion. This dominance is largely attributed to China and New Zealand, prominent Kiwi-producing nations, which not only supply the local markets but also export extensively.

North America and Europe follow, with these regions focusing on incorporating dried kiwi in health-centric diets due to its nutrient density and benefits like high fiber and vitamin C content.

Latin America and the Middle East & Africa, although smaller in market size, are experiencing growth due to rising awareness about healthy eating practices and the gradual introduction of exotic fruits into the diet. The European market benefits from a strong presence of organic and non-GMO products, aligning with the regional demand for sustainable and natural food products.

In North America, the U.S. represents a significant portion of the market, with consumers preferring dried kiwi as a convenient snack option and an ingredient in cereals and salads. This region is also seeing a trend towards innovative packaging and flavor enhancements to attract a broader consumer base.

The growth in these regions, although robust, remains overshadowed by Asia Pacific’s market prevalence, driven by extensive local cultivation and consumption habits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global dried kiwi fruit market, key players have positioned themselves strategically to leverage the growing consumer interest in healthy snacking options. Among these, Bloom Valley, Fu Marca, and Hangzhou Xiaoshan Yusheng Food are notable for their significant impact in 2023.

These companies have capitalized on advanced dehydration technologies that preserve the natural flavor and nutritional value of kiwi fruit, setting them apart in a competitive market.

Bloom Valley, for instance, has expanded its distribution channels, successfully penetrating both online and offline retail markets. This has not only enhanced their market reach but also allowed them to directly engage with health-conscious consumers.

Similarly, Fu Marca has focused on organic and non-GMO product lines, responding to the increasing consumer demand for sustainable and ethically produced food items.

Hangzhou Xiaoshan Yusheng Food has distinguished itself through innovative packaging solutions that extend the shelf life of its products while maintaining taste and freshness. Their investment in research and development has led to the introduction of a variety of flavors, catering to diverse consumer preferences and expanding their market base.

Moreover, smaller players like Terra Mia Organics – Salted Harvest and The Kiwi People have found their niche by offering unique product variations, such as salted and spiced dried kiwi, which appeal to a segment of consumers looking for gourmet snacking options. Their ability to quickly adapt to market trends and consumer feedback has been crucial in maintaining competitiveness.

Overall, the success of these companies in the dried kiwi fruit market can be attributed to their innovative approaches to product development, marketing strategies, and distribution efficiency, which have enabled them to meet the evolving tastes and dietary preferences of global consumers.

Top Key Players in the Market

- Bloom Valley

- Fu Marca

- Hangzhou Xiaoshan Yusheng Food

- Hua Wei Heng

- Huasheng Food

- Kylin Pacific

- Liang Pin Pu Zi

- Little Beauties

- Maozheng County Fengye Food

- Nutraj

- Nutty and Fruity

- One Farm

- Pagoda

- Paradise Fruit

- Patak Foods

- Sunbeam Foods

- Tao Dou

- Terra Mia Organics -Salted Harvest

- The Kiwi People

- Tongren Hengfeng Food

- Xiong Hai Zi

Recent Developments

- In 2024, Kylin Pacific continues to innovate within the dried kiwi fruit sector, notably launching a proprietary dehydration technique that enhances flavor retention and extends shelf life, signaling their commitment to quality and consumer satisfaction in this niche market.

- In 2023, Little Beauties, a player in the dried kiwi fruit market, has continued to grow by doubling its turnover and staff over the past year, focusing on online sales and expanding into new international markets. Their growth is part of a broader increase in the dried kiwi fruit sector, driven by rising health consciousness and the popularity of convenient, nutritious snacks

Report Scope

Report Features Description Market Value (2023) USD 1.6 Billion Forecast Revenue (2033) USD 2.7 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sun Dry, Freeze Dry), By Application (Bakery, Confectionery, Snacks, Smoothies, Others), By Nature (Organic, Conventional), By Form (Whole, Sliced, Diced, Powder), By Packaging (Bulk, Retail, Private Label), By End-User (Household Consumers, Food Service Industry, Food Manufacturers, Others), By Distribution Channel (Supermarkets, Specialty Retailers, Convenience Stores, E-Commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bloom Valley, Fu Marca, Hangzhou Xiaoshan Yusheng Food, Hua Wei Heng, Huasheng Food, Kylin Pacific, Liang Pin Pu Zi, Little Beauties, Maozheng County Fengye Food, Nutraj, Nutty and Fruity, One Farm, Pagoda, Paradise Fruit, Patak Foods, Sunbeam Foods, Tao Dou, Terra Mia Organics -Salted Harvest, The Kiwi People, Tongren Hengfeng Food, Xiong Hai Zi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dried Kiwi Fruit MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Dried Kiwi Fruit MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bloom Valley

- Fu Marca

- Hangzhou Xiaoshan Yusheng Food

- Hua Wei Heng

- Huasheng Food

- Kylin Pacific

- Liang Pin Pu Zi

- Little Beauties

- Maozheng County Fengye Food

- Nutraj

- Nutty and Fruity

- One Farm

- Pagoda

- Paradise Fruit

- Patak Foods

- Sunbeam Foods

- Tao Dou

- Terra Mia Organics -Salted Harvest

- The Kiwi People

- Tongren Hengfeng Food

- Xiong Hai Zi