Global Flavoured Yogurts Market Report By Flavour (Strawberry, Vanilla, Peach, Blueberry, Chocolate, Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122530

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Flavoured Yogurts Market size is expected to be worth around USD 84.6 Billion by 2033, from USD 42.6 Billion in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

The Flavored Yogurts market involves the production and sale of yogurts enhanced with various flavors and ingredients such as fruits, honey, and spices. This market is driven by the rising consumer demand for healthy and tasty snack options.

Flavored yogurts are popular for their probiotic benefits and convenience. Key market participants include dairy producers, food and beverage companies, and retailers. Trends show continuous growth due to increasing health consciousness and innovation in flavor profiles and packaging.

The flavored yogurts market is experiencing dynamic growth, fueled by innovation and expanding consumer preferences toward healthier, diverse, and convenient snack options. Recent product launches by major brands underscore the vibrant activity within this sector. For instance, in May 2024, Rachel’s Organic introduced a limited-edition mixed berries Greek yogurt, featuring a rich blend of blackberries, blueberries, raspberries, strawberries, and blackcurrants. This launch not only diversifies the product offerings but also caters to consumers’ increasing demand for natural and organic ingredients.

Similarly, in February 2024, Danone Canada responded to the rising trend in plant-based diets by introducing a Greek-style pea protein yogurt. This product offers a dairy-free alternative, capturing the interest of health-conscious consumers and those with dietary restrictions. It’s noteworthy that this innovation provides a creamy texture similar to traditional yogurts, ensuring that consumers do not have to compromise on taste or consistency.

These developments highlight the sector’s adaptive strategies in response to evolving dietary trends and consumer tastes. The introduction of such innovative products is strategically positioned to tap into niche markets, expand consumer bases, and stimulate growth within the broader yogurt industry. With the market for flavored yogurts becoming increasingly competitive, companies that continue to innovate and cater to specialized consumer preferences are likely to capture significant market share and enhance their brand strength in the evolving global food landscape.

Key Takeaways

- Market Value: The Flavoured Yogurts Market was valued at USD 42.6 billion in 2023, and is expected to reach USD 84.6 billion by 2033, with a CAGR of 7.1%.

- Flavour Analysis: Strawberry flavor dominated with 32.6%; significant for its popularity among consumers.

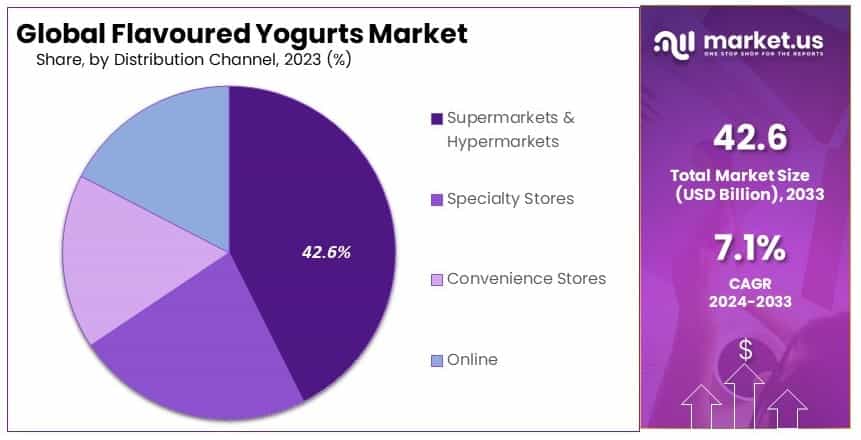

- Distribution Channel Analysis: Supermarkets & Hypermarkets led with 42.6%; crucial for their wide accessibility and variety.

- Dominant Region: Europe held 36.5%; significant due to high consumption and diverse product offerings.

- Analyst Viewpoint: The flavoured yogurts market is highly competitive with substantial growth potential. Future trends indicate increased demand for healthy and convenient snacks.

- Growth Opportunities: Key players can leverage health trends, new flavors, and expanding distribution channels to enhance market share.

Driving Factors

Health and Wellness Trend Drives Market Growth

The shift towards health and wellness has significantly influenced the flavoured yogurts market. Consumers are increasingly seeking healthier food options, and flavoured yogurts have adeptly met this demand by offering probiotic, low-fat, and low-sugar variants.

A notable example is Chobani’s “Less Sugar” line, which contains 45% less sugar than their regular yogurts. This line has experienced a 25% increase in sales over the past year. The rise in sales is driven by consumers’ growing awareness of gut health benefits and a strong desire to reduce sugar intake while still enjoying flavorful snacks. The focus on health and wellness aligns with a broader trend of mindful eating and living, contributing to the robust growth of the flavoured yogurts market.

Innovative Flavors and Premiumization Drive Market Growth

The introduction of unique and exotic flavors, alongside the premiumization trend, is propelling the flavoured yogurts market forward. Companies like Noosa Yoghurt have capitalized on this trend by offering flavors such as Blackberry Serrano and Blood Orange, which cater to the adventurous tastes of millennials and Gen Z. This generation values novel taste experiences and is willing to explore new options.

Additionally, the market is witnessing growth through the incorporation of premium ingredients and artisanal production methods. Stonyfield Organic’s “Grass-fed” yogurt line, which is sourced from pasture-raised cows, has reported a 15% growth. This growth is driven by consumers’ willingness to pay a premium for perceived higher quality and ethical sourcing. The combination of innovative flavors and premiumization is effectively capturing a diverse consumer base, further boosting market expansion.

Convenience and On-the-Go Consumption Drive Market Growth

In today’s fast-paced society, the demand for convenience significantly boosts the flavoured yogurts market. Products designed for on-the-go consumption, such as single-serve cups, pouches, and tubes, are increasingly popular. Danone’s Danimals Squeezables, targeted at children, have seen a 30% increase in sales, as busy parents prefer these mess-free, car-friendly options.

Similarly, Siggi’s drinkable yogurts have gained traction among urban professionals seeking a quick, nutritious breakfast or snack during their commute. This trend towards convenient, portable yogurt options meets the needs of a busy, health-conscious consumer base, driving significant market growth. The focus on convenience, coupled with health benefits, ensures flavoured yogurts remain a preferred choice for many, solidifying their position in the market.

Restraining Factors

Sugar Content Restrains Market Growth

High levels of added sugars in flavored yogurts limit market growth by deterring health-conscious consumers. A single serving can contain up to 25 grams of sugar, equating to six teaspoons. This excessive sugar content has attracted public health campaigns and regulatory scrutiny.

For instance, the UK’s sugar tax in 2018 prompted backlash against high-sugar yogurt brands like Muller Light, resulting in a temporary dip in sales until they reformulated their products with less sugar. Health-focused consumers increasingly avoid sugary options, reducing the appeal of many flavored yogurts. This trend pressures manufacturers to innovate and offer lower-sugar alternatives, which can be costly and time-consuming, thus slowing market expansion.

Plant-Based Alternatives Competition Restrains Market Growth

The rise of plant-based diets poses significant competition to traditional dairy-based flavored yogurts, limiting their market growth. Brands like Silk (Danone) and Forager Project offer coconut, almond, and cashew-based yogurt alternatives. These products appeal to vegans, lactose-intolerant individuals, and those concerned about dairy farming’s environmental impact.

In 2023, the plant-based yogurt market grew by 20%, indicating a strong consumer shift towards these alternatives. This growth suggests a potential cannibalization of market share from traditional dairy yogurts, compelling dairy yogurt producers to innovate or lose customers. The increasing popularity of plant-based options thus presents a substantial challenge to the traditional flavored yogurt market.

Flavour Analysis

Strawberry dominates with 32.6% due to its wide consumer appeal and versatility.

The flavoured yogurts market is segmented by flavour into strawberry, vanilla, peach, blueberry, chocolate, and others. Strawberry is the dominant sub-segment, holding 32.6% of the market share. This dominance is attributed to strawberry’s broad consumer appeal and versatility. Consumers of all ages enjoy the sweet and slightly tangy taste of strawberry yogurt. Additionally, strawberry flavor pairs well with other ingredients, making it a popular choice for yogurt blends and mixed fruit yogurts. The vibrant color and natural sweetness of strawberries also enhance the visual and taste appeal of the product, further driving its popularity.

Strawberry yogurt’s popularity extends beyond individual consumption to include various applications such as smoothies, breakfast bowls, and desserts. The high demand for strawberry-flavoured yogurt is also supported by its association with health benefits, as strawberries are rich in vitamins, antioxidants, and fiber. This makes strawberry yogurt a favorite among health-conscious consumers who seek nutritious and delicious food options.

Other flavours in the market, while not as dominant as strawberry, play significant roles in catering to diverse consumer preferences. Vanilla, for instance, is a classic and versatile flavor that appeals to a wide audience. Its smooth and creamy taste makes it a staple in many households. Peach yogurt, with its sweet and refreshing taste, is another popular choice, especially during the summer months. Blueberry yogurt, known for its rich antioxidant content and distinctive flavor, attracts health-focused consumers. Chocolate yogurt caters to those who prefer a dessert-like experience, offering a rich and indulgent taste.

The role of these other flavours in the market is essential for providing variety and meeting the diverse taste preferences of consumers. Vanilla yogurt serves as a versatile base that can be enjoyed on its own or with added toppings. Peach and blueberry yogurts offer unique taste experiences and health benefits, appealing to consumers seeking both flavor and nutrition. Chocolate yogurt provides a treat-like option that can satisfy sweet cravings in a healthier way compared to traditional desserts.

Distribution Channel Analysis

Supermarkets & Hypermarkets dominate with 42.6% due to wide availability and consumer convenience.

The distribution channel segmentation of the flavoured yogurts market includes supermarkets & hypermarkets, specialty stores, convenience stores, and online. Supermarkets & hypermarkets are the dominant distribution channel, holding 42.6% of the market share. This dominance is due to the wide availability and convenience these stores offer to consumers.

Supermarkets and hypermarkets provide a vast selection of flavoured yogurts, allowing consumers to choose from a variety of brands, flavours, and packaging sizes in one location. The convenience of one-stop shopping and the ability to compare products side by side drive consumer preference for purchasing yogurt in these stores.

Specialty stores, while not as dominant, play a crucial role in the market by offering premium and niche yogurt products. These stores cater to consumers looking for unique flavours, organic options, and artisanal brands that may not be available in larger supermarkets. Specialty stores also provide a personalized shopping experience, with knowledgeable staff who can offer product recommendations and information about the health benefits of different yogurt types.

Convenience stores are another important distribution channel, particularly for on-the-go consumers. These stores offer quick access to flavoured yogurts, making them a popular choice for busy individuals seeking a convenient snack or meal option. The smaller store format and strategic locations near residential and commercial areas enhance the accessibility of flavoured yogurts in convenience stores.

Online sales are growing rapidly as more consumers turn to e-commerce for their grocery shopping needs. The online distribution channel offers the convenience of home delivery, a wide product selection, and the ability to easily compare prices and read reviews. The rise of online grocery shopping is driven by the increasing use of smartphones and the preference for contactless shopping experiences, especially in the wake of the COVID-19 pandemic.

Key Market Segments

By Flavour

- Strawberry

- Vanilla

- Peach

- Blueberry

- Chocolate

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

Growth Opportunities

Functional and Fortified Yogurts Offer Growth Opportunity

Fortified and functional yogurts present significant growth opportunities in the flavored yogurt market. Products like Activia’s “Probiotic Smoothies” with added vitamin C saw a 40% sales increase during the pandemic.

This trend reflects growing consumer interest in health benefits beyond basic nutrition. Yogurts enhanced with vitamin D, omega-3, or collagen can command premium prices and attract health-conscious consumers. These added health benefits not only appeal to a broad audience but also justify higher price points, boosting profitability. The increasing demand for health-enhancing foods suggests a substantial market potential for fortified flavored yogurts.

Personalized Nutrition through Direct-to-Consumer Models Offers Growth Opportunity

Personalized nutrition through direct-to-consumer (DTC) models offers a unique growth opportunity in the flavored yogurt market. Companies like Yomee and Gut Instinct use AI to analyze customers’ gut microbiomes and dietary preferences, delivering customized yogurt subscriptions. This approach provides a tailored consumer experience and valuable data for product development.

The DTC model’s direct relationship with consumers allows for better understanding of their needs and preferences, driving customer loyalty. Personalized yogurts meet the growing demand for individualized health solutions, representing a significant market expansion potential.

Trending Factors

Global Flavors and Cultural Fusion Are Trending Factors

The integration of global flavors into yogurts is a trending factor driving market growth. Brands like Fage popularize Mediterranean flavors with Greek-style yogurts, while Culture Republick introduces globally inspired flavors such as Matcha & Sweet Cream or Pistachio & Salted Caramel. This trend is fueled by increased travel, culinary shows, and a desire for diverse food experiences.

Consumers seek authentic and exotic tastes, making these globally flavored yogurts highly appealing. This fusion of flavors not only broadens the market but also attracts a culturally diverse consumer base, enhancing market reach and growth.

Savory and Unexpected Flavor Combinations Are Trending Factors

Savory and unconventional yogurt flavors are trending, expanding the flavored yogurt market. Brands like Noosa’s Sweet & Spicy line, featuring Mango Sriracha, cater to consumers seeking bold tastes. Similarly, Blue Hill’s vegetable-based yogurts in flavors like beet and carrot offer unique options for increasing vegetable intake.

These innovative flavors attract adventurous eaters and those looking for healthier, non-traditional yogurt options. The shift towards savory and unexpected combinations broadens the market appeal, meeting the demand for new and exciting taste experiences. This trend enhances market diversity and drives growth.

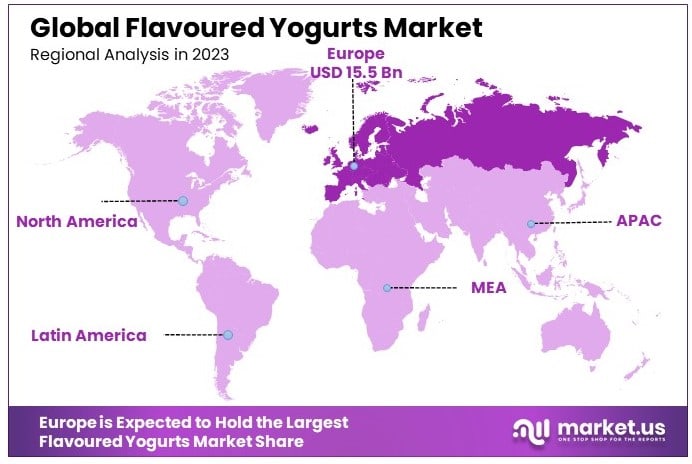

Regional Analysis

Europe Dominates with 36.5% Market Share

Europe’s dominance in the flavored yogurts market, with a 36.5% market share valued at USD 15.5 billion, is driven by several factors. A high consumer preference for dairy products and a strong tradition of yogurt consumption contribute significantly. Additionally, the region’s emphasis on health and wellness encourages the demand for probiotic and fortified yogurts. Europe’s advanced dairy industry infrastructure and innovative product offerings also play a crucial role.

Regional characteristics such as high disposable income, health-conscious consumers, and established retail networks support the flavored yogurt market. The popularity of organic and natural products further boosts sales. European consumers’ willingness to try new flavors and formats enhances market growth. Additionally, regulations promoting healthy eating habits positively influence market dynamics.

Europe’s strong market presence is expected to continue, driven by innovation and a growing demand for health-focused products. The trend towards personalized nutrition and functional foods will likely bolster market growth. The region’s influence will remain significant, shaping global market trends and standards.

North America: 28.3% Market Share

North America holds a 28.3% market share in the flavored yogurts market. The region benefits from high consumer awareness about probiotics and health benefits associated with yogurt consumption. Innovations in flavors and packaging drive market growth. The presence of major yogurt brands and strong marketing campaigns also support market expansion.

Asia Pacific: 22.5% Market Share

Asia Pacific accounts for 22.5% of the flavored yogurts market share. The rising middle-class population and increasing health awareness drive market growth. Urbanization and the adoption of Western dietary habits further boost yogurt consumption. The region’s market is expected to grow rapidly due to its large population base and improving economic conditions.

Middle East & Africa: 8.1% Market Share

The Middle East & Africa hold an 8.1% market share in the flavored yogurts market. Factors such as a growing young population, increasing urbanization, and rising disposable incomes contribute to market growth. The expanding retail sector and the introduction of new yogurt flavors cater to diverse consumer preferences, supporting market expansion.

Latin America: 4.6% Market Share

Latin America represents a 4.6% market share in the flavored yogurts market. The market is driven by increasing health awareness and the popularity of probiotic products. Economic growth and urbanization also support market expansion. However, market growth is moderated by economic instability in some countries, affecting consumer spending power.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The flavored yogurts market features several key players with substantial impact, strategic positioning, and market influence. Leading companies such as General Mills, Inc.; Danone S.A.; and Nestle S.A. dominate the market through extensive product portfolios and strong global presence. These firms leverage their established brand reputations and extensive distribution networks to maintain market leadership.

Danone S.A. stands out with its innovation in health-focused products, like Activia’s probiotic yogurts, driving consumer interest and market growth. General Mills, Inc., known for its Yoplait brand, capitalizes on diverse flavor offerings and strategic marketing campaigns to capture significant market share. Nestle S.A. employs a strategy of fortification and functional benefits in its yogurt products, appealing to health-conscious consumers.

Chobani LLC, a relatively newer entrant, has rapidly gained market influence through its focus on high-quality, natural ingredients and innovative product lines. Its commitment to social responsibility and sustainable practices resonates well with modern consumers, enhancing its market position.

Lactalis and Fonterra Co-operative Group leverage their expertise in dairy production to offer high-quality flavored yogurts. Their extensive experience and robust supply chains ensure consistent product availability and quality, strengthening their market influence.

Arla Foods and Yakult Honsha Co., Ltd., emphasize functional benefits, particularly probiotics, to cater to the growing demand for health-enhancing foods. This strategic positioning helps them secure a loyal customer base and expand their market footprint.

Companies like ULTIMA FOODS, Müller UK & Ireland, and Sodiaal focus on regional market strengths and tailored product offerings. They adapt their strategies to local consumer preferences, which enhances their competitive edge in specific markets.

Rainy Lanes Dairy Foods Ltd., Parmalat S.p.A., Chi Limited, and Cargill, Incorporated, contribute to the market through diverse product innovations and expanding distribution networks. Their strategic initiatives and responsiveness to market trends enable them to influence the flavored yogurts market significantly.

Collectively, these key players drive market dynamics through continuous innovation, strategic marketing, and an unwavering focus on consumer health trends. Their combined efforts shape the growth trajectory and competitive landscape of the flavored yogurts market.

Market Key Players

- General Mills, Inc.

- Danone S.A.

- Nestle S.A.

- Chobani LLC

- Lactalis

- Fonterra Co-operative Group

- Arla Foods

- Yakult Honsha Co., Ltd.

- ULTIMA FOODS

- Sodiaal

- Müller UK & Ireland

- Rainy Lanes Dairy Foods Ltd.

- Parmalat S.p.A.

- Chi Limited

- Cargill, Incorporated

Recent Developments

- May 2024: Rachel’s Organic Launches Limited-Edition Mixed Berries Greek Yogurt Rachel’s Organic has launched a new limited-edition mixed berries Greek yogurt flavor, featuring a blend of blackberries, blueberries, raspberries, strawberries, and blackcurrants. The new product is available in selected Waitrose stores for £2.80 per 450g pot.

- March 2024: SIG Partners with DPA Brasil for Spouted Pouch Packaging SIG has partnered with DPA Brasil to introduce spouted pouch packaging for the Chamyto brand of yogurt. The lightweight yet sturdy design simplifies consumption, particularly for children. The strawberry-flavored Chamyto yogurt is the first product to use this packaging format.

- February 2024: Danone Canada Launches Greek-Style Pea Protein Yogurt Danone Canada has launched a new Greek-style pea protein yogurt, offering a plant-based alternative to traditional dairy yogurt. The product is made with pea protein and features a creamy texture and variety of flavors. It is available in major Canadian retailers.

Report Scope

Report Features Description Market Value (2023) USD 42.6 Billion Forecast Revenue (2033) USD 84.6 Billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavour (Strawberry, Vanilla, Peach, Blueberry, Chocolate, Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, Online) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape General Mills, Inc.;, Danone S.A., Nestle S.A., Chobani LLC, Lactalis, Fonterra Co-operative Group, Arla foods, Yakult Honsha Co., Ltd.,, ULTIMA FOODS, Chobani, LLC., Sodiaal, Müller UK & Ireland, Rainy Lanes Dairy Foods Ltd., Parmalat S.p.A., Chi Limited, Cargill, Incorporated. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the expected market size for flavored yogurts by 2033?The Global Flavoured Yogurts Market size is expected to reach USD 84.6 Billion by 2033. The market is projected to grow at a CAGR of 7.1% during the forecast period from 2024 to 2033.

Which region holds the largest market share for flavored yogurts?Europe holds the largest market share at 36.5%, driven by high consumption and diverse product offerings.

Who are the key players in the flavored yogurts market?Key players include General Mills, Inc.; Danone S.A.; Nestle S.A.; Chobani LLC; Lactalis; and Fonterra Co-operative Group.

-

-

- General Mills, Inc.

- Danone S.A.

- Nestle S.A.

- Chobani LLC

- Lactalis

- Fonterra Co-operative Group

- Arla Foods

- Yakult Honsha Co., Ltd.

- ULTIMA FOODS

- Sodiaal

- Müller UK & Ireland

- Rainy Lanes Dairy Foods Ltd.

- Parmalat S.p.A.

- Chi Limited

- Cargill, Incorporated