Global Thymine (CAS 65-71-4) Market Size, Share, And Business Benefits By Type (Thymine (97%), Thymine 99%), Others), By Form (Powder, Liquid), By Application (Pharmaceutical Intermediates, Bioengineering, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2025

- Report ID: 138020

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

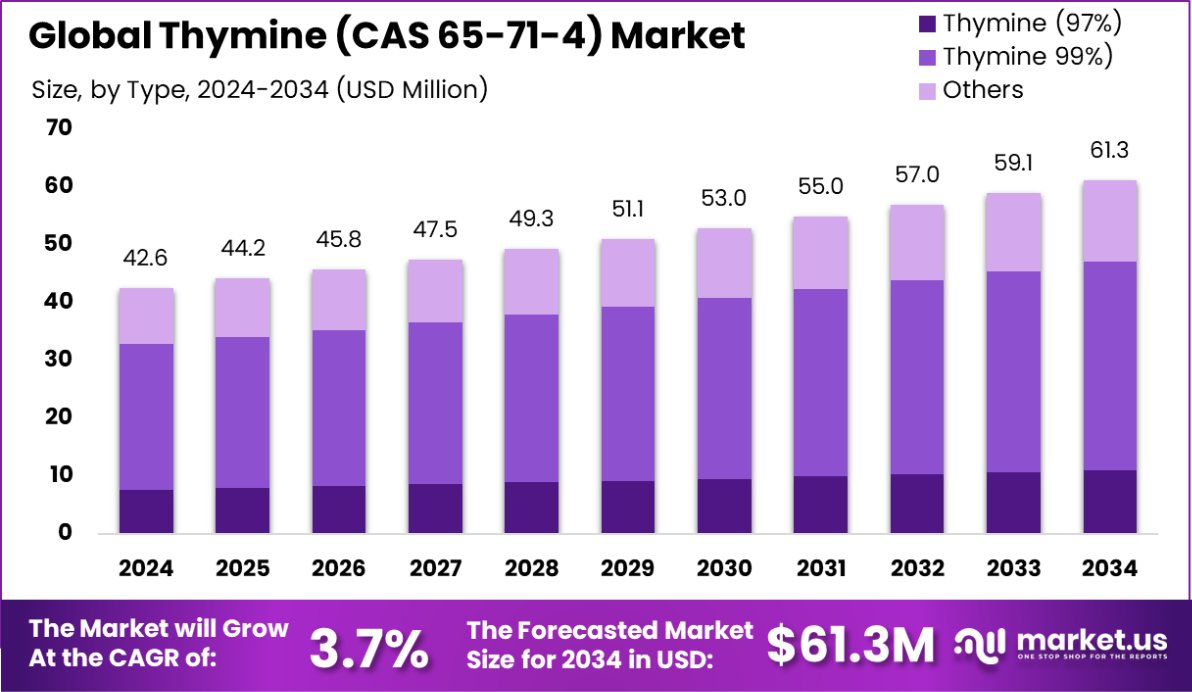

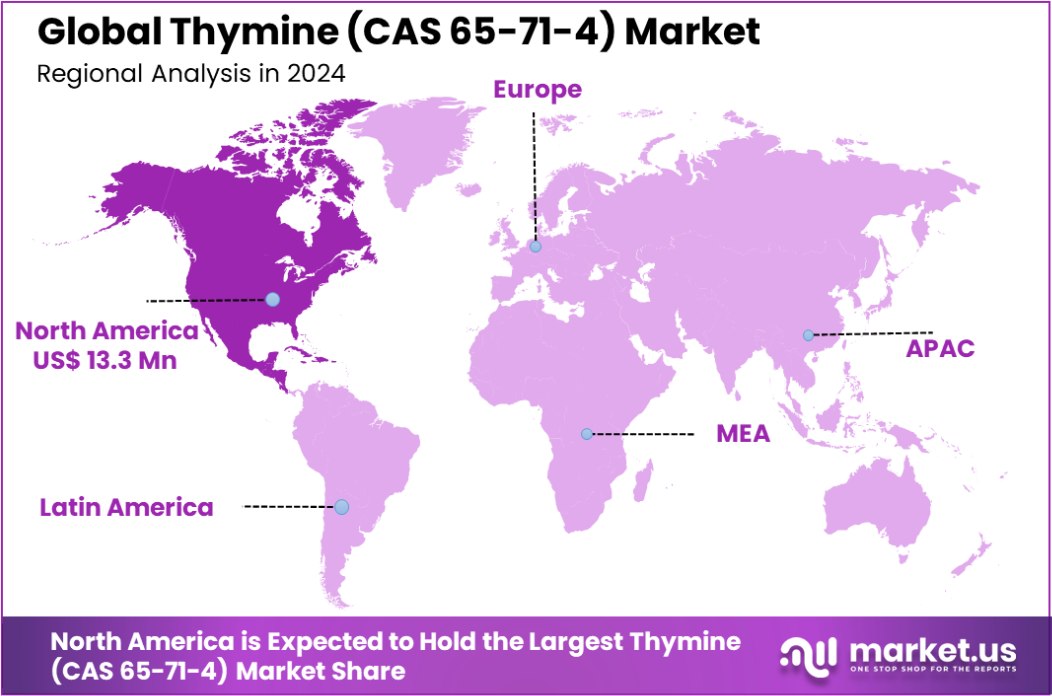

The Global Thymine (CAS 65-71-4) Market is expected to be worth around USD 61.3 Million by 2034, up from USD 42.6 Million in 2024, and grow at a CAGR of 3.7% from 2025 to 2034. North America holds 31.3% of the thymine market, valued at USD 13.3 million.

Thymine, a pyrimidine nucleobase integral to the structure of DNA, has garnered significant attention due to its essential role in genetic coding and cellular functions. As a fundamental component in biotechnology, molecular biology, and pharmacology, the market for thymine is witnessing sustained growth, driven by its widespread applications in research, therapeutics, and diagnostics.

The growing demand for thymine is closely tied to advancements in genomic research and personalized medicine. Thymine’s critical involvement in DNA replication, transcription, and cellular integrity makes it a focal point of biotechnology research.

The rise in genomic research and gene therapies has spurred investment in the development of thymine-based technologies. Furthermore, with increasing research on RNA and DNA sequencing, thymine is integral to various studies in molecular biology.

Government initiatives and funding support these advancements, as seen with Rescorp’s 2022 SEED Awards. The organization awarded $50,000 to Cottrell Scholars for high-risk, high-reward research in chemistry, which indirectly benefits thymine-related studies in biochemistry and molecular biology. Similarly, a 2023 grant of $2.3 million by the University of Michigan to define the “RNA alphabet” further highlights the significance of thymine in understanding genetic codes.

The increasing focus on RNA-based therapies and genetic research positions thymine as a critical chemical in next-generation therapies, such as mRNA vaccines and gene editing. As new technologies emerge, the demand for thymine in RNA research will likely continue its upward trajectory. Additionally, the expanding use of thymine in agricultural biotechnology to develop genetically modified crops presents an additional growth opportunity.

The global drive towards innovation in biopharmaceuticals, coupled with the push for personalized medicine and sustainable agriculture, is expected to drive thymine demand further. This trend, coupled with government-backed research initiatives, ensures a strong pipeline of opportunities in both academic and industrial sectors.

Key Takeaways

- The Global Thymine (CAS 65-71-4) Market is expected to be worth around USD 61.3 Million by 2034, up from USD 42.6 Million in 2024, and grow at a CAGR of 3.7% from 2025 to 2034.

- The thymine (CAS 65-71-4) market is dominated by the thymine (99%) type, holding a 59.1% share.

- The powder form of thymine represents 74.1% of the market, reflecting its widespread use.

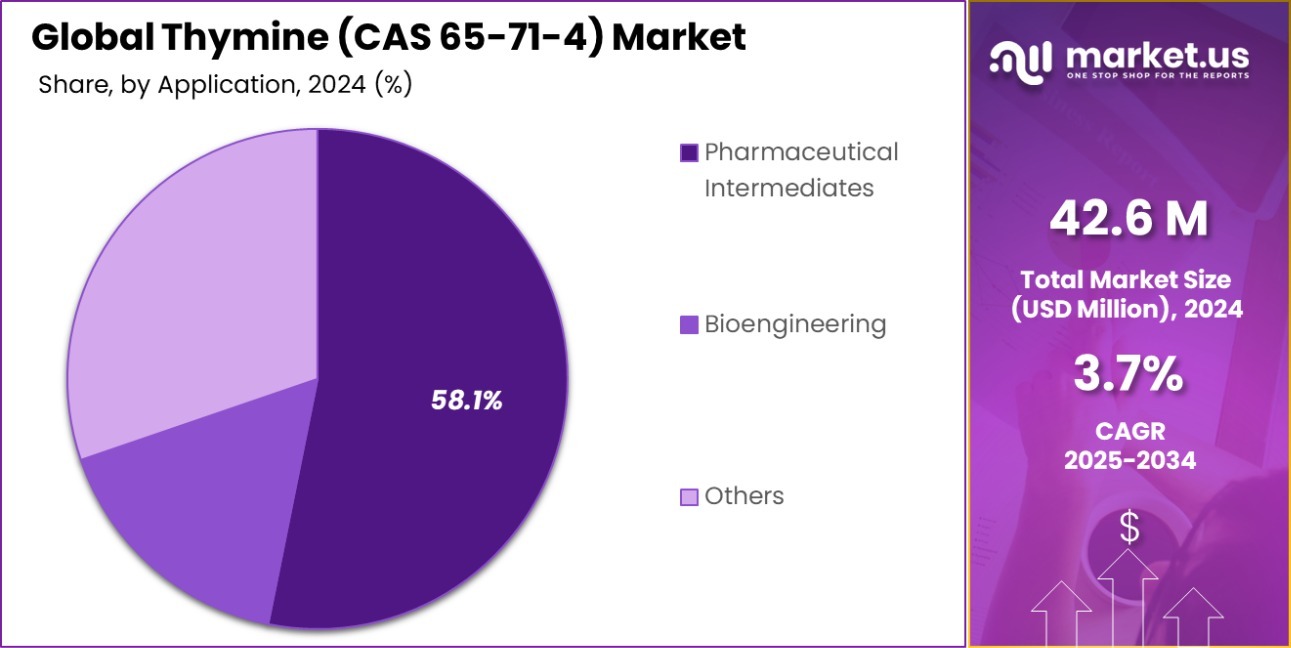

- Pharmaceutical intermediates account for 58.1% of thymine market applications, driving significant demand in drug production.

- North America holds 31.3% of the thymine market, valued at USD 13.3 million.

Business Benefits of Thymine (CAS 65-71-4) Market

Thymine (CAS 65-71-4) is a crucial nucleobase in DNA, contributing significantly to various biological processes, including genetic encoding and synthesis. In the biotechnology and pharmaceutical sectors, thymine plays a key role in the development of synthetic DNA and RNA molecules.

The National Science Foundation (NSF) has awarded $357,923 for a project focused on DNA synthesis, which may involve thymine research, underscoring its importance in scientific advancements. This funding facilitates continued innovation in genetic research and therapeutic applications, particularly in gene editing, biotechnology, and personalized medicine.

From a health and nutrition perspective, thymine’s derivative, thiamin (vitamin B1), is essential for metabolic function, particularly in energy production and nervous system health. The Daily Value (DV) for thiamin, which is used on nutrition and supplement facts labels, is 1.2 mg for adults and children aged 4 years and older. This highlights the importance of ensuring adequate intake of thiamin to prevent deficiencies, which can lead to neurological and cardiovascular issues.

In addition to its biological significance, thymine’s involvement in DNA synthesis opens opportunities for biotechnological applications, including drug development and diagnostic tools, creating valuable business prospects in the healthcare and research industries.

By Type Analysis

Thymine (CAS 65-71-4) market shows 59.1% thymine (99%) type dominance.

In 2024, Thymine (99%) held a dominant market position in the By Type segment of the Thymine (CAS 65-71-4) Market, with a 59.1% share. Thymine (99%) is widely utilized in pharmaceutical and research applications due to its high purity level, enabling accurate DNA/RNA synthesis. The segment’s strong growth reflects increasing demand in the biotechnology and life sciences industries.

In contrast, Thymine (97%) accounted for the remaining 40.9% of the market share. This grade of thymine finds use primarily in educational and basic research applications, where ultra-high purity is not a strict requirement. Despite lower purity, it is still favored for its cost-effectiveness in certain segments.

By Form Analysis

Powder form dominates the thymine market with a 74.1% share.

In 2024, Powder held a dominant market position in the By Form segment of the Thymine (CAS 65-71-4) Market, with a 74.1% share. The powder form is preferred for its ease of handling, stability, and versatility in various applications, including research and drug manufacturing. Its wide usage across pharmaceuticals and biotechnology drives its strong market share.

Liquid form, capturing the remaining 25.9% of the market, is mainly used in specialized applications requiring easier dissolution and incorporation into liquid-based formulations. Despite its smaller market share, liquid thymine is preferred in certain biotechnological and pharmaceutical processes where precise dosages are crucial, driving steady demand in niche applications.

By Application Analysis

Pharmaceutical intermediates application leads the thymine market with a 58.1% share.

In 2024, Pharmaceutical Intermediates held a dominant market position in the By Application segment of the Thymine (CAS 65-71-4) Market, with a 58.1% share. Thymine is extensively used in the production of key pharmaceutical compounds, such as antivirals and anticancer agents. Its high demand in drug development and formulation drives its strong presence in this segment.

Bioengineering accounted for the remaining 41.9% of the market share, with thymine playing a crucial role in genetic engineering and molecular biology applications. Its use in gene synthesis, PCR amplification, and other biotechnology processes contributes to steady demand within the bioengineering sector, supporting advancements in personalized medicine and diagnostic technologies.

Key Market Segments

By Type

- Thymine (97%)

- Thymine 99%)

- Others

By Form

- Powder

- Liquid

By Application

- Pharmaceutical Intermediates

- Bioengineering

- Others

Driving Factors

Growing Demand for Thymine in Pharmaceutical Applications

Thymine (CAS 65-71-4) is increasingly used in the pharmaceutical industry due to its crucial role in DNA synthesis. With rising healthcare needs, the demand for nucleic acids and related compounds like thymine is expected to grow.

The compound plays a vital part in developing genetic therapies and treatments for genetic disorders, cancer, and other chronic diseases. Pharmaceutical companies are increasingly focusing on harnessing thymine for creating effective drug formulations, driving its demand in the biotechnology and molecular research sectors.

Rising Applications in Biotechnology and Genetic Research

The biotechnology sector is another key driver for thymine market growth. As genetic research continues to advance, the demand for nucleotides like thymine has surged. Thymine is a core component in DNA sequencing, molecular cloning, and PCR (Polymerase Chain Reaction) techniques.

With the growing importance of genetic studies in personalized medicine and agriculture, thymine plays a vital role in innovation. Research organizations and biotech companies heavily rely on thymine for exploring new drug treatments and advancing gene-editing technologies, creating a consistent demand for this chemical.

Increasing Investment in Molecular Diagnostics and Gene Editing

Molecular diagnostics and gene-editing technologies are experiencing rapid growth, fueled by advancements in personalized medicine. Thymine is integral to CRISPR-Cas9 technology, which allows precise genetic modifications, contributing to breakthroughs in the treatment of genetic diseases.

With rising investments in gene therapies and molecular diagnostics, the demand for thymine is expected to grow significantly. The increasing focus on targeted treatments and precision medicine in healthcare will continue to drive thymine’s application, providing new avenues for market growth. This investment momentum will sustain its position as a critical biotechnological tool.

Restraining Factors

High Production Costs of Thymine Limit Market Expansion

One of the primary factors restricting thymine market growth is the high cost of its production. Thymine is synthesized through complex chemical processes that require specialized equipment, highly skilled labor, and expensive raw materials.

These factors contribute to its high price, making it a costly option for many manufacturers and limiting its widespread use in various industries. As a result, small and medium-sized companies may struggle to afford the raw material, curbing its overall market potential and slowing down its adoption in low-cost applications.

Limited Awareness and Adoption in Emerging Markets

In many emerging economies, awareness of thymine’s applications in biotechnology and pharmaceuticals remains low. The lack of knowledge about its significance in genetic research, drug formulation, and molecular diagnostics hinders its adoption in these regions.

Moreover, the infrastructure needed to support thymine-based research and production is underdeveloped in many areas, preventing the compound from reaching its full market potential. This limited adoption in developing markets restricts the global growth of the thymine market, particularly in regions with rising healthcare and research demands.

Regulatory Challenges in the Biotech and Pharmaceutical Industries

Thymine’s use in pharmaceutical and biotechnology applications is subject to strict regulatory requirements, which can be a significant barrier to its market growth. Regulatory approvals for new drugs or gene-editing technologies involving thymine can be time-consuming and costly.

Additionally, concerns over the safety, purity, and sourcing of thymine can further complicate the approval process. These regulatory hurdles may delay product development, restrict market access, and increase operational costs for companies, ultimately limiting the broader adoption of thymine in various applications across industries.

Growth Opportunity

Expanding Applications in Personalized Medicine and Genomics

The increasing focus on personalized medicine presents a significant growth opportunity for thymine. As genomic research advances, thymine plays a critical role in DNA sequencing, genetic testing, and CRISPR-based gene therapies.

The rising need for precision medicine, aimed at tailoring treatments to individual genetic profiles, will boost the demand for thymine in both diagnostics and therapeutic applications. Companies that invest in thymine-related technologies for personalized treatments stand to gain a competitive advantage as the healthcare industry continues to shift toward more customized care.

Growth in Biotechnology Research and Gene Therapy Advancements

Thymine is essential in biotechnology research and gene therapies, and as these fields grow, so does the opportunity for thymine’s application. Gene-editing technologies like CRISPR-Cas9 rely on nucleotides such as thymine to modify genes with high precision.

The increasing investment in gene therapies, aimed at treating genetic disorders, cancer, and other diseases, will significantly drive demand for thymine. Research institutions and biotech firms developing new therapies are likely to become key consumers, presenting significant growth potential for thymine in the next decade.

Expanding Demand for Molecular Diagnostics and Screening

The rising demand for molecular diagnostics, driven by advancements in early disease detection and screening, offers a strong growth opportunity for the thymine market. Thymine is used in polymerase chain reaction (PCR) and other diagnostic techniques, which are critical in detecting infections, genetic disorders, and certain cancers.

With the growing need for rapid and accurate diagnostic tools, particularly in the wake of global health challenges, thymine’s role in molecular diagnostics will continue to expand, creating new opportunities for its application and market growth.

Latest Trends

Growing Demand for High-Purity Thymine in Biotech

In recent years, the use of thymine in advanced biotechnology and genetic research has surged. High-purity grades are increasingly sought after to ensure precision in DNA synthesis, CRISPR applications, and molecular diagnostics.

This shift is driven by the growing prevalence of gene therapy projects, personalized medicine development, and the rising importance of nucleotide-based studies, which all rely heavily on the accuracy and reliability that high-purity thymine offers. As such, this trend is reshaping supply chains and quality standards in the market.

Rising Interest in Sustainable and Renewable Sources

A significant trend in the thymine market is the push toward sustainable production. Manufacturers are exploring greener synthesis routes and leveraging renewable feedstocks to reduce their environmental footprint. This approach not only aligns with global sustainability goals but also appeals to customers looking for eco-friendly alternatives.

The demand for sustainably produced thymine is likely to grow as companies focus on reducing their reliance on petrochemical inputs and meeting the increasing expectations of environmentally conscious consumers.

Increased Adoption in New Pharmaceutical Applications

Beyond its traditional uses, thymine is finding new roles in innovative pharmaceutical applications. It is becoming a key component in advanced antiviral drugs and next-generation cancer therapies. These applications have led to higher demand for thymine derivatives and formulations that meet stricter regulatory standards.

As pharmaceutical research expands into novel treatments, thymine’s role as a foundational molecule continues to strengthen, further fueling growth in the global market.

Regional Analysis

The North American thymine (CAS 65-71-4) market holds a 31.3% share, valued at USD 13.3 million

The global Thymine (CAS 65-71-4) market is geographically segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America currently dominates the market with a share of 31.3%, valued at USD 13.3 million.

This region’s leadership is attributed to its advanced pharmaceutical and biotechnology sectors, coupled with significant investments in genetic research and molecular diagnostics. The U.S., in particular, has a robust market for Thymine due to its well-established biotech industry and increasing demand for precision medicine.

Europe holds a notable share in the Thymine market, driven by a strong focus on healthcare innovations and molecular biology research. Key countries like Germany, the UK, and France are leading contributors to the demand for Thymine, particularly for use in drug development and genetic research. The region’s growing emphasis on biotechnology applications further boosts market prospects.

The Asia Pacific region is witnessing rapid growth, driven by expanding biotechnology sectors in China, India, and Japan. Increasing investments in healthcare infrastructure and growing awareness of genetic research are expected to drive the adoption of Thymine in this region, contributing to significant market growth over the forecast period.

Meanwhile, the Middle East & Africa and Latin America are emerging markets with slower adoption, primarily due to limited awareness and infrastructure, but the increasing demand for healthcare advancements presents growth opportunities in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global thymine (CAS 65-71-4) market is characterized by the presence of several key players that are involved in the production, distribution, and supply of thymine for a variety of applications, including pharmaceuticals, biotechnology, and chemical manufacturing. As of 2024, leading companies such as 3B Pharmachem, Sigma-Aldrich, and Cambridge Isotope continue to hold strong positions due to their extensive research and development capabilities and diversified product portfolios.

3B Pharmachem and Sigma-Aldrich, with their global presence and high-quality standards, cater primarily to the pharmaceutical and biotechnology sectors. Their expertise in providing high-purity chemicals and reagents positions them as leaders in the market, particularly in the supply of thymine for DNA synthesis, genetic research, and drug development.

Morre-Tec Industries and Wuhan Yuancheng Gongchuang Technology have capitalized on the growing demand for thymine in the chemical manufacturing industry. Their focus on cost-effective production and reliable supply chains has allowed them to expand their market share, especially in Asia-Pacific and other emerging regions.

Innovative companies like Sarepta Therapeutics and Yulchon Pharmaceutical, which are engaged in gene therapy and biotechnology research, are increasingly utilizing thymine in their cutting-edge applications. These players are expected to drive demand for thymine, especially in specialized pharmaceutical formulations.

Furthermore, Chinese producers such as Taiyuan RHF and Zhangjiagang Aihua Chemical continue to expand their footprint in the global market, benefiting from lower production costs and regional supply advantages.

Top Key Players in the Market

- 3B Pharmachem

- Cambridge Isotope

- Degussa Fine Chemicals

- George Uhe Company

- Morre-Tec Industries

- Sarepta Therapeutics

- Sigma-Aldrich

- Sintofarm S.P.A.

- Taiyuan RHF

- Wuhan Yuancheng Gongchuang Technology

- Yulchon Pharmaceutical

- Zhangjiagang Aihua Chemical

Recent Developments

- In 2023, 3B Pharmachem increased Thymine production and enhanced quality control. By 2024, the company advanced its synthesis technology, improving yield and cost-efficiency, and solidifying its role as a key supplier of pharmaceutical raw materials.

- In 2023, Morre-Tec Industries will produce high-quality Thymine (CAS 65-71-4) for pharmaceuticals, biotech, and agriculture. Also, they improved their production process, enhancing purity and efficiency, and solidifying their position as a leading supplier of specialty chemicals for diverse industries.

Report Scope

Report Features Description Market Value (2024) USD 42.6 Million Forecast Revenue (2034) USD 61.3 Million CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Thymine (97%), Thymine 99%), Others), By Form (Powder, Liquid), By Application (Pharmaceutical Intermediates, Bioengineering, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3B Pharmachem, Cambridge Isotope, Degussa Fine Chemicals, George Uhe Company, Morre-Tec Industries, Sarepta Therapeutics, Sigma-Aldrich, Sintofarm S.P.A., Taiyuan RHF, Wuhan Yuancheng Gongchuang Technology, Yulchon Pharmaceutical, Zhangjiagang Aihua Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Thymine (CAS 65-71-4) MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Thymine (CAS 65-71-4) MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3B Pharmachem

- Cambridge Isotope

- Degussa Fine Chemicals

- George Uhe Company

- Morre-Tec Industries

- Sarepta Therapeutics

- Sigma-Aldrich

- Sintofarm S.P.A.

- Taiyuan RHF

- Wuhan Yuancheng Gongchuang Technology

- Yulchon Pharmaceutical

- Zhangjiagang Aihua Chemical