Global 7-Amino Heptanoic Acid Market Size, Share, Upcoming Investments Report By Product Type (Pharmaceutical Grade, Industry Grade), By Application (Pharmaceuticals, Chemical Intermediates, Research and Development, Others), By End-Use (Pharmaceutical Companies, Chemical Industry, Research Institutes, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138073

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

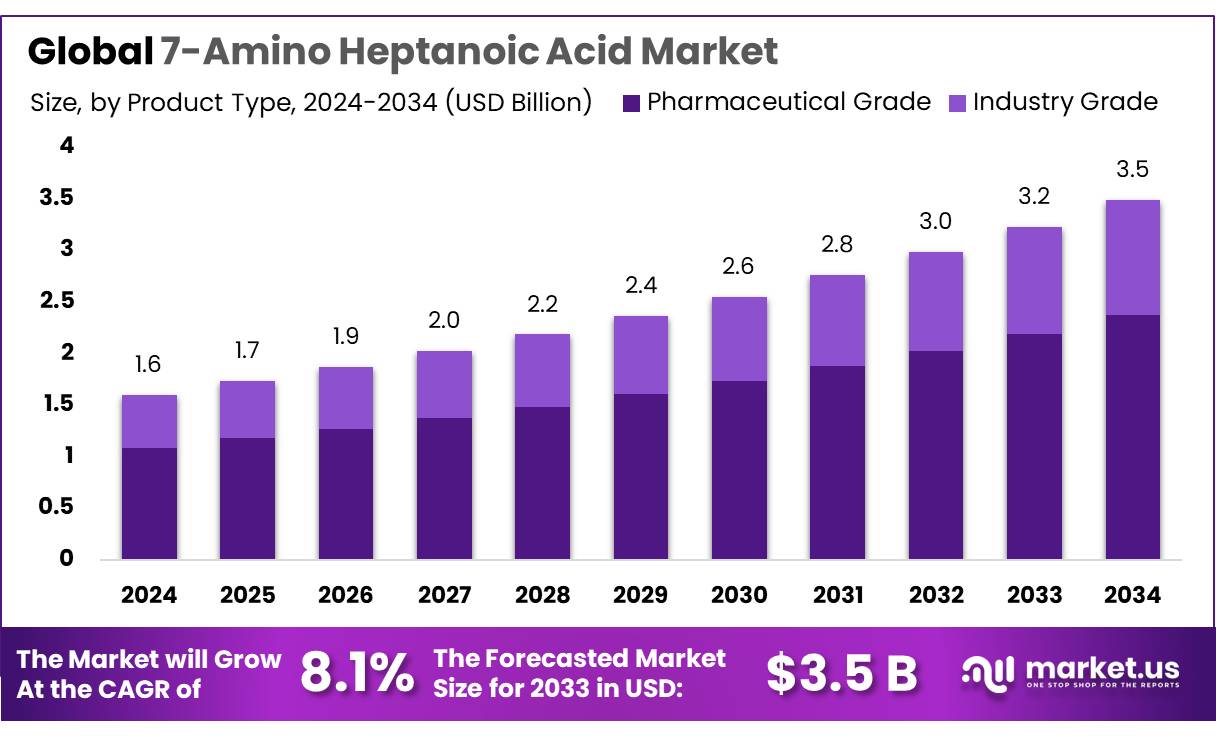

The Global 7-Amino Heptanoic Acid Market size is expected to be worth around USD 3.5 Bn by 2034, from USD 1.6 Bn in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The Global 7-Amino Heptanoic Acid Market is experiencing a significant trajectory of growth driven by the expanding pharmaceutical and biotechnology industries. 7-Amino Heptanoic Acid, a non-proteinogenic alpha amino acid, is predominantly utilized in the synthesis of peptide hormones, antifungal agents, and various other bioactive compounds. Its role as a building block in peptide synthesis makes it a critical raw material in drug development and manufacturing.

Advancements in biotechnological techniques and the increasing adoption of peptide-based drugs over traditional small molecule drugs are also fostering growth in the market. The biotechnological advancements not only enhance the efficacy and efficiency of the production processes but also improve the scalability of amino acid synthesis, thereby reducing costs and facilitating wider adoption.

The primary driving factor for the Global 7-Amino Heptanoic Acid Market is the increasing prevalence of diseases that require novel therapeutic approaches. This is coupled with the pharmaceutical industry’s ongoing efforts to enhance drug efficacy and safety, where peptide-based formulations play a crucial role. The growing trend towards personalized medicine is further augmenting the demand for specialized amino acids like 7-Amino Heptanoic Acid in therapeutic applications.

Emerging markets represent a significant growth opportunity for the 7-Amino Heptanoic Acid industry. As healthcare infrastructure improves in these regions, along with increased healthcare spending and awareness about advanced therapeutics, the demand for peptide-based formulations is expected to rise. Furthermore, collaborations between leading pharmaceutical companies and local players in these markets could facilitate technology transfer and localized production, enhancing market penetration.

Key Takeaways

- 7-Amino Heptanoic Acid Market size is expected to be worth around USD 3.5 Bn by 2034, from USD 1.6 Bn in 2024, growing at a CAGR of 8.1%.

- Pharmaceutical Grade 7-Amino Heptanoic Acid emerged as the leading segment in the market, securing a substantial 68.2% share.

- Pharmaceuticals segment held a dominant position in the 7-Amino Heptanoic Acid market, accounting for more than 56.2% of the total market share.

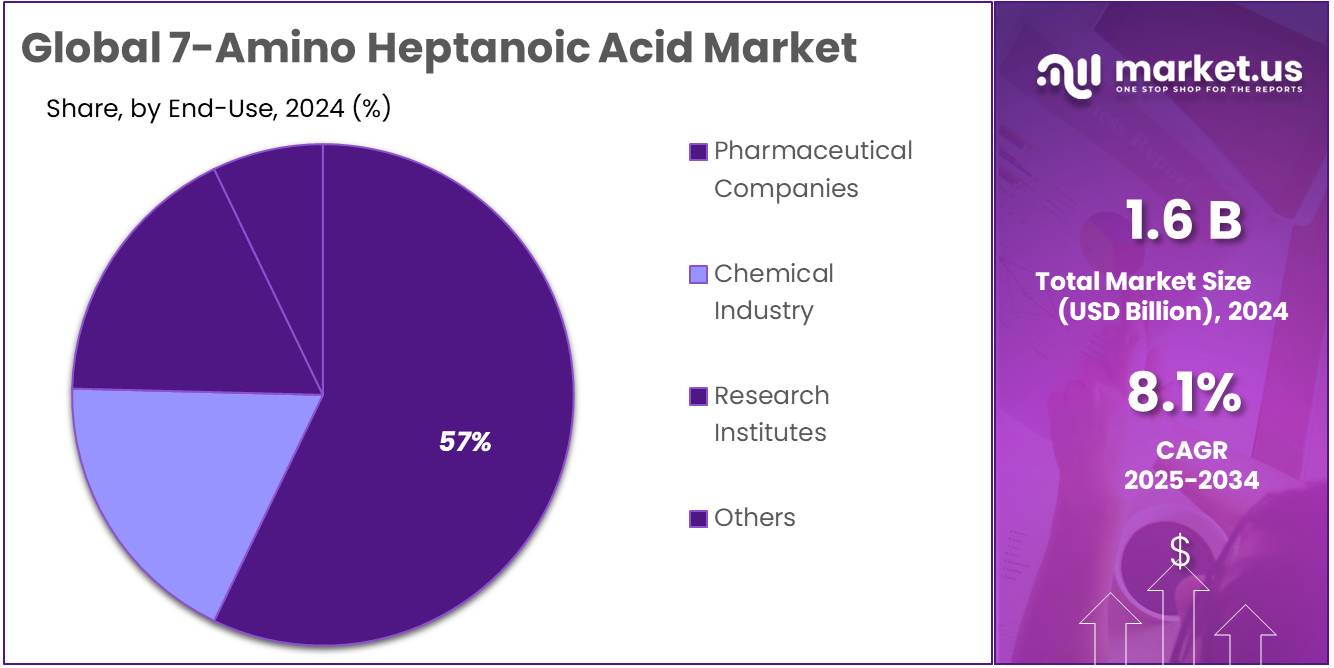

- Pharmaceutical Companies held the largest share of the 7-Amino Heptanoic Acid market, capturing over 58.1%.

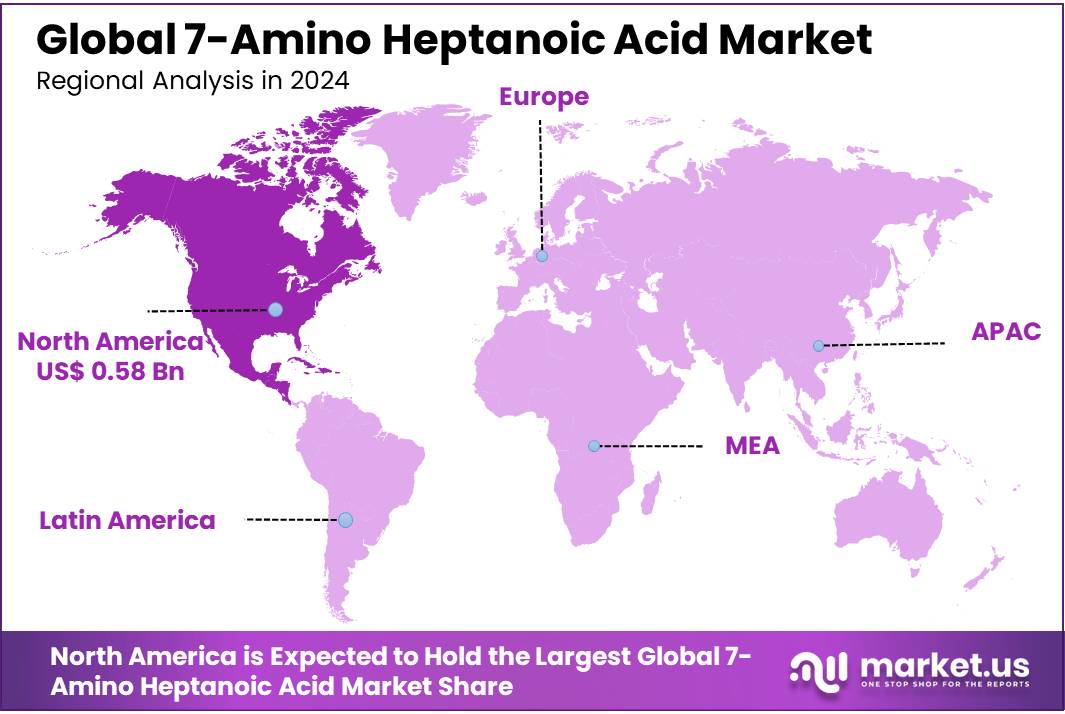

- North America stands out as the dominating region, holding a substantial 36.2% market share with a valuation of USD 0.58 billion.

By Product Type

In 2024, Pharmaceutical Grade 7-Amino Heptanoic Acid emerged as the leading segment in the market, securing a substantial 68.2% share. This dominance is largely attributed to the extensive use of this compound in the pharmaceutical industry, where it’s integral in the synthesis of various peptides and active pharmaceutical ingredients (APIs). The high purity requirements for pharmaceutical applications justify the segment’s larger market share, as the quality directly impacts the efficacy and safety of the final pharmaceutical products.

Industry Grade segment catered primarily to less stringent applications, such as the production of specialty chemicals and intermediates. While this segment covers a diverse range of industrial uses, it commands a smaller portion of the market due to the lower purity requirements and the subsequent lower price points compared to the Pharmaceutical Grade. This distinction in application and purity standards clearly delineates the market dynamics between these two segments, reflecting their respective roles and economic values within the broader 7-Amino Heptanoic Acid market.

By Application

In 2024, the Pharmaceuticals segment held a dominant position in the 7-Amino Heptanoic Acid market, accounting for more than 56.2% of the total market share. This segment’s leadership stems from the critical role 7-Amino Heptanoic Acid plays in drug development and manufacturing, particularly in the synthesis of peptides and various pharmaceutical formulations. The high demand within the pharmaceutical industry is driven by ongoing research and development activities aiming to discover new therapeutic agents, where this compound serves as a building block for many innovative drugs.

The Chemical Intermediates segment also plays a significant role in the market, though it commands a smaller share compared to Pharmaceuticals. This segment involves the use of 7-Amino Heptanoic Acid in various chemical synthesis processes where it acts as an intermediate. Its applications span across multiple industries, including manufacturing and material science, reflecting its versatility but also its lesser focus compared to pharmaceutical applications.

Furthermore, the Research and Development segment, although smaller, is crucial for advancing the understanding and new uses of 7-Amino Heptanoic Acid. This segment includes academic and commercial research institutions that explore novel applications and improve synthesis processes, contributing significantly to the overall market dynamics.

By End-Use

In 2024, Pharmaceutical Companies held the largest share of the 7-Amino Heptanoic Acid market, capturing over 58.1% of it. This segment’s dominance is primarily due to the extensive use of 7-Amino Heptanoic Acid in drug development and synthesis, where it is a valuable component in creating a variety of pharmaceutical products. The consistent demand within this sector is driven by ongoing research and innovations in drug formulations, making it a critical area of focus for the use of this chemical.

The Chemical Industry also represents a significant portion of the market. Here, 7-Amino Heptanoic Acid is utilized as a specialty chemical in a range of applications, from the production of complex organic compounds to serving as an intermediate in various industrial processes. Though its share is smaller than that of the pharmaceutical sector, the versatility and utility of 7-Amino Heptanoic Acid in the chemical industry underscore its importance.

Research Institutes form another key segment. These institutions use 7-Amino Heptanoic Acid in scientific studies and experiments, exploring new ways to apply it in both existing and emerging fields. While this segment does not command as large a market share as pharmaceuticals or chemical industries, its role in pushing the boundaries of scientific knowledge and application is indispensable.

Key Market Segments

By Product Type

- Pharmaceutical Grade

- Industry Grade

By Application

- Pharmaceuticals

- Chemical Intermediates

- Research and Development

- Others

By End-Use

- Pharmaceutical Companies

- Chemical Industry

- Research Institutes

- Others

Drivers

Expanding Pharmaceutical Applications Drive Demand for 7-Amino Heptanoic Acid

The pharmaceutical industry’s reliance on peptides for drug development is well-documented. According to a report by the World Health Organization, peptide-based drugs have shown robust growth in clinical use due to their high efficacy and specificity in targeting diseases. Peptides play a critical role in treatments for a range of conditions, from cancer and diabetes to cardiovascular diseases, which are some of the leading causes of mortality worldwide. This has led to heightened research and development activities focusing on peptide technologies, indirectly boosting the demand for 7-Amino Heptanoic Acid.

Further fueling this demand are the strategic initiatives by governments and health organizations to support pharmaceutical advancements. For instance, the U.S. government’s National Institutes of Health (NIH) has been actively funding research in peptide-based therapeutic agents. Such initiatives underscore the commitment to advancing medical science, where 7-Amino Heptanoic Acid serves as a key ingredient in many research projects.

Moreover, the shift towards personalized medicine is another crucial factor. Personalized or precision medicine tailors medical treatment to individual characteristics of each patient, which often involves peptide-related therapies. This approach has been gaining traction, as evidenced by the growing number of personalized drugs being approved by the U.S. Food and Drug Administration (FDA) each year. The push towards personalized medicine not only highlights the importance of high-quality ingredients like 7-Amino Heptanoic Acid but also ensures sustained demand in the pharmaceutical sector.

Additionally, the rise in chronic diseases globally has led to increased drug manufacturing, where 7-Amino Heptanoic Acid’s role is indispensable. The Centers for Disease Control and Prevention (CDC) reports that chronic diseases such as heart disease, cancer, and diabetes are the leading causes of death and disability in the United States, necessitating ongoing development of effective treatments. The link between chronic disease management and peptide therapeutics, where 7-Amino Heptanoic Acid is vital, illustrates the compound’s significance in the pharmaceutical supply chain.

Looking ahead, the continued growth in the pharmaceutical sector, supported by favorable government policies and the increasing prevalence of chronic diseases, is expected to keep the demand for 7-Amino Heptanoic Acid robust. These trends not only highlight the compound’s critical role in modern medicine but also suggest a positive outlook for its market in the coming years.

Restraints

Regulatory Challenges and Safety Concerns Limiting the Use of 7-Amino Heptanoic Acid

A significant restraint in the 7-Amino Heptanoic Acid market is the stringent regulatory environment surrounding its use, particularly in the pharmaceutical and food industries. The safety concerns associated with the synthesis and application of 7-Amino Heptanoic Acid pose challenges to market growth, as companies must navigate complex regulatory frameworks to ensure compliance.

The production and use of chemical compounds in pharmaceuticals are highly regulated globally to ensure safety and efficacy. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have set rigorous standards that manufacturers must meet. These standards often involve extensive toxicity testing and clinical trials, which can be time-consuming and costly. For instance, the FDA requires detailed documentation and testing results to evaluate the potential risks associated with new drugs, including those utilizing 7-Amino Heptanoic Acid as a precursor or intermediate.

Moreover, the chemical’s use in food products, although less common, is also under scrutiny. The European Food Safety Authority (EFSA) and other bodies have mandates to assess the safety of food additives, including compounds like 7-Amino Heptanoic Acid. These assessments can lead to restrictions or bans if potential health risks are identified. For example, any chemical used in food production in the European Union must undergo a risk assessment by the EFSA, which examines toxicological data to ensure consumer safety.

The impact of these regulations is significant. According to a report by the World Health Organization, the development of new pharmaceutical products can be delayed or halted if compounds fail to meet safety standards, directly affecting the demand for raw materials like 7-Amino Heptanoic Acid. These delays not only increase the costs associated with drug development but also reduce the potential market size for high-purity chemical compounds used in these processes.

Safety concerns extend beyond regulatory compliance. There is also public apprehension about the use of synthetic chemicals in drugs and food, influenced by broader environmental and health-conscious trends. Consumer groups and environmental organizations often raise concerns about the long-term impacts of synthetic compounds, which can influence market perceptions and lead to decreased demand.

In response to these challenges, government and industry initiatives are focusing on improving the safety profiles of chemical compounds. Programs like the U.S. National Toxicology Program (NTP) conduct research to provide data about the adverse effects of chemical substances, including 7-Amino Heptanoic Acid. Such initiatives aim to improve understanding and guide regulatory decisions, ultimately helping to mitigate the market restraints posed by safety concerns.

Opportunity

Emerging Markets Offer New Growth Avenues for 7-Amino Heptanoic Acid

A significant growth opportunity for the 7-Amino Heptanoic Acid market lies in its expanding applications across emerging markets, particularly within the biotechnology and pharmaceutical sectors in Asia-Pacific and Latin America. These regions are witnessing rapid growth in their healthcare and pharmaceutical industries, driven by increasing economic prosperity, growing healthcare expenditures, and rising awareness of advanced medical treatments.

In recent years, countries like China and India have become hotspots for pharmaceutical manufacturing and research, fueled by both local and international investments. According to the World Health Organization, healthcare spending in Asia has been increasing at a faster rate than in Western countries, with China and India projected to become the world’s largest healthcare markets by 2030. This surge is largely due to government initiatives aimed at improving healthcare infrastructure and accessibility, which in turn boosts the demand for pharmaceutical ingredients like 7-Amino Heptanoic Acid.

For instance, the Indian government has launched several initiatives such as the ‘Pharma Vision 2020’, aimed at making India a global leader in end-to-end drug manufacture. Such policies not only encourage domestic production but also attract foreign companies seeking cost-effective manufacturing and skilled labor. This environment creates a fertile ground for increased use of 7-Amino Heptanoic Acid as a building block in drug development and manufacturing.

Moreover, the biotechnology sector in these regions is also on the rise. Government support for biotech research, coupled with collaborations between academic institutions and the pharmaceutical industry, is paving the way for innovations that utilize 7-Amino Heptanoic Acid. For example, in South Korea, government-funded biotech initiatives have led to advancements in peptide-based therapies, which are critical areas of application for 7-Amino Heptanoic Acid.

Latin America is another region offering growth opportunities. Countries like Brazil and Mexico are improving their regulatory frameworks to encourage pharmaceutical and chemical manufacturing. These reforms are designed to ensure higher standards of product quality and safety, aligning with global practices and thus facilitating international trade and cooperation. As these markets mature, the demand for specialized pharmaceutical compounds, including 7-Amino Heptanoic Acid, is expected to rise.

Trends

Integration of Green Chemistry Principles in 7-Amino Heptanoic Acid Production

One of the latest trends shaping the 7-Amino Heptanoic Acid market is the increasing adoption of green chemistry practices in its production process. This trend is driven by the growing global emphasis on sustainability and environmental responsibility, particularly in the chemical manufacturing sector. Green chemistry aims to reduce the environmental impact of chemical production by minimizing waste, reducing the use of hazardous substances, and improving efficiency, which aligns with broader regulatory and consumer demands for more sustainable industrial practices.

In the context of 7-Amino Heptanoic Acid, manufacturers are exploring new synthesis routes that are less toxic and more environmentally friendly. These methods often involve the use of biocatalysts or greener solvents that significantly reduce harmful byproducts and energy consumption during production. For example, the use of enzyme-catalyzed processes allows for more selective reactions that can operate under milder conditions and generate fewer waste products compared to traditional chemical synthesis.

The impact of these green chemistry innovations is substantial. According to a report by the United Nations Environment Programme (UNEP), adopting green chemistry practices can reduce waste by up to 80% in some chemical manufacturing processes. This shift not only helps companies comply with increasingly stringent environmental regulations but also improves their competitiveness in the global market by enhancing the sustainability of their products.

Government initiatives across the world support this trend towards greener chemical processes. In the United States, the Environmental Protection Agency (EPA) has launched programs like the Green Chemistry Challenge, which awards companies that successfully integrate sustainable practices into their manufacturing processes. Such initiatives not only promote environmental stewardship but also encourage the industry to develop safer, more sustainable chemical production methods.

Furthermore, the rise of eco-labeling and consumer awareness around environmental impact are influencing market dynamics. Consumers and businesses are increasingly preferring products manufactured through sustainable practices, driving demand for compounds like 7-Amino Heptanoic Acid produced under green chemistry principles. This consumer-driven demand encourages more companies to adopt greener methods as a way to maintain market relevance and consumer trust.

In addition, the economic benefits associated with green chemistry, such as reduced costs from fewer raw materials and lower waste management expenses, make it an attractive option for manufacturers. The integration of these practices is not just a regulatory or environmental consideration but also a strategic economic decision that can lead to significant cost savings and brand enhancement.

Regional Analysis

North America stands out as the dominating region, holding a substantial 36.2% market share with a valuation of USD 0.58 billion. This prominence is bolstered by a robust pharmaceutical sector and significant investments in biotechnology and healthcare research, particularly in the United States and Canada. The presence of a stringent regulatory framework ensures high standards of product quality and safety, further solidifying the region’s leading position.

Europe follows closely, benefiting from advanced manufacturing capabilities and extensive research in peptide-based therapeutics. Countries such as Germany, France, and Switzerland are key contributors, driven by well-established chemical and pharmaceutical industries. Additionally, the European market is supported by strong regulatory policies focusing on safety and environmental sustainability, which align well with the global shift towards greener chemical processes.

The Asia Pacific region is identified as a rapidly growing market for 7-Amino Heptanoic Acid, led by China and India. This growth is fueled by expanding pharmaceutical manufacturing and increasing investments in healthcare infrastructure. The region’s market expansion is also supported by government initiatives aimed at boosting the biotechnology and pharmaceutical sectors, making it a significant player in the global landscape.

Meanwhile, the Middle East & Africa and Latin America are emerging as potential growth areas, though they currently hold smaller shares of the global market. These regions are witnessing gradual increases in healthcare expenditures and initiatives to enhance local manufacturing capabilities, which could lead to greater market penetration in the future.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The 7-Amino Heptanoic Acid market is characterized by a mix of global giants and specialized regional players, creating a competitive landscape that spans across multiple continents. Leading the pack are well-established chemical conglomerates like BASF SE, Evonik Industries AG, and Arkema Group, known for their extensive research capabilities and vast distribution networks. These companies have leveraged their advanced technological platforms to innovate and scale production, meeting the rigorous standards required in pharmaceutical and industrial applications. Their global presence allows them to efficiently serve the major markets in North America, Europe, and Asia Pacific, maintaining a strong foothold in the industry.

Nanjing Dernor, Shijiazhuang Sdyano, and Jinan Chenghui represent key regional players in Asia, particularly in China, which has become a hub for the manufacturing and export of chemical products including 7-Amino Heptanoic Acid. These companies benefit from local government support and lower manufacturing costs, which enable them to compete effectively in domestic and international markets. Their growth is indicative of the shifting dynamics in the global chemical sector, where Asian manufacturers are ascending in the value chain.

Solvay S.A., Mitsubishi Chemical Corporation, and DuPont de Nemours, Inc. play crucial roles in driving innovation within the sector. These firms invest heavily in R&D to develop sustainable and efficient production processes that align with the global trend towards environmental sustainability. The diversity and strategic approaches of these key players underscore the complexity and vibrancy of the global 7-Amino Heptanoic Acid market, reflecting its broad applications and the evolving demands of end-use industries.

Top Key Players

- Nanjing Dernor

- Shijiazhuang Sdyano

- Abachem

- Jinan Chenghui

- Ouhe

- Faen

- Huidian

- Yunbang

- Lingkai

- Dongzhi

- Xinwest

- BASF SE

- Evonik Industries AG

- Arkema Group

- Solvay S.A.

- Toray Industries, Inc.

- DSM Nutritional Products

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- Lanxess AG

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- LG Chem Ltd.

- Huntsman Corporation

- Wanhua Chemical Group Co., Ltd.

- SABIC (Saudi Basic Industries Corporation)

- Covestro AG

- DIC Corporation

- UBE Industries, Ltd.

- Shandong Haili Chemical Industry Co., Ltd.

Recent Developments

In 2024 Nanjing Dernor, it was highlighted for advancing the production technologies and enhancing the quality and application range of 7-Amino Heptanoic Acid, catering mainly to pharmaceutical and industrial needs.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 3.5 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pharmaceutical Grade, Industry Grade), By Application (Pharmaceuticals, Chemical Intermediates, Research and Development, Others), By End-Use (Pharmaceutical Companies, Chemical Industry, Research Institutes, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nanjing Dernor, Shijiazhuang Sdyano, Abachem, Jinan Chenghui, Ouhe, Faen, Huidian, Yunbang, Lingkai, Dongzhi, Xinwest, BASF SE, Evonik Industries AG, Arkema Group, Solvay S.A., Toray Industries, Inc., DSM Nutritional Products, Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd., Asahi Kasei Corporation, Lanxess AG, DuPont de Nemours, Inc., Eastman Chemical Company, LG Chem Ltd., Huntsman Corporation, Wanhua Chemical Group Co., Ltd., SABIC (Saudi Basic Industries Corporation), Covestro AG, DIC Corporation, UBE Industries, Ltd., Shandong Haili Chemical Industry Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  7-Amino Heptanoic Acid MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

7-Amino Heptanoic Acid MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nanjing Dernor

- Shijiazhuang Sdyano

- Abachem

- Jinan Chenghui

- Ouhe

- Faen

- Huidian

- Yunbang

- Lingkai

- Dongzhi

- Xinwest

- BASF SE

- Evonik Industries AG

- Arkema Group

- Solvay S.A.

- Toray Industries, Inc.

- DSM Nutritional Products

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- Lanxess AG

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- LG Chem Ltd.

- Huntsman Corporation

- Wanhua Chemical Group Co., Ltd.

- SABIC (Saudi Basic Industries Corporation)

- Covestro AG

- DIC Corporation

- UBE Industries, Ltd.

- Shandong Haili Chemical Industry Co., Ltd.