Global 2 - Ethyl Anthraquinone Market Size, Share, Upcoming Investments Report By Grade (Technical Grade, Pharmaceutical Grade, Food Grade, Others), By Purity Level (98%, 99%, 99.5%, 100%), By Type (Granules, Crystals), By Application (Paper, Textile, Detergent Bleaches, Water Purification, Others), By End-use (Chemicals, Textiles, Pharmaceuticals, Paper and Pulp, Others), By Distribution Channel (Direct Sales, Distributors, Retail Stores, Online Platforms, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138114

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

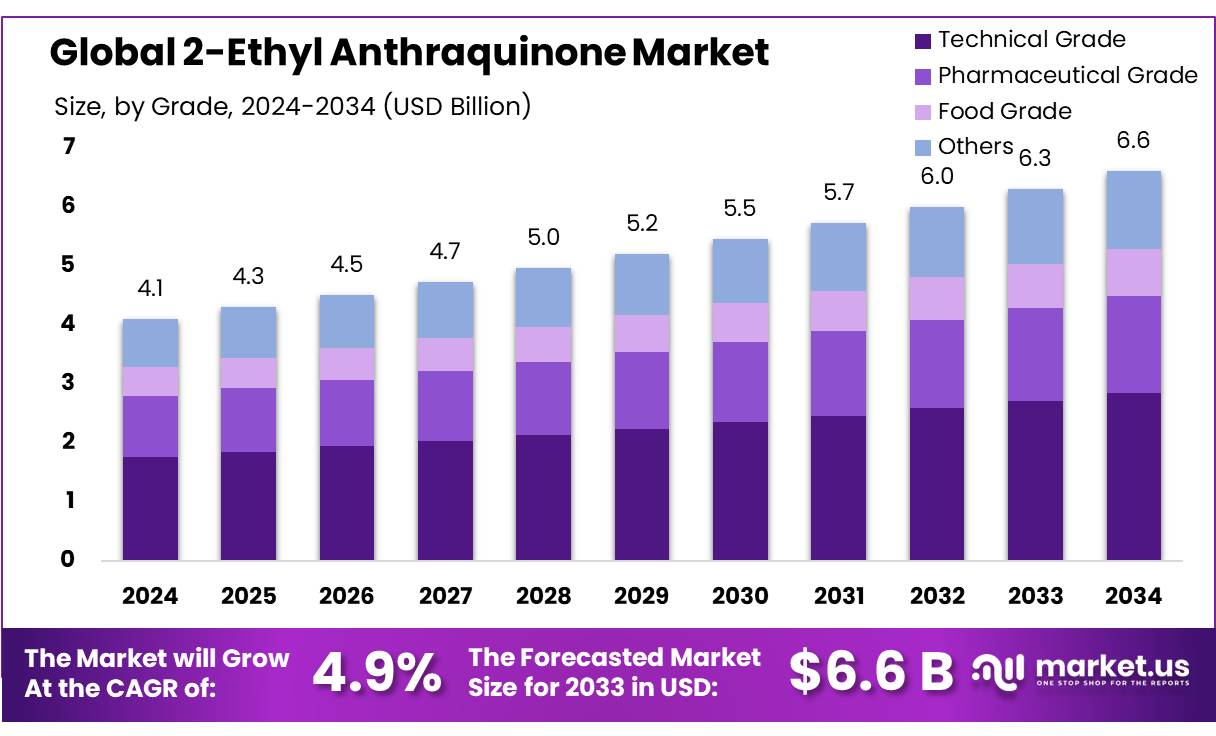

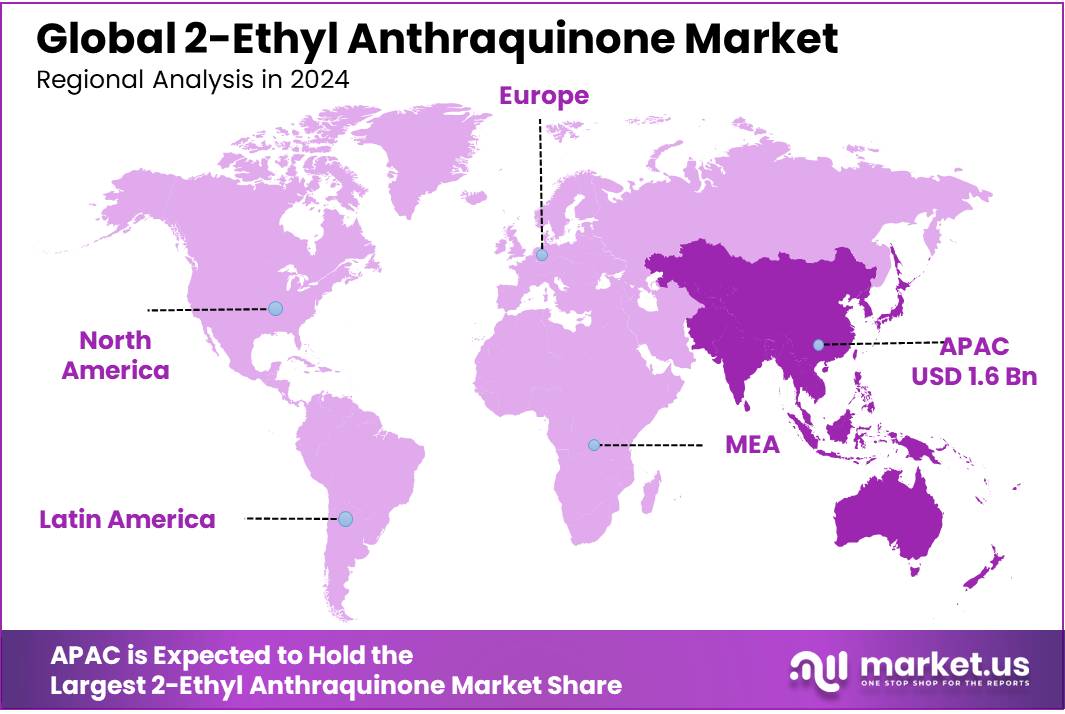

The Global 2 – Ethyl Anthraquinone Market size is expected to be worth around USD 6.6 Bn by 2034, from USD 4.1 Bn in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. The Asia Pacific (APAC) Region Holds Dominant Position in the Market, Accounting for 39.4% of the Market Share with a Valuation of USD 1.6 Billion

The Global 2-Ethyl Anthraquinone Market is witnessing steady growth as demand for this chemical compound rises across a range of industries, particularly in the production of hydrogen peroxide, an important chemical used in various industrial processes. 2-Ethyl Anthraquinone is primarily utilized as a catalyst in the anthraquinone process for the production of hydrogen peroxide, which is a key component in textile bleaching, water treatment, and as an oxidizing agent in various chemical processes. With the increasing use of hydrogen peroxide across multiple sectors, the 2-Ethyl Anthraquinone market is poised to experience continuous growth.

The 2-Ethyl Anthraquinone is closely tied to the global demand for hydrogen peroxide. As industries expand and demand for cleaner and more efficient chemical processes increases, the need for high-quality hydrogen peroxide, and therefore 2-Ethyl Anthraquinone, continues to grow. The market is characterized by a mix of established players and emerging companies that are investing in both the production and research of 2-Ethyl Anthraquinone to meet evolving industrial requirements.

In the context of hydrogen peroxide production, the anthraquinone process is highly favored for its efficiency and scalability. 2-Ethyl Anthraquinone, used as a catalyst in this process, enables the continuous production of hydrogen peroxide, making it indispensable in various applications, including pulp and paper processing, wastewater treatment, and the production of bleach and other cleaning agents. The growth of these industries, particularly in developing economies where industrialization is increasing, has contributed significantly to the expansion of the 2-Ethyl Anthraquinone market.

Several key factors are driving the growth of the Global 2-Ethyl Anthraquinone Market. The increasing demand for hydrogen peroxide, driven by its broad applications in the chemical, pharmaceutical, and food industries, is the most prominent catalyst. Hydrogen peroxide is used in a variety of applications ranging from disinfection and sterilization to environmental applications like wastewater treatment and pollution control, further supporting the demand for 2-Ethyl Anthraquinone.

The future of the Global 2-Ethyl Anthraquinone Market looks promising, with several opportunities for expansion. The continued demand for hydrogen peroxide in emerging markets, particularly in Asia-Pacific, presents a major growth opportunity. As countries in this region industrialize and invest in sectors such as textiles, paper production, and water treatment, the need for efficient and cost-effective chemical production methods like the anthraquinone process will drive further demand for 2-Ethyl Anthraquinone.

Furthermore, the rising focus on sustainable chemical processes offers growth opportunities for manufacturers that can innovate in production techniques, enhancing both the cost-effectiveness and environmental benefits of the anthraquinone process. The increasing adoption of hydrogen peroxide in novel applications, such as in electronics manufacturing and oil recovery, is also likely to expand the scope of the 2-Ethyl Anthraquinone market, further establishing it as a critical component in the global chemical supply chain.

Key Takeaways

- 2 – Ethyl Anthraquinone Market size is expected to be worth around USD 6.6 Bn by 2034, from USD 4.1 Bn in 2024, growing at a CAGR of 4.9%.

- Technical Grade 2-Ethyl Anthraquinone commanded the market with a robust 43.4% share.

- 99.5% purity level of 2-Ethyl Anthraquinone secured a dominant market position, capturing more than a 38.1% share.

- Granules form of 2-Ethyl Anthraquinone held a dominant market position, capturing more than a 63.4% share.

- Paper industry held a dominant position in the 2-Ethyl Anthraquinone market, capturing more than a 39.3% share.

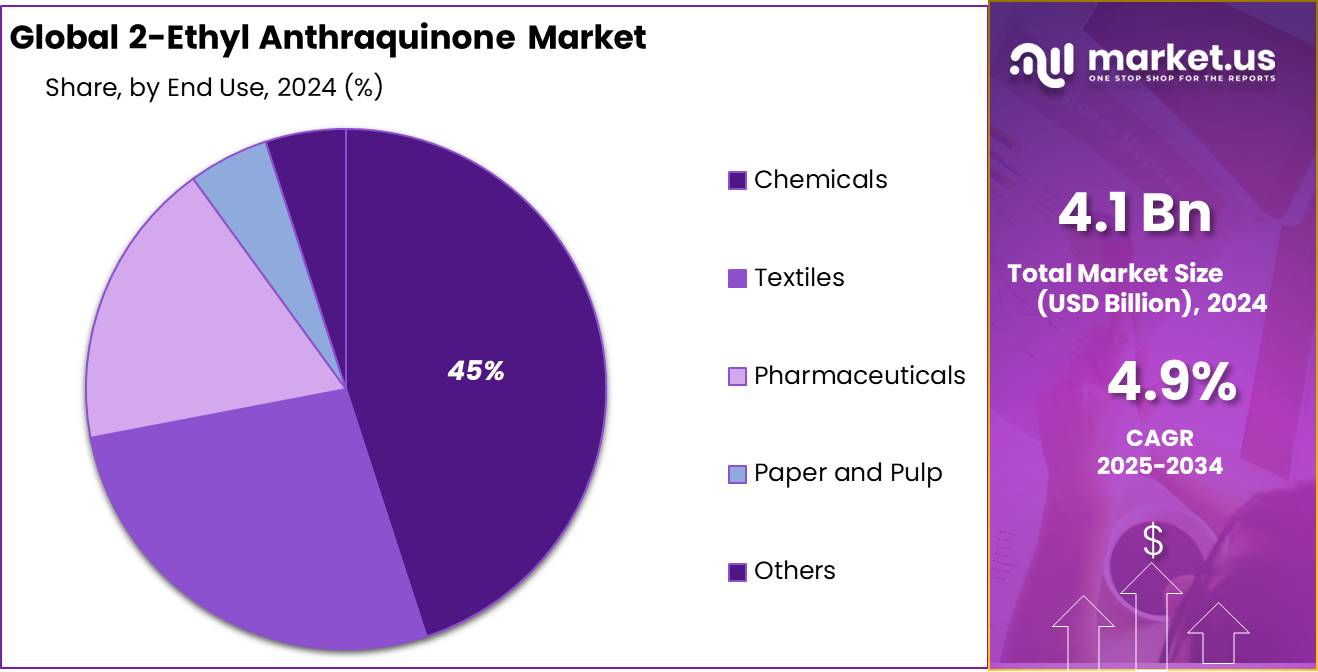

- Chemicals sector held a dominant position in the 2-Ethyl Anthraquinone market, capturing more than a 44.8% share.

- Direct Sales held a dominant position in the 2-Ethyl Anthraquinone market, capturing more than a 39.1% share.

- Asia Pacific (APAC) dominates the market, holding a 39.4% share with a valuation of USD 1.6 billion.

By Grade

In 2024, Technical Grade 2-Ethyl Anthraquinone commanded the market with a robust 43.4% share, indicating its pivotal role in industrial applications. This grade’s predominance is attributed to its extensive use in the synthesis of hydrogen peroxide, a critical component in paper bleaching and wastewater treatment processes. Its reliability for such essential functions ensures a steady demand within the chemical manufacturing sector.

Pharmaceutical Grade followed in significance, tailored to meet stringent purity standards necessary for medical applications. This grade’s utilization in the pharmaceutical industry underscores its importance in the synthesis of various therapeutic agents, where high-grade chemical precursors are crucial for ensuring patient safety and efficacy of medications.

Food Grade 2-Ethyl Anthraquinone, though a smaller segment, is critical for applications that require direct or indirect contact with food products. Its use is governed by strict regulatory standards to prevent contamination and ensure consumer safety, which is paramount in food processing and packaging industries.

By Purity Level

In 2024, the 99.5% purity level of 2-Ethyl Anthraquinone secured a dominant market position, capturing more than a 38.1% share. This high level of purity is particularly valued in applications where superior quality and chemical reactivity are critical, such as in the synthesis of fine chemicals and certain pharmaceutical intermediates. The demand for this purity grade underscores the need for precision in applications that cannot tolerate impurities, which could otherwise affect the efficacy or safety of the final products.

The 99% purity grade also plays a significant role in the market, catering to a range of industrial applications that require high but not absolute purity. This grade balances cost-effectiveness with performance, making it suitable for large-scale processes where the highest purity level may not be necessary.

Meanwhile, the 98% purity level, while still important, caters to more general industrial applications. These typically include uses in manufacturing processes where slight impurities do not significantly impact the quality of the end product, such as certain types of chemical synthesis and industrial reactions.

The 100% purity grade, although less common, finds niche applications where absolute purity is non-negotiable, often in highly specialized and sensitive research environments and some high-tech industries. However, the demand for this grade is limited due to its higher production costs and the specialized nature of its applications.

By Type

In 2024, the granules form of 2-Ethyl Anthraquinone held a dominant market position, capturing more than a 63.4% share. This dominance is primarily due to the granules’ ease of handling and suitability for large-scale industrial processes, where they can be easily measured, transported, and integrated into various chemical syntheses without significant dust generation or loss. Granules are particularly preferred in the production of hydrogen peroxide, a major application of 2-Ethyl Anthraquinone, due to their consistent quality and reactivity, which ensure efficient and controlled chemical reactions.

Crystals of 2-Ethyl Anthraquinone, while holding a smaller share of the market, are crucial in applications requiring precise purity and specific crystalline properties. These are often utilized in more specialized chemical processes and laboratory settings where the exact crystal form can influence the outcome of chemical reactions or the quality of the final product. Crystals are typically favored for their purity and controlled dissolution rates, making them ideal for high-purity applications that demand stringent control over chemical processes.

By Application

In 2024, the paper industry held a dominant position in the 2-Ethyl Anthraquinone market, capturing more than a 39.3% share. This substantial market share is attributed to the crucial role that 2-Ethyl Anthraquinone plays in the production of hydrogen peroxide, an essential bleaching agent widely used in the papermaking process. The demand in this sector is driven by the need for improved paper whiteness and brightness, which directly impacts the quality and commercial value of the final product.

The textile industry also utilizes 2-Ethyl Anthraquinone, though to a lesser extent compared to paper. In textiles, this chemical is used in bleaching processes to ensure the purity of color and fabric quality. The specific properties of 2-Ethyl Anthraquinone make it suitable for delicate textile applications, where precision in the bleaching process is crucial for achieving desired outcomes without damaging the fibers.

For detergent bleaches, 2-Ethyl Anthraquinone serves as a key component in manufacturing strong bleaching agents used in laundry and cleaning products. Its effectiveness in breaking down stains and enhancing the brightness of fabrics contributes to its use in this sector, although the market share here is smaller than in paper.

In water purification, 2-Ethyl Anthraquinone is employed in processes that require the generation of hydrogen peroxide, which is used to treat contaminated water. Its role in this application underscores the compound’s importance in environmental management and public health by assisting in the removal of impurities and pathogens from water supplies.

By End-use

In 2024, the Chemicals sector held a dominant position in the 2-Ethyl Anthraquinone market, capturing more than a 44.8% share. This significant market share is largely due to the essential role of 2-Ethyl Anthraquinone in the production of various chemical intermediates and catalysts used across a wide range of chemical synthesis processes. Its ability to facilitate diverse chemical reactions makes it invaluable in the manufacturing of products such as resins, dyes, and other chemical compounds, where precise chemical properties are critical for quality and performance.

Following the Chemicals sector, the Paper and Pulp industry also relies heavily on 2-Ethyl Anthraquinone, primarily for its role in the hydrogen peroxide production used in paper bleaching. The demand in this segment underscores the need for efficient and eco-friendly bleaching solutions that contribute to producing higher-quality, sustainable paper products.

In the Textiles sector, 2-Ethyl Anthraquinone is used for its bleaching properties, crucial for processing textile fibers to achieve desired whiteness and color standards. This application is particularly important in ensuring that the textiles meet consumer expectations for colorfastness and aesthetic appeal.

The Pharmaceuticals sector utilizes 2-Ethyl Anthraquinone in lesser volumes compared to the Chemicals sector, but its application is vital for synthesizing various pharmaceutical compounds. Its precise chemical properties help in the production of active pharmaceutical ingredients (APIs) that require stringent quality controls.

By Distribution Channel

In 2024, Direct Sales held a dominant position in the 2-Ethyl Anthraquinone market, capturing more than a 39.1% share. This channel’s strong performance is driven by the preference of industrial buyers for establishing direct procurement relationships with manufacturers to ensure supply reliability, cost-effectiveness, and quality assurance. Direct sales allow for more controlled transactions and customized service for large-volume customers, which is crucial in industries where precise chemical specifications and timely delivery are paramount.

Distributors also play a vital role in the market, facilitating broader market reach, especially in regions where direct manufacturer presence is limited. This channel is crucial for smaller and medium-sized enterprises that may not have the volume requirements to justify direct purchasing but still require consistent and reliable access to 2-Ethyl Anthraquinone.

Retail stores and online platforms, while less dominant, cater to the needs of smaller scale or specialized buyers. These channels are particularly important for entities requiring smaller quantities of 2-Ethyl Anthraquinone or those in geographically dispersed areas. Online platforms, in particular, have seen growth by providing ease of access and competitive pricing, appealing to a wide array of buyers seeking both convenience and cost savings.

Key Market Segments

By Grade

- Technical Grade

- Pharmaceutical Grade

- Food Grade

- Others

By Purity Level

- 98%

- 99%

- 99.5%

- 100%

By Type

- Granules

- Crystals

By Application

- Paper

- Textile

- Detergent Bleaches

- Water Purification

- Others

By End-use

- Chemicals

- Textiles

- Pharmaceuticals

- Paper and Pulp

- Others

By Distribution Channel

- Direct Sales

- Distributors

- Retail Stores

- Online Platforms

- Others

Drivers

Growing Demand for Sustainable and Safe Food Packaging

One of the major driving factors for the increased use of 2-Ethyl Anthraquinone (2-EAQ) in the food industry is the growing demand for sustainable and safe food packaging solutions. As food safety regulations become stricter and consumers demand better-quality products, manufacturers are turning to advanced technologies and chemicals like 2-EAQ to enhance packaging materials, particularly in food packaging applications.

2-EAQ, an organic compound often used as a stabilizer and in the production of certain types of food packaging, is seen as a vital component in ensuring the durability and safety of packaging materials. It plays a key role in stabilizing the polymers used to create food packaging, helping to preserve the quality of food products for longer periods, which is crucial in the modern food supply chain. This compound is primarily used in the production of peroxides, which are essential for producing polyethylene terephthalate (PET), a popular plastic used in packaging food and beverages.

In recent years, global concerns about food safety, waste, and environmental sustainability have driven significant changes in packaging practices. According to the Food and Agriculture Organization (FAO), approximately one-third of all food produced globally is lost or wasted, with packaging playing a central role in both preserving food quality and preventing waste. In response to these concerns, governments, environmental organizations, and the food industry are increasingly focused on creating packaging solutions that are not only effective but also environmentally friendly.

In addition, industry giants like Nestlé and Unilever are investing heavily in the development of sustainable packaging. Nestlé, for example, has committed to making 100% of its packaging recyclable or reusable by 2025, a move that aligns with global sustainability trends. This commitment has pushed the company to explore new materials and stabilizing agents, including chemical compounds such as 2-EAQ, to improve the durability and recyclability of their packaging products.

Recent data from the World Health Organization (WHO) also highlights the rising demand for safer and more reliable food packaging. In a 2023 report, the WHO noted that safe food packaging plays a critical role in reducing foodborne illnesses, which impact millions of people globally every year. This underscores the need for packaging materials that not only preserve food quality but also prevent contamination.

The FDA (Food and Drug Administration) in the United States has stringent regulations governing food packaging, ensuring that all materials used are safe for direct food contact. This has led to an increased focus on chemical compounds like 2-EAQ, which are used in the production of food-grade packaging materials. As food safety becomes an even more significant priority, the demand for reliable and safe packaging solutions continues to drive growth in the use of 2-EAQ.

Furthermore, the rise of e-commerce and online grocery shopping has also contributed to the demand for enhanced packaging materials. A 2022 survey by McKinsey & Company found that 45% of global consumers are now purchasing groceries online. This shift in shopping habits requires packaging that can protect food during transport, ensuring it remains fresh, safe, and visually appealing by the time it reaches consumers. This is another key factor pushing the use of 2-EAQ in food packaging.

Restraints

Regulatory Challenges

One significant restraining factor for the 2-Ethyl Anthraquinone market is the stringent environmental regulations that govern the production and use of chemical substances. These regulations are particularly stringent in regions such as Europe and North America, where compliance with environmental standards is rigorously enforced. The production of 2-Ethyl Anthraquinone involves processes that can be hazardous, involving chemicals that may pose risks to the environment and human health if not handled correctly.

For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations mandate comprehensive risk assessments and safety measures for chemicals produced or imported in large quantities. Compliance with such regulations can be costly and time-consuming, often requiring significant investment in technology and process modifications to meet safety standards. This not only increases the operational costs for manufacturers but also limits the speed at which new products can be brought to market.

Moreover, the global push towards greener and more sustainable practices has intensified scrutiny on the chemical industry, urging companies to adopt cleaner and more environmentally friendly technologies. This shift is propelled by not only regulatory bodies but also by a growing consumer preference for sustainable products. Companies failing to meet these evolving standards risk losing market share to more innovative competitors who are aligning their operations with these environmental goals.

Additionally, the handling and disposal of hazardous by-products from the production of 2-Ethyl Anthraquinone pose another significant challenge. Proper disposal processes must be implemented to avoid environmental contamination, which further adds to the costs and complexities of production.

Opportunity

Expanding Role in Sustainable Food Packaging Innovations

A major growth opportunity for 2-Ethyl Anthraquinone (2-EAQ) lies in its expanding role in sustainable food packaging innovations. As environmental concerns grow globally, consumers and governments are increasingly demanding eco-friendly alternatives in every sector, including food packaging. 2-EAQ is emerging as a key player in this transition, especially in the development of recyclable and biodegradable packaging materials.

One of the biggest drivers of this opportunity is the growing consumer preference for sustainable and non-toxic food packaging. According to a 2023 survey by the Food Packaging Forum, nearly 60% of consumers globally are more likely to purchase food products with eco-friendly packaging, reflecting a strong trend toward sustainability in the food industry. In particular, food brands are prioritizing materials that are recyclable, reusable, or made from renewable resources. The use of 2-EAQ in food packaging enables companies to meet these demands by providing an efficient, safe, and stable way to produce high-quality materials that are also environmentally friendly.

Government initiatives are also contributing to the growth of sustainable food packaging solutions, thereby benefiting the demand for 2-EAQ. In the European Union, the Circular Economy Action Plan, introduced in 2020, is a key policy pushing for the transition to more sustainable products, including food packaging. The European Commission has set ambitious targets to make all packaging recyclable by 2030, and this regulatory push is driving investments in more sustainable packaging materials. Many of these materials, including bio-based PET and other plastics, require stabilizers like 2-EAQ to maintain their integrity and functionality. As these new regulations take effect, the demand for chemicals that aid in sustainable packaging will likely continue to grow.

In the U.S., the Environmental Protection Agency (EPA) has been actively promoting recycling and reducing single-use plastics through its “Sustainable Materials Management” program. In 2022, the EPA reported that over 4.5 million tons of plastic were recycled in the U.S., and this number is expected to grow with more emphasis on packaging materials. The increasing use of 2-EAQ in enhancing the recyclability and performance of PET will contribute to meeting these national sustainability goals.

Trends

Shift Towards Biodegradable and Compostable Packaging Using 2-Ethyl Anthraquinone

One of the most significant trends in the food packaging industry today is the shift towards biodegradable and compostable materials. This trend is directly influenced by increasing global concern over plastic pollution and the growing pressure from both consumers and governments to adopt more sustainable practices. 2-Ethyl Anthraquinone (2-EAQ) is at the heart of this shift, playing a vital role in the development of biodegradable packaging solutions that offer the same level of performance and protection as conventional plastic packaging, without the negative environmental impact.

The food industry is particularly focused on reducing its reliance on single-use plastics, which are among the largest contributors to environmental degradation. A report from the European Commission states that around 80% of marine litter is plastic, with food packaging being one of the primary culprits. In response, many food manufacturers are turning to alternative materials that can break down naturally, without harming the environment. 2-EAQ is increasingly being used to stabilize and enhance biodegradable polymers, which can be used to create packaging that decomposes more quickly and safely compared to traditional plastics.

In addition, governments around the world are pushing for stricter regulations on plastic waste, further fueling the demand for biodegradable alternatives. In the European Union, for example, the Single-Use Plastics Directive, which came into effect in 2021, bans the use of certain single-use plastic items and encourages the adoption of sustainable packaging materials. Similarly, in the United States, various states have implemented bans or restrictions on plastic bags, straws, and other disposable plastic products, driving manufacturers to seek out new materials that meet these regulations.

In the food sector, companies are increasingly focusing on packaging that uses biodegradable or compostable materials, which not only offer an environmentally friendly solution but also meet consumer demand for sustainability. The use of 2-EAQ helps food brands create packaging that can be disposed of in a more eco-conscious manner, addressing both regulatory pressure and consumer preferences. According to a study by the Food Packaging Forum, nearly 70% of consumers now actively seek out products with sustainable packaging, and this percentage is expected to rise as environmental awareness increases.

For example, some leading food companies like Nestlé and Coca-Cola are actively investing in biodegradable packaging. Nestlé has committed to making 100% of its packaging recyclable or reusable by 2025, and Coca-Cola has pledged to use 50% recycled content in its PET plastic bottles by 2030. The use of 2-EAQ in the production of biodegradable PET could help these companies meet their sustainability targets, offering both a solution for eco-friendly packaging and a way to reduce their carbon footprints.

Moreover, there is a growing push for compostable packaging that can break down in a natural environment. The inclusion of 2-EAQ in these formulations aids in enhancing the mechanical properties of the material, making it more robust and suitable for a wide range of food products, from fresh produce to processed snacks. This trend aligns with the global movement towards a circular economy, where products are designed with their entire lifecycle in mind, from production to disposal.

Regional Analysis

Asia Pacific (APAC) dominates the market, holding a 39.4% share with a valuation of USD 1.6 billion. This region’s lead is propelled by robust industrial growth, particularly in China and India, where there is substantial investment in chemical manufacturing infrastructure. The demand in APAC is driven by widespread applications in paper and pulp bleaching, water treatment, and the burgeoning electronics industry, which relies on advanced materials that include 2-Ethyl Anthraquinone.

In North America, the market is driven by the demand in the paper and pulp industries and the region’s focus on sustainable chemical processes. The United States and Canada are significant contributors, leveraging 2-Ethyl Anthraquinone in extensive water treatment operations and the production of eco-friendly bleaching agents.

Europe’s market is characterized by stringent environmental regulations that influence the production and use of industrial chemicals. The region maintains a steady demand for 2-Ethyl Anthraquinone, used primarily in the dye and pigment industries, aligning with Europe’s strong regulatory framework for chemical safety and environmental sustainability.

The Middle East & Africa and Latin America are emerging markets with growing industrial activities. In these regions, the focus is on expanding the chemical sector’s capacity, with investments targeting improvements in local manufacturing capabilities and technological updates. These markets are expected to witness significant growth due to increasing industrialization and the adoption of more advanced chemical processes that include the use of 2-Ethyl Anthraquinone.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The 2-Ethyl Anthraquinone market is highly competitive, featuring a mix of global giants and specialized regional players, each contributing significantly to the industry’s growth and technological advancements. Key players like BASF and Huntsman Corporation are renowned for their extensive research capabilities and broad market reach, driving innovation especially in the development of high-purity grades of 2-Ethyl Anthraquinone suitable for sensitive applications in pharmaceuticals and electronics.

Jiangsu Honglin Chemical Co., Ltd., Shandong Longda Fine Chemical Co., Ltd., and Hebei Kailite Sensitizing Chemicals Co., Ltd. play crucial roles in regional markets, particularly in Asia. These companies capitalize on localized industrial growth and less stringent regulatory environments to produce 2-Ethyl Anthraquinone efficiently and cost-effectively. Their strategic focus often includes enhancing production techniques and expanding capacity to meet the growing demand from local and international markets.

Tokyo Chemical Industry Co., Ltd. and Merck KGaA focus on producing high-grade chemicals that serve niche markets, including high-tech industries where quality and specificity are paramount. These companies invest heavily in R&D to improve product performance and environmental sustainability, aligning with global trends towards greener manufacturing processes. This diverse array of companies underscores the dynamic nature of the 2-Ethyl Anthraquinone market, driven by innovation, regulatory challenges, and evolving industrial demands.

Top Key Players

- BASF

- Changzhou Hongyu Chemical Co., Ltd.

- Clariant

- DIC Corporation

- Hebei Kailite Sensitizing Chemicals Co., Ltd.

- Hebei Longbang Technology Co., Ltd.

- Henan Baofeng Chemical Industry Co., Ltd.

- Huntsman Corporation

- Jiangsu Honglin Chemical Co., Ltd.

- Jilin Zirui New Material Co., Ltd.

- Lanxess

- Merck KGaA

- North China Pharmaceutical Group Corporation

- Puyang Tianyuan Chemical Co., Ltd.

- Quzhou Fuyang Shenglong Chemical Co., Ltd.

- Shandong Longda Fine Chemical Co., Ltd.

- Shandong Yurun Chemical Co., Ltd.

- Spolchemie a.s.

- Taizhou Hongxing Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Wego Chemical Group

- Weifang Fengyi Chemical Co., Ltd.

- Yixing Lironda Chemical Co., Ltd.

- Zhejiang Chuangxing Chemical Co., Ltd.

Recent Developments

In 2024, BASF continues to be a key player in the 2-Ethyl Anthraquinone market, leveraging its extensive expertise in chemical manufacturing to meet the growing global demand for this compound.

Changzhou Hongyu Chemical Co., Ltd. has positioned itself as a significant player in the 2-Ethyl Anthraquinone market by 2024, focusing on the production of chemical intermediates including heterocyclic compounds such as pyrimidine and quinoline series.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Bn Forecast Revenue (2034) USD 6.6 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Technical Grade, Pharmaceutical Grade, Food Grade, Others), By Purity Level (98%, 99%, 99.5%, 100%), By Type (Granules, Crystals), By Application (Paper, Textile, Detergent Bleaches, Water Purification, Others), By End-use (Chemicals, Textiles, Pharmaceuticals, Paper and Pulp, Others), By Distribution Channel (Direct Sales, Distributors, Retail Stores, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF, Changzhou Hongyu Chemical Co., Ltd., Clariant, DIC Corporation, Hebei Kailite Sensitizing Chemicals Co., Ltd., Hebei Longbang Technology Co., Ltd., Henan Baofeng Chemical Industry Co., Ltd., Huntsman Corporation, Jiangsu Honglin Chemical Co., Ltd., Jilin Zirui New Material Co., Ltd., Lanxess, Merck KGaA, North China Pharmaceutical Group Corporation, Puyang Tianyuan Chemical Co., Ltd., Quzhou Fuyang Shenglong Chemical Co., Ltd., Shandong Longda Fine Chemical Co., Ltd., Shandong Yurun Chemical Co., Ltd., Spolchemie a.s., Taizhou Hongxing Chemical Co., Ltd., Thermo Fisher Scientific Inc., Tokyo Chemical Industry Co., Ltd., Wego Chemical Group, Weifang Fengyi Chemical Co., Ltd., Yixing Lironda Chemical Co., Ltd., Zhejiang Chuangxing Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2 – Ethyl Anthraquinone MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

2 – Ethyl Anthraquinone MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Changzhou Hongyu Chemical Co., Ltd.

- Clariant

- DIC Corporation

- Hebei Kailite Sensitizing Chemicals Co., Ltd.

- Hebei Longbang Technology Co., Ltd.

- Henan Baofeng Chemical Industry Co., Ltd.

- Huntsman Corporation

- Jiangsu Honglin Chemical Co., Ltd.

- Jilin Zirui New Material Co., Ltd.

- Lanxess

- Merck KGaA

- North China Pharmaceutical Group Corporation

- Puyang Tianyuan Chemical Co., Ltd.

- Quzhou Fuyang Shenglong Chemical Co., Ltd.

- Shandong Longda Fine Chemical Co., Ltd.

- Shandong Yurun Chemical Co., Ltd.

- Spolchemie a.s.

- Taizhou Hongxing Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Wego Chemical Group

- Weifang Fengyi Chemical Co., Ltd.

- Yixing Lironda Chemical Co., Ltd.

- Zhejiang Chuangxing Chemical Co., Ltd.