Global Ferric Citrate Market Size, Share, Growth Analysis By Product Type (Capsules, Tablets, Oral Solution), By Grade (Reagent Grade, Food Grade, Other), By Application (Water Purification, Food Additive, Other), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 137898

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

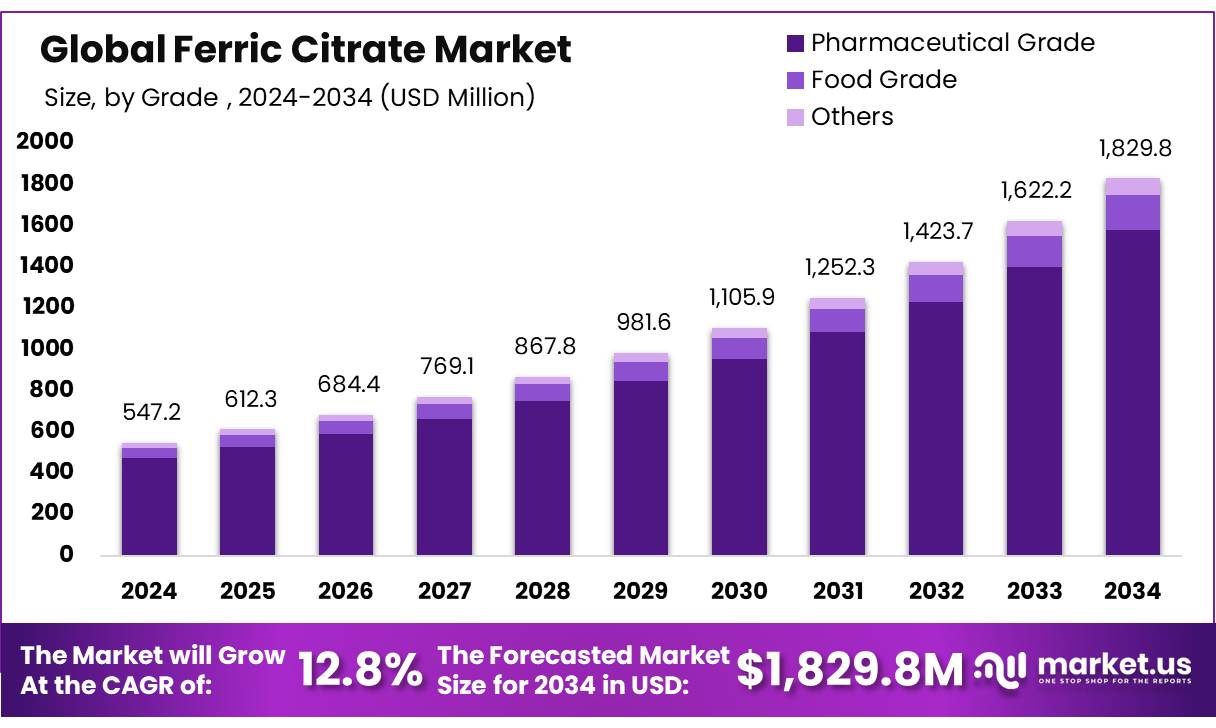

The Global Ferric Citrate Market is expected to be worth around USD 1829.8 Million by 2034, up from USD 547.2 Million in 2024, and grow at a CAGR of 12.8% from 2025 to 2034. North America holds 38.0% of the Ferric Citrate market, valued at USD 208.0 Million.

Ferric Citrate is a chemical compound that consists of iron and citric acid and is often used as a source of iron supplementation. It is primarily utilized in medical applications to treat iron deficiency anemia and is also used as a phosphate binder in patients with chronic kidney disease (CKD), helping to reduce phosphate levels in the blood. Ferric citrate works by providing bioavailable iron, which is essential for the production of red blood cells and the proper functioning of various enzymes in the body.

The global ferric citrate market has been expanding, largely driven by the increasing prevalence of chronic kidney disease (CKD) and iron deficiency anemia. As the global population ages and the number of CKD patients grows, the demand for phosphate binders such as ferric citrate has surged, especially in developed markets such as North America and Europe, where high-quality healthcare and advanced treatments are widely accessible. Additionally, the rising awareness of iron deficiency, particularly in women and children, has contributed to a steady demand for iron supplements, further boosting the market for ferric citrate.

In the pharmaceutical sector, ferric citrate’s dual role as an iron supplement and a phosphate binder makes it valuable for managing both iron deficiency and high phosphate levels in CKD patients. Furthermore, as healthcare systems in developing countries improve and access to treatments increases, the ferric citrate market is expected to grow significantly in these regions. The market faces challenges from alternative iron supplements and phosphate binders, but continuous research and innovation in the formulation and delivery of ferric citrate products are expected to support its growth.

Key Takeaways

- The global ferric citrate market was valued at US$ 547.2 million in 2024.

- The global ferric citrate market is projected to grow at a CAGR of 12.8% and is estimated to reach US$ 1,829.8 million by 2034.

- Among grades, pharmaceutical grade accounted for the largest market share of 86.5%.

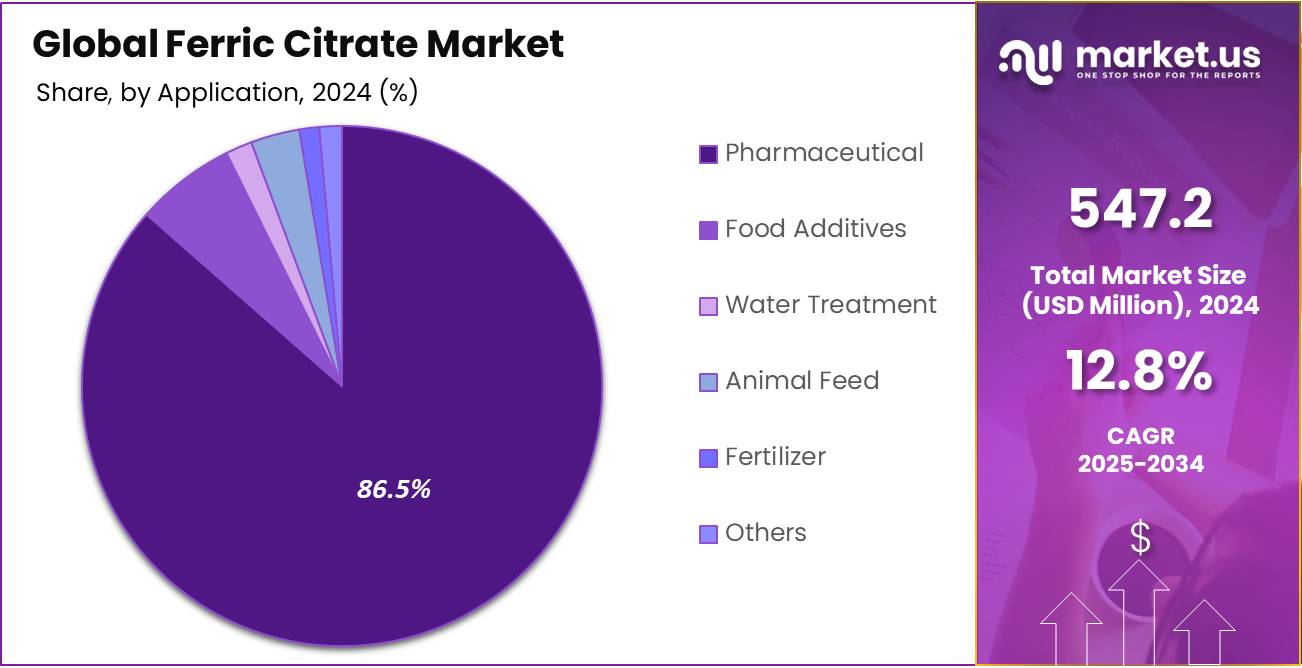

- Among applications, pharmaceuticals accounted for the majority of the market share at 86.5%.

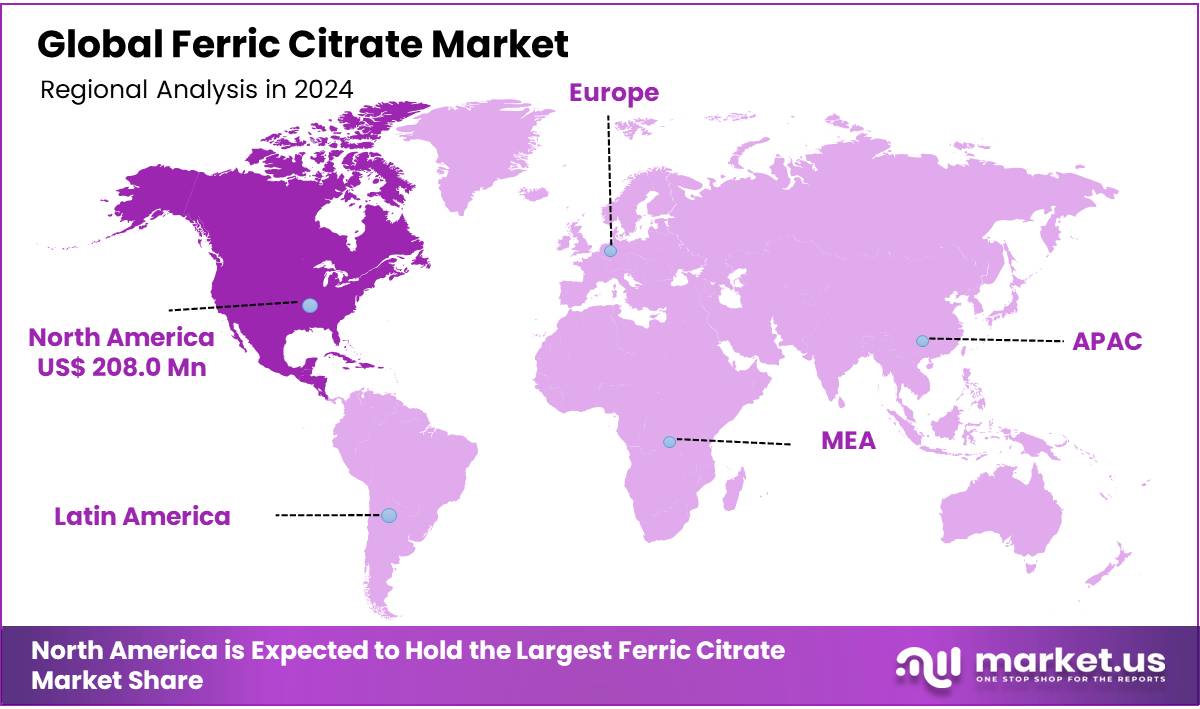

- North America is estimated as the largest market for ferric citrate with a share of 38.0% of the market share.

- Asia-Pacific is anticipated to register the highest CAGR of 14.1%.

- Europe with a revenue share of 34.6% in 2024 and expected to register a CAGR of 12.9%.

Grade Analysis

Simple Ferric Citrates Dominated the Market, Owing to Their Widespread Application Across Various Industries

The ferric citrate market is segmented based on pharmaceutical grade, food grade, and others. In 2024, the grade simple ferric citrates segment held a significant revenue share of 86.5% due to its critical role in managing chronic kidney disease (CKD) and iron deficiency anemia. Ferric citrate, in its pharmaceutical-grade form, is primarily used as a phosphate binder for CKD patients undergoing dialysis, helping to control elevated phosphate levels in the blood. This is a key factor driving its demand, as the global prevalence of CKD continues to rise with the aging population and increasing lifestyle-related health issues. Pharmaceutical-grade ferric citrate is specifically designed to meet strict quality standards for bioavailability, purity, and safety, making it highly effective for managing both iron deficiency and phosphate levels in patients with complex health needs.

The growing incidence of iron deficiency anemia, particularly in vulnerable populations such as pregnant women, elderly individuals, and those with chronic illnesses, further boosts the demand for pharmaceutical-grade ferric citrate, as it is considered one of the more effective treatments for replenishing iron levels.

Additionally, the regulatory approvals and clinical recommendations for pharmaceutical-grade ferric citrate in key markets such as North America and Europe also contribute to its strong market share. Furthermore, the dual functionality of pharmaceutical-grade ferric citrate, acting as both an iron supplement and a phosphate binder, positions it as an essential component in the treatment regimens for CKD patients, solidifying its dominant role in the market. As healthcare awareness and access continue to improve globally, the demand for pharmaceutical-grade ferric citrate is expected to remain strong.

Global Ferric Citrate Market, By Grade, 2020-2024 (USD Mn)

Grade 2020 2021 2022 2023 2024 Pharmaceutical Grade 311.4 344.1 381.5 423.6 473.2 Food Grade 33.5 37.0 40.9 45.3 50.5 Others 15.8 17.4 19.2 21.2 23.5 Application Analysis

The Ferric Citrate Market Was Dominated By the Personal Care & Cosmetics Industry.

Based on application, the market is further divided into pharmaceutical, food additives, water treatment, animal feed, fertilizer & others. The predominance of the pharmaceutical sector, commanding a substantial 86.5% market share in 2024. This dominance is largely driven by the compound’s essential role in managing chronic kidney disease (CKD) and iron deficiency anemia.

Pharmaceutical-grade ferric citrate is widely used as a phosphate binder for CKD patients, particularly those undergoing dialysis. By reducing elevated phosphate levels in the blood, ferric citrate helps to prevent complications such as bone disease, which is common among CKD patients. Additionally, ferric citrate is highly effective in replenishing iron levels in patients with anemia, especially those suffering from iron deficiency, making it a critical treatment option in clinical practice.

The rising prevalence of chronic kidney disease and iron deficiency anemia globally, particularly in aging populations and individuals with lifestyle-related health conditions, is fueling the demand for pharmaceutical-grade ferric citrate.

Moreover, regulatory approvals and clinical guidelines recommending ferric citrate for managing iron deficiency and phosphate levels further bolster its role in the pharmaceutical sector. As healthcare systems evolve and access to effective treatments increases, the pharmaceutical sector is expected to continue driving the growth of the ferric citrate market, maintaining its substantial share.

Global Ferric Citrate Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 Pharmaceutical 311.4 344.1 381.5 423.6 473.2 Food Additives 22.4 24.8 27.4 30.4 33.9 Water Treatment 6.2 6.8 7.5 8.2 9.1 Animal Feed 11.1 12.2 13.5 14.9 16.6 Fertilizer 4.5 4.9 5.4 6.0 6.7 Others 5.2 5.7 6.3 6.9 7.7 Key Market Segments

By Grade

- Pharmaceutical Grade

- Food Grade

- Others

By Application

- Pharmaceutical

- Food Additives

- Water Treatment

- Animal Feed

- Fertilizer

- Others

Drivers

Increasing Prevalence of Chronic Kidney Disease (CKD) is Estimated to Boost The Ferric Citrate Market.

The increasing prevalence of Chronic Kidney Disease (CKD) is expected to significantly boost the ferric citrate market, particularly in its pharmaceutical-grade form. CKD, a condition marked by the gradual loss of kidney function, often leads to elevated phosphate levels in the blood, a condition that can result in serious complications like cardiovascular disease and bone mineral disorders. Ferric citrate is a widely used phosphate binder that helps control phosphate levels in CKD patients, particularly those undergoing dialysis.

As the global population ages and lifestyle-related diseases such as hypertension and diabetes increase, the incidence of CKD is rising, creating a larger patient base in need of effective treatments. Furthermore, CKD patients frequently suffer from iron deficiency anemia, a common comorbidity, which further drives demand for ferric citrate as an iron supplement. The dual role of ferric citrate—as both a phosphate binder and iron supplement—makes it an essential component in the management of CKD. As healthcare awareness grows and CKD diagnoses increase worldwide, particularly in developed regions with aging populations, the demand for ferric citrate is expected to rise. This trend, combined with ongoing advancements in CKD treatments, will contribute to the continued growth and dominance of the ferric citrate market in the pharmaceutical sector.

- By 2040, CKD is anticipated to become the fifth leading cause of death globally, reflecting one of the most significant increases among major causes of mortality.

Restraints

Competition from Other Phosphate Binders May Hinder The Growth Of The Market to a Certain Extent

Competition from other phosphate binders is a significant restraint that may hinder the growth of the ferric citrate market to some extent. While ferric citrate is a widely used and effective treatment for controlling phosphate levels in chronic kidney disease (CKD) patients, it faces competition from other phosphate binders that are also used for the same purpose. These alternatives include calcium-based binders (like calcium acetate and calcium carbonate), lanthanum carbonate, and sevelamer hydrochloride, which are commonly prescribed to CKD patients for controlling phosphate levels.

Each grade of phosphate binder has its advantages, such as cost-effectiveness, side-effect profiles, and ease of use, which can influence physicians’ prescribing preferences. For example, calcium-based binders are often more affordable and readily available, making them a popular choice, especially in regions with cost-sensitive healthcare systems. On the other hand, sevelamer, a non-calcium-based phosphate binder, is favored by patients who need to avoid calcium buildup, which can cause complications like vascular calcification.

As a result, the presence of these competitive phosphate binders in the market can limit the market share of ferric citrate. While ferric citrate has certain advantages, such as its dual role as both a phosphate binder and iron supplement, it must compete with these other options in terms of cost, efficacy, and patient tolerance. This competitive landscape could slow the overall market growth for ferric citrate.

Opportunity

Advancements in Nanotechnology For Drug Delivery

Advancements in nanotechnology for drug delivery present a significant opportunity for the ferric citrate market, particularly in the context of improving the efficacy and bioavailability of ferric citrate, especially for patients with chronic kidney disease (CKD) or iron deficiency anemia. Nanotechnology is a rapidly evolving field with the potential to enhance drug delivery systems by improving the targeted release and absorption of drugs, leading to more effective treatments with fewer side effects. For ferric citrate, nanotechnology could be leveraged to improve the delivery of iron to the bloodstream in a more controlled and efficient manner.

Nanoparticles could be used to encapsulate ferric citrate, allowing it to be absorbed more efficiently in the gastrointestinal tract and directly transported to where it is most needed. This could help overcome challenges associated with conventional oral iron supplements, which can have poor bioavailability and cause gastrointestinal side effects. By using nanotechnology to create more efficient and targeted delivery systems, ferric citrate could become a more appealing treatment option for patients who need to manage both iron deficiency and phosphate levels in CKD, particularly those who struggle with the side effects of traditional treatments.

Additionally, nanostructured ferric citrate formulations could potentially enable extended release of the active ingredients, reducing the need for frequent dosing and improving patient adherence to treatment regimens. This innovation could open new avenues for ferric citrate as a more effective, patient-friendly, and innovative therapeutic option, giving it a competitive edge in the market and boosting its growth prospects. As research in nanomedicine progresses, the integration of nanotechnology into ferric citrate formulations represents a valuable opportunity to enhance its therapeutic benefits and increase its appeal in the pharmaceutical market.

Trends

Shift Towards Personalized Nutrition

The shift towards personalized nutrition is emerging as a significant trend in the ferric citrate market, offering new opportunities for growth and innovation. Personalized nutrition involves tailoring dietary and supplement recommendations based on an individual’s genetic makeup, health conditions, lifestyle, and nutritional needs, which allows for more effective and targeted treatments. This trend is gaining traction in the healthcare and wellness industries, as consumers seek solutions that cater to their specific health profiles rather than adopting one-size-fits-all approaches.

For the ferric citrate market, this shift offers the opportunity to develop more customized iron supplementation therapies for patients, particularly those with chronic kidney disease (CKD) or iron deficiency anemia. Ferric citrate, as both a phosphate binder and an iron supplement, plays a dual role in managing these conditions. However, the way it is dosed and administered could be optimized through personalized nutrition, ensuring patients receive the most appropriate amount of ferric citrate based on their iron levels, phosphate concentration, and individual health factors.

Advances in genetic testing and biomarker profiling are enabling healthcare providers to assess an individual’s unique response to different iron formulations, allowing for better management of iron deficiency and phosphate control in CKD patients. By aligning ferric citrate dosages with personalized health data, patients may experience better treatment outcomes, fewer side effects, and enhanced adherence to their prescribed regimen. This move toward personalized care in the ferric citrate market also enhances its role in precision medicine, which is expected to become a major driver of pharmaceutical market growth in the coming years.

Geopolitical Impact Analysis

Geopolitical Tensions And Disruptions In The Global Supply Chain Have A Negative Impact On The Growth Of The Ferric Citrate Market.

The Russia-Ukraine conflict, which escalated in 2022, led to substantial disruptions in the supply of critical raw materials essential for chemical manufacturing. Russia’s role as a major exporter of natural gas—a key feedstock for various chemical processes—meant that sanctions and supply interruptions caused shortages and increased costs for chemical producers globally. For instance, the European Union faced a significant reduction in gas imports from Russia, compelling chemical companies to seek alternative energy sources or reduce production. This situation was exacerbated by the 2022–2023 Russia–European Union gas dispute, which further strained energy supplies to Europe.

The economic environment in Europe remained bleak throughout 2023, with predictions of low growth persisting into 2024. The combination of high operational costs and declining demand due to inflationary pressures led several companies to announce capacity reductions. Various countries imposed sanctions on Russian products, including fertilizers, which indirectly affected the availability of ferric citrate. Although some countries like the U.S. did not impose direct sanctions on Russian fertilizers, the overall trade restrictions led to a reconfiguration of global supply chains34. This reconfiguration often resulted in longer lead times and increased logistics costs for importing ferric citrate.

Regional Analysis

North America Held the Largest Share of the Global Ferric Citrate Market

In 2024, North America dominated the global ferric citrate market, accounting for 38.0% of the total market share due to several key factors, primarily driven by the high prevalence of chronic kidney disease (CKD), iron deficiency anemia, and advanced healthcare infrastructure in the region. The United States and Canada have some of the highest rates of CKD and iron deficiency, especially among the aging population, which has led to an increased demand for effective phosphate binders and iron supplements. Ferric citrate, being both a phosphate binder and an iron supplement, is widely prescribed for patients with CKD and those suffering from iron deficiency, making it a crucial part of treatment regimens.

Additionally, the well-established healthcare system in North America ensures that ferric citrate is readily available and prescribed, supported by a strong network of hospitals, clinics, and pharmacies. North America also benefits from significant investment in research and development, which has led to innovations in ferric citrate formulations, improving its efficacy and patient compliance.

Regulatory approvals from the FDA and other health authorities further support the widespread use of ferric citrate in the region. Moreover, with rising awareness about CKD and iron deficiency, government initiatives to promote effective treatment for these conditions and a growing demand for better healthcare solutions have bolstered North America’s leading position in the ferric citrate market.

Global Ferric Citrate Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 138.7 152.8 168.8 186.8 208.0 Europe 124.5 137.6 152.6 169.5 189.4 Asia Pacific 74.5 83.3 93.4 104.9 118.4 Middle East & Africa 12.9 13.9 15.1 16.3 17.8 Latin America 10.0 10.8 11.6 12.6 13.7 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

To Maintain a Competitive Edge, Major Companies In The Ferric Citrate Market Focus On Product Innovation and Research & Development (R&D)

The ferric citrate market is highly competitive, with major companies employing a variety of strategic approaches to maintain their market position and drive growth. Ferric citrate is widely used in the pharmaceutical sector for treating iron-deficiency anemia and chronic kidney disease (CKD), as well as in food additives, agriculture, and industrial applications. Leading manufacturers adopt product differentiation, research and development (R&D), strategic partnerships, market expansion, and cost optimization to sustain their market leadership.

The following are some of the major players in the industry

- American Elements

- FUJIFILM Wako Pure Chemical Corporation

- DC Fine Chemicals S. L.

- Global Calcium Pvt. Ltd.

- Lifeasible

- Jost Chemical Co.

- West Bengal Chemical Industries Limited

- ALPHA CHEMIKA

- Shanghai Chemex

- SimSon Pharma Limited

- Central Drug House Pvt. Ltd.

- Other Key Players

Key Development

28 June 2018: Akebia Therapeutics acquired Keryx Biopharmaceuticals, the original developer of Auryxia® (ferric citrate), allowing them to expand their presence in the pharmaceutical market for kidney disease treatments.

Report Scope

Report Features Description Market Value (2024) US$ 547.2 Mn Market Volume (2024) XX Ton Forecast Revenue (2034) US$ 1,829.8 Mn CAGR (2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Pharmaceutical Grade, Food Grade, and Others), By Application (Pharmaceutical, Food Additives, Water Treatment, Animal Feed, Fertilizer, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape American Elements, FUJIFILM Wako Pure Chemical Corporation, DC Fine Chemicals S. L., Global Calcium Pvt. Ltd., Lifeasible, Jost Chemical Co., West Bengal Chemical Industries Limited, ALPHA CHEMIKA, Shanghai Chemex, SimSon Pharma Limited, Central Drug House Pvt. Ltd. & Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Elements

- FUJIFILM Wako Pure Chemical Corporation

- DC Fine Chemicals S. L.

- Global Calcium Pvt. Ltd.

- Lifeasible

- Jost Chemical Co.

- West Bengal Chemical Industries Limited

- ALPHA CHEMIKA

- Shanghai Chemex

- SimSon Pharma Limited

- Central Drug House Pvt. Ltd.

- Other Key Players