Global Bioethanol Yeast Market Size, Share, And Business Benefits By Type (Baker's, Brewer's), By Form (Active, Instant, Fresh), By Feedstock (Cellulosic Biomass, Corn, Sugarcane), By Genus (Saccharomyces, Kluyveromyces), By Application (Food, Animal Feed, Biofuel, Cleaning and Disinfection, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137702

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Bioethanol Yeast Market

- By Type Analysis

- By Form Analysis

- By Feedstock Analysis

- By Genus Analysis

- By Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

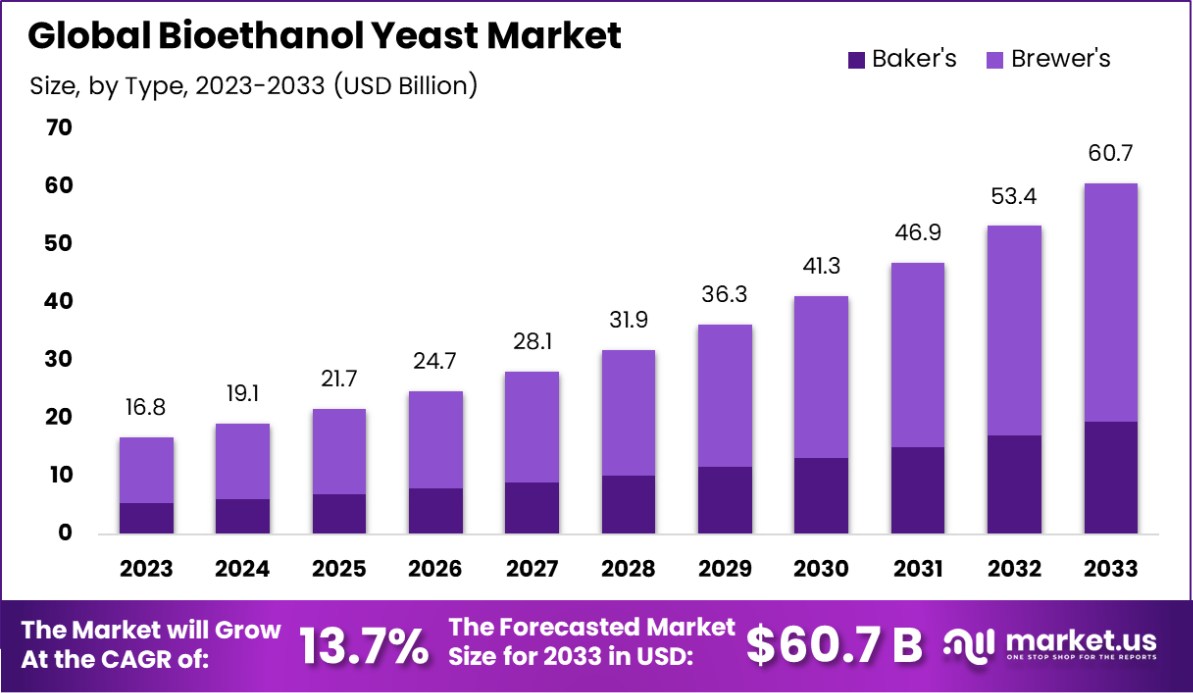

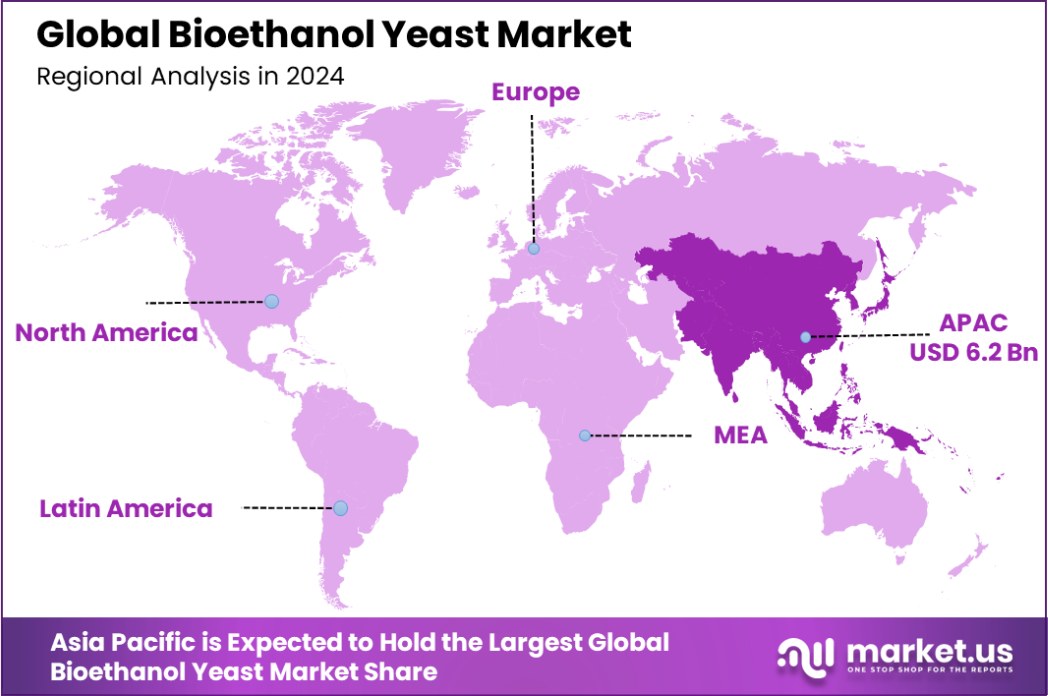

The Global Bioethanol Yeast Market is expected to be worth around USD 60.7 Billion by 2033, up from USD 16.8 Billion in 2023, and grow at a CAGR of 13.7% from 2024 to 2033. Asia-Pacific holds 37.8% of the Bioethanol Yeast Market, USD 6.2 billion.

The bioethanol yeast market, an integral part of the biofuel industry, has witnessed robust growth in recent years, driven by its pivotal role in bioethanol production. As a crucial fermenting agent, bioethanol yeast facilitates the conversion of sugars and starches into ethanol, supporting sustainable energy solutions.

The industrial landscape for bioethanol yeast is bolstered by stringent governmental policies aimed at reducing carbon footprints and promoting renewable energy sources. Initiatives such as the Renewable Fuel Standard (RFS) in the United States and similar mandates in Europe have created a conducive environment for market expansion.

One of the primary driving factors for this market is the growing emphasis on energy security and environmental sustainability. Bioethanol, being a cleaner alternative to fossil fuels, has gained traction, particularly in the transportation and energy sectors.

The increasing utilization of lignocellulosic feedstocks, coupled with advancements in yeast strain engineering to enhance ethanol yield and stress tolerance, has further fueled market growth.

Emerging trends in the market include the adoption of genetically modified yeast strains and the integration of advanced fermentation technologies to optimize production processes. Furthermore, the development of yeasts capable of fermenting non-conventional feedstocks such as agricultural residues and industrial waste aligns with global efforts to minimize resource wastage.

Future opportunities lie in the exploration of untapped feedstock resources and advancements in synthetic biology, paving the way for more efficient and resilient yeast strains. As countries intensify their renewable energy goals, the bioethanol yeast market is poised for sustained growth, supporting global decarbonization objectives.

The Bioethanol Yeast Market is witnessing dynamic growth, driven by increasing global focus on sustainable energy solutions and advancements in biotechnology. This market is becoming pivotal as nations enhance bioethanol production capacities to meet renewable energy targets.

A case in point is the European Union, where bioethanol production is set to rise by 2.4% to 5.38 million liters in 2024, according to the U.S. Department of Agriculture. Simultaneously, EU consumption reached 6.58 billion liters in 2023, reflecting a 4.5% surge. These figures underscore a robust demand for bioethanol yeast, essential for efficient production processes.

India, on the other hand, is making substantial strides in ethanol production. The country has more than doubled its capacity within four years, reaching 1,623 crore liters by September 2024, as per the Press Information Bureau.

This rapid expansion has catalyzed investment, with Indian biotech startups in this sector attracting $600 million in follow-on funding, bolstered by 31 deals totaling $938.8 million in 2022. Such developments highlight the strategic importance of bioethanol yeast in fostering innovation and enhancing production efficiency globally.

The market is set to thrive as advancements in fermentation technologies, coupled with supportive government policies, propel the adoption of bioethanol yeast. Stakeholders are poised to benefit from a growing ecosystem that aligns with global sustainability goals and renewable energy mandates.

Key Takeaways

- The Global Bioethanol Yeast Market is expected to be worth around USD 60.7 Billion by 2033, up from USD 16.8 Billion in 2023, and grow at a CAGR of 13.7% from 2024 to 2033.

- Brewer’s yeast dominates the market with a 68.3% global share.

- Fresh bioethanol yeast accounts for 46.4% of market preference worldwide.

- Corn-based feedstock leads bioethanol yeast production with 56.3% market contribution.

- Saccharomyces genus remains the most utilized, holding an 85.3% share.

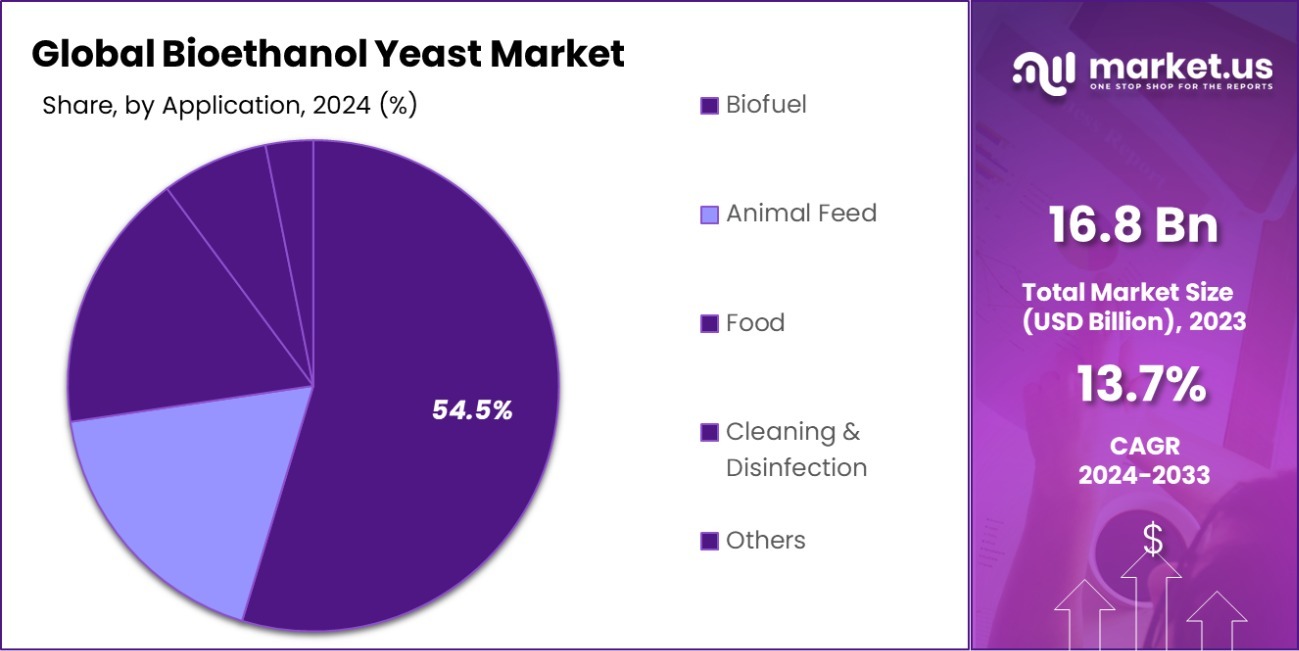

- Biofuel applications drive demand, with bioethanol yeast capturing 54.5% of usage.

- Asia-Pacific holds 37.8% of the Bioethanol Yeast Market, valued at USD 6.2 billion.

Business Benefits of Bioethanol Yeast Market

Bioethanol yeast offers multiple economic benefits in the biofuel industry. Yeast plays a critical role in converting biomass into ethanol, a renewable fuel that can be used in most gasoline-powered vehicles to reduce carbon monoxide and other emissions.

Currently, the most common bioethanol production in the U.S. involves the fermentation of corn starch-derived sugars using yeast, which metabolizes these sugars to produce ethanol and carbon dioxide. This process not only helps reduce reliance on petroleum but also supports agricultural economies by utilizing crop residues like corn stover, which comprises husks, cobs, and stalks left after corn is harvested.

The Department of Energy’s Bioethanol Program supports the development of technologies to optimize yeast performance in ethanol production. Innovations such as genetically engineered yeast strains capable of fermenting both five-carbon and six-carbon sugars can increase the yield of ethanol from cellulosic materials, making the process more economically viable.

For instance, the POET-DSM Advanced Biofuels joint venture aims to produce 20 million gallons of cellulosic ethanol annually, utilizing yeast technologies that can ferment sugars derived from corn cobs. This production capacity demonstrates the scale at which modern bioethanol plants operate and the significant volume of fuel they contribute to the U.S. fuel supply.

The advancement of these technologies is key to increasing the economic feasibility of bioethanol, potentially leading to reduced costs and increased production efficiency. Each step of the production process, from biomass handling to enzyme development and fermentation, has been subject to continuous improvement, driven by both governmental and private sector research.

By Type Analysis

Brewer’s yeast dominates the bioethanol yeast market, accounting for a substantial 68.3% share globally.

In 2023, Brewer’s held a dominant market position in the By Type segment of the Bioethanol Yeast Market, with a 68.3% share. Brewer’s yeast’s popularity stems from its robust alcohol tolerance and efficiency in fermenting various sugars, making it a preferred choice in bioethanol production.

In the same year, Baker’s yeast accounted for a smaller segment of the Bioethanol Yeast Market. Although primarily utilized for bread-making, its application in bioethanol is growing owing to its availability and cost-effectiveness. Baker’s yeast’s ability to ferment glucose effectively supports its use in renewable energy sources.

By Form Analysis

Fresh bioethanol yeast leads with 46.4%, reflecting its widespread preference in fermentation industries.

In 2023, Fresh held a dominant market position in the By Form segment of the Bioethanol Yeast Market, with a 46.4% share. The preference for fresh yeast is attributed to its high viability and activity, which are essential for efficient fermentation processes in bioethanol production.

Active yeast secured a substantial market share in 2023. Valued for its consistency and strong fermentation capacity, active yeast is essential in settings that require precise control over the fermentation environment, thereby supporting sustained energy production.

Instant yeast, known for its convenience and fast activation time, also played a significant role in the bioethanol yeast market in 2023. Its ease of use and storage stability make it suitable for rapid-scale bioethanol production processes, accommodating industrial demands for quicker turnaround times.

By Feedstock Analysis

Corn-based bioethanol yeast applications capture 56.3%, emphasizing its role in cost-effective ethanol production.

In 2023, Corn held a dominant market position in the By Feedstock segment of the Bioethanol Yeast Market, with a 56.3% share. Corn’s high starch content makes it an efficient source for ethanol production, thus favoring its use over other feedstocks in terms of yield and process efficiency.

Sugarcane followed closely, leveraging its abundant availability and high sugar content, which facilitate efficient fermentation and ethanol yield. In 2023, it supported a vital segment of the market, appreciated for its renewable nature and lower environmental impact compared to traditional fossil fuels.

Cellulosic biomass also carved out a market niche in 2023, valued for its potential to convert non-food plant materials into ethanol. This segment capitalizes on technological advancements in enzyme development, enhancing the breakdown of complex carbohydrates into fermentable sugars.

By Genus Analysis

Saccharomyces genus yeast rules the market with 85.3%, known for high ethanol yield efficiency.

In 2023, Saccharomyces held a dominant market position in the By Genus segment of the Bioethanol Yeast Market, with an 85.3% share. Its widespread use is attributed to its robust fermenting capabilities and resilience in various production environments, making it a cornerstone in commercial ethanol production.

Conversely, Kluyveromyces also found its footing in the market by leveraging its ability to ferment lactose into ethanol and valuable by-products. This yeast is particularly valued in industries that aim to utilize dairy waste, thus contributing to sustainable production practices in the bioethanol industry.

By Application Analysis

Biofuel production utilizes 54.5% bioethanol yeast, underscoring its significance in renewable energy solutions.

In 2023, Biofuel held a dominant market position in the By Application segment of the Bioethanol Yeast Market, with a 54.5% share. This segment benefits from the global shift towards renewable energy sources, with bioethanol representing a key alternative to fossil fuels, thus driving demand for efficient yeast strains.

The Food industry also utilized bioethanol yeast extensively, particularly for alcoholic beverage production and baking. This segment leverages yeast’s fermenting abilities to enhance flavors and textures in various culinary applications, maintaining a significant presence in the market.

Animal Feed applications incorporated bioethanol yeast to improve the nutritional content and digestibility of feed products. Yeast derivatives are used to enrich feed with proteins and vitamins, thus supporting healthier livestock.

In Cleaning and Disinfection, bioethanol yeast contributes to the production of eco-friendly cleaning agents. The segment utilizes ethanol’s natural properties as a solvent and disinfectant, promoting safer and more sustainable cleaning solutions.

Key Market Segments

By Type

- Baker’s

- Brewer’s

By Form

- Active

- Instant

- Fresh

By Feedstock

- Cellulosic Biomass

- Corn

- Sugarcane

By Genus

- Saccharomyces

- Kluyveromyces

By Application

- Food

- Animal Feed

- Biofuel

- Cleaning and Disinfection

- Others

Driving Factors

Increased Focus on Renewable Energy Fuels Market Expansion

As global efforts intensify to reduce carbon emissions, the bioethanol yeast market is experiencing substantial growth. Governments worldwide are implementing policies that support renewable energy sources, including bioethanol.

This shift aims to decrease reliance on fossil fuels and mitigate climate change impacts. Bioethanol yeast plays a crucial role in converting biomass into ethanol, making it a key component in sustainable fuel production. The expanding renewable energy sector directly boosts the demand for effective and efficient bioethanol yeast strains.

Advancements in Yeast Fermentation Technologies

Recent technological advancements in yeast fermentation are pivotal in driving the bioethanol yeast market. Enhanced yeast strains are being developed to increase ethanol yields and improve fermentation efficiency. These innovations not only reduce production costs but also increase the viability of bioethanol as a competitive alternative to traditional fuels.

Such improvements in yeast technology are critical for the scalability of bioethanol production, attracting investment and research interest, and ensuring the industry’s sustainable growth.

Rising Awareness of Environmental Sustainability

The growing public and regulatory focus on environmental sustainability is propelling the bioethanol yeast market forward. Consumers are increasingly aware of the environmental impacts of their choices, including the fuels they use.

This awareness drives demand for cleaner, greener alternatives such as bioethanol, which significantly lowers greenhouse gas emissions compared to conventional fuels. As a result, the market for bioethanol yeast, essential for producing these eco-friendly fuels, is seeing an uptick as both consumers and industries seek more sustainable energy solutions.

Restraining Factors

Competition from Other Renewable Energy Technologies

The bioethanol yeast market faces competition from other renewable energy technologies, such as solar and wind power, which are also benefiting from technological advancements and increased funding. These alternatives are becoming more cost-effective and efficient, attracting interest and investment that might otherwise flow into bioethanol production.

This competition can limit market opportunities for bioethanol yeast as energy producers and governments may prioritize other forms of renewable energy that offer higher energy outputs and lower environmental impacts.

Fluctuating Agricultural Feedstock Prices

The cost and availability of agricultural feedstocks, such as corn and sugarcane, significantly influence the bioethanol yeast market. These feedstocks are susceptible to price volatility due to factors like weather conditions, agricultural policies, and global market trends, which can disrupt bioethanol production costs and profitability.

When feedstock prices rise, the production of bioethanol becomes less economically attractive, potentially restraining market growth and investment in bioethanol yeast technologies.

Regulatory and Policy Uncertainty

The bioethanol yeast industry often faces uncertainty related to government policies and regulatory frameworks. Changes in biofuel mandates, subsidies, or support programs can create unpredictable market conditions and deter investment.

For instance, a reduction in government incentives for bioethanol can make it less competitive against fossil fuels and other renewable resources. This uncertainty can slow down the adoption of bioethanol technologies and hinder the growth of the bioethanol yeast market, as producers may be cautious in expanding capacities or investing in new technologies.

Growth Opportunity

Expanding Markets in Developing Countries Boosts Potential

Developing countries present a fertile ground for the bioethanol yeast market due to their increasing energy needs and ongoing shifts towards renewable resources. These regions are focusing more on bioethanol to diversify their energy sources and reduce oil dependency, which opens new opportunities for market players.

By investing in local production facilities and creating region-specific products, companies can capitalize on local agricultural resources and government incentives, thus fostering market growth and expansion in these promising areas.

Innovations in Yeast Strain Development Enhance Efficiency

There is a substantial opportunity for growth in the bioethanol yeast market through the innovation and development of more efficient yeast strains. By engineering strains that can produce higher ethanol yields, tolerate higher alcohol concentrations, and convert a wider range of sugars, companies can significantly enhance bioethanol production efficiency.

These advancements could reduce production costs and increase the attractiveness of bioethanol as an alternative fuel, driving further adoption and market growth.

Integration with Biorefineries Offers New Revenue Streams

The integration of bioethanol yeast technologies into existing biorefineries represents a significant growth opportunity. By utilizing bioethanol yeast in biorefineries, manufacturers can produce not only fuel but also high-value byproducts such as animal feed, pharmaceuticals, and cosmetics.

This approach can open up new revenue streams and increase the profitability of both the bioethanol and biorefinery industries. As sustainability continues to be a priority, the ability to maximize resource efficiency while reducing waste will be a compelling market advantage.

Latest Trends

Adoption of Genetically Modified Yeasts for Higher Yields

The bioethanol yeast market is witnessing a trend towards the adoption of genetically modified (GM) yeasts that are engineered to enhance bioethanol production. These yeasts are designed to have a higher tolerance to the stresses of ethanol production, such as high temperatures and varying pH levels, leading to higher yields and more efficient processes.

This trend is driven by the need for more cost-effective and sustainable production methods, making GM yeasts increasingly popular among producers seeking to optimize their operations and output.

Utilization of Agricultural Waste as Feedstock

There’s a growing trend in the bioethanol yeast market towards using agricultural waste products as feedstock instead of traditional crops like corn and sugarcane. This shift helps reduce the overall cost of bioethanol production and addresses the food vs. fuel debate by utilizing non-food biomass.

Technologies that enable the conversion of cellulose and hemicellulose into fermentable sugars are crucial here, allowing producers to turn waste materials into valuable bioethanol, thereby promoting sustainable practices and resource efficiency.

Collaborative Ventures Between Bioethanol and Automotive Industries

Collaborations between bioethanol producers and automotive manufacturers are becoming more common as the demand for cleaner burning fuels increases. These partnerships aim to tailor bioethanol products to meet specific engine requirements, enhancing fuel efficiency and reducing emissions.

Such collaborations not only boost the use of bioethanol in transportation but also encourage automotive companies to design vehicles that are optimized for these fuels, further embedding bioethanol into the energy landscape and expanding its market reach.

Regional Analysis

The Asia-Pacific bioethanol yeast market holds a 37.8% share, valued at USD 6.2 billion.

In the global bioethanol yeast market, diverse regional dynamics play pivotal roles. Asia-Pacific, the dominant region, commands a substantial 37.8% market share, translating into a market value of USD 6.2 billion.

This region’s growth is propelled by extensive bioethanol production initiatives, particularly in countries like China and India, where government support for biofuel technologies fosters considerable market expansion.

North America follows, driven by robust regulatory frameworks promoting sustainable fuel alternatives. The U.S. is a significant contributor, with policies encouraging the use of bioethanol blending in automotive fuels.

Europe also shows strong market activity, with a focus on reducing carbon footprints aligning well with the adoption of bioethanol. European Union directives supporting renewable energy sources effectively stimulate the bioethanol yeast sector.

Conversely, the Middle East & Africa and Latin America are emerging regions in this market. In Latin America, Brazil stands out with its long-established bioethanol industry, primarily derived from sugarcane, positioning it as a key player.

The Middle East & Africa are gradually catching up, with investments in biofuel technology beginning to materialize, albeit from a smaller base. These regions represent untapped potential, slowly unfolding as technological and governmental supports begin to take shape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Bioethanol Yeast Market in 2023, key companies play crucial roles in shaping industry dynamics through strategic initiatives and technological advancements. AB Mauri, Lallemand Inc., and Lesaffre are leaders in yeast innovation, focusing on the development of robust yeast strains capable of improving ethanol yields and operational efficiencies. Their research into stress-tolerant yeasts is particularly relevant for enhancing bioethanol production under varied fermentation conditions.

Angel Yeast Co., Ltd. and Oriental Yeast Co., Ltd., with their strong foothold in the Asia-Pacific region, capitalize on local market expansions and the increasing adoption of biofuels in this region. These companies emphasize production scale-ups and regional distribution networks to meet growing demands.

Cargill, Inc. and Associated British Foods plc extend their influence in the bioethanol yeast market through vertically integrated operations and supply chain mastery, which ensure consistent feedstock availability and cost control. Their ability to manage the entire value chain from raw materials to finished products provides them a competitive edge in maintaining product quality and customer satisfaction.

On the technological front, DSM and Novozymes are at the forefront of enzyme technology, providing complementary solutions alongside yeast products for efficient starch-to-ethanol conversion. Their continuous investment in biotechnology research positions them well to address the evolving needs of bioethanol producers.

Companies like Pacific Ethanol, Inc., emphasize geographical and application diversification to optimize their market position. By adjusting to local regulatory environments and market conditions, they can effectively manage market fluctuations and capitalize on regional growth opportunities.

Top Key Players in the Market

- AB Mauri

- AngelYeast Co., Ltd.

- Associated British Foods plc

- Biorigin

- Cargill, Inc.

- DSM

- Foodchem International Corporation

- LALLEMAND Inc.

- Leiber GmbH

- Lesaffre

- Novozymes

- Omega Yeast Labs, LLC.

- Oriental Yeast Co., Ltd

- Pacific Ethanol, Inc.

Recent Developments

- In 2023, AB Mauri expanded its commitment to sustainability in the bioethanol yeast sector by enhancing its use of renewable energy sources across various operational sites. The company focused on achieving 100% renewable electricity usage at its manufacturing locations in Brazil, Chile, Colombia, Spain, and India through strategic partnerships with renewable energy suppliers and on-site solar installations.

- In 2023, Biorigin focused on sustainability by managing a carbon-neutral cycle, offsetting emissions through environmental projects, and using 100% renewable energy, demonstrating its commitment to reducing its carbon footprint.

Report Scope

Report Features Description Market Value (2023) USD 16.8 Billion Forecast Revenue (2033) USD 60.7 Billion CAGR (2024-2033) 13.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Baker’s, Brewer’s), By Form (Active, Instant, Fresh), By Feedstock (Cellulosic Biomass, Corn, Sugarcane), By Genus (Saccharomyces, Kluyveromyces), By Application (Food, Animal Feed, Biofuel, Cleaning and Disinfection, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AB Mauri, AngelYeast Co., Ltd., Associated British Foods plc, Biorigin, Cargill, Inc., DSM, Foodchem International Corporation, LALLEMAND Inc., Leiber GmbH, Lesaffre, Novozymes, Omega Yeast Labs, LLC., Oriental Yeast Co., Ltd, Pacific Ethanol, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bioethanol Yeast MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Bioethanol Yeast MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AB Mauri

- AngelYeast Co., Ltd.

- Associated British Foods plc

- Biorigin

- Cargill, Inc.

- DSM

- Foodchem International Corporation

- LALLEMAND Inc.

- Leiber GmbH

- Lesaffre

- Novozymes

- Omega Yeast Labs, LLC.

- Oriental Yeast Co., Ltd

- Pacific Ethanol, Inc.