Global Black Phosphorus Market Size, Share, And Report Analysis By Form (Crystal, Powder), By Application (Electronic devices, Energy storage, Sensors, Photovoltaics, Biomedical devices, Others), By End-User (Electronics, Automotive, Aerospace and Defense, Energy, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137885

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

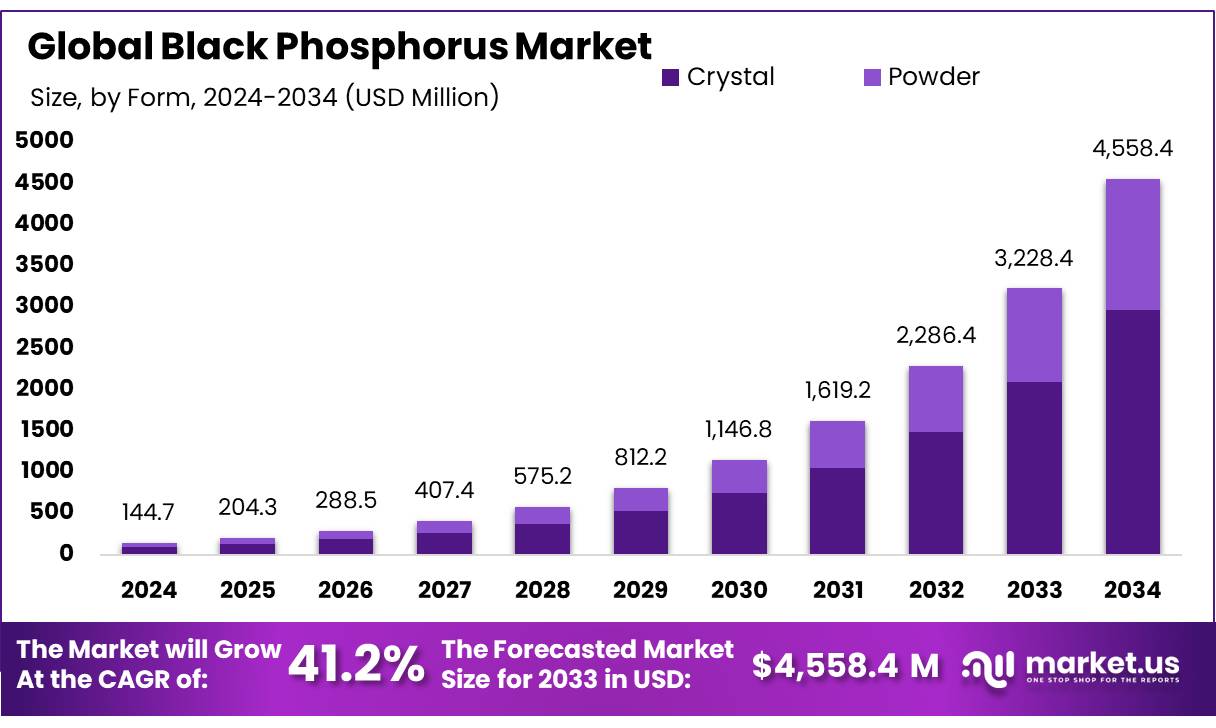

The Global Black Phosphorus Market size is expected to be worth around USD 4558.4 Mn by 2034, from USD 144.7 Mn in 2024, growing at a CAGR of 41.2% during the forecast period from 2025 to 2034.

Black phosphorus market is a unique allotrope of phosphorus with a layered, two-dimensional structure similar to graphite. Its puckered honeycomb lattice gives it distinct electronic and optical properties. The weak bonding between layers allows it to be easily exfoliated into ultra-thin sheets.

This material has gained attention for its potential in electronics, optoelectronics, and energy storage. Its tunable bandgap and high carrier mobility make it a versatile option for designing nanoelectronic devices. Additionally, its properties can be adjusted by varying the number of layers, allowing for a wide range of technological applications.

Black phosphorus is a conductive material with properties that make it suitable for electronic applications. Its energy barrier, which ranges from 0.3 to 2 eV depending on the number of layers, can be adjusted to tailor its electronic behavior for specific uses, such as in transistors.

Energy storage Black phosphorus is used as an anode material in lithium-ion and sodium-ion batteries. Its high conductivity and large surface area enable efficient charge and discharge cycles, enhancing battery performance. In lithium-ion batteries, BP offers a high theoretical capacity of approximately 2596 mAh/g and excellent electrical conductivity, which improve energy storage efficiency. Its layered structure supports fast ion diffusion, making it a promising option for next-generation energy storage systems.

The primary driver for the black phosphorus market is its exceptional material properties, which enable advancements in electronics and renewable energy sectors. With the global push towards sustainable and high-performance materials, black phosphorus aligns well with industry needs. For instance, the global renewable energy capacity reached over 3,000 GW in 2023, highlighting the demand for high-efficiency energy storage materials.

Another significant driver is the growing focus on miniaturization and high-speed electronic devices. Black phosphorus, with its tunable bandgap (ranging from 0.3 eV to 2 eV) and high carrier mobility, is well-suited for high-frequency transistors and low-power electronic components. The material is also gaining traction in photonics for applications such as infrared sensors and lasers, driven by its excellent light absorption properties.

Key Takeaways

- Black Phosphorus Market size is expected to be worth around USD 4558.4 Mn by 2034, from USD 144.7 Mn in 2024, growing at a CAGR of 41.2%.

- Crystal form of black phosphorus held a dominant position in the market, capturing more than a 65.1% share.

- Electronic devices held a dominant position in the black phosphorus market, capturing more than a 38.1% share.

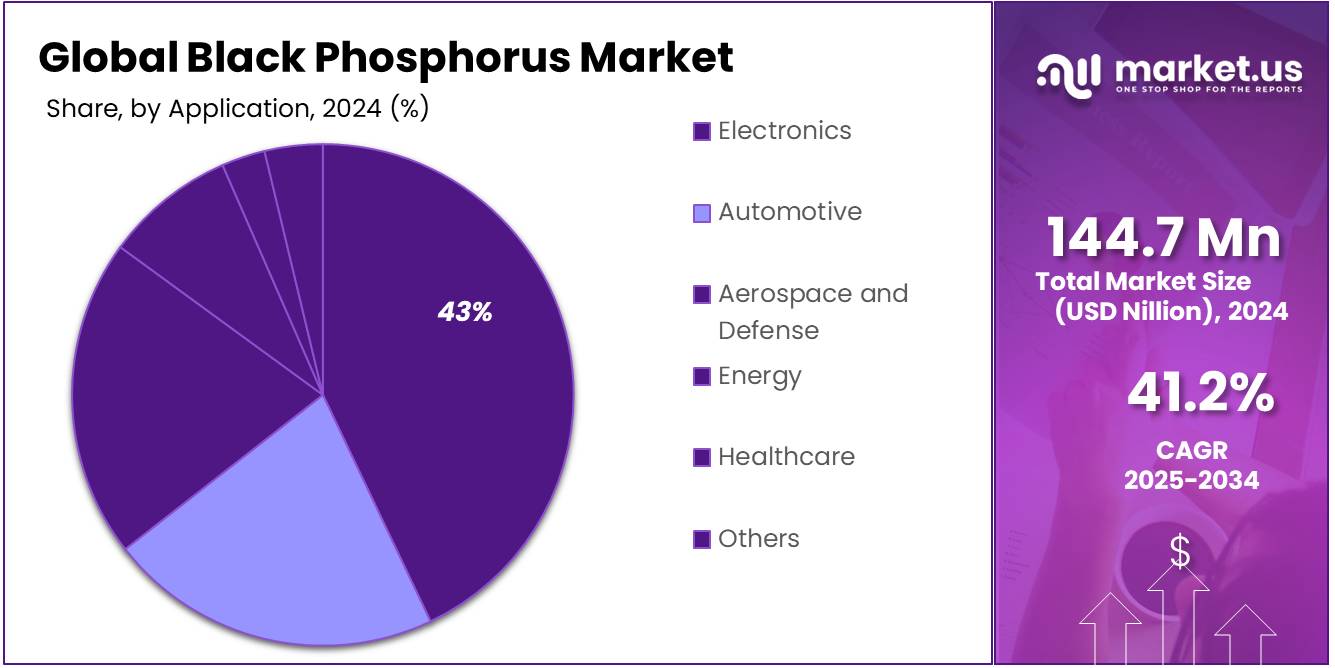

- Electronics held a dominant market position in the Black Phosphorus market, capturing more than a 43.1% share.

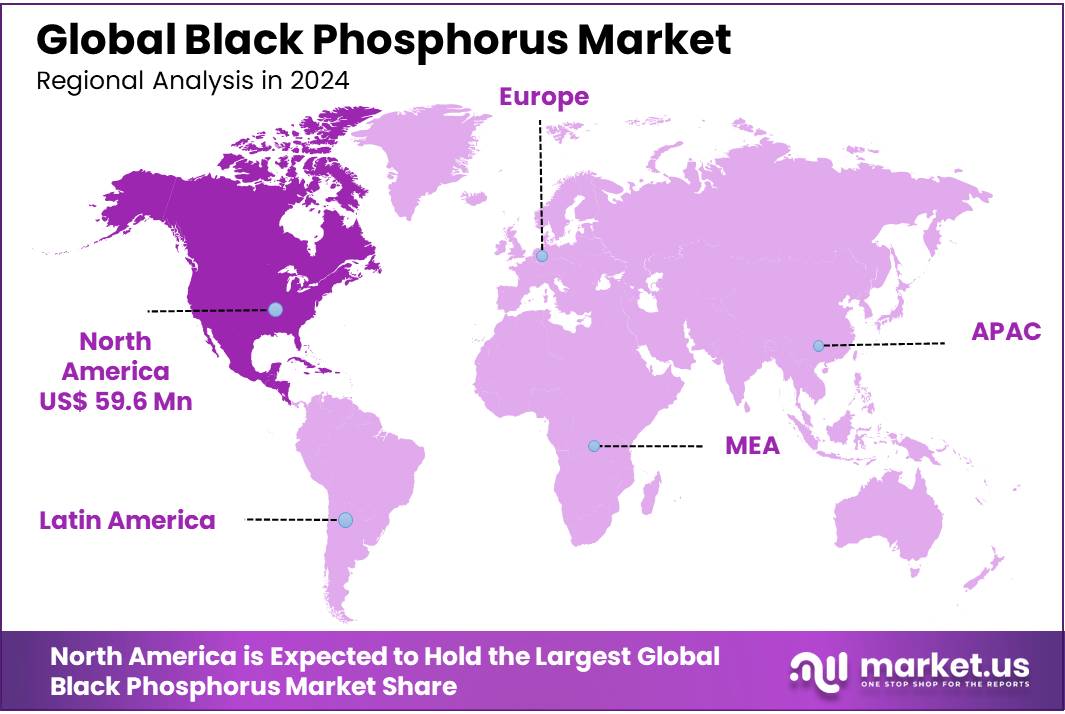

- North America is the dominant region in the market, commanding a 41.3% share with a market value of USD 59.6 million.

By Form

In 2024, the crystal form of black phosphorus held a dominant position in the market, capturing more than a 65.1% share. This significant share can be attributed to its widespread use in research and development for advanced electronic and optoelectronic applications. The crystalline form is highly valued for its superior structural integrity, making it ideal for applications such as photodetectors, field-effect transistors, and quantum devices. Its ability to maintain a stable structure under experimental and operational conditions has made it the preferred choice in industries exploring next-generation technologies.

The powdered form of black phosphorus, while holding a smaller market share, plays a critical role in applications where flexibility and dispersibility are required. Powdered black phosphorus is frequently used in the production of energy storage devices like lithium-ion batteries and supercapacitors due to its excellent electrochemical properties. Additionally, it is gaining traction in biomedical applications, such as drug delivery systems and photothermal therapy, where its fine particle size and chemical reactivity are advantageous.

By Application

In 2024, electronic devices held a dominant position in the black phosphorus market, capturing more than a 38.1% share. This dominance stems from the material’s exceptional electrical properties, including its high carrier mobility and tunable bandgap, which make it ideal for next-generation electronics such as transistors, photodetectors, and flexible electronic circuits. Its ability to operate efficiently at nanoscale levels has made it a key material in developing advanced technologies for consumer electronics and high-performance computing devices.

The energy storage segment also represents a significant application area, leveraging black phosphorus for its high theoretical capacity and excellent conductivity. It is increasingly used in lithium-ion batteries and other energy storage devices, where its properties enhance battery life and energy density. This application is crucial for the growing demand in electric vehicles and renewable energy systems, making it a rapidly expanding segment within the market.

Sensors utilizing black phosphorus are gaining traction due to its sensitivity to environmental changes. Its ability to detect various physical and chemical stimuli has positioned it as a valuable material in precision sensors for industrial and environmental monitoring.

In photovoltaics, black phosphorus is being explored for its potential to enhance solar cell efficiency. Its unique optical properties allow it to capture a broader spectrum of sunlight, offering promising solutions for improving renewable energy technologies.

The biomedical field is also witnessing growing applications for black phosphorus in drug delivery systems, bioimaging, and photothermal therapy. Its biocompatibility and degradability make it suitable for innovative healthcare technologies.

By End-User

In 2024, Electronics held a dominant market position in the Black Phosphorus market, capturing more than a 43.1% share. This segment benefits significantly from the unique properties of black phosphorus, such as its exceptional ability to conduct electricity and its flexibility, making it ideal for use in semiconductors and optoelectronics. The demand within this sector is propelled by the continuous advancement in consumer electronics, where manufacturers are keen on integrating newer, more efficient materials that can enhance the performance and durability of devices.

The automotive industry also makes substantial use of black phosphorus, particularly in the development of sensors and batteries that are more efficient and reliable. As the automotive sector increasingly moves towards electric vehicles, the demand for materials that can provide superior thermal and electrical conductivity, like black phosphorus, is expected to grow. This trend is likely to continue as the push for environmentally friendly transportation solutions becomes more pronounced.

In aerospace and defense, black phosphorus’s application is relatively nascent but promising, driven by its potential in lightweight and strong composite materials. These materials are crucial for improving the performance and fuel efficiency of aircraft and spacecraft. The defense sector also explores its use in advanced communication systems and other technologies that require high-performance materials.

The energy sector’s interest in black phosphorus primarily revolves around its application in photovoltaics and batteries. The material’s efficiency in converting sunlight to electricity and its ability to enhance battery performance by increasing capacity and longevity is particularly appealing. As the world shifts towards renewable energy sources, materials like black phosphorus that can improve the efficiency and output of solar panels are increasingly in demand.

Healthcare is another emerging field for the application of black phosphorus. Its biodegradable properties make it an excellent candidate for drug delivery systems and biodegradable implants. Research is ongoing into how this material can be used to develop solutions that are both effective and safer for long-term medical applications.

Key Market Segments

By Form

- Crystal

- Powder

By Application

- Electronic devices

- Energy storage

- Sensors

- Photovoltaics

- Biomedical devices

- Others

By End-User

- Electronics

- Automotive

- Aerospace and Defense

- Energy

- Healthcare

- Others

Drivers

Rising Demand in Advanced Electronics and Renewable Energy

Black phosphorus has emerged as a critical material due to its exceptional semiconducting properties, including high carrier mobility and a direct bandgap that can be adjusted from 0.3 to 2.0 eV, making it particularly suitable for applications ranging from field-effect transistors (FETs) to photodetectors and sensors. These characteristics enable significant improvements in device performance, including higher speed and greater sensitivity, which are essential for the development of next-generation electronic devices.

The renewable energy sector, especially photovoltaics, is another key area driving the demand for black phosphorus. Its ability to absorb a wide spectrum of light and its favorable electrical properties enhance the efficiency of solar cells. Research institutions and renewable energy companies are increasingly focusing on integrating black phosphorus into solar panels to boost their performance and reduce the costs associated with solar energy generation.

Moreover, the global push towards electric vehicles (EVs) and the need for more efficient energy storage solutions have led to increased investments in battery technology, where black phosphorus is used to improve the performance of lithium-ion batteries. Its high capacity for energy storage helps in extending the range of electric vehicles, making them more appealing to consumers and more competitive in the automotive market.

Governments and regulatory bodies worldwide are supporting the research and adoption of advanced materials like black phosphorus through funding and policy-making aimed at fostering innovation in technology and sustainability. For instance, the U.S. Department of Energy has funded multiple projects exploring the use of novel materials in energy applications, aiming to reduce dependency on imported materials and increase energy security.

This combination of technological advancements, supported by government initiatives and the growing need for high-performance materials in key economic sectors, positions black phosphorus as a material of strategic importance in the global push towards advanced technology and sustainable practices. As industries continue to evolve, the demand for materials that can provide enhanced efficiency, sustainability, and innovation is likely to keep rising, further driving the growth of the black phosphorus market.

Restraints

Handling and Stability Challenges of Black Phosphorus

A major restraining factor for the widespread adoption of black phosphorus in various industries is its environmental stability and handling challenges. Black phosphorus is highly sensitive to oxygen and moisture, which can lead to rapid degradation of its properties when exposed to ambient conditions. This sensitivity significantly complicates its storage, handling, and integration into manufacturing processes, requiring stringent protective measures such as inert atmosphere packaging and specialized equipment that can increase production costs and operational complexities.

The degradation issue not only affects the material’s performance but also its long-term reliability and durability, which are crucial for applications in electronics and energy storage where consistent performance over an extended period is essential. For instance, in semiconductor applications, even minor degradation can lead to significant losses in efficiency and functionality, limiting the practical usability of black phosphorus-based devices.

The current lack of standardized methods for synthesizing and processing black phosphorus at scale also poses a significant barrier. The high-quality synthesis of black phosphorus is complex and costly, hindering its adoption, especially in cost-sensitive industries. Despite its superior properties, these manufacturing and stability challenges make it less competitive compared to more established materials like graphene and transition metal dichalcogenides, which are easier to handle and more stable under environmental conditions.

Government and academic research initiatives are actively exploring solutions to these issues. For example, research funded by national science foundations is focused on developing new chemical vapor deposition (CVD) techniques and protective coatings that could enhance the stability and ease of handling of black phosphorus. These developments are critical to overcoming the material’s inherent limitations and unlocking its full potential in commercial applications.

Opportunity

Expanding Applications in Biomedical and Sensor Technologies

A significant growth opportunity for black phosphorus lies in its expanding applications within the biomedical and sensor technology sectors. Black phosphorus’s unique physical and chemical properties, such as its high surface area, flexibility, and biodegradability, make it highly suitable for medical applications, including drug delivery systems, bio-imaging, and photothermal therapy. Its ability to degrade in biological environments into non-toxic byproducts allows for safe in vivo applications, which is a crucial advantage in developing therapeutic and diagnostic tools.

In the sensor technology sector, black phosphorus’s sensitivity to changes in its environment, such as pH changes, heat, and light, positions it as a promising material for developing advanced sensors. These sensors can be used in various applications, from environmental monitoring to wearable health devices, offering more sensitivity and faster response times than many currently used materials. The flexibility of black phosphorus also enables the development of wearable sensors that conform to the dynamic contours of human skin, enhancing comfort and functionality in medical monitoring devices.

The growth in these sectors is supported by increasing investment in research and development from both government and private sectors. For instance, several national health institutes and technology companies across North America and Europe are funding projects that explore the use of black phosphorus in next-generation medical and sensor devices. This research is driven by the need for more efficient and less invasive medical treatments and the growing demand for environmental and health monitoring technologies.

Moreover, ongoing advancements in material synthesis and processing techniques are making it easier and more cost-effective to produce high-quality black phosphorus. This progress is expected to reduce barriers to entry and enable new players to explore innovative applications of black phosphorus in various fields.

Trends

Innovation in Black Phosphorus for Next-Generation Electronics

One of the latest trends in the black phosphorus market is its rapidly increasing application in next-generation electronics, driven by the material’s outstanding semiconducting properties. Black phosphorus is emerging as a highly desirable material for electronic devices due to its unique ability to be thinned down to a few atomic layers, similar to graphene, but with a direct and adjustable bandgap. This feature enables the development of ultra-thin, flexible electronic components such as transistors, sensors, and photodetectors that are more efficient and responsive than those made with traditional materials.

In 2024, significant advancements were made in the processing techniques of black phosphorus, enhancing its stability and scalability for commercial use. Researchers have developed new methods for encapsulating black phosphorus with materials that protect it from oxidation without degrading its electronic properties. These advancements have led to an increase in the use of black phosphorus in various high-tech applications, from wearable technology to advanced computing systems, where reduced dimensions and improved functionality are continuously sought.

Moreover, the integration of black phosphorus with other two-dimensional materials is a growing trend in the field of materials science, known as heterostructuring. This approach allows for the creation of novel hybrid materials that combine the best properties of each component, such as high mobility, flexibility, and environmental stability. These hybrids are being explored for their potential in a range of applications, from ultrafast computing to highly sensitive biochemical sensors.

Government and academic institutions worldwide are supporting these innovations through funding and research initiatives aimed at overcoming the traditional barriers associated with black phosphorus, such as its sensitivity to air and moisture. For instance, the U.S. Department of Energy and European Research Council are funding projects that focus on enhancing the material’s stability and manufacturability, crucial steps towards its commercialization.

Regional Analysis

North America is the dominant region in the market, commanding a 41.3% share with a market value of USD 59.6 million. This leadership is primarily due to robust investments in research and development, particularly in the United States, where there is significant focus on next-generation materials for electronics and energy storage solutions. North American firms are also pioneers in adopting advanced manufacturing techniques that integrate black phosphorus into various applications, from wearables to renewable energy systems.

Europe follows closely, with substantial growth driven by government funding and collaborations between academia and industry, especially in the development of energy-efficient and miniaturized electronic devices. European regulatory support for environmentally sustainable and innovative materials further strengthens its market position, encouraging companies to explore black phosphorus applications in green technologies.

The Asia Pacific region is rapidly emerging as a key player due to its expanding electronics manufacturing base and significant investments in renewable energy projects. Countries like China, Japan, and South Korea are leading the way in integrating black phosphorus into consumer electronics and automotive technologies, leveraging local manufacturing capabilities and government incentives.

The Middle East & Africa and Latin America are in earlier stages of development but are expected to grow as awareness of the benefits of black phosphorus increases. In these regions, the focus is gradually shifting towards improving technological infrastructure and establishing research centers dedicated to material science, which could catalyze future market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Black Phosphorus market features a competitive landscape with a mix of established companies and dynamic startups that are driving innovation and expansion. Among the key players, American Elements LLC and Merck stand out for their extensive experience and broad product portfolios in advanced materials, including black phosphorus. These companies are pivotal in supplying high-purity black phosphorus to industries such as electronics, healthcare, and renewable energy, where the demand for innovative materials is particularly acute.

2D Semiconductors and Canatu are also making significant strides, focusing on the development of black phosphorus applications in next-generation electronics and wearables. 2D Semiconductors, for instance, specializes in producing black phosphorus-based semiconductors that are critical for miniaturized and energy-efficient devices. Canatu, on the other hand, is exploring the integration of black phosphorus into transparent conductive films used in touch screens and flexible displays.

CVD Equipment Corporation and XRC Labs are enhancing the production technologies to increase the yield and quality of black phosphorus materials. Their efforts are crucial in scaling the supply to meet the growing demand across various industries. With the ongoing research and development, these companies are poised to explore new applications and market opportunities, setting the stage for the next wave of innovations in the black phosphorus market.

Top Key Players

- 2D Semiconductors

- ACS Material LLC

- Advanced Materials Science (AMS)

- American Elements LLC

- Black Phosphorus Limited

- Canatu

- CVD Equipment Corporation

- HQ Graphene

- Hunan Azeal Materials Co. Ltd.

- Manchester Nanomaterials

- Merck

- Nanochemazone

- Nanomaterials Technology Pvt. Ltd.

- Nanotura

- NSL

- Ossila Ltd.

- Researchers Nano

- Stanford Advanced Materials

- Strategic Elements (SEL)

- The Phoenician Group, Inc.

- U.S. Research Nanomaterials, Inc (USRN)

- XRC Labs

Recent Developments

In 2024 2D semiconductors, black phosphorus is highly regarded for its potential in next-generation electronics due to its adjustable band gaps and high carrier mobility, which are essential for developing efficient and miniaturized devices.

ACS Material LLC is a leading supplier of advanced nanomaterials, including black phosphorus. They offer high-quality black phosphorus powder and crystals for research and development purposes.

Report Scope

Report Features Description Market Value (2024) USD 144.7 Mn Forecast Revenue (2034) USD 4558.4 Mn CAGR (2025-2034) 41.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Crystal, Powder), By Application (Electronic devices, Energy storage, Sensors, Photovoltaics, Biomedical devices, Others), By End-User (Electronics, Automotive, Aerospace and Defense, Energy, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 2D Semiconductors, ACS Material LLC, Advanced Materials Science (AMS), American Elements LLC, Black Phosphorus Limited, Canatu, CVD Equipment Corporation, HQ Graphene, Hunan Azeal Materials Co. Ltd., Manchester Nanomaterials, Merck, Nanochemazone, Nanomaterials Technology Pvt. Ltd., Nanotura, NSL, Ossila Ltd., Researchers Nano, Stanford Advanced Materials, Strategic Elements (SEL), The Phoenician Group, Inc., U.S. Research Nanomaterials, Inc (USRN), XRC Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 2D Semiconductors

- ACS Material LLC

- Advanced Materials Science (AMS)

- American Elements LLC

- Black Phosphorus Limited

- Canatu

- CVD Equipment Corporation

- HQ Graphene

- Hunan Azeal Materials Co. Ltd.

- Manchester Nanomaterials

- Merck

- Nanochemazone

- Nanomaterials Technology Pvt. Ltd.

- Nanotura

- NSL

- Ossila Ltd.

- Researchers Nano

- Stanford Advanced Materials

- Strategic Elements (SEL)

- The Phoenician Group, Inc.

- U.S. Research Nanomaterials, Inc (USRN)

- XRC Labs