Global Lithium Ion Battery Market Size, Share, And Business Benefits By Battery Type (Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Lithium Titanate Oxide (LTO)), By Capacity (Below 3,000 mAH, 3,001-10,000 mAH , 10,001-60,000 mAH Above), By Application (Automotive, Energy Storage Systems (ESS), Consumer Electronics, Medical Devices, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 28771

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

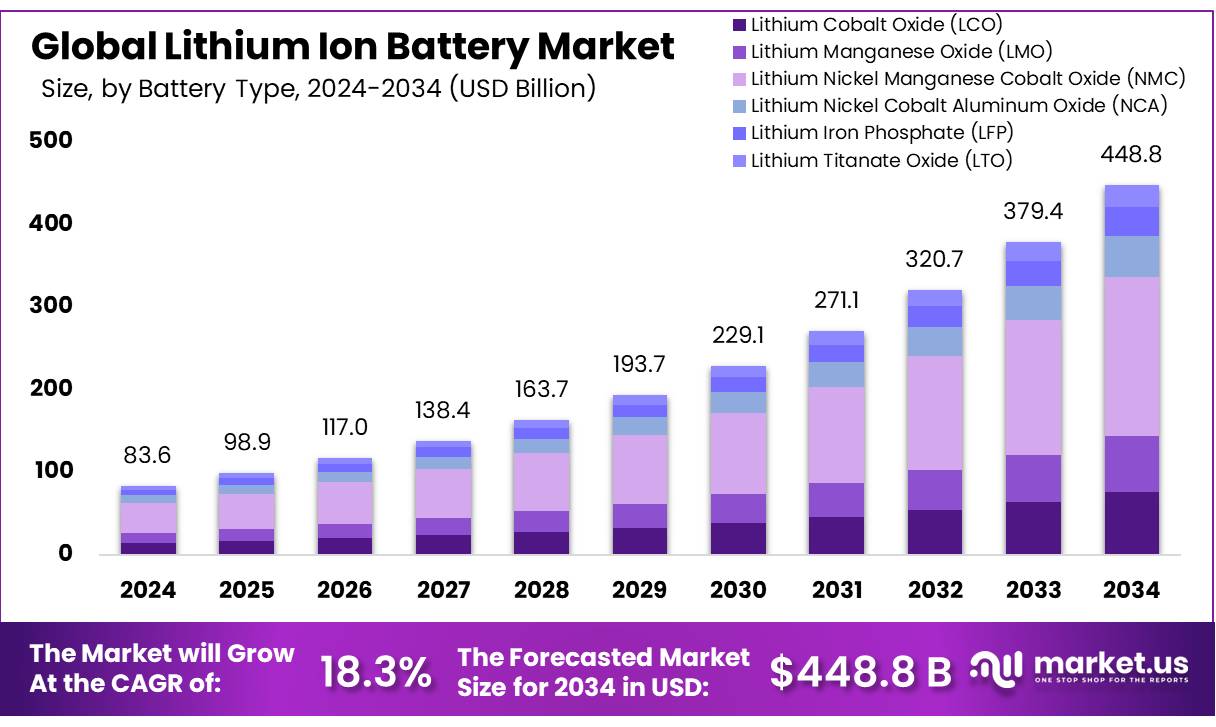

The Global Lithium-Ion Battery Market is expected to be worth around USD 448.8 billion by 2034, up from USD 83.6 billion in 2024, growing at a CAGR of 18.3% during the forecast period from 2025 to 2034.

The global lithium-ion (Li-ion) battery market has emerged as a cornerstone of modern energy storage, driven by the rapid adoption of electric vehicles (EVs), renewable energy systems, and portable electronics. Li-ion batteries dominate due to their high energy density, long cycle life, and declining costs. Technology is pivotal in the transition toward electrification and decarbonization, and it is supported by advancements in cathode materials (NMC, LFP) and battery management systems.

Global demand for Lithium-Ion Batteries is projected to surge in the coming decade, rising from approximately 700 GWh in 2022 to around 4.7 TWh by 2030. The majority of this demand, roughly 4,300 GWh, will come from mobility applications, particularly electric vehicles (EVs), driven by the rapid growth of the mobility sector.

The Asia-Pacific area dominates the market, with China leading in both manufacturing capacity and consumption. The region’s growth is bolstered by strong government support, significant investments in battery technology, and a well-established supply chain. North America and Europe are also witnessing substantial growth, driven by policy initiatives aimed at reducing carbon emissions and promoting clean energy. The U.S. Department of Energy has announced plans to award $3 billion to 25 battery manufacturing projects across 14 states, aiming to enhance domestic production and reduce reliance on foreign supply chains.

Technological advancements are further propelling market expansion. Innovations in battery chemistry, such as the development of silicon-based anodes and solid-state batteries, promise higher energy densities and improved safety profiles. Moreover, efforts to establish standardized pricing for key battery materials, including lithium carbonate and cobalt hydroxide, are being realized through initiatives like the collaboration between Benchmark Minerals Intelligence and Intercontinental Exchange.

Key Takeaways

- The Global Lithium-Ion Battery Market size is expected to grow from USD 83.6 billion in 2024 to USD 448.8 billion by 2034 at a CAGR of 18.3%.

- Lithium Nickel Manganese Cobalt Oxide (NMC) holds 42.4% market share, driven by EV and electronics applications.

- The 3,001–10,000 mAh segment captures 34.5% share, fueled by consumer electronics demand.

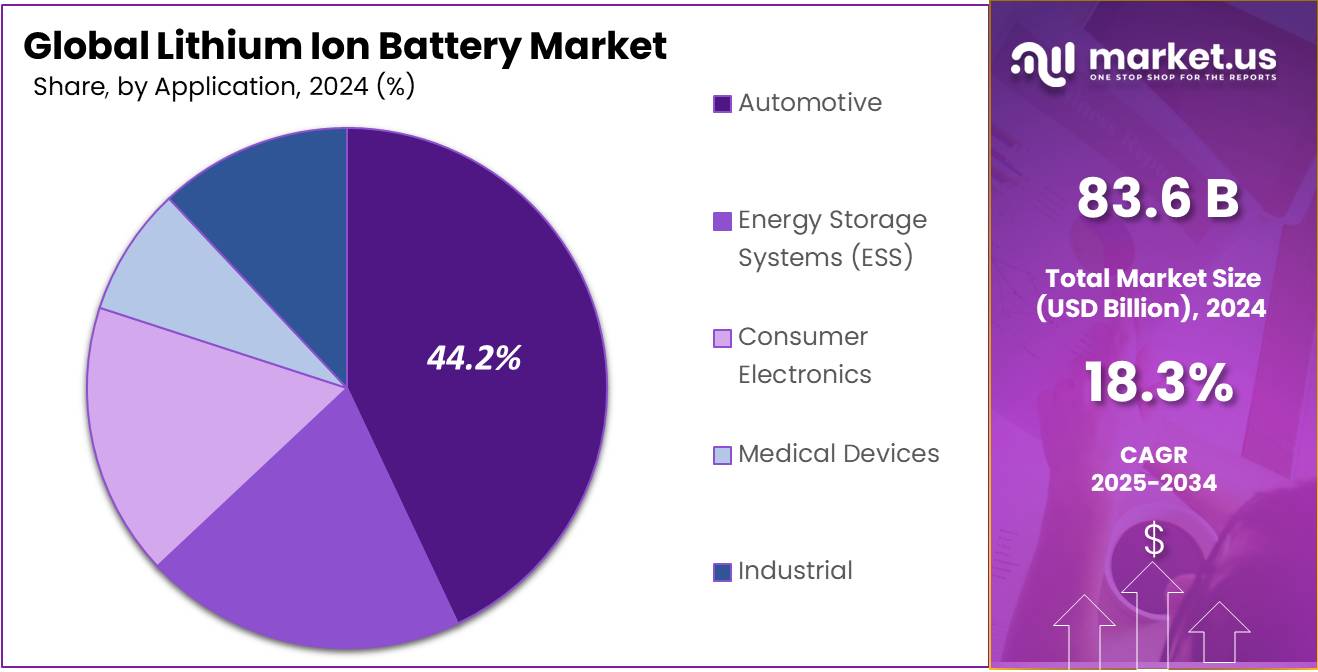

- The automotive sector dominates with a 44.2% share, propelled by global EV adoption and incentives.

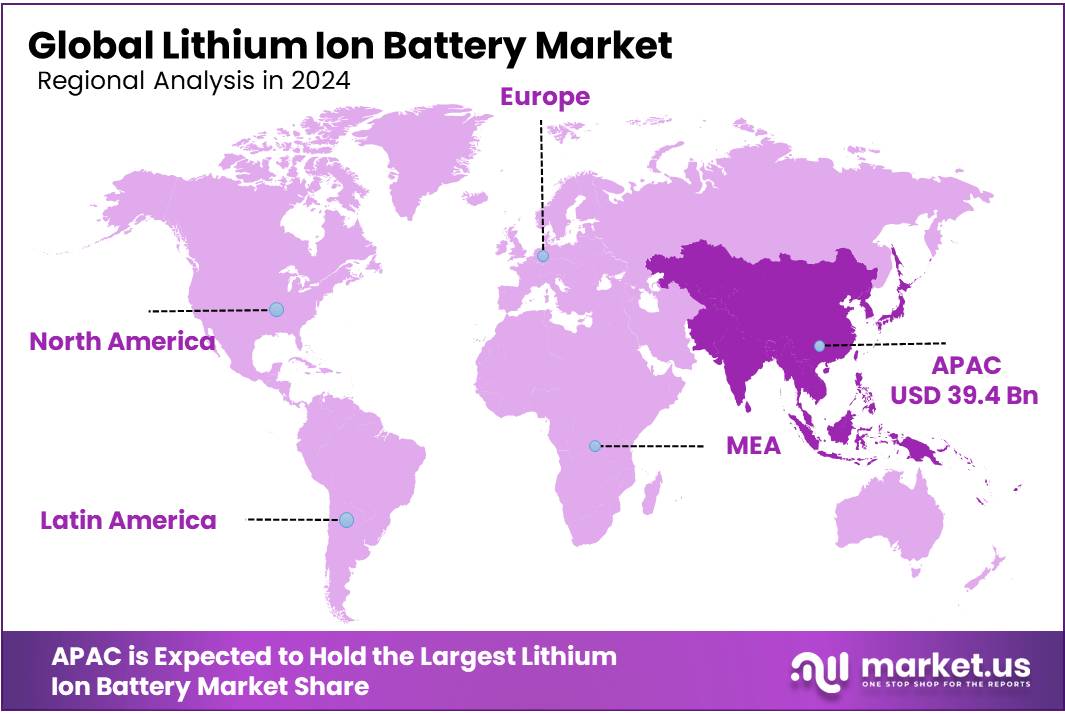

- Asia-Pacific leads with a 48.5% share, generating USD 39.4 billion, due to manufacturing and R&D strength.

Analyst Viewpoint

The Lithium-Ion Battery Market is a powerhouse for investors, driven by electric vehicles (EVs) and renewable energy storage. Investment opportunities shine in Asia-Pacific, where 47% of production thrives. Consumers crave longer-lasting, eco-friendly batteries, pushing brands to innovate. However, risks loom of cobalt and lithium shortages could spike costs. Geopolitical tensions, like China’s mineral dominance, add uncertainty.

Technology is a game-changer, with AI optimizing production and silicon-anode batteries boosting range. Regulatory pressures, like the EU’s 2023 battery lifecycle rules, demand greener practices but reward compliant players. Safety concerns, with thermal runaway risks, urge investment in safer chemistries. Consumers prioritize affordability and sustainability, favoring brands with transparent supply chains. Investors should back companies innovating in recycling and alternative materials to dodge raw material risks.

By Battery Type

Lithium Nickel Manganese Cobalt Oxide (NMC) Dominance

In 2024, Lithium Nickel Manganese Cobalt Oxide (NMC) held a dominant market position, capturing more than a 42.4% share of the global lithium-ion battery market. This prominence is attributed to NMC’s balanced performance characteristics, offering high energy density, long cycle life, and thermal stability, making it a preferred choice for various applications, particularly in electric vehicles (EVs) and portable electronics.

The demand for NMC batteries has been significantly driven by the automotive sector’s shift towards electrification. Major automakers have increasingly adopted NMC chemistries, especially the NMC811 variant, due to its higher nickel content, which enhances energy density and reduces reliance on cobalt, a metal associated with supply chain and ethical sourcing concerns.

The NMC segment is projected to maintain its leading position, supported by ongoing research and development efforts aimed at optimizing battery performance and reducing costs. Advancements in material science are expected to further enhance the energy density and safety profiles of NMC batteries, reinforcing their suitability for high-performance applications.

By Capacity

3,001–10,000 mAh Segment Leadership

The 3,001–10,000 mAh capacity segment held a dominant market position, capturing more than a 34.5% share of the global lithium-ion battery market. This segment’s prominence is primarily due to its widespread use in consumer electronics, such as smartphones, tablets, and laptops, which require batteries that offer a balance between compact size and sufficient energy storage.

Moreover, the 3,001–10,000 mAh batteries are also extensively utilized in various other applications, including power tools, medical devices, and certain electric vehicles, where moderate energy capacity is adequate. Their versatility and adaptability make them a preferred choice across multiple industries.

The 3,001–10,000 mAh segment is expected to maintain its leading position in the market. The continuous innovation in consumer electronics, with devices becoming more power-intensive yet compact, will drive the demand for batteries within this capacity range. Additionally, the growth of wearable technology and portable medical equipment will further bolster the market share of this segment.

By Application

Automotive Sector’s Commanding Share

The automotive sector held a dominant position in the global lithium-ion battery market, capturing more than a 44.2% share. This significant share is primarily driven by the rapid adoption of electric vehicles (EVs) worldwide. Governments across various countries have implemented stringent emission regulations and offered incentives to promote the use of EVs, leading to increased demand for lithium-ion batteries in the automotive industry.

The automotive industry’s shift towards electrification has been further propelled by advancements in battery technology, resulting in improved energy density, longer driving ranges, and reduced charging times. These enhancements have made EVs more appealing to consumers, thereby boosting the demand for lithium-ion batteries.

The automotive segment is expected to maintain its leading position in the lithium-ion battery market. Continued technological innovations, coupled with supportive government policies and increasing environmental awareness among consumers, are anticipated to drive further growth in this segment.

Key Market Segments

By Battery Type

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Iron Phosphate (LFP)

- Lithium Titanate Oxide (LTO)

By Capacity

- Below 3,000 mAH

- 3,001-10,000 mAH

- 10,001-60,000 mAH Above

By Application

- Automotive

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

- Energy Storage Systems (ESS)

- Utility

- Commercial & Industrial

- Residential

- Consumer Electronics

- Smartphones

- Laptops/Tablets

- Wearables

- UPS

- Others

- Medical Devices

- Industrial

Drivers

One of the primary forces propelling the lithium-ion battery market forward is the rapid global adoption of electric vehicles (EVs). In 2024, global EV sales reached over 17 million units, marking a 25% increase from the previous year. This surge underscores a significant shift in consumer preferences and governmental policies favoring sustainable transportation solutions.

China led the charge, with EV sales soaring by 40% to 11 million units in 2024, accounting for nearly two-thirds of global EV sales. This growth was bolstered by domestic incentives and a robust manufacturing ecosystem. In the United States, EV sales experienced a 9% uptick, reaching 1.8 million units, reflecting growing consumer interest and supportive infrastructure developments.

Government initiatives have played a pivotal role in this expansion. For instance, India’s approval of the $1.3 billion PM E-DRIVE scheme aims to subsidize various electric vehicles, including two-wheelers and buses, to promote cleaner transportation and reduce pollution.

Restraints

Safety Risks and Fire Hazards: A Major Restraint in the Lithium-Ion Battery Market

Lithium-ion batteries have revolutionized energy storage across various sectors, but their safety concerns, particularly the risk of fires and explosions, pose significant challenges to their widespread adoption. In 2024, the United States Consumer Product Safety Commission reported at least 25,000 incidents of fire or overheating related to lithium-ion batteries over five years.

These incidents often stem from factors such as overcharging, physical damage, or manufacturing defects, leading to thermal runaway, a condition where the battery’s temperature rapidly increases, potentially causing fires or explosions. The commercial sector is not immune to these risks.

A survey conducted by Aviva in January 2025 revealed that 54% of UK businesses experienced incidents involving lithium-ion batteries, including overheating, smoking, or explosions. Such events not only endanger lives but also result in substantial property damage and financial losses.

Opportunity

Government Initiatives Fueling Lithium-Ion Battery Market Growth in India

India’s lithium-ion battery market is witnessing significant growth, propelled by robust government initiatives aimed at bolstering domestic manufacturing and reducing reliance on imports. A cornerstone of this growth is the Production-Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage, launched with an outlay of ₹18,100 crore.

This scheme aims to establish 50 GWh of battery manufacturing capacity, encouraging companies like Reliance Industries and Amara Raja to invest in large-scale battery production facilities. Complementing the PLI scheme, the Indian government has introduced customs duty exemptions on capital goods used in battery manufacturing.

Trends

Grid-Scale Energy Storage: A Key Emerging Factor in the Lithium-Ion Battery Market

The increasing integration of renewable energy sources like wind and solar into power grids has highlighted the need for efficient energy storage solutions. Lithium-ion batteries have emerged as a leading technology to address this challenge, offering rapid response times and scalability.

In the United States, battery storage capacity experienced a significant expansion, growing fivefold between 2021 and 2024 to exceed 26 GW. This growth has positioned battery storage ahead of traditional pumped hydro capacity, marking a pivotal shift in energy storage infrastructure.

Government policies have played a crucial role in this development. Regulatory frameworks like the Federal Energy Regulatory Commission’s Order 841 have facilitated the participation of energy storage in wholesale electricity markets, enhancing grid reliability and promoting further investment in battery technologies.

Regional Analysis

Asia-Pacific: Leading the Charge in the Lithium-Ion Battery Market

In 2024, the Asia-Pacific (APAC) region solidified its dominance in the global lithium-ion battery market, capturing a substantial 48.5% share, equivalent to approximately USD 39.4 billion in revenue. This commanding position is primarily attributed to the region’s robust manufacturing capabilities, significant investments in research and development, and the presence of key industry players.

China, Japan, and South Korea are at the forefront of this growth, with China alone accounting for a significant portion of global battery production. The country’s aggressive push towards electric vehicle (EV) adoption and renewable energy integration has spurred demand for lithium-ion batteries.

India is emerging as a significant player, with government initiatives like the Production Linked Incentive (PLI) scheme aiming to boost domestic battery manufacturing. The country’s focus on reducing import dependence and promoting clean energy solutions is expected to drive substantial growth in the coming years.

The APAC region’s dominance is also fueled by the widespread adoption of consumer electronics, increasing demand for energy storage solutions, and supportive government policies promoting sustainable energy practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- BYD, a Chinese leader in EVs and batteries, is one of the world’s largest lithium-ion battery producers. Known for its Blade Battery—a safer, longer-lasting alternative BYD supplies major automakers, including Tesla, and its electric cars. The company’s vertical integration, from raw materials to finished batteries, gives it a cost advantage. With expanding factories in China, Europe, and beyond, BYD is crucial in meeting global EV demand while pushing sustainable battery tech.

- Panasonic Corporation, a pioneer in lithium-ion batteries, is Tesla’s long-time partner, supplying cells for the Model 3 and Model Y. Its high-energy-density batteries set industry standards. The Japanese giant is expanding into solid-state and next-gen batteries while investing in U.S. gigafactories. Panasonic’s focus on reliability and efficiency keeps it at the forefront of the EV and energy storage markets, with growing demand from automakers and renewable energy projects.

- Toshiba specializes in fast-charging, durable lithium-ion batteries, particularly for industrial and automotive applications. Its SCiB batteries, known for long lifespans and safety, are used in EVs, trains, and grid storage. Though smaller than rivals, Toshiba’s niche in high-performance, high-stability batteries makes it a key player, especially in Japan’s EV and infrastructure sectors.

Top Key Players in the Market

- BYD Co. Ltd.

- Panasonic Corporation

- Toshiba Corporation

- Samsung SDI Co. Ltd.

- AEG

- Tesla Inc

- LG Energy Solution Ltd

- Hitachi Energy Ltd.

- GS Yuasa International Ltd.

- NEC Corporation

- Saft

- Narada Power Source Co., Ltd.

- Contemporary Amperex Technology Co., Limited.

- BAK Power

- Clarios

Recent Developments

- In 2025, BYD unveiled a new sodium-ion battery technology, reducing reliance on lithium, aimed at sustainable EV innovation. This development enhances cost-efficiency and addresses lithium supply constraints. BYD signed a 2025-2028 agreement with Fengyuan for LFP cathode material supply, securing production for EVs and energy storage systems.

- In 2025, Toshiba launched an upgraded SCiB lithium-ion battery with niobium-titanium oxide anodes, offering higher energy density and ultra-fast charging. This targets EV and industrial applications, emphasizing safety and longevity. Toshiba aims to expand production in Japan to meet growing EV demand.

Report Scope

Report Features Description Market Value (2024) USD 83.6 Billion Forecast Revenue (2034) USD 448.8 Billion CAGR (2025-2034) 18.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium Nickel, Manganese Cobalt Oxide (NMC), Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Lithium Titanate Oxide (LTO)), By Capacity (Below 3,000 mAH, 3,001-10,000 mAH, 10,001-60,000 mAH Above), By Application (Automotive, Energy Storage Systems (ESS), Consumer Electronics, Medical Devices, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BYD Co. Ltd., Panasonic Corporation, Toshiba Corporation, Samsung SDI Co., Ltd., AEG, Tesla Inc., LG Energy Solution Ltd, Hitachi Energy Ltd., GS Yuasa International Ltd., NEC Corporation, Saft, Narada Power Source Co., Ltd., Contemporary Amperex Technology Co., Limited, BAK Power, Clarios Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Lithium Ion Battery MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Lithium Ion Battery MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BYD Co. Ltd.

- Panasonic Corporation

- Toshiba Corporation

- Samsung SDI Co. Ltd.

- AEG

- Tesla Inc

- LG Energy Solution Ltd

- Hitachi Energy Ltd.

- GS Yuasa International Ltd.

- NEC Corporation

- Saft

- Narada Power Source Co., Ltd.

- Contemporary Amperex Technology Co., Limited.

- BAK Power

- Clarios