Global Battery Technology Market Size, Share Analysis Report By Control Technology (Battery Chargers, Battery Conditioners, Smart Battery System), By Technology Type (Lithium-ion Battery, Lead-acid Battery, Nickel Metal Hydride Battery, Other), By Application (Portable Batteries, Industrial Batteries, Automotive Batteries), By End-use (Automotive Industry, Consumer Electronics, Residential and Commercial Industry, Power Industry, Defense and Aviation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146394

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

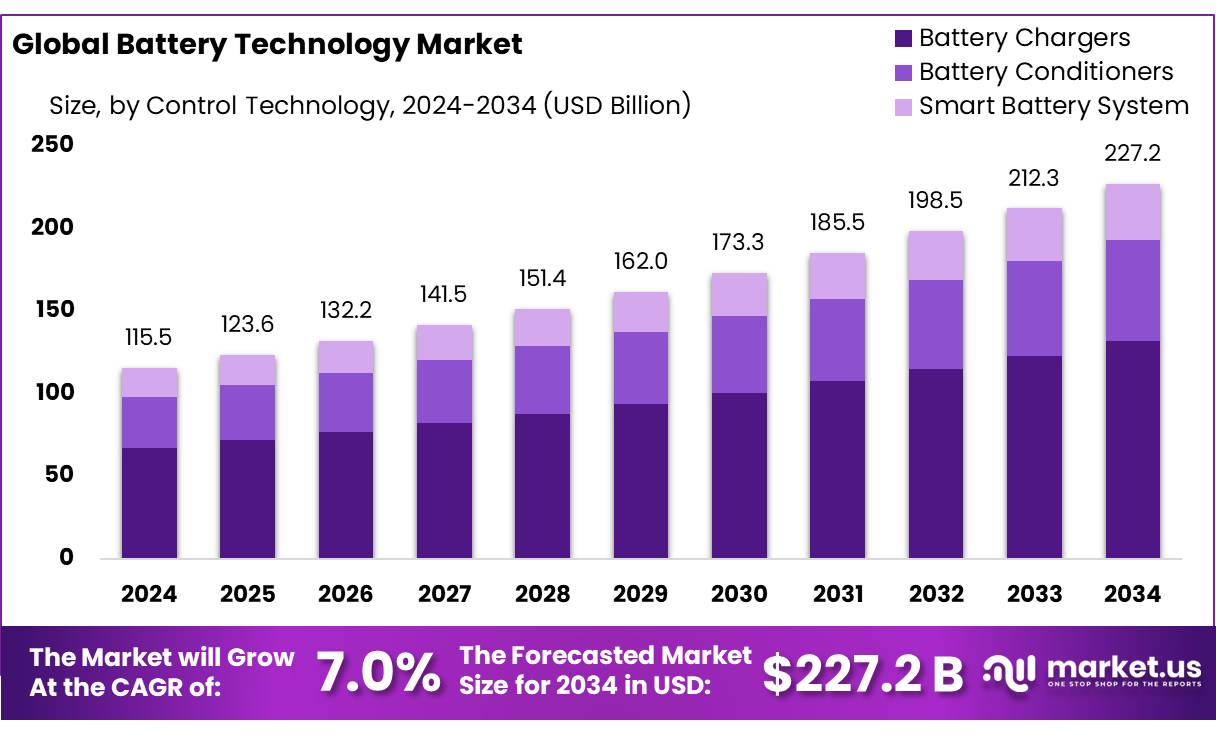

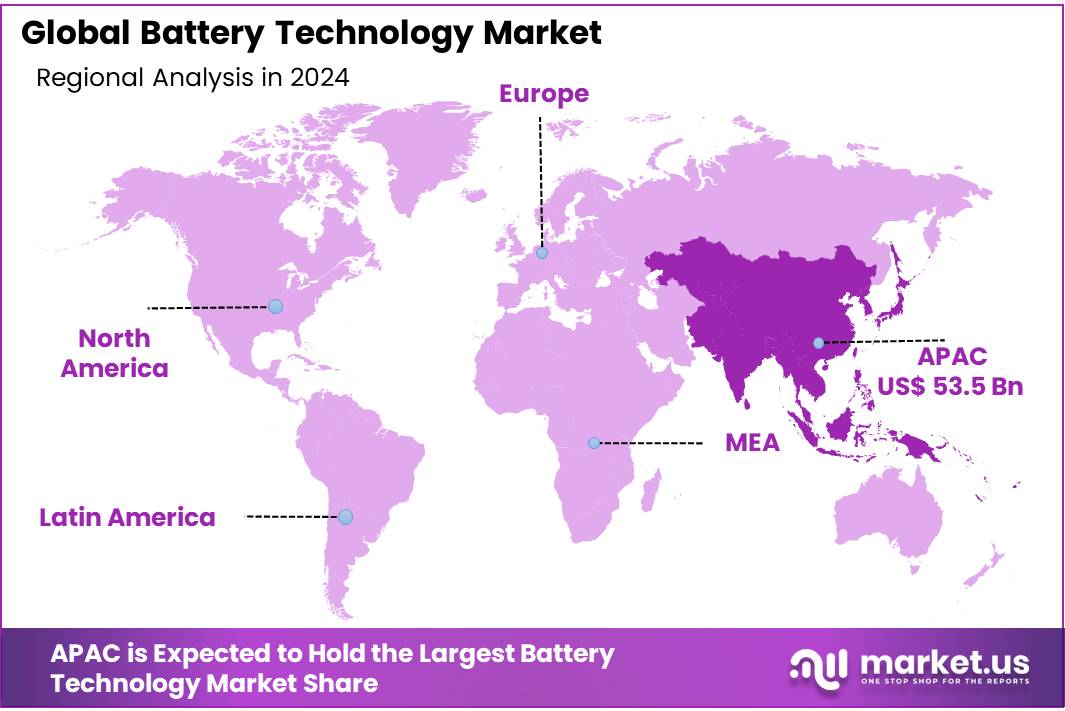

The Global Battery Technology Market size is expected to be worth around USD 227.2 Bn by 2034, from USD 115.5 Bn in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. Asia-Pacific (APAC) held a dominant market position, capturing more than a 46.4% share, holding USD 53.5 Billion revenue.

Battery technology has become a pivotal industry in today’s energy landscape, fueled by the global push towards renewable energy sources and the electrification of transport. As of 2025, advancements in battery technology are increasingly driven by the demand for efficient, sustainable, and cost-effective energy storage solutions. This sector is crucial for enabling the widespread adoption of electric vehicles (EVs), renewable energy integration into the grid, and enhancing portable electronic devices’ performance and longevity.

The battery industry is characterized by rapid technological innovations, intense competition, and heavy investments in research and development. The market is dominated by lithium-ion batteries, which accounted for approximately 70% of the global battery market due to their high energy density and long lifecycle.

The production of these batteries is concentrated in Asia, with China, Japan, and South Korea leading the way, collectively holding over 85% of the global production capacity. The U.S. and Europe are also ramping up efforts to establish their battery production capabilities to reduce dependency on Asian manufacturers and secure their energy future.

Government initiatives across various countries significantly influence the market. For example, the U.S. government has pledged to support EV infrastructure with a $7.5 billion investment aimed at establishing a nationwide network of EV chargers.

Renewable Energy Integration Batteries play a critical role in stabilizing the grid when integrating volatile renewable energy sources like solar and wind. The EU’s Green Deal aims to reduce greenhouse gas emissions by at least 55% by 2030, indirectly boosting the demand for advanced battery storage solutions.

From an investment perspective, the battery technology sector presents compelling opportunities underscored by its integral role in the global shift towards sustainable energy and electrified transport. Investors are particularly attracted to the robust growth prospects of the electric vehicle (EV) market, which is heavily reliant on advancements in battery technology.

The regulatory environment is also a critical factor influencing the battery sector. Governments worldwide are implementing stricter regulations regarding carbon emissions and waste management, pushing companies towards sustainable practices. For instance, the European Union’s Battery Directive mandates the collection and recycling of at least 45% of sold batteries, aiming to increase this target significantly by 2030. Such regulations not only affect how companies operate but also shape investment trends as businesses strive to align with these new norms.

Key Takeaways

- The battery technology market is projected to reach USD 227.2 billion by 2034, up from USD 115.5 billion in 2024, growing at a CAGR of 7.0%.

- Battery chargers dominated the battery control technology sector, accounting for 57.9% of the market share.

- Lithium-ion batteries led the battery technology landscape with a strong 67.4% share.

- Portable batteries held the top spot, capturing 42.7% of the market.

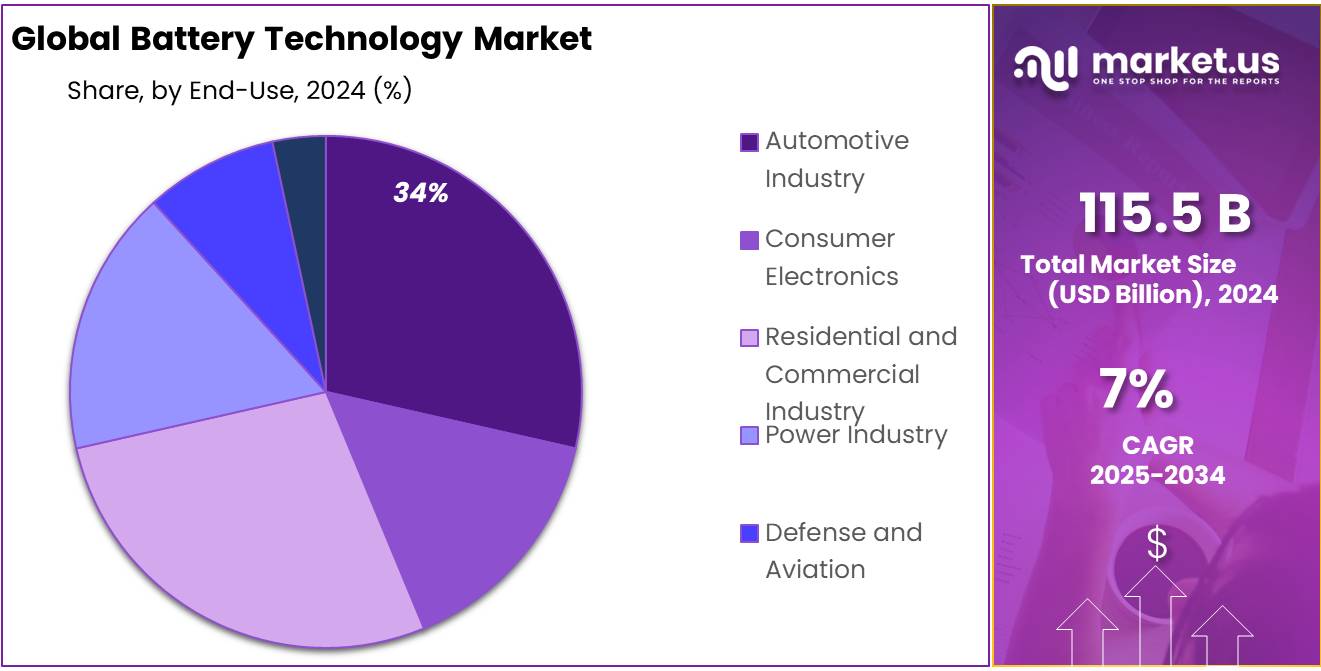

- The automotive sector emerged as the leading application, holding a 34.5% share of the global market.

- Asia-Pacific (APAC) dominated the global battery technology market with a 46.4% share, valued at USD 53.5 billion.

US Tariff Impact Analysis

The recent US tariff actions implemented in April 2025 have significantly impacted the battery technology industry, particularly concerning raw material costs and supply chain continuity. According to Battery Tech Online, the US has imposed tariffs up to 82% on Chinese-origin battery components, including lithium-ion cells and critical minerals. These tariffs have substantially increased the cost base for US manufacturers. In April 2025, the US imposed a 173% tariff on Chinese-origin lithium-ion batteries, significantly increasing production costs for US manufacturers .

Geopolitical tensions, particularly between the US and China, continue to disrupt global trade routes and logistics networks, affecting the availability and movement of essential materials and components for battery production. Commodity price volatility, especially for key ingredients like lithium, cobalt, and graphite, remains high due to climatic fluctuations and export restrictions from major producers.

Governments and private entities are increasingly investing in localized and alternative solutions, including domestically sourced raw materials and advanced battery technologies. Stricter international standards on battery safety and environmental impact are driving innovation in formulation and sourcing practices. The adoption of solid-state and fast-charging battery technologies is also rising, aiding manufacturers in improving energy density and charging efficiency.

By Control Technology

Battery Chargers Lead with 57.9% Share Due to High Demand in Various ApplicationsIn 2024, battery chargers held a dominant market position, capturing more than a 57.9% share of the battery control technology sector. This significant market share is largely due to the expanding adoption of rechargeable batteries across a myriad of applications, from consumer electronics to electric vehicles. Battery chargers are essential for maintaining the lifecycle and efficiency of batteries, making them a critical component in the technology stack of modern electronic devices and automotive systems.The market dominance of battery chargers is supported by ongoing innovations that enhance charging speed and energy efficiency, appealing to both consumer and industrial users. As the global push for renewable energy solutions and sustainable practices intensifies, the demand for advanced, fast-charging technology continues to grow. This trend is expected to sustain the strong market position of battery chargers through 2025, reflecting their pivotal role in the broader battery technology landscape.By Technology Type

Lithium-ion Batteries Command 67.4% Market Share Due to Superior PerformanceIn 2024, Lithium-ion batteries held a dominant market position, capturing more than a 67.4% share in the battery technology landscape. This commanding share is attributed to their superior energy density, longer lifecycle, and relatively fast charging capabilities compared to other battery technologies. Lithium-ion batteries are the cornerstone of modern portable electronics, electric vehicles, and renewable energy storage systems, where high efficiency and reliability are paramount.Their widespread adoption is driven by continuous advancements in lithium-ion technology, which enhance performance and reduce risks associated with battery safety. As the global market continues to shift towards sustainable energy solutions and as electric mobility grows, the demand for lithium-ion batteries is expected to remain robust. This trend is anticipated to sustain their significant market share through 2025, underlining their critical role in powering the next generation of technology and transportation solutions.By Application

Portable Batteries Lead with 42.7% Share, Fueled by Consumer Electronics DemandIn 2024, portable batteries held a dominant market position, capturing more than a 42.7% share of the battery technology market. This significant market share is primarily driven by the extensive use of portable electronics such as smartphones, laptops, tablets, and wearable devices. Portable batteries are essential in today’s mobile-first world, where consumers demand constant connectivity and long-lasting power on the go.The dominance of portable batteries is reinforced by advancements in battery technology that offer longer life spans and faster charging times, meeting the evolving needs of modern consumers. As technology continues to integrate more deeply into everyday life, the demand for portable batteries is expected to remain strong. This ongoing trend highlights the pivotal role portable batteries play in the global technology ecosystem, ensuring they maintain a significant market share through 2025 and beyond.By End-use

Automotive Industry Drives Battery Demand with 34.5% Market Share in 2024In 2024, the automotive industry held a dominant market position, capturing more than a 34.5% share of the global battery technology market. This strong performance is fueled by the ongoing transition to electric vehicles (EVs), with major carmakers investing heavily in EV production and battery-powered mobility solutions. Batteries are at the core of this transformation, serving as the primary energy source for electric and hybrid vehicles.

The demand for efficient, high-capacity batteries has surged with growing consumer interest in cleaner transport options and stricter emission regulations worldwide. As governments offer incentives for EV adoption and phase out internal combustion engines, battery integration in the automotive sector is expected to rise steadily. By 2025, this momentum is likely to keep the automotive segment at the forefront of battery consumption, reinforcing its vital role in shaping the future of mobility.

Key Market Segments

By Control Technology

- Battery Chargers

- Battery Conditioners

- Smart Battery System

By Technology Type

- Lithium-ion Battery

- Lithium Nickel Manganese Cobalt

- Lithium Iron Phosphate

- Lithium Cobalt Oxide

- Lithium Titanate Oxide

- Lithium Manganese Oxide

- Lithium Nickel Cobalt Aluminum Oxide

- Lead-acid Battery

- Flooded Lead-acid Battery

- Valve Regulated Lead Acid (VRLA) Battery

- Nickel Metal Hydride Battery

- Other

By Application

- Portable Batteries

- Industrial Batteries

- Automotive Batteries

By End-use

- Automotive Industry

- Consumer Electronics

- Residential and Commercial Industry

- Power Industry

- Defense and Aviation

- Others

Drivers

Electric Vehicle Growth Fuels Battery Technology Demand

One of the biggest driving forces behind battery technology is the explosive growth in electric vehicles (EVs) worldwide. As governments push for cleaner transportation and reduced carbon emissions, EV adoption is becoming a global movement—making high-performing batteries more important than ever.

In 2024, global EV sales crossed 14 million units, up from 10 million in 2022, with more than 35% of all new vehicles sold in China being electric, according to the International Energy Agency (IEA). This massive demand puts batteries at the center of the automotive transition, especially lithium-ion batteries that power most EV models. As the market expands, manufacturers need batteries that last longer, charge faster, and operate safely in extreme conditions.

Governments are actively supporting this shift. The United States announced $3.5 billion in funding under the Bipartisan Infrastructure Law to boost domestic battery manufacturing and recycling. Similarly, the European Union’s Battery Regulation, adopted in 2023, mandates sustainable battery production, including a minimum recycled content of 16% for cobalt and 6% for lithium by 2031, pushing innovation across the battery supply chain.

Restraints

Raw Material Supply Chain Challenges Restrain Battery Growth

A major restraining factor in battery technology today is the unstable supply chain for critical raw materials like lithium, cobalt, and nickel. These materials are essential for producing high-performance batteries, especially those used in electric vehicles and renewable energy storage. But the sourcing, processing, and transportation of these elements face serious challenges—both geopolitical and environmental.

Cobalt, for instance, is heavily mined in the Democratic Republic of the Congo, which supplies about 70% of the world’s cobalt. According to the U.S. Geological Survey (USGS), the global cobalt production reached 230,000 metric tons in 2023, but demand is growing faster than supply. This over-dependence on a single region creates risks around price volatility, labor issues, and supply disruptions. Lithium also shows a similar trend. Despite rising output from Australia and Chile, global demand is expected to outstrip supply significantly by 2030 if mining capacity doesn’t scale fast enough.

To address this, governments have launched support programs. The European Union’s Critical Raw Materials Act (2023) aims to ensure at least 10% of raw materials are mined and 40% are processed within the EU by 2030. Similarly, the U.S. Inflation Reduction Act includes incentives for sourcing materials from domestic or allied nations.

Opportunity

Battery Recycling Opens a New Growth Avenue

One of the biggest growth opportunities in battery technology is recycling. As millions of electric vehicles (EVs), smartphones, and storage systems reach the end of their battery life, the need for recycling solutions is growing fast. This isn’t just about waste management—battery recycling offers a way to recover valuable materials like lithium, cobalt, and nickel and reduce dependence on mining.

According to the International Energy Agency (IEA), by 2040, recycled materials could supply over 10% of lithium, 25% of cobalt, and 35% of nickel used in EV batteries. This shift could make battery production more sustainable, affordable, and less vulnerable to raw material shortages. In 2023 alone, the world generated more than 500,000 metric tons of lithium-ion battery waste, much of it still going to landfills or incineration. This creates a huge opportunity to turn waste into value.

Governments are already stepping in. The European Union’s new Battery Regulation, effective from 2023, mandates that by 2031, batteries must include at least 16% recycled cobalt, 6% lithium, and 85% lead. Similarly, the U.S. Department of Energy allocated $192 million in 2023 for battery recycling and reuse initiatives to support a domestic supply chain.

Trends

Solid-State Batteries: A Breakthrough Trend in 2025

In 2025, solid-state batteries have emerged as a transformative trend in battery technology, offering enhanced energy density, safety, and longevity. Unlike traditional lithium-ion batteries that use liquid electrolytes, solid-state batteries employ solid electrolytes, reducing the risk of leakage and thermal runaway. This innovation is particularly significant for electric vehicles (EVs), where safety and performance are paramount.

Leading automotive manufacturers are investing heavily in solid-state battery technology. Toyota, for instance, has announced plans to introduce solid-state batteries in its hybrid vehicles by 2025, aiming for mass production in the following years . These batteries are expected to offer a range of up to 800 kilometers on a single charge and significantly reduce charging times.

The potential of solid-state batteries extends beyond EVs. In aerospace, their high energy density and safety make them ideal for applications in drones and satellites. Companies like Lyten are exploring lithium-sulfur solid-state batteries, which could further enhance performance and reduce reliance on critical minerals .

Governments are supporting the development of solid-state battery technology through funding and policy initiatives. In the United States, the Department of Energy has outlined a blueprint to establish a secure battery materials and technology supply chain by 2030, emphasizing the importance of advanced battery technologies like solid-state .

Regional Analysis

Asia-Pacific Leads Global Battery Technology Market with 46.4% Share, Valued at $53.5 Billion

In 2024, the Asia-Pacific (APAC) region solidified its position as the global leader in battery technology, commanding a dominant 46.4% market share, equivalent to USD 53.5 billion. This leadership is fueled by the region’s rapid adoption of electric vehicles (EVs), significant investments in renewable energy storage, and robust manufacturing capabilities. China, Japan, South Korea, and India are at the forefront, driving innovation and production in battery technology.

China remains the epicenter of this growth, with companies like CATL and BYD leading global EV battery production. CATL, for instance, held a 36.8% global market share in EV batteries up to October 2024 . The country’s aggressive push towards electrification, supported by substantial government incentives and infrastructure development, has propelled its battery industry to new heights.

Japan and South Korea contribute significantly through technological advancements and high-quality battery manufacturing. Companies such as Panasonic, Samsung SDI, and LG Energy Solution are pivotal in supplying batteries for various applications, from consumer electronics to automotive sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BAK Power Battery Co., Ltd., based in China, is a key manufacturer of lithium-ion batteries, primarily serving the electric vehicle and energy storage sectors. The company focuses on cylindrical, prismatic, and polymer cells and exports to over 50 countries. BAK continues to expand its R&D in high-energy-density and fast-charging technologies to stay competitive in the EV battery race, with significant production facilities located in Shenzhen and Zhengzhou.

Exide Industries Ltd., headquartered in India, is a major player in lead-acid and advanced lithium-ion batteries. The company supplies batteries for automotive, industrial, and solar applications, and has a strong network across South Asia. In 2024, Exide ramped up its lithium-ion gigafactory plans in partnership with SVOLT Energy to support India’s EV ambitions and renewable energy storage needs, positioning itself as a future-ready energy solutions provider.

Fujitsu, a Japanese multinational, plays a significant role in battery technology through its consumer electronics division, offering rechargeable nickel-metal hydride (NiMH) and lithium-ion batteries. Known for quality and durability, Fujitsu batteries are widely used in portable devices, medical equipment, and industrial systems. The company emphasizes sustainability and energy efficiency, aligning its battery innovations with its broader corporate goal of achieving net-zero carbon emissions by 2050.

Top Key Players in the Market

- American Battery Technology Company

- BAK Power Battery Co., Ltd.

- EXIDE INDUSTRIES LTD.

- Fujitsu

- Samsung SDI Co., Ltd.

- General Electric Co.

- Hitachi

- Maxell Corp.

- Honda Motor Co., Ltd.

- Honeywell International Inc.

- Sony Corporation

- HBL Engineering Limited

- Panasonic Corporation

- Chaowei Power Holdings Ltd

Recent Developments

In 2024, Samsung SDI remained a key player in the global battery technology sector, focusing on innovation and strategic partnerships. The company reported annual battery sector sales revenue of approximately KRW 15.7 trillion, reflecting a decrease from the previous year .

In 2024, Exide Industries Ltd., headquartered in Kolkata, continued to lead India’s battery sector with a strong focus on both traditional and advanced energy storage solutions. The company reported consolidated net sales of ₹4,016.72 crore for the quarter ending December 2024, marking a 0.93% year-over-year increase .

Report Scope

Report Features Description Market Value (2024) USD 115.5 Bn Forecast Revenue (2034) USD 227.2 Bn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Control Technology (Battery Chargers, Battery Conditioners, Smart Battery System), By Technology Type (Lithium-ion Battery, Lead-acid Battery, Nickel Metal Hydride Battery, Other), By Application (Portable Batteries, Industrial Batteries, Automotive Batteries), By End-use (Automotive Industry, Consumer Electronics, Residential and Commercial Industry, Power Industry, Defense and Aviation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American Battery Technology Company, BAK Power Battery Co., Ltd., EXIDE INDUSTRIES LTD., Fujitsu, Samsung SDI Co., Ltd., General Electric Co., Hitachi , Maxell Corp., Honda Motor Co., Ltd., Honeywell International Inc., Sony Corporation, HBL Engineering Limited, Panasonic Corporation, Chaowei Power Holdings Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Battery Technology MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Battery Technology MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- American Battery Technology Company

- BAK Power Battery Co., Ltd.

- EXIDE INDUSTRIES LTD.

- Fujitsu

- Samsung SDI Co., Ltd.

- General Electric Co.

- Hitachi

- Maxell Corp.

- Honda Motor Co., Ltd.

- Honeywell International Inc.

- Sony Corporation

- HBL Engineering Limited

- Panasonic Corporation

- Chaowei Power Holdings Ltd