Global Forklift Battery Market Size, Share, And Business Benefits By Type (Lithium-ion Batteries, Lead-acid Batteries, Nickel-cadmium Batteries, Others), By Voltage (24 Volts, 36 Volts, 48 Volts, 72 Volts), By End User(Warehouses, Manufacturing, Retail and Wholesale Stores, Construction, Others), By Sales Channel(OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146248

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

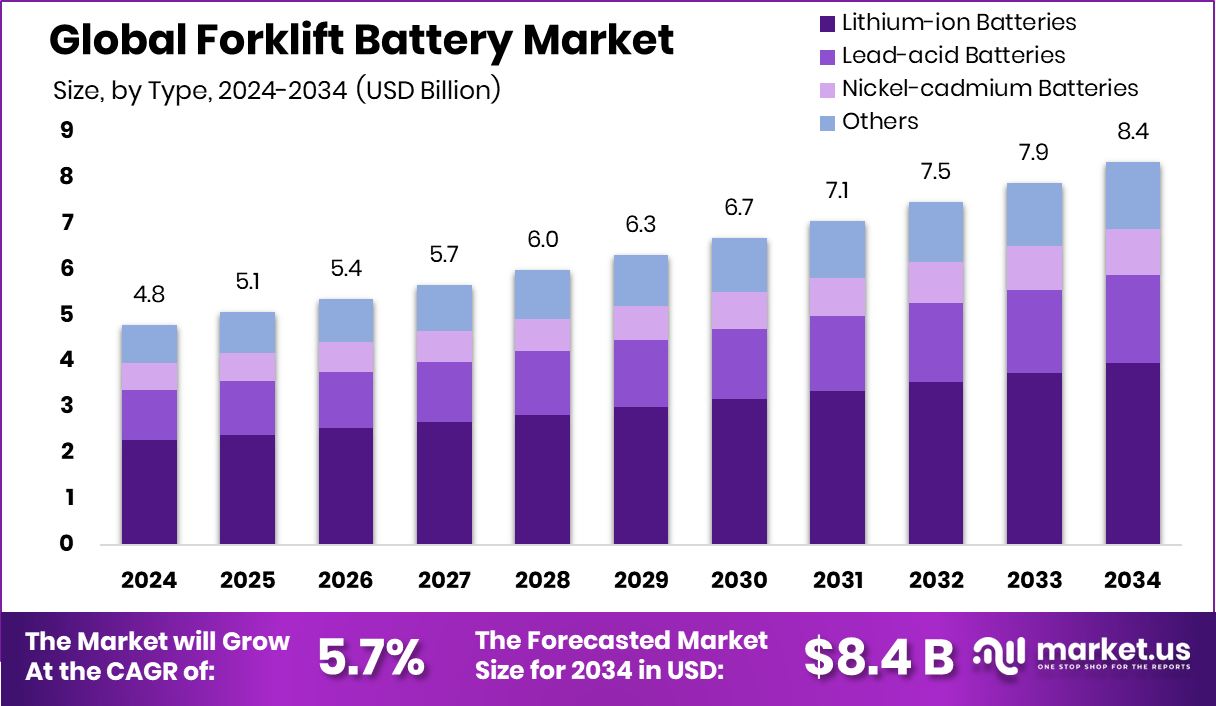

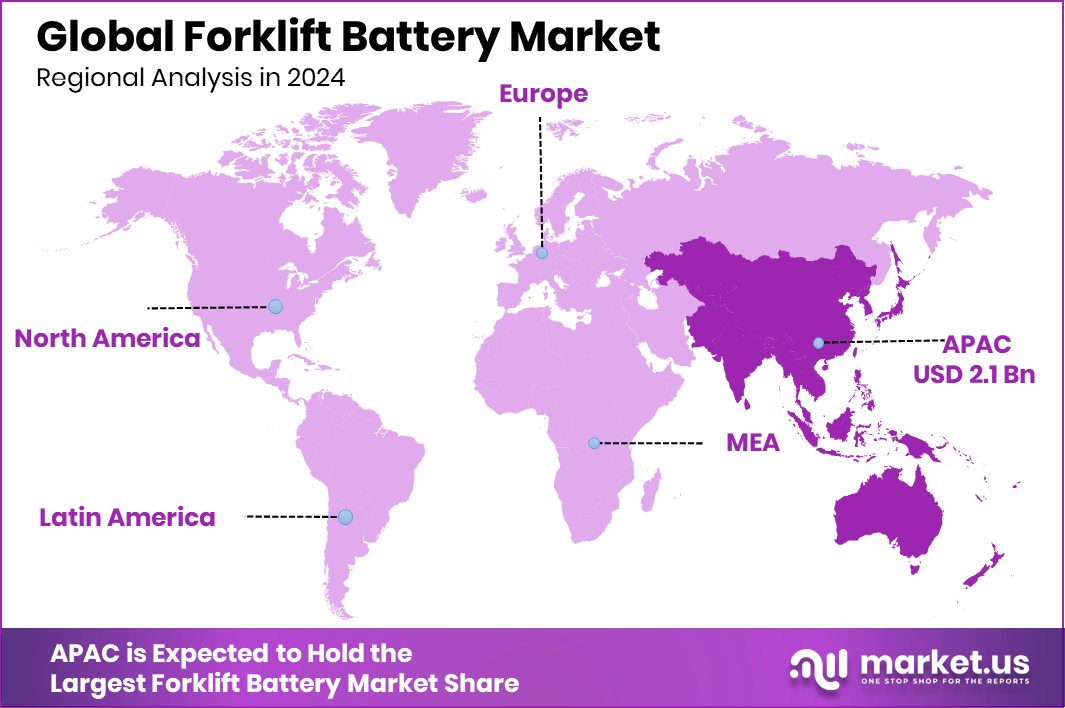

Global Forklift Battery Market is expected to be worth around USD 8.4 billion by 2034, up from USD 4.8 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. USD 2.1 Bn market value reflects Asia-Pacific’s commitment to sustainable logistics solutions.

A forklift battery is a crucial component used to power electric or hybrid forklifts. These batteries are primarily deep-cycle lead-acid or lithium-ion batteries designed to provide high power output and withstand the rigorous demands of heavy lifting and frequent charge cycles. Their capacity to deliver consistent performance over extended periods makes them ideal for operations in warehousing, manufacturing, and other industrial sectors.

The forklift battery market encompasses the production, distribution, and sale of batteries specifically designed for use in forklifts. This market responds to the demand from industries that require reliable and efficient material handling solutions. As companies increasingly focus on sustainability and operational efficiency, the forklift battery market adapts by offering advanced battery technologies that promise longer life spans, faster charging times, and reduced environmental impact.

The growth of the forklift battery market is propelled by the increasing adoption of electric forklifts driven by the global shift toward sustainability. Industries are actively replacing diesel-powered forklifts with electric variants to reduce emissions and comply with stringent environmental regulations. This transition fuels the demand for high-efficiency batteries.

Demand for forklift batteries is rising due to the expansion of warehouses and distribution centers, especially with the boom in e-commerce. The need for efficient logistics and faster turnaround times in warehouses requires reliable forklifts, directly boosting the demand for durable and faster-charging batteries.

Significant opportunities lie in the development of batteries that offer faster charging capabilities and longer operational lifespans without degradation. The integration of renewable energy sources with charging infrastructure also presents a promising frontier, potentially reducing operational costs and enhancing the eco-friendliness of warehouse operations.

Key Takeaways

- Global Forklift Battery Market is expected to be worth around USD 8.4 billion by 2034, up from USD 4.8 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034.

- Lithium-ion batteries hold a significant 47.4% share in the Forklift Battery Market.

- The 48-volt batteries are preferred, representing 38.5% of the market’s demand.

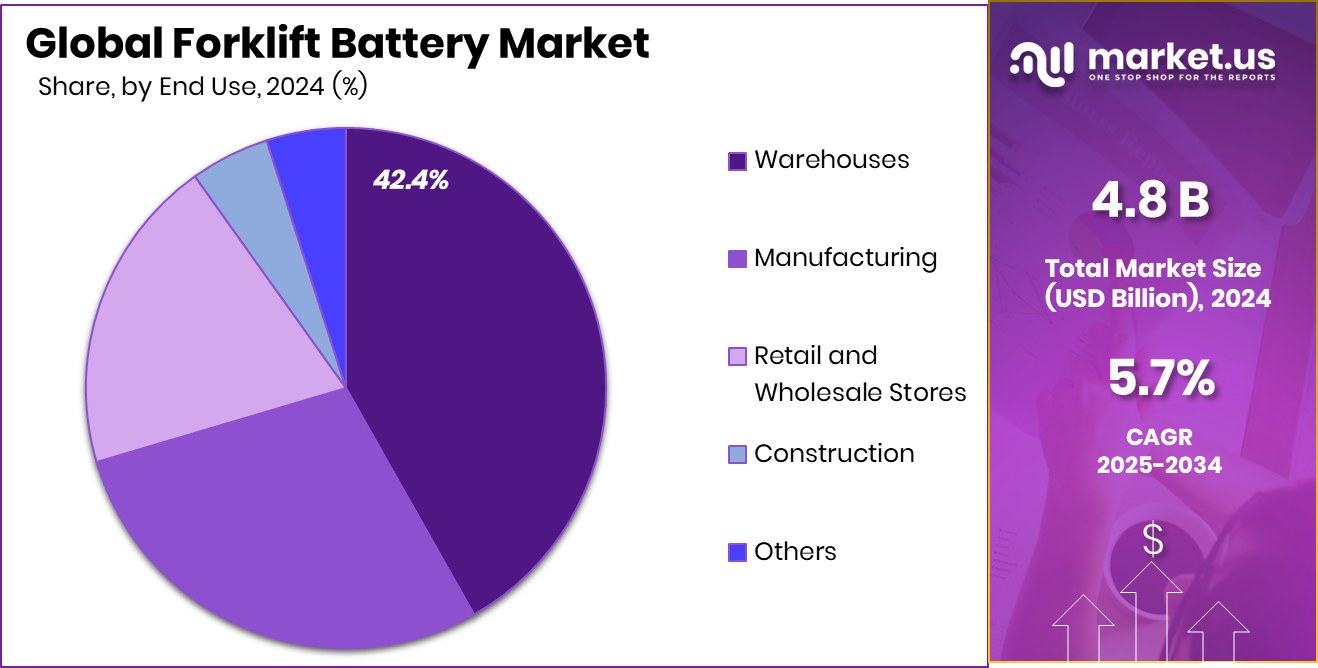

- Warehouses, the largest end-user segment, account for 42.4% of forklift battery sales.

- OEMs dominate the sales channel, contributing to 64.5% of the market’s transactions.

- Strong growth in e-commerce boosts Asia-Pacific’s demand, accounting for USD 2.1 Bn.

By Type Analysis

In 2024, Lithium-ion Batteries held a dominant market position in the by-type segment of the Forklift Battery Market, with a 47.4% share. This substantial market share reflects the industry’s preference for lithium-ion technology due to its high energy density, longer lifecycle, and reduced maintenance compared to traditional lead-acid batteries.

The efficiency of lithium-ion batteries in terms of faster charging times and longer operational hours aligns perfectly with the operational demands of modern warehouses and distribution centers. As e-commerce continues to expand, the logistical requirement for more efficient and environmentally friendly forklift operations drives this segment’s growth.

Furthermore, as companies increasingly prioritize sustainability, lithium-ion batteries are recognized for their lower environmental impact. This is due to their lack of toxic heavy metals and more efficient recycling processes compared to their counterparts.

The growing regulatory pressure to reduce carbon footprints and increase energy efficiency in industrial operations also plays a crucial role in bolstering the adoption of lithium-ion batteries in forklifts.

By Voltage Analysis

In 2024, 48 Volts held a dominant market position in the by-voltage segment of the Forklift Battery Market, with a 38.5% share. This segment’s prominence is primarily attributed to the widespread adoption of 48V batteries in electric forklifts, which are commonly used in medium-duty tasks across warehouses and distribution centers.

These batteries provide an optimal balance between performance and cost, offering sufficient power for most day-to-day operations without the higher expenses associated with higher voltage systems.

The 48V forklift battery’s popularity is bolstered by its compatibility with a wide range of forklift models, including both stand-up and sit-down types, making it a versatile choice for businesses seeking to enhance operational efficiency and reduce downtime. Its capability to handle multiple shifts on a single charge, when coupled with fast-charging technology, meets the increasing demands for higher productivity in logistics and manufacturing environments.

By End User Analysis

In 2024, Warehouses held a dominant market position in the By End User segment of the Forklift Battery Market, with a 42.4% share. This significant market share reflects the critical role that efficient, high-capacity batteries play in warehouse operations, which are increasingly reliant on electric forklifts for a variety of material-handling tasks. As warehouses expand both in size and operational scope, particularly with the growth of e-commerce, the demand for reliable and durable forklift batteries has surged.

The prominence of warehouses in this market segment is further amplified by the continuous push towards automation and the integration of electric forklifts into digital and automated warehouse systems. These systems require consistent and reliable power sources to maintain prolonged operational cycles and ensure seamless logistics and inventory management.

Moreover, the shift toward sustainability in logistics operations drives warehouse managers to opt for electric forklifts equipped with advanced battery technologies, such as lithium-ion, to minimize emissions and energy costs. This trend not only supports environmental policies but also enhances the economic efficiency of warehouse operations by reducing the total cost of ownership of material-handling equipment.

By Sales Channel Analysis

In 2024, OEMs (Original Equipment Manufacturers) held a dominant market position in the By Sales Channel segment of the Forklift Battery Market, with a 64.5% share. This commanding presence is largely due to the trust and reliability associated with purchasing batteries directly from the original manufacturers. OEMs provide batteries that are specifically designed to match the specifications and performance requirements of their forklift models, ensuring optimal efficiency and safety.

The preference for OEM-supplied forklift batteries is also driven by the comprehensive after-sales support, including warranty and maintenance services, which are crucial for operational continuity in industrial applications. Businesses tend to favor OEMs for their proven track record in delivering high-quality, durable batteries that can withstand the demanding environments of warehousing and manufacturing.

Additionally, as forklift technology evolves, including the integration of IoT and advanced battery management systems, OEMs are best positioned to offer the most updated and compatible battery solutions. This not only helps in maintaining the health of the forklift’s power system but also ensures compliance with industry standards and regulations.

Key Market Segments

By Type

- Lithium-ion Batteries

- Lead-acid Batteries

- Nickel-cadmium Batteries

- Others

By Voltage

- 24 Volts

- 36 Volts

- 48 Volts

- 72 Volts

By End User

- Warehouses

- Manufacturing

- Retail and Wholesale Stores

- Construction

- Others

By Sales Channel

- OEM

- Aftermarket

Driving Factors

Rising Demand for Eco-Friendly Solutions Drives Market

The push toward environmentally friendly solutions is a major driving factor in the forklift battery market. As industries worldwide shift towards sustainable practices, the demand for electric forklifts has surged, subsequently boosting the need for high-quality forklift batteries.

This trend is largely driven by the global emphasis on reducing greenhouse gas emissions and minimizing fossil fuel dependency. Electric forklifts offer a cleaner alternative to traditional internal combustion engine models, which rely on diesel or gas.

By adopting electric forklifts powered by rechargeable batteries, companies not only comply with stringent environmental regulations but also achieve greater efficiency and lower operational costs.

Restraining Factors

High Initial Investment Limits Market Adoption Rates

One of the primary restraining factors in the forklift battery market is the high initial investment required for electric forklifts and their batteries. While electric forklifts offer long-term savings on fuel and maintenance, the upfront cost of purchasing these vehicles and their associated high-capacity batteries can be significantly higher compared to traditional diesel or gasoline-powered forklifts.

This financial barrier can deter small to medium-sized enterprises or those with limited capital from transitioning to electric models. Additionally, the need for infrastructure upgrades, such as charging stations, adds to the initial expenses, further complicating the adoption process for many companies.

Despite the long-term benefits and operational savings, these initial costs remain a substantial hurdle, slowing down the market penetration of electric forklifts and their batteries in several industries.

Growth Opportunity

Integration of Renewable Energy in Charging Systems

A significant growth opportunity within the forklift battery market is the integration of renewable energy sources with forklift battery charging systems. As businesses increasingly focus on sustainability, the use of solar panels and other renewable energy technologies to power battery charging stations presents a lucrative prospect.

This approach not only reduces the carbon footprint associated with the operation of electric forklifts but also decreases the energy costs over the life of the battery. With the rising cost of electricity and growing environmental concerns, companies are motivated to invest in green energy solutions.

Additionally, government incentives for renewable energy usage and the potential for enhanced public image make this an attractive opportunity for growth in the forklift battery market.

Latest Trends

Lithium-Ion Batteries Becoming Standard in Material Handling

One of the latest trends in the forklift battery market is the increasing adoption of lithium-ion batteries across material-handling industries. These batteries are rapidly becoming the standard due to their superior performance characteristics compared to traditional lead-acid batteries.

Lithium-ion batteries offer longer life spans, faster charging times and require less maintenance, making them highly efficient for continuous use in high-demand environments such as warehouses and distribution centers.

Additionally, they are more environmentally friendly as they emit no gases during operation and are more efficient in energy use. This shift is driven by the ongoing pursuit of operational efficiency and sustainability in logistics operations, pushing companies to invest in advanced battery technology to stay competitive and eco-conscious.

Regional Analysis

Asia-Pacific dominates the Forklift Battery Market with a 45.5% share, valued at USD 2.1 Bn.

The Forklift Battery Market demonstrates notable regional variances, reflecting diverse industrial activities and environmental regulations. In Asia-Pacific, the market leads with a 45.5% share, amounting to USD 2.1 billion. This dominance is driven by rapid industrialization, expanding logistics sectors, and escalating adoption of electric vehicles across countries like China, Japan, and India.

North America follows, leveraging advancements in material handling technologies and stringent emissions standards, which spur the demand for electric forklifts. The region’s focus on sustainable practices supports the growth of the forklift battery market.

Europe, with its strong regulatory framework for environmental protection, also sees significant adoption of electric forklifts. The market here benefits from extensive manufacturing and distribution networks demanding efficient and eco-friendly forklift solutions.

Latin America and the Middle East & Africa, though smaller in market size compared to Asia-Pacific, North America, and Europe, are gradually expanding. Factors such as increasing urbanization and industrialization, along with government initiatives to modernize infrastructure, contribute to the growth in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the global forklift battery market, key players such as Amara Raja Batteries, BYD, and Crown Equipment are pivotal in shaping industry trends and advancements.

Amara Raja Batteries is renowned for its robust manufacturing capabilities and strong foothold in the Asian market. In 2024, the company continues to leverage its extensive distribution network and reputation for reliable battery solutions to expand its presence globally. With a focus on innovation and sustainability, Amara Raja is strategically positioned to benefit from the rising demand for efficient and eco-friendly energy solutions in material handling.

BYD stands out with its integration of cutting-edge technology and vertical manufacturing processes. The company’s commitment to research and development in battery technology, particularly lithium-ion batteries, allows it to offer products that are not only efficient but also align with global sustainability goals. BYD’s ability to produce high-quality batteries at competitive prices makes it a formidable competitor in the market, particularly in regions striving for greener logistic solutions.

Crown Equipment has carved a niche for itself by not only manufacturing forklifts but also by providing tailored battery solutions that enhance the efficiency and productivity of their equipment. Crown’s focus on customer-centric innovations and after-sales support ensures high customer retention and attracts new clients looking for comprehensive material handling solutions.

Top Key Players in the Market

- Amara Raja Batteries

- BYD

- Crown Equipment

- East Penn Manufacturing

- Electrovaya

- EnerSys

- Exide Technologies

- Flux Power Holdings

- GB Industrial Battery

- Godrej Enterprises Group

- HAWKER

- Hoppecke Batteries

- Midac Batteries

- OneCharge

- Toyota Industries Corporation

- Trojan Battery

Recent Developments

- In April 2025, Electrovaya is set to commence battery system manufacturing at its new facility in Jamestown, NY. This marks the first phase of a significant investment in U.S. manufacturing, with plans to produce both lithium-ion cells and battery systems. The project involves over $70 million in investments and is expected to create more than 250 jobs.

- In November 2024, Amara Raja Energy and Mobility Ltd plans to begin commercial operations at its new lead-acid battery recycling plant in Tamil Nadu. The facility, expected to supply 25-30% of the company’s overall raw material needs over time, will handle 100,000 metric tons of lead recycling annually, with plans to expand to a total capacity of 150,000 metric tons in phases.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Billion Forecast Revenue (2034) USD 8.4 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lithium-ion Batteries, Lead-acid Batteries, Nickel-cadmium Batteries, Others), By Voltage (24 Volts, 36 Volts, 48 Volts, 72 Volts), By End User(Warehouses, Manufacturing, Retail and Wholesale Stores, Construction, Others), By Sales Channel(OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amara Raja Batteries, BYD, Crown Equipment, East Penn Manufacturing, Electrovaya, EnerSys, Exide Technologies, Flux Power Holdings, GB Industrial Battery, Godrej Enterprises Group, HAWKER, Hoppecke Batteries, Midac Batteries, OneCharge, Toyota Industries Corporation, Trojan Battery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amara Raja Batteries

- BYD

- Crown Equipment

- East Penn Manufacturing

- Electrovaya

- EnerSys

- Exide Technologies

- Flux Power Holdings

- GB Industrial Battery

- Godrej Enterprises Group

- HAWKER

- Hoppecke Batteries

- Midac Batteries

- OneCharge

- Toyota Industries Corporation

- Trojan Battery