Global Battery Analyzers Market Size, Share Analysis Report By Type (Stationary, Portable), By Battery Type (Lithium-Ion Battery, Nickel-Cadmium Battery, Lead Acid Battery, Others), By Product Type ( Handheld Battery Analyzers, Benchtop Battery Analyzers, Automatic Battery Analyzers), By Technology (Conductance Testing, Load Testing, Impedance Testing, Cyclic Charging Testing, Others), By End-use (Automotive, IT and Telecom, Healthcare, Aviation and Defense, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145978

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

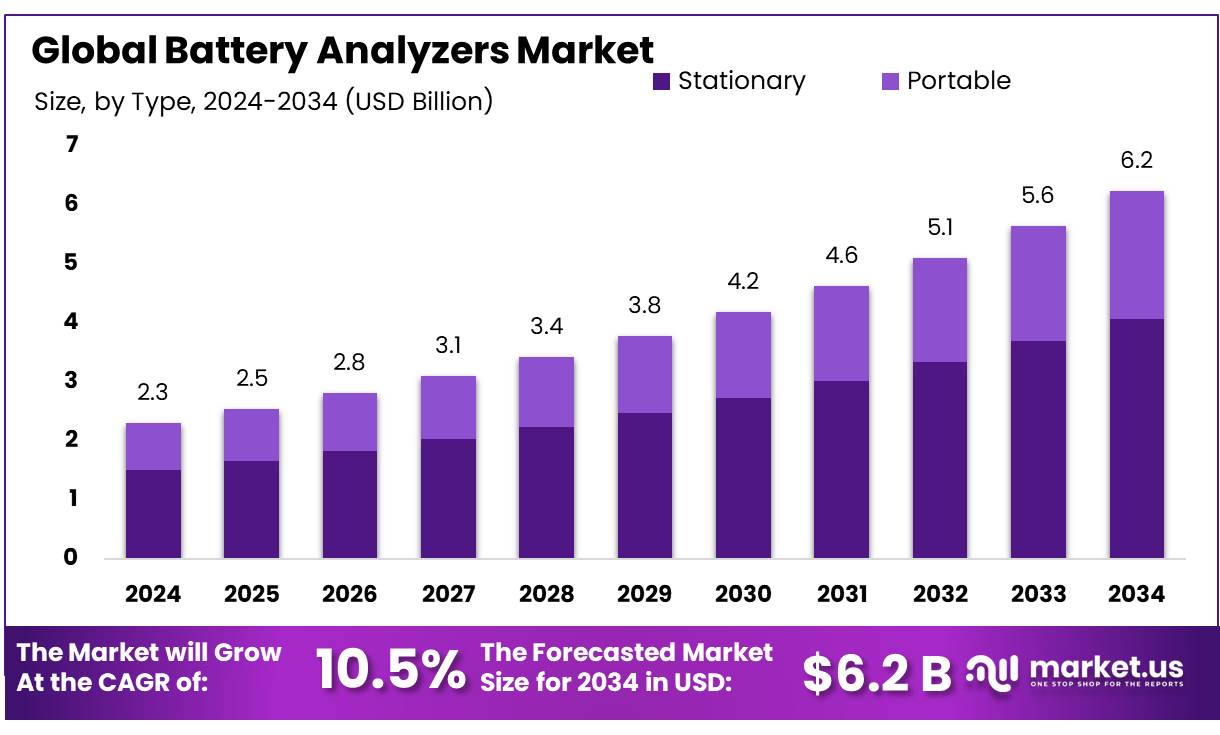

The Global Battery Analyzers Market size is expected to be worth around USD 6.2 Bn by 2034, from USD 2.3 Bn in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034.

Battery analyzers are essential tools for evaluating the health, capacity, and performance of batteries across various sectors, including electric vehicles (EVs), renewable energy storage, telecommunications, and industrial applications. As the global shift towards electrification and sustainable energy intensifies, the demand for reliable battery testing solutions is witnessing significant growth.

The market for battery analyzers is heavily influenced by the growing adoption of electric vehicles (EVs) and renewable energy systems, where accurate battery diagnostics are crucial. According to the International Energy Agency (IEA), global electric car sales doubled in 2021, pushing the number to over 6.6 million. This surge is a primary driver for the enhanced demand for battery analyzers, as these tools ensure the optimal operation of EV batteries by assessing their capacity and state of health.

Additionally, the increase in installations of renewable energy systems, such as solar and wind, which rely on battery storage systems to manage supply and demand, further escalates the need for battery analyzers. Government reports indicate that global renewable energy installation capacity is projected to grow by more than 60% from 2020 levels by 2026, encompassing an additional 2900 GW. In response, governments worldwide are not only incentivizing renewable energy adoption through subsidies but also investing in technologies that can ensure the longevity and efficiency of these installations, including advanced battery analysis technologies.

Furthermore, as countries intensify their efforts to curb emissions, the transition towards electrification of transport and energy storage solutions will likely accelerate. This shift is anticipated to provide substantial growth opportunities for the battery analyzer industry. Government initiatives, like the European Green Deal, aim to reduce greenhouse gas emissions by at least 55% by 2030, underscoring a strong commitment to renewable energy and, inherently, to technologies enabling efficient energy storage and management.

Key Takeaways

- Battery Analyzers Market size is expected to be worth around USD 6.2 Bn by 2034, from USD 2.3 Bn in 2024, growing at a CAGR of 10.5%.

- Stationary held a dominant market position, capturing more than a 65.3% share in the battery analyzers market.

- Lithium-Ion Battery held a dominant market position, capturing more than a 48.3% share in the global battery analyzers market.

- Handheld Battery Analyzers held a dominant market position, capturing more than a 43.3% share.

- Conductance Testing held a dominant market position, capturing more than a 34.2% share in the battery analyzers market.

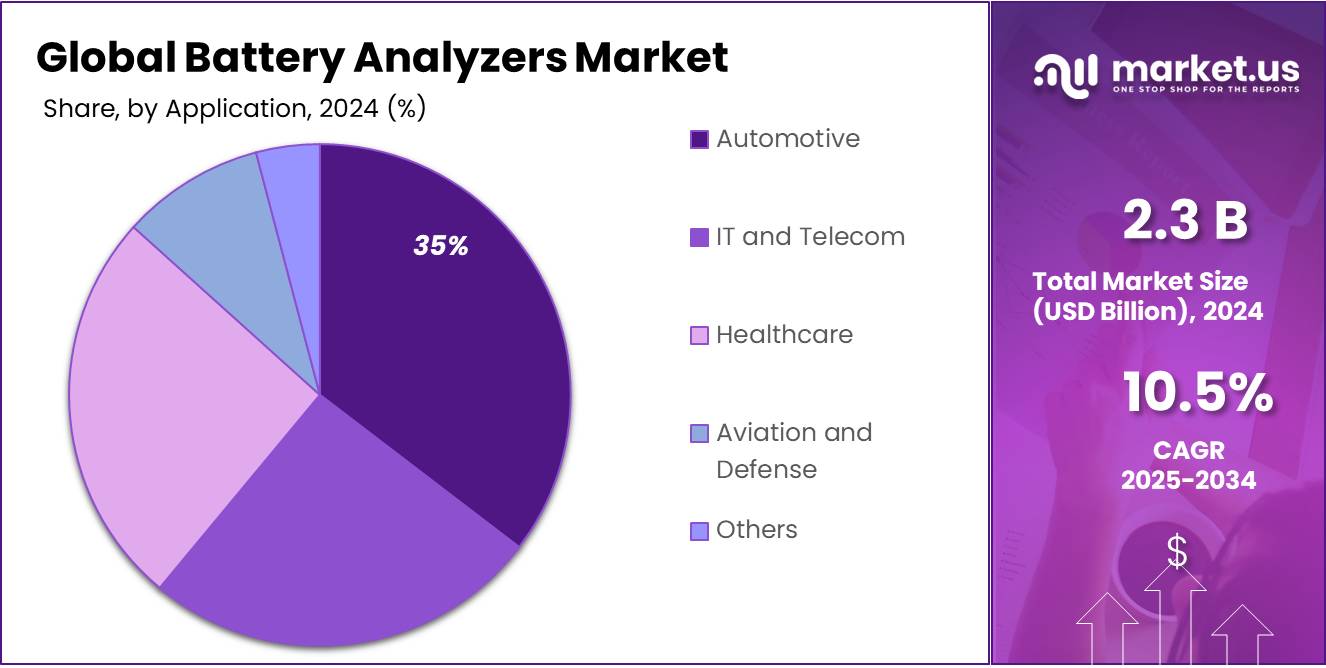

- Automotive held a dominant market position, capturing more than a 34.5% share in the battery analyzers market.

- North America held a dominant position in the global Battery Analyzers market, accounting for 46.3% of the total market share, valued at approximately USD 1.06 billion.

By Type

Stationary Battery Analyzers dominate with 65.3% due to their steady demand in labs and grid systems.

In 2024, Stationary held a dominant market position, capturing more than a 65.3% share in the battery analyzers market. This growth is largely driven by their reliability in testing and diagnostics in controlled environments such as energy research labs, power utilities, and manufacturing plants. These analyzers are typically used for long-term battery monitoring, quality assurance in production lines, and lifecycle testing, making them a preferred choice for continuous, high-accuracy performance checks. Their fixed installation enables in-depth testing of large-scale battery systems, especially in renewable power stations and telecom infrastructure. Looking ahead to 2025, demand is expected to remain steady, supported by the rising need for efficient battery management in electric grid storage and industrial energy backup systems.

By Battery Type

Lithium-Ion Battery leads with 48.3% share owing to its dominance in EVs and portable electronics.

In 2024, Lithium-Ion Battery held a dominant market position, capturing more than a 48.3% share in the global battery analyzers market. This stronghold comes from the growing use of lithium-ion batteries across electric vehicles, smartphones, laptops, and energy storage systems. As these batteries are widely adopted for their high energy density and long life cycles, accurate testing becomes crucial—driving the demand for analyzers specifically tailored for lithium-ion chemistry. The increasing push for EV adoption and grid-scale battery storage systems further fueled analyzer sales. By 2025, steady growth is expected as more industries shift to lithium-based power, supported by advancements in cell design and government clean energy targets.

By Product Type

Handheld Battery Analyzers lead with 43.3% thanks to their portability and ease of on-site testing.

In 2024, Handheld Battery Analyzers held a dominant market position, capturing more than a 43.3% share in the overall battery analyzers market. These devices are especially popular among field technicians and service engineers due to their compact design and convenience during maintenance work in remote or confined locations. From telecom base stations to uninterruptible power supply (UPS) systems, handheld analyzers offer quick diagnostics without the need for heavy setups. Their usage has grown in routine battery health checks across industries like automotive, aerospace, and backup power systems. Going into 2025, demand is expected to stay strong as more sectors value mobility and real-time testing, especially with expanding EV infrastructure and renewable energy integration.

By Technology

Conductance Testing dominates with 34.2% for its fast, non-invasive battery health diagnostics.

In 2024, Conductance Testing held a dominant market position, capturing more than a 34.2% share in the battery analyzers market. This method has gained popularity due to its ability to provide quick and reliable insights into a battery’s condition without needing to discharge it. It’s widely used in automotive, telecom, and data center applications where uptime is critical, and rapid assessments are essential. Conductance testing helps identify weak batteries before they fail, improving system reliability and reducing downtime. As industries move toward predictive maintenance strategies, 2025 is likely to see continued preference for this technology—especially in large-scale battery installations where speed and safety matter.

By End-use

Automotive sector tops with 34.5% as EV growth fuels battery testing demand worldwide.

In 2024, Automotive held a dominant market position, capturing more than a 34.5% share in the battery analyzers market. This rise is closely linked to the ongoing shift toward electric vehicles (EVs), hybrid models, and advanced battery management systems. Automotive service centers and manufacturers are increasingly relying on analyzers to assess battery performance, ensure safety, and extend vehicle battery life. With EV adoption rising globally and traditional vehicles still requiring frequent battery checks, the demand for both portable and stationary analyzers has expanded. Heading into 2025, the automotive sector is expected to maintain its lead, supported by government incentives for EVs and stricter emission norms pushing electrification in transportation.

Key Market Segments

By Type

- Stationary

- Portable

By Battery Type

- Lithium-Ion Battery

- Nickel-Cadmium Battery

- Lead Acid Battery

- Others

By Product Type

- Handheld Battery Analyzers

- Benchtop Battery Analyzers

- Automatic Battery Analyzers

By Technology

- Conductance Testing

- Load Testing

- Impedance Testing

- Cyclic Charging Testing

- Others

By End-use

- Automotive

- IT and Telecom

- Healthcare

- Aviation and Defense

- Others

Drivers

The Surge in Electric Vehicle Adoption Drives Demand for Battery Analyzers

One significant driving factor for the growth of the battery analyzer market is the rapid expansion of the electric vehicle (EV) sector. The increased adoption of EVs is largely fueled by the global push towards reducing carbon emissions and enhancing energy efficiency in transportation.

Governments worldwide are supporting this shift through incentives, subsidies, and stringent emissions regulations, creating a booming market for EVs and, by extension, for technologies that ensure their optimal performance.

For instance, the European Union’s push towards a greener transport sector includes targets under the European Green Deal, aiming for a 90% reduction in transport emissions by 2050. This policy framework encourages the adoption of electric vehicles and supports infrastructure developments such as charging stations. With more electric vehicles on the road, the demand for battery analyzers escalates as these tools are crucial in maintaining battery health, thus ensuring vehicle reliability and efficiency.

In practical terms, battery analyzers play a critical role by enabling EV owners and service providers to perform regular health checks on batteries, which are integral to the performance and longevity of electric vehicles. These devices help in detecting problems before they lead to battery failure, thereby reducing maintenance costs and extending the battery’s life.

Moreover, as per a 2021 report from the International Energy Agency (IEA), global EV sales are projected to reach 125 million by 2030 under current policy scenarios. This projection underscores the expected increase in demand for battery analyzers, as every electric vehicle relies heavily on its battery’s performance.

Restraints

High Costs and Technical Complexity Limit Battery Analyzer Adoption

A major factor restraining the growth of the battery analyzer market is the high cost associated with advanced diagnostic tools and the technical complexity involved in their operation. These factors can deter small businesses and individual consumers from adopting this technology, despite recognizing its benefits.

The sophisticated technology behind battery analyzers, which ensures accurate readings and detailed battery health reports, often comes with a hefty price tag. For small automotive shops or independent EV owners, the initial investment in high-quality battery analyzers can be prohibitive. This financial barrier is particularly significant in less affluent regions where the adoption of advanced technologies is slower due to budget constraints.

Moreover, the operation of battery analyzers often requires technical expertise. The data provided by these devices needs to be interpreted correctly to be beneficial. This necessity for specialized knowledge can be a stumbling block for widespread usage, especially among individuals or businesses without access to technical training. For instance, in a survey conducted by a leading automotive association, over 40% of small auto repair shops reported difficulty in interpreting data from advanced diagnostic tools, including battery analyzers.

Government initiatives that could potentially alleviate these challenges are still in nascent stages in many countries. While subsidies and training programs exist in sectors like renewable energy and electric vehicles, similar support for the adoption of battery diagnostics tools is less common. The absence of robust educational programs on the effective use of such tools means that their benefits are not fully realized across the potential user base.

Opportunity

Integration with Renewable Energy Systems: A Lucrative Growth Avenue for Battery Analyzers

A significant growth opportunity for the battery analyzer market lies in its integration with renewable energy systems. As the world shifts towards sustainable energy sources like solar and wind, the need for effective battery management systems to store and regulate this energy is paramount. Battery analyzers can play a crucial role in ensuring these storage systems operate efficiently and reliably.

The global renewable energy sector is witnessing exponential growth, with governments across the globe setting ambitious targets to increase their shares of renewable in the energy mix. For instance, the European Union has set a target to achieve 32% renewable energy of its total energy consumption by 2030.

This initiative is part of the broader European Green Deal, which aims to reduce greenhouse gas emissions by at least 55% by 2030. In such a landscape, the demand for battery storage systems is skyrocketing, as these systems are essential for balancing energy supply and demand, particularly when renewable energy generation is intermittent.

Battery analyzers ensure that the batteries used in these storage systems are maintained at optimal health, which is crucial for maximizing storage efficiency and lifespan. This is particularly important in regions where energy storage plays a critical role in stabilizing the grid against the variable nature of renewable energy sources.

Furthermore, as battery technology evolves and the cost of renewable energy installations continues to decrease, the use of battery analyzers in this sector is expected to become more prevalent. They are becoming an indispensable tool for managing the large-scale battery storage systems that are increasingly being deployed alongside renewable energy projects.

Trends

Wireless Technology and IoT Integration: Reshaping Battery Analyzer Capabilities

One of the latest trends revolutionizing the battery analyzer market is the integration of wireless technology and the Internet of Things (IoT). This trend is significantly enhancing the functionality and accessibility of battery analyzers, making them more efficient and easier to use in a variety of settings, from industrial applications to personal EV use.

The incorporation of wireless technology allows battery analyzers to send real-time data directly to smartphones, tablets, or central management systems. This connectivity not only simplifies the monitoring process but also enables remote diagnostics and management. For instance, an electric vehicle owner can check the health of their car’s battery from the convenience of their home using a mobile app connected to their battery analyzer. This feature is particularly useful for fleet managers who need to maintain optimal battery performance across multiple vehicles.

Moreover, IoT-enabled battery analyzers can be integrated into larger smart systems within homes or businesses. In these setups, they play a critical role in energy management systems, optimizing battery usage based on real-time data and predictive analytics. This capability is vital in environments relying on renewable energy sources, where energy storage and consumption need to be meticulously balanced.

Governments and industries are recognizing the importance of these technologies. For example, initiatives like the Smart Grids Innovation Challenge by the International Energy Agency (IEA) are promoting the development of advanced technologies that improve the reliability and efficiency of electricity services, including through better battery management.

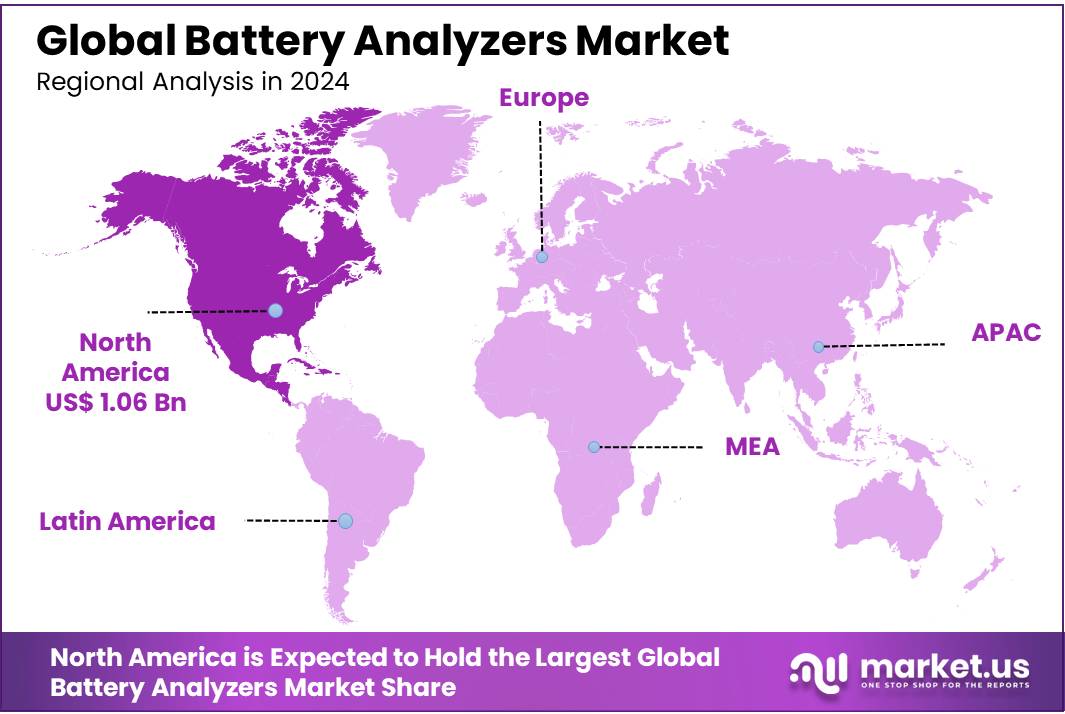

Regional Analysis

In 2024, North America held a dominant position in the global Battery Analyzers market, accounting for 46.3% of the total market share, valued at approximately USD 1.06 billion. This regional dominance is largely attributed to the region’s advanced electric vehicle (EV) ecosystem, growing renewable energy capacity, and well-established battery manufacturing and testing infrastructure. The United States, in particular, is leading in the deployment of grid-scale battery storage.

According to the U.S. Energy Information Administration (EIA), the nation’s operational battery energy storage capacity surged to 12.2 GW in 2023, a significant leap from 7.8 GW in 2022, reflecting strong investment momentum in battery-related technologies.

Additionally, government-backed initiatives have played a critical role. Furthermore, Canada’s investments in clean transportation and battery innovation, including funding under the Net Zero Accelerator Initiative, are supporting domestic production of batteries and essential tools like analyzers for quality control and performance testing.

The region is also home to several key EV manufacturers, battery R&D hubs, and academic institutions focusing on energy storage innovation. With rising consumer demand for EVs and increasing regulatory pressure to transition toward clean energy, North America is expected to retain its leadership in the battery analyzers market. The strategic alignment of federal funding, industrial growth, and technological capability firmly establishes North America as a powerhouse in the global battery diagnostics ecosystem.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ACE Instruments, based in India, offers a diverse range of battery analyzers designed for industrial, laboratory, and R&D use. The company focuses on portable and precision testing solutions, supporting lithium-ion, lead-acid, and nickel-based battery types. ACE has gained traction in emerging markets due to its affordable pricing and customization capabilities. It also serves sectors such as solar, EV, and telecom. Their analyzers are known for high accuracy, user-friendly interfaces, and integration with automation and monitoring systems.

AMETEK Inc., a U.S.-based manufacturer, provides advanced battery analyzers through its business units like AMETEK Programmable Power and Solartron Analytical. Their products support high-voltage and high-capacity battery testing, catering to aerospace, automotive, and energy sectors. In 2024, the company increased its investments in AI-integrated battery testing solutions. AMETEK’s analyzers are trusted for their robust design, wide testing ranges, and compatibility with lithium-ion and solid-state batteries used in EVs and industrial storage systems.

Fluke Corporation, a global leader in testing tools, provides rugged battery analyzers ideal for industrial and utility applications. Known for durability and precision, Fluke’s analyzers measure internal resistance, conductance, and voltage in real-time. The company supports maintenance teams in power plants, telecoms, and critical backup systems. In 2024, Fluke enhanced its analyzers with wireless connectivity and cloud-based diagnostics. Their tools ensure compliance with industry standards and are widely used for predictive battery health analysis.

Top Key Players in the Market

- ACE Instruments

- AMETEK Inc.

- B&K Precision Corporation

- Fluke Corporation

- Cadex Electronics Inc.

- Teledyne FLIR LLC

- Johnson Controls International plc

- National Instruments

- Panasonic Corporation

- PulseTech Products Corporation

- Seiko Instruments

- Texas Instruments

- Xiamen Tmax Battery Equipments Limited

Recent Developments

In 2024, Fluke Corporation does not operate within the Iced Tea market sector. Fluke is primarily recognized for its expertise in manufacturing electronic test and measurement tools, serving industries such as electrical, industrial, and biomedical sectors.

In 2024, AMETEK Inc. does not operate within the Iced Tea market sector. AMETEK is primarily recognized for its expertise in electronic instruments and electromechanical devices, serving industries such as aerospace, power, and industrial automation. There is no publicly available information or credible sources indicating AMETEK’s involvement in the production, distribution, or marketing of iced tea products.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 6.2 Bn CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Stationary, Portable), By Battery Type (Lithium-Ion Battery, Nickel-Cadmium Battery, Lead Acid Battery, Others), By Product Type ( Handheld Battery Analyzers, Benchtop Battery Analyzers, Automatic Battery Analyzers), By Technology (Conductance Testing, Load Testing, Impedance Testing, Cyclic Charging Testing, Others), By End-use (Automotive, IT and Telecom, Healthcare, Aviation and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ACE Instruments, AMETEK Inc., B&K Precision Corporation, Fluke Corporation, Cadex Electronics Inc., Teledyne FLIR LLC, Johnson Controls International plc, National Instruments, Panasonic Corporation, PulseTech Products Corporation, Seiko Instruments, Texas Instruments, Xiamen Tmax Battery Equipments Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ACE Instruments

- AMETEK Inc.

- B&K Precision Corporation

- Fluke Corporation

- Cadex Electronics Inc.

- Teledyne FLIR LLC

- Johnson Controls International plc

- National Instruments

- Panasonic Corporation

- PulseTech Products Corporation

- Seiko Instruments

- Texas Instruments

- Xiamen Tmax Battery Equipments Limited