Global Food Glazing Agents Market By Ingredient(Carnauba wax, Shellac, Candelilla wax, Stearic Acid-Based Ingredient), By Function(Coating Agent, Surface Finishing Agents, Firming Agent, Film Formers), By Applications(Confectionery Sector, Bakery Products, Poultry and Fish, Fruit and Vegetables, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 33506

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

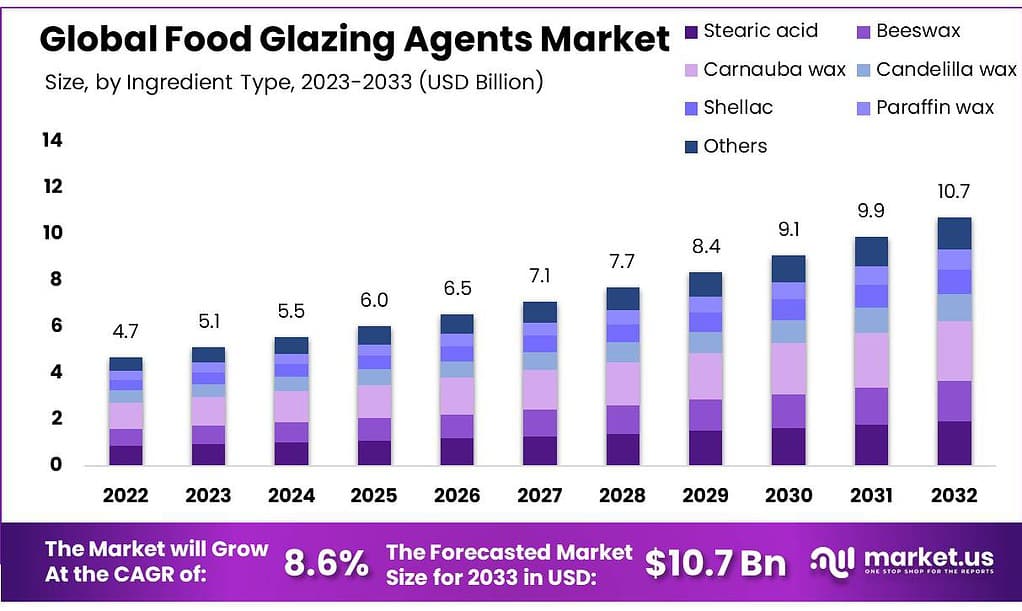

The Food Glazing Agents Market size is expected to be worth around USD 10.7 billion by 2033, from USD 4.7 Billion in 2023, growing at a CAGR of 8.6% during the forecast period from 2023 to 2033.

The market is expected to see a surge in demand for glazing agents and consumer attention toward texture and appearance in the future. Overall demand will rise due to increased demand for fish & chicken, processed meats, and functional foods. The industry will see an increase in food glazing agents used in confectionery and bakery products due to the increasing demand for custom-made food items.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: Anticipated market value of around USD 10.7 billion by 2033, growing from USD 4.7 billion in 2023, showcasing a robust CAGR of 8.6%.

- Ingredient Analysis: Carnauba wax leads with over 24.1% market share due to its natural gloss and preservation properties.

- Function Analysis: Coating agents dominate, accounting for over 39.8% of the market, essential for preservation and visual enhancement.

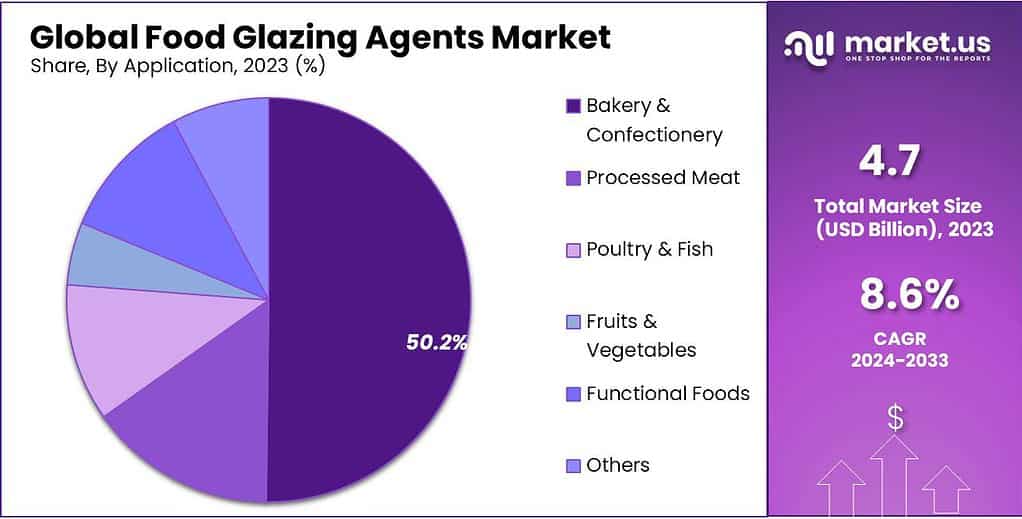

- Application Analysis: Confectionery holds over 50.2% market share, utilizing glazing agents extensively to enhance appearance and preserve quality.

- Market Drivers: Consumer preferences for visually appealing, fresh, and attractive food products drive demand for glazing agents.

- Market Restraints: Challenges include increasing consumer awareness regarding food additives, differing regional regulations, safety concerns, and cost implications for natural glazing agents.

- Opportunities: Rising demand for natural and clean-label ingredients presents an opportunity for the development of natural glazing agents.

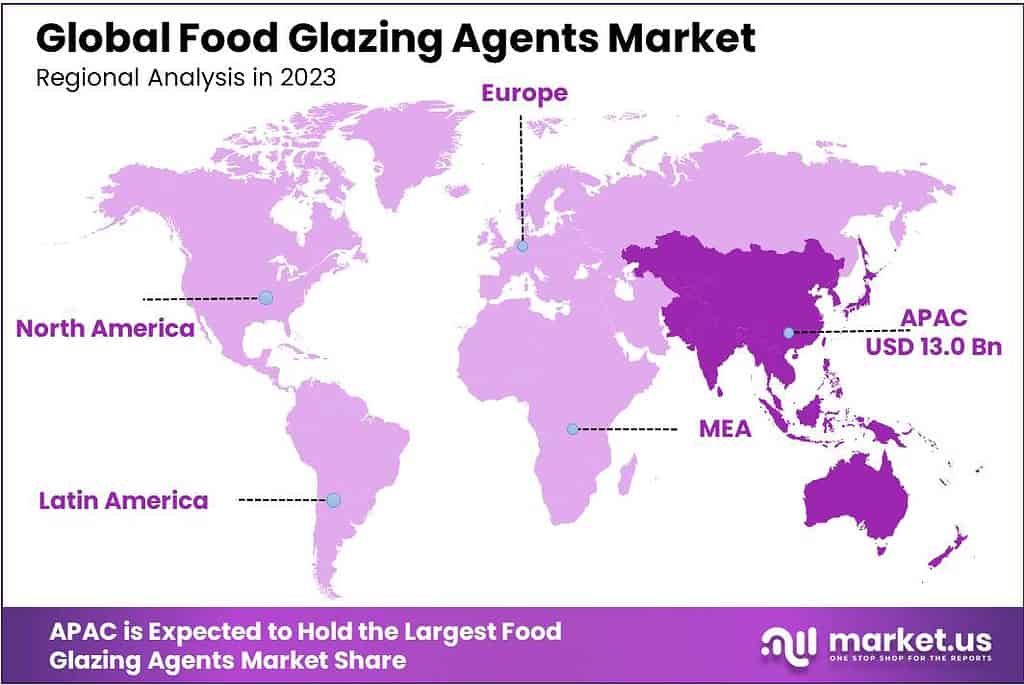

- Regional Analysis: Asia Pacific and Europe lead the market, with developing economies like India and China expected to drive industry growth.

- Key Companies: Notable players like Stearinerie Dubois, Capol GmbH, Koster Keunen contribute significantly to market growth.

Ingredient Analysis

Carnauba wax emerged as the frontrunner, commanding a dominant market position by securing over 24.1% share. Renowned for its natural and high-gloss finish, Carnauba wax became a preferred choice among manufacturers for its ability to provide a shiny coating on various food products, enhancing their appearance and preserving freshness.

Shellac was the second-largest ingredient. Shellac is dried flakes that are mixed with ethanol to make liquid shellac. It can be used in food glazing agents, wood finish, and as a paintbrush. Two of the most important countries that export shellac are India and Indonesia.

The segment of candelilla wax is expected to grow rapidly over the forecast period. Candelilla waxes come from the candelilla shrub, which is native to the southwestern United States and Northern Mexico. Candelilla wax is in high demand because of its ability to be used in cosmetics and food.

Over the forecast period, the segment of stearic acid-based ingredients is expected to grow faster. It is mainly used in diet supplements. The market for food glazing is expected to grow due to the increasing awareness of health issues.

Function Analysis

Coating Agents emerged as the dominant force in the food glazing landscape, commanding a substantial market share of over 39.8%. These agents played a pivotal role in food preservation by forming protective layers, ensuring freshness, and improving the overall visual appeal of diverse food products. Their ability to create an attractive sheen made them a preferred choice among manufacturers seeking to enhance product presentation.

Another name for food surface finishing agents is food additives, which are used to give food products a uniform texture and spice up their appearance, particularly in confectioneries and bakery products.

Over the forecast period, the firming agent’s segment will experience high growth. Food-firming agents can be used to preserve residual pectin in food to ensure that it is firm during processing. These agents can also be used to extend the product’s lifecycle. It is expected that it will fuel the industry’s demand.

Filmmakers are those who are most closely associated with modernist cuisines like whipped cream, bread dough, and head-on beers. This segment is estimated to grow at an impressive CAGR over the forecast period. This is due to the increasing number of food industries around the world.

Application Analysis

Confectionery emerged as the dominant force in the food glazing market, capturing a significant share of over 50.2%. This sector extensively utilized glazing agents in chocolates, candies, and confectionery items to impart shine, prevent moisture loss, and enhance their visual appeal, making them more enticing to consumers. The use of glazing agents played a pivotal role in maintaining the attractiveness and quality of these sweet treats.

To enhance the appearance of confectionery products, mainly pastries, cakes, and chocolates, manufacturers are now using glazing agents. They are expected to increase demand in the functional food and bakery applications segment.

The bakery was second in revenue share in 2021. This segment is expected to grow in popularity due to the changing lifestyles and increased consumption of packaged food items. For bakery products, food-glazing agents can only be used to create a perfect texture, shine, custom designs, and an enhanced taste.

The market penetration for fruits and vegetables is medium to high. Vendors are using food glazing agents to give fruits and vegetables a shiny appearance. Food glazing agents will be looking for opportunities in this segment. These agents also help preserve the freshness and quality of the product.

Note: Actual Numbers Might Vary In The Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Ingredient

- Carnauba wax

- Shellac

- Candelilla wax

- Stearic Acid-Based Ingredient

By Function

- Coating Agent

- Surface Finishing Agents

- Firming Agent

- Film Formers

By Applications

- Confectionery Sector

- Bakery Products

- Poultry and Fish

- Fruit and Vegetables

- Other Applications

Drivers

The food glazing agents market has experienced significant growth owing to several influential drivers that have shaped its trajectory. A primary catalyst has been the evolving consumer preference for visually appealing food products.

Consumers increasingly appreciate food items that not only taste delicious but also appear fresh, attractive, and inviting. Glazing agents play a pivotal role in adding visual appeal to foods from confectionary delights to fresh produce that meet this rising consumer demand for visually appealing items.

Market forces have also been driven by the need to extend shelf life and protect quality in food products. Glazing agents act as protective coatings, serving as barriers against moisture loss, microbial contamination, and oxidation, thereby prolonging the freshness of perishable goods.

This focus on preserving food quality aligns with the consumers’ desire for convenience and longer-lasting products, contributing significantly to the adoption of glazing agents across different food categories. Advancements in food processing technologies have been instrumental in driving market growth. These technological innovations have led to the development of more efficient and adaptable glazing agents.

Manufacturers can now create agents that not only enhance the appearance but also fulfill specific functional requirements such as texture improvement, moisture retention, and flavor preservation. This evolution in technology has encouraged wider utilization of glazing agents across various food applications.

Demand for convenience foods has given food glazing agents an enormous boost, leading them to find greater use in ready-to-eat meals, snacks, and processed food products to maintain their visual appeal and quality. Consumers increasingly require quick meals on the go so the need for these agents continues to expand as consumers demand more convenient eating solutions. As more products incorporate them, glazing agents will continue to find greater application in various food items.

Conformance to stringent food safety regulations and standards has also played a pivotal role in driving market expansion. Accreditation by regulatory bodies as safe for consumption has given manufacturers confidence, leading to widespread use of approved glazing agents and market expansion. Food glazing agents have seen exponential growth since their introduction into food production, quickly meeting consumer expectations for delicious, safe and long-lasting meals across various food categories.

Restraints

One notable restraint is the increasing consumer awareness and scrutiny regarding food additives. Concerns about the inclusion of additives, including glazing agents, in food products have led to a growing demand for natural and clean-label alternatives.

Some consumers are apprehensive about the use of synthetic ingredients, leading to a shift in preferences towards products with simpler ingredient lists. This heightened consumer consciousness poses a challenge to the widespread acceptance of food glazing agents, particularly those perceived as synthetic or non-natural.

Regulation challenges and different standards across regions can hamper market expansion. Complying with stringent regulations and differing approval processes for glazing agents across countries creates barriers to entry for manufacturers hoping to market products globally, creating additional costs while complicating the adoption of glazing agents across markets.

Perceptions about glazing agents as potentially toxic or allergenic substances is another impediment to market growth. Although most glazing agents are considered safe within regulatory limits, certain consumer groups remain concerned with how these additives might impact health – this perception may stymie product sales containing glazing agents and negatively influence market penetration.

Cost considerations associated with glazing agents in food production processes may also act as an impediment. Some natural or specialty glazing agents may cost more than their synthetic alternatives, increasing production expenses for manufacturers. This cost factor may prevent widespread adoption, particularly among smaller food producers operating with tight budgets.

Opportunities

While food glazing agents market poses numerous obstacles and difficulties, it also presents valuable opportunities that could drive its expansion within the food industry.

One notable opportunity lies in the increasing demand for clean-label and natural food ingredients. As consumers gravitate towards healthier and more transparent food choices, there’s a burgeoning opportunity for the development and utilization of natural glazing agents derived from sources such as plant-based materials or organic compounds.

Manufacturers can capitalize on this trend by innovating and introducing natural alternatives that cater to consumer preferences for clean-label products, fostering wider acceptance and market growth.

Glazing agents present an exciting opportunity, given their wide-ranging applications. Not only are traditional uses for confectionery and bakery products being exploited; there’s growing potential in functional foods, convenience foods and pharmaceutical applications as well.

By developing tailored glazing agents tailored specifically to these diverse sectors, new markets may open up while stimulating innovation within the industry. Technology and research innovations present opportunities to create improved glazing agents.

Advancements in food science allow for the creation of glazing agents that not only enhance visual appeal, but also feature improved functionality such as enhanced texture, extended shelf life and nutritional benefits. This technological progress opens doors for creating more versatile and efficient glazing agents to meet changing consumer expectations and industry requirements.

Food industry’s globalization offers ample opportunity for market expansion. As trade in food products grows worldwide, glazing agents may find success in emerging markets or regions where their usage may not yet be widespread, potentially opening the way for increased adoption and penetration rates.

As stated previously, the food glazing agents market holds many promising opportunities, driven by demand for natural ingredients and applications as well as technological developments and global expansion. Exploiting these opportunities can fuel innovation, market expansion, and the continued evolution of glazing agents within food industries worldwide.

Challenges

Food glazing agents face numerous hurdles that impede their development and acceptance within the industry context. One major challenge lies in consumer acceptance of synthetic additives in food products. Consumer demand for cleaner labels and natural ingredients leads to mistrust towards synthetic glazing agents.

Overcoming this challenge requires considerable efforts in both educating the public on their safety as well as developing and promoting natural alternatives that satisfy these preferences. Regulated complexity and disparate standards across regions present yet another formidable hurdle for companies that aim to operate globally.

Adherence to various regulatory frameworks for glazing agents across countries requires diligent compliance efforts that could result in delays or additional costs for market entry and product approval, while simultaneously meeting quality standards across all markets is no small task.

Resolving safety and allergenic risks related to certain glazing agents remains a difficult challenge. While most glazing agents are considered safe within regulatory limits, specific consumer groups remain concerned over potential health implications.

Addressing such concerns through extensive research, transparency, and clear labeling practices is vital for building consumer trust and increasing adoption rates. Cost considerations also pose an obstacle when it comes to using glazing agents in food production processes, with natural or specialized glazing agents often coming at a higher price point compared to synthetic alternatives, increasing overall manufacturing expenses for manufacturers and posing an obstacle to widespread adoption; particularly among smaller food producers with tight budgets who face difficulties penetrating new markets.

Food glazing agents’ market challenges include consumer perception toward synthetic additives, regulatory complexities, safety issues, and cost implications. Overcoming these hurdles requires industry efforts in innovation, transparency, regulatory compliance, and consumer education to foster greater acceptance and sustainable growth within the market.

Regional Analysis

The Asia Pacific accounted for 31.5% of the total revenue share in 2023. Due to the shift in consumer preferences, developing economies in the Asia Pacific, including India and China, are expected to drive industry faster.

Europe was the market leader in food glazing agents due to its high demand and high prices for bakery applications, as well as the strict regulatory framework. It accounts for 31% of revenue share in 2021.

Market growth will also be boosted by the development of existing units and the increasing number of food processing units. This market is dominated by Germany, Italy, the U.K., and France. They account for a large portion of the industry’s overall sales.

Market growth in the Asia Pacific is expected to be boosted by the expansion of the food and beverage industry. This can be attributed to the rapid industrialization of India and China. It has also led to an increase in purchasing power which will positively impact the sales of bakery products and confectionery foods.

Due to their higher purchasing power, confectionery items are always in high demand in developed countries, such as North America and Europe. Due to an increase in purchasing power per capita, confectionery food items are expected to be in high demand in developing countries like the Asia Pacific and Central & South America.

Note: Actual Numbers Might Vary In The Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Companies

The majority of manufacturing companies are located in North America and Europe, while they also supply a variety of glazing products around the world. Master Foods and Zeelandia are just a few of the companies that have merged their operations. ADM is both involved in distribution and manufacturing.

Кеу Маrkеt Рlауеrѕ

- Stearinerie Dubois

- Capol GmbH

- Koster Keunen

- Colorcon Inc.

- Mantrose-Haeuser Co. Inc.

- Freudenberg Chemical Specialities SE & Co. KG

- Masterol Foods

- Macphie Limited

- Royal Zeelandia Group BV

- Puratos Group

- BJ International

- British Wax

- Carnauba Do Brasil LTDA

Recent Developments

In 2022, OKS, an established provider of specialty lubricants, and Capol, an industry leader in glazing, anti-sticking, and sealing agents, provide products with optimized sustainability that rank among the market’s premier solutions.

Report Scope

Report Features Description Market Value (2023) USD 4.7 Bn Forecast Revenue (2032) USD 10.7 Bn CAGR (2023-2032) 8.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Ingredient(Carnauba wax, Shellac, Candelilla wax, Stearic Acid-Based Ingredient), By Function(Coating Agent, Surface Finishing Agents, Firming Agent, Film Formers), By Applications(Confectionery Sector, Bakery Products, Poultry and Fish, Fruit and Vegetables, Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Stearinerie Dubois, Capol GmbH, Koster Keunen, Colorcon Inc., Mantrose-Haeuser Co. Inc., Freudenberg Chemical Specialities SE & Co. KG, Masterol Foods, Macphie Limited, Royal Zeelandia Group BV, Puratos Group, BJ International, British Wax, Carnauba Do Brasil LTDA Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are food glazing agents?Food glazing agents are additives used in the food industry to impart a glossy finish, improve appearance, and protect the surface of food products. They are applied to enhance visual appeal and preserve the freshness of various food items.

What is the purpose of using food glazing agents?Food glazing agents serve multiple purposes including providing shine and gloss to food surfaces, preventing moisture loss, extending shelf life by acting as a protective barrier, and enhancing visual appeal to attract consumers.

How do food glazing agents impact food production?Glazing agents play a significant role in food production by ensuring the visual appeal, shelf life, and overall quality of products. They help in the packaging process and contribute to maintaining the appearance of food items during storage and transportation.

Are food glazing agents safe for consumption?Generally, food glazing agents approved for use by regulatory authorities (such as the FDA in the US or the EFSA in the EU) are considered safe when used within specified limits. However, some individuals may have allergies or sensitivities to specific glazing agents, so it's essential to check labels for ingredients.

-

-

- Stearinerie Dubois

- Capol GmbH

- Koster Keunen

- Colorcon Inc.

- Mantrose-Haeuser Co. Inc.

- Freudenberg Chemical Specialities SE & Co. KG

- Masterol Foods

- Macphie Limited

- Royal Zeelandia Group BV

- Puratos Group

- BJ International

- British Wax

- Carnauba Do Brasil LTDA