Global Lithium Ion Battery Recycling Market Size, Share Analysis Report By Components (Active Material, Non-Active Material), By Chemistry (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Manganese Oxide, Lithium Nickel Cobalt Aluminum Oxide, Lithium Nickel Manganese Cobalt Oxide), By Source (Electric Vehicles, Electronics, Power Tools, Others), By Process (Physical/Mechanical, Hydrometallurgical, Pyrometallurgical), By End User (Automotive, Non-automotive, Consumer Electronics, Power, Marine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 130782

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

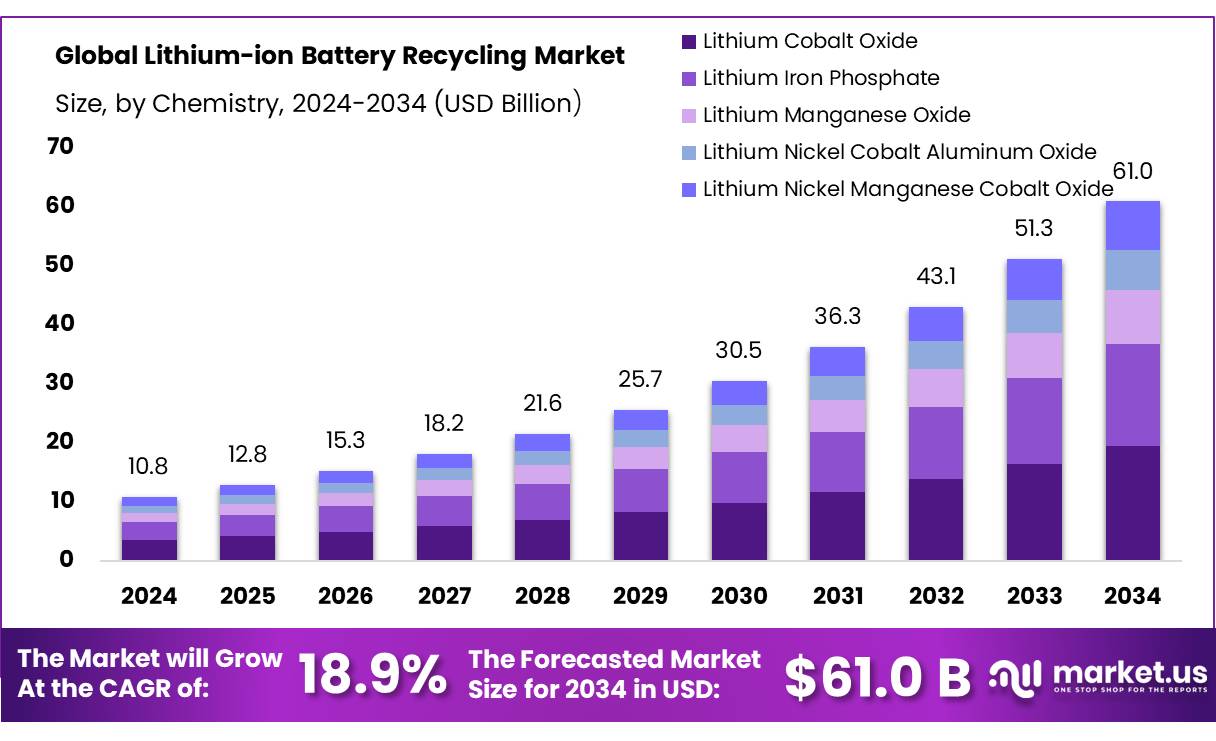

The global Lithium Ion Battery Recycling Market size is expected to be worth around USD 61.0 billion by 2034, from USD 10.8 billion in 2024, growing at a CAGR of 18.9% during the forecast period from 2023 to 2033.

The Lithium-ion Battery Recycling market is a crucial segment of the battery value chain, addressing the environmental need to manage end-of-life batteries from electronic devices and electric vehicles (EVs). As the adoption of lithium-ion batteries has surged globally, the imperative to recycle these batteries to recover valuable metals such as lithium, cobalt, and nickel, while mitigating environmental harm, has become increasingly important.

The rapid expansion of the electric vehicle market, primarily driven by companies like Tesla, Inc. and BYD Co Ltd, has significantly contributed to the volume of lithium-ion batteries in circulation. This influx has led to an increased focus on developing efficient recycling technologies and infrastructure. Governments around the world are implementing stringent regulations regarding battery disposal and recycling to ensure sustainable practices. For instance, the European Union has set ambitious battery recycling targets under its new Batteries Directive, aiming for a minimum recycling efficiency of 70% by weight for lithium-ion batteries.

Governmental support for lithium-ion battery recycling is robust, with various initiatives and funding mechanisms in place to promote sustainable practices. The U.S. Department of Energy, for example, has invested $15 million in projects aimed at improving recycling processes as part of its broader commitment to enhancing battery technology and reducing environmental impact. Similarly, China has mandated that battery producers are responsible for establishing systems for collecting, storing, and recycling used batteries, enforcing a recycling rate of no less than 20%.

Key Takeaways

- Lithium Ion Battery Recycling Market size is expected to be worth around USD 61.0 billion by 2033, from USD 10.8 billion in 2024, growing at a CAGR of 18.9%.

- Active Material in the lithium-ion battery recycling market held a commanding position, accounting for more than 63.20% of the market share.

- Lithium Cobalt Oxide secured a leading position in the lithium-ion battery recycling market, capturing a significant 32.20% market share.

- Electric vehicles (EVs) maintained a dominant market position in the lithium-ion battery recycling sector, capturing more than a 67.20% share.

- Hydrometallurgical process held a dominant market position in the lithium-ion battery recycling market, capturing more than a 47.20% share.

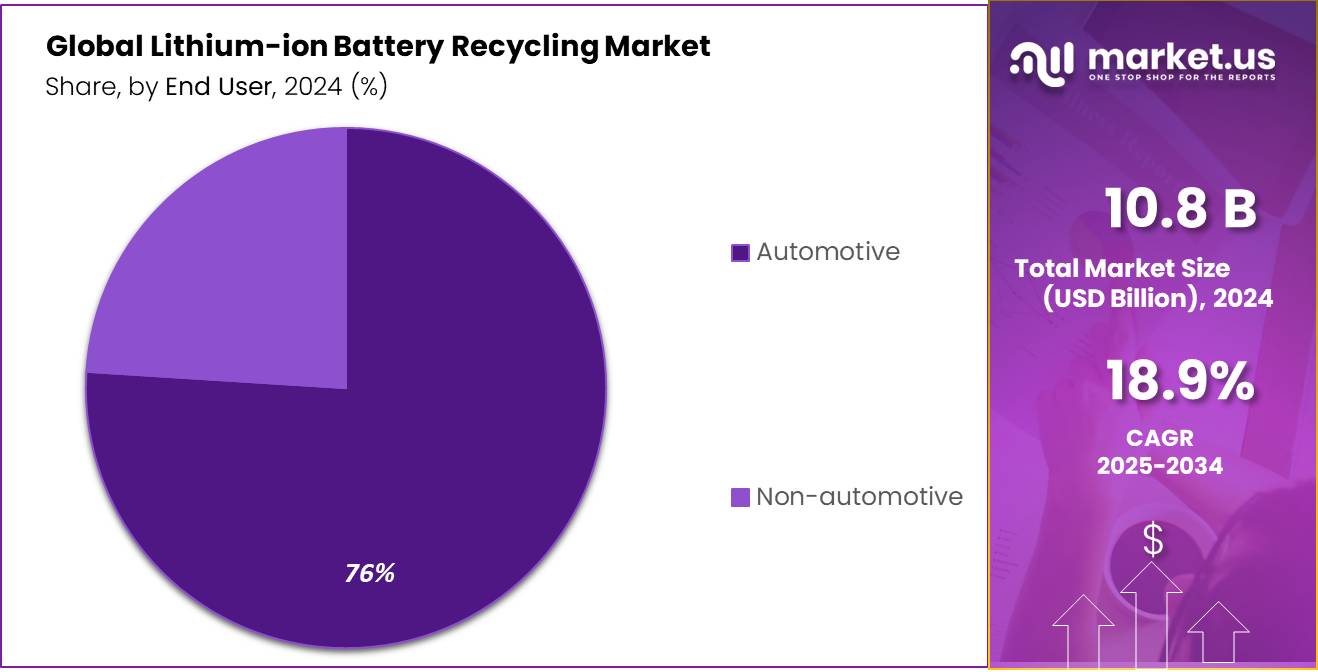

- Automotive sector held a commanding position in the lithium-ion battery recycling market, capturing more than a 76.30% share.

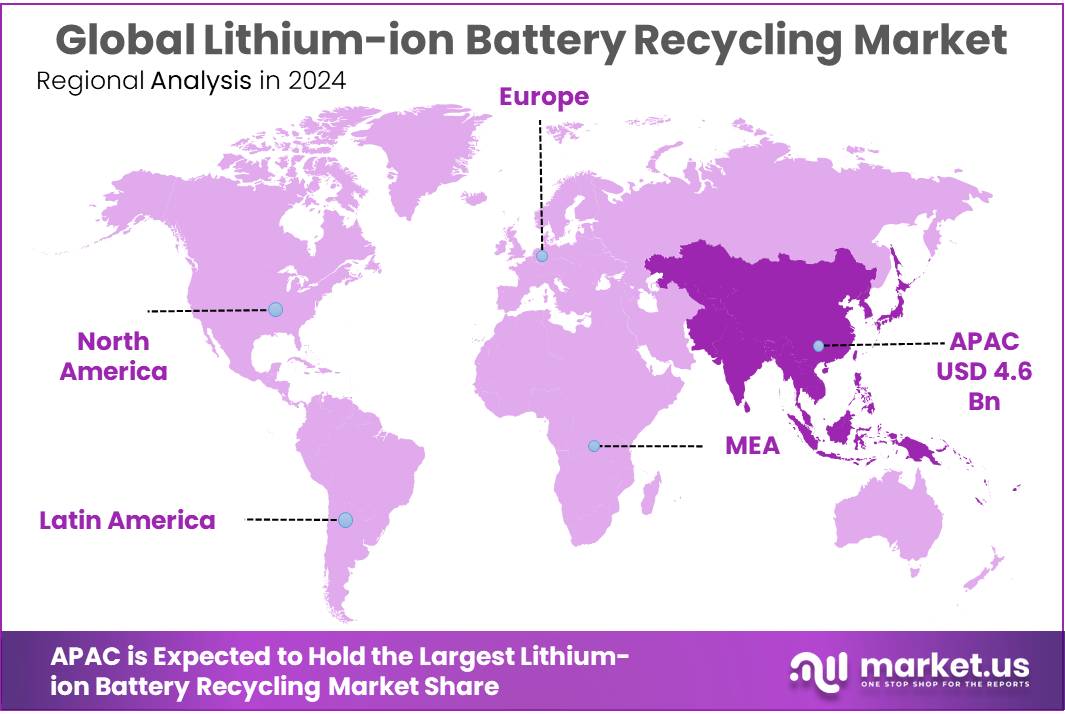

- Asia-Pacific (APAC) region dominated the lithium-ion battery recycling market, holding a significant 43.20% market share and valued at approximately USD 4.6 billion.

Analysts’ Viewpoint

From an investment perspective, in lithium-ion battery recycling is emerging as a critical and lucrative venture as the global demand for lithium-ion batteries surges, primarily driven by the electric vehicle (EV) and renewable energy sectors. This market is propelled by the need to address the environmental challenges of battery disposal and the opportunity to recover valuable materials like lithium, cobalt, and nickel. The increasing focus on sustainability and the circular economy further enhances the appeal of this sector, making it an attractive option for forward-thinking investors.

However, there are considerable risks and challenges. The technology for recycling lithium-ion batteries is complex and requires significant capital investment. The efficiency of material recovery and the purity of extracted materials are crucial for profitability but can be technically challenging to achieve. Additionally, the regulatory landscape is evolving, with governments around the world beginning to implement stricter regulations on battery disposal and recycling, which could impact operational scopes and costs.

Consumer insight indicates a growing awareness and demand for environmentally responsible products, which includes sustainably recycled materials. Technologically, advancements in recycling processes are continually being developed to enhance economic viability and environmental outcomes. For investors, the key to success in this market will be to stay ahead of technological innovations, understand the regulatory environment, and align with consumer values that prioritize sustainability.

By Components

Active Material Dominates Lithium-ion Battery Recycling Market with a 63.20% Share

In 2024, the segment of Active Material in the lithium-ion battery recycling market held a commanding position, accounting for more than 63.20% of the market share. This segment’s dominance is attributed to its critical role in the recovery of valuable materials such as lithium, cobalt, nickel, and manganese, which are essential for the manufacturing of new batteries.

As the demand for sustainable and environmentally friendly battery solutions escalates, the significance of recycling these active materials has become paramount, further solidifying their dominant status in the market. The process not only supports the circular economy but also reduces the environmental impact associated with the extraction of new raw materials.

By Chemistry

Lithium Cobalt Oxide Leads with 32.20% in Lithium-ion Battery Recycling

In 2024, Lithium Cobalt Oxide secured a leading position in the lithium-ion battery recycling market, capturing a significant 32.20% market share. This segment’s prominence stems from the high value of cobalt and the increasing focus on recycling lithium-ion batteries due to environmental and supply chain concerns. Lithium Cobalt Oxide batteries are widely used in consumer electronics such as smartphones and laptops, which contributes to their substantial volume in the recycling stream. As global efforts to minimize ecological impact intensify, the importance of reclaiming valuable materials from these batteries highlights the segment’s substantial share in the market.

By Source

Electric Vehicles Take the Lead in Lithium-ion Battery Recycling with a 67.20% Share

In 2024, electric vehicles (EVs) maintained a dominant market position in the lithium-ion battery recycling sector, capturing more than a 67.20% share. This substantial market share is driven by the growing adoption of electric vehicles worldwide, coupled with stringent environmental regulations promoting responsible disposal and recycling of batteries. As the number of end-of-life electric vehicles increases, so does the volume of batteries needing recycling. This trend underscores the critical role of electric vehicles as a primary source of recyclable lithium-ion batteries, ensuring the sustainability of battery materials and supporting the global transition to green energy.

By Process

Hydrometallurgical Process Dominates with 47.20% in Lithium-ion Battery Recycling

In 2024, the Hydrometallurgical process held a dominant market position in the lithium-ion battery recycling market, capturing more than a 47.20% share. This process’s prominence is largely due to its efficiency in extracting valuable metals such as lithium, cobalt, nickel, and manganese from spent batteries. The hydrometallurgical method, known for its environmental friendliness compared to other recycling processes, uses aqueous solutions to recover metals, thereby reducing the ecological footprint of lithium-ion battery disposal. As the demand for sustainable recycling methods increases, the hydrometallurgical process continues to be a key player in supporting the circular economy within the battery industry.

By End User

Automotive Sector Leads Lithium-ion Battery Recycling with 76.30% Market Share

In 2024, the automotive sector held a commanding position in the lithium-ion battery recycling market, capturing more than a 76.30% share. This substantial market share reflects the intense focus on sustainable practices within the automotive industry, driven by increasing environmental regulations and the push for circular economy principles. As the adoption of electric vehicles continues to rise, so does the need for efficient recycling of their spent lithium-ion batteries, which are critical for reclaiming valuable metals and reducing the environmental impact of automotive production and waste. This trend emphasizes the automotive sector’s pivotal role in advancing battery recycling technologies and practices.

Key Market Segments

By Components

- Active Material

- Non-Active Material

By Chemistry

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Manganese Oxide

- Lithium Nickel Cobalt Aluminum Oxide

- Lithium Nickel Manganese Cobalt Oxide

By Source

- Electric Vehicles

- Electronics

- Power Tools

- Others

By Process

- Physical/Mechanical

- Hydrometallurgical

- Pyrometallurgical

By End User

- Automotive

- Non-automotive

- Consumer Electronics

- Power

- Marine

- Others

Driving Factors

Surge in Electric Vehicle Sales Drives Demand for Lithium-ion Battery Recycling

One major driving factor for the growth of the lithium-ion battery recycling market is the significant increase in electric vehicle (EV) sales. Governments around the world are rolling out initiatives to promote the adoption of EVs to reduce carbon emissions and dependency on fossil fuels. For instance, according to the International Energy Agency (IEA), global electric car sales doubled in 2021, surpassing 6.6 million units. This surge has led to a corresponding increase in the number of lithium-ion batteries reaching the end of their life cycles, necessitating robust recycling solutions to manage this waste effectively and sustainably.

Furthermore, the recycling of lithium-ion batteries is crucial for recovering valuable materials like lithium, cobalt, nickel, and manganese. These materials are in high demand for the production of new batteries, and recycling helps mitigate the environmental impact of mining new resources. For example, the U.S. Department of Energy highlights that recycling batteries can significantly reduce energy consumption, greenhouse gas emissions, and reliance on imported materials.

Additionally, financial incentives and regulatory measures by governments to support battery recycling infrastructures have bolstered the market. For instance, the European Union’s Battery Directive mandates the collection and recycling of batteries as part of its broader environmental policies, which has been pivotal in driving the lithium-ion battery recycling industry in Europe.

The combination of increased EV sales, the necessity for sustainable resource management, and supportive governmental policies creates a strong foundation for the continued expansion of the lithium-ion battery recycling sector. These efforts are essential not only for environmental sustainability but also for maintaining the supply chain stability of critical materials needed in various high-tech industries.

Restraining Factors

High Costs of Recycling Processes Limit Lithium-ion Battery Market Growth

One of the primary restraining factors in the lithium-ion battery recycling market is the high cost associated with the recycling processes. Recycling lithium-ion batteries involves complex and costly techniques to efficiently extract and purify valuable materials such as lithium, cobalt, nickel, and manganese. These processes require significant technological investments and sophisticated machinery, which can be a barrier for many potential recyclers entering the market.

For instance, the process of disassembling batteries to retrieve reusable materials is labor-intensive and hazardous, as it involves handling toxic substances and flammable materials. According to a report by the Environmental Protection Agency (EPA), the costs associated with ensuring safety standards and environmental compliance further elevate the expenses of recycling operations. This financial burden can dissuade companies from investing in recycling technologies and infrastructure, particularly in regions where regulatory incentives are insufficient or non-existent.

Moreover, the economic viability of recycling is also challenged by the fluctuating prices of raw materials recovered from batteries. When the prices of these materials drop, the profitability of recycling decreases, making it less appealing for businesses to invest in or prioritize recycling initiatives. This variability can lead to inconsistencies in the recycling rates and capacities across different markets.

To address these challenges, some governments are considering the implementation of extended producer responsibility (EPR) policies that would require battery manufacturers to bear a portion of the recycling costs. Such policies are aimed at easing the financial load on recycling facilities and encouraging more sustainable practices throughout the battery life cycle.

These economic hurdles emphasize the need for continued innovation in recycling technologies that can reduce costs and enhance efficiency, as well as supportive policies that can help scale recycling solutions in line with global sustainability goals.

Growth Opportunity

Expansion of Renewable Energy Storage Presents Opportunities for Lithium-ion Battery Recycling

A significant growth opportunity for the lithium-ion battery recycling market stems from the expanding sector of renewable energy storage. As governments and industries push for greener energy solutions, the demand for efficient and scalable energy storage systems, predominantly those using lithium-ion batteries, is on the rise. This trend not only supports the integration of renewable energy sources like solar and wind but also underscores the need for sustainable end-of-life management of batteries.

The International Renewable Energy Agency (IRENA) reports that to achieve the goals set by the Paris Agreement, renewable energy capacity must double by 2030, requiring substantial advancements in energy storage solutions to manage the intermittent nature of solar and wind energies. According to IRENA, this will lead to a corresponding surge in the demand for lithium-ion batteries, expected to reach an installed energy storage capacity of 2,500 gigawatt-hours by 2030. As this capacity expands, so does the volume of spent batteries, highlighting the critical need for effective recycling methods to recover valuable materials and reduce environmental impact.

Recognizing this, several government initiatives have been implemented to promote the recycling of lithium-ion batteries. For example, the European Union’s Green Deal and Circular Economy Action Plan emphasize enhancing the sustainability of battery life cycles by improving recycling rates and technologies. These policies aim not only to protect the environment but also to secure a supply of critical raw materials necessary for the continuity of the renewable energy sector.

The link between renewable energy expansion and lithium-ion battery usage creates a robust market for recycling services, ensuring that materials are reused and environmental standards are met. This relationship fosters a sustainable cycle that supports both economic and ecological goals, presenting substantial growth opportunities within the lithium-ion battery recycling industry.

Latest Trends

Adoption of Advanced Mechanical Separation Techniques in Lithium-ion Battery Recycling

One of the latest trends in the lithium-ion battery recycling industry is the increasing adoption of advanced mechanical separation techniques. These methods are gaining traction because they enhance the efficiency and effectiveness of the recycling process, allowing for better recovery rates of valuable materials such as lithium, cobalt, and nickel. Unlike traditional methods, which often involve chemical solvents, mechanical separation is less harmful to the environment and reduces the overall carbon footprint of the recycling process.

The U.S. Department of Energy (DOE) has been actively supporting research and development in this area, recognizing that improved recycling technologies are critical to the sustainability of the battery supply chain. According to the DOE, advancements in mechanical separation technologies not only support environmental goals but also help meet the growing demand for critical battery materials. These technologies can disassemble spent batteries and separate valuable components more efficiently than ever before, significantly reducing the energy and costs associated with recycling.

Furthermore, the adoption of these technologies is being driven by the tightening of global regulations concerning battery disposal and recycling. For instance, the European Union’s Battery Directive mandates the collection and recycling of all spent batteries and accumulators, pushing for higher recovery efficiencies and less environmental impact. This regulatory environment fosters innovation in recycling techniques, making mechanical separation a more attractive option for companies in the industry.

This trend towards advanced mechanical separation in lithium-ion battery recycling reflects a broader shift towards more sustainable and economically viable practices within the industry. As these technologies continue to evolve and gain regulatory support, they are set to play a crucial role in shaping the future of battery recycling, aligning industrial practices with global sustainability objectives.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region dominated the lithium-ion battery recycling market, holding a significant 43.20% market share and valued at approximately USD 4.6 billion. This commanding presence is primarily driven by the high concentration of battery manufacturing and consumption activities in countries such as China, South Korea, and Japan. These nations are not only leading producers of lithium-ion batteries but also among the first to establish comprehensive battery recycling frameworks to address the increasing volumes of end-of-life batteries.

The dominance of APAC in this market is further bolstered by robust government initiatives aimed at promoting sustainable practices in the energy sector. For example, China has implemented strict regulations regarding the disposal and recycling of batteries, which mandate recycling and reuse of critical materials. Similarly, South Korea and Japan have advanced recycling technologies and infrastructures that efficiently recover valuable metals from spent batteries, demonstrating a commitment to circular economic policies.

Moreover, the growth of electric vehicles (EVs) and renewable energy installations in the region contributes significantly to the demand for battery recycling services. As these markets expand, so does the generation of battery waste, necessitating effective recycling solutions to manage the environmental impact and supply chain sustainability of battery materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ACCUREC Recycling GmbH specializes in advanced battery recycling technologies. Based in Germany, ACCUREC has developed proprietary processes to recover precious metals and rare materials from spent batteries. Their state-of-the-art facilities ensure high recovery rates and environmentally responsible handling, positioning them as a leader in the European recycling sector.

AkkuSer is a Finnish company dedicated to the recycling of lithium-ion batteries with a zero-landfill policy. Their closed-loop system recycles batteries from electronic devices and EVs, recovering up to 80% of the materials, which are then reused in new battery production.

American Zinc Recycling Corp stands out in the North American market by focusing on zinc-based battery recycling. They utilize advanced smelting technology to recover zinc and other valuable metals, which significantly contributes to the supply chain of various industries, including automotive and energy storage.

Market Key Players

- Umicore

- ACCUREC Recycling GmbH

- AkkuSer

- American Zinc Recycling Corp

- AQUA METALS, INC.

- ATTERO

- BATREC INDUSTRIE AG

- CIRBA SOLUTIONS

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LTD.

- DOWA ECO-SYSTEM Co., Ltd.

- Duesenfeld

- ECOBAT

- ELEMENTAL HOLDING SA

- Liviumcorp

- Fortum

- GEM CO., LTD.

- Glencore

- Li-Cycle Corp.

- Lithion Recycling Inc.

- Neometals Ltd

- ONTO TECHNOLOGY

- RECYCLICO BATTERY MATERIALS INC

- Redux GmbH

- REDWOOD MATERIALS

- San Lan Technologies Co., Ltd

- SITRASA

- SNAM

- STENA RECYCLING

- Sumitomo Metal Mining Co., Ltd.

- TATA CHEMICALS LIMITED

- uRecycle Group

- VEOLIA

Recent Development

In 2023 Umicore simplifies the recycling process by reducing the number of steps involved but also achieves high recovery yields of over 95% for valuable metals like nickel, copper, and cobalt, and aims for over 70% for lithium.

SNAM’s approach is characterized by its comprehensive recycling solutions, which include the logistics, sorting, and treatment of batteries, ensuring compliance with stringent European environmental standards.

Report Scope

Report Features Description Market Value (2024) USD 10.8 Bn Forecast Revenue (2034) USD 61.0 Bn CAGR (2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Components (Active Material, Non-Active Material), By Chemistry (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Manganese Oxide, Lithium Nickel Cobalt Aluminum Oxide, Lithium Nickel Manganese Cobalt Oxide), By Source (Electric Vehicles, Electronics, Power Tools, Others), By Process (Physical/Mechanical, Hydrometallurgical, Pyrometallurgical), By End User (Automotive, Non-automotive, Consumer Electronics, Power, Marine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Umicore, ACCUREC Recycling GmbH, AkkuSer, American Zinc Recycling Corp, AQUA METALS, INC., ATTERO, BATREC INDUSTRIE AG, CIRBA SOLUTIONS, CONTEMPORARY AMPEREX TECHNOLOGY CO., LTD., DOWA ECO-SYSTEM Co., Ltd., Duesenfeld, ECOBAT, ELEMENTAL HOLDING SA, Liviumcorp, Fortum, GEM CO., LTD., Glencore, Li-Cycle Corp., Lithion Recycling Inc., Neometals Ltd, ONTO TECHNOLOGY, RECYCLICO BATTERY MATERIALS INC, Redux GmbH, REDWOOD MATERIALS, San Lan Technologies Co., Ltd, SITRASA, SNAM, STENA RECYCLING, Sumitomo Metal Mining Co., Ltd., TATA CHEMICALS LIMITED, uRecycle Group, VEOLIA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lithium Ion Battery Recycling MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Lithium Ion Battery Recycling MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Umicore

- ACCUREC Recycling GmbH

- AkkuSer

- American Zinc Recycling Corp

- AQUA METALS, INC.

- ATTERO

- BATREC INDUSTRIE AG

- CIRBA SOLUTIONS

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LTD.

- DOWA ECO-SYSTEM Co., Ltd.

- Duesenfeld

- ECOBAT

- ELEMENTAL HOLDING SA

- Liviumcorp

- Fortum

- GEM CO., LTD.

- Glencore

- Li-Cycle Corp.

- Lithion Recycling Inc.

- Neometals Ltd

- ONTO TECHNOLOGY

- RECYCLICO BATTERY MATERIALS INC

- Redux GmbH

- REDWOOD MATERIALS

- San Lan Technologies Co., Ltd

- SITRASA

- SNAM

- STENA RECYCLING

- Sumitomo Metal Mining Co., Ltd.

- TATA CHEMICALS LIMITED

- uRecycle Group

- VEOLIA