Global Solid-State Car Battery Market, Component(Cathode Materials, Electrolyte, Anode Materials), Material Type(BEV (Battery Electric Vehicle), PHEV (Plug-in Hybrid Electric Vehicle), Technology(Ceramic Electrolytes, Polymer Electrolyte, Sulfide Electrolyte), Vehicle Type(Passenger Electric Vehicle, Electric Two-Wheelers, Commercial Vehicles), and by Regionand Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 83340

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

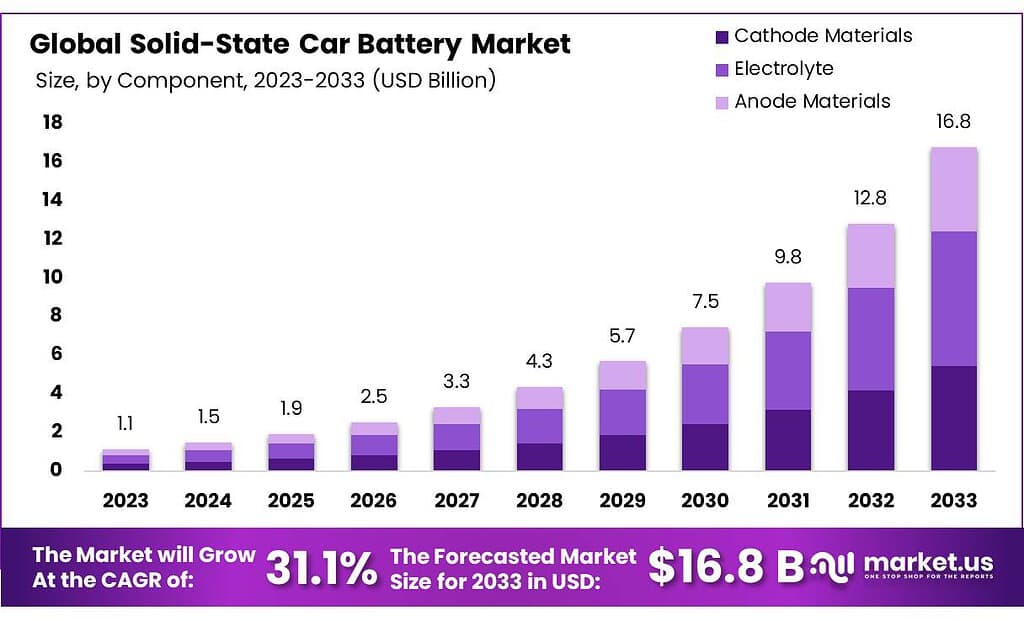

The Solid-State Car Battery Market size is expected to be worth around USD 16.8 billion by 2033, from USD 1.1 Bn in 2023, growing at a CAGR of 31.1% during the forecast period from 2023 to 2033.

Solid-state batteries use solid electrodes and a solid electrolyte, instead of liquid or polymer gel electrolytes that are found in lithium-ion or lithium polymer batteries. These batteries have excellent safety efficiency, high energy density, and a wider range of operating temperatures. This type of battery is capable enough to hold sufficient energy over liquid Li-ion batteries.

In addition, these batteries offer both stability as well as safety over liquid Li-ion batteries. Solid-state batteries reduce the chance of electrolyte volatility and flammability at high temperatures. Owing to these aforementioned parameters, this type of battery is considered to be a suitable option for Electric Vehicle (EV) manufacturers over lithium-ion batteries.

Solid-state batteries offer possible solutions to several problems of liquid Li-ion batteries such as limited voltage, flammability, poor cycling performance as well as strength. In addition, with recent advancements in electrolytes and processing technology, solid-state batteries are poised to aid in energy storage challenges on a larger scale. As such, these aforementioned factors are anticipated to bolster the revenue growth of the global solid-state car battery over the forecast period.

Key Takeaways

- Market Growth: The Solid-State Car Battery Market is set to reach USD 16.8 billion by 2033, exhibiting a remarkable 31.1% CAGR from its 2023 value of USD 1.1 billion.

- Technological Advancements: Key technologies like ceramic electrolytes and polymer electrolytes contribute to enhanced safety, energy density, and overall performance in solid-state batteries.

- Component Significance: Electrolyte commands a substantial market share of 41.6% in 2023, underscoring its critical role in facilitating ion movement and boosting solid-state battery efficiency.

- Material Type Dominance: Battery Electric Vehicles (BEVs) hold a significant market share of 64.8%, reflecting a strong consumer preference for fully electric vehicles.

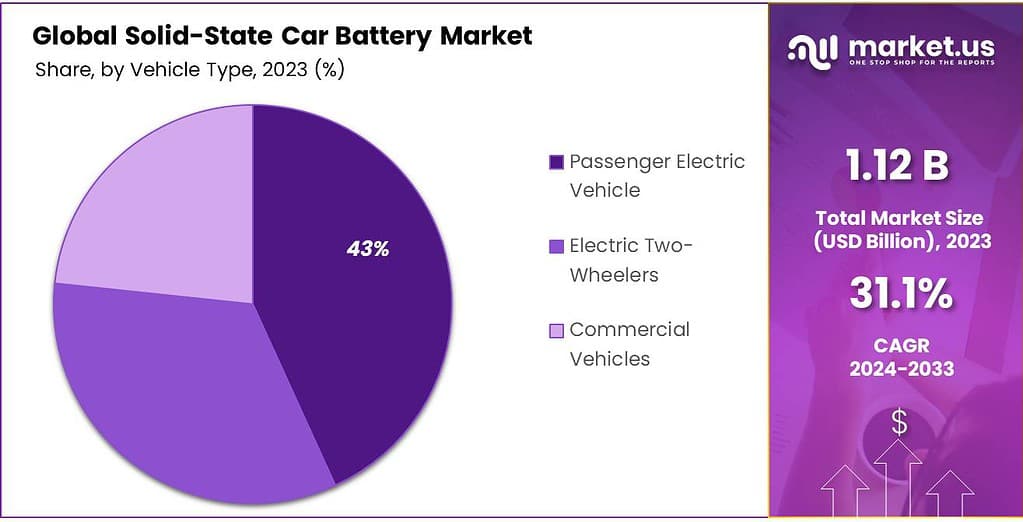

- Vehicle Type Preference: Passenger Electric Vehicles capture a major market position with a share of 43.2%, signaling an increasing consumer inclination towards personal electric transportation.

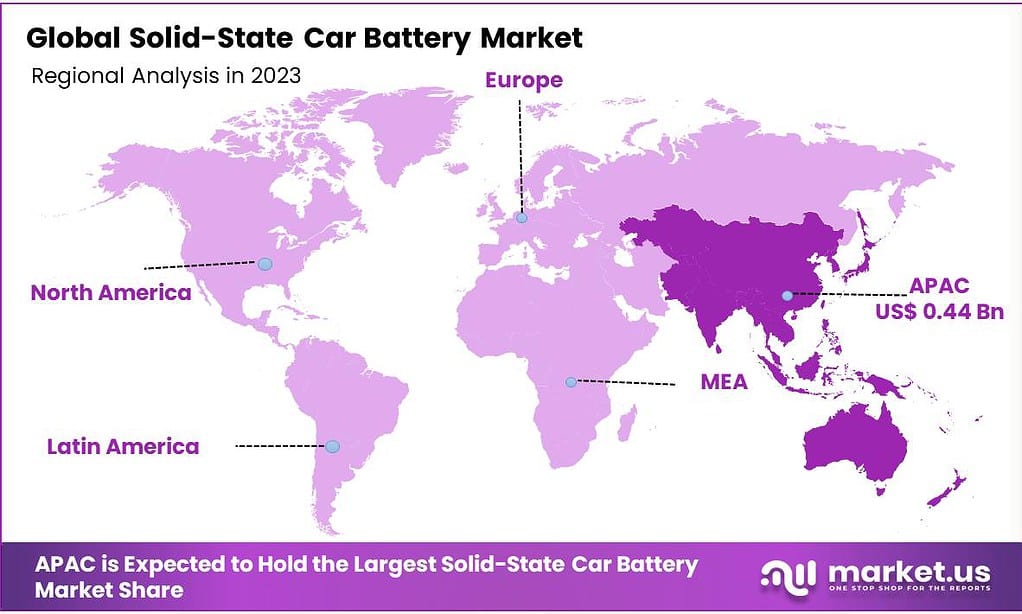

- Regional Leadership: Asia-Pacific leads the global market with a dominant 37% share, driven by robust developments in China, India, and other countries.

By Component

In 2023, Electrolyte took the lead among the components in the Solid-State Car Battery Market, holding a strong market position with more than 41.6% share. The electrolyte is a really important part of the battery. It helps ions move between the cathode and anode. When Electrolyte dominates the market, it shows how crucial it is in making solid-state car batteries work well and efficiently.

Cathode Materials are also a big part of the market. They decide how much energy the battery can hold and how well it performs. Making new and better cathode materials is necessary to store more energy and improve the overall abilities of solid-state car batteries. This helps in making better electric vehicles.

Anode Materials are really important in solid-state car batteries. They store and release energy when the battery is working. Making constant improvements in anode materials helps make solid-state car batteries work better and last longer. This supports the industry’s aim of creating electric vehicles that are more dependable and high-performing.

As the Solid-State Car Battery Market keeps getting better, each part—like Electrolyte, Cathode Materials, and Anode Materials—plays a big role. People are always researching and working on making these parts safer, better at storing energy, and overall more efficient in electric vehicles. This ongoing effort leads to continuous innovation and improvement in the market.

By Technology

The Solid-State Car Battery Market is marked by the utilization of various technologies, each playing a significant role in advancing electric vehicle (EV) batteries. Among these, Ceramic Electrolytes stand out as materials, often ceramics, that facilitate ion conduction between the cathode and anode. Known for their high thermal stability and safety benefits, ceramic electrolytes contribute to the robustness of solid-state battery technology in EVs.

Polymer Electrolytes represent another essential technology in solid-state car batteries. These electrolytes leverage polymer materials to conduct ions, creating a stable medium for ion flow between battery electrodes. The use of polymer electrolytes is recognized for enhancing safety and energy density in electric vehicles, addressing crucial aspects of battery performance.

Sulfide Electrolytes offer an alternative to traditional liquid electrolytes in solid-state batteries. Comprising solid materials containing sulfur ions, these electrolytes contribute to improved safety and performance in electric vehicle batteries. Using sulfide electrolytes in solid-state car batteries makes the electric vehicle industry focus more on safety and making batteries work better.

As the market for Solid-State Car Batteries keeps getting better, these different technologies become important. They help make batteries safer, store more energy, and work better overall in electric vehicles. People are continuously researching and improving these technologies. This ongoing work is expected to bring more innovations, making solid-state batteries even more appealing and efficient for electric vehicles.

By Material Type

In 2023, BEV (Battery Electric Vehicle) took the lead in the Solid-State Car Battery Market, holding a strong market position with more than a 64.8% share. This means that Battery Electric Vehicles were the most popular, capturing a significant portion of the market. Battery Electric Vehicles (BEVs) are vehicles that run entirely on electricity stored in their batteries.

They don’t use any gasoline or fuel, making them fully electric. The dominance of BEVs in the market indicates a growing preference for cars that are powered solely by electric batteries, showcasing a strong demand for clean and sustainable transportation solutions. PHEV (Plug-in Hybrid Electric Vehicle) represents another segment in the market.

Plug-in Hybrid Electric Vehicles use a combination of an internal combustion engine and a rechargeable battery. While they can run on electric power alone for shorter distances, they also have a gasoline engine for longer trips. As the Solid-State Car Battery Market evolves, the dominance of BEVs reflects the increasing popularity of fully electric vehicles, emphasizing the industry’s shift towards cleaner and greener mobility solutions.

PHEVs, although holding a smaller market share in this scenario, provide a transitional option for consumers who may be easing into the electric vehicle trend or need a hybrid solution for longer journeys. The market dynamics are shaped by the ongoing preferences and choices of consumers in the quest for more sustainable and efficient transportation.

Vehicle Type

In 2023, Passenger Electric Vehicle secured a dominant market position in the Solid-State Car Battery Market, capturing over 43.2% of the share. This indicates that among the different vehicle types, Passenger Electric Vehicles were the most prevalent, holding a significant portion of the market. Passenger Electric Vehicles include cars designed for personal transportation that run entirely on electricity stored in their batteries.

The substantial market share suggests a growing preference for electric cars among consumers, reflecting an increased demand for sustainable and eco-friendly personal transportation solutions. Electric Two-Wheelers represent another segment in the market. This category includes electric motorcycles, scooters, and bicycles.

While they play a role in sustainable mobility, their market share is comparatively smaller, indicating that the majority of the market is driven by four-wheeled Passenger Electric Vehicles. Commercial Vehicles, encompassing electric buses, trucks, and vans, form another essential segment. These vehicles are designed for various commercial purposes, such as public transportation and freight.

Although holding a significant share, their market presence is not as dominant as Passenger Electric Vehicles, reflecting a different set of considerations and challenges in the commercial vehicle sector. As the Solid-State Car Battery Market progresses, the dominance of Passenger Electric Vehicles underscores the widespread acceptance and adoption of electric cars for personal use.

However, the diverse market segments highlight the versatility of solid-state car batteries, catering to different transportation needs and contributing to the overall evolution of the automotive industry towards cleaner and more sustainable options.

Market Key Segmentation

Component

- Cathode Materials

- Electrolyte

- Anode Materials

Material Type

- BEV (Battery Electric Vehicle)

- PHEV (Plug-in Hybrid Electric Vehicle)

Technology

- Ceramic Electrolytes

- Polymer Electrolyte

- Sulfide Electrolyte

Vehicle Type

- Passenger Electric Vehicle

- Electric Two-Wheelers

- Commercial Vehicles

Drivers

The Solid-State Car Battery Market is growing because of important reasons. One big reason is the industry’s focus on making batteries safer and more efficient for electric vehicles. Solid-state batteries, using technologies like ceramic electrolytes, polymer electrolytes, and sulfide electrolytes, bring improvements in safety, energy density, and overall performance compared to regular batteries.

Another key factor driving growth is the increasing demand for electric vehicles (EVs). People around the world are moving towards cleaner and greener transportation choices, and governments are encouraging the use of EVs. This growing interest in electric mobility boosts the demand for advanced battery technologies, such as solid-state batteries, making the market expand and develop.

Continuous research and development are crucial for making progress in the Solid-State Car Battery Market. Ongoing work to enhance technologies like ceramic electrolytes, polymer electrolytes, and sulfide electrolytes leads to better battery performance, longer lifespan, and increased safety.

This dedication to improving battery components positions solid-state batteries as a crucial part of the future of electric vehicles. In summary, the Solid-State Car Battery Market is moving forward because of the focus on making electric mobility safer and more efficient, the increasing demand for electric vehicles, and the continuous efforts in research and development to enhance battery technologies. These factors work together to drive the market in a positive direction and shape the future of how cars are powered.

Restraints

While the Solid-State Car Battery Market shows promise, it faces certain challenges that act as restraints to its widespread adoption. One significant restraint is the complexity and cost associated with the manufacturing processes of solid-state batteries. The technologies involved, such as ceramic electrolytes, polymer electrolytes, and sulfide electrolytes, often require intricate production methods, resulting in higher production costs compared to conventional batteries.

Another restraint is the scalability of production. Achieving mass production of solid-state batteries, especially in large formats suitable for electric vehicles, remains a challenge. The industry is working towards overcoming scalability issues, but the current limitations pose hurdles to the widespread integration of solid-state batteries in the automotive market.

The overall market penetration of electric vehicles, which heavily influences the demand for solid-state car batteries, is still evolving. While EV adoption is growing, it is not yet at a level that ensures consistent and widespread demand for advanced battery technologies like solid-state batteries.

In summary, the Solid-State Car Battery Market faces restraints in terms of manufacturing complexity, production scalability, and the gradual growth of the electric vehicle market. Addressing these challenges is essential for solid-state batteries to become a mainstream and integral part of the automotive industry.

Opportunities

The Solid-State Car Battery Market holds promising opportunities for growth and development. One notable opportunity lies in the continuous advancements in research and development. Ongoing efforts to enhance the technologies involved, such as ceramic electrolytes, polymer electrolytes, and sulfide electrolytes, can lead to the creation of more efficient and cost-effective solid-state batteries.

Manufacturers investing in R&D have the potential to stay ahead in the market by introducing cutting-edge solutions that cater to evolving industry needs. Additionally, the market can explore opportunities in strategic collaborations and partnerships. Forming alliances with other industry players, research institutions, and technology providers can accelerate innovation and contribute to overcoming challenges such as manufacturing complexity and scalability.

Collaborative efforts can lead to the development of standardized processes and materials, fostering widespread adoption of solid-state batteries.

The global push towards sustainable transportation provides a growth avenue. As governments and consumers increasingly prioritize eco-friendly mobility solutions, the demand for electric vehicles and advanced battery technologies is expected to rise.

Solid-state batteries, with their safety and performance benefits, can position themselves as key contributors to the transition toward cleaner and more sustainable transportation options. In summary, the Solid-State Car Battery Market has opportunities in research and development, strategic collaborations, and the broader shift toward sustainable transportation.

By proactively addressing these opportunities, manufacturers can contribute to the evolution of the automotive industry and solidify the role of solid-state batteries in the future of electric mobility.

Challenges

The Solid-State Car Battery Market faces certain challenges that warrant attention for sustained growth. One significant challenge is the complexity and cost associated with the manufacturing processes of solid-state batteries. Technologies like ceramic electrolytes, polymer electrolytes, and sulfide electrolytes involve intricate production methods, leading to higher production costs compared to conventional batteries.

Overcoming this challenge requires innovations in production techniques to make solid-state batteries more cost-effective. scalability of production is another challenge for the market. Achieving mass production of solid-state batteries, especially in large formats suitable for electric vehicles, remains a hurdle. The industry is actively working on solutions, but addressing scalability issues is crucial for ensuring the widespread integration of solid-state batteries in the automotive market.

The gradual growth of the electric vehicle market poses a challenge. The overall market penetration of electric vehicles, which significantly influences the demand for solid-state car batteries, is still evolving. While electric vehicle adoption is increasing, it is not yet at a level that ensures consistent and widespread demand for advanced battery technologies like solid-state batteries.

The Solid-State Car Battery Market encounters challenges related to manufacturing complexity, production scalability, and the evolving electric vehicle market. Addressing these challenges is imperative for solid-state batteries to become a mainstream and integral part of the automotive industry.

Regional Analysis

Asia-Pacific leads the global Solid-State Car Battery Market with a substantial 37% share. The region’s dominance stems from robust developments in the automotive sector, particularly in China, India, and other countries. Increased governmental initiatives to enhance the efficiency of automotive projects contribute to the demand for solid-state car batteries.

North America anticipates the fastest growth in the forecast period, driven by a burgeoning market and rising expenditure. Players in the Canadian and U.S. markets have the potential to expand their business portfolios into neighboring countries.

Europe is poised for stable growth from 2023 to 2032, driven by a rising demand for solid-state car batteries in commercial automotive projects. The region’s market growth is further fueled by the presence of key players in the industry.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Their substantial roles underscore their impact on advancing solid-state battery technology and driving market competitiveness.

Top Key Players

Hitachi Ltd.

Enevate Corporation

BMW Group

Ionic Materials

LG Chem Ltd.

NGK Spark Plug

Johnson Battery Technologies

OthersRecent Developments

In July 2023, ProLogium Technology Co, Ltd. signed an agreement with MAHLE GmbH for the development of the first thermal management system for ProLogium’s next-generation solid-state batteries. This agreement will help in the commercialization of solid-state battery solutions that offer energy density, improved safety, and lifespan.

In May 2023, Sakuu Corporation introduced Li-Metal Cypress Battery Cell Chemistry for manufacturing license. Further, this Li-Metal chemistry can deliver high-power density and high energy density, with a focus on safety.

In December 2022, Solid Power announced its partnership with BMW Group. Under this partnership agreement, Solid Power, Inc. has granted the BMW Group an R&D license for Solid Power’s all-solid-state cell design and manufacturing know-how.

Report Scope

Report Features Description Market Value (2022) USD 1.1 Bn Forecast Revenue (2032) USD 16.8 Bn CAGR (2023-2032) 31.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Component(Cathode Materials, Electrolyte, Anode Materials), Material Type(BEV (Battery Electric Vehicle), PHEV (Plug-in Hybrid Electric Vehicle), Technology(Ceramic Electrolytes, Polymer Electrolyte, Sulfide Electrolyte), Vehicle Type(Passenger Electric Vehicle, Electric Two-Wheelers, Commercial Vehicles) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hitachi Ltd., Enevate Corporation, BMW Group, Ionic Materials, LG Chem Ltd., NGK Spark Plug, Johnson Battery Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Solid-State Car Battery Market?Solid-State Car Battery Market size is expected to be worth around USD 16.8 billion by 2033, from USD 1.1 Bn in 2023

What is the CAGR for the Solid-State Car Battery Market?The Solid-State Car Battery Market is registered to grow at a CAGR of 31.1% during 2023-2032.Who are the major players operating in the Solid-State Car Battery Market?Hitachi Ltd., Enevate Corporation, BMW Group, Ionic Materials, LG Chem Ltd., NGK Spark Plug, Johnson Battery Technologies, Others

Solid-State Car Battery MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Solid-State Car Battery MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Toyota Motor Corporation

- Solid Power

- QuantumScape

- Samsung SDI

- Ilika

- BrightVolt

- Panasonic

- Cymbet

- LG Chem, among others.