Global Cobalt Carbonate (CAS 513-79-1) Market By Type (Co 45%, Co 47%, Others), By Form (Powder, Granules, Crystal), By Application (Animal Feeds, Agricultural Products, Chemical Reagents, Others), By Distribution Channel (Direct Sales, Distributors & Wholesalers, Online Platforms, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138623

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

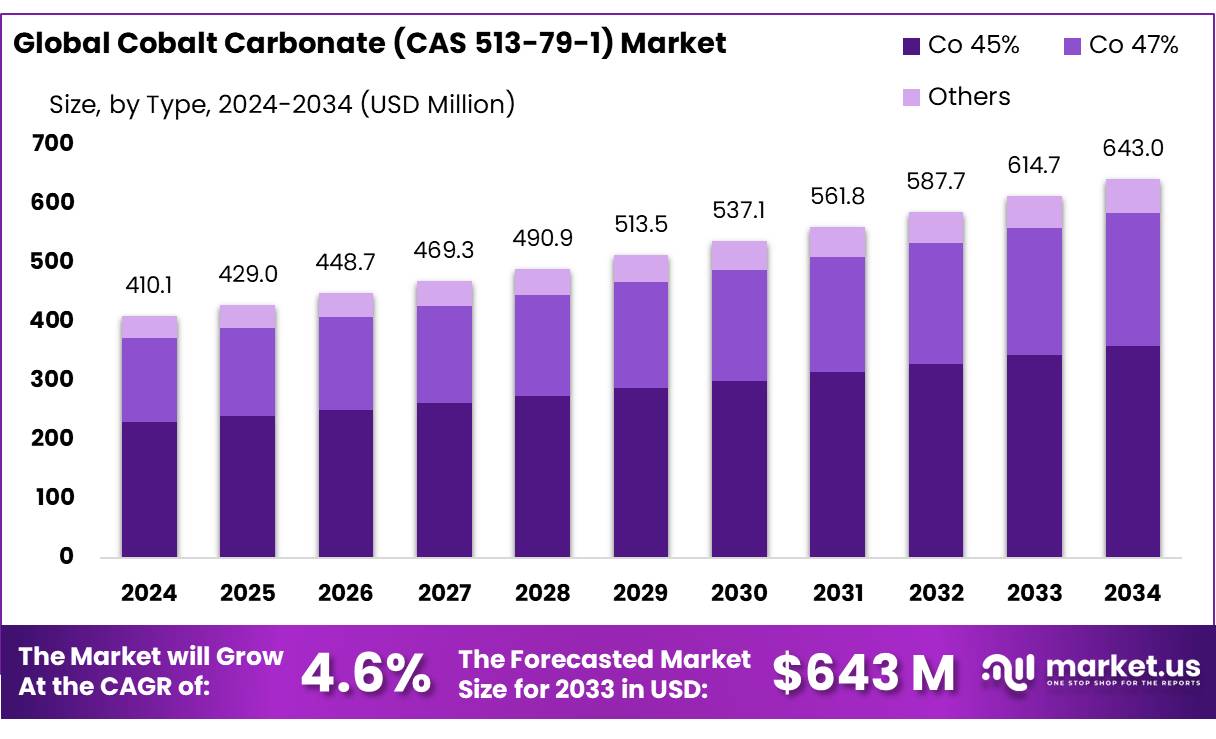

The Global Cobalt Carbonate (CAS 513-79-1) Market size is expected to be worth around USD 643.0 Mn by 2034, from USD 410.1 Mn in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The global Cobalt Carbonate (CAS 513-79-1) market is experiencing steady growth, driven by its wide applications in battery production, pigments, catalysts, and animal nutrition. As an essential precursor in the production of cobalt-based chemicals, cobalt carbonate plays a key role in sectors like lithium-ion batteries, ceramics, and vitamin B12 supplements.

Emerging applications are expected to further boost market expansion. The growing demand for Cobalt Carbonate (CAS 513-79-1) is linked to the broader cobalt industry, particularly driven by the rising adoption of electric vehicles (EVs) and energy storage systems, increasing the need for cobalt-based materials in battery production.

The supply chain dynamics of cobalt are a significant factor in market development. With over 70% of global cobalt production concentrated in the Democratic Republic of the Congo (DRC), supply risks are a concern. Additionally, China controls around 60% of global cobalt refining capacity, which affects both supply and pricing trends of Cobalt Carbonate (CAS 513-79-1) worldwide.

Despite strong growth prospects, the Cobalt Carbonate (CAS 513-79-1) market faces challenges related to supply chain instability, price volatility, and environmental concerns. Ethical issues surrounding cobalt mining in the DRC, including child labor and hazardous conditions, have led to growing scrutiny on the industry. Furthermore, the development of cobalt-free or low-cobalt battery chemistries, such as lithium iron phosphate (LFP) batteries, could potentially reduce demand in the future.

Governments are pushing for more sustainable cobalt sourcing, which has led to the emergence of alternative sourcing strategies. These include initiatives for cobalt recycling, deep-sea mining, and secondary cobalt recovery, which aim to address both environmental concerns and supply chain risks.

Key Takeaways

- Cobalt Carbonate (CAS 513-79-1) Market size is expected to be worth around USD 643.0 Mn by 2034, from USD 410.1 Mn in 2024, growing at a CAGR of 4.6%.

- Co 45% held a dominant market position, capturing more than a 56.4% share.

- Powder held a dominant market position, capturing more than a 62.1% share of the Cobalt Carbonate market.

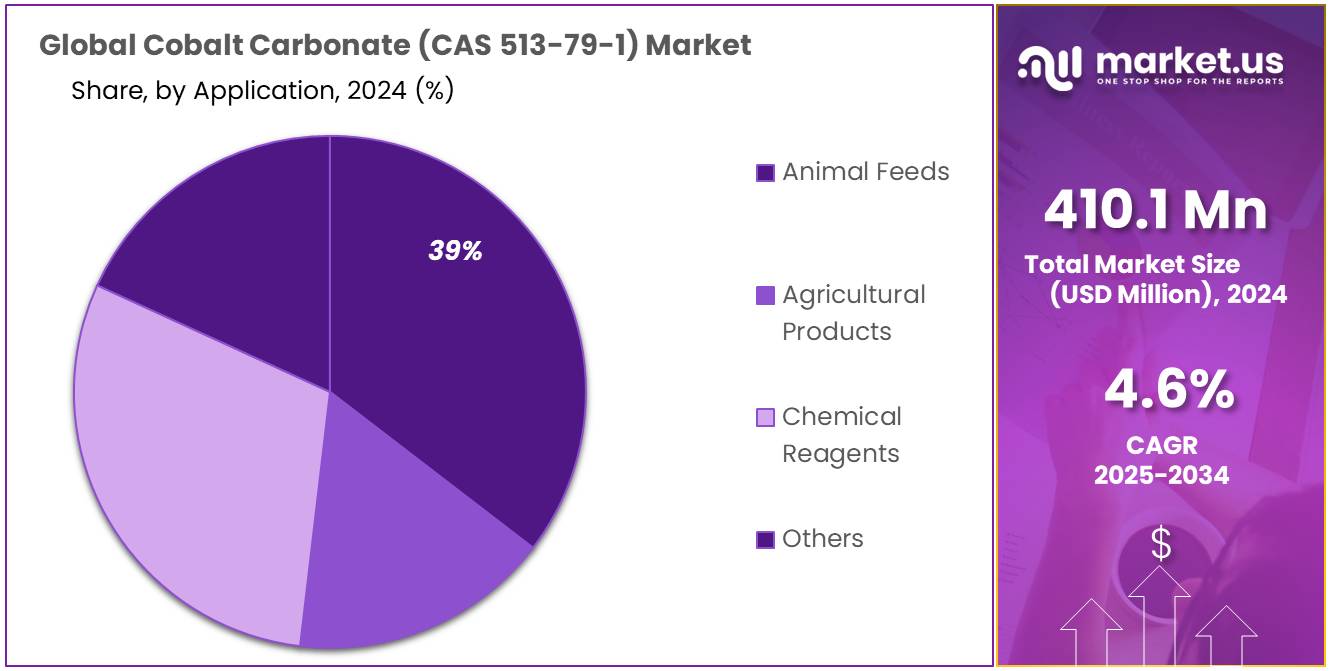

- Animal Feeds held a dominant market position, capturing more than a 39.2% share of the Cobalt Carbonate market.

- Direct Sales held a dominant market position, capturing more than a 46.2% share of the Cobalt Carbonate market.

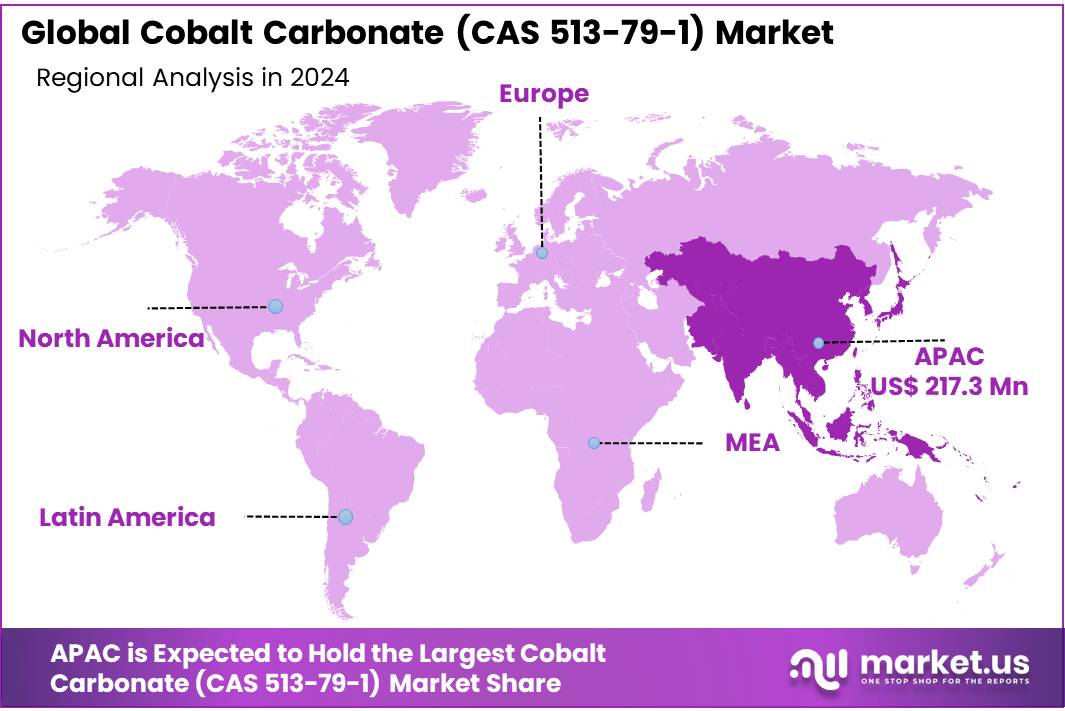

- Asia Pacific dominates the market, holding a significant share of 52.9%, valued at USD 217.3 million.

By Type

In 2024, Co 45% held a dominant market position, capturing more than a 56.4% share of the Cobalt Carbonate (CAS 513-79-1) market. The Co 45% segment has remained the leading choice due to its widespread use in various industrial applications, such as the production of catalysts, ceramics, and pigments. Its relatively lower cobalt content compared to higher concentrations, like Co 47%, makes it more affordable and accessible for many manufacturing processes.

The Co 47% segment, while smaller in comparison, holds a key position in high-performance applications that require a higher concentration of cobalt. In 2024, Co 47% accounted for a significant portion of the market, driven by its use in specialized products such as high-quality catalysts and advanced battery technologies.

By Form

In 2024, Powder held a dominant market position, capturing more than a 62.1% share of the Cobalt Carbonate (CAS 513-79-1) market. The powdered form of Cobalt Carbonate is widely used in various industrial applications due to its ease of handling and versatility. It is especially popular in the production of ceramics, pigments, and battery materials, where precise control over material properties is crucial. Powdered Cobalt Carbonate (CAS 513-79-1) is also preferred in chemical processes because it can be easily mixed with other compounds and dissolved when necessary.

Granules, while less common than the powdered form, hold a significant share of the market, especially in sectors that require specific particle sizes for manufacturing. In 2024, the granules segment accounted for a growing portion of the market as industries in metallurgy and agriculture increasingly adopted Cobalt Carbonate granules for specialized processes.

The Crystal form of Cobalt Carbonate (CAS 513-79-1), while useful in certain high-end applications, represents the smallest segment of the market. It is primarily used in research and specialty chemical manufacturing, where its crystalline structure offers unique properties required for specific processes.

By Application

In 2024, Animal Feeds held a dominant market position, capturing more than a 39.2% share of the Cobalt Carbonate (CAS 513-79-1) market. The use of Cobalt Carbonate in animal feeds has been a major driver due to its essential role in animal nutrition, particularly in ruminant livestock like cattle and sheep. Cobalt is a crucial component of Vitamin B12, which is vital for the growth and overall health of animals.By Distribution Channel

In 2024, Direct Sales held a dominant market position, capturing more than a 46.2% share of the Cobalt Carbonate (CAS 513-79-1) market. Direct sales remain the preferred method for many industrial buyers due to the high-value nature of the product and the need for reliable and customized supply solutions. Companies involved in the production of Cobalt Carbonate typically work directly with large manufacturers and key players in industries such as agriculture, chemicals, and animal feeds. This channel offers manufacturers the ability to negotiate bulk pricing, ensure product quality, and create tailored supply agreements.

Distributors & Wholesalers are another critical segment in the Cobalt Carbonate distribution landscape, holding a significant market share in 2024. This channel plays an important role in reaching smaller-scale manufacturers and regional buyers who may not have direct access to large producers. Distributors often provide the flexibility and accessibility that manufacturers in emerging markets need.

Online Platforms, while still a smaller channel compared to Direct Sales and Distributors, have started gaining traction, particularly for smaller or non-industrial buyers. The ease of purchasing smaller quantities of Cobalt Carbonate through digital platforms is appealing for research institutions, educational sectors, and small-scale manufacturers.

Key Market Segments

By Type

- Co 45%

- Co 47%

- Others

By Form

- Powder

- Granules

- Crystal

By Application

- Animal Feeds

- Agricultural Products

- Chemical Reagents

- Others

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Online Platforms

- Others

Drivers

Growing Demand for Cobalt in Electric Vehicle Batteries

One of the major driving factors for the Cobalt Carbonate (CAS 513-79-1) market is the increasing demand for cobalt in the production of electric vehicle (EV) batteries. As the global automotive industry shifts toward cleaner energy and sustainability, cobalt has become a critical component in lithium-ion batteries, which power electric vehicles.

In fact, cobalt consumption for electric vehicle batteries is projected to grow significantly. According to the World Bank, the demand for cobalt could increase by as much as 500% by 2050, largely due to its use in EV batteries and energy storage systems. This means that Cobalt Carbonate, as a key precursor in the production of cobalt-based compounds for battery cathodes, is becoming a vital material in the renewable energy transition.

Governments around the world are playing a significant role in driving this demand. For instance, the European Union has set ambitious goals to make Europe the global leader in electric vehicle production, with plans to achieve net-zero carbon emissions by 2050. The European Commission estimates that the adoption of electric vehicles in Europe will require a massive increase in the supply of critical raw materials, including cobalt. Additionally, in the U.S., the Biden Administration has pushed for a major increase in electric vehicle production, with a target of 50% of all vehicle sales being electric by 2030.

On the industrial side, companies are increasingly investing in cobalt sourcing and production. The demand for cobalt in batteries is pushing manufacturers to ensure a stable supply of high-quality Cobalt Carbonate (CAS 513-79-1). In 2024, global cobalt production reached an estimated 160,000 metric tons, with a significant portion being directed toward battery manufacturing. According to Roskill, a leading commodities analysis firm, over 60% of global cobalt demand is now driven by the battery sector, a trend that is expected to intensify in the coming years.

Restraints

Supply Chain Constraints and Price Volatility

Cobalt is primarily sourced from a few key regions, with the Democratic Republic of Congo (DRC) accounting for around 70% of global cobalt production. This heavy reliance on a single country for cobalt extraction introduces substantial risks to the supply chain, including geopolitical instability, labor strikes, and environmental concerns. According to the US Geological Survey (USGS), the DRC’s political instability and the challenges faced in the mining sector have led to periodic disruptions in cobalt supply, affecting prices and availability.

The price of cobalt has historically been volatile, which presents a challenge for manufacturers who rely on stable and predictable prices. In some cases, cobalt prices nearly doubled, which in turn led to higher costs for manufacturers of cobalt-based chemicals, including Cobalt Carbonate. As of 2024, the price of cobalt has seen some stabilization, but concerns remain over future supply constraints, especially as the demand for electric vehicle batteries continues to rise. According to the World Bank, the price of cobalt could face additional upward pressure due to competition from other industries, such as renewable energy storage and electronics, that also require cobalt.

Moreover, the ethical and environmental concerns associated with cobalt mining, particularly in the DRC, are also contributing to supply chain challenges. Many companies are under increasing pressure to ensure that their cobalt sourcing is ethical and transparent, with growing calls for more sustainable and responsible mining practices. The Responsible Cobalt Initiative, launched in 2016 by various stakeholders, aims to address these concerns by promoting better practices and improving the traceability of cobalt in the supply chain. However, implementing such initiatives has proven to be difficult, and these supply chain complexities add to the uncertainty for manufacturers of Cobalt Carbonate (CAS 513-79-1).

Governments around the world are trying to address these challenges by investing in cobalt recycling technologies and exploring alternative sources of cobalt. For instance, the European Commission has identified cobalt as a “critical raw material” and is actively working on strategies to reduce dependence on imports by promoting recycling and alternative mining sources. In addition, the U.S. Department of Energy is funding research into the development of more efficient cobalt recycling methods, with the goal of ensuring a more sustainable and reliable supply of cobalt in the future. However, these efforts are still in the early stages, and it will take years before the supply chain becomes less reliant on traditional mining.

Opportunity

Growth Opportunities in Cobalt Carbonate Driven by Renewable Energy Storage

According to the International Energy Agency (IEA), global renewable energy capacity grew by 10% in 2022, with solar and wind accounting for over 90% of the increase. As renewable energy adoption accelerates, energy storage solutions, including those based on cobalt, are in high demand. In 2024, the market for energy storage systems is expected to grow by 15%, with demand for cobalt rising due to its importance in high-capacity, long-duration battery storage systems. This surge in demand is expected to continue, with BloombergNEF predicting that the global market for energy storage will exceed $20 billion by 2025, which could further drive cobalt requirements.

Governments around the world are heavily investing in energy storage to meet their carbon reduction goals. For example, the European Union has set a target of achieving net-zero carbon emissions by 2050 and has allocated significant funding for energy storage infrastructure as part of its Green Deal. Similarly, the United States, under the Biden administration, has invested billions into clean energy initiatives, including large-scale storage projects. This is part of a broader effort to transition away from fossil fuels and reduce the carbon footprint of the power sector. According to the US Department of Energy, energy storage projects in the U.S. are expected to increase by 40% annually, creating substantial growth opportunities for the cobalt industry.

The rise of electric vehicles (EVs), which are also heavily reliant on cobalt for their batteries, further boosts the demand for Cobalt Carbonate. The International Energy Agency (IEA) has reported that electric vehicle sales surpassed 10 million units in 2022, and they are projected to continue growing rapidly. As countries such as China, the U.S., and European nations set ambitious EV adoption targets—such as the European Union’s goal of having 30 million EVs on the road by 2030—this surge will likely create a consistent demand for cobalt for battery production. According to IEA, cobalt consumption in EV batteries alone is expected to rise by more than 60% by 2030.

Trends

Increasing Use of Cobalt Carbonate in Electric Vehicle (EV) Batteries

Cobalt is a critical material in these batteries, used primarily in the cathodes, where it enhances energy density and stability, crucial for longer battery life and faster charging times. This surge in demand for EVs is directly impacting the Cobalt Carbonate (CAS 513-79-1) market.

In 2024, the global electric vehicle market is expected to grow by over 30% compared to 2023, with more than 10 million electric vehicles expected to be sold globally, according to the International Energy Agency (IEA). This growth is being driven by government policies, environmental regulations, and consumer demand for cleaner transportation options.

For example, the European Union has set a target for all new cars sold in the region to be zero-emission by 2035, while China, the world’s largest EV market, has been offering incentives to consumers and manufacturers to boost electric vehicle adoption. These efforts are pushing automakers to increase production, which, in turn, is driving the demand for cobalt-based components, including Cobalt Carbonate.

In addition, the Biden administration in the United States has allocated more than $5 billion to support the development of domestic supply chains for critical minerals, including cobalt, to reduce dependence on foreign sources and promote the production of electric vehicles. The U.S. Department of Energy predicts that the demand for cobalt in the EV sector will grow rapidly, with a forecasted increase of up to 200% by 2030. This trend indicates that Cobalt Carbonate, which is used as a precursor in the production of cobalt-based cathode materials, will see sustained demand in the coming years. With major global manufacturers like Tesla, General Motors, and Volkswagen ramping up production of EVs, Cobalt Carbonate is expected to be in high demand to support these efforts.

The demand for Cobalt Carbonate is also supported by the ongoing efforts to develop more sustainable and efficient battery technologies. Research is being conducted to improve the performance of lithium-ion batteries, reduce cobalt content, and explore alternative materials. However, cobalt remains a crucial element for high-performance batteries, particularly in the near term. The trend of increasing EV production, alongside technological advancements, is likely to create significant opportunities for the Cobalt Carbonate (CAS 513-79-1) market.

Furthermore, as the EV market expands, it creates a knock-on effect on other industries. For instance, the growing demand for cobalt in batteries is leading to innovations in the mining and refining sectors. Companies are investing in more efficient and environmentally responsible mining methods to meet the growing need for cobalt. The World Bank estimates that by 2030, the demand for critical minerals like cobalt could increase by over 500% as more countries adopt electric vehicles and renewable energy systems.

Regional Analysis

Asia Pacific dominates the market, holding a significant share of 52.9%, valued at USD 217.3 million. This region’s dominance can be attributed to the rising demand for cobalt-based products, especially in the rapidly growing electric vehicle (EV) and battery sectors, particularly in China and Japan. Additionally, the region is home to several key players and large-scale manufacturers involved in the production of cobalt carbonate.

North America holds a substantial market share, supported by the ongoing growth in the energy storage and electronics industries. The U.S. and Canada are the primary contributors, with a strong focus on technological advancements and renewable energy solutions. However, the market in North America is relatively smaller compared to Asia Pacific, but it continues to show promising growth prospects.

Europe also remains a key player in the market, with countries like Germany, France, and the UK leading in the development of advanced materials and technologies. The region’s focus on sustainable and green technologies has contributed to a growing demand for cobalt carbonate, particularly in battery applications for electric mobility and energy storage systems.

In the Middle East & Africa, the market for cobalt carbonate is growing at a slower pace but is expected to gain momentum due to expanding industrial activities in countries like Saudi Arabia and South Africa.

Latin America holds a modest market share, with Brazil being the largest contributor in the region, although its demand for cobalt carbonate is relatively low in comparison to other regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Cobalt Carbonate (CAS 513-79-1) market is dominated by several key players who are integral to the production, distribution, and innovation of cobalt-based products. Zhangjiagang Huayi Chemical is a leading producer in the sector, known for its significant contribution to cobalt-related materials, including Cobalt Carbonate. The company’s strategic positioning in China, one of the largest producers of cobalt, allows it to cater to the growing demand in both local and international markets, particularly in industries like battery manufacturing and chemical processing.

Cixi Feilan Non-ferrous Metals is another important player, offering a range of cobalt-based products. Its robust production capacity and strong supply chain management enable it to meet the rising demand, particularly from the automotive and energy sectors, which require cobalt for EV batteries and storage solutions.

Tirupati Industries and Ganzhou Tengyuan Cobalt Industrial are active participants in the cobalt market, with extensive operations in cobalt extraction, processing, and distribution, supporting industries that rely on high-purity cobalt materials.

Jyoti Dye-Chem, Galico Cobalt & Nickel Material, and Jiangxi Tungsten Industry further strengthen the market by producing high-quality cobalt compounds used in various applications, including catalysts, pigments, and electroplating. These companies benefit from the global push towards cleaner energy technologies, with cobalt being a key material in lithium-ion batteries, driving growth in both production and consumption.

Zhejiang Huangyan Jiangkou Chemical and Huanghua Jinhua Additives also contribute significantly to the market, focusing on enhancing cobalt extraction processes and meeting the evolving demands for more sustainable and efficient production methods.

Top Key Players

- Zhangjiagang Huayi Chemical

- Cixi Feilan Non-ferrous Metals

- Tirupati Industries

- Ganzhou Tengyuan Cobalt Industrial

- Jyoti Dye-Chem

- Galico Cobalt & Nickel Material

- Jiangxi Tungsten Industry

- Zhejiang Huangyan Jiangkou Chemical

- Huanghua Jinhua Addtives

Recent Developments

In 2024, Zhangjiagang Huayi Chemical is expected to produce over 50,000 metric tons of Cobalt Carbonate, reflecting a robust year-on-year growth rate. Their strategic location near major cobalt sources in China, coupled with strong relationships with international clients, positions the company well to meet both domestic and global demand.

In 2024, Cixi Feilan Non-ferrous Metals is expected to expand its production capacity by 10% compared to 2023, increasing its output to approximately 35,000 metric tons of cobalt carbonate.

Report Scope

Report Features Description Market Value (2024) USD 410.1 Mn Forecast Revenue (2034) USD 643.0 Mn CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Co 45%, Co 47%, Others), By Form (Powder, Granules, Crystal), By Application (Animal Feeds, Agricultural Products, Chemical Reagents, Others), By Distribution Channel (Direct Sales, Distributors & Wholesalers, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zhangjiagang Huayi Chemical, Cixi Feilan Non-ferrous Metals, Tirupati Industries, Ganzhou Tengyuan Cobalt Industrial, Jyoti Dye-Chem, Galico Cobalt & Nickel Material, Jiangxi Tungsten Industry, Zhejiang Huangyan Jiangkou Chemical, Huanghua Jinhua Addtives Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cobalt Carbonate (CAS 513-79-1) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Cobalt Carbonate (CAS 513-79-1) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zhangjiagang Huayi Chemical

- Cixi Feilan Non-ferrous Metals

- Tirupati Industries

- Ganzhou Tengyuan Cobalt Industrial

- Jyoti Dye-Chem

- Galico Cobalt & Nickel Material

- Jiangxi Tungsten Industry

- Zhejiang Huangyan Jiangkou Chemical

- Huanghua Jinhua Addtives