Global Environmental Technology Market By Component(Solutions, Services), By Technological(Waste Valorization/Recycling and Composting, Greentech/Renewable Energy (Wind Energy, Photovoltaics, and Geothermal Energy), Desalination, Bioremediation, Green Hydrogen, Carbon Capture, Utilization and Storage (CCUS), Other Technological Solutions), By Application(Wastewater Treatment, Water Purification Management, Sewage Treatment, Pollution Monitoring, Dust Emissions, Dry Steaming, Gas Dissolution, Precision Cooling, Solid Waste Treatment, Other Applications), By End-use(Industrial, Residential, Commercial), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 73362

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

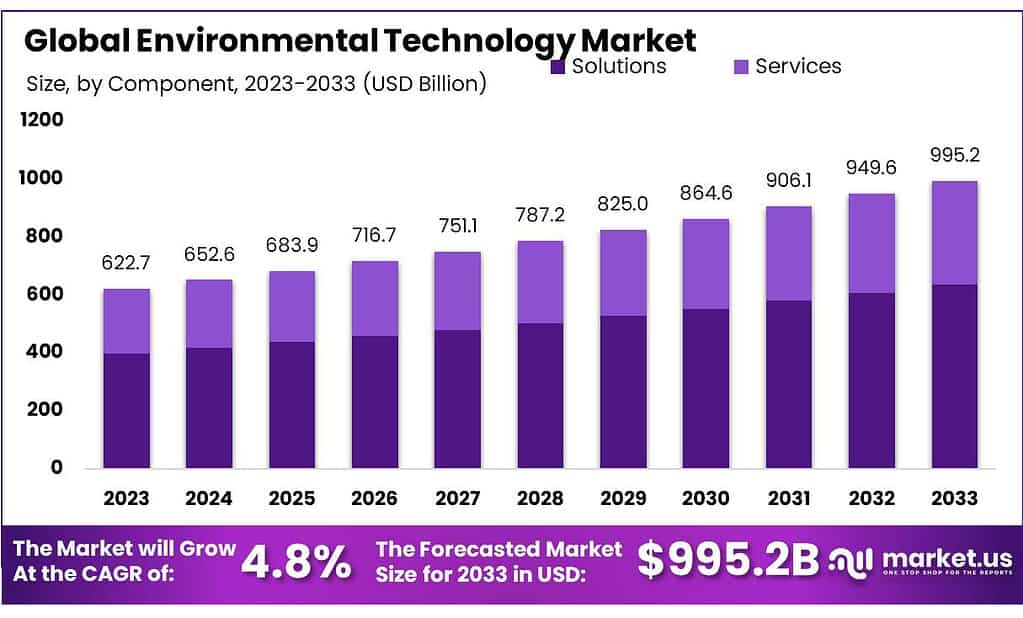

The global Environmental Technology Market size is expected to be worth around USD 995.2 Billion by 2033, from USD 622.7 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

The Environmental Technology Market encompasses a wide range of products, services, and solutions designed to protect the environment, conserve natural resources, and mitigate the negative impacts of human activities. Often referred to as “green technology” or “clean technology,” this market includes innovations and developments in renewable energy, water treatment and conservation, air pollution control, waste management, and recycling.

Environmental technologies aim to offer sustainable alternatives to traditional practices, reducing carbon footprints, lowering greenhouse gas emissions, and promoting the efficient use of resources. This market caters to various sectors, including industrial, commercial, residential, and governmental, providing tools and methods to address environmental challenges while supporting economic growth and development.

Driven by increasing environmental awareness, regulatory policies aimed at environmental protection, and the global commitment to combat climate change, the Environmental Technology Market is experiencing significant growth. Advances in technology, coupled with decreasing costs of green solutions, further fuel this expansion, making environmental technologies more accessible and appealing to a broader audience.

Key stakeholders in this market include technology developers, manufacturers, service providers, policy-makers, and end-users who adopt and implement these solutions. As environmental concerns continue to rise, the Environmental Technology Market plays a crucial role in shaping a sustainable future, highlighting the importance of innovation and collaboration in addressing global environmental issues.

Key Takeaways

- The Environmental Technology Market is projected to reach approximately USD 995.2 billion by 2033, up from USD 622.7 billion in 2023, with a compound annual growth rate (CAGR) of 4.8%.

- Solutions dominated the market in 2023, capturing more than 64.2% share.

- Waste Valorization/Recycling & Composting held the largest market share in technological solutions in 2023, accounting for over 45.3%.

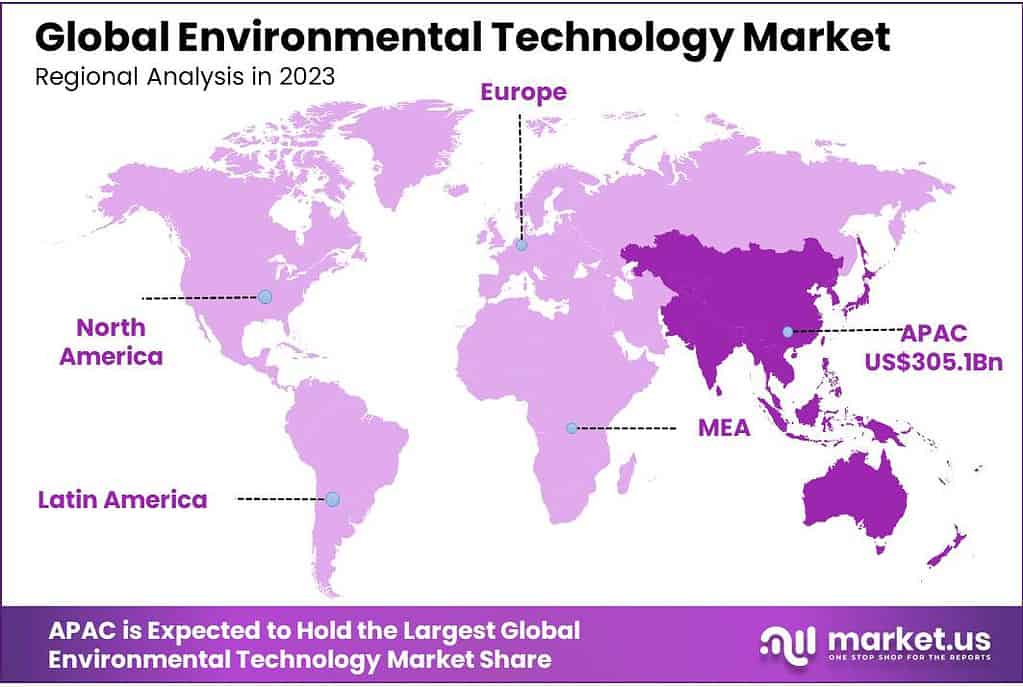

- The Asia Pacific region led the market with a commanding 49.7% share as of 2023.

- In 2023, wastewater treatment held the largest market share within the application segment, with over 55.2%.

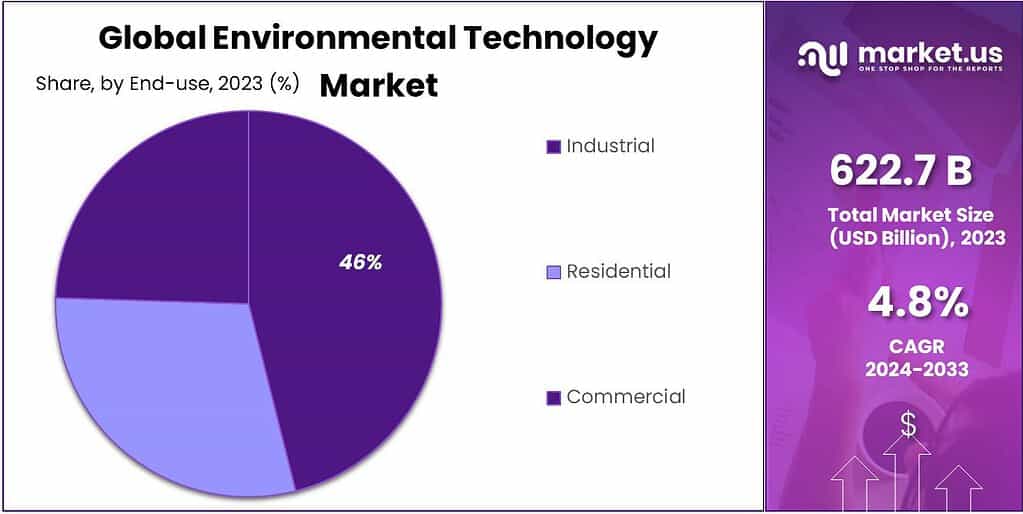

- Industrial use accounted for more than 47.3% of the market in 2023, securing the dominant end-use category.

By Component

In 2023, Solutions within the Environmental Technology Market held a dominant market position, capturing more than a 64.2% share. This segment’s leadership is attributed to the increasing demand for innovative and effective environmental technologies across various sectors.

Solutions such as renewable energy systems, water purification technologies, waste management methods, and pollution control devices are crucial for addressing the pressing environmental challenges of today. Their widespread adoption is driven by the need to mitigate the impact of industrial activities, urbanization, and climate change, showcasing a growing preference for sustainable practices.

Services, although occupying a smaller share of the market compared to solutions, play a vital role in ensuring the effective implementation and operation of environmental technologies. This segment includes consulting, maintenance, and support services that help businesses, governments, and organizations optimize their use of green technologies. The demand for these services is on the rise, as they provide the necessary expertise and support for deploying environmental solutions effectively, ensuring compliance with regulations, and achieving sustainability goals.

Both components are integral to the Environmental Technology Market, with Solutions leading due to the direct impact they have on improving environmental outcomes. As awareness and regulatory pressures increase, the synergy between innovative solutions and specialized services is expected to drive further growth in this market, emphasizing the importance of technology in advancing environmental sustainability.

By Technological

In 2023, Waste Valorization/Recycling & Composting within the Environmental Technology Market held a dominant market position, capturing more than a 45.3% share. This segment’s prominence is largely due to the global push towards reducing waste and promoting circular economy practices.

By transforming waste materials into valuable resources and enhancing the recycling and composting processes, waste valorization efforts are crucial in minimizing landfill use, reducing greenhouse gas emissions, and conserving natural resources. The increasing consumer and regulatory demand for sustainable waste management solutions further underscores the significance of this technology in today’s environmental landscape.

Greentech/Renewable Energy, encompassing Wind Energy, Photovoltaics, and Geothermal Energy, also constitutes a substantial portion of the market. These technologies are at the forefront of the transition to cleaner, more sustainable energy sources, driven by the urgent need to address climate change and reduce dependence on fossil fuels. The growing investment in and adoption of renewable energy sources highlight their critical role in achieving global energy and environmental goals.

Desalination technology, essential for addressing water scarcity by converting seawater into potable water, is increasingly important in regions facing water stress. Though it occupies a smaller market share, its importance is amplified by the growing global demand for freshwater amidst changing climate conditions and population growth.

Bioremediation, a process that utilizes living organisms to remove or neutralize contaminants from soil and water, is gaining traction as an effective and eco-friendly cleanup strategy for polluted environments. Its market share reflects the rising interest in sustainable remediation techniques.

Green Hydrogen production, aimed at creating a clean fuel alternative, is emerging as a promising solution for decarbonizing various sectors, including transportation and industry, highlighting its potential market impact.

Carbon Capture, Utilization, and Storage (CCUS) technologies are critical for reducing CO2 emissions from industrial processes and power generation, playing a vital role in global efforts to combat climate change.

By Application

In 2023, Wastewater Treatment within the Environmental Technology Market held a dominant market position, capturing more than a 55.2% share. This segment’s leadership is largely attributed to the increasing global focus on water conservation and the need to treat and reuse wastewater in light of dwindling fresh water resources.

Technologies that facilitate the treatment and purification of wastewater are crucial for ensuring water security, supporting sustainable agricultural and industrial processes, and protecting aquatic ecosystems. The demand for advanced wastewater treatment solutions highlights the growing awareness of the importance of water management in maintaining environmental health and human well-being.

Water Purification Management also represents a significant portion of the market, emphasizing the critical role of clean water in public health and environmental sustainability. Technologies that purify water to make it safe for drinking and other uses are essential in addressing waterborne diseases and contaminants, particularly in areas lacking access to clean water supplies.

Sewage Treatment is another vital application, focusing on the processing of domestic and industrial sewage to prevent pollution and protect water quality. The increasing urbanization and industrialization globally drive the demand for effective sewage treatment solutions to mitigate the environmental impacts of sewage disposal.

Pollution Monitoring technologies are essential for tracking air and water quality, providing the data needed for regulatory compliance and environmental protection efforts. The significance of this segment is underscored by the global push for cleaner air and water, making pollution monitoring a key area of investment.

Applications such as Dust Emissions, Dry Steaming, Gas Dissolution, and Precision Cooling address specific environmental challenges related to air quality, industrial emissions, and climate control, reflecting the diverse needs across different sectors for environmental technology solutions.

Solid Waste Treatment is crucial in managing the growing volumes of waste generated by human activities, emphasizing the importance of technologies that can reduce, recycle, and repurpose solid waste.

By End-use

In 2023, Industrial use of environmental technology held a dominant market position, capturing more than a 47.3% share. This significant share is largely due to the industrial sector’s critical need for sustainable practices and compliance with environmental regulations.

Industries across the board, from manufacturing to energy production, are increasingly adopting environmental technologies to reduce emissions, manage waste, and minimize their ecological footprint. The push towards greener processes and the global drive to combat climate change have made environmental technologies indispensable in industrial operations, aiming to balance economic growth with environmental stewardship.

Residential use also constitutes a substantial part of the market, as homeowners and communities seek ways to reduce energy consumption, manage waste, and ensure clean water. The growing awareness of environmental issues among the public has led to increased adoption of green technologies in homes, from solar panels and rainwater harvesting systems to energy-efficient appliances and sustainable building materials.

Commercial applications, including offices, retail spaces, and hospitality venues, are incorporating environmental technologies to enhance sustainability and operational efficiency. This segment’s market share reflects the commercial sector’s efforts to meet consumer expectations for environmental responsibility and to reduce operating costs through energy and resource conservation.

Each end-use category showcases the diverse applications of environmental technologies in addressing specific sustainability challenges. With Industrial use leading due to the sector’s significant environmental impact and regulatory pressures, the Environmental Technology Market is set to grow, driven by the universal commitment to creating a more sustainable and eco-friendly future.

Key Market Segments

By Component

- Solutions

- Services

By Technological

- Waste Valorization/Recycling & Composting

- Greentech/Renewable Energy (Wind Energy, Photovoltaics, and Geothermal Energy)

- Desalination

- Bioremediation

- Green Hydrogen

- Carbon Capture, Utilization & Storage (CCUS)

- Other Technological Solutions

By Application

- Wastewater Treatment

- Water Purification Management

- Sewage Treatment

- Pollution Monitoring

- Dust Emissions

- Dry Steaming

- Gas Dissolution

- Precision Cooling

- Solid Waste Treatment

- Other Applications

By End-use

- Industrial

- Residential

- Commercial

Drivers

Global Regulatory Policies and Environmental Awareness Propel the Environmental Technology Market

A significant driver propelling the Environmental Technology Market forward is the tightening of global regulatory policies alongside a surge in environmental awareness among consumers and businesses. Governments around the world are implementing stricter environmental regulations to combat climate change, reduce pollution, and promote sustainable practices. These regulations often mandate the reduction of carbon emissions, the treatment of industrial waste, the conservation of water, and the adoption of renewable energy sources, compelling industries to integrate environmental technologies into their operations.

The Paris Agreement, a landmark in the global push towards climate action, exemplifies international commitment to limiting global warming. Signatory countries are obliged to present national plans to reduce greenhouse gas emissions, directly influencing the adoption of green technologies. Similarly, regulations like the European Union’s Green Deal aim to make Europe the first climate-neutral continent by 2050, setting a precedent for environmental policy that significantly impacts market dynamics in environmental technologies.

Concurrently, there’s a growing environmental consciousness among consumers who are increasingly demanding sustainable products and practices. This shift in consumer behavior is encouraging businesses across various sectors to adopt environmentally friendly technologies not only to comply with regulations but also to align with market expectations and enhance their brand reputation. Companies are investing in green technologies to improve their sustainability credentials, reduce operational costs, and tap into new markets that value environmental stewardship.

Moreover, the investment in renewable energy sources such as wind, solar, and bioenergy is on the rise, driven by the need to transition away from fossil fuels. Environmental technologies that enable the efficient use and management of these renewable sources are crucial for achieving this energy transition. The development of smart grids, energy storage solutions, and advanced materials for solar panels are examples of how the market is responding to the demand for renewable energy technologies.

Restraints

High Initial Investment and Slow Return on Investment: Key Restraints in the Environmental Technology Market

One of the primary restraints facing the Environmental Technology Market is the high initial investment required for the development, implementation, and scaling of green technologies. Many environmental technologies, particularly those in renewable energy, waste management, and water treatment sectors, necessitate significant upfront capital for research and development, infrastructure, and technology deployment. This financial barrier can be especially daunting for small and medium-sized enterprises (SMEs) and developing countries, where funding is often limited.

The challenge is compounded by the slow return on investment (ROI) associated with many environmental technologies. While these technologies promise long-term cost savings and environmental benefits, the immediate financial gains are not always apparent. For instance, the installation of solar panels or the transition to a zero-waste manufacturing process involves substantial initial costs, and the break-even point can be years down the line. This slow ROI can deter businesses and governments from investing in environmental technologies, even when the long-term benefits are clear.

Furthermore, the complexity and rapid evolution of environmental technologies can present additional financial risks. Keeping pace with technological advancements requires ongoing investment in equipment upgrades and workforce training, further straining budgets. The uncertainty regarding future regulations and market demands also adds a layer of financial risk, making stakeholders hesitant to commit large sums to environmental technologies.

The financial challenges are further exacerbated in regions where there is limited access to financing options or incentives for green investments. Although various grants, subsidies, and green financing schemes are available in some countries, the lack of a unified global approach to funding environmental technology projects remains a significant barrier to market growth.

Opportunity

Digitalization and IoT Integration: Unlocking New Opportunities in the Environmental Technology Market

A significant opportunity within the Environmental Technology Market lies in the digitalization and integration of the Internet of Things (IoT) technologies. As the world becomes increasingly connected, leveraging digital tools and IoT solutions presents a transformative pathway for environmental technologies to become more efficient, accessible, and impactful. This digital shift is poised to revolutionize how we monitor, manage, and mitigate environmental challenges across various sectors, including energy, waste management, water conservation, and pollution control.

Digitalization in environmental technologies enables the real-time collection and analysis of vast amounts of data, enhancing decision-making processes and operational efficiencies. For instance, IoT-enabled sensors can monitor air and water quality with unprecedented precision, providing immediate insights for pollution control measures. Similarly, smart grids, which rely on digital communication technology, optimize electricity distribution from renewable sources, balancing supply and demand to reduce energy wastage and improve grid stability.

Furthermore, digital tools facilitate greater transparency and traceability in environmental management practices. Blockchain technology, for example, can track the lifecycle of products and materials, promoting circular economy principles and enabling more sustainable consumption patterns. This level of transparency not only helps businesses comply with regulatory standards but also meets the growing consumer demand for accountability and sustainability in production processes.

The opportunity for innovation in the Environmental Technology Market through digitalization is vast. Emerging technologies such as artificial intelligence (AI) and machine learning (ML) offer predictive capabilities to foresee environmental impacts and optimize technology deployment. For water conservation efforts, AI can predict usage patterns and identify leaks in distribution systems, significantly reducing water loss. In waste management, ML algorithms can improve sorting processes, enhancing recycling rates and material recovery.

The integration of digital and IoT technologies represents a burgeoning field within the Environmental Technology Market, promising to make environmental solutions more effective and scalable. As these technologies continue to evolve and their costs decrease, their adoption across the environmental sector is expected to accelerate, driving market growth.

Trends

Circular Economy and Zero-Waste Technologies: A Growing Trend in the Environmental Technology Market

A significant trend shaping the Environmental Technology Market is the shift towards circular economy practices and the adoption of zero-waste technologies. This movement, driven by the urgent need to reduce waste, conserve resources, and minimize environmental impact, is transforming how products are designed, used, and recycled. The circular economy aims to keep products, materials, and resources in use for as long as possible, extracting the maximum value from them while in use and recovering and regenerating products and materials at the end of their service life.

The push for circular economy practices has led to the development and implementation of innovative environmental technologies focused on resource recovery, recycling, and waste minimization. For instance, advanced recycling technologies are being deployed to process complex waste streams, such as electronic waste and plastics, into usable materials. Similarly, bio-based and biodegradable materials are being developed to replace non-renewable and difficult-to-recycle materials in products and packaging.

Zero-waste technologies, which aim to eliminate waste entirely or reduce it to the minimum, are becoming increasingly prevalent across industries. From manufacturing processes that reduce scrap materials to food production systems that utilize every part of raw materials, businesses are adopting practices and technologies that align with zero-waste principles. These efforts are not only reducing environmental impact but also driving innovation and efficiency in production processes.

The trend towards a circular economy and zero-waste technologies is also being fueled by changing regulatory landscapes and consumer demands. Governments worldwide are introducing policies and regulations that encourage circular economy practices, such as extended producer responsibility (EPR) schemes and bans on single-use plastics. Meanwhile, consumers are increasingly seeking out products and brands that prioritize sustainability and responsible resource use, further incentivizing companies to invest in circular and zero-waste technologies.

Regional Analysis

As of 2023, the Asia Pacific region has emerged as the leading market for environmental technologies, securing a dominant 49.7% market share. This impressive growth is driven by the increasing demand for sustainable and eco-friendly solutions across industries such as renewable energy, waste management, water treatment, and pollution control within key countries including China, India, Korea, Thailand, Malaysia, and Vietnam. The expansion in this region is underpinned by rising disposable incomes and a growing consumer base that is actively seeking innovative environmental solutions to address the challenges posed by rapid industrialization and urbanization.

In North America, a strong commitment to environmental stewardship and innovation in green technologies significantly boosts the demand for environmental technologies. The region’s focus on advancing renewable energy sources, enhancing waste recycling, and improving water conservation efforts, combined with a growing preference for sustainable practices, positions North America as a pivotal market for environmental technologies. The emphasis on research and development, alongside stringent environmental regulations, further solidifies the region’s role in driving the adoption of advanced environmental solutions.

Europe is also anticipated to experience significant growth in the Environmental Technology Market. This growth is fueled by the robust demand for technologies that facilitate cleaner production processes, energy efficiency, and lower carbon emissions, in line with the region’s stringent standards for environmental protection and sustainability. European consumers and industries are increasingly inclined towards solutions that offer quality, efficiency, and environmental benefits, promoting the adoption of environmental technologies across various sectors, from manufacturing to services, establishing Europe as a key contributor to the global environmental technology landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the burgeoning Environmental Technology Market, several key players lead the charge in driving innovation and sustainability across various sectors. Tesla, Inc. stands out prominently with its groundbreaking electric vehicles, solar energy solutions, and energy storage products, revolutionizing transportation and energy sectors alike.

Siemens AG also plays a pivotal role, offering a diverse array of environmental technologies encompassing renewable energy, water treatment, and waste management, showcasing a commitment to sustainable infrastructure and energy efficiency. Waste Management, Inc. emerges as a significant player, specializing in waste collection, recycling, and resource recovery services, contributing to the reduction of landfill waste and promoting a circular economy.

Market Key Players

- Abatement Technologies

- AECOM

- Arcadis N.V

- BacTech Inc.

- Carbon Clean

- CarbonCure Technologies Inc.

- Covanta Holding Corporation

- Cypher Environmental

- Hitachi Zosen Corporation

- Lennox International

- SUEZ

- Sunfire GmbH

- Svante Inc.

- Teledyne Technologies Incorporated

- Total SA

- TRC Companies Inc.

- Veolia

- Waste Connections

Recent Development

In 2023 Abatement Technologies, the company showcased its expertise through a range of advanced air purification systems, filtration devices, and HVAC solutions designed to mitigate airborne contaminants and improve indoor air quality in residential, commercial, and industrial settings.

In 2023 CarbonCure Technologies, the company continued to make significant strides, expanding its market presence globally and forging partnerships with concrete manufacturers.

Report Scope

Report Features Description Market Value (2023) USD 622.7 Bn Forecast Revenue (2033) USD 995.2 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Solutions, Services), By Technological(Waste Valorization/Recycling and Composting, Greentech/Renewable Energy (Wind Energy, Photovoltaics, and Geothermal Energy), Desalination, Bioremediation, Green Hydrogen, Carbon Capture, Utilization and Storage (CCUS), Other Technological Solutions), By Application(Wastewater Treatment, Water Purification Management, Sewage Treatment, Pollution Monitoring, Dust Emissions, Dry Steaming, Gas Dissolution, Precision Cooling, Solid Waste Treatment, Other Applications), By End-use(Industrial, Residential, Commercial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Abatement Technologies, AECOM, Arcadis N.V, BacTech Inc., Carbon Clean, CarbonCure Technologies Inc., Covanta Holding Corporation, Cypher Environmental, Hitachi Zosen Corporation, Lennox International, SUEZ, Sunfire GmbH, Svante Inc., Teledyne Technologies Incorporated, Total SA, TRC Companies Inc., Veolia, Waste Connections Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Name the major industry players in the Environmental Technology Market?Abatement Technologies, AECOM, Arcadis N.V, BacTech Inc., Carbon Clean, CarbonCure Technologies Inc., Covanta Holding Corporation, Cypher Environmental, Hitachi Zosen Corporation, Lennox International, SUEZ, Sunfire GmbH, Svante Inc., Teledyne Technologies Incorporated, Total SA, TRC Companies Inc., Veolia, Waste Connections

What is the size of Environmental Technology Market?Environmental Technology Market size is expected to be worth around USD 995.2 Billion by 2033, from USD 622.7 Billion in 2023

What CAGR is projected for the Environmental Technology Market?The Environmental Technology Market is expected to grow at 4.8% CAGR (2023-2033). Environmental Technology MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Environmental Technology MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abatement Technologies

- AECOM

- Arcadis N.V

- BacTech Inc.

- Carbon Clean

- CarbonCure Technologies Inc.

- Covanta Holding Corporation

- Cypher Environmental

- Hitachi Zosen Corporation

- Lennox International

- SUEZ

- Sunfire GmbH

- Svante Inc.

- Teledyne Technologies Incorporated

- Total SA

- TRC Companies Inc.

- Veolia

-

-

-

- Waste Connections

-

-

-