Global Indigo Dyes Market Size, Share, And Business Benefits By Type (Natural Indigo Dyes, Synthetic Indigo Dyes), By Form (Powder, Liquid, Paste), By Application (Textile Industry, Leather Industry, Paper Industry, Food Industry, Others), By Distribution Channel (Direct Sales, Indirect Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145746

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

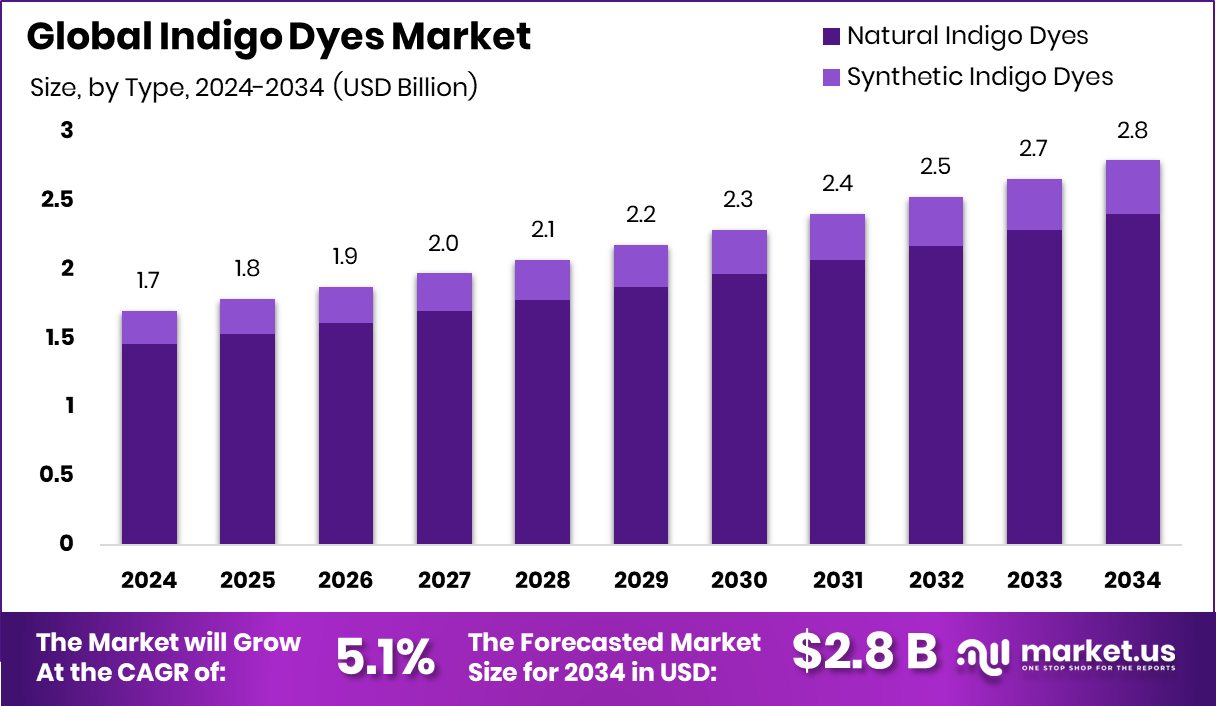

The Global Indigo Dyes Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034. Strong denim production and sustainable fashion boosted North America’s 46.20% Indigo Dyes Market growth.

Indigo dye is a natural colorant traditionally derived from the plant Indigofera tinctoria, though it can also be synthesized. It has been used for centuries in textile dyeing, particularly for denim, and remains one of the most famous and durable blue dyes in history. The deep blue hue it produces has made it a staple in the fashion and textile industries. Indigo is considered an eco-friendly alternative to synthetic dyes, appealing to those looking for more sustainable options.

The Indigo Dyes market has seen a steady rise in demand, driven by growing consumer interest in sustainable and natural products. Industries such as textiles, paints, and cosmetics are the primary consumers of indigo dyes, with an increasing emphasis on eco-consciousness and organic ingredients. This has led to both the revival of natural indigo production methods and the development of synthetic variants that mimic the traditional dye’s rich color.

The demand for Indigo Dyes is primarily fueled by the fashion industry’s shift toward sustainability. With increased awareness about harmful chemicals in synthetic dyes, both manufacturers and consumers are turning to indigo as a safer, more eco-friendly option. This shift is accelerating the adoption of indigo dye in various applications, including natural cosmetics and personal care products.

As sustainability continues to influence purchasing decisions, there are significant opportunities for indigo dye manufacturers to innovate in both natural and synthetic formulations. Rising awareness of eco-friendly products and the global push for green production methods provide ample growth prospects in emerging markets.

Key Takeaways

- The Global Indigo Dyes Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 5.1% from 2025 to 2034.

- The Indigo Dyes market is dominated by natural indigo dyes, accounting for 86.30% of sales.

- Powdered indigo dyes make up 56.40% of the market, offering convenience and effectiveness in application.

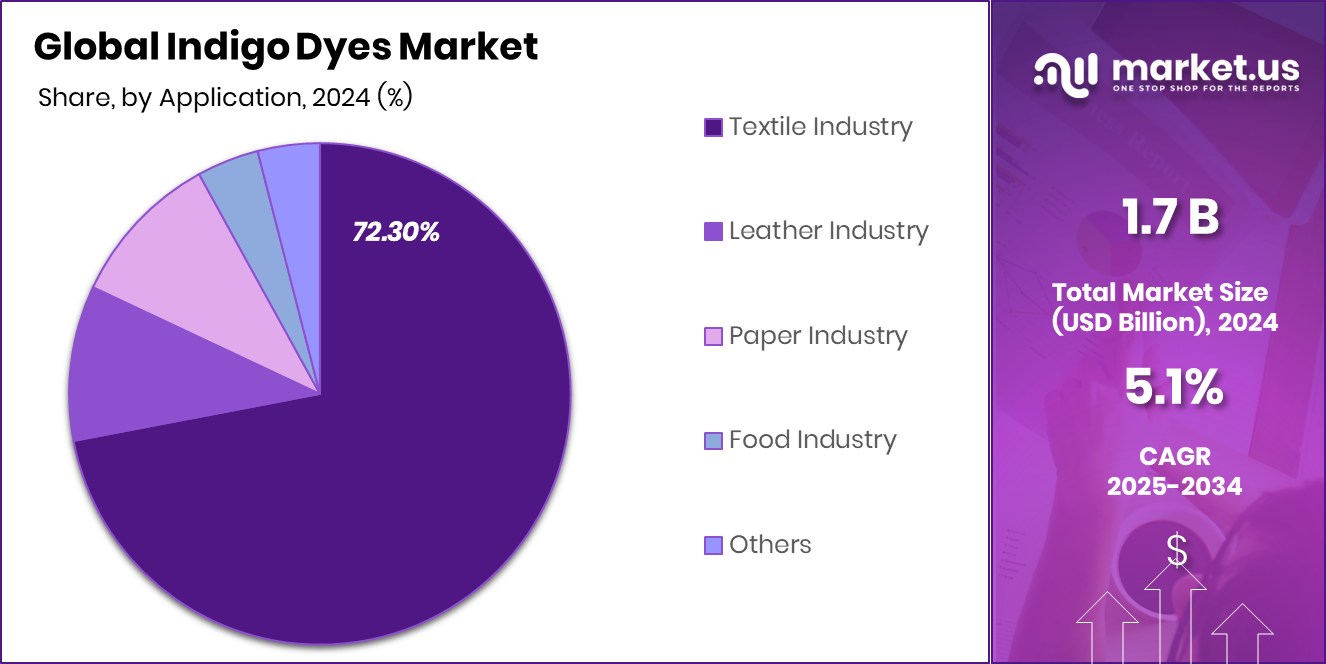

- The textile industry leads in indigo dye usage, contributing to 72.30% of the overall demand.

- Direct sales channels hold a significant share, accounting for 64.30% of indigo dye market distribution.

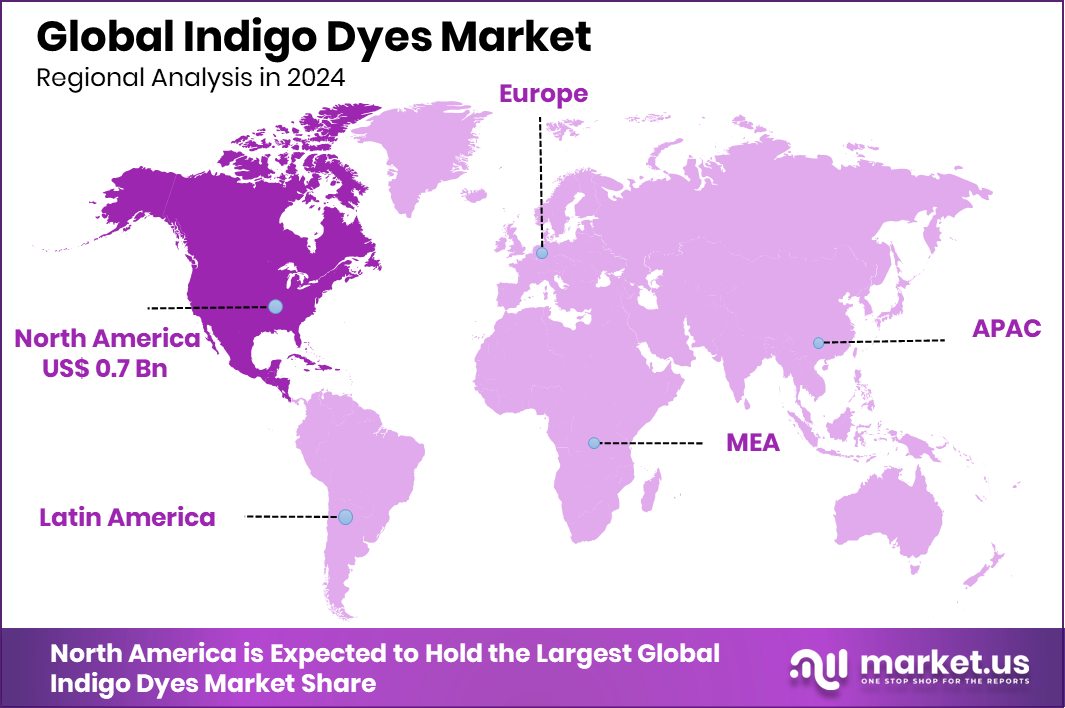

- The market in North America reached a value of USD 0.7 billion.

By Type Analysis

Natural indigo dyes account for 86.30% of the indigo dye market share.

In 2024, Natural Indigo Dyes held a dominant market position in the By Type segment of the Indigo Dyes Market, with an 86.30% share. This strong foothold can be attributed to the growing preference for plant-based, eco-friendly dyeing solutions among textile manufacturers.

Natural Indigo, traditionally extracted from Indigofera tinctoria, has seen rising demand due to stricter environmental regulations and shifting consumer trends favoring sustainable fashion. As brands move toward clean-label and biodegradable alternatives, the uptake of natural dyes has significantly outpaced synthetic variants in multiple regions.

By Form Analysis

Powdered indigo dyes dominate the market, representing 56.40% of total sales.

In 2024, Powder held a dominant market position in the By Form segment of the Indigo Dyes Market, with a 56.40% share. The widespread use of indigo dye in powder form is primarily driven by its ease of storage, long shelf life, and compatibility with a broad range of textile applications.

Powdered indigo is especially favored in traditional and industrial dyeing units where batch processing methods are prevalent, offering controlled concentration and uniform color results during dyeing operations. Its lower transportation cost due to reduced volume and weight also adds to its commercial viability across global markets.

Additionally, the powder form allows flexibility in blending and formulation, making it suitable for custom dyeing processes in the denim and fashion industry. This adaptability has enabled manufacturers to cater to a variety of fabric types and colorfastness requirements, further strengthening the dominance of powdered indigo in the supply chain.

By Application Analysis

The textile industry utilizes 72.30% of indigo dyes for dyeing fabrics and garments.

In 2024, the Textile Industry held a dominant market position in the By Application segment of the Indigo Dyes Market, with a 72.30% share. This significant market share is largely driven by the extensive use of indigo dyes in denim production, which remains a staple across global apparel markets. Indigo’s unique ability to produce the iconic blue shades essential to denim and other cotton-based textiles has sustained its high demand within the textile sector.

The textile industry’s reliance on indigo dye is further reinforced by the rise in casual wear and fashion trends emphasizing vintage and worn-in looks, which are often achieved through indigo-based dyeing techniques.

By Distribution Channel Analysis

Direct sales channels contribute 64.30% to the overall distribution of indigo dyes.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the Indigo Dyes Market, with a 64.30% share. This strong performance reflects the preference of large-scale buyers, particularly in the textile industry, to engage in direct procurement from manufacturers. Direct sales allow buyers to ensure consistent product quality, secure better pricing through bulk orders, and establish long-term supply agreements for uninterrupted operations.

Manufacturers benefit from direct sales by building strong relationships with textile producers and reducing costs associated with intermediaries. This approach also enables faster response times, better customization of dye formulations, and direct feedback channels, which are essential for industries with strict quality standards like apparel and denim manufacturing.

Key Market Segments

By Type

- Natural Indigo Dyes

- Synthetic Indigo Dyes

By Form

- Powder

- Liquid

- Paste

By Application

- Textile Industry

- Leather Industry

- Paper Industry

- Food Industry

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Driving Factors

Rising Demand for Sustainable Textile Dyeing Solutions

One of the biggest drivers of the Indigo Dyes Market is the growing demand for eco-friendly textile dyeing. As more people and fashion brands focus on protecting the environment, they are choosing dyes that come from natural sources.

Natural indigo dye is plant-based and biodegradable, making it safer for workers and better for the planet. Many clothing companies now prefer to use sustainable dyes in denim and cotton fabrics.

Governments and buyers are also pushing for cleaner production methods, especially in countries with strong textile industries. This shift toward green fashion is helping the indigo dyes market grow quickly. It is also opening up new opportunities for producers of natural indigo to meet rising global demand.

Restraining Factors

High Production Costs of Natural Indigo Dyes

One major challenge in the Indigo Dyes Market is the high cost of producing natural indigo dyes. Making dye from plants takes a lot of time, effort, and land. It also requires careful handling and traditional processing, which makes it more expensive than synthetic dyes.

For many small and mid-size textile companies, these higher prices can be a problem, especially in price-sensitive markets. Synthetic dyes, though less eco-friendly, are cheaper and easier to produce in bulk.

This cost difference slows down the shift toward natural options, even though they are better for the environment. As a result, high production costs remain a strong barrier to the wider adoption of natural indigo dyes across the industry.

Growth Opportunity

Growing Use in Organic and Sustainable Fashion

A major growth opportunity for the Indigo Dyes Market lies in the rising popularity of organic and sustainable fashion. More consumers today want clothes made from natural materials and eco-friendly dyes.

Natural indigo, which comes from plants, fits perfectly into this trend. Brands are now focusing on green labels and certifications, which often require the use of non-toxic, biodegradable dyes. Indigo is especially popular in denim and handmade garments, making it a good choice for eco-fashion collections.

As awareness about environmental issues grows, both small designers and big clothing companies are looking for natural dye alternatives. This shift opens new doors for natural indigo producers to expand their customer base and enter high-value, eco-conscious markets worldwide.

Latest Trends

Adoption of Eco-Friendly Dyeing Techniques

A significant trend in the indigo dyes market is the increasing adoption of eco-friendly dyeing techniques. As environmental concerns grow, both manufacturers and consumers are seeking sustainable alternatives to traditional synthetic dyes, which often involve toxic chemicals and excessive water usage.

Natural indigo dye, derived from plants, offers a biodegradable and less polluting option. This shift is particularly evident in the denim industry, where brands are exploring natural indigo for limited-edition items and sustainable fashion lines.

However, the labor-intensive and time-consuming production process of natural indigo poses challenges for large-scale adoption. Despite these hurdles, the push for greener dyeing methods continues to influence market dynamics, encouraging innovation and a reevaluation of traditional practices.

Regional Analysis

In 2024, North America held a 46.20% share of the Indigo Dyes Market.

In 2024, North America dominated the Indigo Dyes Market with a 46.20% share, reaching a market value of USD 0.7 billion. This leadership position is largely driven by the region’s strong denim production industry and increasing shift toward sustainable and natural dyes in the apparel sector. Major brands across the United States and Canada have adopted eco-conscious manufacturing practices, further boosting demand for natural indigo dyes.

Europe followed closely, with steady demand supported by the region’s growing organic textile movement and strict environmental regulations encouraging the use of plant-based dyes. The Asia Pacific region also held a significant share of the market, driven by its large-scale textile production hubs in countries like India, China, and Bangladesh. However, cost sensitivity and continued reliance on synthetic dyes slightly moderated growth.

The Middle East & Africa region showed moderate growth, primarily supported by expanding textile industries in parts of North Africa. Latin America contributed a smaller share to the overall market, but showed emerging potential with increasing interest in artisanal and sustainable clothing lines.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global indigo dyes market experienced significant developments, with key players such as Clariant AG, DyStar, and Hangzhou Fucai Chem Co., Ltd. making notable contributions.

Clariant AG continued to focus on sustainability and innovation within the specialty chemicals sector. The company reported that 36% of its sales were directed toward consumer industries, including textiles, indicating a substantial involvement in the dyes market. Clariant’s commitment to sustainable products aligns with the increasing demand for eco-friendly indigo dyes in the textile industry.

DyStar maintained its position as a leading supplier of textile dyes, offering an extensive product range that covers almost all fibers and quality specifications. The company’s adherence to international legal requirements and compliance with brand and retailer restricted substance lists (RSL) underscores its dedication to quality and regulatory standards.

Hangzhou Fucai Chem Co., Ltd., a Chinese manufacturer, specializes in producing various dyes, including indigo blue, disperse dyes, and reactive dyes. The company’s emphasis on high-quality products and technical expertise has enabled it to serve a broad international market, contributing to the global supply of indigo dyes.

Top Key Players in the Market

- AMA Herbal

- Archroma

- Atul Ltd.

- Clariant AG

- Dystar

- Hangzhou Fucai Chem Co.,Ltd

- Jacquard Products

- Jihua Group

- Kiri Industries Ltd.

- Kirpal

- Kyung-In Synthetic Corporation

- Matrix Pharma Chem

- Megha International

- Sumitomo Chemical Co., Ltd.

- Taiwan Dyestuffs & Pigments Corp.

- Yucheng Jinhe Industrial Co.,Ltd

Recent Developments

- In May 2024, AMA Herbal Group introduced Bio Indigo PReR™, a pre-reduced natural indigo dye in liquid form. This innovative product is designed to offer an eco-friendly and efficient solution for textile dyeing, aiming to reduce environmental impact. The development reflects AMA Herbal’s commitment to sustainable practices in the textile industry.

- In April 2024, Archroma, G-Star RAW, and Advance Denim renewed their commitment to producing aniline-free denim apparel using DENISOL® PURE INDIGO 30, aiming to reduce the environmental impact of denim production.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural Indigo Dyes, Synthetic Indigo Dyes), By Form (Powder, Liquid, Paste), By Application (Textile Industry, Leather Industry, Paper Industry, Food Industry, Others), By Distribution Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AMA Herbal, Archroma, Atul Ltd., Clariant AG, Dystar, Hangzhou Fucai Chem Co.,Ltd, Jacquard Products, Jihua Group, Kiri Industries Ltd., Kirpal, Kyung-In Synthetic Corporation, Matrix Pharma Chem, Megha International, Sumitomo Chemical Co., Ltd., Taiwan Dyestuffs & Pigments Corp., Yucheng Jinhe Industrial Co.,Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMA Herbal

- Archroma

- Atul Ltd.

- Clariant AG

- Dystar

- Hangzhou Fucai Chem Co.,Ltd

- Jacquard Products

- Jihua Group

- Kiri Industries Ltd.

- Kirpal

- Kyung-In Synthetic Corporation

- Matrix Pharma Chem

- Megha International

- Sumitomo Chemical Co., Ltd.

- Taiwan Dyestuffs & Pigments Corp.

- Yucheng Jinhe Industrial Co.,Ltd