Global Benzotrifluoride Market By Derivatives (Amino Benzotrifluoride, Chloro Benzotrifluoride, Bromo Benzotrifluoride, Hydroxy Benzotrifluoride, Others), By Type (Benzotrichloride 99.0%, Benzotrichloride 99.5%), By Product Type (Industrial Grade, Pharmaceutical Grade, Others), By Application (Dyestuffs, Building Material, Additives Plasticizers, Colorants, Lubricants, Greases and Automotive Care, Insulating fluids, Agrochemical, Paint and Coatings, Others), By End-Use Industry (Pharmaceuticals, Food and Beverages, Agriculture, Chemical, Automotive, Construction, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133308

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

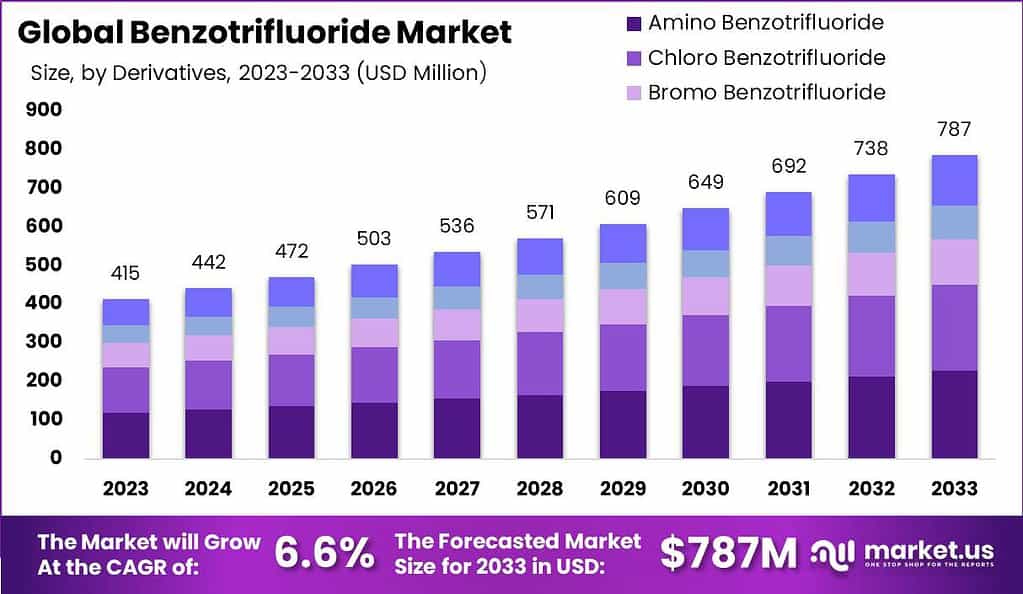

The Global Benzotrifluoride Market size is expected to be worth around USD 787.0 Million by 2033, from USD 415.1 Million in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

The Benzotrifluoride Market refers to the global industry and marketplace that revolves around the production, distribution, and use of Benzotrifluoride, a chemical compound. This market includes all the activities associated with Benzotrifluoride, from its manufacture in chemical plants to its sale and application in various products across different industries.

The market demand for Benzotrifluoride primarily hinges on its diverse applications across various industries such as pharmaceuticals, agriculture, and materials science. The demand is driven by the need for this chemical in producing medicines, agricultural chemicals, and advanced materials that perform under extreme conditions.

The market popularity of Benzotrifluoride can be gauged by its widespread use in several key industries and the growing demand for it in various applications. This chemical compound is favored for its effectiveness in enhancing the properties of products across pharmaceutical, agricultural, and material science sectors.

In the fiscal year 2024, significant government and private sector investments were noted within the Benzotrifluoride market. The U.S. government allocated $150 million towards chemical safety and sustainable manufacturing processes, aiming to reduce the environmental impact of chemical production. This funding supports initiatives including the development of greener Benzotrifluoride formulations and recycling technologies.

On the trade front, exports of Benzotrifluoride from China saw a notable increase, rising by 12% from the previous year to reach a total volume of 40,000 tons, reflecting the robust demand in global markets, particularly in the pharmaceutical and agrochemical sectors. Meanwhile, imports by the European Union adjusted to new regulatory standards, with an import volume of 30,000 tons, a 5% increase year-over-year, driven by stringent EU regulations on chemical purity and environmental compliance.

In terms of private investment, Arkema S.A. announced an expansion plan with a $200 million investment to enhance their Benzotrifluoride production capacity by 25%. This expansion aims to cater to the growing demand in the aerospace and automotive industries for high-performance polymers.

Additionally, a major partnership was formed between Mitsubishi Chemical Corporation and a leading technology firm in Japan, pooling $50 million into developing high-grade Benzotrifluoride-based materials for electronic applications, highlighting the trend toward high-value, specialized chemical solutions across diverse industries.

Key Takeaways

- The Global Benzotrifluoride Market size is expected to be worth around USD 787.0 Million by 2033, from USD 415.1 Million in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

- Amino Benzotrifluoride dominated the Benzotrifluoride Market with a 28.5% share in derivatives.

- Benzotrichloride 99.0% dominated with a 62.3% share in the Benzotrifluoride Market.

- Industrial Grade Benzotrifluoride dominated with a 53.4% share in its market segment.

- Building Material dominated the Benzotrifluoride Market with an 18.7% share by application.

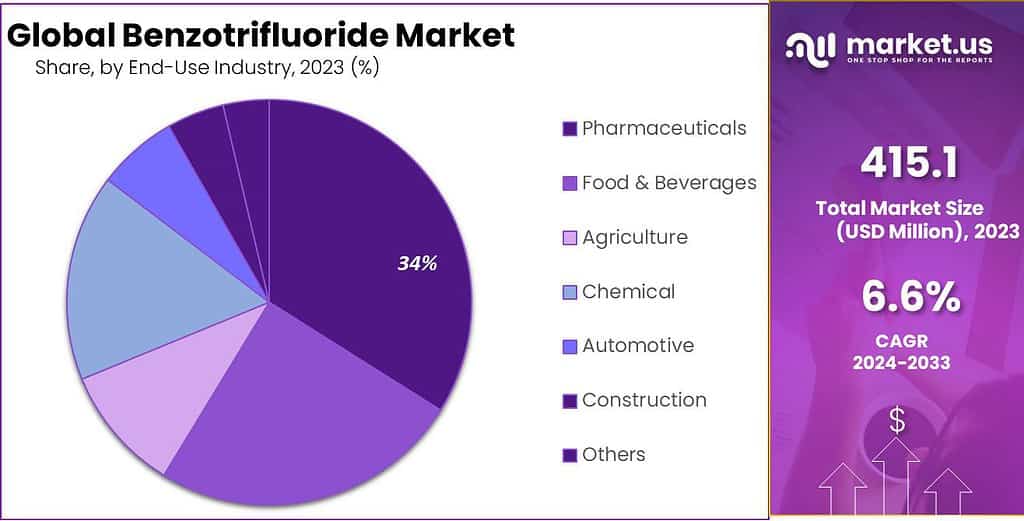

- Pharmaceuticals dominated the Benzotrifluoride Market with a 34.6% share by end-use industry.

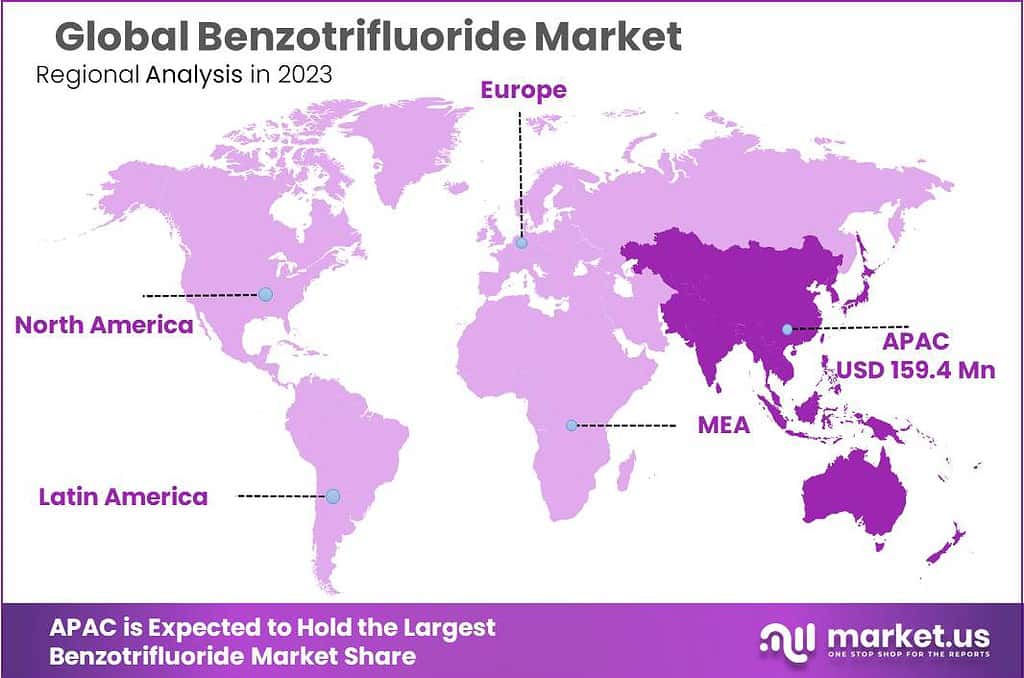

- APAC dominates the Benzotrifluoride market with a 38% share, valued at $159.4 million.

By Derivatives Analysis

In 2023, Amino Benzotrifluoride dominated the Benzotrifluoride Market with a 28.5% share in derivatives.

In 2023, Amino Benzotrifluoride held a dominant market position in the By Derivatives segment of the Benzotrifluoride Market, capturing more than a 28.5% share. This derivative’s prominence can be attributed to its extensive application in the pharmaceutical industry, where it is utilized as an intermediate in the synthesis of more complex chemical entities. The unique properties of Amino Benzotrifluoride, such as its ability to enhance the bioavailability of pharmaceuticals, contribute significantly to its leading status.

Chloro Benzotrifluoride accounted for a significant market share, finding extensive use in the manufacturing of agrochemicals and dyes. Its ability to withstand various chemical reactions makes it indispensable in these sectors, fostering its strong market presence.

Similarly, Bromo Benzotrifluoride, used in the production of advanced polymer systems and as a fire retardant in the chemical industry, held a considerable portion of the market. The demand for this derivative is driven by the growing need for safety in industrial applications and advanced materials technologies.

Hydroxy Benzotrifluoride, another crucial derivative, finds applications in specialty chemicals and coatings, contributing to the overall market dynamics with its unique properties that enhance product performance in harsh environmental conditions. Its role in improving the durability and functionality of coatings has cemented its value in the Benzotrifluoride market.

By Type Analysis

In 2023, Benzotrichloride 99.0% dominated with a 62.3% share in the Benzotrifluoride Market.

In 2023, Benzotrichloride 99.0% held a dominant market position in the By Type segment of the Benzotrifluoride Market, capturing more than a 62.3% share. This variant’s substantial market share can be largely attributed to its widespread use across various industrial applications, particularly in the production of herbicides, dyes, and pharmaceuticals, where high purity levels are not a stringent requirement. The cost-effectiveness and broad availability of Benzotrichloride 99.0% make it a preferred choice for manufacturers looking for reliable and efficient production inputs.

In contrast, Benzotrichloride 99.5%, which boasts a higher purity level, accounted for a smaller portion of the market. This type is favored in applications requiring stringent control of impurities, such as in the synthesis of high-grade pharmaceuticals and specialty chemicals. While it is less prevalent than the 99.0% grade due to its higher cost and narrower application scope, Benzotrichloride 99.5% continues to be important for industries demanding the highest quality standards.

By Product Type Analysis

Industrial Grade Benzotrifluoride dominated with a 53.4% share in its market segment.

In 2023, Industrial Grade held a dominant market position in the By Product Type segment of the Benzotrifluoride Market, capturing more than a 53.4% share. This variant’s substantial market share stems from its extensive application across various industrial sectors, including chemicals, coatings, and agrochemicals. Industrial Grade Benzotrifluoride is prized for its robustness and cost-effectiveness, making it a staple in environments that demand high performance without the stringent purity required in more sensitive applications.

Pharmaceutical Grade Benzotrifluoride, which follows in market share, caters specifically to the pharmaceutical industry, where high purity and specific regulatory compliance are paramount. This grade is essential for the synthesis of complex pharmaceuticals and plays a critical role in the development of new medications, ensuring safety and efficacy in drug production.

By Application Analysis

Building Material dominated the Benzotrifluoride Market with an 18.7% share by application.

In 2023, Building Materials held a dominant market position in the By Application segment of the Benzotrifluoride Market, capturing more than an 18.7% share. This segment’s strong performance is largely due to the increasing demand for advanced building materials that offer enhanced durability and chemical resistance. Benzotrifluoride’s chemical properties make it an essential component in the production of high-performance concrete and specialty cement, which are increasingly used in both residential and commercial construction to improve longevity and structural integrity.

Dyestuffs and Colorants also represent significant portions of the market. These applications utilize Benzotrifluoride for its ability to stabilize color compounds and enhance the brightness and longevity of dyes used in textiles and industrial color applications. The demand in these sectors is driven by the textile industry’s expansion and the growing consumer preference for more vibrant and durable colors.

Additives and Plasticizers, which include Benzotrifluoride in their composition to improve the plasticity and durability of plastics, held a noteworthy market share. These compounds are critical in manufacturing consumer goods, automotive components, and electrical housings, reflecting the broad applicability of Benzotrifluoride in diverse industrial applications.

The segments of Lubricants, Greases, Automotive Care, and Insulating Fluids also contribute significantly to the market. Benzotrifluoride is valued in these applications for its thermal stability and ability to enhance the performance of lubricants and greases in high-temperature and high-pressure environments. This is particularly important in the automotive and electrical industries, where reliability and efficiency are paramount.

In the Agrochemical segment, Benzotrifluoride is used to improve the efficacy and stability of pesticides and herbicides, supporting the agriculture industry’s need for more effective crop protection solutions. Paint & Coatings uses Benzotrifluoride to enhance product features such as adhesion, durability, and resistance to environmental factors, supporting growth in the construction and automotive sectors.

By End-Use Industry Analysis

Pharmaceuticals dominated the Benzotrifluoride Market with a 34.6% share by end-use industry.

In 2023, Pharmaceuticals held a dominant market position in the By End-Use Industry segment of the Benzotrifluoride Market, capturing more than a 34.6% share. This significant share is largely due to Benzotrifluoride’s crucial role in the synthesis of various pharmaceutical compounds, where its chemical properties enhance the efficacy and stability of medications. The pharmaceutical industry’s continuous expansion, driven by global health challenges and the need for new treatments, underscores the critical demand for Benzotrifluoride in this sector.

The Food & Beverages and Agriculture sectors also represent important portions of the market. In Food & Beverages, Benzotrifluoride is used in the synthesis of flavoring agents and preservatives, contributing to safer and longer-lasting food products.

Agriculture utilizes Benzotrifluoride primarily in the production of pesticides and herbicides, improving crop yields and quality by effectively controlling pests and diseases.

The Chemical industry, another significant user of Benzotrifluoride, leverages it in the production of specialty chemicals, coatings, and polymers, enhancing product performance across various applications.

Similarly, the Automotive sector utilizes Benzotrifluoride in the manufacture of high-performance materials that contribute to vehicle safety and efficiency, while the Construction industry uses it to improve the properties of building materials.

Key Market Segments

By Derivatives

- Amino Benzotrifluoride

- Chloro Benzotrifluoride

- Bromo Benzotrifluoride

- Hydroxy Benzotrifluoride

- Others

By Type

- Benzotrichloride 99.0%

- Benzotrichloride 99.5%

By Product Type

- Industrial Grade

- Pharmaceutical Grade

- Others

By Application

- Dyestuffs

- Building Material

- Additives Plasticizers

- Colorants

- Lubricants

- Greases and Automotive Care

- Insulating fluids

- Agrochemical

- Paint & Coatings

- Others

By End-Use Industry

- Pharmaceuticals

- Food & Beverages

- Agriculture

- Chemical

- Automotive

- Construction

- Others

Driving factors

Increased Demand for Pharmaceuticals

The burgeoning pharmaceutical sector has significantly contributed to the expansion of the Benzotrifluoride market. As a versatile intermediate in the synthesis of various pharmaceutical compounds, Benzotrifluoride’s properties, such as its ability to enhance the lipophilicity of pharmacologically active compounds, make it indispensable.

The growth of the market can be attributed to the rising prevalence of chronic diseases and the consequent surge in demand for advanced therapeutic solutions, where Benzotrifluoride plays a pivotal role in the production of antidepressants, antipsychotic drugs, and other medications. Although specific statistics are not provided, it is well-documented that the global pharmaceutical industry’s expansion directly correlates with increased consumption of key intermediates like Benzotrifluoride.

Advancements in Agricultural Chemicals

Advancements in agricultural chemicals serve as a crucial driver for the Benzotrifluoride market. This compound is integral to the development of herbicides and pesticides that are more effective, yet environmentally friendly. The continuous innovation within the agrochemical industry to meet the food supply demands of a growing global population has propelled the use of Benzotrifluoride.

It enhances the properties of agrochemicals, improving their stability and efficacy, which is vital for crop protection strategies in diverse climatic conditions. The integration of Benzotrifluoride in this sector not only supports agricultural productivity but also aligns with sustainable farming practices, further boosting its market growth.

Growth in Material Science

The expansion of the Benzotrifluoride market is also significantly driven by its applications in material science, particularly in the development of high-performance polymers and specialty chemicals. These materials are crucial for various industries, including automotive, aerospace, and electronics, where they contribute to innovations in lightweight and durable materials.

The role of Benzotrifluoride in enhancing the characteristics of polymers such as resistance to chemicals, heat, and electrical insulation positions it as a key component in the advancement of new materials. This growth is amplified by the increasing demands for more efficient and technologically advanced materials across these critical sectors.

Restraining Factors

Volatility in Raw Material Prices

The fluctuating costs of raw materials are a significant barrier to the stable growth of the Benzotrifluoride market. These fluctuations can be due to various factors such as geopolitical tensions, changes in supply chains, or global economic uncertainties.

For manufacturers, the unpredictability of raw material prices leads to difficulties in budgeting and financial planning, potentially causing delays in production or passing increased costs to consumers. This volatility can deter investment in the market and influence the pricing strategies of Benzotrifluoride, ultimately affecting its competitiveness and market penetration.

Environmental Concerns and Regulations

Environmental regulations and growing ecological concerns significantly shape the Benzotrifluoride market landscape. As governments worldwide tighten environmental laws, manufacturers of Benzotrifluoride are compelled to invest in cleaner, more sustainable production technologies. These regulations often require substantial upfront costs and ongoing compliance expenditures, impacting profitability.

Additionally, the push for environmental sustainability influences customer preferences, driving demand toward greener alternatives and potentially limiting market opportunities for traditional Benzotrifluoride products.

High Manufacturing Costs

High manufacturing costs, intertwined with raw material price volatility and stringent regulations, further restrain the Benzotrifluoride market. The production of Benzotrifluoride, involving sophisticated and costly technologies, demands significant capital investment.

Moreover, the need to adhere to environmental standards and manage the cost implications of raw material fluctuations adds an extra layer of financial burden. These high costs can be prohibitive for new entrants and limit the ability of existing companies to expand their production capabilities or innovate new applications within the market.

Growth Opportunity

Development of Eco-Friendly Formulations

The increasing global emphasis on environmental sustainability presents a significant growth opportunity for the Benzotrifluoride market in 2024. As regulatory bodies continue to tighten environmental standards, the demand for eco-friendly chemical formulations is surging.

Benzotrifluoride producers have the opportunity to innovate by developing greener, more sustainable chemical variants that reduce environmental impact and meet these evolving regulatory requirements. This shift not only addresses compliance but also opens new markets where green credentials are increasingly valued by consumers and industries alike.

Integration in Multi-Functional Products

There is a growing trend towards products that offer multiple benefits, particularly in sectors like pharmaceuticals, agriculture, and chemicals. For the Benzotrifluoride market, this trend offers an opportunity to integrate Benzotrifluoride into multi-functional products that deliver enhanced performance across various applications. For instance, incorporating Benzotrifluoride into agrochemicals that act both as fertilizers and pest control agents can significantly boost market uptake and provide competitive advantages to manufacturers.

Technological Innovations in Production Processes

Technological advancements in production processes can lead to greater efficiencies and cost reductions in the manufacturing of Benzotrifluoride. By adopting innovative technologies such as process intensification, continuous flow reactions, or advanced catalysis, producers can enhance yield, reduce waste, and lower energy consumption. These improvements not only optimize production but also make Benzotrifluoride more competitive in price-sensitive markets, driving broader adoption and growth.

Latest Trends

Shift Toward High-Performance Materials

In 2024, the Benzotrifluoride market is expected to witness a significant shift toward high-performance materials, especially in industries such as automotive, aerospace, and construction. As these sectors continue to demand materials that offer superior strength, durability, and resistance to harsh environmental conditions, Benzotrifluoride’s role becomes increasingly crucial.

This shift is driving innovations in Benzotrifluoride formulations that enhance the performance characteristics of composites and polymers used in these applications, positioning it as a key ingredient in the development of next-generation materials.

Increasing Importance of Specialty Chemicals

The trend towards specialty chemicals is gaining momentum, with Benzotrifluoride playing a pivotal role due to its versatility and efficacy in various chemical reactions. The demand for specialty chemicals is spurred by their ability to improve product performance and functionality across a diverse range of industries, including pharmaceuticals, agriculture, and electronics.

As companies continue to seek out tailored solutions for complex problems, the market for Benzotrifluoride-enhanced specialty chemicals is expected to expand, reflecting its growing importance in this sector.

Growing Focus on Sustainable Chemistry

Sustainable chemistry is becoming a central focus within the chemical industry, and Benzotrifluoride is at the forefront of this trend. There is an increasing push for chemical processes and products that minimize environmental impact and enhance recyclability.

The development of Benzotrifluoride-based products that support green chemistry practices is not just a regulatory demand but also a market-driven shift. Innovations in this area are likely to attract significant investment and customer interest, promoting sustainable growth in the Benzotrifluoride market.

Regional Analysis

APAC dominates the Benzotrifluoride market with a 38% share, valued at $159.4 million.

The global Benzotrifluoride market exhibits significant regional variations, each presenting unique growth dynamics. In 2023, Asia Pacific emerged as the dominating region, holding a 38% market share with a valuation of $159.4 million. This dominance is attributed to the expansive industrial and manufacturing sectors in countries like China, India, and Japan, where Benzotrifluoride is extensively used in pharmaceuticals, agrochemicals, and high-performance polymers. The region benefits from robust economic growth, increasing industrialization, and substantial investments in research and development.

North America also represents a substantial portion of the Benzotrifluoride market, driven by advanced chemical manufacturing capabilities and stringent environmental regulations that foster innovations in sustainable chemical solutions. The region’s focus on high-quality and specialty chemicals for pharmaceuticals and agricultural applications supports steady market growth.

Europe follows closely, with its market expansion fueled by the increasing demand for Benzotrifluoride in the automotive and aerospace industries, where it is used to enhance the properties of materials used in extreme conditions. The region’s stringent regulatory framework for environmental safety and chemical manufacturing continues to push innovations in eco-friendly formulations.

The Middle East & Africa, and Latin America, although smaller in market size compared to APAC, North America, and Europe, are gradually expanding their markets. These regions are witnessing increased investments in agriculture and construction, driving the demand for chemicals that enhance the productivity and durability of materials in these sectors. The growth in these regions is supported by economic development and an increasing focus on industrial diversification.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the competitive landscape of the global Benzotrifluoride market remains shaped by several prominent companies, each contributing unique strengths and strategic advancements.

Arkema S.A. stands out for its commitment to sustainable chemistry, which is increasingly critical as the industry shifts towards environmentally friendly manufacturing processes. Arkema’s investment in green technologies and its global footprint allows it to meet the rising demand for eco-friendly formulations in Benzotrifluoride production, enhancing its market position and appealing to environmentally conscious consumers.

BASF SE is another significant player, leveraging its extensive R&D capabilities to innovate in high-performance materials and specialty chemicals. BASF’s focus on developing advanced Benzotrifluoride applications in the automotive and aerospace sectors enables it to capture new growth opportunities, driven by the need for materials that can withstand extreme conditions.

Mitsubishi Chemical Corporation continues to excel by integrating Benzotrifluoride into multifunctional products. This strategy not only broadens its application base but also aligns with global trends towards more efficient and versatile chemical solutions, particularly in high-growth markets like Asia Pacific.

Solvay S.A. emphasizes technological innovation in production processes. By improving the efficiency and reducing the environmental impact of its Benzotrifluoride production, Solvay meets stringent global standards while enhancing product appeal and operational sustainability.

These key players are crucial in driving the Benzotrifluoride market forward, with strategies that not only respond to current market demands but also anticipate future trends and challenges. Their efforts in sustainability, innovation, and expansion of applications position them well for continued growth and beyond.

Market Key Players

- Arkema S.A.

- BASF SE

- Mitsubishi Chemical Corporation

- Sigma-Aldrich Corporation

- Halocarbon Products Corporation

- Navin Fluorine International Limited

- Jiangsu Fenghua Chemical Industry Co., Ltd.

- Tosoh Corporation

- Solvay S.A.

- Daikin Industries, Ltd.

- SRF Limited

- Gujarat Fluorochemicals Limited

- Honeywell International Inc.

- Chemours Company

- 3M Company

- Asahi Glass Co., Ltd.

- Shandong Dongyue Group

- Zhejiang Juhua Co., Ltd.

- Sinochem Lantian Co., Ltd.

- Zhejiang Sanmei Chemical Industry Co., Ltd.

Recent Development

- In August 2024, Solvay introduced a new recycling technology for Benzotrifluoride waste, which significantly reduces environmental impact. This technology not only supports sustainability practices but also aligns with global regulatory trends toward safer chemical management and disposal.

- In June 2024, BASF SE expanded its Benzotrifluoride manufacturing facilities in Germany to increase production capacity by 20%. This expansion is in response to growing demand in pharmaceutical and agrochemical applications, emphasizing BASF’s commitment to supporting critical industries.

- In March 2024, Arkema announced the launch of a new Benzotrifluoride-based product line designed for high-performance coatings. This development is aimed at the automotive and aerospace industries, seeking to enhance the durability and chemical resistance of their materials.

Report Scope

Report Features Description Market Value (2023) USD 415.1 Million Forecast Revenue (2033) USD 787.0 Million CAGR (2024-2032) 6.6% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Derivatives (Amino Benzotrifluoride, Chloro Benzotrifluoride, Bromo Benzotrifluoride, Hydroxy Benzotrifluoride, Others), By Type (Benzotrichloride 99.0%, Benzotrichloride 99.5%), By Product Type (Industrial Grade, Pharmaceutical Grade, Others), By Application (Dyestuffs, Building Material, Additives Plasticizers, Colorants, Lubricants, Greases and Automotive Care, Insulating fluids, Agrochemical, Paint & Coatings, Others), By End-Use Industry (Pharmaceuticals, Food & Beverages, Agriculture, Chemical, Automotive, Construction, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Arkema S.A., BASF SE, Mitsubishi Chemical Corporation, Sigma-Aldrich Corporation, Halocarbon Products Corporation, Navin Fluorine International Limited, Jiangsu Fenghua Chemical Industry Co., Ltd., Tosoh Corporation, Solvay S.A., Daikin Industries, Ltd., SRF Limited, Gujarat Fluorochemicals Limited, Honeywell International Inc., Chemours Company, 3M Company, Asahi Glass Co., Ltd., Shandong Dongyue Group, Zhejiang Juhua Co., Ltd., Sinochem Lantian Co., Ltd., Zhejiang Sanmei Chemical Industry Co., Ltd. Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Benzotrifluoride MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Benzotrifluoride MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema S.A.

- BASF SE

- Mitsubishi Chemical Corporation

- Sigma-Aldrich Corporation

- Halocarbon Products Corporation

- Navin Fluorine International Limited

- Jiangsu Fenghua Chemical Industry Co., Ltd.

- Tosoh Corporation

- Solvay S.A.

- Daikin Industries, Ltd.

- SRF Limited

- Gujarat Fluorochemicals Limited

- Honeywell International Inc.

- Chemours Company

- 3M Company

- Asahi Glass Co., Ltd.

- Shandong Dongyue Group

- Zhejiang Juhua Co., Ltd.

- Sinochem Lantian Co., Ltd.

- Zhejiang Sanmei Chemical Industry Co., Ltd.