Global Ethylene Oxide Market By Derivative(Ethylene Glycols, Ethoxylates, Ethanolamines, Glycol Ethers, Polyethylene Glycol, Others) ,By End-user Industry(Automotive, Agrochemicals, Food and Beverage, Textile, Personal Care, Pharmaceuticals, Detergents, Others), By Function(Sterilizing Agent, Fumigating Agent, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123603

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

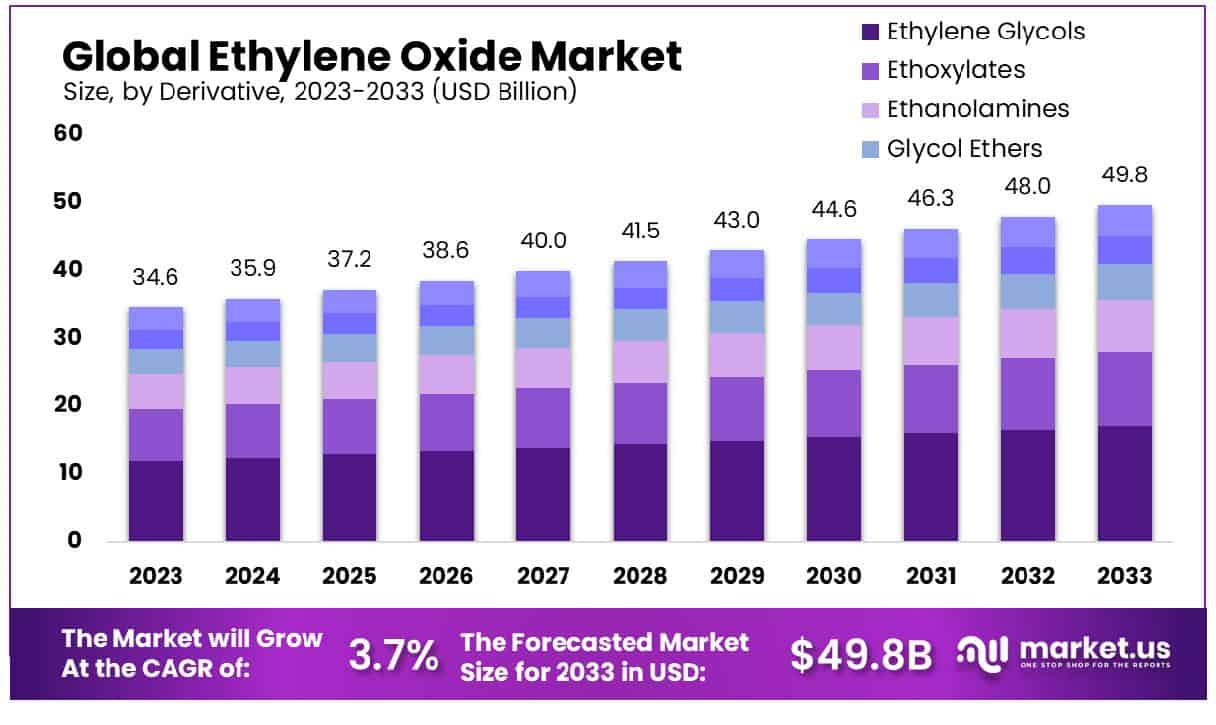

The Global Ethylene Oxide Market size is expected to be worth around USD 49.8 Billion by 2033, From USD 34.6 Billion by 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2033.

The Ethylene Oxide Market encompasses the production, distribution, and application of ethylene oxide, a critical organic compound primarily used as an intermediate in the manufacture of various industrial chemicals. It is pivotal in producing ethylene glycol, which is integral in the production of polyester fibers, automotive antifreeze, and resins.

Additionally, it serves significant roles in sterilization processes for medical equipment and as a fumigant. This market’s growth is driven by rising demands in key sectors such as automotive, textiles, and healthcare, particularly in emerging economies. Strategic insights into this market are essential for senior executives aiming to capitalize on these expanding applications.

The Ethylene Oxide market is currently experiencing significant shifts driven by the robust demand across various applications including antifreeze, textiles, and detergents. As a critical component in the production of ethylene glycol, the importance of Ethylene Oxide cannot be overstated, especially in regions experiencing rapid industrial growth.

In India, a key player in the global chemical landscape, the production of major chemicals and petrochemicals reached 26,570 thousand metric tons from April to September 2022. This reflects a continuing growth trend with a Compound Annual Growth Rate (CAGR) of 4.61% from 2017 to 2022. Such growth underscores the expanding capacity and output within the sector, directly impacting the Ethylene Oxide market due to its integral role in the larger chemical production ecosystem.

Moreover, the chemical sector’s contribution to India’s Gross Value Added (GVA) in manufacturing has seen a noteworthy increase, climbing to 15.39% in 2020-21 from 13.61% in the preceding year. This growth not only highlights the sector’s expanding economic footprint but also signals a favorable environment for the Ethylene Oxide market, propelled by governmental and industrial support in scaling production capabilities.

Key Takeaways

- The Global Ethylene Oxide Market is projected to grow from USD 34.6 billion in 2023 to USD 49.8 billion by 2033, expanding at a CAGR of 3.7%.

- Asia-Pacific holds 43.1% of the Ethylene Oxide Market, valued at USD 14.9 billion.

- Ethylene Glycols dominate the derivatives segment at 34.5%, essential for various applications.

- The automotive industry, the largest end-user, constitutes 34.2% of market demand.

- Sterilizing agents lead functions, representing 57.2% due to essential medical uses.

Driving Factors

Boosting Demand for Ethylene Derivatives in Automotive and Textile Industries

The surge in the demand for ethylene derivatives, particularly in the automotive and textile industries, significantly propels the Ethylene Oxide Market. Ethylene derivatives like ethylene glycol are extensively used in the production of automotive antifreeze and coolants, as well as polyester fibers in textiles. The automotive industry relies on these derivatives for efficient engine performance and vehicle maintenance, while the textile industry utilizes them to produce durable and versatile fabrics.

As global automotive production and textile manufacturing volumes increase, the demand for ethylene oxide correspondingly rises. This trend is particularly evident in emerging economies where industrial growth is rapid, thereby driving significant market expansion for ethylene oxide.

Expansion of Antifreeze Production in Colder Climates

In colder climates, the expansion of antifreeze production is a critical driver for the Ethylene Oxide Market. Ethylene glycol, a primary derivative of ethylene oxide, is a key component in antifreeze formulations, providing the necessary properties to prevent freezing and overheating in automotive engines.

As temperatures drop, the demand for effective antifreeze solutions increases, particularly in regions prone to severe winter conditions. This demand not only boosts the local production capacities but also increases the import of ethylene glycol in these colder regions, thereby augmenting the overall market growth for ethylene oxide.

Growth in the Usage of Sterilization Agents in the Healthcare Industry

The healthcare industry’s increasing reliance on sterilization agents to maintain high standards of hygiene and patient safety is another potent driver for the Ethylene Oxide Market. Ethylene oxide is a highly effective sterilant for medical equipment and supplies that cannot withstand traditional high-temperature sterilization methods.

With the rising global health awareness and subsequent regulations requiring stringent sterilization practices, the demand for ethylene oxide has escalated. This is particularly accentuated during periods of health crises, such as pandemics, where the necessity for effective sterilization is paramount, thereby significantly boosting market growth.

Restraining Factors

Impact of Stringent Environmental Regulations on Volatile Organic Compound Emissions

The Ethylene Oxide Market faces significant growth restraints due to stringent environmental regulations concerning the emission of volatile organic compounds (VOCs). Ethylene oxide is classified as a high-VOC emitter, leading to potential environmental and health hazards. Regulatory bodies globally, including the Environmental Protection Agency (EPA) in the United States and the European Environment Agency (EEA) in Europe, have imposed strict guidelines on the emission levels of VOCs, particularly in the chemical manufacturing sector.

These regulations necessitate the implementation of costly emission control technologies and adherence to operational standards that limit production capacities and increase operational costs. This regulatory pressure not only curtails the expansion of existing facilities but also acts as a barrier to the entry of new players in the market, ultimately restraining the growth potential of the Ethylene Oxide Market.

Challenges Posed by Fluctuations in Raw Material Prices

Fluctuations in the prices of raw materials, particularly ethylene, pose a significant challenge to the stability and growth of the Ethylene Oxide Market. Ethylene, as the primary feedstock for ethylene oxide production, has a price that is highly susceptible to the dynamics of the oil and gas industry, which are influenced by geopolitical tensions, changes in energy policies, and other economic factors.

The price volatility of ethylene directly impacts the cost-effectiveness of producing ethylene oxide, making it difficult for manufacturers to maintain consistent profit margins. This unpredictability in costs can lead to reduced investment in production capacity and innovation, further restraining market growth.

By Derivative Analysis

Ethylene Glycols hold a significant 34.5% share in the Ethylene Oxide Market by derivative.

In 2023, Ethylene Glycols held a dominant market position in the By Derivative segment of the Ethylene Oxide Market, capturing more than a 34.5% share. This substantial market share can be attributed to its widespread use in various industrial applications including the production of polyester fibers and antifreeze formulations. Ethylene Glycols are crucial for the manufacturing sectors due to their effective properties as coolant and heat transfer agents, particularly in automotive and HVAC systems.

Following Ethylene Glycols, Ethoxylates accounted for a significant portion of the market. These compounds, known for their surfactant properties, are integral to the production of detergents and cleaning agents. The demand for Ethoxylates has been driven by the growing need for household and industrial cleaning solutions, reflecting broader trends in hygiene and sanitation.

Ethanolamines, which combine properties of amines and alcohols, are used extensively in chemical synthesis, particularly in the production of agricultural chemicals and personal care products. Their versatility supports a robust position in the Ethylene Oxide Market.

Glycol Ethers are another noteworthy derivative, utilized in a variety of applications from paints to pharmaceuticals. Their effective solvent properties underpin their steady market demand.

Polyethylene Glycol, commonly used in medical applications and as an ingredient in personal care products, continues to see growth aligned with health sector advancements.

By End-user Analysis

The automotive sector dominates the market as the largest end-user industry, accounting for 34.2%.

In 2023, Automotive held a dominant market position in the By End-user Industry segment of the Ethylene Oxide Market, capturing more than a 34.2% share. The automotive sector’s significant consumption of ethylene oxide derivatives, particularly ethylene glycols used in antifreeze and coolant solutions, underscores its pivotal role. The increasing production of vehicles and the need for high-performance coolant solutions drive this demand, highlighting the sector’s reliance on advanced chemical inputs for operational efficiency.

Agrochemicals represent another key segment, utilizing ethylene oxide derivatives to produce surfactants and solvents used in pesticide and fertilizer formulations. This usage aligns with the increasing need for high-efficiency agricultural products to meet global food demands.

The Food and Beverage industry also leverages these chemicals, particularly in packaging solutions that require sterile and durable materials, showcasing the versatility of ethylene oxide derivatives in ensuring food safety and extending shelf life.

Textile industries consume ethylene oxide for the production of solvents and emulsifiers crucial in dyeing and finishing processes. This reflects the sector’s ongoing need for chemicals that enhance product quality and manufacturing efficiency.

Personal Care and Pharmaceutical industries use these derivatives extensively in solvents, emulsifiers, and sterilants, reflecting their critical role in hygiene, health and wellness products.

Detergents continue to be a strong segment due to the surfactant properties of ethoxylates derived from ethylene oxide, crucial for effective cleaning products.

By Function Analysis

As a sterilizing agent, ethylene oxide plays a pivotal role, commanding a 57.2% market function.

In 2023, Sterilizing Agents held a dominant market position in the By Function segment of the Ethylene Oxide Market, capturing more than a 57.2% share. This substantial share is primarily due to the critical role of ethylene oxide as a sterilant in medical and pharmaceutical applications. The demand for sterilizing agents is driven by stringent regulatory requirements for sterile medical devices and supplies, underscoring the healthcare industry’s reliance on high-efficacy sterilization technologies.

Ethylene oxide’s efficacy in destroying microorganisms without damaging heat-sensitive medical equipment makes it indispensable in hospital settings, pharmaceutical manufacturing, and biotechnology. Its application extends to the sterilization of surgical instruments, syringes, and implants, reinforcing its pivotal position in ensuring patient safety and healthcare quality.

Fumigating Agent constitutes the next significant segment, utilized extensively as a pesticide in agricultural and food storage applications. Ethylene oxide’s role as a fumigant helps in controlling pests and bacteria during the storage and transport of consumable goods, supporting food safety standards and distribution efficiency.

The “Others” category includes various minor uses of ethylene oxide, such as in chemical synthesis and as an intermediate in the production of other industrial chemicals. These applications, while smaller in scale, highlight the versatility of ethylene oxide and its integration into diverse industrial processes.

Key Market Segments

By Derivative

- Ethylene Glycols

- Ethoxylates

- Ethanolamines

- Glycol Ethers

- Polyethylene Glycol

- Others

By End-user Industry

- Automotive

- Agrochemicals

- Food and Beverage

- Textile

- Personal Care

- Pharmaceuticals

- Detergents

- Others

By Function

- Sterilizing Agent

- Fumigating Agent

- Others

Growth Opportunities

Expansion into Emerging Markets with Growing Industrial Sectors

The global Ethylene Oxide Market is poised for significant growth in 2023, particularly through expansion into emerging markets that boast rapidly growing industrial sectors. Countries in Asia, Africa, and South America, where industrialization is accelerating, present lucrative opportunities for market participants. These regions are witnessing substantial growth in key end-use sectors such as textiles, automotive, and healthcare, which extensively utilize ethylene oxide derivatives.

By establishing production facilities or forming strategic partnerships in these markets, ethylene oxide producers can leverage lower operational costs, benefit from local government incentives, and cater directly to regional demand. This strategic expansion not only diversifies the market presence of these companies but also mitigates risks associated with geopolitical and economic instability in traditional markets.

Development of Environmentally Friendly Production Technologies

Another significant growth opportunity in 2023 for the Ethylene Oxide Market lies in the development and implementation of environmentally friendly production technologies. As regulatory pressures concerning VOC emissions and environmental sustainability intensify, investing in green technologies becomes imperative. Innovations that reduce emissions, enhance energy efficiency, or utilize alternative, less harmful feedstocks are particularly promising.

Such technologies not only comply with stringent environmental regulations but also appeal to a growing segment of environmentally conscious consumers and industries. Companies that lead in sustainable production practices are likely to gain competitive advantages, including eligibility for subsidies and better market positioning, further driving their growth in a market that is increasingly defined by eco-friendly operational mandates.

Latest Trends

Adoption of Bio-Based Ethylene Oxide Production Methods

A transformative trend in the 2023 Ethylene Oxide Market is the adoption of bio-based production methods. As industries increasingly prioritize sustainability, the shift towards bio-based ethylene, derived from renewable sources like biomass, sets a significant precedent. This method not only aligns with global environmental targets but also reduces reliance on volatile fossil fuel markets, offering a more stable supply chain.

Bio-based ethylene oxide production is gaining traction among major market players who are looking to reduce their carbon footprint and meet the stringent regulatory standards for green manufacturing practices. This trend is supported by advances in biotechnology and increased investment in renewable resources, positioning bio-based ethylene oxide as a viable and eco-friendly alternative that could reshape market dynamics and consumer preferences in the chemical sector.

Increasing Use of Ethylene Oxide for the Production of Non-Ionic Surfactants

Another prominent trend is the increasing utilization of ethylene oxide in the production of non-ionic surfactants. These surfactants are crucial in numerous applications, including detergents, personal care products, and industrial cleaners, owing to their mildness, versatility, and effectiveness in various temperature and pH conditions.

The demand for non-ionic surfactants is rising, driven by the expanding markets of personal care and home cleaning products, especially in emerging economies with growing consumer bases. Ethylene oxide’s role as a key feedstock in these surfactants supports market growth and innovation in product formulations, enhancing the performance and environmental profile of the final products.

Regional Analysis

In 2023, the Asia-Pacific region dominated the Ethylene Oxide Market with a 43.1% share, valued at USD 14.9 billion.

The global Ethylene Oxide Market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each exhibiting distinct market dynamics and growth potentials.

Asia-Pacific is the dominant region in the Ethylene Oxide Market, commanding a significant 43.1% market share with a valuation of USD 14.9 billion. This region’s market predominance is driven by rapid industrialization, particularly in China and India, alongside a robust expansion in the automotive, textile, and healthcare sectors, which extensively utilize ethylene oxide derivatives.

North America follows, with a strong emphasis on advanced manufacturing techniques and stringent environmental regulations that push for cleaner and more efficient production methods. The market in this region is characterized by a high demand for ethylene oxide in the production of polyester fibers and antifreeze agents, supported by a well-established automotive industry.

Europe exhibits a mature market landscape with steady demand. The region’s focus on sustainable and eco-friendly industrial practices is increasing the adoption of bio-based ethylene oxide, aligning with stricter EU regulations on VOC emissions. This shift is gradually transforming the production methodologies within the region.

The Middle East & Africa region, though smaller in market size compared to Asia-Pacific or North America, is experiencing gradual growth due to increasing healthcare needs and rising industrial activities in the Gulf Cooperation Council (GCC) countries.

Latin America, although the smallest segment, is seeing growth in local manufacturing and an increase in export activities, particularly in countries like Brazil and Argentina, which are slowly advancing in chemical manufacturing capabilities.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global Ethylene Oxide Market continues to be shaped by the strategic activities and developments of key players including BASF, SABIC, Indorama Ventures, and several other industry giants. Each company is uniquely positioned to influence the market dynamics through innovation, geographic expansion, and strategic partnerships.

BASF and SABIC are leading the way with significant investments in environmentally friendly production technologies. These companies are at the forefront of adopting bio-based ethylene oxide production methods, aligning with global sustainability trends. Their focus on reducing the environmental impact of their operations while enhancing efficiency sets a competitive standard in the market.

Indorama Ventures and India Glycols Ltd. are expanding their footprint in emerging markets. These companies are leveraging growth opportunities in Asia-Pacific and other developing regions where demand for ethylene oxide derivatives is increasing due to rapid industrialization and economic growth. Their strategic expansions are not only boosting their market share but also improving regional market dynamics by introducing advanced manufacturing practices and products.

DowDupont and LyondellBasell Industries Holdings B.V. continue to innovate in the production of non-ionic surfactants, which are crucial in numerous consumer and industrial applications. Their development efforts are enhancing the performance and sustainability of ethylene oxide-based products, meeting the rising consumer demand for environmentally safer and more efficient products.

Huntsman International, LOTTE Chemical Corporation, and INEOS are emphasizing operational improvements and capacity expansions to meet the global demand effectively. By optimizing their production processes and increasing their output, they are better positioned to handle the fluctuations in raw material prices and the stringent regulatory environment.

Market Key Players

- BASF

- SABIC

- Indorama Venture Public Company Ltd.

- India Glycols Ltd.

- DowDupont

- Formosa Plastic Ltd.

- Huntsman International

- LOTTE Chemical Corporation

- Royal Dutch Shell

- Indian Oil Corporation

- Akzo Nobel N.V.

- Indorama Ventures Public Company Limited

- INEOS

- KAZANORGSINTEZ

- LyondellBasell Industries Holdings B.V

- Nippon Shokubai Co., Ltd.

Recent Development

- In 2023, SABIC reported a net income of US$ 0.35 billion for the year 2023, with total assets amounting to US$ 78.5 billion and a production output of 53.5 million metric tons.

- In 2023, India Glycols Ltd. has demonstrated notable financial performance recently. As of the first quarter of FY22, the company reported a significant net revenue growth of 124% year-over-year. Furthermore, it experienced a 39% increase in EBITDA during the same period. Despite a sales decline of 11% in Q1-FY22 compared to Q4-FY21.

Report Scope

Report Features Description Market Value (2023) USD 34.6 Billion Forecast Revenue (2033) USD 49.8 Billion CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Derivative(Ethylene Glycols, Ethoxylates, Ethanolamines, Glycol Ethers, Polyethylene Glycol, Others) ,By End-user Industry(Automotive, Agrochemicals, Food and Beverage, Textile, Personal Care, Pharmaceuticals, Detergents, Others), By Function(Sterilizing Agent, Fumigating Agent, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF, SABIC, Indorama Venture Public Company Ltd., India Glycols Ltd., DowDupont, Formosa Plastic Ltd., Huntsman International, LOTTE Chemical Corporation, Royal Dutch Shell, Indian Oil Corporation, Akzo Nobel N.V., Indorama Ventures Public Company Limited, INEOS, KAZANORGSINTEZ, LyondellBasell Industries Holdings B.V, Nippon Shokubai Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Ethylene Oxide Market Size in 2023?The Global Ethylene Oxide Market Size is USD 34.6 Billion in 2023.

What is the projected CAGR at which the Global Ethylene Oxide Market is expected to grow at?The Global Ethylene Oxide Catalyst Market is expected to grow at a CAGR of 3.7% (2024-2033).

List the segments encompassed in this report on the Global Ethylene Oxide Market?Market.US has segmented the Global Ethylene Oxide Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Derivative(Ethylene Glycols, Ethoxylates, Ethanolamines, Glycol Ethers, Polyethylene Glycol, Others) ,By End-user Industry(Automotive, Agrochemicals, Food and Beverage, Textile, Personal Care, Pharmaceuticals, Detergents, Others), By Function(Sterilizing Agent, Fumigating Agent, Others)

List the key industry players of the Global Ethylene Oxide Market?BASF, SABIC, Indorama Venture Public Company Ltd., India Glycols Ltd., DowDupont, Formosa Plastic Ltd., Huntsman International, LOTTE Chemical Corporation, Royal Dutch Shell, Indian Oil Corporation, Akzo Nobel N.V., Indorama Ventures Public Company Limited, INEOS, KAZANORGSINTEZ, LyondellBasell Industries Holdings B.V, Nippon Shokubai Co., Ltd.

Name the key areas of business for Global Ethylene Oxide Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Ethylene Oxide Market.

-

-

- BASF

- SABIC

- Indorama Venture Public Company Ltd.

- India Glycols Ltd.

- DowDupont

- Formosa Plastic Ltd.

- Huntsman International

- LOTTE Chemical Corporation

- Royal Dutch Shell

- Indian Oil Corporation

- Akzo Nobel N.V.

- Indorama Ventures Public Company Limited

- INEOS

- KAZANORGSINTEZ

- LyondellBasell Industries Holdings B.V

- Nippon Shokubai Co., Ltd.