Global Ethoxydiglycol Market By Grade (Technical Grade, Pharmaceutical Grade, Cosmetic Grade, Food Grade), By Application (Solvent, Coalescing Agent, Emulsifier, Plasticizer, Lubricant, Others), By End-Use (Paints and Coatings, Textiles, Personal Care, Automotive, Electronics, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132762

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

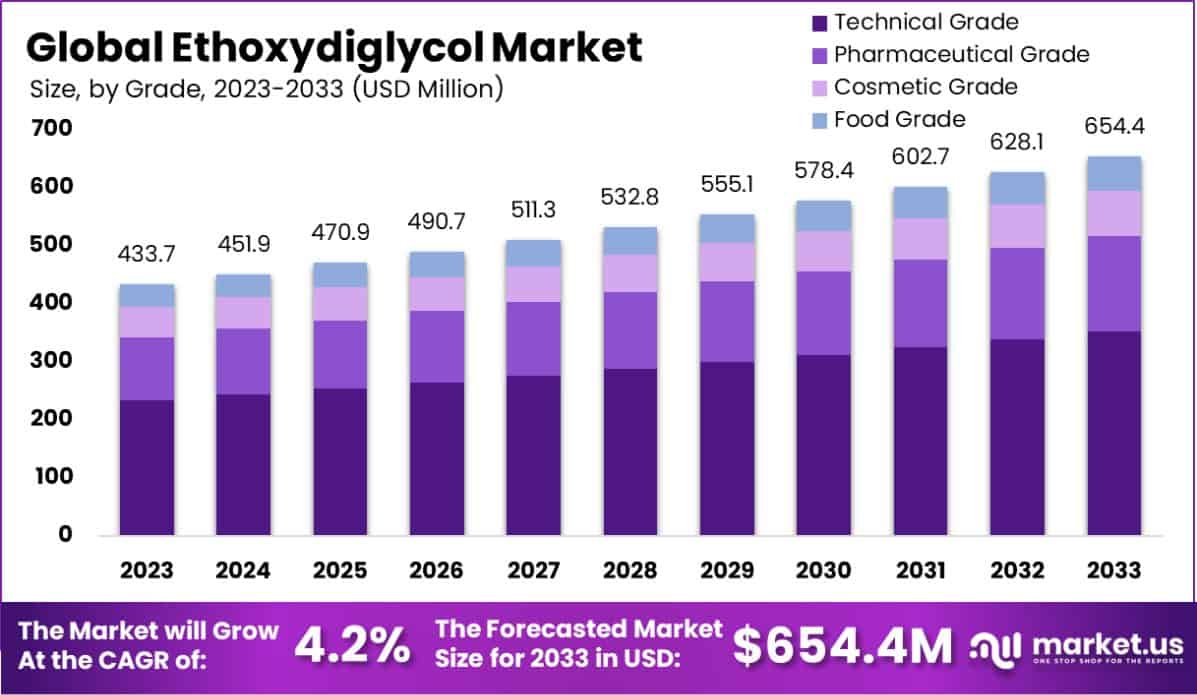

The Global Ethoxydiglycol Market is expected to be worth around USD 654.4 Million by 2033, up from USD 433.7 Million in 2023, and grow at a CAGR of 4.2% from 2024 to 2033.

Ethoxydiglycol (also known as diethylene glycol monoethyl ether) is a solvent commonly used in personal care, cosmetics, pharmaceuticals, and industrial applications. It serves as a solvent, humectant, and emulsifier, enhancing the delivery and stability of active ingredients in formulations.Its mild nature and compatibility with various substances make it a key ingredient in skin care, hair care, and other cosmetic products.

Ethoxydiglycol Market Growth is driven by the expanding demand in the cosmetics and pharmaceutical industries, where it enhances the efficacy of active ingredients. Increased awareness of personal care products’ efficacy contributes to steady market expansion.

The Ethoxydiglycol market is poised for sustained growth, underpinned by the expanding demand for advanced formulations in the cosmetics and personal care sectors. As a solvent and humectant, Ethoxydiglycol plays a critical role in improving the stability and efficacy of active ingredients, particularly in high-performance skincare products.

The ingredient’s ability to attract moisture and enhance ingredient delivery significantly boosts its application in anti-aging, moisturizing, and skin health products. According to the US Food and Drug Administration (FDA), Ethoxydiglycol is safe for use in cosmetics, with concentrations ranging from 0.0004% to 80% deemed acceptable by the Cosmetic Ingredient Review (CIR) Expert Panel.

Market demand is further propelled by the ingredient’s capacity to improve moisture retention and its synergy with key actives like vitamin C, DHA (self-tanning agent), and benzoyl peroxide, as noted by Cosmetics.specialchem.com. As such, Ethoxydiglycol is integral to the performance of targeted products such as vitamin C serums and acne treatments.

With increasing consumer preference for effective, science-backed skincare solutions, the market for Ethoxydiglycol is expected to grow steadily. Additionally, the shift toward clean-label, sustainable formulations offers significant opportunities for innovation and differentiation within the personal care industry.

As the market continues to evolve, Ethoxydiglycol will likely maintain a pivotal role in meeting both functional and consumer-driven demands for high-quality, efficacious personal care products.

Demand is spurred by the rising consumer interest in high-performance skincare and drug delivery systems, with a focus on safer, effective formulations. Opportunities exist in the development of clean-label and eco-friendly products, responding to consumer preferences for sustainability in personal care and industrial applications.

Key Takeaways

- The Global Ethoxydiglycol Market is expected to be worth around USD 654.4 Million by 2033, up from USD 433.7 Million in 2023, and grow at a CAGR of 4.2% from 2024 to 2033.

- The technical grade segment of the Ethoxydiglycol market accounts for 54.3% of total demand.

- Solvent applications represent 44.3% of the Ethoxydiglycol market, driving its use in various industries.

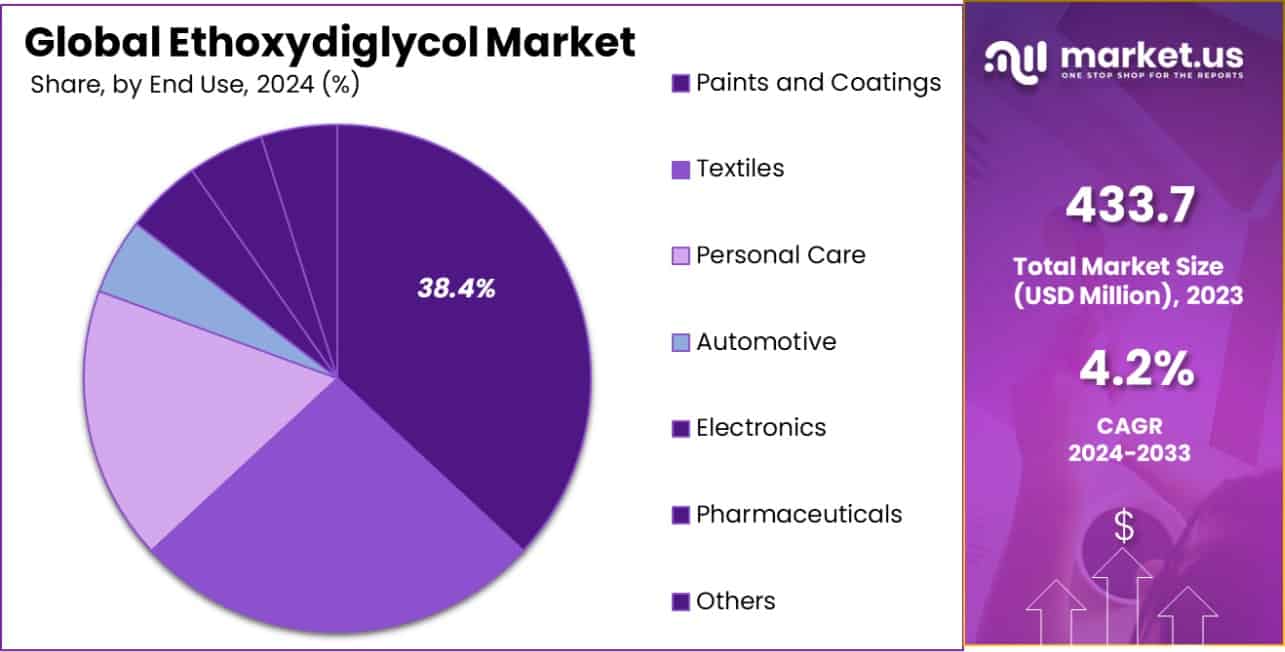

- Ethoxydiglycol’s primary end-use in the market is in paints and coatings, capturing 38.4% of demand.

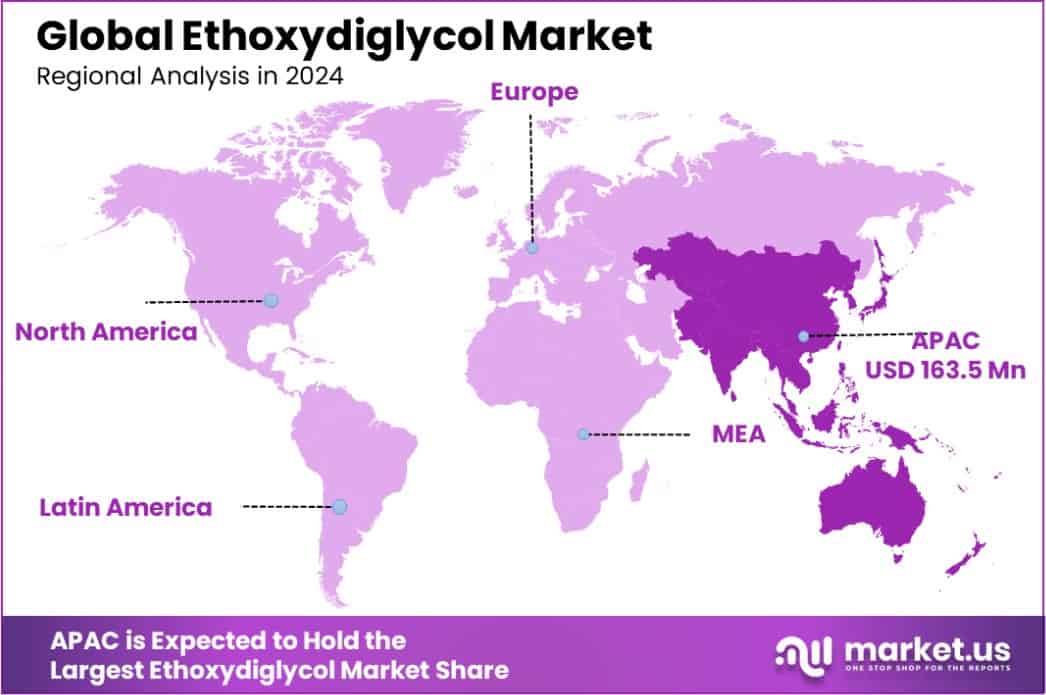

- In Asia Pacific, the Ethoxydiglycol market holds 37.7% share, valued at USD 163.5 million.

By Grade Analysis

The Ethoxydiglycol market shows a technical grade of 54.3% for quality standards.

In 2023, Technical Grade held a dominant market position in the By Grade segment of the Ethoxydiglycol market, accounting for 54.3% of the total market share. This grade is primarily utilized in industrial applications, including paints, coatings, and solvents, where high-quality performance is essential. The demand for technical-grade Ethoxydiglycol is driven by its versatility and cost-effectiveness in non-consumable products.

Pharmaceutical Grade, Cosmetic Grade, and Food Grade follow in market share, but with significantly smaller portions. Pharmaceutical-grade Ethoxydiglycol is used in medical formulations, such as drug delivery systems and topical applications, ensuring safety and efficacy at a high standard.

The market for Cosmetic Grade Ethoxydiglycol, while more niche, is growing due to increasing consumer demand for safe and effective ingredients in skincare and personal care products. The Food Grade segment is the smallest, with Ethoxydiglycol used sparingly in food applications as a solvent and stabilizer in flavorings and food additives.

Overall, the dominance of technical-grade Ethoxydiglycol reflects its widespread use in industrial applications, while the other grades maintain steady but smaller shares within their respective sectors. The diversity of Ethoxydiglycol’s applications across various industries supports its steady growth and robust demand in 2023.

By Application Analysis

Solvent application accounts for 44.3% of the total Ethoxydiglycol market share.

In 2023, Solvent held a dominant market position in the By Application segment of the Ethoxydiglycol market, accounting for 44.3% of the total market share. Ethoxydiglycol is widely used as a solvent in various industrial applications due to its excellent solvency properties, particularly in paints, coatings, inks, and cleaning products. Its ability to dissolve a wide range of substances, including resins, oils, and other chemicals, has made it indispensable in these sectors.

Following solvents, Coalescing Agent, Emulsifier, Plasticizer, and Lubricant applications contribute to the market, albeit with smaller shares. Coalescing Agents are key in paint and coating formulations, where they help particles to fuse and form a smooth film. This segment is critical to the paint industry, driving demand for Ethoxydiglycol.

The Emulsifier segment benefits from Ethoxydiglycol’s ability to stabilize mixtures of water and oils, which is crucial in cosmetics, pharmaceuticals, and food industries. The Plasticizer and Lubricant applications are smaller but significant, with Ethoxydiglycol improving the flexibility of plastics and enhancing the smooth functioning of machinery and engines.

Overall, while solvents remain the leading application, Ethoxydiglycol’s versatile functionality in coalescing, emulsifying, plasticizing, and lubricating roles supports its broad adoption across various industries, ensuring steady market growth in 2023.

By End-Use Analysis

Paints and coatings dominate the Ethoxydiglycol market with a 38.4% share.

In 2023, Paints and Coatings held a dominant market position in the By End-Use segment of the Ethoxydiglycol market, capturing 38.4% of the total market share. Ethoxydiglycol is widely used in paints and coatings due to its excellent solvency properties, ability to act as a coalescing agent, and contribution to improved film formation.

It helps enhance the performance and durability of coatings, making it a preferred choice for both industrial and decorative applications, including automotive coatings, architectural finishes, and industrial machinery.

Following the dominance of paints and coatings, other end-use segments, including Textiles, Personal Care, Automotive, Electronics, and Pharmaceuticals, contribute to the market in smaller but growing shares.

The Textiles industry uses Ethoxydiglycol as a solvent and stabilizer in dye formulations, enhancing the color-fastness and texture of fabrics. In Personal Care, it is commonly found in skincare products, acting as a solvent and humectant in lotions and creams.

The Automotive and Electronics sectors use Ethoxydiglycol for applications such as adhesives, lubricants, and cleaning agents, where its stability and solvency properties are highly valued. Lastly, the Pharmaceuticals segment relies on Ethoxydiglycol as an excipient in drug formulations, contributing to better absorption and stability.

Overall, the diverse range of end-use applications, with paints and coatings leading, reflects the broad adoption and growing demand for Ethoxydiglycol across various industries.

Key Market Segments

By Grade

- Technical Grade

- Pharmaceutical Grade

- Cosmetic Grade

- Food Grade

By Application

- Solvent

- Coalescing Agent

- Emulsifier

- Plasticizer

- Lubricant

- Others

By End-Use

- Paints and Coatings

- Textiles

- Personal Care

- Automotive

- Electronics

- Pharmaceuticals

- Others

Driving Factors

Increasing Demand for Solvents in Industrial Applications

The growing use of Ethoxydiglycol as a solvent in industries like paints, coatings, and cleaning products is a key driver of market growth. Its ability to dissolve a wide range of substances, including resins and oils, makes it essential in many manufacturing processes.

As industries continue to seek efficient and eco-friendly solvents, Ethoxydiglycol’s versatility and effectiveness in formulations ensure its steady demand. This trend is further supported by stricter environmental regulations that promote the use of safer and more sustainable solvents in industrial applications.

Rising Adoption in Paints and Coatings Sector

The paints and coatings industry is a major driver of the Ethoxydiglycol market. This compound is widely used to improve the performance of coatings, offering enhanced film formation, improved drying time, and better overall finish quality. As demand for high-performance, durable paints rises, especially in automotive, construction, and industrial coatings, Ethoxydiglycol’s role becomes even more critical.

Additionally, as the trend for eco-friendly and low-VOC (volatile organic compounds) paints grows, Ethoxydiglycol serves as an effective, sustainable solution for these formulations.

Growth in Personal Care and Cosmetics Products

Ethoxydiglycol’s increasing application in the personal care and cosmetics industries is fueling its market growth. It serves as an effective solvent, humectant, and stabilizer in a wide range of skincare, haircare, and cosmetic products. With rising consumer awareness about product safety and ingredient transparency, Ethoxydiglycol is preferred due to its mild and non-toxic properties.

Furthermore, the growing trend for multifunctional, efficient ingredients in beauty products supports the demand for Ethoxydiglycol, making it an essential component in a variety of personal care formulations.

Restraining Factors

Regulatory Challenges and Safety Concerns in Usage

Ethoxydiglycol is subject to various regulations in multiple regions, particularly due to its chemical nature. These regulations, while aimed at ensuring safety, can limit its widespread use in certain industries. Concerns about the potential health and environmental risks of solvent-based products can lead to stringent rules, making it more challenging for companies to develop and market Ethoxydiglycol-based products.

Compliance with these regulations often leads to increased production costs and limits market expansion, especially in regions with strict environmental and safety laws.

Fluctuating Raw Material Prices Impacting Market Growth

The production cost of Ethoxydiglycol is highly influenced by the fluctuating prices of raw materials, such as ethylene oxide and other feedstock chemicals. Any significant price changes in these inputs can lead to increased production costs, which, in turn, affect the pricing and profitability of Ethoxydiglycol-based products.

This volatility in raw material prices can also make it difficult for manufacturers to maintain consistent pricing, leading to market instability and limiting the long-term growth potential of the Ethoxydiglycol market, especially in price-sensitive industries.

Availability of Alternative Solvents and Chemicals

One of the key restraints to the growth of the Ethoxydiglycol market is the increasing availability of alternative solvents and chemicals. In industries like paints, coatings, and cosmetics, there is growing competition from newer, more environmentally friendly or cost-effective solvents.

Alternatives such as bio-based solvents, alcohols, and plant-derived chemicals are gaining popularity due to their sustainability benefits. As a result, Ethoxydiglycol faces pressure from these competing products, which could limit its market share, especially as companies strive to meet environmental and consumer demand for greener solutions.

Growth Opportunity

Expansion into Emerging Markets for Enhanced Reach

The Ethoxydiglycol market is poised for significant growth by expanding into emerging markets such as Asia and Latin America.

These regions exhibit increased demand for personal care and pharmaceutical products, which prominently utilize Ethoxydiglycol as a solvent and carrier.

By penetrating these markets, companies can tap into new customer bases and leverage rising consumer spending on beauty and health products, driving revenue growth.

Innovation in Skincare and Cosmetic Formulations

There is a notable opportunity for growth through innovation in skincare and cosmetic formulations incorporating Ethoxydiglycol.

As consumers increasingly seek products with enhanced efficacy and stability, Ethoxydiglycol’s properties as a viscosity decreasing agent and solvent are highly valued.

Developing advanced, multifunctional products that meet the evolving preferences for high-performance cosmetics can set brands apart in a competitive market.

Strategic Alliances with Local Distributors

Forming strategic alliances with local distributors can significantly bolster the Ethoxydiglycol market’s growth.

These partnerships can facilitate smoother market entry and expansion, especially in regions with stringent regulatory landscapes and diverse consumer bases.

By collaborating with established local entities, companies can navigate market nuances more effectively, ensuring product availability and compliance, thus enhancing market penetration and presence.

Latest Trends

Rising Demand for Clean and Natural Cosmetic Ingredients

The Ethoxydiglycol market is witnessing a significant trend towards clean and natural cosmetic ingredients. Consumers are increasingly aware of the contents of their beauty products, opting for items with fewer synthetic chemicals.

Ethoxydiglycol, known for its low toxicity and excellent solvency properties, is becoming a preferred choice in formulations aiming to meet these consumer expectations. This shift is prompting manufacturers to highlight the purity and safety profiles of their products, enhancing brand credibility and consumer trust.

Enhanced Focus on Sustainable and Eco-friendly Solvents

Sustainability is a driving force in the Ethoxydiglycol market, with an increasing trend towards eco-friendly solvents. Manufacturers are investing in technologies and processes that reduce environmental impact, making Ethoxydiglycol an attractive component due to its biodegradable packaging nature.

This trend is not only responding to regulatory pressures but also to consumer demand for environmentally responsible products, creating a competitive advantage for companies prioritizing green chemistry.

Integration of Advanced Technology in Production Processes

The integration of advanced technology in the production processes of Ethoxydiglycol is a prominent trend. Automated and precision manufacturing technologies are being adopted to enhance efficiency and consistency in production.

This technological advancement allows for tighter quality control, scalability, and cost-effectiveness, meeting the growing demand from the cosmetics and pharmaceutical industries more effectively. This trend is setting new standards in manufacturing, ensuring that high-quality products can be delivered to meet global market demands.

Regional Analysis

The Ethoxydiglycol market in Asia Pacific holds a 37.7% share, valued at USD 163.5 million.

The Ethoxydiglycol market demonstrates varied regional dynamics, with significant growth opportunities and market penetration across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific emerges as the dominant region, capturing 37.7% of the market with a valuation of USD 163.5 million, driven by robust demand in the cosmetics and personal care industries, particularly in emerging economies such as China and India.

North America and Europe also show substantial market presence, attributed to advanced cosmetic formulations and stringent regulatory standards promoting safe and effective solvents. Meanwhile, Latin America and the Middle East & Africa are experiencing gradual growth. This is fueled by increasing awareness of personal hygiene and expanding pharmaceutical sectors, though these regions currently hold smaller shares of the global market.

Companies are strategically expanding their footprint and distribution networks in these lesser-tapped regions to capitalize on emerging consumer markets and regulatory environments conducive to growth in specialty solvents.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Ethoxydiglycol market continues to be influenced significantly by the strategic initiatives and product innovations from key industry players such as Hexion, INOVYN, TotalEnergies, Wacker Chemie AG, Dow Chemical, Solvay, Evonik Industries, Celanese, Wanhua Chemical Group, BASF, The Dow Chemical Company, SABIC, Eastman Chemical, and Oxea.

These companies have been pivotal in driving the market forward through advanced R&D investments and expanding production capacities to meet the rising demand, especially from the cosmetics and pharmaceutical sectors.

Dow Chemical and BASF stand out for their extensive distribution networks and strong brand reputations, which allow them to dominate in various regional markets. Evonik and Wacker Chemie are noted for their commitment to sustainability, investing in eco-friendly production processes that align with global regulatory standards and consumer preferences for greener products.

INOVYN and TotalEnergies are enhancing their portfolios by developing multifunctional and safer solvents, aiming to tap into niche applications within personal care and industrial processes.

Overall, these companies are not only enhancing their competitive edges through technological innovations but are also actively participating in strategic partnerships and mergers to strengthen their market positions globally. This proactive approach is critical for maintaining leadership in the evolving Ethoxydiglycol market landscape.

Top Key Players in the Market

- Hexion

- INOVYN

- TotalEnergies

- Wacker Chemie AG

- Dow Chemical

- Solvay

- Evonik Industries

- Celanese

- Wanhua Chemical Group

- BASF

- The Dow Chemical Company

- SABIC

- Eastman Chemical

- Oxea

Recent Developments

- In 2024, Hexion Inc., a prominent player in the specialty chemicals market, announced a strategic collaboration with Clariant to develop high-performance intumescent coatings, showcasing its commitment to innovation in chemical technologies.

- In 2023, TotalEnergies has continued to enhance its position in the Ethoxydiglycol market by leveraging its extensive expertise in specialty chemicals and solvents within the broader scope of its multi-energy strategy. This year, the company has focused on integrating Ethoxydiglycol into its portfolio of products that support sustainable practices in various industries, particularly cosmetics and pharmaceuticals.

Report Scope

Report Features Description Market Value (2023) USD 433.7 Million Forecast Revenue (2033) USD 654.4 Million CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Technical Grade, Pharmaceutical Grade, Cosmetic Grade, Food Grade), By Application (Solvent, Coalescing Agent, Emulsifier, Plasticizer, Lubricant, Others), By End-Use (Paints and Coatings, Textiles, Personal Care, Automotive, Electronics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hexion, INOVYN, TotalEnergies, Wacker Chemie AG, Dow Chemical, Solvay, Evonik Industries, Celanese, Wanhua Chemical Group, BASF, The Dow Chemical Company, SABIC, Eastman Chemical, Oxea Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hexion

- INOVYN

- TotalEnergies

- Wacker Chemie AG

- Dow Chemical

- Solvay

- Evonik Industries

- Celanese

- Wanhua Chemical Group

- BASF

- The Dow Chemical Company

- SABIC

- Eastman Chemical

- Oxea