Global L-Lysine Sulfate (Cas 60343-69-3) Market Size, Share, And Business Benefits By Type (L-Lysine Sulphate 65%, L-Lysine Sulphate 70%, L-Lysine Sulphate 80%), By Application (Feed Industry, Food Industry, Pharmaceutical Industry, Others), By Distribution Channel (Direct Sales, Distributors and Traders, Online Channels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140518

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

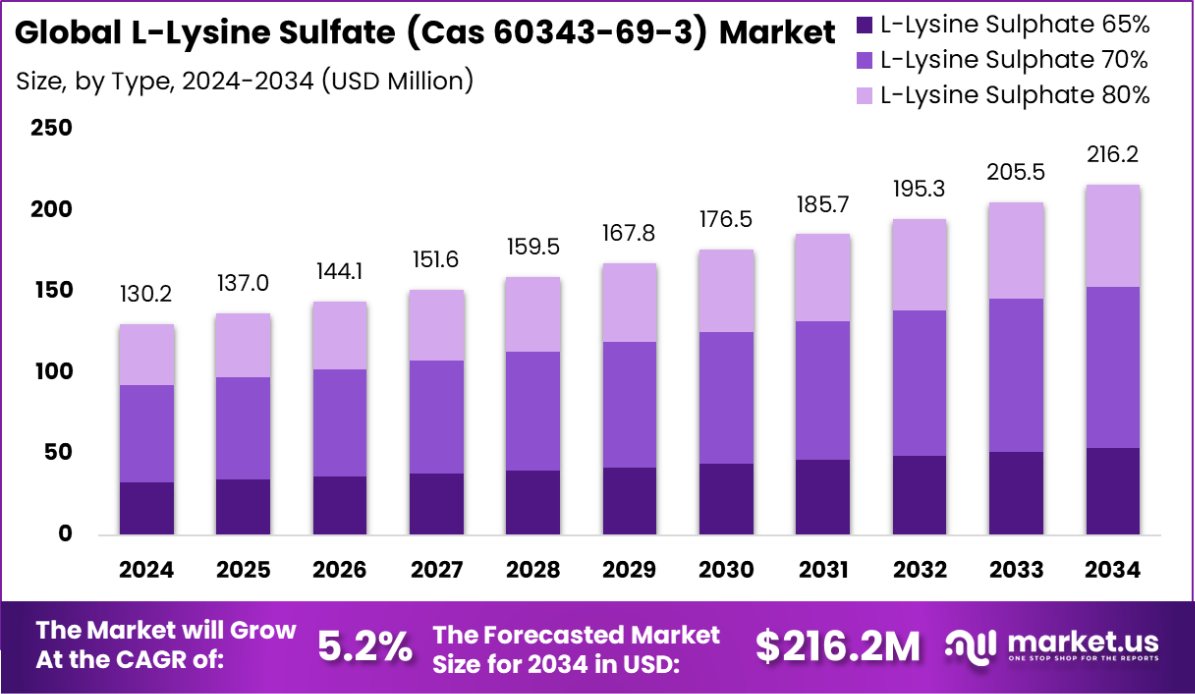

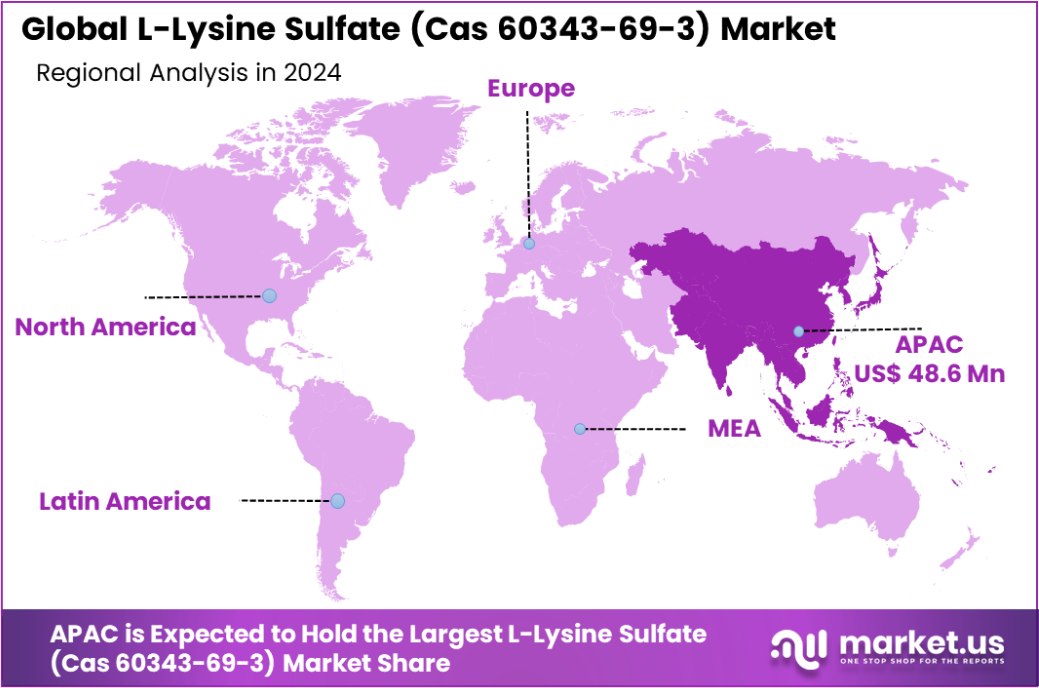

Global L-Lysine Sulfate (Cas 60343-69-3) Market is expected to be worth around USD 216.2 Million by 2034, up from USD 130.2 Million in 2024, and grow at a CAGR of 5.2% from 2025 to 2034. Asia-Pacific dominates the L-Lysine Sulfate market with 37.4%, USD 48.6 Mn.

L-Lysine Sulfate is a biologically active form of the amino acid L-Lysine, commonly used as a nutritional supplement and in animal feed formulations. It plays a crucial role in protein synthesis, immune function, and the production of collagen and elastin. Its sulfate form increases its solubility, making it more bioavailable for use in various industries. It is predominantly utilized in animal nutrition to support the growth and health of livestock, poultry, and aquaculture.

The growth of the L-Lysine Sulfate market is primarily driven by the increasing demand for animal protein worldwide. With a growing global population and shifting dietary habits, the need for efficient, high-quality feed additives has surged. Additionally, the rise in awareness of the benefits of L-Lysine Sulfate in improving livestock productivity has contributed to its adoption in agriculture. The expanding aquaculture industry further supports market growth as L-Lysine Sulfate is essential for optimal fish growth.

The demand for L-lysine sulfate is heavily influenced by the rapid expansion of the animal feed industry. As the need for protein-rich food increases, livestock feed manufacturers are incorporating L-Lysine Sulfate to optimize feed conversion ratios and enhance animal health. Moreover, the growing trend toward sustainable farming practices, which includes improving feed efficiency, continues to drive demand for this amino acid supplement.

Opportunities for the L-Lysine Sulfate market lie in emerging economies where meat consumption is increasing due to urbanization and rising income levels. Additionally, research and development in the field of functional feed additives are expected to open new avenues for growth. The expansion of L-lysine sulfate applications beyond traditional animal feed, including in human nutrition and pharmaceutical products, presents significant potential for market diversification.

Despite the promising growth, the market faces challenges related to price fluctuations of raw materials and regulatory constraints in various regions. Intense competition from other feed additives and synthetic amino acids, such as D, L-Methionine, and Threonine, could also pressure L-Lysine Sulfate market players to innovate and improve cost-effectiveness. However, ongoing product development and partnerships in global markets may alleviate these pressures.

Key Takeaways

- Global L-Lysine Sulfate (Cas 60343-69-3) Market is expected to be worth around USD 216.2 Million by 2034, up from USD 130.2 Million in 2024, and grow at a CAGR of 5.2% from 2025 to 2034.

- L-Lysine Sulfate (CAS 60343-69-3) market is dominated by L-Lysine Sulfate 70%, accounting for 46.5%.

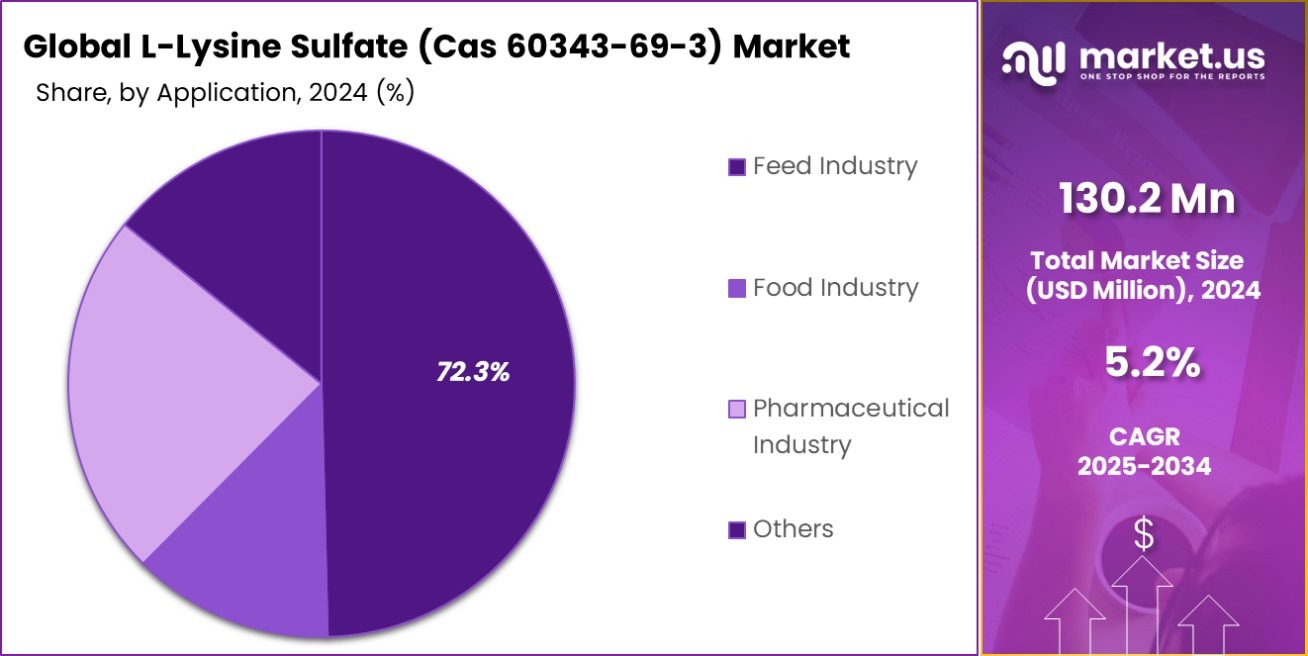

- The feed industry remains the primary application segment for L-Lysine Sulfate (CAS 60343-69-3), with a 72.3% share.

- Direct sales lead the distribution channels for L-Lysine Sulfate (CAS 60343-69-3), capturing 58.2% of the market.

- The Asia-Pacific L-Lysine Sulfate market holds 37.4%, valued at USD 48.6 million.

By Type Analysis

L-lysine sulfate 70% (CAS 60343-69-3) dominates the market with a 46.5% share.

In 2024, L-Lysine Sulfate 70% held a dominant market position in the By Type segment of the L-Lysine Sulfate (CAS 60343-69-3) market, commanding a 46.5% share. The widespread use of L-Lysine Sulfate 70% in various applications, particularly in animal nutrition, has driven its significant market presence.

The product is particularly favored for its higher concentration, which makes it a cost-effective solution for the formulation of animal feed. The increase in demand for high-protein feed, especially in poultry and swine farming, has further bolstered the growth of L-Lysine Sulfate by 70%.

Additionally, this variant is known for its enhanced stability and ease of use in large-scale production, factors that contribute to its popularity among manufacturers. With global trends leaning towards more sustainable and efficient animal farming practices, the need for high-quality, concentrated amino acids like L-Lysine Sulfate 70% is expected to rise.

The segment’s growth is also supported by the expansion of animal husbandry in emerging markets, where rising protein consumption is driving the demand for premium feed ingredients. Moving forward, L-Lysine Sulfate 70% is expected to continue to lead the market, supported by its versatility and essential role in improving the feed conversion ratio in livestock production.

By Application Analysis

The feed industry drives L-lysine sulfate demand, accounting for 72.3% market share.

In 2024, the Feed Industry held a dominant market position in the By Application segment of the L-Lysine Sulfate (CAS 60343-69-3) market, with a 72.3% share. This significant share is primarily driven by the growing demand for high-quality animal feed additives to enhance the nutritional value of livestock feed.

L-Lysine Sulfate, being an essential amino acid, plays a crucial role in promoting growth, improving feed conversion efficiency, and maintaining overall animal health, which makes it a key ingredient in the feed industry.

The rise in global meat consumption, particularly in regions like Asia-Pacific and Latin America, has amplified the need for fortified animal feed. In addition, the increasing demand for high-protein diets for poultry, swine, and aquaculture has further solidified L-Lysine Sulfate’s position in animal nutrition. The emphasis on optimizing feed formulations to boost productivity in livestock farming has contributed to its widespread adoption.

Moreover, regulatory advancements and a growing awareness of the benefits of balanced animal nutrition have supported the Feed Industry’s dominance in this market segment. Moving forward, the continued growth of the global animal husbandry sector, along with rising consumer preference for protein-rich diets, is expected to sustain the Feed Industry’s lead in the L-Lysine Sulfate market.

By Distribution Channel Analysis

Direct sales channel holds 58.2% of L-Lysine Sulfate market distribution globally.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the L-Lysine Sulfate (CAS 60343-69-3) market, with a 58.2% share. This strong market position can be attributed to the growing preference for direct procurement by large-scale manufacturers, particularly in the animal feed industry.

Direct sales allow suppliers to offer more competitive pricing, streamline supply chains, and provide tailored solutions to their customers. It also facilitates better communication and closer relationships between manufacturers and end-users, fostering long-term partnerships.

Large agricultural enterprises and feed producers often opt for direct sales due to the convenience and cost-effectiveness associated with bulk purchasing. By eliminating intermediaries, direct sales also provide more control over product quality, shipping schedules, and order customization, which are crucial factors in the competitive animal nutrition market. Furthermore, direct sales channels allow for faster response times to market demands and regulatory changes, offering a significant advantage to suppliers in a rapidly evolving market.

As the global demand for L-Lysine Sulfate continues to rise, particularly in emerging economies with expanding livestock sectors, the dominance of direct sales is expected to persist. This distribution model is anticipated to remain a key driver of growth, ensuring efficient access to high-quality L-Lysine Sulfate for large-scale producers.

Key Market Segments

By Type

- L-Lysine Sulphate 65%

- L-Lysine Sulphate 70%

- L-Lysine Sulphate 80%

By Application

- Feed Industry

- Food Industry

- Pharmaceutical Industry

- Others

By Distribution Channel

- Direct Sales

- Distributors and Traders

- Online Channels

- Others

Driving Factors

Growing Demand for Animal Feed and Nutrition

The L-Lysine Sulfate market is experiencing significant growth due to the increasing demand for high-quality animal feed and nutritional supplements. As a critical amino acid, L-Lysine plays a vital role in promoting the healthy growth and development of livestock, especially poultry and swine. The rising global demand for meat products and the expansion of livestock farming are driving the need for more efficient and nutritious animal feeds.

Additionally, advancements in livestock farming practices and an increased focus on improving the overall health of animals have further propelled L-Lysine Sulfate consumption. As a result, manufacturers are focusing on scaling up production to meet the market’s rising needs, making this a key growth driver in the sector.

Restraining Factors

High Production Costs of L-Lysine Sulfate

One of the major restraints impacting the L-Lysine Sulfate market is the high production cost associated with its manufacturing process. Producing L-Lysine Sulfate involves complex biochemical processes, such as fermentation or synthetic routes, which require significant investment in technology, raw materials, and energy. This leads to higher production costs compared to other amino acids or feed additives.

Additionally, fluctuations in the prices of raw materials, such as corn and soybean meal, which are used in the production of L-Lysine, further contribute to cost unpredictability. As a result, these high costs are often passed on to consumers, which can limit the widespread adoption of L-Lysine Sulfate, especially in price-sensitive regions or for smaller-scale operations.

Growth Opportunity

Increasing Adoption of Sustainable and Organic Farming

A significant growth opportunity for the L-Lysine Sulfate market lies in the increasing adoption of sustainable and organic farming practices. As consumers demand more organic and eco-friendly food products, livestock farmers are transitioning toward organic feed and more natural, environmentally responsible production methods. L-lysine, being a vital amino acid for animal nutrition, is a key component of organic and sustainable animal feed formulations.

This shift offers a unique opportunity for L-Lysine Sulfate suppliers to tap into the growing organic farming sector. Additionally, government initiatives supporting sustainable agriculture and raising awareness of the environmental benefits of organic farming further enhance the demand for organic feed additives, including L-Lysine Sulfate, positioning the market for future growth.

Latest Trends

Growing Focus on Plant-Based Animal Feed Ingredients

A notable trend in the L-Lysine Sulfate market is the growing shift toward plant-based animal feed ingredients. With increasing consumer interest in plant-based diets and rising concerns over environmental sustainability, many livestock producers are turning to plant-based alternatives for animal feed. L-lysine sulfate, derived from both plant and microbial sources, is gaining traction as an essential ingredient in these plant-based feed formulations.

This trend is driven by the need to reduce reliance on animal-derived proteins and minimize the environmental impact of livestock farming. Additionally, the use of plant-based feed aligns with the global push for more sustainable agricultural practices, offering significant growth potential for L-Lysine Sulfate in the plant-based and alternative protein feed markets.

Regional Analysis

The Asia-Pacific L-Lysine Sulfate market holds a 37.4% share, valued at USD 48.6 million.

The L-Lysine Sulfate (CAS 60343-69-3) market is segmented by key regions, each contributing to the global demand in distinct ways. Asia-Pacific is the dominant region, accounting for 37.4% of the market share, valued at USD 48.6 million. This region’s dominance is driven by the rapid expansion of the livestock industry, particularly in China and India, where demand for animal feed and nutritional additives continues to rise due to growing populations and increasing meat consumption.

In North America, the market is supported by a well-established animal farming sector, especially in the United States. The region is experiencing steady growth, driven by advancements in livestock management and nutritional practices, though it holds a smaller share compared to Asia-Pacific.

Europe is another significant player, with demand primarily concentrated in Western European countries like Germany and France. The market here is bolstered by stringent animal welfare regulations and a growing preference for high-quality feed additives. Middle East & Africa and Latin America are emerging markets with moderate growth, where increasing agricultural investments are expected to drive demand for L-Lysine Sulfate, particularly in animal feed.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global L-Lysine Sulfate market in 2024 is highly competitive, with several key players driving growth through strategic initiatives, product innovation, and expanding market presence. ADM (Archer Daniels Midland) is a prominent player with a strong foothold in the animal nutrition and feed industry.

Their extensive network and robust production capabilities position them as a key contributor to the global L-Lysine Sulfate market. Similarly, Ajinomoto Co., Inc. and CJ CheilJedang have been expanding their global reach through consistent advancements in fermentation-based processes, which enable them to cater to the rising demand for high-quality L-Lysine in animal feed, particularly in emerging markets.

Agrolife GmbH and Chengfu Group focus on strengthening their positions through partnerships and geographic expansion, particularly in the Asia-Pacific region, where demand for animal feed additives is surging. Evonik Industries and Fufeng Group are major players known for their technological capabilities in amino acid production, providing a competitive edge in terms of quality and cost-efficiency.

EPPEN Biotech and Global Bio-chem Technology Group continue to innovate by improving their fermentation technologies, meeting the growing demand for L-Lysine Sulfate in the agriculture and animal feed industries. Smaller players like JIGCHEM UNIVERSAL and NB Group Co., Ltd contribute to market dynamics by focusing on niche segments and expanding product portfolios.

Top Key Players in the Market

- ADM

- Agrolife GmbH

- Ajinomoto Co., Inc.

- Chengfu Group

- CJ (China)

- CJ CheilJedang

- EPPEN Biotech

- Evonik Industries

- Fufeng Group

- Global Bio-chem Technology Group Company Limited

- Ingredients Network

- JIGCHEM UNIVERSAL

- NB Group Co., Ltd

- Newseed Chemical Co., Limited

Recent Developments

- In April 2024, Ajinomoto Co. launched a new plant-based L-Lysine Sulfate product designed for animal feed, emphasizing sustainability and higher efficiency in livestock nutrition.

- In March 2024, Evonik Industries expanded its production capacity for L-Lysine Sulfate at its site in Slovakia, enhancing its supply chain to meet increasing global demand.

Report Scope

Report Features Description Market Value (2024) USD 130.2 Million Forecast Revenue (2034) USD 216.2 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (L-Lysine Sulphate 65%, L-Lysine Sulphate 70%, L-Lysine Sulphate 80%), By Application (Feed Industry, Food Industry, Pharmaceutical Industry, Others), By Distribution Channel (Direct Sales, Distributors and Traders, Online Channels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Agrolife GmbH, Ajinomoto Co., Inc., Chengfu Group, CJ (China), CJ CheilJedang, EPPEN Biotech, Evonik Industries, Fufeng Group, Global Bio-chem Technology Group Company Limited, Ingredients Network, JIGCHEM UNIVERSAL, NB Group Co., Ltd, Newseed Chemical Co., Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global L-Lysine Sulfate (Cas 60343-69-3) MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Global L-Lysine Sulfate (Cas 60343-69-3) MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Agrolife GmbH

- Ajinomoto Co., Inc.

- Chengfu Group

- CJ (China)

- CJ CheilJedang

- EPPEN Biotech

- Evonik Industries

- Fufeng Group

- Global Bio-chem Technology Group Company Limited

- Ingredients Network

- JIGCHEM UNIVERSAL

- NB Group Co., Ltd

- Newseed Chemical Co., Limited