Global 2-ethyl-3,4-ethylenedioxythiophene Market By Purity (High Purity EDOT, Standard Purity EDOT), By Application (Displays, Solar cells, Batteries, Sensors, Others), By End-use Industry (Electronics, Automotive, Energy, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139649

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

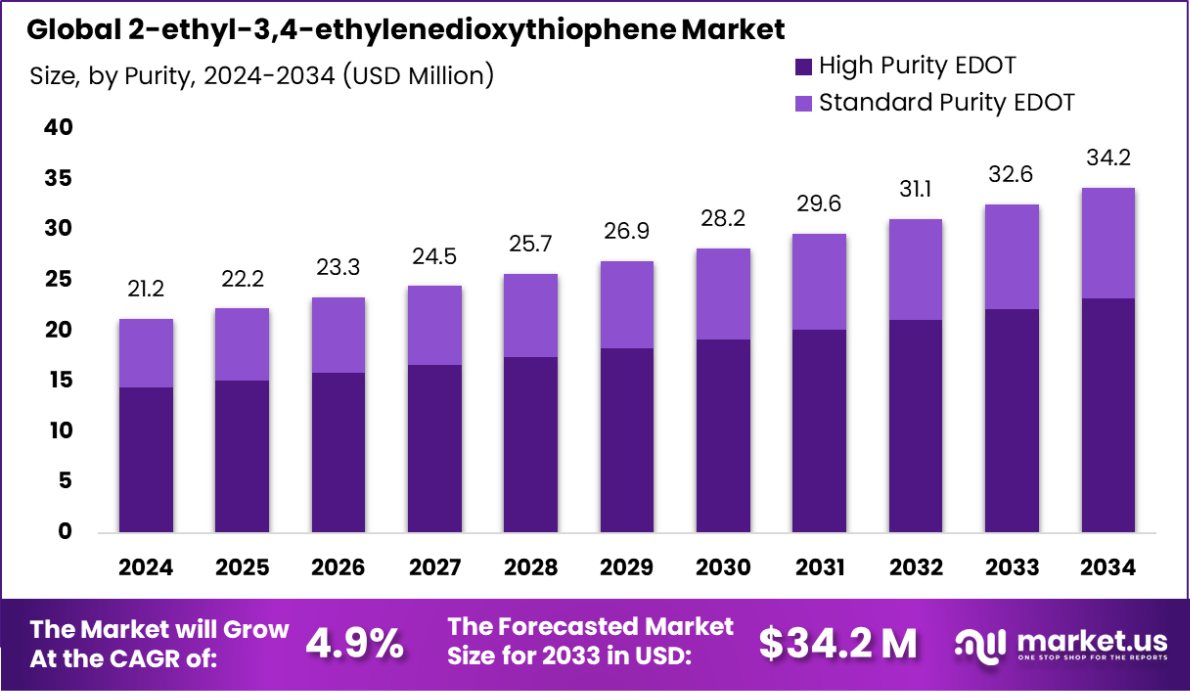

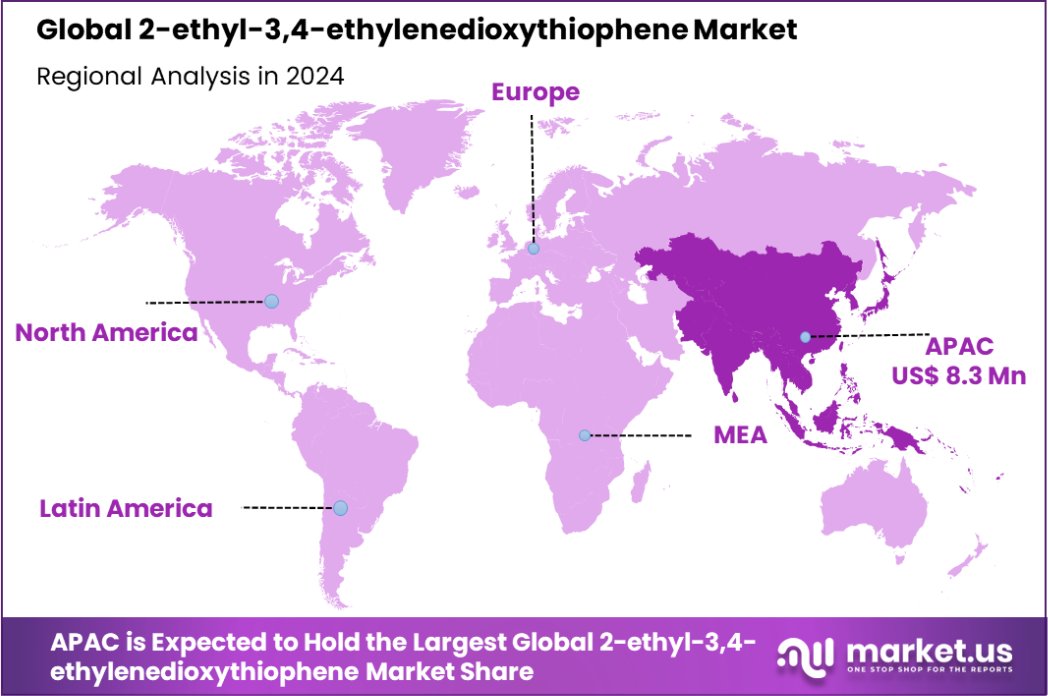

Global 2-ethyl-3,4-ethylenedioxythiophene Market is expected to be worth around USD 34.2 Million by 2034, up from USD 21.2 Million in 2024, and grow at a CAGR of 4.9% from 2025 to 2034. Asia-Pacific dominates with 39.2% market share, valued at USD 8.3 million.

2-Ethyl-3,4-ethylenedioxythiophene, commonly called EDOT, is a chemical compound used primarily as a monomer in producing conductive polymers. It’s a derivative of thiophene, a sulfur-containing heterocycle. The ethylene deoxy bridge in its structure enhances its electropolymerization properties, making it integral to developing polythiophenes used in electronic devices, such as organic light-emitting diodes (OLEDs), solar cells, and smart windows due to its stability and high conductivity.

The market for 2-ethyl-3,4-ethylenedioxythiophene is driven by its growing applications in the electronics industry, especially in the production of antistatic coatings and electronic devices. The demand is propelled by the ongoing advancements in consumer electronics, where conductive polymers are essential for enhancing the performance and durability of devices.

Opportunities within the 2-ethyl-3,4-ethylenedioxythiophene market are vast, particularly in emerging technologies such as flexible electronics and green energy solutions. Innovations in material science that allow for more efficient and cost-effective production of EDOT polymers can open new applications in industrial sectors.

Furthermore, the growing interest in sustainable and renewable energy sources positions EDOT as a critical material in developing new-generation solar cells, offering substantial growth prospects for stakeholders in this sector.

Key Takeaways

- Global 2-ethyl-3,4-ethylenedioxythiophene Market is expected to be worth around USD 34.2 Million by 2034, up from USD 21.2 Million in 2024, and grow at a CAGR of 4.9% from 2025 to 2034.

- High-purity EDOT, accounting for 67.2%, is preferred for optimal performance in advanced applications.

- Displays, using 32.2% of the market, benefit significantly from EDOT’s enhanced conductive properties.

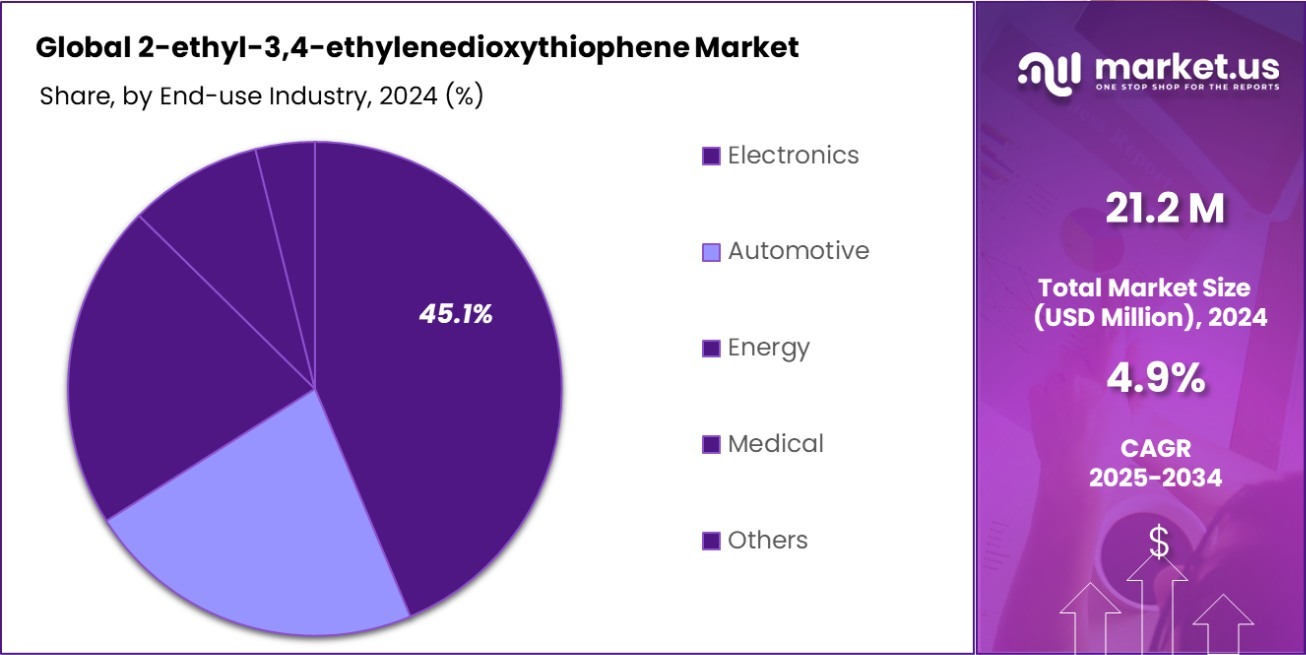

- In the electronics sector, EDOT’s market share stands at 45.1%, driven by demand for efficient materials.

- Asia-Pacific dominates the 2-ethyl-3,4-ethylenedioxythiophene market, holding a 39.2% share, valued at USD 8.3 million, driven by electronics growth.

By Purity Analysis

High Purity EDOT dominates with a 67.2% market share, ensuring superior quality.

In 2024, High Purity EDOT held a dominant market position in the By Purity segment of the 2-ethyl-3,4-ethylenedioxythiophene (EDOT) market, capturing a substantial 67.2% share. This segment benefits significantly from its superior quality and consistency, which are essential for advanced applications in electronics and conductive polymers.

High-purity EDOT is particularly preferred for its excellent electrical properties, making it ideal for producing high-performance poly(3,4-ethylenedioxythiophene) (PEDOT), widely used in antistatic coatings and electronic devices.

On the other hand, Standard Purity EDOT, which caters to less critical applications where high conductivity and purity are not paramount, held the remainder of the market share. This segment is utilized mainly in applications where cost considerations outweigh the stringent requirements for material performance, such as in simpler antistatic applications and bulk polymer production.

The distinct market preferences highlight the diverse applications of EDOT and underscore the importance of purity levels in determining the material’s suitability for various industrial uses. As the market continues to evolve, the demand for both high and standard-purity EDOT is expected to grow, driven by expanding applications in electronics and smart materials.

By Application Analysis

Displays hold 32.2% of the market, driven by demand in electronics.

In 2024, Displays held a dominant market position in the By Application segment of the 2-ethyl-3,4-ethylenedioxythiophene (EDOT) market, securing a 32.2% share. This segment benefits significantly from the rising demand for advanced display technologies, including OLED and conductive polymers, where EDOT’s properties enhance color contrast and energy efficiency.

The material’s superior conductivity and transparency make it ideal for use in touchscreens and flexible displays, which are increasingly prevalent in smartphones, tablets, and high-end consumer electronics.

Following Displays, the Solar Cells segment also captured a significant portion of the market, driven by the growing shift towards renewable energy sources and the need for more efficient photovoltaic cells. EDOT’s application in solar cells focuses on improving charge collection and overall cell efficiency, which is critical in maximizing energy capture from solar installations.

Batteries and Sensors represent other critical applications of EDOT, with each segment leveraging the material’s conductive properties. In batteries, EDOT is used to enhance the conductivity and longevity of electrode materials, whereas, in sensors, its stability and sensitivity to environmental changes make it suitable for various detection and monitoring applications.

By End-Use Industry Analysis

Electronics end-use leads at 45.1%, reflecting growing tech industry integration.

In 2024, Electronics held a dominant market position in the By End-Use Industry segment of the 2-ethyl-3,4-ethylenedioxythiophene (EDOT) market, with a commanding 45.1% share. This segment is propelled by the increasing integration of conductive polymers in consumer electronics, where EDOT’s properties are crucial for developing flexible, durable, and lightweight electronic components. Applications range from antistatic coatings to capacitors and organic transistors, highlighting the material’s versatility and critical role in the electronics industry.

The Automotive sector also shows significant utilization of EDOT, especially in the manufacturing of sensors and actuators used in modern vehicles for enhanced performance and safety features. As automotive manufacturers continue to incorporate more electronic components into vehicles, the demand for EDOT in this sector is expected to grow.

In the Energy sector, EDOT is gaining traction in applications like organic photovoltaics and conductive coatings for energy storage devices, aligning with the global shift towards sustainable energy solutions. Meanwhile, the Medical sector explores the use of EDOT in biomedical devices, including biosensors and implants, benefiting from the polymer’s biocompatibility and stable electrical properties.

Key Market Segments

By Purity

- High Purity EDOT

- Standard Purity EDOT

By Application

- Displays

- Solar cells

- Batteries

- Sensors

- Others

By End-use Industry

- Electronics

- Automotive

- Energy

- Medical

- Others

Driving Factors

Rising Demand for Conductive Polymers in Electronics

The increasing use of conductive polymers in modern electronics is a key driver for the 2-ethyl-3,4-ethylenedioxythiophene market. This material is widely used in organic semiconductors, sensors, and flexible displays due to its high conductivity and stability.

With the growing adoption of wearable technology, smart devices, and next-gen electronic components, industries are actively seeking advanced polymer-based materials for improved performance. Additionally, the shift towards lightweight and energy-efficient electronic components further fuels demand, making 2-ethyl-3,4-ethylenedioxythiophene a crucial part of future electronic innovations.

Restraining Factors

High Production Costs Limiting Market Expansion

The high production costs of 2-ethyl-3,4-ethylenedioxythiophene pose a significant challenge to market growth. The synthesis process requires specialized materials, advanced techniques, and strict quality control, making manufacturing expensive. Additionally, limited large-scale production facilities and high research and development expenses add to the overall costs.

These factors make the material less accessible for price-sensitive industries, slowing adoption. As a result, many companies explore alternative conductive polymers that offer cost-efficiency while maintaining performance. Overcoming these cost barriers is crucial for wider commercial adoption of this material.

Growth Opportunity

Expanding Applications in Flexible and Wearable Electronics

The growing demand for flexible and wearable electronics presents a major opportunity for 2-ethyl-3,4-ethylenedioxythiophene. As industries shift towards bendable displays, smart textiles, and lightweight sensors, this material’s high conductivity, flexibility, and stability make it ideal for next-gen devices.

Companies investing in innovative electronic materials can leverage this trend to develop high-performance conductive films, coatings, and circuits. With continuous advancements in organic electronics and Internet of Things (IoT) devices, the market for 2-ethyl-3,4-ethylenedioxythiophene is set to expand, unlocking new commercial possibilities.

Latest Trends

Rising Use in Organic and Printed Electronics

A key trend in the 2-ethyl-3,4-ethylenedioxythiophene market is its increasing use in organic and printed electronics. With the growing demand for lightweight, flexible, and cost-effective electronic components, manufacturers are turning to conductive polymers for printed circuit boards, flexible sensors, and transparent electrodes.

This trend is driven by technological advancements in roll-to-roll printing and additive manufacturing, making electronic production cheaper and more scalable. As industries move towards sustainable and energy-efficient materials, this polymer is gaining traction, opening new opportunities in displays, smart packaging, and wearable technology.

Regional Analysis

Asia-Pacific dominates the 2-ethyl-3,4-ethylenedioxythiophene market, holding a 39.2% share, valued at USD 8.3 million.

The 2-ethyl-3,4-ethylenedioxythiophene market exhibits varying growth trends across different regions, with Asia-Pacific emerging as the dominant market, accounting for 39.2% of the global share, valued at USD 8.3 million. The region’s leadership is driven by expanding electronics manufacturing hubs in China, Japan, and South Korea, along with rising investments in flexible electronics and organic semiconductors.

North America follows closely, supported by a strong presence of R&D-driven companies and advanced material innovations. The region benefits from the increasing adoption of conductive polymers in wearable devices and sensors. Meanwhile, Europe sees steady growth due to its focus on sustainable materials and advancements in printed electronics, particularly in Germany and France.

The Middle East & Africa region experiences slower adoption, constrained by limited industrial applications but shows potential with increasing smart city initiatives. Latin America, led by Brazil and Mexico, is witnessing moderate demand as the region expands its consumer electronics and automotive sectors.

With Asia-Pacific continuing to lead and North America and Europe showing strong innovation-driven demand, the global market is expected to expand further as electronic and smart material applications increase worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global 2-ethyl-3,4-ethylenedioxythiophene market is characterized by the presence of several key players, each contributing to market growth through product innovation, supply chain expansion, and strategic collaborations. Suzhou Yacoo Science Co., Ltd. holds a strong position due to its expertise in conductive polymer intermediates, leveraging its advanced R&D capabilities to expand its global reach. Chem-Impex International, Inc. benefits from a robust distribution network, catering to high-demand sectors such as organic electronics and sensor technology.

ARVIK PHARMA PVT. LTD. is increasingly focusing on specialty chemical synthesis, allowing it to serve niche applications where high-purity conductive materials are essential. Meanwhile, Qingdao Fuqiang New Material Technology Co., Ltd. is gaining traction due to its cost-effective production strategies and growing partnerships in the Asia-Pacific market, particularly in China and South Korea.

Ningbo Taikang Chemical Co., Ltd. is expanding its manufacturing capabilities to cater to the rising demand for printed electronics and flexible circuits, making it a key supplier in emerging markets. Lastly, Aartia Kem Science is focusing on high-performance conductive polymer solutions, targeting industries such as smart textiles and medical sensors.

With Asia-Pacific leading the market, companies expanding in the region are expected to experience higher growth opportunities. Innovation in material properties, scalability, and application expansion will determine competitive positioning, with R&D investments and strategic collaborations playing a crucial role in sustaining market leadership.

Top Key Players in the Market

- Suzhou Yacoo Science Co., Ltd.

- Chem-Impex International, Inc.

- ARVIK PHARMA PVT. LTD.

- Qingdao Fuqiang New Material Technology Co., Ltd.

- Ningbo Taikang Chemical Co., Ltd.

- Aartia Kem Science

Recent Developments

- In February 2025, Suzhou Yacoo Science Co., Ltd. opened a new research center focused on developing next-generation conductive polymers based on 2-ethyl-3,4-ethylenedioxythiophene.

- In November 2024, Aartia Kem Science introduced a new water-soluble derivative of 2-ethyl-3,4-ethylenedioxythiophene for biomedical applications.

- In September 2024, Ningbo Taikang Chemical Co., Ltd. announced a joint venture with a European chemical company to expand its 2-ethyl-3,4-ethylenedioxythiophene production capabilities.

Report Scope

Report Features Description Market Value (2024) USD 21.2 Million Forecast Revenue (2034) USD 34.2 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (High Purity EDOT, Standard Purity EDOT), By Application (Displays, Solar cells, Batteries, Sensors, Others), By End-use Industry (Electronics, Automotive, Energy, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Suzhou Yacoo Science Co., Ltd., Chem-Impex International, Inc., ARVIK PHARMA PVT. LTD., Qingdao Fuqiang New Material Technology Co., Ltd., Ningbo Taikang Chemical Co., Ltd., Aartia Kem Science Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2-ethyl-3,4-ethylenedioxythiophene MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

2-ethyl-3,4-ethylenedioxythiophene MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

Top Key Players in the Market

- Suzhou Yacoo Science Co., Ltd.

- Chem-Impex International, Inc.

- ARVIK PHARMA PVT. LTD.

- Qingdao Fuqiang New Material Technology Co., Ltd.

- Ningbo Taikang Chemical Co., Ltd.

- Aartia Kem Science