Global Pouches Market Size, Share, And Business Benefits By Type (Stand-up Pouches, Flat Pouches, Roll Stock), By Material (Plastic, Metal, Paper, Bioplastics), By Treatment Type(Aseptic, Standard, Retort, Hot-Filled), By End Use (Food and Beverages, Healthcare, Personal Care and Cosmetics, Homecare, Others), By Closure Type (Tear Notch, Zipper, Spout), By Pouches Weight (less than 10 gms, 10-20 gms, 20-50 gms, 50-70 gms , greater than 70 gms), By Sealer (Direct Heat Sealer, Vacuum Pouch Sealer, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2025

- Report ID: 137855

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Pouches Market

- By Type Analysis

- By Material Analysis

- By Treatment Type Analysis

- By End-Use Analysis

- By Closure Type Analysis

- By Pouches WeightAnalysis

- By Sealer Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

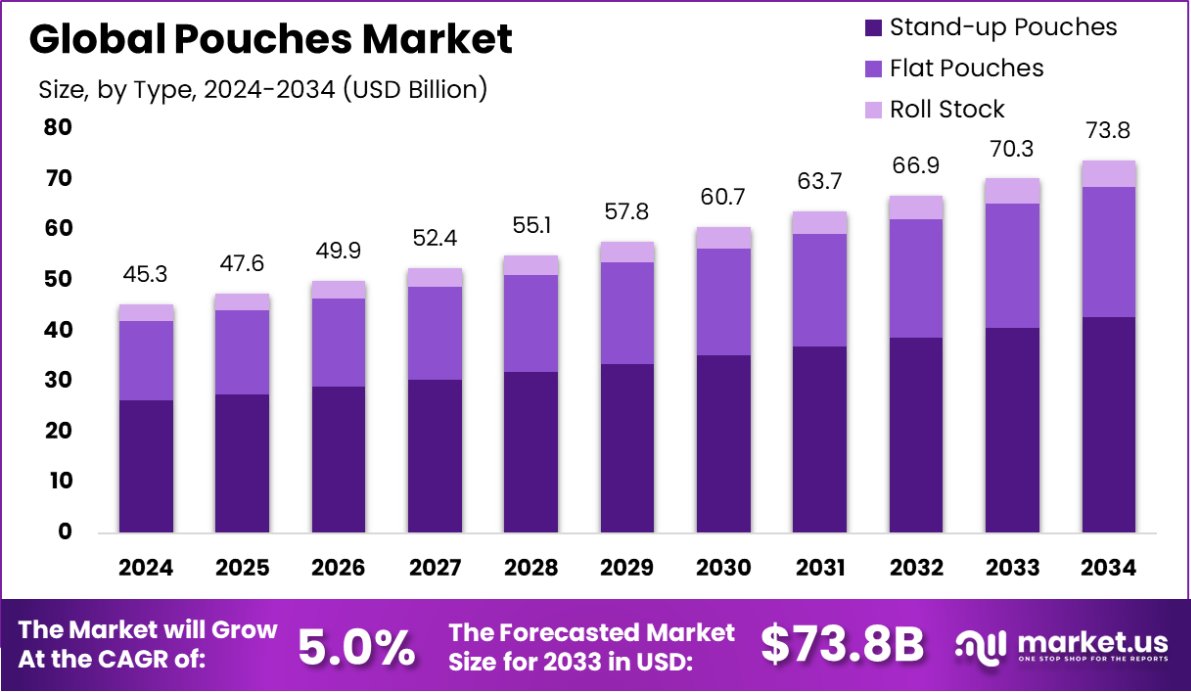

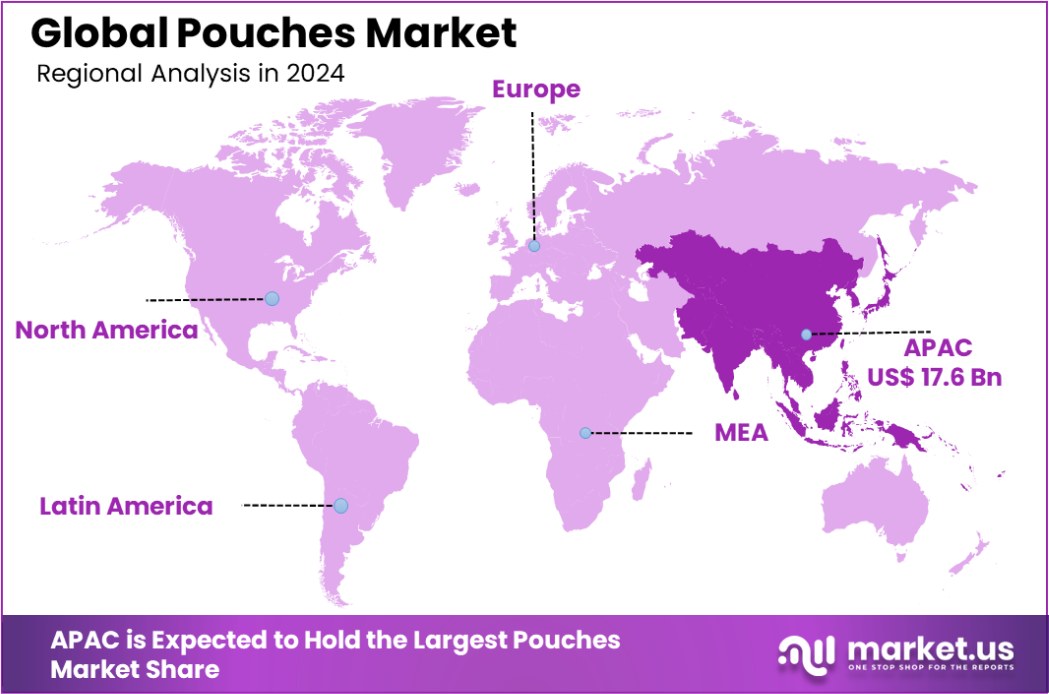

The Global Pouches Market is expected to be worth around USD 73.8 Billion by 2034, up from USD 45.3 Billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034. Asia-Pacific pouches market holds 38.2%, valued at USD 17.6 billion.

The pouches market has witnessed notable growth across various sectors, driven by evolving consumer preferences and advancements in packaging technology. Pouches, known for their lightweight structure, portability, and extended shelf-life benefits, are gaining traction in industries such as food and beverage, pharmaceuticals, and nicotine products.

Packaging innovations are shaping the pouches market as manufacturers prioritize flexible, eco-friendly, and cost-effective solutions. The demand for resealable and single-use pouches is expanding across retail and e-commerce channels.

With sustainability concerns escalating, regulatory bodies are pushing for biodegradable and recyclable alternatives, compelling brands to adopt greener materials. Industries such as tobacco alternatives and health supplements are integrating pouches into their product lines to enhance consumer accessibility and regulatory compliance.

Consumer lifestyle changes are influencing the adoption of pouches, with convenience, portion control, and on-the-go consumption being primary motivators. The growing preference for flexible packaging over rigid formats is enhancing the market’s scope. In the nicotine sector, pouches have emerged as an alternative to traditional tobacco products.

According to the CDC, in 2022, 2.9% of U.S. adults had tried nicotine pouches, while 0.4% reported current use. Among middle and high school students in 2024, 1.8% reported current usage. Rising awareness and the decline of combustible tobacco consumption are driving nicotine pouch sales, which surged from 126 million in August 2019 to 808 million in March 2022.

Additionally, 29.2% of adults who smoked had encountered nicotine pouches, while 5.6% had tried them. Notably, 16.8% of adult smokers expressed interest in trying nicotine pouches within the next six months. These trends indicate a growing market potential for nicotine pouches as an alternative product category within the broader pouches industry.

Sustainability remains a key trend in the pouches market, with companies developing compostable and recyclable materials to align with environmental regulations. The push for low-waste packaging solutions is prompting brands to integrate bio-based polymers. Additionally, digital printing and smart packaging technologies are enhancing consumer engagement and product authenticity.

E-commerce expansion is fueling demand for durable and lightweight pouches, particularly in food, pharmaceuticals, and personal care products. As regulatory frameworks evolve, businesses will need to adapt to stringent labeling and safety standards, particularly in emerging markets.

Key Takeaways

- The Global Pouches Market is expected to be worth around USD 73.8 Billion by 2034, up from USD 45.3 Billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034.

- Stand-up pouches dominate the pouches market, holding a strong 58.2% share.

- Plastic remains the preferred material in the market, capturing a 62.1% share.

- Standard treatment type leads the market segment, accounting for 43.2% globally.

- Food and beverage applications hold the largest share at 69.2% overall.

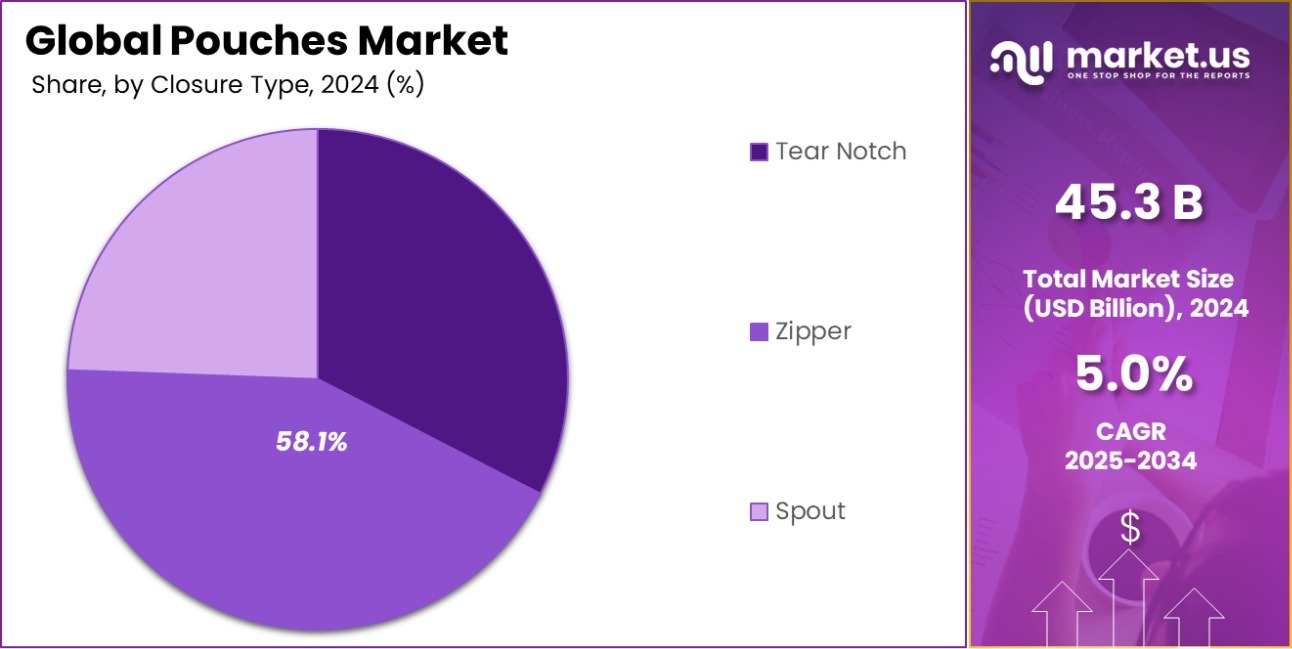

- Zipper closures are the most popular, securing a 58.1% market share.

- Pouches weighing 20-50 grams contribute significantly, covering 39.2% of demand.

- Direct heat sealers dominate sealing technology, commanding a 64.1% market share.

- Asia-Pacific pouches market holds 38.2% share, valued at USD 17.6 billion.

Business Benefits of Pouches Market

Pouches offer substantial environmental advantages over their rigid counterparts such as glass jars and steel cans, making them a valuable choice for businesses focused on sustainability. According to a government report, flexible pouches are associated with more than a 60% lower impact on climate change. This is a crucial consideration for companies aiming to reduce their carbon footprint.

In addition to their positive effects on climate change, pouches are also more water-efficient during production. They use up to 76% less water than rigid plastic bottles, highlighting their role in promoting more sustainable manufacturing practices.

The adoption of pouches also contributes to a reduction in greenhouse gas emissions. Data shows that pouches generate up to 62% less smart greenhouse gas emissions compared to their rigid plastic counterparts. This supports businesses in achieving their environmental goals and compliance with regulatory standards regarding emissions.

Furthermore, switching from rigid plastic bottles to pouches can decrease fossil fuel consumption by 61%. This not only helps conserve non-renewable resources but also aligns with global efforts to minimize dependency on fossil fuels, thereby supporting energy sustainability initiatives.

By Type Analysis

Stand-up pouches dominate the market, holding a significant 58.2% share due to their convenience and durability.

In 2023, Stand-up Pouches held a dominant market position in the By Type segment of the Pouches Market, capturing a 58.2% share. The popularity of Stand-up Pouches stems from their convenience and efficient use of shelf space, making them a preferred choice for both retailers and consumers seeking practical packaging solutions.

Flat Pouches accounted for 29.3% of the market. These pouches are favored for their cost-effectiveness and minimal material use, which appeals to companies aiming to reduce packaging costs and environmental impact. Their simplicity and versatility in packaging size and design drive their adoption across various industries.

Roll Stock captured 12.5% of the market share. This format is extensively utilized for its adaptability in packaging size and volume, allowing for customization and scalability in production. Roll stock is integral for businesses that prioritize flexible packaging solutions and efficiency in manufacturing processes.

By Material Analysis

Plastic remains the preferred material for pouches, accounting for 62.1% of the market due to flexibility.

In 2024, Plastic held a dominant market position in the By Material segment of the Pouches Market, with a 62.1% share. Plastic pouches remain prevalent due to their durability, lightweight nature, and cost efficiency, making them ideal for a broad range of applications from food to healthcare products.

Metal accounted for 15.7% of the market. Metal pouches are chosen for their superior barrier properties, which extend the shelf life of contents. They are commonly used in the food industry, especially for high-temperature sterilization processes, providing safety and preserving food quality.

Paper made up 12.2% of the market share. Paper pouches are increasingly popular as they cater to the growing consumer preference for sustainable packaging. They are primarily used in markets that value environmental friendliness, such as organic and natural food products.

Bioplastics held a 10.0% share of the market. These pouches are gaining traction as they offer an eco-friendly alternative to traditional plastics. Made from renewable resources, bioplastics are favored in applications where sustainability is a priority, aligning with global trends towards reducing plastic waste.

By Treatment Type Analysis

Standard treatment leads with 43.2%, highlighting its cost-effectiveness and widespread application in packaging industries.

In 2024, Standard held a dominant market position in the By Treatment Type segment of the Pouches Market, with a 43.2% share. Standard pouches are widely utilized across various industries for their cost-effectiveness and versatility in packaging non-perishable goods, contributing to broad market acceptance.

Aseptic pouches captured 24.8% of the market. These pouches are essential for sterile packaging requirements, especially in the food and pharmaceutical sectors. Their ability to maintain product purity without refrigeration supports their application in extending product shelf life.

Retort pouches accounted for 21.5% of the market. They are preferred for their ability to withstand high-temperature sterilization, preserving the quality and extending the shelf life of food products without the need for cold storage.

Hot-filled pouches made up 10.5% of the market share. These pouches are designed to endure the thermal stresses of hot filling processes, making them suitable for high-temperature food products like sauces and soups. Their use facilitates the maintenance of flavor and nutritional value.

By End-Use Analysis

The food and beverages sector holds a 69.2% market share, emphasizing the high demand for secure packaging.

In 2024, Food and Beverages held a dominant market position in the By End Use segment of the Pouches Market, with a 69.2% share. This sector’s strong preference for pouches arises from their effectiveness in preserving freshness and extending shelf life, which is essential for maintaining food quality.

Healthcare accounted for 12.8% of the market. Pouches in this sector are critical for ensuring the sterility and safety of medical products. Their use spans from pharmaceuticals to medical devices, where secure, contamination-free packaging is paramount.

Personal Care and Cosmetics made up 10.1% of the market share. In this industry, pouches are valued for their portability and ease of use, enhancing consumer convenience and reducing product waste, especially in liquid and gel formulations.

Homecare held 7.9% of the market. Pouches in-home care are appreciated for their practicality and effectiveness in containing and dispensing a variety of cleaning products, driving their adoption in a market focused on functionality and convenience.

By Closure Type Analysis

Zipper pouches, preferred for resealability and freshness retention, command a 58.1% market share across industries.

In 2024, Zipper held a dominant market position in the By Closure Type segment of the Pouches Market, with a 58.1% share. Zippers are highly favored for their resealability, which enhances product freshness and provides consumer convenience, making them a top choice for food products and other perishables.

Tear Notch accounted for 25.4% of the market. This closure type is popular for its easy-open feature, which is essential for single-use or on-the-go packaging solutions. It’s particularly prevalent in snack and confectionery packaging, offering quick and hassle-free access.

Spout closures captured 16.5% of the market. These are primarily used in liquid or semi-liquid products due to their precise pouring capabilities, reducing spillage, and improving usability. Common applications include beverages, sauces, and cleaning products, where control and convenience are key.

By Pouches WeightAnalysis

Pouches weighing 20-50 grams capture a 39.2% share, reflecting demand for lightweight and portable packaging solutions.

In 2024, 20-50 gms held a dominant market position in the By Pouches Weight segment of the Pouches Market, with a 39.2% share. This weight range is especially preferred in the food and snack industry for its balance of product quantity and portability, appealing to consumer preferences for moderate-serving packages.

Less than 10 gms accounted for 17.8% of the market. These small pouches are ideal for single servings or sample sizes, popular in industries like cosmetics and condiments, where minimal product amounts are packaged for trial or individual use.

The 10-20 gms segment captured 22.5% of the market. This range is favored for its suitability for small, convenient snack packages and health supplements, which benefit from precise portion control and ease of transport.

Pouches weighing 50-70 gms made up 12.0% of the market share. These are typically used for products requiring a larger quantity but still need to maintain consumer convenience, such as pet foods and larger snack formats.

Pouches weighing more than 70 gms held 8.5% of the market. This category caters to bulk packaging needs, common in homecare products and large-format food items, where substantial product amounts are necessary.

By Sealer Analysis

Direct heat sealers dominate with a 64.1% share, ensuring strong, airtight seals for product safety and preservation.

In 2024, Direct Heat Sealer held a dominant market position in the By Sealer segment of the Pouches Market, with a 64.1% share. This sealer type is extensively utilized due to its efficiency in sealing a variety of materials, ensuring airtight closures that extend product shelf life and protect against contamination.

Vacuum Pouch Sealer comprised the remaining 35.9% of the market. This technology is pivotal in food preservation, as it effectively removes air before sealing, thereby reducing oxidation and extending the freshness of perishable goods. Its adoption is particularly prominent in food industries that require enhanced protection for their products.

Key Market Segments

By Type

- Stand-up Pouches

- Flat Pouches

- Roll Stock

By Material

- Plastic

- Metal

- Paper

- Bioplastics

By Treatment Type

- Aseptic

- Standard

- Retort

- Hot-Filled

By End Use

- Food and Beverages

- Healthcare

- Personal Care and Cosmetics

- Homecare

- Others

By Closure Type

- Tear Notch

- Zipper

- Spout

By Pouches Weight

- <10 gms

- 10-20 gms

- 20-50 gms

- 50-70 gms

- >70 gms

By Sealer

- Direct Heat Sealer

- Vacuum Pouch Sealer

- Others

Driving Factors

Consumer Preference Shift Towards Convenient, Healthy Options

The refrigerated snacks market is witnessing growth driven by a shift in consumer preferences toward healthier and more convenient food choices. As lifestyles become busier, individuals are increasingly opting for quick and nutritious options that align with their health goals.

Refrigerated snacks, often packed with natural ingredients and fewer preservatives, cater to this need effectively. This trend is reinforced by rising awareness about the benefits of fresh, minimally processed foods, making refrigerated snacks a popular choice among health-conscious consumers.

Expansion of Retail Channels and Improved Distribution Networks

The accessibility of refrigerated snacks has significantly improved due to the expansion of retail channels and the enhancement of distribution networks. Supermarkets, convenience stores, and online grocery platforms are now more focused on stocking a diverse range of refrigerated snack products.

This not only increases consumer exposure to these products but also enhances purchase convenience. The strategic placement of refrigerated snacks in high-traffic sections and the expansion of refrigerated spaces in stores are pivotal factors that drive sales in this sector.

Innovation and Diversification in Product Offerings

Manufacturers in the refrigerated snacks market are continuously innovating and diversifying their product offerings to attract a broader customer base. By introducing unique flavors, functional ingredients, and appealing packaging, brands are enhancing consumer interest and engagement.

These innovations address specific dietary preferences and requirements, such as gluten-free, vegan, and protein-rich options, further stimulating market growth. This focus on innovation helps brands stand out in a competitive market and meet evolving consumer tastes and preferences.

Restraining Factors

High Costs Associated with Refrigeration and Logistics

The refrigerated snacks market faces challenges due to the high costs associated with maintaining the necessary refrigeration and logistics. These snacks require continuous cold storage to preserve freshness and prevent spoilage, leading to increased operational expenses.

The need for specialized storage facilities and transportation also adds a financial burden on producers and distributors. This can result in higher retail prices for consumers, potentially limiting the market’s growth as price-sensitive customers might opt for non-refrigerated alternatives that are more affordable.

Strict Regulations and Quality Standards Compliance

Navigating the complex landscape of food safety regulations and quality standards presents a significant hurdle for refrigerated snack manufacturers. These regulations are stringent, with specific requirements for storage, handling, and packaging to ensure consumer safety.

Compliance requires additional resources and meticulous operational processes, which can be particularly challenging for smaller or newer market entrants. These regulatory pressures can restrict market growth by increasing production costs and creating barriers to entry for potential new competitors.

Consumer Concerns Over Preservatives and Additives

While refrigerated snacks are often marketed as healthy, there remains a consumer skepticism regarding the use of preservatives and additives, which are sometimes necessary to extend shelf life and maintain product quality. These concerns can deter consumers from looking for all-natural or organic options.

As awareness and education around food ingredients increase, consumers are more vigilant about product labels, often avoiding snacks that contain unfamiliar or artificial ingredients, thereby restraining the market growth for refrigerated snacks that do not meet these clean label expectations.

Growth Opportunity

Rising Interest in Global Flavors and Fusion Snacks

The refrigerated snacks market can capitalize on the growing consumer interest in international cuisines by introducing flavors and fusion snacks from around the world. As people become more adventurous with their food choices, the introduction of exotic and ethnic flavors in refrigerated snack formats can attract a diverse consumer base seeking new taste experiences.

This approach not only enhances product appeal but also differentiates offerings in a competitive market, opening avenues for growth among culturally curious consumers.

Partnerships with Health and Fitness Sectors

There’s a notable opportunity for growth in the refrigerated snacks market through strategic partnerships with the health and fitness industry. By collaborating with gyms, wellness centers, and health-focused events, brands can position their products directly to health-conscious consumers.

These partnerships can enhance brand visibility and credibility, especially for snacks that are protein-rich, low-calorie, or have other health benefits. This targeted approach can effectively tap into a demographic that values convenience without compromising on their dietary goals.

Advancements in Eco-Friendly Packaging Solutions

Investing in innovative and sustainable packaging solutions presents a significant growth opportunity for the refrigerated snacks market. As environmental concerns become more prominent, consumers are increasingly favoring products that come in eco-friendly packaging.

Developing biodegradable, recyclable, or reusable packaging can appeal to this environmentally aware customer base, potentially boosting sales. Moreover, such initiatives can also reduce the carbon footprint of packaging processes, aligning with global sustainability trends and possibly qualifying products for eco-certifications that further attract conscientious buyers.

Latest Trends

Increased Demand for Plant-Based Refrigerated Snacks

The refrigerated snacks market is seeing a surge in consumer demand for plant-based options. This trend is driven by a growing awareness of environmental and health concerns associated with animal products. Manufacturers are responding by expanding their offerings of snacks made from vegetables, legumes, and grains, which are not only perceived as healthier but also align with vegetarian and vegan lifestyles.

These plant-based snacks are becoming staples in supermarkets, indicating a permanent shift in consumer preferences toward sustainability and health-conscious eating.

Emphasis on Protein-Enriched Snack Options

Protein-enriched refrigerated snacks are gaining popularity as consumers increasingly seek snacks that provide more than just convenience. These snacks are designed to offer nutritional benefits, such as higher protein content, which is essential for muscle repair and overall health.

Brands are leveraging this trend by introducing a variety of high-protein yogurts, cheese snacks, and meat-based products that cater to fitness enthusiasts and health-conscious consumers looking for fulfilling snack options that fit their active lifestyles.

Technological Innovations in Refrigeration

Technological advancements in refrigeration technology are shaping the refrigerated snacks market by improving product quality and extending shelf life. Innovations such as advanced cooling systems and smart refrigeration units allow for better temperature control, reducing the risk of spoilage and maintaining the freshness of snacks.

This not only helps in reducing waste but also ensures that snacks retain their nutritional value and taste over time, enhancing consumer satisfaction and trust in refrigerated snack products.

Regional Analysis

The Asia-Pacific pouches market holds a 38.2% share, valued at USD 17.6 billion.

The pouches market exhibits varied growth dynamics across different regions, characterized by unique consumer preferences and economic conditions. In North America, the market is driven by increasing consumer demand for convenient packaging solutions, with the U.S. leading in terms of adoption due to its robust food and beverage sector.

The European market benefits from stringent sustainability regulations that propel the demand for eco-friendly pouches, particularly in Germany and the UK.

Asia-Pacific dominates the global landscape with a 38.2% share, valuing approximately USD 17.6 billion. This region’s growth is fueled by rapid urbanization and expanding retail sectors in countries like China and India, making it a pivotal area for market players. Latin America and the Middle East & Africa, though smaller in scale, are witnessing gradual growth.

Latin America’s market is bolstered by the burgeoning personal care and pharmaceutical industries, particularly in Brazil and Mexico. Conversely, the Middle East & Africa see an uptick driven by an increasing number of modern retail formats that demand innovative packaging solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global pouches market in 2024 witnessed a dynamic landscape, with key players leveraging innovation, sustainability, and strategic expansions to strengthen their positions. Amcor Plc, Berry Global Inc., and Mondi Plc maintained strong market shares through advancements in recyclable and high-barrier flexible packaging solutions, catering to the growing emphasis on sustainability in food and non-food sectors.

Companies such as Constantia Flexibles Group GmbH, Huhtamaki Group, and Sealed Air Corp. focused on lightweight materials and mono-material structures, aligning with circular economy goals. Sonoco Products Co. and Smurfit Kappa expanded their paper-based pouch offerings, tapping into consumer preference for eco-friendly alternatives.

Dai Nippon Printing Co. Ltd., Goglio SpA, and Tetra Pak Group drove innovation through high-performance laminated pouches designed for extended shelf life, particularly in the food and beverage segment. Meanwhile, UFlex Ltd. and ProAmpac strengthened their footprints by enhancing flexible packaging solutions with smart packaging features, improving convenience and product tracking capabilities.

Coveris Management GmbH and Südpack concentrated on high-barrier film technologies to extend applications in pharmaceutical and medical packaging. Winpak Ltd. and CCL Industries Inc. introduced advanced lidding and spouted pouch designs to address consumer convenience trends.

Strategic mergers and investments played a critical role in shaping competition. Companies such as Nabtesco Corp. and Montana Tech Components AG explored automation and enhanced manufacturing efficiency, reinforcing production capabilities in high-demand regions.

Top Key Players in the Market

- Amcor Plc

- American Packaging Corp.

- Berry Global Inc.

- CCL Industries Inc.

- Clifton Packaging Group Ltd.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Dai Nippon Printing Co. Ltd.

- Goglio SpA

- GUALAPACK S.P.A

- Huhtamaki Group

- Mondi Plc

- Montana Tech Components AG

- Nabtesco Corp.

- Polymer Packaging Inc.

- ProAmpac

- ProAmpac Holdings Inc.

- Sealed Air Corp.

- Smurfit Kappa

- Sonoco Products Co.

- Stora Enso Oyj

- Südpack

- Tetra Pak Group

- UFlex Ltd.

- Winpak Ltd.

Recent Developments

- In 2024, Amcor Plc launched a 2-liter recycle-ready stand-up pouch for home care and introduced an all-polyethylene spouted pouch with Stonyfield Organic, enhancing recyclability. These innovations strengthen Amcor’s commitment to sustainable packaging solutions.

- In 2024, Berry Global Inc. specializes in flexible packaging, including pouches. Sales declined to $12.3B from $12.7B in 2023, but EPS grew for the 12th year. The company completed a major spin-off, strengthening its focus on sustainable packaging solutions.

Report Scope

Report Features Description Market Value (2024) USD 45.3 Billion Forecast Revenue (2034) USD 73.8 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Stand-up Pouches, Flat Pouches, Roll Stock), By Material (Plastic, Metal, Paper, Bioplastics), By Treatment Type(Aseptic, Standard, Retort, Hot-Filled), By End Use (Food and Beverages, Healthcare, Personal Care and Cosmetics, Homecare, Others), By Closure Type (Tear Notch, Zipper, Spout), By Pouches Weight (<10 gms, 10-20 gms, 20-50 gms, 50-70 gms , >70 gms), By Sealer (Direct Heat Sealer, Vacuum Pouch Sealer, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor Plc, American Packaging Corp., Berry Global Inc., CCL Industries Inc., Clifton Packaging Group Ltd., Constantia Flexibles Group GmbH, Coveris Management GmbH, Dai Nippon Printing Co. Ltd., Goglio SpA, GUALAPACK S.P.A, Huhtamaki Group, Mondi Plc, Montana Tech Components AG, Nabtesco Corp., Polymer Packaging Inc., ProAmpac, ProAmpac Holdings Inc., Sealed Air Corp., Smurfit Kappa, Sonoco Products Co., Stora Enso Oyj, Südpack, Tetra Pak Group, UFlex Ltd., Winpak Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor Plc

- American Packaging Corp.

- Berry Global Inc.

- CCL Industries Inc.

- Clifton Packaging Group Ltd.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Dai Nippon Printing Co. Ltd.

- Goglio SpA

- GUALAPACK S.P.A

- Huhtamaki Group

- Mondi Plc

- Montana Tech Components AG

- Nabtesco Corp.

- Polymer Packaging Inc.

- ProAmpac

- ProAmpac Holdings Inc.

- Sealed Air Corp.

- Smurfit Kappa

- Sonoco Products Co.

- Stora Enso Oyj

- Südpack

- Tetra Pak Group

- UFlex Ltd.

- Winpak Ltd.