Global Ceramic Inks Market By Type(Decorative, Functional), By Formulation(Solvent-based Inks, Water-based Inks, Oil-based Inks), By Technology(Digital Printing, Analog Printing), By Application(Ceramic Tiles, Glass Printing, Food Container Printing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121463

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

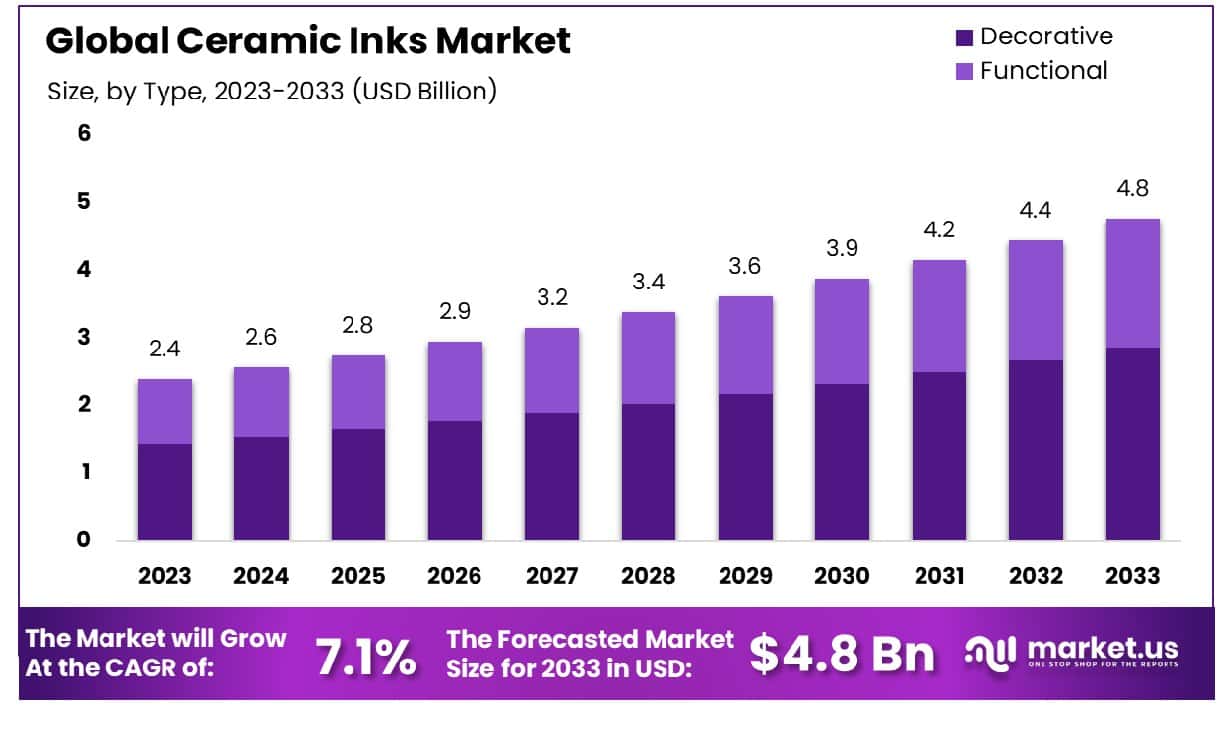

The Global Ceramic Inks Market size is expected to be worth around USD 4.8 Billion by 2033, From USD 2.4 Billion by 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033

The Ceramic Inks Market denotes the specialized segment within the broader printing industry focused on developing, manufacturing, and distributing inks specifically formulated for ceramic substrates. These inks, meticulously engineered for durability, vividness, and compatibility with high-temperature firing processes, enable intricate and enduring designs on ceramic surfaces across various applications, including tiles, glass, and packaging.

With escalating demand driven by burgeoning construction activities, evolving consumer preferences for personalized ceramics, and technological advancements enhancing ink performance, the Ceramic ink market presents lucrative opportunities for stakeholders to innovate, diversify, and capitalize on the dynamic landscape of decorative and functional ceramics.

The Ceramic Inks Market continues to exhibit promising growth prospects, fueled by a myriad of factors influencing the ceramics and glass industries. As the demand for ceramic products, particularly tiles and glassware, persists in both residential and commercial sectors, the market for ceramic inks experiences a corresponding surge. This growth trajectory is further bolstered by advancements in digital printing technologies, enabling manufacturers to achieve intricate designs and patterns on ceramic surfaces with high precision and efficiency.

Moreover, the burgeoning demand for flat glass serves as a significant catalyst for the ceramic inks market. With projections indicating a substantial increase from 11.2 billion square meters in 2023 to 14.3 billion square meters by 2027, at an average annual growth rate of 4.9%, the need for innovative printing solutions on glass surfaces escalates. This trend aligns seamlessly with the capabilities of ceramic inks, offering durable, vibrant, and customizable printing solutions for diverse applications in architecture, automotive, and interior design sectors.

Furthermore, the global market value of flat glass is poised to surpass £400 billion by 2030, underscoring the immense potential for ceramic inks within this burgeoning market segment. As manufacturers and stakeholders capitalize on these opportunities, investing in research and development initiatives to enhance ink formulations, printing technologies, and application methods will be imperative to sustain competitiveness and meet evolving consumer preferences.

Key Takeaways

- Market Growth: The Global Ceramic Inks Market size is expected to be worth around USD 4.8 Billion by 2033, From USD 2.4 Billion by 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033

- Regional Dominance: Asia Pacific dominates the Ceramic Inks Market with a share of 39.5%, totaling USD 0.9 billion.

- Segmentation Insights:

- By Type: Decorative ink dominates with a 60.0% market share.

- By Formulation: Solvent-based inks lead at 47.5% formulation preference.

- By Technology: Digital printing technology captures 60.4% of the market.

- By Application: Ceramic tiles application holds a substantial 47.3% market share.

- Growth Opportunities: In 2023, the global ceramic inks market saw growth driven by expanding ceramic industries in emerging markets and technological advancements in ink formulations, promising innovation and market expansion.

Driving Factors

Increasing Demand for Ceramic Tiles in Construction Projects

The growth of the ceramic inks market is substantially fueled by the increasing demand for ceramic tiles in construction projects worldwide. As urbanization persists and infrastructural development accelerates, the construction sector witnesses a surge in demand for ceramic tiles, owing to their durability, aesthetic appeal, and versatility. With ceramic tiles being extensively utilized in residential, commercial, and industrial construction, the demand for ceramic inks, crucial for tile decoration and customization, experiences a proportional upswing.

According to recent industry reports, the global ceramic tiles market is projected to grow at a CAGR of approximately 6% from 2021 to 2026, indicating a sustained demand trajectory. This growth translates directly to increased consumption of ceramic inks, as manufacturers strive to meet the evolving preferences of construction projects worldwide.

Growing Adoption of Digital Printing Technology in Ceramic Decoration

The integration of digital printing technology in ceramic decoration processes has emerged as a pivotal driver for the ceramic inks market. Digital printing offers unparalleled flexibility, precision, and customization capabilities, enabling manufacturers to produce intricate designs, patterns, and textures on ceramic surfaces with ease. This technology not only enhances efficiency and reduces production time but also facilitates cost-effective customization, catering to the diverse aesthetic preferences of consumers.

Industry analysts predict a significant expansion in the global digital printing market for ceramic tiles, with a projected CAGR of over 12% during the forecast period. This exponential growth underscores the increasing adoption of digital printing technology, thereby propelling the demand for ceramic inks tailored for digital applications.

Rising Popularity of Ceramic Products in Interior Design and Architectural Applications

The burgeoning popularity of ceramic products in interior design and architectural applications amplifies the demand for ceramic inks, driving market growth. Ceramic tiles, renowned for their aesthetic appeal, durability, and low maintenance, have become indispensable elements in contemporary interior design schemes and architectural projects. The versatility of ceramic surfaces allows for seamless integration into diverse spaces, ranging from residential kitchens and bathrooms to commercial offices and public venues.

Market research indicates a steady rise in consumer preferences for ceramic products in interior design, with a notable inclination toward innovative and customizable solutions. This consumer-driven trend fosters opportunities for manufacturers to introduce a wide array of ceramic inks, catering to evolving design trends and aesthetic preferences in the interior design and architectural landscape.

Restraining Factors

Stringent Environmental Regulations Regarding the Use of Ceramic Inks

One of the primary restraining factors for the ceramic inks market is the presence of stringent environmental regulations governing their use. As environmental consciousness grows globally, regulatory bodies impose stricter guidelines to mitigate the environmental impact of industrial processes, including the production and application of ceramic inks. Restrictions on the use of certain chemicals and compounds in ceramic ink formulations compel manufacturers to invest in research and development to develop eco-friendly alternatives.

These regulations not only necessitate modifications in manufacturing processes but also increase compliance costs for manufacturers. Moreover, the need for adherence to sustainability standards adds complexity to supply chain management, potentially hindering market growth. However, this regulatory pressure also serves as a catalyst for innovation, driving the development of environmentally sustainable ceramic ink formulations that align with regulatory requirements and consumer preferences for eco-conscious products.

High Initial Investment Costs Associated with Digital Ceramic Printing Equipment

The high initial investment costs associated with digital ceramic printing equipment pose a significant barrier to market growth in the ceramic inks sector. Digital printing technology offers unparalleled advantages in terms of flexibility, customization, and efficiency, making it an attractive option for ceramic decoration. However, the acquisition of digital printing equipment entails substantial upfront investments, including the cost of printers, software, and training.

Industry analysis suggests that the initial investment for digital ceramic printing equipment can range from hundreds of thousands to millions of dollars, depending on the scale and sophistication of the operation. These substantial capital requirements may deter small and medium-sized enterprises (SMEs) from adopting digital printing technology, limiting market penetration and growth potential.

Furthermore, the need for ongoing maintenance, consumables, and upgrades adds to the total cost of ownership, making it a significant consideration for businesses evaluating the feasibility of transitioning to digital ceramic printing. Despite these challenges, advancements in printing technology and the emergence of leasing and financing options offer potential avenues to mitigate the financial barriers associated with adoption, fostering market expansion in the long run.

By Type Analysis

Decorative ink holds a dominant share at 60.0%, indicating its significant presence in the market for aesthetic applications.

In 2023, Decorative held a dominant market position in the By Type segment of the Ceramic Inks Market, capturing more than a 60.0% share. This commanding presence underscores the consumer preference for aesthetically appealing ceramic products, especially in sectors like interior decoration, architecture, and household items. The Decorative segment’s ascendancy can be attributed to its versatility in offering vibrant color palettes, intricate designs, and customizable options, catering to diverse artistic tastes and design requirements.

Conversely, the Functional segment, while constituting a significant portion of the Ceramic Inks Market, trailed behind Decorative in market share. This segment primarily caters to industrial applications, including ceramic tiles for flooring, automotive ceramics, and electronic components. Although Functional ceramic inks prioritize durability, chemical resistance, and high-performance attributes, their market share in 2023 remained subordinate to the visually compelling allure of Decorative ceramic inks.

These market dynamics signify a dual nature within the Ceramic Inks Market, where consumer-driven demand for visually captivating ceramic products coexists with industrial requisites for functional excellence. Manufacturers and stakeholders in the ceramic inks industry must navigate this dichotomy by strategically balancing their product offerings between Decorative and Functional segments, aligning with evolving consumer preferences and industrial requirements.

Looking ahead, opportunities abound for innovation and product development within both segments of the Ceramic Inks Market. Advancements in ink formulation technologies, digital printing techniques, and sustainable materials sourcing can further enhance the attractiveness and performance of ceramic inks, fostering continued growth and expansion in this dynamic market landscape.

By Formulation Analysis

Solvent-based inks constitute 47.5% of formulations, reflecting a preference for this type in various printing processes.

In 2023, Solvent-based Inks held a dominant market position in the By Formulation segment of the Ceramic Inks Market, capturing more than a 47.5% share. This notable market share reflects the widespread adoption of solvent-based inks in ceramic printing applications, driven by their superior adhesion properties, fast drying times, and compatibility with various substrates. Industries such as ceramics manufacturing, automotive, and electronics rely on solvent-based inks to achieve high-quality, durable prints on ceramic surfaces, contributing to their prominent market position.

Following Solvent-based Inks, Water-based Inks emerged as the second most prevalent formulation in the Ceramic Inks Market, albeit with a smaller market share. Water-based inks are gaining traction due to their environmentally friendly profile, low volatile organic compound (VOC) emissions, and ease of clean-up, aligning with sustainability initiatives across industries. Despite their growing popularity, Water-based Inks still face challenges related to adhesion and color vibrancy on certain ceramic substrates, limiting their widespread adoption compared to solvent-based counterparts.

Lastly, Oil-based Inks constituted a smaller portion of the Ceramic Inks Market in 2023. While oil-based formulations offer excellent adhesion and durability, they are gradually being phased out in favor of solvent-based and water-based alternatives due to environmental concerns and regulatory restrictions on volatile organic compounds (VOCs). However, in niche applications where extreme durability and resistance to harsh environments are paramount, oil-based inks continue to find relevance, albeit in limited market segments.

As the Ceramic Inks Market evolves, manufacturers and stakeholders must anticipate shifts in formulation preferences driven by regulatory changes, technological advancements, and sustainability imperatives. Strategies focused on innovation, product differentiation, and environmental stewardship will be pivotal in maintaining competitiveness and capitalizing on emerging opportunities within the Ceramic Inks Market.

By Technology Analysis

Digital printing technology leads with 60.4%, showcasing its pivotal role in modern printing practices.

In 2023, Digital Printing held a dominant market position in the By Technology segment of the Ceramic Inks Market, capturing more than a 60.4% share. This significant market share underscores the growing preference for digital printing technologies in ceramic decoration and manufacturing processes. Digital printing offers unparalleled flexibility, precision, and customization capabilities, enabling manufacturers to produce intricate designs, vibrant colors, and high-resolution graphics on ceramic substrates with efficiency and accuracy.

Following Digital Printing, Analog Printing emerged as the second most prevalent technology in the Ceramic Inks Market, albeit with a smaller market share. Analog printing methods, such as screen printing and pad printing, have been traditional stalwarts in the ceramic industry, offering reliability, consistency, and cost-effectiveness for mass production. However, the inherent limitations of analog printing, including longer setup times, limited color options, and lower resolution outputs, have spurred the adoption of digital printing technologies as the preferred choice for modern ceramic decoration and manufacturing applications.

The dominance of Digital Printing in the Ceramic Inks Market reflects broader trends in the printing industry toward digitalization, automation, and on-demand manufacturing. As consumer preferences gravitate towards personalized and customizable ceramic products, digital printing technologies continue to gain traction for their ability to meet these evolving demands efficiently and effectively.

Looking ahead, advancements in digital printing technologies, such as UV-curable, solvent-based, and water-based ceramic inks, are expected to further enhance the capabilities and performance of digital printing in the Ceramic Inks Market. Manufacturers and stakeholders must continue to invest in research and development to capitalize on the growth opportunities presented by digital printing and maintain a competitive edge in the dynamic ceramic decoration landscape.

By Application Analysis

Ceramic tiles application commands 47.3%, highlighting its substantial utilization within the digital printing industry.

In 2023, Ceramic Tiles held a dominant market position in the By Application segment of the Ceramic Inks Market, capturing more than a 47.3% share. This commanding market share highlights the widespread use of ceramic inks in the production of ceramic tiles for various applications, including residential, commercial, and industrial sectors. Ceramic tiles remain a staple in interior design and construction, offering durability, aesthetic appeal, and versatility, which are enhanced by vibrant and intricate designs achieved through ceramic ink printing technologies.

Following Ceramic Tiles, Glass Printing emerged as the second most prevalent application in the Ceramic Inks Market, although with a smaller market share. Glass printing finds application in diverse industries such as automotive, architecture, and consumer goods, where customized glass products require high-resolution printing for branding, decoration, and functional purposes. While not as ubiquitous as ceramic tiles, glass printing represents a niche market segment that continues to witness steady growth and innovation in ceramic ink technologies.

Additionally, Food Container Printing and other applications constituted a smaller portion of the Ceramic Inks Market in 2023. Food container printing involves the application of food-safe ceramic inks on packaging materials, ensuring compliance with regulatory standards while providing branding opportunities for food manufacturers. Other applications encompass a wide range of sectors, including sanitaryware, electronic components, and decorative accessories, each presenting unique challenges and opportunities for ceramic ink manufacturers and suppliers.

As the Ceramic Inks Market evolves, manufacturers and stakeholders must adapt to changing consumer preferences, technological advancements, and regulatory requirements across different application segments. Strategies focused on product innovation, customization capabilities, and sustainability will be instrumental in meeting the diverse needs of end-users and maintaining competitiveness in the dynamic ceramic ink printing landscape.

Key Market Segments

By Type

- Decorative

- Functional

By Formulation

- Solvent-based Inks

- Water-based Inks

- Oil-based Inks

By Technology

- Digital Printing

- Analog Printing

By Application

- Ceramic Tiles

- Glass Printing

- Food Container Printing

- Others

Growth Opportunities

Expansion of the Ceramic Industry in Emerging Markets

The global ceramic inks market witnessed promising growth opportunities in 2023, primarily fueled by the expansion of the ceramic industry in emerging markets. As developing economies continue to urbanize and industrialize, there has been a significant surge in construction activities, particularly in the residential and commercial sectors. This trend has propelled the demand for ceramic tiles and other ceramic products, subsequently driving the need for high-quality ceramic inks for decoration and printing purposes.

Countries such as China, India, Brazil, and Turkey have emerged as key players in the ceramic industry, offering substantial growth potential for ceramic ink manufacturers. These regions boast burgeoning construction sectors, rising disposable incomes, and evolving consumer preferences, thereby creating a conducive environment for market expansion. Furthermore, government initiatives aimed at infrastructural development and urbanization projects have further bolstered the demand for ceramic products, thereby amplifying the need for innovative and efficient ceramic ink solutions.

Technological Advancements in Ceramic Ink Formulations

Another significant driver of growth in the global ceramic inks market in 2023 was the continuous technological advancements in ceramic ink formulations. Manufacturers have been investing heavily in research and development activities to enhance the performance, durability, and aesthetic appeal of ceramic inks. Advanced formulations with improved adhesion, color intensity, and resistance properties have gained traction among end-users, including ceramic tile producers and decorators.

Moreover, the integration of digital printing technologies has revolutionized the ceramic printing process, enabling high-resolution printing and customization capabilities. This has unlocked new opportunities for product differentiation and personalized designs, catering to the diverse preferences of consumers. As manufacturers continue to innovate and optimize their ceramic ink formulations, the market is poised for sustained growth, driven by the ever-evolving needs of the ceramic industry and the growing demand for premium-quality ceramic products.

Latest Trends

Shift towards Eco-friendly and Sustainable Ceramic Ink Solutions

In 2023, the global ceramic inks market witnessed a significant trend towards eco-friendly and sustainable solutions. With increasing environmental awareness and stringent regulations, manufacturers are prioritizing the development of ceramic ink formulations that minimize environmental impact and promote sustainability throughout the product lifecycle. This shift is driven by the growing demand from consumers, businesses, and regulatory bodies for greener alternatives in the ceramic industry.

Companies are investing in research and development to create ceramic inks that utilize renewable resources, reduce carbon emissions, and minimize hazardous chemicals. Water-based and UV-curable ceramic inks are gaining traction due to their lower environmental footprint compared to solvent-based alternatives. Additionally, recyclable packaging and waste reduction initiatives are being implemented to further enhance sustainability practices across the ceramic ink supply chain.

Integration of Nanotechnology for Enhanced Ceramic Printing Capabilities

Another notable trend in the global ceramic inks market in 2023 was the integration of nanotechnology for enhanced printing capabilities. Nanomaterials, such as nanoparticles and nanocomposites, are being incorporated into ceramic ink formulations to improve print resolution, color intensity, and durability. These advancements enable finer details, sharper images, and vibrant colors in ceramic printing applications.

Furthermore, nanotechnology enhances the performance of ceramic inks by increasing scratch resistance, chemical stability, and adhesion to substrates. This results in higher-quality printed ceramics with enhanced aesthetic appeal and longevity, meeting the evolving demands of end-users across various industries. As nanotechnology continues to evolve, its integration into ceramic ink formulations is expected to drive innovation and competitiveness in the market, paving the way for new opportunities and growth in the years to come

Regional Analysis

In the Asia Pacific region, the Ceramic Inks Market accounted for a 39.5% share, equivalent to USD 0.9 billion.

In the global ceramic inks market, regional dynamics play a pivotal role in shaping market trends and opportunities. Across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, distinct market landscapes emerge, each driven by unique socio-economic factors and industry dynamics.

North America, a mature market with advanced technological infrastructure, exhibits a steady demand for ceramic inks, propelled by the region’s robust manufacturing sector. The region boasts a significant market share, driven by increased investments in research and development activities aimed at enhancing product performance and sustainability. Moreover, stringent regulations pertaining to environmental protection further bolster market growth, with a notable emphasis on eco-friendly ink formulations.

In Europe, a similar trend of steady growth is observed, fueled by the presence of established ceramic manufacturing hubs and a growing preference for customized ceramic solutions across various end-user industries. Market players in this region focus on innovation and product differentiation to gain a competitive edge, catering to diverse customer requirements and stringent quality standards.

Asia Pacific emerges as the dominating region in the global ceramic inks market, commanding a substantial market share of 39.5% and valued at USD 0.9 billion. The region’s dominance can be attributed to its burgeoning manufacturing sector, particularly in countries like China and India, coupled with rapid urbanization and infrastructural development. Additionally, favorable government policies and investments in the construction industry further propel market expansion across the region.

In contrast, the Middle East & Africa, and Latin America regions exhibit moderate growth prospects, characterized by evolving consumer preferences and increasing infrastructural investments. While these regions offer untapped potential, market players face challenges related to economic uncertainties and regulatory frameworks.

Overall, Asia Pacific stands out as the dominating region in the global ceramic inks market, driven by robust industrial growth and substantial investments, presenting lucrative opportunities for market players seeking expansion and strategic partnerships.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Ceramic Inks Market witnessed notable contributions from a range of key players, each making significant strides in driving market dynamics and shaping industry trends. Among these, prominent companies such as Ferro Corporation, FRITTA, and Colorobbia Italia SpA emerged as pivotal entities, leveraging their expertise and innovative approaches to consolidate their market positions.

Ferro Corporation, renowned for its advanced ceramic ink solutions, continued to demonstrate robust growth fueled by strategic investments in research and development. Their commitment to technological advancements and sustainable practices underscored their resilience in a competitive landscape.

Similarly, FRITTA showcased a steadfast commitment to quality and customer satisfaction, exemplified through their diverse product portfolio catering to varied application needs. Their emphasis on product differentiation and tailored solutions positioned them as a preferred choice among discerning clientele.

Meanwhile, Colorobbia Italia SpA remained a driving force in the market, capitalizing on its extensive experience and global reach to deliver unparalleled value to customers worldwide. Their proactive approach to market trends and proactive engagement with emerging opportunities fortified their market standing.

Beyond these industry stalwarts, a cohort of emerging players including Kao Chimigraf, Esmalglass-Itaca Grupo, and Zschimmer & Schwarz made noteworthy contributions, injecting dynamism into the market landscape. As the Ceramic Inks Market continues to evolve, collaboration, innovation, and strategic foresight will remain pivotal for sustaining growth and unlocking new avenues of opportunity.

Market Key Players

- Ferro Corporation

- FRITTA

- Colorobbia Italia SpA

- Kao Chimigraf

- Esmalglass-Itaca Grupo

- Zschimmer & Schwarz

- Torrecid Group

- INKCID

- Rex-Tone Industries Ltd

- Sicer S.P.A

- Sun Chemical

- TECGLASS

- Megacolor Ceramic Products

- Guangdong Dow Technology Co., Ltd.

- Belgium Glass and Ceramics (P) Ltd

Recent Development

- In April 2024, Recent developments include Lithoz establishing a ceramic 3D printing hub in Japan with AS ONE and Mitsui Kinzoku, AML3D’s capital raising initiative, and AMS acquiring Nikon SLM Solutions’ system.

- In July 2023, The LIFE REPLAY project, led by the Ceramic Industry Research Association (ITC-AICE), pioneers recycling waste ceramic inkjet inks into high-quality products, fostering a circular economy in the European ceramic industry.

- In September 2022, FUJIFILM Dimatix introduced eco-friendly aqueous ceramic ink printing with STARFIRE® 1024 AQMF and AQLF printheads, supporting the ceramic tile industry’s transition to sustainability. Collaboration with System Ceramics SpA enhances R&D efforts.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Billion Forecast Revenue (2033) USD 4.8 Billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Decorative, Functional), By Formulation(Solvent-based Inks, Water-based Inks, Oil-based Inks), By Technology(Digital Printing, Analog Printing), By Application(Ceramic Tiles, Glass Printing, Food Container Printing, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ferro Corporation, FRITTA, Colorobbia Italia SpA, Kao Chimigraf, Esmalglass-Itaca Grupo, Zschimmer & Schwarz, Torrecid Group, INKCID, Rex-Tone Industries Ltd, Sicer S.P.A, Sun Chemical, TECGLASS, Megacolor Ceramic Products, Guangdong Dow Technology Co., Ltd., Belgium Glass and Ceramics (P) Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Ceramic Inks Market Size in 2023?The Global Ceramic Inks Market Size is USD 2.4 Billion in 2023.

What is the projected CAGR at which the Global Ceramic Inks Market is expected to grow at?The Global Ceramic Inks Market is expected to grow at a CAGR of 7.1% (2024-2033).

List the key industry players of the Global Ceramic Inks Market?Ferro Corporation, FRITTA, Colorobbia Italia SpA, Kao Chimigraf, Esmalglass-Itaca Grupo, Zschimmer & Schwarz, Torrecid Group, INKCID, Rex-Tone Industries Ltd, Sicer S.P.A, Sun Chemical, TECGLASS, Megacolor Ceramic Products, Guangdong Dow Technology Co., Ltd., Belgium Glass and Ceramics (P) Ltd

Name the key areas of business for Global Ceramic Inks Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Ceramic Inks Market.

List the segments encompassed in this report on the Global Ceramic Inks Market?Market.US has segmented the Global Ceramic Inks Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Decorative, Functional), By Formulation(Solvent-based Inks, Water-based Inks, Oil-based Inks), By Technology(Digital Printing, Analog Printing), By Application(Ceramic Tiles, Glass Printing, Food Container Printing, Others)

-

-

- Ferro Corporation

- FRITTA

- Colorobbia Italia SpA

- Kao Chimigraf

- Esmalglass-Itaca Grupo

- Zschimmer & Schwarz

- Torrecid Group

- INKCID

- Rex-Tone Industries Ltd

- Sicer S.P.A

- Sun Chemical

- TECGLASS

- Megacolor Ceramic Products

- Guangdong Dow Technology Co., Ltd.

- Belgium Glass and Ceramics (P) Ltd