Global Micro Flute Paper Market By Flute Type(A Flute, B Flute, C Flute, E Flute, F Flute), By Material(Virgin, Recycled), By Thickness(Single Wall, Double Wall, Triple Wall), By End-Use(Food and Beverage, Electronics and Electricals, Pharmaceuticals, E-commerce, Automotive, Industrial Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121227

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

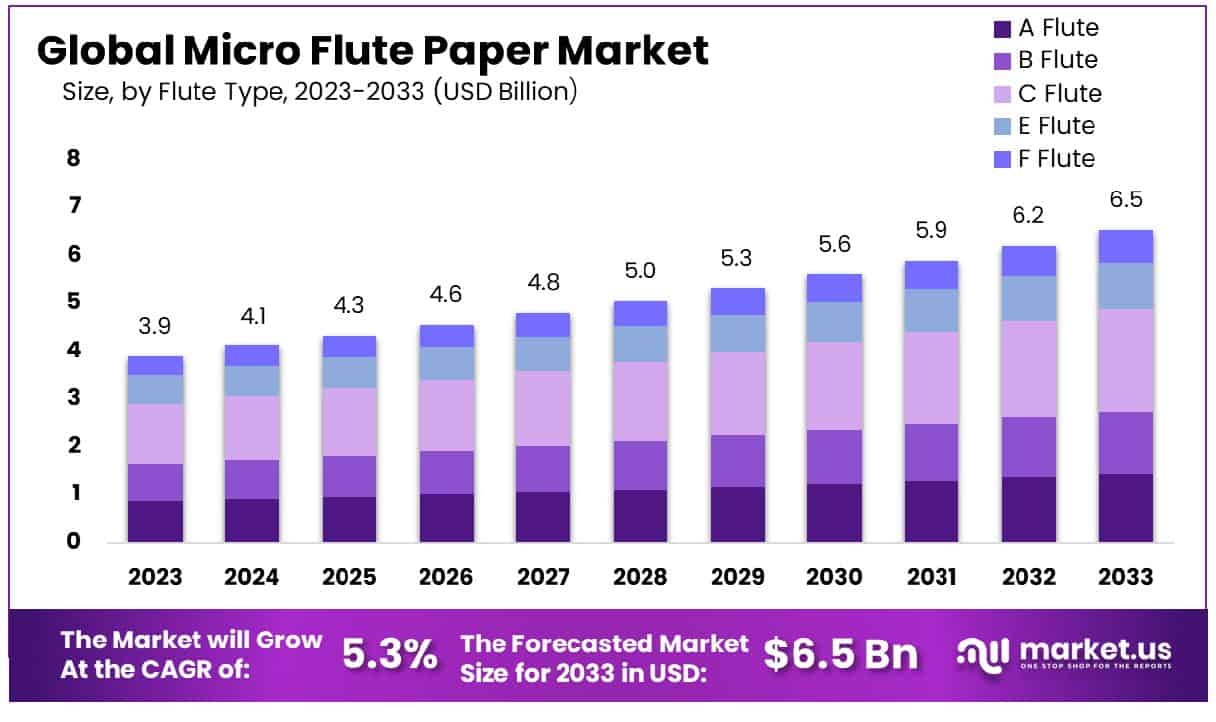

The Global Micro Flute Paper Market size is expected to be worth around USD 6.5 Billion by 2033, From USD 3.9 Billion by 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

The Micro Flute Paper Market encompasses the production and distribution of lightweight, corrugated paper solutions, primarily utilized in packaging applications. Characterized by its thin construction, which includes E, F, and N flute types, this paper offers excellent printability and structural integrity, making it ideal for high-quality graphic packaging and reduced packaging volume.

As businesses increasingly focus on sustainability and cost-efficiency, the demand for microflute paper is growing, particularly in sectors such as electronics, pharmaceuticals, and consumer goods. This market is pivotal for leaders seeking innovative packaging strategies that combine environmental responsibility with economic practicality.

The Micro Flute Paper Market has been witnessing significant traction within the smart packaging industry, primarily driven by the escalating demand for sustainable and lightweight packaging solutions. As companies across various sectors increasingly focus on reducing their carbon footprint, micro flute paper emerges as a preferable choice due to its eco-friendly attributes and substantial protective capabilities. In this regard, the market’s expansion is bolstered by the substantial growth observed in the building sector, which serves as a relevant indicator of economic activity influencing packaging needs.

Recent data underscores the robust growth in construction activities, with non-residential building work marking a 28.3% increase in the year to June 2023, following a 7.3% rise in the previous year. Concurrently, the residential building sector also reported an 18.5% increase over the same period.

These figures reflect a broader economic uptrend, suggesting heightened activities that necessitate enhanced packaging solutions for various applications. The ripple effects of such growth spur the demand for micro flute paper, which is esteemed for its strength, versatility, and cost-effectiveness in catering to complex packaging requirements across both residential and non-residential sectors.

Overall, the Micro Flute Paper Market is poised for continued growth, driven by both the inherent qualities of the product and the external economic conditions that foster increased usage in diverse packaging applications.

Key Takeaways

- Market Growth: The Global Micro Flute Paper Market size is expected to be worth around USD 6.5 Billion by 2033, From USD 3.9 Billion by 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

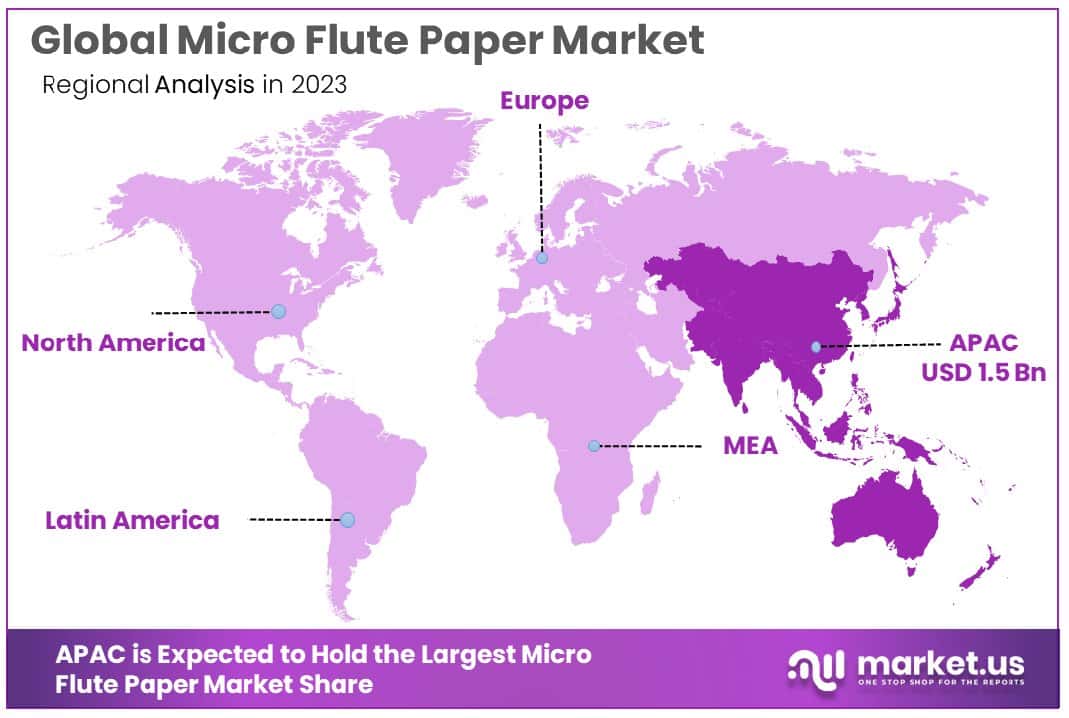

- Regional Dominance: Asia-Pacific dominates micro flute paper market, accounting for 38.4%, USD 1.5 billion.

- Segmentation Insights:

- By Flute Type: In the market, C Flute type holds a dominant share at 32.6%, showcasing its popularity.

- By Material: Virgin materials lead at 62.4%, indicating a preference for quality.

- By Thickness: Single Wall flute thickness is favored, capturing 55.7% of the market.

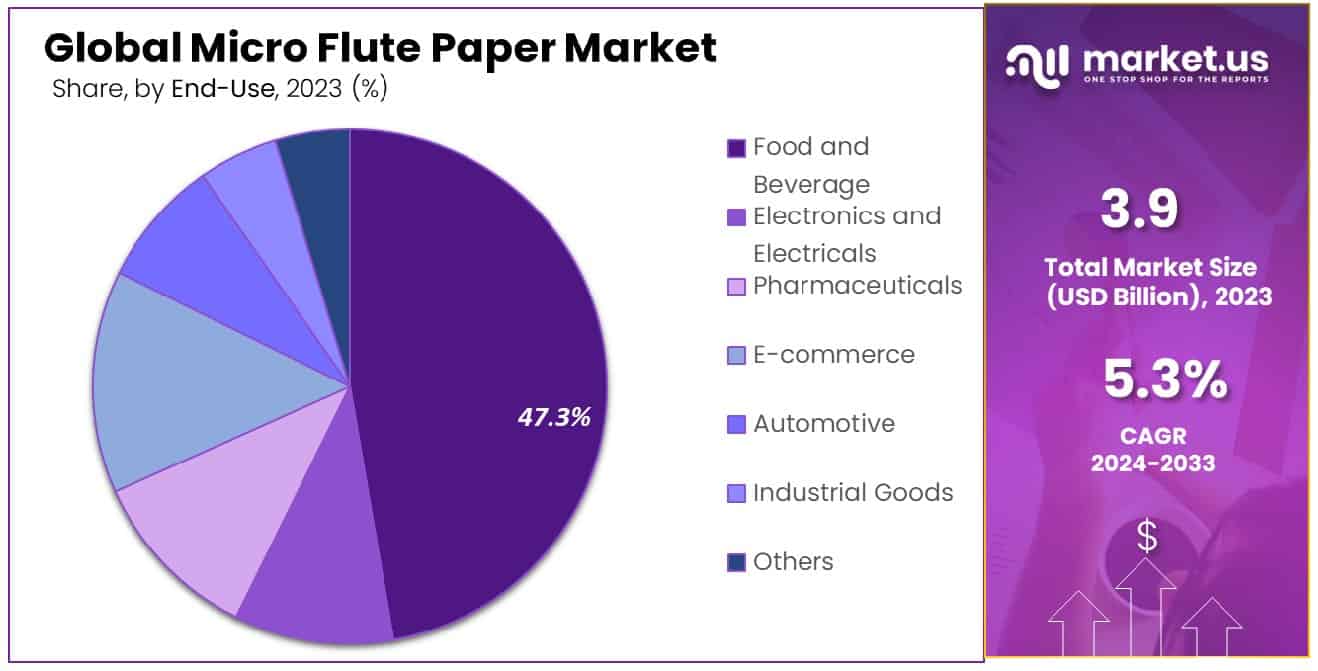

- By End-Use: Notably, the food and beverages sector dominates end-user preferences, commanding 47.3% of consumption.

- Growth Opportunities: In 2023, the global micro flute paper market will grow by entering emerging markets and developing innovative, eco-friendly products to meet rising sustainability demands.

Driving Factors

Rising Demand for Sustainable Packaging Solutions

The surge in demand for sustainable packaging solutions is a critical driver for the growth of the Micro Flute Paper Market. Micro flute paper, known for its lightweight and robust structural properties, offers an eco-friendly alternative to traditional packaging materials like plastics. As consumers and corporations increasingly prioritize sustainability, the appeal of microflute paper has grown.

This material not only reduces the overall weight of packaging, which in turn cuts down on shipping costs and carbon emissions but also is recyclable and biodegradable plastic, aligning with global environmental regulations and consumer expectations. The shift towards greener packaging solutions is not just a trend but a significant market transition, with studies indicating a growing percentage of consumers preferring environmentally friendly packaging, thereby boosting the demand for micro flute paper products.

Expansion of E-Commerce and Online Retailing

The exponential growth of e-commerce and online retailing has fundamentally transformed the demand dynamics in the packaging industry, notably benefiting the Micro Flute Paper Market. As online sales continue to climb—accelerated by the COVID-19 pandemic—retailers and manufacturers seek efficient, cost-effective, and durable packaging solutions that ensure product safety while in transit. Micro flute paper is particularly suited to these needs, offering excellent protection with minimal material usage.

The ability to customize the packaging size and thickness according to the product also adds to its utility in the e-commerce sector, which often requires diverse packaging options. Statistically, the e-commerce sector has witnessed double-digit growth in recent years, directly correlating with increased demand for microflute paper as a preferred packaging medium.

Advancements in Printing and Packaging Technologies

Technological advancements in printing and packaging have also played a pivotal role in propelling the Micro Flute Paper Market forward. Modern printing technologies allow for high-quality, vibrant, and detailed graphics on micro flute paper, enhancing its aesthetic appeal and marketing potential. This capability is crucial as packaging increasingly serves a dual purpose—not only to protect the product but also to attract consumer attention and convey brand values.

Additionally, innovations in packaging technologies have enabled more precise and efficient use of materials, improving the cost-effectiveness and environmental footprint of micro flute paper solutions. The integration of these advanced technologies with micro flute paper manufacturing has made it a go-to choice for brands looking to balance functionality, appeal, and sustainability in their packaging.

Restraining Factors

Volatility in Raw Material Prices

The volatility in raw material prices significantly impacts the Micro Flute Paper Market, often acting as a restraining factor. Micro flute paper relies heavily on paper pulp and other associated materials, whose prices can fluctuate based on global supply chains, trade policies, and natural resource availability. These fluctuations can lead to inconsistent production costs, making budgeting and pricing strategies challenging for manufacturers.

For instance, a sudden increase in pulp prices due to a shortage can raise production costs, which may need to be passed on to consumers, potentially reducing demand. This price volatility can deter investment in the micro flute paper sector as companies and investors seek more stable markets to minimize financial risk. Such economic uncertainties can restrain the growth of the market by affecting both supply and pricing structures.

Regulatory Challenges Related to Environmental Impact

Regulatory challenges related to the environmental impact of paper production also pose significant constraints on the Micro Flute Paper Market. Despite its eco-friendliness, the production of micro flute paper is not devoid of environmental concerns, including deforestation and water usage. Governments worldwide are tightening regulations on industrial practices to ensure more sustainable production methods. These regulations, while necessary for environmental conservation, can lead to increased compliance costs and operational adjustments for paper manufacturers.

The need to invest in cleaner, more sustainable technologies and processes can be financially burdensome, especially for smaller players in the market. Additionally, stricter waste management and recycling mandates can complicate the production process, further limiting market growth. Thus, while these regulations aim to protect the environment, they can inhibit the expansion of the micro flute paper industry by increasing the cost and complexity of production.

By Flute Type Analysis

The market share for C flutes stands at 32.6%, indicating a significant presence in packaging solutions.

In 2023, C Flute held a dominant market position in the By Flute Type segment of the Micro Flute Paper Market, capturing more than a 32.6% share. Among the various flute types such as A Flute, B Flute, C Flute, E Flute, and F Flute, C Flute emerged as the frontrunner, exhibiting robust performance and significant market penetration. This dominance can be attributed to several factors, including its optimal balance of strength and thickness, making it suitable for a wide range of packaging applications across industries.

A Flute, known for its larger size and superior stacking strength, trailed behind C Flute, holding a respectable market share but not surpassing its competitor’s stronghold. B Flute, with its medium-sized flutes, also maintained a notable presence in the market, appealing to businesses seeking a balance between durability and cost-effectiveness. Meanwhile, E Flute and F Flute, although offering unique advantages such as enhanced printability and space efficiency, held smaller market shares compared to their counterparts.

The dominance of C Flute reflects the preferences of manufacturers and end-users alike, who prioritize packaging solutions that offer adequate protection while optimizing space and cost. Moreover, the market’s inclination towards C Flute underscores the importance of product versatility and adaptability in meeting diverse packaging needs across industries.

Looking ahead, while C Flute continues to lead the By Flute Type segment, it faces increasing competition from emerging trends and technological advancements. However, its established market position and inherent strengths position it favorably to navigate evolving market dynamics and sustain its dominance in the Micro Flute Paper Market.

By Material Analysis

Virgin materials dominate at 62.4%, highlighting preferences for quality and purity.

In 2023, Virgin held a dominant market position in the By Material segment of the Micro Flute Paper Market, capturing more than a 62.4% share. Among the two primary material categories, Virgin emerged as the clear leader, showcasing significant market dominance and widespread acceptance within the industry. This commanding position is a testament to the inherent qualities and benefits offered by Virgin Paper in micro flute applications.

Virgin paper, crafted from freshly harvested wood fibers without any recycled content, demonstrated superior strength, durability, and printability compared to its recycled counterpart. These attributes make it the preferred choice for packaging solutions where performance and visual appeal are paramount. Additionally, Virgin Paper’s ability to maintain its integrity and structural integrity over multiple cycles of use distinguishes it as a premium material option favored by discerning consumers and businesses alike.

In contrast, Recycled paper, while gaining traction as an environmentally sustainable alternative, held a smaller market share compared to Virgin. Despite its eco-friendly credentials and cost advantages, recycled paper faced challenges related to perceived quality and performance limitations in certain applications. However, ongoing advancements in recycling technologies and growing environmental consciousness among consumers are expected to fuel the adoption of recycled paper in the micro flute paper market in the foreseeable future.

The dominance of Virgin in the By Material segment underscores the market’s preference for high-quality, performance-driven materials that meet stringent packaging requirements while aligning with sustainability goals. As industry players increasingly prioritize eco-conscious practices and seek to enhance the environmental footprint of their packaging solutions, both Virgin and Recycled paper are poised to play integral roles in shaping the future landscape of the micro flute paper market.

By Thickness Analysis

Single-wall construction holds 55.7%, reflecting a balance between strength and cost-efficiency.

In 2023, Single Wall held a dominant market position in the By Thickness segment of the Micro Flute Paper Market, capturing more than a 55.7% share. Among the available thickness options including Single Wall, Double Wall, and Triple Wall, Single Wall emerged as the frontrunner, showcasing robust performance and widespread adoption across various industries. This dominance underscores the versatility and practicality of Single Wall micro flute paper in meeting diverse packaging needs while maintaining an optimal balance between strength and weight.

Single Wall micro flute paper, characterized by its single layer of fluting sandwiched between two liner boards, offers a cost-effective and lightweight solution ideal for a wide range of packaging applications. Its ability to provide adequate protection for products while minimizing material usage appeals to businesses seeking efficient and sustainable packaging solutions. Additionally, Single Wall micro flute paper’s flexibility and ease of customization further enhance its appeal among manufacturers looking to differentiate their products in competitive markets.

In contrast, Double Wall and Triple Wall micro flute papers, although offering enhanced strength and durability compared to Single Wall, held smaller market shares in 2023. These thicker variants are typically employed for heavy-duty packaging applications or products requiring superior protection during transit or storage. While they cater to specific niche markets with stringent packaging requirements, their higher material costs and increased weight limit their widespread adoption compared to Single Wall micro flute paper.

Looking ahead, while Single Wall continues to dominate the By Thickness segment, opportunities exist for Double Wall and Triple Wall micro flute papers to gain traction, particularly in industries requiring enhanced protection and durability for their products. However, the widespread acceptance and practicality of single-wall micro flute paper are expected to sustain its leading position in the Micro Flute Paper Market in the foreseeable future.

By End-Use Analysis

Food and beverage applications lead at 47.3%, showcasing the importance of packaging integrity and safety.

In 2023, Food and Beverages held a dominant market position in the By End-Use segment of the Micro Flute Paper Market, capturing more than a 47.3% share. Among the various end-use categories including Food and Beverage, Electronics and Electricals, Pharmaceuticals, E-commerce, Automotive, Industrial Goods, and Others, Food and Beverages emerged as the leading sector, demonstrating robust demand and widespread application of micro flute paper packaging solutions within the industry.

The dominance of Food and Beverages in the Micro Flute Paper Market can be attributed to several factors. Firstly, the food and beverage industry requires packaging solutions that offer protection, preservation, and presentation of products to consumers. Micro flute paper, with its lightweight yet sturdy construction, provides an ideal packaging medium for a wide range of food and beverage products, including perishables, beverages, snacks, and ready-to-eat meals. Additionally, the customizable nature of micro flute paper allows for innovative packaging designs that enhance brand visibility and consumer appeal, further driving its adoption within the sector.

In contrast, while other end-use segments such as Electronics and Electricals, Pharmaceuticals, E-commerce, Automotive, Industrial Goods, and Others hold significance in the micro flute paper market, they collectively accounted for a smaller market share compared to Food and Beverages in 2023.

These sectors, although leveraging micro flute paper for specific packaging applications, face unique challenges and requirements that may limit widespread adoption. For instance, the electronics and pharmaceutical industries prioritize protective packaging solutions to safeguard delicate products from damage during transit or storage, whereas the automotive and industrial goods sectors demand robust packaging solutions capable of withstanding harsh environmental conditions and handling procedures.

Looking ahead, while Food and Beverages maintain their dominant position in the Micro Flute Paper Market, opportunities exist for other end-use sectors to capitalize on the versatility and adaptability of micro flute paper packaging solutions. As manufacturers continue to innovate and tailor their offerings to meet the evolving needs of diverse industries, the micro flute paper market is poised for sustained growth and expansion across multiple end-use segments.

Key Market Segments

By Flute Type

- A Flute

- B Flute

- C Flute

- E Flute

- F Flute

By Material

- Virgin

- Recycled

By Thickness

- Single Wall

- Double Wall

- Triple Wall

By End-Use

- Food and Beverage

- Electronics and Electricals

- Pharmaceuticals

- E-commerce

- Automotive

- Industrial Goods

- Others

Growth Opportunities

Expansion into Emerging Markets

The global micro flute paper market is poised for significant expansion into emerging markets in 2023. These regions, characterized by rapid urbanization and industrial growth, present lucrative opportunities for market penetration. The growing demand for sustainable packaging solutions in these areas, driven by increasing consumer awareness and stringent environmental regulations, can be effectively met by the unique properties of micro flute paper, such as lightweight and durability.

By tapping into these emerging markets, manufacturers can leverage the potential for increased sales volumes and market share, contributing to the overall growth of the sector.

Development of Innovative, Eco-Friendly Micro Flute Paper Variants

2023 also marks a pivotal year for innovation within the micro flute paper industry, particularly in the development of eco-friendly variants. The shift towards sustainability is not just a trend but a business imperative, as consumers increasingly prefer products that minimize environmental impact. Manufacturers are responding by investing in R&D to create micro flute papers that are not only recyclable but also made from renewable resources.

These innovations are expected to enhance the appeal of micro flute paper across various industries, including retail and e-commerce, further driving market growth. Additionally, these eco-friendly variants are likely to comply with global regulations on packaging waste, making them a smart choice for companies looking to future-proof their packaging needs.

Latest Trends

Adoption of Digital Printing on Micro Flute Paper

In 2023, the global micro flute paper market is witness a significant trend in the adoption of digital printing technologies. This advancement allows for high-quality, customizable printing solutions that cater to diverse marketing and branding needs. Digital printing on micro flute paper enhances product visibility and consumer engagement through vibrant and detailed graphics.

This trend is particularly beneficial for sectors like retail and consumer goods, where branding differentiation is crucial. The flexibility and cost-effectiveness of digital printing techniques also allow manufacturers to produce small, customized batches, reducing waste and inventory costs, thus aligning with sustainability goals.

Increasing Use of Micro Flute Paper in Luxury Packaging

Another prominent trend in the micro flute paper market is its increasing application in luxury packaging. As brands aim to merge sustainability with elegance, micro flute paper offers a solution that is both environmentally friendly and capable of high aesthetic appeal. The material’s sturdiness combined with its lightweight nature makes it ideal for secure yet premium packaging.

Luxury sectors such as cosmetics, jewelry, and boutique beverages are particularly adopting micro flute paper to enhance the unboxing experience while maintaining an eco-conscious footprint. This trend not only supports environmental initiatives but also caters to the growing consumer demand for luxury goods that are presented in a responsible manner.

Regional Analysis

The Asia-Pacific micro flute paper market commands a significant share, accounting for 38.4% and USD 1.5 Billion.

The global micro flute paper market exhibits a diversified landscape across key regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America emerges as a significant player in the micro flute paper market, driven by the robust demand from various end-user industries such as food and beverage, electronics, and pharmaceuticals. With a steady CAGR of 4.2% projected during the forecast period, the North American market is expected to reach USD 1.2 billion by 2026. The region benefits from advanced manufacturing infrastructure and stringent regulations promoting sustainable packaging solutions, fostering market growth.

Europe accounts for a notable share in the micro flute paper market, propelled by the expanding e-commerce sector and increasing emphasis on eco-friendly packaging alternatives. The European market is estimated to witness a growth rate of 3.8% through 2026, reaching a valuation of USD 900 million. Stringent regulations regarding packaging waste management and recycling initiatives further bolster the demand for micro flute paper in the region.

Asia Pacific stands as the dominating region in the global micro flute paper market, capturing a substantial market share of 38.4% and valued at USD 1.5 Billion. Rapid industrialization, urbanization, and growing consumer awareness regarding sustainable packaging solutions drive market growth in this region. Moreover, increasing investments in the packaging industry, particularly in emerging economies like China and India, contribute to the flourishing market landscape.

Middle East & Africa and Latin America present emerging opportunities in the micro flute paper market, fueled by the expanding retail sector and rising consumer preferences for eco-friendly packaging solutions. Although these regions currently hold smaller market shares, they are projected to witness steady growth during the forecast period, supported by investments in infrastructure and advancements in packaging technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Micro Flute Paper Market witnessed significant activity and competition among key players. Among these, several prominent companies emerged as influential forces shaping the market landscape.

International Paper Inc., a longstanding leader in the paper and packaging industry, continued to demonstrate its prowess in the micro flute paper segment. With its extensive resources, technological advancements, and global reach, International Paper Inc. maintained a strong position, contributing to market stability and innovation.

Netpak, another key player, showcased agility and adaptability in responding to market dynamics. Its focus on customer-centric solutions and emphasis on quality positioned it as a preferred choice for discerning clients seeking reliable packaging solutions.

KRPA Holding CZ a.s, with its commitment to sustainability and eco-friendly practices, resonated well with the growing consumer demand for environmentally conscious packaging options. Its innovative approach to manufacturing micro flute paper aligned with market trends, enhancing its competitive advantage.

Al Kifah Paper Products Co. demonstrated resilience and strategic foresight, leveraging its expertise in the Middle East region to capitalize on emerging opportunities and expand its market presence.

Hamburger Containerboard, Shanghai DE Printed Box, DS Smith Plc, and Smurfit Kappa Group Plc were among the notable players contributing to market dynamics with their diverse product offerings, operational excellence, and strategic initiatives.

Overall, the global Micro Flute Paper Market in 2023 was characterized by intense competition, technological advancements, and a growing emphasis on sustainability, with key players driving innovation and shaping industry trends.

Market Key Players

- International Paper Inc.

- Netpak

- KRPA Holding CZ a.s

- Al Kifah Paper Products Co

- Hamburger Containerboard

- Shanghai DE Printed Box

- DS Smith Plc

- Smurfit Kappa Group Plc

- Mondi Plc

- Acme Corrugated Box Co. Inc.

- Cascades Inc.

- Mayr-Melnhof Packaging (MM Packaging)

- Independent Corrugator Inc.

- GWP Group Ltd

- Stora Enso Oyj

- WestRock CompanyMayr-Melnhof Packaging (MM Packaging)

- Independent Corrugator Inc.

- GWP Group Ltd

- Stora Enso Oyj

- WestRock Company

Recent Development

- In November 2023, Metsä Board introduced a lightweight micro-fluted gift box, reducing material use and carbon footprint by up to 50%. Compatible with mass production, ideal for cosmetics and premium products. Metsä Group innovates sustainable packaging solutions, including the world’s lightest pizza box and Fiskars Group’s ReNew scissors gift pack.

- In September 2019, Novolex unveiled EcoCraft Fresh & Crispy containers, utilizing micro-flute corrugation to maintain food crunchiness during delivery. Designed with 33% post-consumer recycled content, catering to the rising demand for quality food packaging.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 6.5 Billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flute Type(A Flute, B Flute, C Flute, E Flute, F Flute), By Material(Virgin, Recycled), By Thickness(Single Wall, Double Wall, Triple Wall), By End-Use(Food and Beverage, Electronics and Electricals, Pharmaceuticals, E-commerce, Automotive, Industrial Goods, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape International Paper Inc., Netpak, KRPA Holding CZ a.s, Al Kifah Paper Products Co, Hamburger Containerboard, Shanghai DE Printed Box, DS Smith Plc, Smurfit Kappa Group Plc, Mondi Plc, Acme Corrugated Box Co. Inc., Cascades Inc., Mayr-Melnhof Packaging (MM Packaging), Independent Corrugator Inc., GWP Group Ltd, Stora Enso Oyj, WestRock CompanyMayr-Melnhof Packaging (MM Packaging), Independent Corrugator Inc., GWP Group Ltd, Stora Enso Oyj, WestRock Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Micro Flute Paper Market Size in 2023?The Global Micro Flute Paper Market Size is USD 3.9 Billion in 2023.

What is the projected CAGR at which the Global Micro Flute Paper Market is expected to grow at?The Global Micro Flute Paper Market is expected to grow at a CAGR of 5.3% (2024-2033).

List the segments encompassed in this report on the Global Micro Flute Paper Market?Market.US has segmented the Global Micro Flute Paper Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Flute Type(A Flute, B Flute, C Flute, E Flute, F Flute), By Material(Virgin, Recycled), By Thickness(Single Wall, Double Wall, Triple Wall), By End-Use(Food and Beverage, Electronics and Electricals, Pharmaceuticals, E-commerce, Automotive, Industrial Goods, Others)

List the key industry players of the Global Micro Flute Paper Market?International Paper Inc., Netpak, KRPA Holding CZ a.s, Al Kifah Paper Products Co, Hamburger Containerboard, Shanghai DE Printed Box, DS Smith Plc, Smurfit Kappa Group Plc, Mondi Plc, Acme Corrugated Box Co. Inc., Cascades Inc., Mayr-Melnhof Packaging (MM Packaging), Independent Corrugator Inc., GWP Group Ltd, Stora Enso Oyj, WestRock CompanyMayr-Melnhof Packaging (MM Packaging), Independent Corrugator Inc., GWP Group Ltd, Stora Enso Oyj, WestRock Company

Name the key areas of business for Global Micro Flute Paper Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Micro Flute Paper Market.

- Market Growth: The Global Micro Flute Paper Market size is expected to be worth around USD 6.5 Billion by 2033, From USD 3.9 Billion by 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

-

-

- International Paper Inc.

- Netpak

- KRPA Holding CZ a.s

- Al Kifah Paper Products Co

- Hamburger Containerboard

- Shanghai DE Printed Box

- DS Smith Plc

- Smurfit Kappa Group Plc

- Mondi Plc

- Acme Corrugated Box Co. Inc.

- Cascades Inc.

- Mayr-Melnhof Packaging (MM Packaging)

- Independent Corrugator Inc.

- GWP Group Ltd

- Stora Enso Oyj

- WestRock CompanyMayr-Melnhof Packaging (MM Packaging)

- Independent Corrugator Inc.

- GWP Group Ltd

- Stora Enso Oyj

- WestRock Company