Global 3-Methyl-5-Phenyl-1-Pentanol Market Size, Share, And Business Benefits By Purity (High Purity, Low Purity), By Application (Fragrances, Chemical Intermediates, Others), By End-User Industry (Cosmetics, Pharmaceuticals, Chemical Manufacturing, Others), By Distribution Channel (Direct Sales, Distributors and Wholesalers, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139455

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

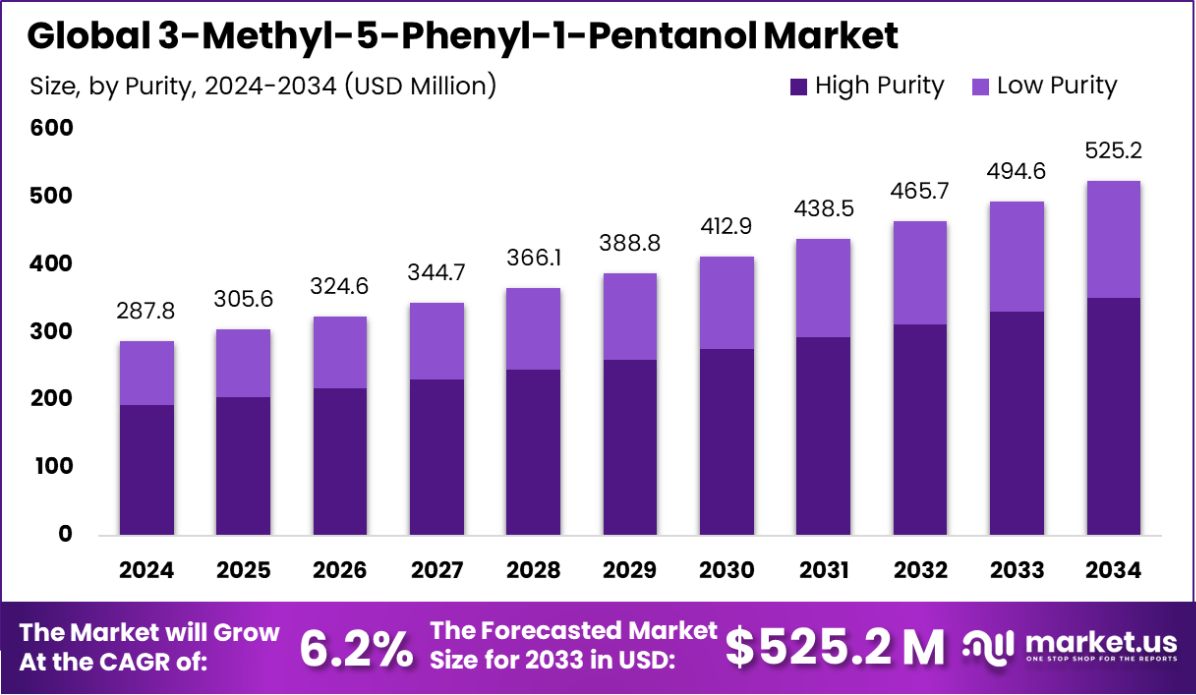

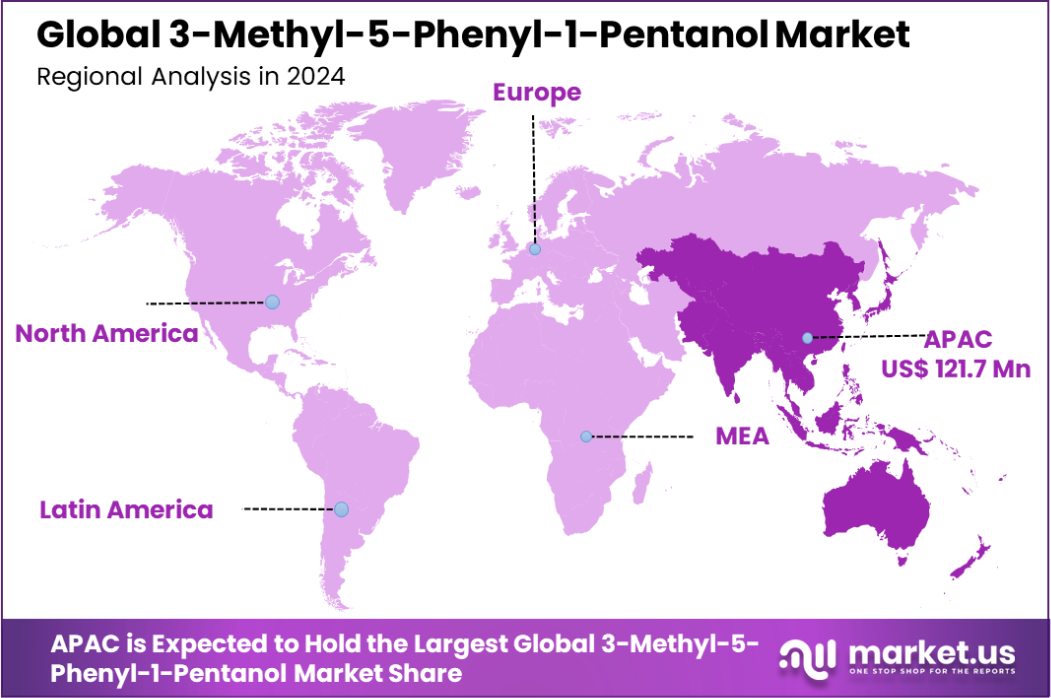

The Global 3-Methyl-5-Phenyl-1-Pentanol Market is expected to be worth around USD 525.2 million by 2034, up from USD 287.8 million in 2024, and grow at a CAGR of 6.2% from 2025 to 2034. The Asia-Pacific 3-Methyl-5-Phenyl-1-Pentanol market is valued at USD 121.7 Mn, representing 34.9%.

3-Methyl-5-Phenyl-1-Pentanol is an organic compound used primarily in the fragrance and flavor industries due to its pleasant floral and fruity aroma. This chemical compound is synthesized through specific chemical processes and finds applications in the production of perfumes, cosmetics, and personal care products. Its stable molecular structure and versatile properties make it an ideal choice for use in a variety of formulations aimed at enhancing sensory appeal.

The global demand for 3-Methyl-5-Phenyl-1-Pentanol is driven by the expanding fragrance and flavor industries, particularly in emerging markets. The growing preference for natural and high-quality ingredients in personal care and cosmetics products further accelerates its market expansion. Additionally, consumer trends focusing on sustainable and eco-friendly products are influencing manufacturers to incorporate such compounds into their offerings, fueling market growth.

The rising consumer demand for premium and niche fragrances presents a significant opportunity for growth in the 3-Methyl-5-Phenyl-1-Pentanol market. With increasing disposable incomes, consumers are seeking higher-quality, long-lasting fragrances, creating a growing demand for this compound. Moreover, the expanding applications in the food and beverage industry provide new avenues for market penetration and innovation in flavor enhancement.

The 3-methyl-5-phenyl-1-pentanol market is poised for steady growth, primarily driven by increasing demand in the fragrance and flavor industries. As consumer preferences shift towards premium and sustainable products, this compound’s role in enhancing sensory appeal has become more significant.

With a reported 94.2% synthesis yield using hydrogenation at 105-110°C and 1.2 MPa pressure, the efficiency and scalability of its production process further support its growing market adoption. This positions 3-methyl-5-phenyl-1-pentanol as a key ingredient in high-value applications, offering substantial opportunities for manufacturers in both established and emerging markets.

Key Takeaways

- The Global 3-Methyl-5-Phenyl-1-Pentanol Market is expected to be worth around USD 525.2 million by 2034, up from USD 287.8 million in 2024, and grow at a CAGR of 6.2% from 2025 to 2034.

- The 3-Methyl-5-Phenyl-1-Pentanol market is increasingly driven by high-purity demand, reaching 67.9% purity.

- Fragrances dominate the market, accounting for 46.3% of the total demand for 3-Methyl-5-Phenyl-1-Pentanol.

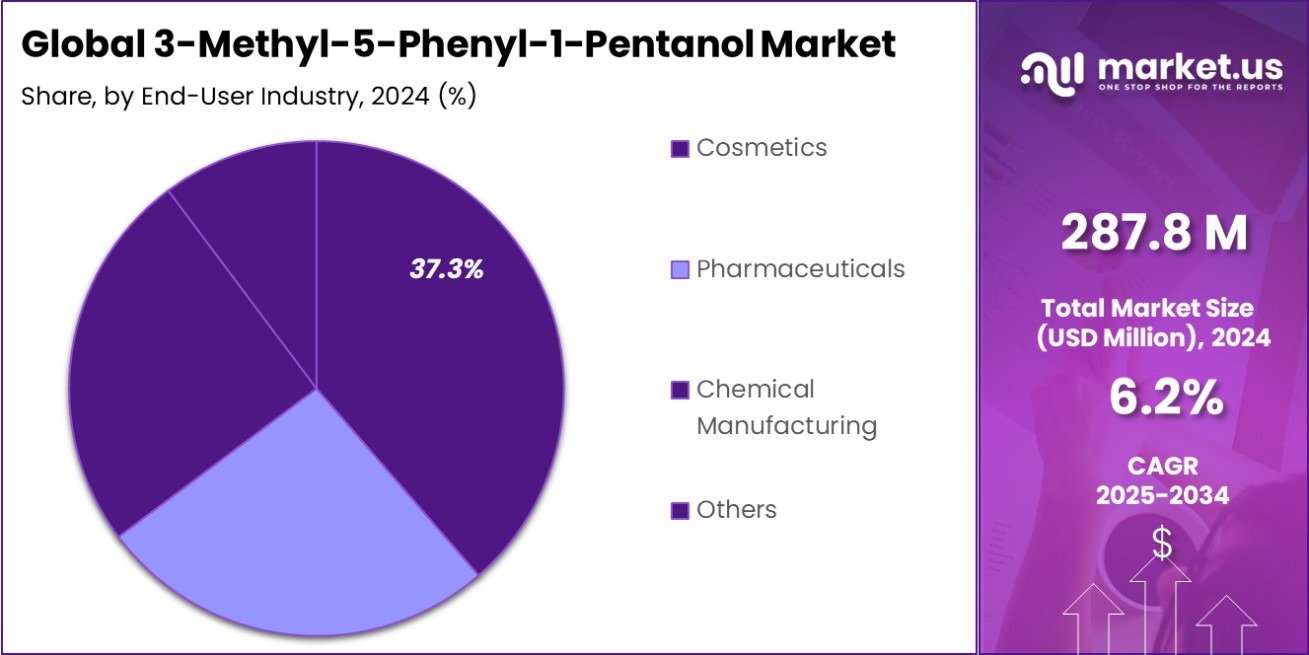

- The cosmetics industry is a major end-user, contributing 37.3% to the market for this compound.

- Direct sales lead the distribution channels, comprising 53.3% of the market share for 3-Methyl-5-Phenyl-1-Pentanol.

- The Asia-Pacific region holds 34.9% of the 3-Methyl-5-Phenyl-1-Pentanol market, valued at USD 121.7 Mn.

By Purity Analysis

High purity 3-Methyl-5-Phenyl-1-Pentanol accounts for 67.9% market share.

In 2024, High Purity held a dominant market position in the By Purity segment of the 3-Methyl-5-Phenyl-1-Pentanol market, with a 67.9% share. This category, representing a significant portion of the overall market, emphasizes the increasing demand for high-purity chemical compounds across various industries.

High purity 3-Methyl-5-Phenyl-1-Pentanol is crucial in applications requiring superior quality and precision, such as pharmaceuticals, fine chemicals, and advanced material development. The substantial market share can be attributed to the rising need for high-performance compounds in these sectors.

On the other hand, Low Purity 3-Methyl-5-Phenyl-1-Pentanol, while holding a smaller market portion, also contributes to the overall market dynamics. This segment is typically utilized in less stringent applications, where purity requirements are not as high. The demand for low-purity variants is primarily driven by cost considerations and the suitability of the compound in industrial-scale processes, where exact purity levels may not be a critical factor.

By Application Analysis

Fragrance applications dominate the 3-Methyl-5-Phenyl-1-Pentanol market at 46.3%.

In 2024, Fragrances held a dominant market position in the By Application segment of the 3-Methyl-5-Phenyl-1-Pentanol market, with a 46.3% share. This segment is driven by the compound’s unique aromatic properties, making it an essential ingredient in the formulation of perfumes and other fragrance products.

The widespread adoption of 3-Methyl-5-Phenyl-1-Pentanol in the fragrance industry is a result of its ability to deliver high-quality, long-lasting scents, which are highly valued by both consumers and manufacturers. The significant market share in this category reflects the strong demand for premium and customized fragrances in personal care, cosmetics, and household products.

Chemical Intermediates, while holding a smaller share of the market, also play a pivotal role in the 3-Methyl-5-Phenyl-1-Pentanol market. The compound’s use as a chemical intermediate is crucial in the synthesis of other specialty chemicals, which find applications across various industries, including pharmaceuticals, agrochemicals, and fine chemicals.

Despite its relatively smaller market presence compared to fragrances, this segment remains an important area of focus, driven by the need for high-quality intermediates in diverse industrial processes.

By End-User Industry Analysis

Cosmetics industry holds 37.3% of the 3-Methyl-5-Phenyl-1-Pentanol market.

In 2024, Cosmetics held a dominant market position in the By End-User Industry segment of the 3-Methyl-5-Phenyl-1-Pentanol market, with a 37.3% share. The strong market presence of cosmetics can be attributed to the compound’s distinctive fragrance and skin-care properties, which make it an essential ingredient in various cosmetic formulations.

Its use in perfumes, lotions, creams, and other personal care products aligns with the growing consumer demand for premium, high-quality, and innovative cosmetic products. The segment’s dominance reflects both the popularity of fragrances in cosmetics and the industry’s increasing emphasis on high-performance ingredients.

Pharmaceuticals, while holding a smaller market share, also contribute significantly to the 3-Methyl-5-Phenyl-1-Pentanol market. The compound’s role in the pharmaceutical sector is centered on its use in the synthesis of specialized formulations, such as therapeutic agents, where fragrance and compound stability are important. The sector continues to see steady growth as demand for advanced pharmaceutical products rises.

Chemical Manufacturing, another key segment, focuses on the use of 3-Methyl-5-Phenyl-1-Pentanol as an intermediate in the production of specialty chemicals. While this segment holds a smaller share compared to cosmetics, it remains integral to the broader chemical industry, supporting the creation of a wide range of chemical products.

By Distribution Channel Analysis

Direct sales channel contributes 53.3% to 3-Methyl-5-Phenyl-1-Pentanol market growth.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the 3-Methyl-5-Phenyl-1-Pentanol market, with a 53.3% share. This channel’s leading position is driven by the direct engagement between manufacturers and end-users, which allows for greater control over pricing, customer relationships, and product distribution.

Direct sales are particularly important for companies that target large-scale industries, such as cosmetics and pharmaceuticals, where bulk purchasing and customized solutions are common. This segment continues to grow as businesses seek to establish more direct and personalized connections with customers.

Distributors and Wholesalers represent a significant portion of the market, though they account for a smaller share than direct sales. This channel is vital for reaching a wide range of industries and regions, facilitating the efficient movement of 3-Methyl-5-Phenyl-1-Pentanol to various sectors that require the compound in bulk. Distributors and wholesalers help ensure consistent product availability and offer valuable logistical support.

Online Retail, while a growing segment, holds a smaller share of the market. As e-commerce platforms become more integral to supply chains, online retail is gradually gaining traction, particularly among smaller businesses and consumers looking for niche products. Despite its smaller market presence, this channel is expected to continue growing as digital transactions become more ubiquitous.

Key Market Segments

By Purity

- High Purity

- Low Purity

By Application

- Fragrances

- Chemical Intermediates

- Others

By End-User Industry

- Cosmetics

- Pharmaceuticals

- Chemical Manufacturing

- Others

By Distribution Channel

- Direct Sales

- Distributors and Wholesalers

- Online Retail

- Others

Driving Factors

Growing Demand in the Fragrance and Cosmetic Industry

The 3-Methyl-5-Phenyl-1-Pentanol market is seeing a significant boost due to the growing demand for this compound in the fragrance and cosmetics industry. As a versatile ingredient, it is used in perfumes, deodorants, and other cosmetic products to enhance their fragrance profile.

Consumers’ increasing preference for personal care products with sophisticated scents and long-lasting effects is fueling the demand for high-quality fragrance ingredients. This trend, along with the rise in disposable income and changing lifestyle preferences, is driving the market for 3-Methyl-5-Phenyl-1-Pentanol, making it a key component in fragrance formulation.

Restraining Factors

Regulatory Challenges in Chemical Production and Use

One of the key restraining factors in the 3-Methyl-5-Phenyl-1-Pentanol market is the regulatory challenges associated with its production and use. As a chemical compound, 3-Methyl-5-Phenyl-1-Pentanol is subject to strict regulations governing its manufacturing processes, safety standards, and environmental impact.

This can lead to higher production costs and longer lead times for companies seeking to introduce the compound into the market. Additionally, compliance with regional and international regulations can become complex, especially with concerns around sustainability and toxicity. Such regulatory hurdles can hinder market expansion, limiting the overall growth potential of 3-Methyl-5-Phenyl-1-Pentanol in various industries.

Growth Opportunity

Expanding Use in Natural Fragrance Formulations

A significant growth opportunity in the 3-Methyl-5-Phenyl-1-Pentanol market lies in its expanding use in natural and organic fragrance formulations. As consumers increasingly demand clean and sustainable beauty products, there is a shift towards using naturally sourced ingredients in fragrances. 3-Methyl-5-Phenyl-1-Pentanol, with its ability to mimic natural floral and woody scents, is well-positioned to meet this demand.

Manufacturers are seeking to replace synthetic fragrances with naturally derived alternatives, creating a market opportunity for this compound. As the demand for eco-friendly products continues to rise, the potential for growth in this segment is substantial, driving market expansion.

Latest Trends

Rising Popularity of Sustainable and Eco-Friendly Ingredients

A key trend in the 3-Methyl-5-Phenyl-1-Pentanol market is the rising popularity of sustainable and eco-friendly ingredients in fragrance and personal care products. Consumers are becoming more conscious about the environmental and social impact of the products they purchase, leading brands to prioritize natural, biodegradable, and responsibly sourced components.

This trend is pushing manufacturers to seek ingredients like 3-Methyl-5-Phenyl-1-Pentanol, which can deliver high-quality, natural fragrances without the environmental harm of synthetic alternatives. As the clean beauty movement gains momentum, this trend supports growth in the market for sustainable fragrance solutions, encouraging more companies to adopt greener practices.

Regional Analysis

The Asia-Pacific region holds a 34.9% share of the 3-Methyl-5-Phenyl-1-Pentanol market, valued at USD 121.7 million.

Asia-Pacific holds the largest share of the market, accounting for 34.9% of the global market, valued at USD 121.7 million. This dominance is driven by the region’s booming fragrance and cosmetics industry, particularly in countries like China, India, and Japan, where consumer demand for personal care products continues to rise. The increasing preference for natural and sustainable ingredients in these markets further strengthens the growth prospects for 3-Methyl-5-Phenyl-1-Pentanol.

North America follows with a significant market share due to strong demand from the personal care and fragrance sectors in the U.S. and Canada. The region benefits from a growing trend towards clean and natural beauty products, as well as a robust regulatory framework supporting product innovation.

Europe is another key region, with demand driven by the increasing focus on eco-friendly and sustainable fragrance formulations. The European market is expected to expand as consumers increasingly prioritize natural ingredients in cosmetics and fragrances.

MEA and Latin America represent smaller shares of the market, though both regions are witnessing gradual growth due to rising consumer awareness and demand for premium personal care products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global 3-Methyl-5-Phenyl-1-Pentanol market is highly competitive, with several major chemical companies leading the charge in terms of production, innovation, and market presence. In 2024, companies such as Zhejiang NHU, Xinrui Aromatics, and Xinhua Chemical are expected to maintain significant positions in the market, particularly in Asia-Pacific, which dominates the market share.

BASF SE, Dow Chemical Company, and Eastman Chemical Company are also poised to play vital roles in shaping the market. These global chemical giants bring advanced technology, research, and robust distribution networks that enable them to efficiently cater to diverse regional markets.

Their commitment to sustainability and innovation is driving the use of 3-Methyl-5-Phenyl-1-Pentanol in eco-friendly and natural fragrance formulations, aligning with current consumer trends toward sustainable beauty and personal care products.

Clariant AG, Lanxess AG, and Evonik Industries AG are focusing on expanding their product portfolios and improving product performance through R&D in specialty chemicals. Their strategic investments in the fragrance and cosmetics sectors are expected to accelerate growth in the market.

The strong presence of SABIC, Mitsubishi Chemical Corporation, LG Chem Ltd. in Asia Akzo Nobel N.V., and PPG Industries, Inc. in Europe further strengthens the competitive landscape. These companies are poised to benefit from the growing demand for natural ingredients in both established and emerging markets.

Top Key Players in the Market

- Zhejiang NHU

- Xinrui Aromatics

- Xinhua Chemical

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Solvay S.A.

- Clariant AG

- Lanxess AG

- Evonik Industries AG

- Arkema Group

- Ashland Global Holdings Inc.

- Huntsman Corporation

- INEOS Group Holdings S.A.

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- SABIC (Saudi Basic Industries Corporation)

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Wacker Chemie AG

- Akzo Nobel N.V.

- PPG Industries, Inc.

- LyondellBasell Industries N.V.

Recent Developments

- In 2023, Zhejiang NHU made a key development in the 3-Methyl-5-Phenyl-1-Pentanol sector by enhancing its production capabilities. This development aimed at improving yield efficiency, allowing the company to meet growing global demand in the fragrance and flavor market.

- In 2023, Xinrui Aromatics expanded production capabilities for 3-Methyl-5-Phenyl-1-Pentanol, responding to growing demand. By 2024, the company introduced improved formulations for personal care and industrial applications, emphasizing sustainability and high-purity standards in their aromatic chemical production.

Report Scope

Report Features Description Market Value (2024) USD Billion Forecast Revenue (2034) USD Billion CAGR (2025-2034) Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (High Purity, Low Purity), By Application (Fragrances, Chemical Intermediates, Others), By End-User Industry (Cosmetics, Pharmaceuticals, Chemical Manufacturing, Others), By Distribution Channel (Direct Sales, Distributors and Wholesalers, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zhejiang NHU, Xinrui Aromatics, Xinhua Chemical, BASF SE, Dow Chemical Company, Eastman Chemical Company, Solvay S.A., Clariant AG, Lanxess AG, Evonik Industries AG, Arkema Group, Ashland Global Holdings Inc., Huntsman Corporation, INEOS Group Holdings S.A., Mitsubishi Chemical Corporation, LG Chem Ltd., SABIC (Saudi Basic Industries Corporation), Sumitomo Chemical Co., Ltd., Toray Industries, Inc., Wacker Chemie AG, Akzo Nobel N.V., PPG Industries, Inc., LyondellBasell Industries N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3-Methyl-5-Phenyl-1-Pentanol MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

3-Methyl-5-Phenyl-1-Pentanol MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zhejiang NHU

- Xinrui Aromatics

- Xinhua Chemical

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Solvay S.A.

- Clariant AG

- Lanxess AG

- Evonik Industries AG

- Arkema Group

- Ashland Global Holdings Inc.

- Huntsman Corporation

- INEOS Group Holdings S.A.

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- SABIC (Saudi Basic Industries Corporation)

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Wacker Chemie AG

- Akzo Nobel N.V.

- PPG Industries, Inc.

- LyondellBasell Industries N.V.