Global 1,4 Butanediol Derivatives Market By Derivative Type (Tetrahydrofuran, Gamma-Butyrolactone, Polybutylene Succinate, Butanediol-Based Solvents), By Functionality (Solvents, Intermediate Chemicals, Plasticizers, Additives), By Application (Textiles, Automotive, Pharmaceuticals, Cosmetics, Plastics), By End User (Chemical Manufacturing, Consumer Goods, Automotive Industry, Healthcare, Textile Industry, Others), By Sales Channel (Direct Sale, Indirect Sale) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 138738

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

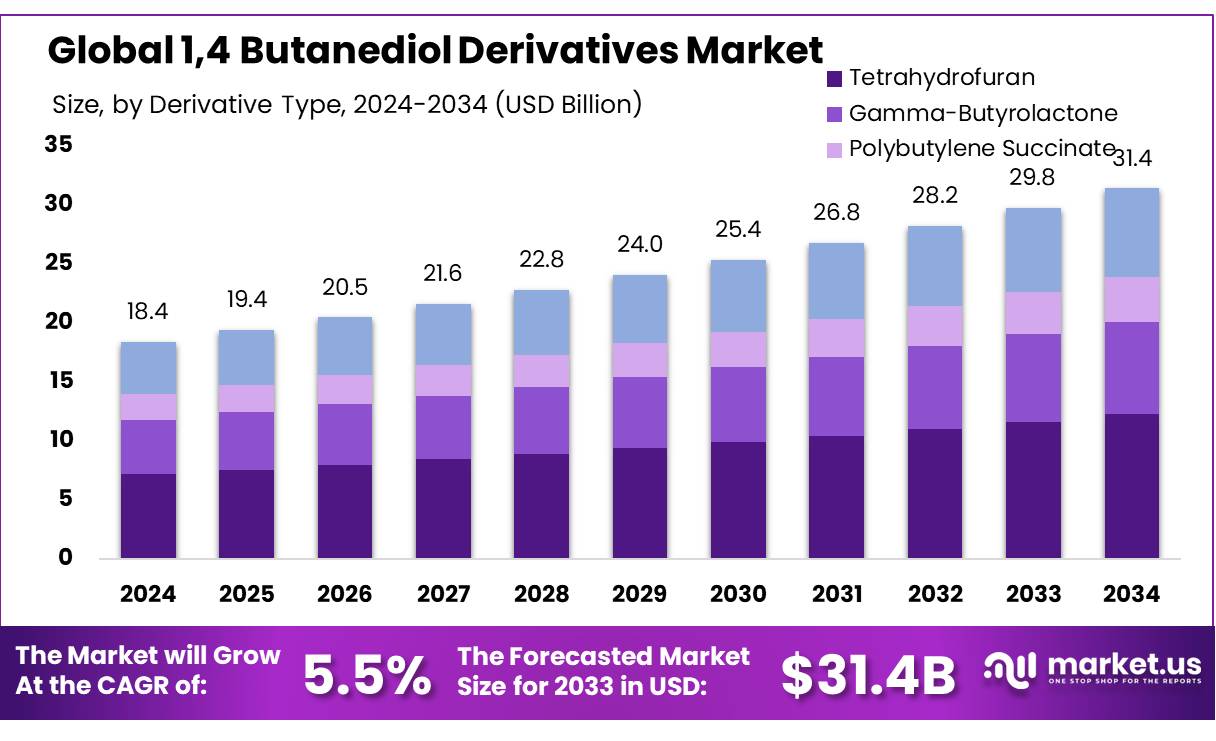

The Global 1,4 Butanediol Derivatives Market size is expected to be worth around USD 31.4 Bn by 2034, from USD 18.4 Bn in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

1,4-Butanediol (BDO) and its derivatives are essential chemicals widely used across a variety of industries, including automotive, pharmaceuticals, textiles, and plastics. BDO is a versatile organic compound primarily utilized as an intermediate in the production of several chemicals such as tetrahydrofuran (THF), polybutylene terephthalate (PBT), gamma-butyrolactone (GBL), and more. These derivatives serve as critical components in manufacturing high-performance materials like synthetic fibers, resins, and elastomers. The global market for 1,4-Butanediol derivatives has witnessed significant growth, driven by rising demand from key end-use industries, innovation in production methods, and the increasing trend toward sustainable and bio-based alternatives.

The 1,4-Butanediol derivatives market is heavily influenced by developments in chemical manufacturing technologies and the expansion of applications in various sectors. Key players in the market include major chemical companies such as BASF SE, LyondellBasell Industries, and Eastman Chemical Company, which invest heavily in product innovation and sustainable practices. The increasing adoption of eco-friendly production methods, such as bio-based BDO from renewable feedstocks, has further enhanced the market’s outlook, particularly in developed economies focused on reducing carbon footprints.

Demand from End-Use Industries growing need for high-performance materials such as PBT, which is used in automotive applications, is a key driver. Moreover, the increasing consumption of plastics in industries like packaging, construction, and electronics continues to fuel demand for BDO derivatives. Polyurethane production, particularly for foams in furniture and automotive seating, is another critical application.

Key Takeaways

- 1,4 Butanediol Derivatives Market size is expected to be worth around USD 31.4 Bn by 2034, from USD 18.4 Bn in 2024, growing at a CAGR of 5.5%

- Tetrahydrofuran held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 38.5% share.

- Solvents held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 37.3% share.

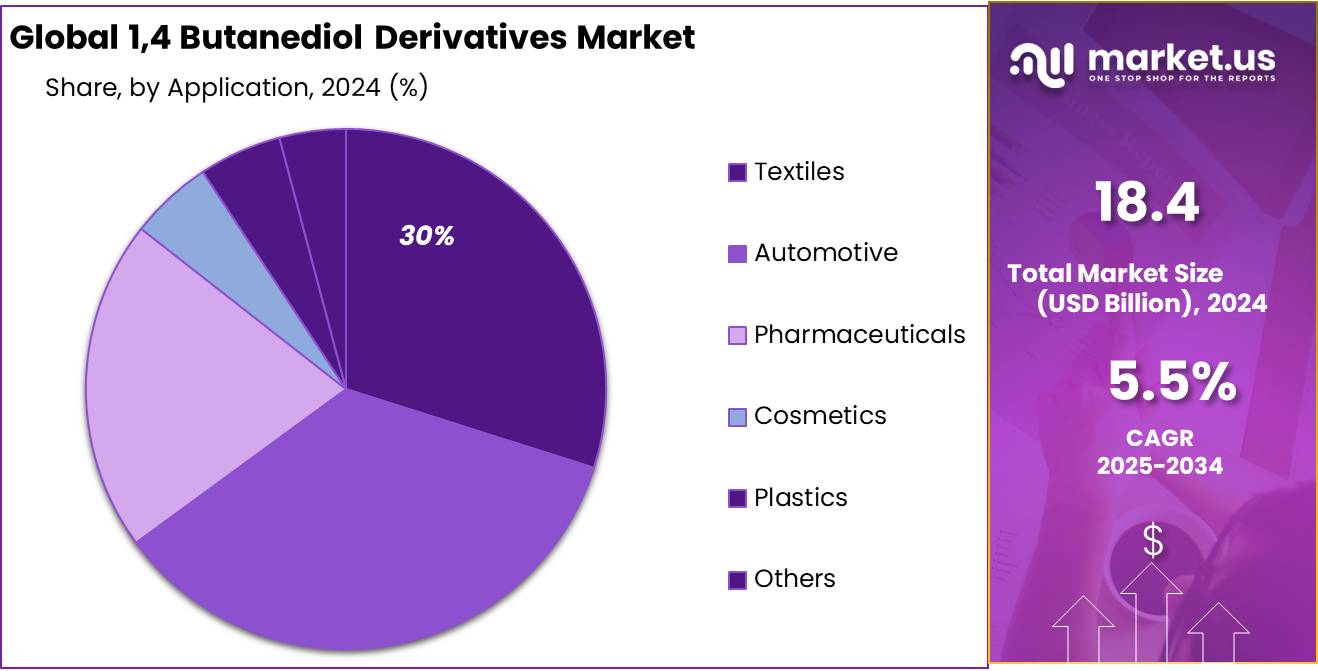

- Textiles segment held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 28.5% share.

- Chemical Manufacturing sector held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 37.4% share.

- Direct Sales held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 66.3% share.

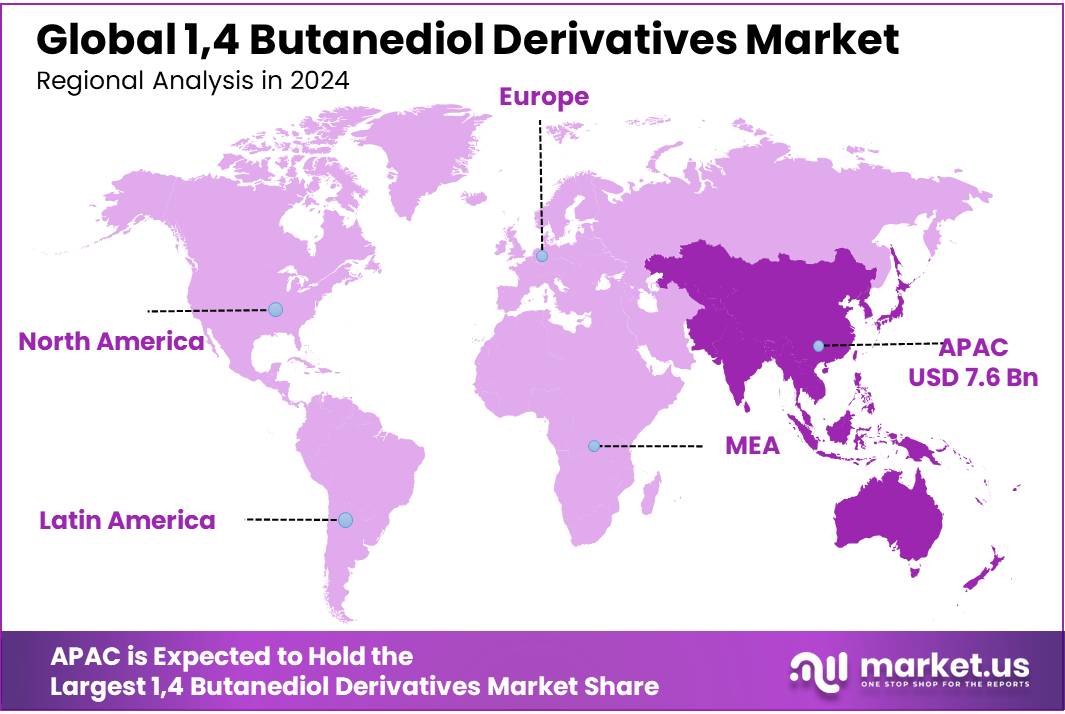

- Asia Pacific (APAC) leading the charge, holding a dominant 41.8% market share and generating revenues of approximately $7.6 billion.

By Derivative Type

In 2024, Tetrahydrofuran held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 38.5% share. This significant market share is largely attributed to Tetrahydrofuran’s critical role as an industrial solvent and its widespread use in the manufacture of polymers such as polytetramethylene ether glycol (PTMEG). PTMEG is essential for producing spandex fibers, which are highly demanded in the textile industry for sportswear and stretchable fabrics. The strength and elasticity provided by PTMEG contribute greatly to Tetrahydrofuran’s dominance in the market.

Gamma-Butyrolactone (GBL) also represents a substantial segment within the market. Valued for its applications as a chemical intermediate, GBL is used in the production of pyrrolidones, which are utilized in pharmaceutical and pesticide formulations. The versatility and effectiveness of GBL in various chemical synthesis processes support its strong standing in the industry.

Another important derivative, Polybutylene Succinate (PBS), is gaining traction due to its biodegradable properties, aligning with global trends towards sustainable and environmentally friendly materials. PBS is used in packaging, agricultural films, and compostable bags, markets that are expanding as businesses and consumers increasingly prioritize green products.

Butanediol-based solvents round out the segment, noted for their specialty applications in the electronics and cosmetic industries. These solvents are prized for their low toxicity and high solvency power, making them ideal for delicate and precise applications such as cleaning electronic components and formulating skin care products.

By Functionality

In 2024, Solvents held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 37.3% share. This segment’s leadership stems from the widespread use of 1,4 Butanediol derivatives as solvents in various industrial applications, including the production of pharmaceuticals and electronic components. These solvents are highly valued for their effectiveness in facilitating chemical reactions and processes without compromising the safety or integrity of the end products. Their ability to dissolve a wide range of materials makes them indispensable in complex manufacturing settings.

Intermediate Chemicals also constitute a significant portion of the market, serving as critical building blocks in the synthesis of more complex chemicals. These intermediates are essential for producing polyurethanes, biodegradable plastics, and elastomers, which are in high demand across multiple industries, including automotive, construction, and medical devices. The versatility and reliability of these intermediate products ensure their continued importance within the market.

Plasticizers, which are used to increase the plasticity or fluidity of materials, particularly in the production of flexible PVC, represent another key functionality segment. These additives improve the flexibility, workability, and durability of plastics, making them more versatile for use in consumer goods, packaging, and construction materials.

Additives are utilized to enhance the properties of polymers, such as improving their strength, stability, and color. This segment is crucial for industries that require materials with specific characteristics, such as high-performance engineering plastics used in high-temperature or chemically resistant applications.

By Application

In 2024, the Textiles segment held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 28.5% share. This substantial market share is primarily attributed to the extensive use of 1,4 Butanediol derivatives in the production of spandex and other high-performance fibers. These materials are essential for creating stretchable, durable fabrics used in a wide range of apparel, from everyday clothing to specialized sportswear and medical textiles.

The Automotive segment also utilizes 1,4 Butanediol derivatives extensively, particularly in the manufacture of polyurethane foams used in seating, insulation, and interior applications. The demand in this sector is supported by the automotive industry’s ongoing trends towards lightweight and energy-efficient vehicles, where these materials play a crucial role in reducing overall vehicle weight and enhancing passenger comfort.

In Pharmaceuticals, 1,4 Butanediol derivatives serve as solvents and intermediates in drug formulation and manufacturing processes. Their application in this sector is critical due to their effectiveness in ensuring the stability and efficacy of pharmaceutical compounds, particularly in injectable and topical drug products.

The Cosmetics industry benefits from 1,4 Butanediol derivatives mainly in the form of humectants and solvents used in skincare and haircare products. These derivatives help in formulating products that provide better moisture retention, improved texture, and enhanced application properties, meeting the high standards of today’s beauty product consumers.

The Plastics industry uses 1,4 Butanediol derivatives as plasticizers and chain extenders in the production of various plastic materials. These applications are crucial for producing high-quality, durable plastic products used in consumer goods, packaging, and construction.

By End User

In 2024, the Chemical Manufacturing sector held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 37.4% share. This sector’s leading position is attributed to its extensive use of 1,4 Butanediol derivatives as intermediate chemicals in the production of various industrial compounds.

The Consumer Goods sector also significantly utilizes 1,4 Butanediol derivatives, particularly in products such as toys, packaging materials, and household items. This sector benefits from the versatility of 1,4 Butanediol derivatives to improve product durability and performance, meeting consumer expectations for high-quality goods.

In the Automotive Industry, 1,4 Butanediol derivatives are used in the production of polyurethane foams, which are essential for vehicle insulation, seating, and interior applications. The demand in this industry is fueled by trends towards more comfortable and energy-efficient vehicles, requiring lightweight and durable materials.

The Healthcare sector employs these derivatives in medical devices and pharmaceuticals, where they are used as solvents and plasticizers to ensure safety, effectiveness, and patient comfort. The increasing focus on advanced medical technologies and improved drug formulations supports the growth of this segment.

The Textile Industry relies on 1,4 Butanediol derivatives for producing elastic fibers and polymers, vital for manufacturing stretchable, durable fabrics used in various apparel and industrial textiles.

By Sales Channel

In 2024, Direct Sales held a dominant market position in the 1,4 Butanediol derivatives market, capturing more than a 66.3% share. This distribution channel’s significant share can be attributed to its effectiveness in establishing strong, direct relationships between manufacturers and large industrial consumers who demand reliable and consistent supply chains. Direct sales allow for greater control over pricing and customer service, ensuring that clients receive tailored support and technical assistance, which is crucial for industries reliant on precise chemical specifications and high-quality standards.

Indirect Sales, though holding a smaller market share, still play a crucial role in reaching out to smaller businesses and regions where direct sales operations are less feasible. This channel, which includes distributors, resellers, and online platforms, enables manufacturers to expand their market reach and flexibility. Indirect sales are particularly important for catering to niche markets or smaller customers who may not require the large volumes that justify direct sales but still benefit from access to 1,4 Butanediol derivatives for various applications.

Key Market Segments

By Derivative Type

- Tetrahydrofuran

- Gamma-Butyrolactone

- Polybutylene Succinate

- Butanediol-Based Solvents

By Functionality

- Solvents

- Intermediate Chemicals

- Plasticizers

- Additives

By Application

- Textiles

- Automotive

- Pharmaceuticals

- Cosmetics

- Plastics

By End User

- Chemical Manufacturing

- Consumer Goods

- Automotive Industry

- Healthcare

- Textile Industry

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Drivers

Increasing Demand for Sustainable and Biodegradable Plastics

A major driving factor for the growth of the 1,4 Butanediol derivatives market is the increasing demand for sustainable and biodegradable plastics. As global awareness of environmental issues such as plastic pollution and carbon emissions has grown, both consumers and regulatory bodies are pushing for materials that can degrade naturally and minimize environmental impact. This shift is significantly influencing industries such as packaging, automotive, and consumer goods, where traditional plastics are being replaced with more sustainable alternatives.

1,4 Butanediol derivatives, particularly polybutylene succinate (PBS), play a critical role in this transition. PBS is a biodegradable plastic that can be produced using 1,4 Butanediol, offering a greener alternative to petroleum-based plastics. It degrades in various environments, including marine conditions, which makes it an attractive option for reducing plastic waste in oceans—a major global concern. The demand for PBS is especially notable in the packaging industry, which is under pressure to reduce the environmental impact of its products due to governmental regulations and consumer preferences for sustainable packaging solutions.

Governments around the world are supporting this trend through initiatives and legislation aimed at reducing the use of non-degradable plastics. For example, the European Union has set ambitious targets to ensure all plastic packaging on the EU market is either reusable or recyclable by 2030. Such policies are not only promoting the use of biodegradable plastics but are also stimulating innovation and investments in the sector to develop new materials that meet these regulatory requirements.

Moreover, advancements in biotechnology are enhancing the production efficiency of bio-based 1,4 Butanediol, making the production of biodegradable derivatives more economically viable. These advancements are crucial for increasing the commercial appeal of PBS and other biodegradable plastics, as they help reduce production costs and improve material properties, making them more competitive with conventional plastics in terms of both performance and price.

Restraints

Volatility in Raw Material Prices and Supply Chain Disruptions

A significant restraining factor for the growth of the 1,4 Butanediol derivatives market is the volatility in raw material prices coupled with supply chain disruptions. 1,4 Butanediol and its derivatives largely depend on petrochemical feedstocks, the prices of which are closely tied to the fluctuations in global oil markets. These fluctuations can be caused by geopolitical tensions, changes in oil production levels, and other economic factors, leading to unpredictable costs for manufacturers of 1,4 Butanediol derivatives.

The impact of raw material price volatility is compounded by supply chain disruptions, which can occur due to various reasons including political instability, natural disasters, and, as recently witnessed, pandemics such as COVID-19. These disruptions can lead to delays or shortages in raw material supplies, which in turn affect production schedules, inflate costs, and disrupt the overall market dynamics.

For instance, during the COVID-19 pandemic, many chemical manufacturing sectors experienced severe disruptions in their supply chains due to lockdowns and other restrictions. These interruptions not only impacted the production capabilities of 1,4 Butanediol derivative manufacturers but also affected their ability to meet customer demands in a timely manner, leading to a loss of business and increased operational costs.

Furthermore, the dependency on specific geographic regions for raw materials also poses a risk. Many derivatives of 1,4 Butanediol are produced using feedstocks sourced from specific areas known for their petrochemical industries. Any instability in these regions can directly impact the global supply chains, affecting the availability and price stability of these critical raw materials.

These challenges highlight the need for manufacturers in the 1,4 Butanediol derivatives market to develop more robust supply chain strategies and explore alternative raw materials that could mitigate some of these risks. Innovations in bio-based alternatives and improvements in recycling technologies might also provide pathways to reduce dependency on volatile petrochemical feedstocks and create a more stable supply chain environment. However, the transition to these alternatives requires significant investment in research and development, and the scalability of such solutions remains a critical challenge for the industry.

Opportunity

Expansion into Bio-based Derivatives: A Sustainable Future for 1,4 Butanediol

A major growth opportunity for the 1,4 Butanediol derivatives market lies in the expansion into bio-based derivatives. As industries globally are urged to reduce their environmental footprint, the demand for sustainable and eco-friendly products continues to rise. This trend is significantly influenced by both consumer preferences for greener products and stricter governmental regulations aimed at reducing carbon emissions and dependence on non-renewable resources.

Bio-based 1,4 Butanediol derivatives, such as bio-based Tetrahydrofuran and Polybutylene Succinate, are derived from renewable resources and present a sustainable alternative to their petrochemical counterparts. These derivatives not only help in reducing the environmental impact associated with chemical production but also align with global sustainability goals. For instance, the European Union’s Bioeconomy Strategy aims to accelerate the innovation and adoption of renewable resources for industrial purposes, encouraging industries to shift towards bio-based chemicals.

The market for bio-based polymers is expected to grow substantially. This growth is supported by the increasing availability of bio-based feedstocks, advancements in biotechnological methods for chemical synthesis, and more competitive pricing as production technologies mature.

Moreover, government initiatives such as subsidies, tax incentives, and preferential procurement policies are making it economically viable for companies to invest in bio-based technologies. For example, the U.S. Department of Agriculture’s BioPreferred program aims to increase the purchase and use of bio-based products, providing a significant market for industries to develop and commercialize bio-based 1,4 Butanediol derivatives.

Embracing this opportunity, chemical manufacturers can not only meet the increasing market demand for sustainable products but also gain a competitive edge in a market that is increasingly influenced by environmental, social, and governance (ESG) criteria.

Developing bio-based derivatives of 1,4 Butanediol allows companies to leverage the growing consumer and regulatory push towards sustainability, thereby securing growth and future relevance in the evolving chemical industry landscape. This strategic shift not only supports global sustainability efforts but also opens up new business opportunities in a world that is rapidly moving towards greener alternatives.

Trends

The Rise of Green Chemistry in 1,4 Butanediol Derivatives Production

A significant trend shaping the 1,4 Butanediol derivatives market is the increasing adoption of green chemistry practices. As environmental sustainability becomes a central focus for industries worldwide, the chemical sector is moving towards more eco-friendly production methods and materials. This shift is driven by both regulatory pressures and a growing consumer demand for products that minimize environmental impact.

Green chemistry in the production of 1,4 Butanediol derivatives involves developing processes that reduce waste, lower emissions of volatile organic compounds, and eliminate the use of toxic solvents and reagents. These initiatives are not only about complying with environmental regulations but also about improving process efficiency and reducing operational costs. For instance, innovations in catalysis and biocatalysis are enabling manufacturers to synthesize 1,4 Butanediol derivatives at lower temperatures and pressures, significantly reducing energy consumption and enhancing safety.

Moreover, the market for environmentally friendly solvents is expanding. Solvents are a critical component in the production of many 1,4 Butanediol derivatives, used extensively in industries such as pharmaceuticals, textiles, and automotive. The development of bio-based and recyclable solvents is gaining traction, supported by advancements in materials science and biotechnology. These sustainable solvents are designed to provide the same or improved efficacy as their traditional counterparts while being biodegradable and less toxic.

Governmental initiatives are further bolstering this trend. For example, the European Green Deal and the United States’ Green New Deal include provisions to support research and development in sustainable chemistry, offering grants and tax incentives for companies that adopt green technologies. Such policies are encouraging the chemical industry to invest in sustainable practices and technologies, which is particularly relevant for the production and application of 1,4 Butanediol derivatives.

Regional Analysis

In 2024, the 1,4 Butanediol derivatives market demonstrates a diverse landscape across different regions, with Asia Pacific (APAC) leading the charge, holding a dominant 41.8% market share and generating revenues of approximately $7.6 billion. This prominence is attributed to the extensive industrial activities in major APAC economies such as China, India, and South Korea, where there is a significant demand for 1,4 Butanediol derivatives in textiles, automotive, and consumer goods manufacturing.

North America follows as a key player in the market, driven by advanced technological infrastructure and stringent regulatory frameworks that promote the use of sustainable and high-performance chemical derivatives in industries like automotive, healthcare, and consumer goods. The region’s focus on bio-based and green chemical solutions is accelerating the adoption of sustainable 1,4 Butanediol derivatives, aligning with the global push towards reducing environmental impact.

Europe also maintains a significant position in the market, underpinned by its strong regulatory environment, particularly the EU regulations concerning chemical safety and environmental sustainability. European manufacturers are leading in the development of bio-based 1,4 Butanediol derivatives, catering to the increasing demand for eco-friendly products across its well-established automotive and textile sectors.

The Middle East & Africa and Latin America are emerging markets with growing potential, driven by expanding industrialization and government initiatives to foster local manufacturing sectors. These regions are gradually adopting more sophisticated chemical processes, with a growing awareness and integration of sustainable practices in chemical production, providing new opportunities for market expansion in 1,4 Butanediol derivatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The 1,4 Butanediol derivatives market features a roster of leading players, each contributing significantly to the industry’s growth and development through technological advancements and expansive distribution networks. Among them, BASF SE, Eastman Chemical, and LyondellBasell Industries Holdings B.V. stand out due to their global presence and robust product portfolios.

BASF SE, for instance, leverages its extensive research and development capabilities to innovate and improve the efficiency and sustainability of its chemical products. Eastman Chemical, renowned for its commitment to safety and sustainability, consistently develops high-performance materials that cater to a diverse range of industries, including automotive, paints, and coatings.

Similarly, companies like Mitsubishi Chemical Group Corporation and SINOPEC are crucial in driving growth in the Asia Pacific region, which is the largest market for 1,4 Butanediol derivatives. These companies capitalize on regional growth opportunities by expanding their production capacities and enhancing their product offerings to meet the rising demand from rapidly industrializing economies. Genomatica, Inc., on the other hand, represents a pivotal force in the shift towards sustainable chemical solutions, focusing on bio-based technologies to produce 1,4 Butanediol derivatives that reduce reliance on fossil fuels.

Top Key Players

- Ashland

- BASF SE

- Dairen Chemical

- DCC

- Eastman Chemical

- Evonik Industries AG

- Formosa Plastics

- Genomatica, Inc.

- Huntsman Corporation

- Invista

- Kraton Corporation

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals

- Ningbo Jiangning Chemical

- Repsol

- Sabic

- Samsung Fine Chemicals

- SINOPEC (China Petrochemical Corporation)

- Sipchem Company

Recent Developments

In 2024, Ashland continues to play a crucial role in the 1,4 Butanediol derivatives sector, utilizing its expertise in specialty chemicals to innovate and supply high-quality products. Ashland is particularly renowned for its focus on sustainable and advanced material solutions, which cater to various industries, including cosmetics, pharmaceuticals, and automotive.

In 2024, BASF SE has significantly advanced its 1,4-Butanediol (BDO) derivatives sector by expanding its biomass balance portfolio. The company introduced BMBCert™ 1,4-butanediol, tetrahydrofuran (THF), polytetrahydrofuran (PolyTHF®), and 3-(dimethylamino)propylamine (DMAPA), produced at sites in Ludwigshafen, Germany, Geismar, Louisiana, and Ulsan, South Korea.

Report Scope

Report Features Description Market Value (2024) USD 18.4 Bn Forecast Revenue (2034) USD 31.4 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Derivative Type (Tetrahydrofuran, Gamma-Butyrolactone, Polybutylene Succinate, Butanediol-Based Solvents), By Functionality (Solvents, Intermediate Chemicals, Plasticizers, Additives), By Application (Textiles, Automotive, Pharmaceuticals, Cosmetics, Plastics), By End User (Chemical Manufacturing, Consumer Goods, Automotive Industry, Healthcare, Textile Industry, Others), By Sales Channel (Direct Sale, Indirect Sale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ashland, BASF SE, Dairen Chemical, DCC, Eastman Chemical, Evonik Industries AG, Formosa Plastics, Genomatica, Inc., Huntsman Corporation, Invista, Kraton Corporation, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation, Mitsui Chemicals, Ningbo Jiangning Chemical, Repsol, Sabic, Samsung Fine Chemicals, SINOPEC (China Petrochemical Corporation), Sipchem Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  1,4 Butanediol Derivatives MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

1,4 Butanediol Derivatives MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ashland

- BASF SE

- Dairen Chemical

- DCC

- Eastman Chemical

- Evonik Industries AG

- Formosa Plastics

- Genomatica, Inc.

- Huntsman Corporation

- Invista

- Kraton Corporation

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals

- Ningbo Jiangning Chemical

- Repsol

- Sabic

- Samsung Fine Chemicals

- SINOPEC (China Petrochemical Corporation)

- Sipchem Company