The Global C8-C10 Fatty Acid Market Size, Share, And Business Benefits By Type (C8 Fatty Acids, C10 Fatty Acids), By Source (Natural Sources, Synthetic Sources), By Application (Lubricants, Plasticizer, Daily Chemicals, Flavoring and Perfuming Agents), By End-use (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139475

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

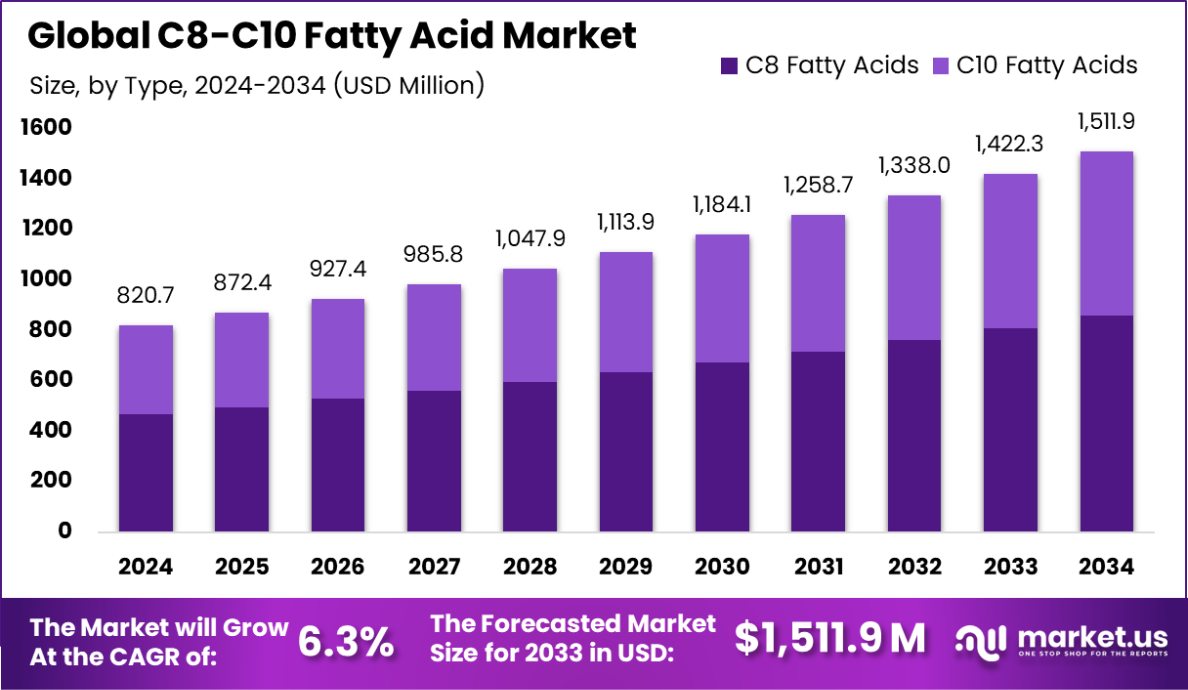

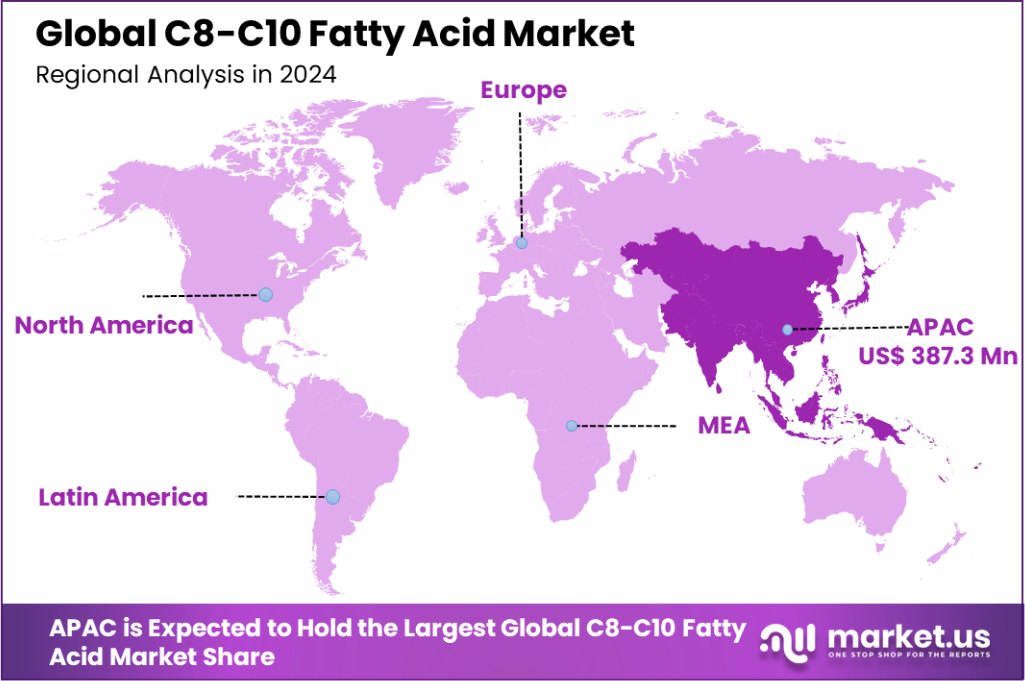

The Global C8-C10 Fatty Acid Market is expected to be worth around USD 1,511.9 million by 2034, up from USD 820.7 million in 2024, and grow at a CAGR of 6.3% from 2025 to 2034. Asia-Pacific dominates the C8-C10 Fatty Acid Market with 47.3%, USD 387.3 Mn.

C8-C10 fatty acids, also known as caprylic and capric acids, are medium-chain saturated fatty acids derived primarily from coconut oil and palm kernel oil. These fatty acids are used in various industries, including food, cosmetics, pharmaceuticals, and personal care, due to their antimicrobial properties, ability to improve skin hydration and use as emulsifiers. They play a crucial role in formulations for cleansing agents, fragrances, and flavorings.

The growth of the C8-C10 fatty acid market is driven by the rising demand for natural ingredients in food and personal care products. Consumers are increasingly seeking natural, plant-derived components, which has enhanced the appeal of C8-C10 fatty acids for product formulations. Additionally, these fatty acids’ functional properties, such as enhancing the bioavailability of active ingredients, fuel market expansion in pharmaceuticals and nutraceuticals.

Opportunities in the C8-C10 fatty acid market arise from the expanding applications in the health and wellness sector, particularly in weight management and digestive health products. The growing trend toward plant-based and organic products presents a significant opportunity, especially as more consumers prefer non-synthetic, sustainable options. This shift offers long-term growth potential for C8-C10 fatty acids.

The C8-C10 Fatty Acid market is poised for steady growth, driven by their versatile applications in industries ranging from food to biotechnological advancements. Emerging research highlights the potential of C8 and C10 fatty acids in neurological health, with studies showing that these acids can achieve cerebral concentrations of up to 200 µM in mice following enriched supplementation.

Additionally, the higher metabolic accumulation of C10 (35.0 ± 0.8%) in brain glutamine compared to C8 (28.5 ± 0.4%) could indicate a more efficient bioactivity. Furthermore, innovation within the sector is supported by initiatives such as a U.S. Department of Energy-backed project that aims to produce caprylic acid-derived lubricants from cellulosic sugars, with DOE funding of $1,990,758. This alignment between research and industrial investment underscores the sector’s expanding potential across diverse applications.

Key Takeaways

- The Global C8-C10 Fatty Acid Market is expected to be worth around USD 1,511.9 million by 2034, up from USD 820.7 million in 2024, and grow at a CAGR of 6.3% from 2025 to 2034.

- C8 fatty acids dominate the C8-C10 fatty acid market, accounting for 57.1% of the share.

- Natural sources contribute significantly to the market, with 71.3% of C8-C10 fatty acids sourced naturally.

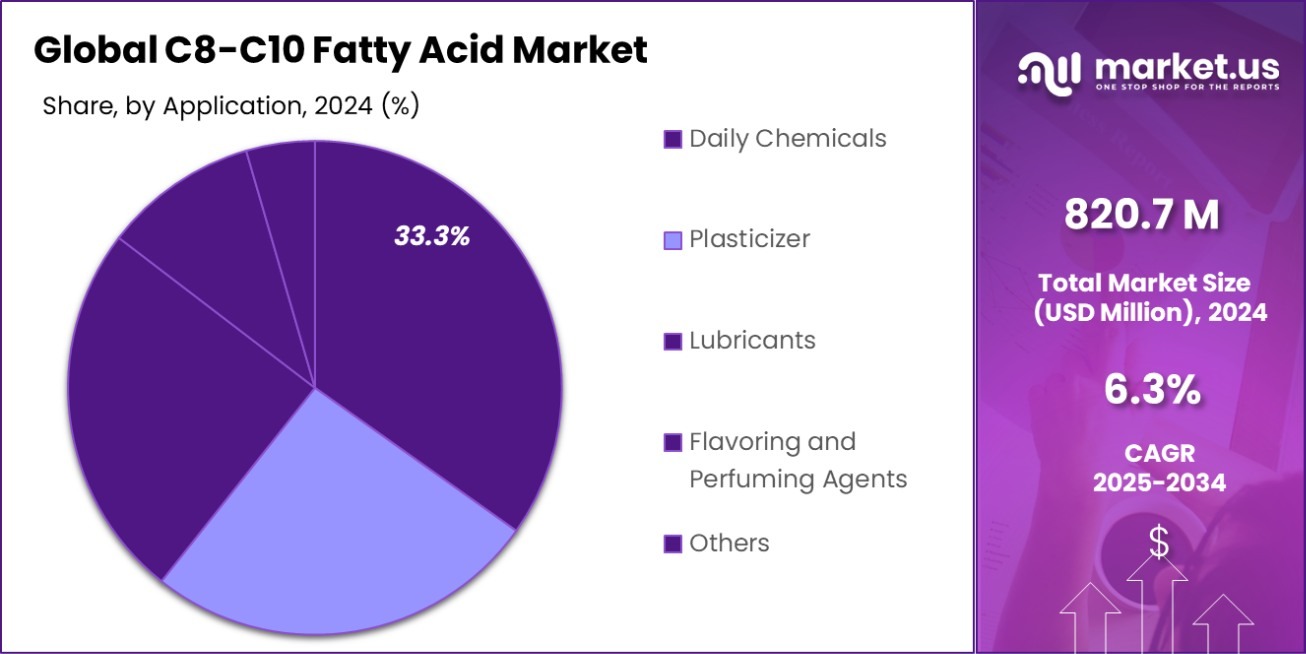

- The daily chemicals sector remains a key application area, holding 33.3% of the market share.

- The food and beverage industry is the largest end-user, representing 37.3% of the C8-C10 market.

- In Asia-Pacific, the C8-C10 Fatty Acid Market holds a 47.3% share, valued at USD 387.3 million.

By Type Analysis

The C8-C10 fatty acid market is driven by C8 fatty acids’ dominance.

In 2024, C8 Fatty Acids held a dominant market position in the By Type segment of the C8-C10 Fatty Acid Market, with a 57.1% share. This market share underscores the significant demand for C8 fatty acids, driven by their widespread use in various applications including surfactants, lubricants, and personal care products.

The unique chemical properties of C8 fatty acids, such as their ability to break down oils and fats efficiently, have made them a preferred choice in industrial applications.

On the other hand, C10 Fatty Acids represented a notable portion of the market, contributing a significant share to the overall C8-C10 Fatty Acid Market. C10 fatty acids, although not as dominant as their C8 counterparts, have seen steady demand, particularly in the production of specialized surfactants, esters, and industrial chemicals.

This market dynamic highlights the ongoing growth in both C8 and C10 fatty acids, with each segment catering to specific end-user requirements. The continued innovation in fatty acid derivatives, along with their increasing usage in diverse industrial applications, is expected to drive further market growth in the coming years.

By Source Analysis

Natural sources account for the majority of the C8-C10 fatty acid market share.

In 2024, Natural Sources held a dominant market position in the By Source segment of the C8-C10 Fatty Acid Market, with a 71.3% share. This strong market presence can be attributed to the growing consumer preference for natural and sustainable ingredients, particularly in industries such as cosmetics, personal care, and food production.

Fatty acids derived from natural sources are perceived as more environmentally friendly and are in higher demand due to increasing awareness of sustainability and the benefits of natural products.

On the other hand, Synthetic Sources held a relatively smaller share of the market. Despite the advantages of synthetic fatty acids, including cost-effectiveness and consistency in supply, they are generally less favored compared to their natural counterparts in consumer-facing products. However, synthetic sources continue to play an essential role in the industrial and chemical sectors, where they are often used for applications that do not emphasize natural sourcing.

The continued dominance of natural sources in the C8-C10 fatty acid market reflects the rising trend toward cleaner, greener alternatives, positioning natural fatty acids as a key driver of growth within the market in the coming years.

By Application Analysis

Daily chemicals represent a significant application segment for C8-C10 fatty acids’ usage.

In 2024, Daily Chemicals held a dominant market position in the By Application segment of the C8-C10 Fatty Acid Market, with a 33.3% share. This significant market share is driven by the increasing use of C8-C10 fatty acids in a wide range of daily chemical applications, including personal care, household products, and cleaning agents.

The versatility and effectiveness of these fatty acids in formulations for soaps, detergents, and cosmetics have contributed to their widespread adoption in the daily chemicals sector.

The Lubricants application segment also captured a noteworthy portion of the market, driven by the demand for high-performance lubricants in industrial and automotive applications. C8-C10 fatty acids are valued for their ability to enhance lubrication properties, offering superior performance in various mechanical systems.

In addition, the Plasticizer segment is another key area where C8-C10 fatty acids are extensively used. Fatty acids serve as plasticizers in polymer and PVC production, improving the flexibility and processing characteristics of the material.

Lastly, Flavoring and Perfuming Agents represent a specialized but growing application for C8-C10 fatty acids, driven by their natural appeal in food and fragrance products.

By End-Use Analysis

The food and beverage sector holds a substantial share of the fatty acid market.

In 2024, Food and Beverage held a dominant market position in the By End-Use segment of the C8-C10 Fatty Acid Market, with a 37.3% share. This dominance is primarily attributed to the increasing demand for natural and functional ingredients in food processing, where C8-C10 fatty acids are valued for their emulsifying, flavoring, and preservative properties. Their ability to improve food texture and extend shelf life has led to widespread use in a variety of food and beverage applications, including bakery products, dairy, and confectionery.

The Cosmetics and Personal Care sector also represents a significant portion of the market. C8-C10 fatty acids are extensively used in skin care, hair care, and beauty products due to their moisturizing and emulsifying properties. Their gentle nature makes them ideal for sensitive skin formulations, contributing to their growing presence in this end-use segment.

Additionally, the Pharmaceuticals sector has seen a steady application of C8-C10 fatty acids, particularly in drug formulations where they serve as excipients or stabilizers, enhancing the solubility and bioavailability of active pharmaceutical ingredients.

Key Market Segments

By Type

- C8 Fatty Acids

- C10 Fatty Acids

By Source

- Natural Sources

- Synthetic Sources

By Application

- Lubricants

- Plasticizer

- Daily Chemicals

- Flavoring and Perfuming Agents

By End-use

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

- Others

Driving Factors

Growing Demand for Natural Ingredients in Consumer Products

The growing preference for natural ingredients in consumer products is a key driving factor for the C8-C10 Fatty Acid Market. As consumers become more aware of the potential risks associated with synthetic chemicals, there is a clear shift toward products made with natural, sustainable, and environmentally friendly ingredients.

C8-C10 fatty acids, derived from renewable sources such as coconut and palm oil, are increasingly used in personal care, food, and cleaning products. Their mild nature and multifunctional properties, such as emulsifying and moisturizing, make them a sought-after ingredient in a wide range of formulations, further driving market growth.

Restraining Factors

Volatility in Raw Material Prices and Supply

One of the major restraining factors for the C8-C10 Fatty Acid Market is the volatility in raw material prices and supply. The primary sources of C8-C10 fatty acids are coconut and palm oils, which are subject to fluctuations in price and availability due to factors like climate conditions, trade policies, and geopolitical tensions.

These uncertainties can disrupt production processes, increase costs, and ultimately affect the pricing of end products. Additionally, environmental concerns surrounding palm oil production, including deforestation, can lead to regulatory challenges, further complicating the stability of supply chains for C8-C10 fatty acids.

Growth Opportunity

Expansion of Eco-Friendly Product Lines in Cosmetics

A significant growth opportunity for the C8-C10 Fatty Acid Market lies in the expansion of eco-friendly product lines within the cosmetics and personal care industries. As consumer demand for natural, sustainable, and cruelty-free beauty products continues to rise, C8-C10 fatty acids are well-positioned to meet these needs.

Their mild and non-toxic properties make them ideal for use in a wide range of cosmetic formulations, including moisturizers, shampoos, and soaps. Brands that focus on incorporating C8-C10 fatty acids in their eco-conscious products can attract environmentally aware consumers, driving market growth in this sector.

Latest Trends

Increasing Use of C8-C10 Fatty Acids in Clean Beauty

One of the latest trends in the C8-C10 Fatty Acid Market is the increasing use of these fatty acids in clean beauty products. As consumers become more conscious about the ingredients in their beauty and personal care products, there has been a surge in demand for products free from harmful chemicals.

C8-C10 fatty acids, known for their natural origin and skin-friendly properties, are increasingly used in clean beauty formulations. Their ability to act as emulsifiers and moisturizers while being safe for sensitive skin makes them highly sought after in this growing segment.

Regional Analysis

In 2024, the Asia-Pacific region accounted for 47.3% of the C8-C10 Fatty Acid Market, valued at USD 387.3 million.

In 2024, the Asia-Pacific region dominated the C8-C10 Fatty Acid Market with a substantial share of 47.3%, valued at USD 387.3 Mn. This leadership is driven by the high demand for C8-C10 fatty acids in various end-use industries such as cosmetics, personal care, food, and beverages.

The growing preference for natural ingredients and the expanding consumer base in countries like China, India, and Japan have significantly contributed to this dominance. Additionally, the presence of key producers and suppliers in the region bolsters its market position.

North America and Europe hold notable shares in the market, benefiting from the increasing trend toward sustainable and eco-friendly products. These regions have witnessed a rise in consumer demand for clean beauty and natural-based food ingredients. However, their market shares are smaller compared to Asia-Pacific, owing to the relatively lower production capacities and higher raw material costs.

The Middle East & Africa and Latin America are emerging markets for C8-C10 fatty acids. While these regions are still developing in terms of demand and production, there is growing interest in the use of fatty acids in industrial and consumer goods. As awareness of natural ingredients increases, these regions are expected to experience steady market growth in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global C8-C10 Fatty Acid Market is marked by the significant presence of several key players, each contributing to the market’s growth through innovation, strategic partnerships, and expansion in emerging markets.

Godrej Industries, a leading player, has capitalized on its vast distribution network in Asia-Pacific, helping it secure a substantial market share. The company’s strong focus on sustainable practices and eco-friendly products positions it well within the natural ingredient-driven market trend.

BASF SE, a global chemical leader, continues to innovate in the oleochemicals segment. Its research into advanced applications of C8-C10 fatty acids, especially in personal care and cleaning products, has helped maintain its leadership position. BASF’s commitment to sustainable development and its extensive global reach enables it to cater to diverse market needs.

Musim Mas, Wilmar, and IOI Oleochemical are all major players in the Asia-Pacific region, benefiting from the region’s large-scale production of palm and coconut oils, essential raw materials for C8-C10 fatty acid production. Their integrated supply chains, from raw material sourcing to product distribution, provide them with a competitive edge in cost control and market reach.

P&G Chemicals and Emery Oleochemicals focus on the growing demand for C8-C10 fatty acids in cosmetics and personal care products. Their ability to provide high-quality, sustainable fatty acids for these industries has contributed to their strong market positions.

Ecogreen Oleochemicals and Ferro Corporation have been key players in driving the market’s focus on greener, bio-based products, capitalizing on the rising demand for eco-conscious solutions across multiple applications.

Top Key Players in the Market

- Godrej Industries

- BASF SE

- WujiangJinyu Lanolin Co.

- Ferro Corporation

- LK OLEO

- Musim Mas

- IOI Oleochemical

- Permata Hijau Group

- Emery Oleochemicals

- Pacific Oleochemicals

- Wilmar

- P&G Chemicals

- VVF LLC

- Ecogreen Oleochemicals

- Bakrie Sumatera Plantations

- Kao Chemicals

- Temix

Recent Developments

- In 2023, Godrej Industries expanded its production capacity of C8-C10 fatty acids to meet growing demand, while integrating sustainable practices. The company focused on eco-friendly sourcing and manufacturing, aligning with market trends for sustainability in the personal care and detergent industries.

- In 2023, Wujiang Jinyu Lanolin Co. will be a prominent player in the C8-C10 fatty acid sector, producing high-quality fatty acids for cosmetics, pharmaceuticals, and industrial applications. Also, they launched an eco-friendly refining process, reducing waste and increasing efficiency, marking a significant step in sustainability.

Report Scope

Report Features Description Market Value (2024) USD 820.7 Million Forecast Revenue (2034) USD 1,511.9 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (C8 Fatty Acids, C10 Fatty Acids), By Source (Natural Sources, Synthetic Sources), By Application (Lubricants, Plasticizer, Daily Chemicals, Flavoring and Perfuming Agents), By End-use (Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Godrej Industries, BASF SE, WujiangJinyu Lanolin Co., Ferro Corporation, LK OLEO, Musim Mas, IOI Oleochemical, Permata Hijau Group, Emery Oleochemicals, Pacific Oleochemicals, Wilmar, P&G Chemicals, VVF LLC, Ecogreen Oleochemicals, Bakrie Sumatera Plantations, Kao Chemicals, Temix Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  C8-C10 Fatty Acid MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

C8-C10 Fatty Acid MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Godrej Industries

- BASF SE

- WujiangJinyu Lanolin Co.

- Ferro Corporation

- LK OLEO

- Musim Mas

- IOI Oleochemical

- Permata Hijau Group

- Emery Oleochemicals

- Pacific Oleochemicals

- Wilmar

- P&G Chemicals

- VVF LLC

- Ecogreen Oleochemicals

- Bakrie Sumatera Plantations

- Kao Chemicals

- Temix