Global Low Smoke Halogen Free Flame Retardant Polypropylene Market By Application(Construction, Automotive, Electrical & Electronics, Industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb 2025

- Report ID: 14901

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

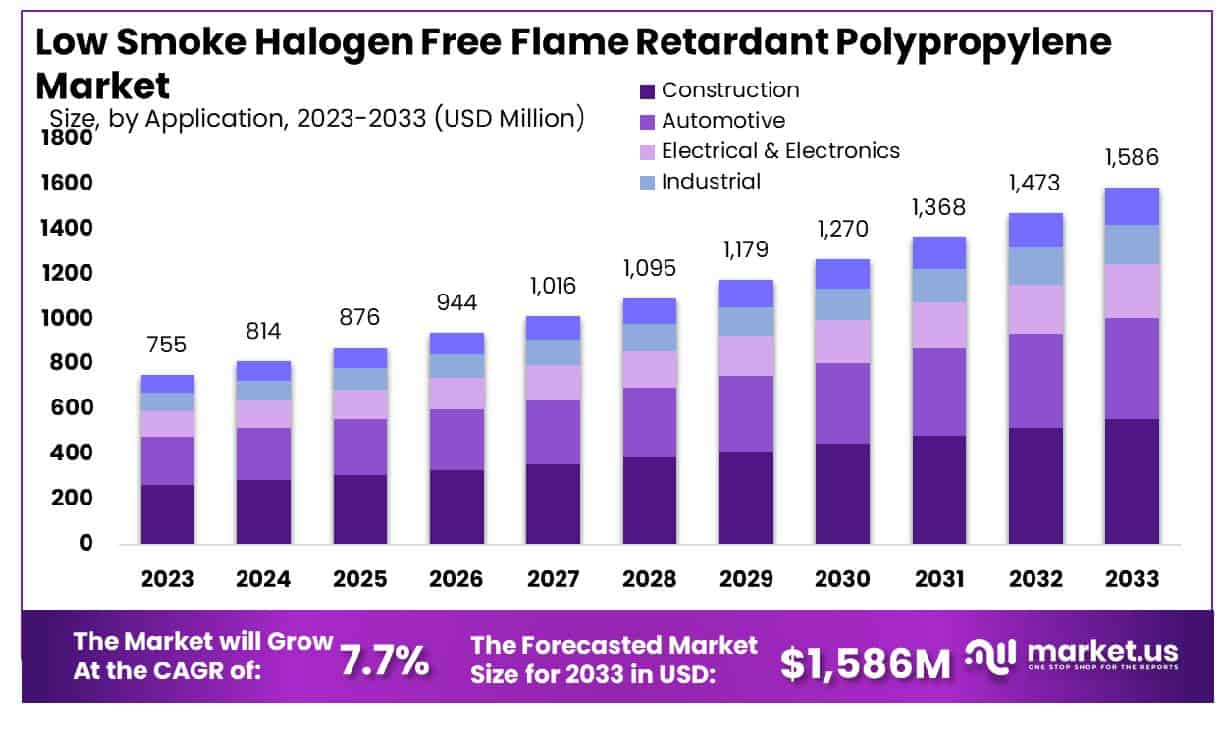

The Global Low Smoke Halogen Free Flame Retardant Polypropylene Market size is expected to be worth around USD 1586.24 Million by 2033, From USD 755.46 Million by 2023, growing at a CAGR of 7.70% during the forecast period from 2024 to 2033.

The Low Smoke Halogen Free Flame Retardant Polypropylene (LSHF FR PP) market encompasses a specialized segment of flame retardant polymers designed for applications requiring high safety standards. This market addresses the increasing demand for materials that mitigate the risk of fire while reducing the emission of toxic halogenated gases during combustion.

LSHF FR PP is extensively utilized in the automotive, construction, and electronics industries due to its superior properties such as low smoke emission, non-toxicity, and effective flame resistance. As safety regulations become more stringent, this market is poised for significant growth, offering substantial opportunities for industry leaders in product safety innovation.

The Low Smoke Halogen Free (LSHF) Flame Retardant Polypropylene compound market is poised for significant growth, driven by stringent regulatory requirements for fire safety and environmental sustainability. The escalating enforcement of regulations that mandate the reduction of toxic emissions in case of fires has spurred the adoption of LSHF materials across various industries, including construction, automotive, and electrical & electronics. These industries are increasingly favoring LSHF flame retardant polypropylene due to its ability to combine fire safety with a lower environmental impact.

Moreover, recent data highlighting the rising global atmospheric concentrations of greenhouse gases such as CO2, CH4, and N2O underscores the urgency for environmentally friendly materials. According to the latest figures, the surface mean mixing ratios of CO2, CH4, and N2O in 2022 were recorded at 417.1 [±0.4] ppm, 1911.9 [±3.3] ppb, and 335.9 [±0.4] ppb, respectively.

These values have shown a considerable increase from their 2019 levels, intensifying the call for sustainable industrial practices. The market for LSHF materials, particularly flame retardant polypropylene, is expected to benefit as industries seek to align with these environmental goals while adhering to enhanced safety standards.

The growth trajectory of the LSHF flame retardant polypropylene market is also supported by technological advancements that improve material performance without compromising environmental safety. The focus on reducing hazardous emissions and enhancing recyclability aligns with global sustainability trends, presenting significant opportunities for market expansion.

Key Takeaways

- Market Growth: The Global Low Smoke Halogen Free Flame Retardant Polypropylene Market size is expected to be worth around USD 1586.24 Million by 2033, From USD 755.46 Million by 2023, growing at a CAGR of 7.70% during the forecast period from 2024 to 2033.

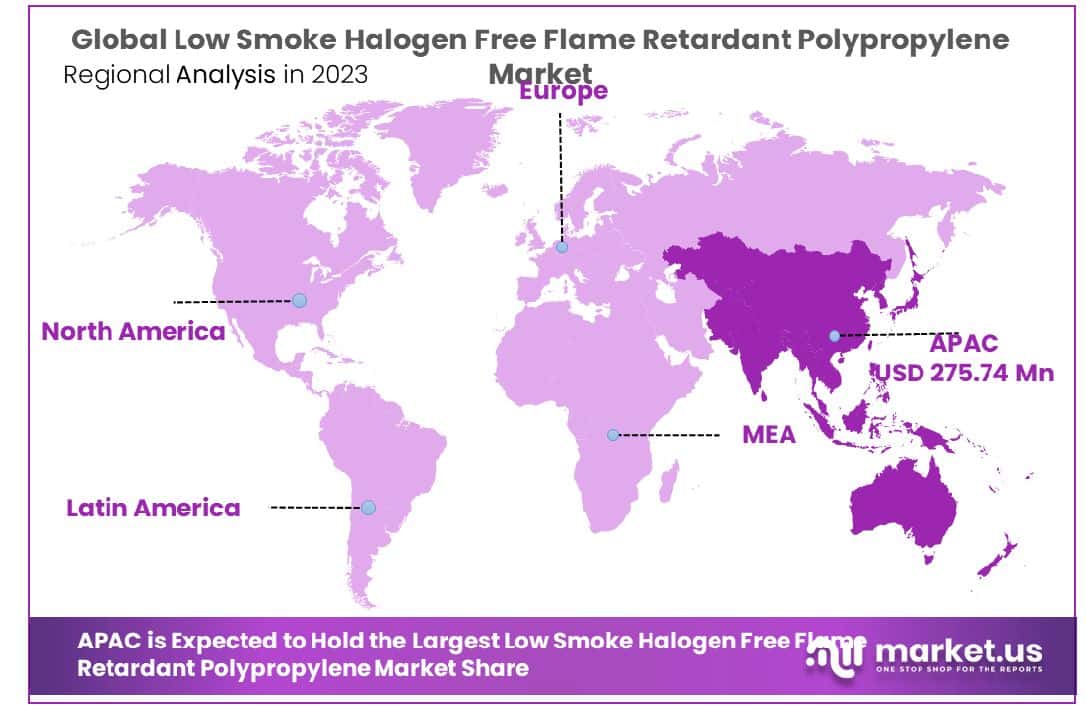

- Regional Dominance: Asia-Pacific holds 36.5% of the Low Smoke Halogen-Free market.

- Segmentation Insights:

- By Application: The construction application captures 32.1% of the Low Smoke Halogen-Free Flame Retardant Polypropylene market.

- Growth Opportunities: The 2023 growth of the Low Smoke Halogen-Free Flame Retardant Polypropylene Market is driven by rising demand in construction and stringent government safety regulations to prevent fire hazards.

Driving Factors

Increased Demand for Halogen-Free Materials in Wires and Cables

The expanding utilization of wires and cables across multiple industries, including telecommunications, automotive, and construction, is significantly driving the demand for halogen-free flame-retardant polypropylene. This growth is catalyzed by the rising need for safer, environmentally friendly, and non-toxic materials in consumer and industrial applications.

As industries strive to enhance safety standards while minimizing environmental impact, low-smoke halogen-free (LSHF) materials are increasingly preferred due to their ability to inhibit flame propagation and produce minimal smoke and toxic gases during combustion. This shift is particularly relevant in sectors where wiring density is high and the risk of fire needs to be aggressively managed, promoting the use of halogen-free solutions.

Impact of Regulatory Frameworks on Market Expansion

Favorable government regulations and stringent safety standards play a pivotal role in the adoption of low-smoke halogen-free flame retardant polypropylene. Globally, governments are intensifying regulations to mitigate the hazards associated with fires, which include the toxic emissions released by traditional halogenated flame retardants.

Regulations such as the Restriction of Hazardous Substances (RoHS) and similar legislative frameworks in various countries mandate the reduction of hazardous substances in manufacturing processes. These standards are compelling manufacturers to transition to halogen-free alternatives, thereby boosting the market for LSHF flame-retardant polypropylene. The enforcement of these regulations ensures continued market growth by legally necessitating the use of safer, more sustainable materials in a wide range of applications.

Combined Market Dynamics

The synergy between growing industrial demand for safer wire and cable materials and the enforcement of strict regulatory standards creates a robust environment for the growth of the LSHF flame retardant polypropylene market. As industries adopt more stringent safety measures and environmental policies, the demand for materials that meet these new standards increases, ensuring a steady rise in market penetration and expansion.

This dual influence not only supports market growth from a volume perspective but also enhances the technological advancement and quality improvement of flame-retardant polypropylene products, aligning with global sustainability and safety trends.

Restraining Factors

High Processing Costs Impacting Market Penetration

The production of low-smoke halogen-free flame retardant polypropylene (LSHF FR PP) involves advanced technologies that can lead to higher processing costs compared to conventional materials. These increased costs are primarily due to the use of specialty additives, which are essential to achieve the desired flame retardant properties without using halogens.

Moreover, the modification of processing equipment to handle these advanced materials can add further financial burdens on manufacturers. This elevation in cost can restrain market growth, as it may lead to higher product prices that could be less attractive to price-sensitive consumers and industries, potentially slowing down adoption rates in cost-constrained environments.

Regulatory Challenges Limiting Formulation Flexibility

Developing polypropylene formulations that meet stringent environmental regulations, such as those enforced by the Environmental Protection Agency (EPA), poses significant challenges. These restrictions often limit the type of chemicals and additives that can be used in the manufacturing process, which may complicate the development of new and effective halogen-free flame-retardant compounds.

This factor can delay product development and market entry for newer, more efficient formulations, thereby hindering the growth of the market. Compliance with these regulations requires continuous research and development investment to innovate materials that not only meet fire safety standards but also comply with environmental regulations, adding to the overall cost and complexity of production.

By Application Analysis

The construction sector accounts for 32.1% of the applications in the low-smoke halogen-free market.

In 2023, Construction held a dominant market position in the By Application segment of the Low Smoke Halogen-Free Flame Retardant Polypropylene Market, capturing more than a 32.1% share. This substantial market share is indicative of stringent building codes and the growing emphasis on fire safety in residential and commercial construction sectors.

The automotive sector also demonstrated notable demand, accounting for a significant portion of the market. This is driven by the increasing requirements for flame-retardant materials in vehicle manufacturing to enhance safety standards and reduce the risk of fire in automotive components.

The Electrical & Electronics segment followed closely, fueled by the rising proliferation of flame-retardant polymers in consumer electronics and appliances, where safety and compliance with international standards are paramount. The demand in this sector is expected to continue growing, propelled by advancements in electronic device manufacturing and global digitalization trends.

Industrial applications of Low Smoke Halogen-Free Flame Retardant Polypropylene also saw a healthy uptake due to its critical role in reducing fire hazards in various industrial environments, thereby improving workplace safety and meeting occupational health standards.

Other applications, including various minor and emerging uses in different sectors, collectively contributed to the remaining market share. These applications benefit from the material’s properties, such as low smoke emission and non-toxicity during combustion, making it suitable for a broad range of uses in safety-conscious industries.

Key Market Segments

By Application

- Construction

- Automotive

- Electrical & Electronics

- Industrial

- Others

Growth Opportunities

Rising Trend of Using Fire-Resistant Plastics and Polymers in Commercial and Residential Structures

The global market for Low Smoke Halogen-Free Flame Retardant Polypropylene is poised for significant growth, propelled by the escalating trend of incorporating fire-resistant plastics and polymers in construction. As urbanization accelerates, and the density of commercial and residential structures increases, the demand for materials that enhance fire safety standards also rises.

The construction industry’s pivot towards these advanced materials can be attributed to their ability to significantly mitigate the risk of fire-related incidents, thereby ensuring greater safety and durability of the built environment. This trend not only responds to market demand but also aligns with the increasing consumer awareness and preference for safety features in living and working spaces.

Favorable Government Regulations and Safety Standards to Reduce the Frequency of Fire Disasters

Another critical growth driver for the Low Smoke Halogen-Free Flame Retardant Polypropylene market is the tightening of government regulations and safety standards worldwide. Governments are intensifying regulations to lower the incidence of fire disasters, mandating the use of materials that comply with high safety benchmarks.

This regulatory landscape is creating a conducive environment for market expansion as manufacturers and stakeholders across the supply chain are compelled to innovate and adhere to these enhanced safety measures. The resulting compliance with these stringent standards not only boosts the market growth but also establishes a robust framework for the adoption of these polymers in a variety of applications, from industrial to everyday consumer products.

Latest Trends

Growing Consumption of Flame-Retardant Plastics in the Electrical and Electronic Market, and Increasing Demand from the Halogen-Free Wire and Cable Market

A prominent trend in the 2023 Low Smoke Halogen-Free Flame Retardant Polypropylene Market is the increased consumption of flame-retardant plastics in the electrical and electronics industry. This trend is underpinned by the sector’s rigorous safety requirements and the ongoing miniaturization of electronic devices, which demand materials that can ensure high performance under fire exposure.

Additionally, the halogen-free wire and cable market is expanding rapidly, driven by the global shift towards safer, non-toxic materials in response to consumer safety concerns and environmental regulations. This demand is reshaping the market landscape, pushing manufacturers to innovate and expand their flame-retardant product lines to capture this growing segment.

Rising Demand for Thermoplastics to Reduce Carbon Emissions, and High Demand to Reduce Fire Hazards in Automotive and Construction Industries

The market for Low Smoke Halogen-Free Flame Retardant Polypropylene is also benefiting from the rising demand for thermoplastics that help reduce carbon emissions. As industries and governments alike prioritize sustainability, the adoption of environmentally friendly thermoplastics in production processes is seen as a vital step towards achieving lower carbon footprints. Moreover, there is an escalating demand within the automotive and construction industries for materials that can significantly diminish fire hazards.

These industries are integrating flame-retardant polypropylene not only to meet enhanced safety regulations but also to cater to the increasing consumer expectations for safety and durability in automotive parts and construction materials. These trends highlight a growing market emphasis on safety, sustainability, and compliance, driving innovation and growth in the Low Smoke Halogen-Free Flame Retardant Polypropylene sector.

Regional Analysis

In 2023, Asia-Pacific held a 36.5% share of the Low Smoke Halogen-Free Flame Retardant Polypropylene Market.

In the Low Smoke Halogen-Free Flame Retardant Polypropylene Market, regional dynamics reflect varying degrees of market penetration and regulatory environments. Asia-Pacific is the dominating region, accounting for 36.5% of the global market share. This significant market presence is driven by robust manufacturing sectors and stringent safety regulations in countries like China, Japan, and South Korea. The region benefits from increased infrastructure development and a high concentration of electronic manufacturing, which extensively utilizes flame-retardant polypropylene to meet safety standards.

North America also represents a substantial portion of the market, driven by stringent fire safety regulations across both the United States and Canada. The region’s focus on reducing fire hazards in the automotive and construction sectors supports the demand for advanced flame-retardant materials. Additionally, North American manufacturers are pioneers in adopting eco-friendly and advanced material technologies, further fueling the regional market growth.

Europe follows closely, with its market expansion facilitated by the EU’s strict regulations on fire safety and environmental sustainability. The European market is characterized by high demand in the automotive and electronics sectors, where safety standards are particularly rigorous.

The Middle East & Africa, and Latin America markets, although smaller in comparison, are experiencing gradual growth. In these regions, the market is driven by increasing urbanization and industrialization, which amplify the need for fire safety materials. The growth in these markets is also spurred by the ongoing development in infrastructure and the automotive sector, which are increasingly incorporating fire-retardant solutions to meet global standards.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Low Smoke Halogen-Free Flame Retardant Polypropylene Market will be significantly shaped by the strategic initiatives and product offerings of key players such as Huber Engineered Materials, Israel Chemicals Ltd., Chemtura Corporation, Clariant International Ltd, BASF SE, Thor Group, and Lanxess A.G.

Huber Engineered Materials is noted for its innovation in developing flame retardant additives that enhance the performance and safety of polypropylene materials used in various industries. Their commitment to sustainability and safety is a strong market differentiator.

Israel Chemicals Ltd. plays a crucial role in the market with its extensive portfolio of flame retardants that cater to stringent global standards, helping manufacturers improve the fire resistance of their products while maintaining environmental compliance.

Chemtura Corporation has been a pioneer in introducing advanced flame-retardant solutions that are both effective and environmentally friendly. Their products are critical in industries where safety and performance are paramount.

Clariant International Ltd consistently drives market trends through its focus on R&D, producing flame retardants that not only meet but exceed regulatory requirements across diverse applications, particularly in the automotive and electrical sectors.

BASF SE leverages its global presence and integrated supply chain to deliver high-quality flame-retardant polypropylene materials. Their products are integral to enhancing fire safety in consumer products and industrial applications.

Thor Group and Lanxess A.G both emphasize innovation in their product lines, with Thor Group focusing on specialized additives that improve material properties, and Lanxess A.G capitalizing on its expertise in specialty chemicals to offer tailored solutions that address the specific needs of their global clientele.

Market Key Players

- Huber Engineered Materials

- Israel Chemicals Ltd.

- Chemtura Corporation

- Clariant International Ltd

- BASF SE

- Thor Group

- Lanxess A.G

Recent Development

- In January 2024, Sirmax introduces an eco-friendly polypropylene compound for automotive interiors, reducing carbon footprint by 21%. Plans for India expansion and the US flame-retardant compound line reflect a commitment to sustainability and innovation.

- In October 2023, Sirmax unveils sustainable polypropylene compounds for automotive and appliance sectors at Fakuma 2023. Expanding production in the US and India to meet market demand, reinforcing commitment to sustainability and innovation.

Report Scope

Report Features Description Market Value (2023) USD 755.46 Million Forecast Revenue (2033) USD 1586.24 Million CAGR (2024-2033) 7.70% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application(Construction, Automotive, Electrical & Electronics, Industrial, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Huber Engineered Materials, Israel Chemicals Ltd., Chemtura Corporation, Clariant International Ltd, BASF SE, Thor Group, Lanxess A.G Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low Smoke Halogen Free Flame Retardant Polypropylene MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Low Smoke Halogen Free Flame Retardant Polypropylene MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Huber Engineered Materials

- Israel Chemicals Ltd.

- Chemtura Corporation

- Clariant International Ltd

- BASF SE

- Thor Group

- Lanxess A.G