Global Ethyl Methacrylate Market Size, Share, And Business Benefits By Purity (Upto 99%, Above 99%), By Application (Coatings, Adhesives and Sealants, Plastics and Polymers, Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147973

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

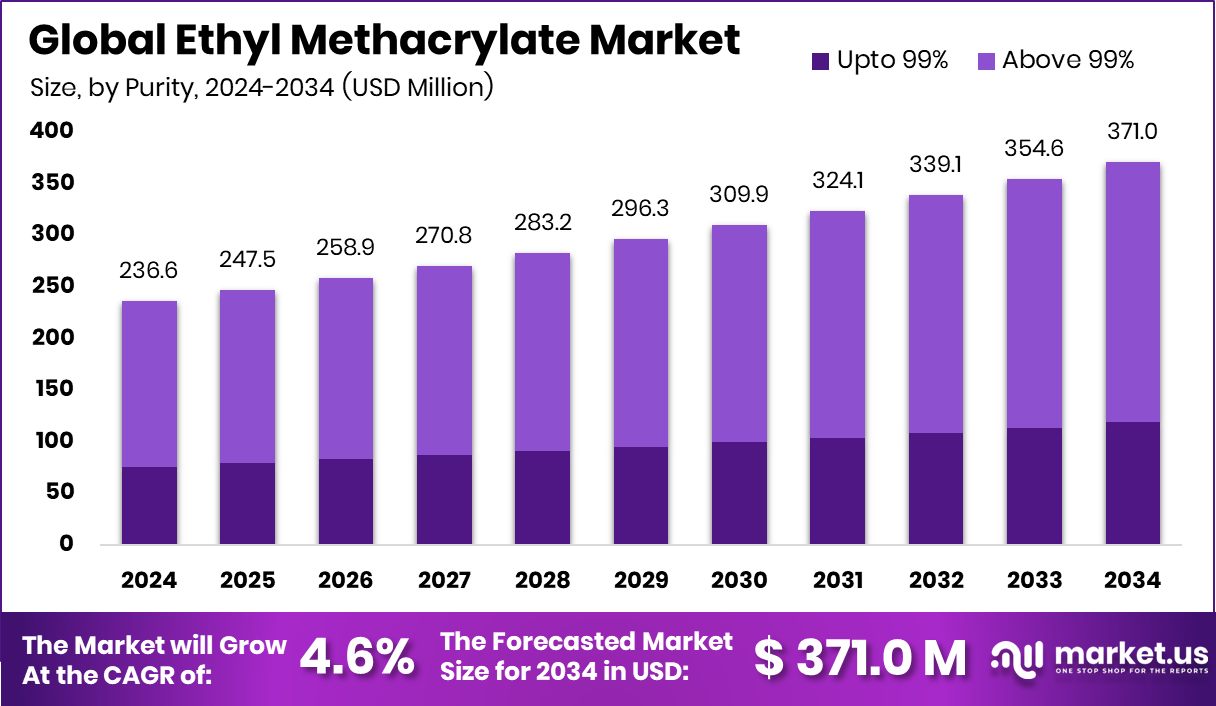

The Global Ethyl Methacrylate Market is expected to be worth around USD 371.0 million by 2034, up from USD 236.6 million in 2024, and grow at a CAGR of 4.6% from 2025 to 2034. Increasing demand for high-performance coatings drives North America’s 44.8% market share.

Ethyl Methacrylate (EMA) is a colorless liquid monomer derived from methacrylic acid, commonly used in the production of polymers and resins. It is primarily utilized in the manufacturing of acrylic resins, adhesives, coatings, and dental materials due to its excellent adhesion, hardness, and durability properties. Additionally, EMA is known for its rapid curing capability and resistance to weathering, making it a preferred choice for various industrial applications, including automotive coatings, electronics, and construction materials.

The Ethyl Methacrylate market is experiencing significant growth, driven by increasing demand for acrylic-based products in diverse industries. The expansion of the construction sector, along with rising automotive production, is propelling the consumption of EMA-based adhesives and coatings.

Additionally, the surge in demand for dental materials and medical devices is further boosting market growth. According to an industry report, Bristol-based battery technology firm Anaphite secured £1.6 million, comprising £685k in grant funding through the Investor Partnerships Future Economy programme and over £880k from private investors.

Growing demand for durable and high-performance coatings is a key driver in the Ethyl Methacrylate market. The rising preference for lightweight, scratch-resistant, and UV-stable coatings in automotive and construction applications is fueling the demand for EMA-based products.

Furthermore, the increasing focus on sustainable and eco-friendly coating solutions is encouraging manufacturers to incorporate bio-based and low-VOC variants, opening up new growth avenues in the market. According to an industry report, an Israeli startup, specializing in digital printing for optical lens coatings, raised $35 million in a Series A funding round.

Key Takeaways

- The Global Ethyl Methacrylate Market is expected to be worth around USD 371.0 million by 2034, up from USD 236.6 million in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- In 2024, Ethyl Methacrylate with above 99% purity captured a dominant 67.3% market share.

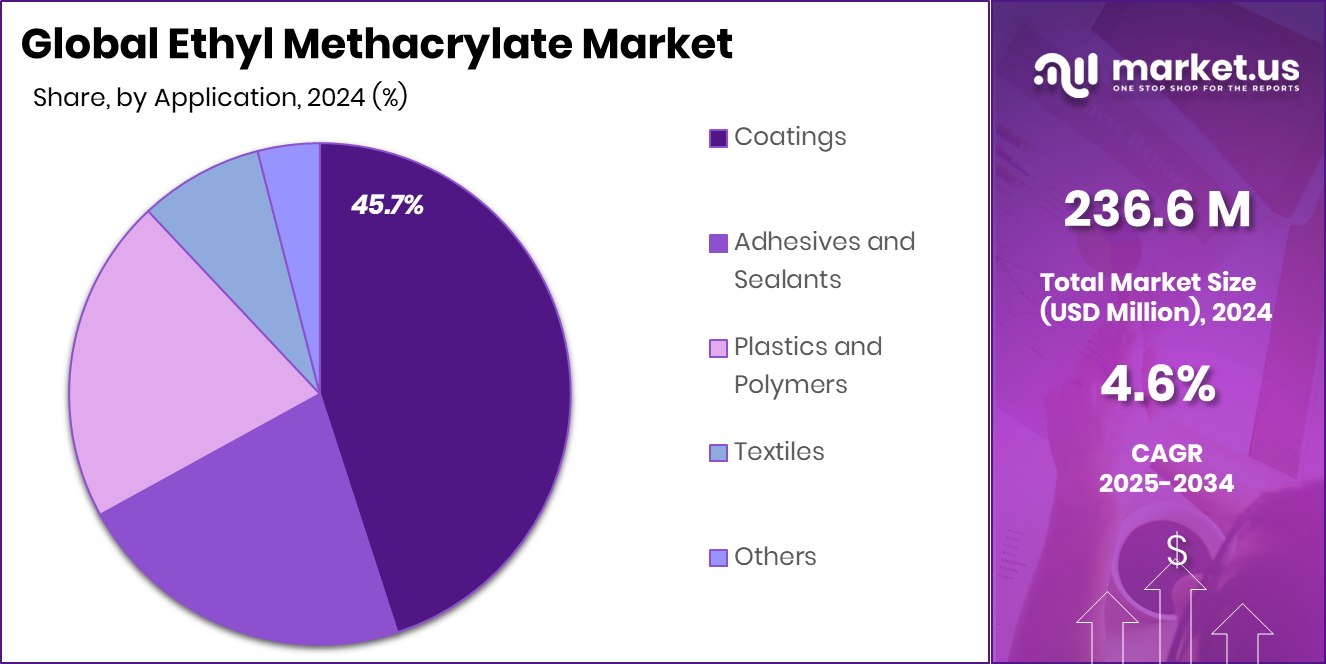

- Coatings application led the Ethyl Methacrylate market in 2024, accounting for a substantial 45.7% share.

- The Ethyl Methacrylate market in North America was valued at USD 105.9 million.

By Purity Analysis

In 2024, Ethyl Methacrylate with above 99% purity dominated, capturing 67.3%.

In 2024, Above 99% held a dominant market position in the By Purity segment of the Ethyl Methacrylate Market, with a 67.3% share. This significant share underscores the extensive usage of high-purity ethyl methacrylate in applications demanding superior quality and performance. Industries such as coatings and adhesives are increasingly favoring above 99% purity due to their enhanced chemical stability, consistent composition, and effective binding properties.

The rising demand for high-performance coatings, especially in automotive and industrial sectors, further amplifies the demand for above 99% purity ethyl methacrylate. Additionally, the focus on regulatory compliance and quality assurance drives the preference for higher purity grades.

The consistency and reduced impurities associated with above 99% purity ethyl methacrylate enable manufacturers to achieve optimal end-product characteristics, thereby contributing to its dominant market share in 2024.

By Application Analysis

Coatings application accounted for a substantial 45.7% share in the ethyl methacrylate market.

In 2024, Coatings held a dominant market position in the By Application segment of the Ethyl Methacrylate Market, with a 45.7% share. The substantial share is attributed to the extensive utilization of ethyl methacrylate in high-performance coating formulations, particularly within the automotive, industrial, and architectural sectors.

The compound’s excellent adhesion properties and weather resistance make it a preferred choice for coating applications, where durability and finish quality are critical. The increasing focus on surface protection and aesthetic enhancement has propelled the demand for ethyl methacrylate-based coatings, particularly in regions with rapidly expanding construction and infrastructure projects.

Furthermore, the ongoing advancements in coating technologies, aimed at improving wear resistance and environmental compliance, have further cemented the position of coatings as a leading application segment for ethyl methacrylate. The consistent demand from industrial and automotive sectors, coupled with the rising preference for high-gloss and UV-resistant coatings, continues to bolster the segment’s growth trajectory.

Key Market Segments

By Purity

- Up to 99%

- Above 99%

By Application

- Coatings

- Adhesives and Sealants

- Plastics and Polymers

- Textiles

- Others

Driving Factors

Growing Demand for Durable Coatings Drives Growth

The demand for ethyl methacrylate is rising due to its extensive use in durable coatings across the automotive, industrial, and construction sectors. Its superior adhesive properties, weather resistance, and ability to enhance surface finish make it a preferred ingredient in protective coatings. Additionally, the surge in infrastructure development and automotive manufacturing is fueling the need for high-performance coatings, boosting the consumption of ethyl methacrylate.

Furthermore, stringent regulations promoting environmentally friendly coatings have prompted manufacturers to adopt formulations based on ethyl methacrylate, known for its minimal VOC emissions. As industries seek longer-lasting protective solutions, the market for ethyl methacrylate is expected to witness sustained demand growth in the coming years.

Restraining Factors

Fluctuating Raw Material Prices Impact Market Stability

The ethyl methacrylate market faces challenges due to volatile raw material prices, particularly for methacrylic acid and other petrochemical derivatives. Unstable crude oil prices and supply chain disruptions contribute to fluctuating costs, affecting profit margins for manufacturers. Additionally, the dependency on petrochemical feedstocks makes the market susceptible to price spikes caused by geopolitical tensions and regulatory changes.

Small and medium-sized manufacturers struggle to maintain consistent production costs, leading to potential price adjustments and reduced profitability. Consequently, cost-sensitive end-users may explore alternative materials or low-cost substitutes, posing a significant restraint for the ethyl methacrylate market’s overall growth trajectory.

Growth Opportunity

Rising Demand for Eco-Friendly Coatings Fuels Growth

The increasing focus on sustainable and eco-friendly coatings presents a significant growth opportunity for the ethyl methacrylate market. With stringent environmental regulations and growing awareness of green building practices, manufacturers are shifting towards low-VOC and water-based coating formulations.

Ethyl methacrylate, known for its excellent adhesion and weather resistance, is emerging as a key component in producing environmentally compliant coatings. Additionally, the construction and automotive sectors are actively seeking durable yet sustainable coating solutions, further driving demand.

This trend is expected to open new avenues for ethyl methacrylate producers, particularly in regions with aggressive sustainability targets, creating a favorable market landscape for the coming years.

Latest Trends

Innovative Bio-Based Alternatives Gain Market Traction

The Ethyl Methacrylate market is witnessing a shift towards bio-based alternatives as companies strive to reduce their carbon footprint and meet stringent environmental regulations. Bio-derived ethyl methacrylate offers similar performance characteristics to its petrochemical counterpart, making it a viable option for coatings and adhesives applications.

Additionally, advancements in green chemistry have enabled the production of bio-based ethyl methacrylate with lower emissions and reduced environmental impact.

Major manufacturers are investing in sustainable raw materials and developing eco-friendly formulations to cater to the growing demand for sustainable products. This emerging trend not only aligns with regulatory mandates but also appeals to environmentally conscious consumers, creating a promising growth avenue for market players.

Regional Analysis

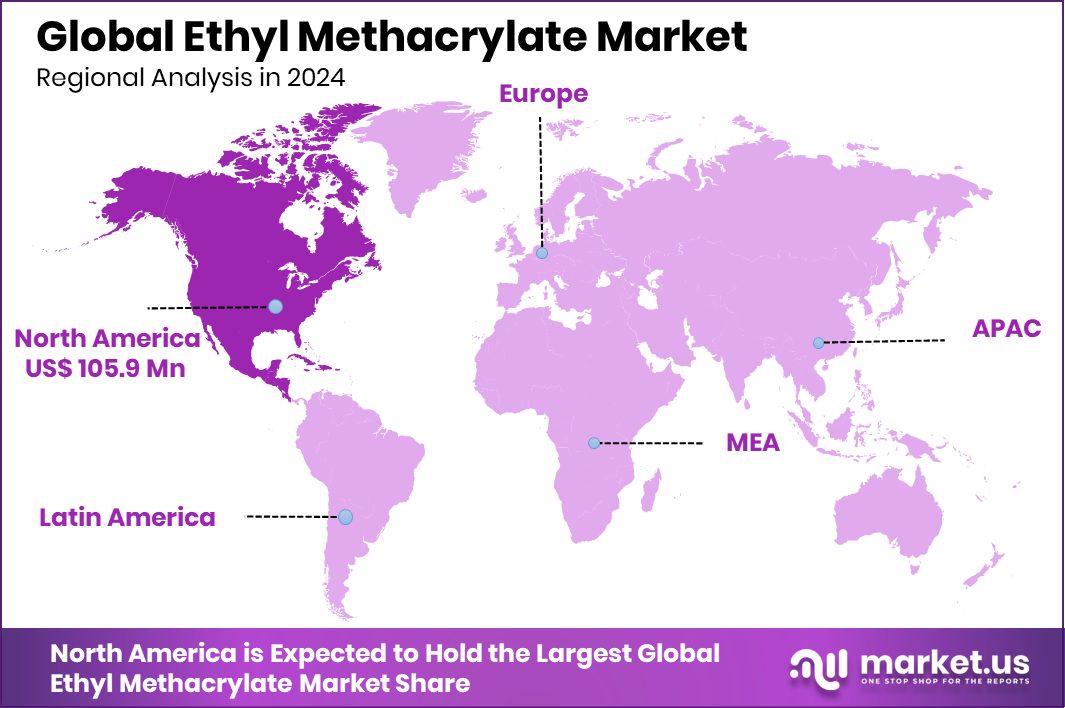

In 2024, North America dominated the Ethyl Methacrylate market with a 44.8% share.

In 2024, North America emerged as the leading region in the Ethyl Methacrylate Market, capturing a significant 44.8% share, valued at USD 105.9 million. The region’s dominance is primarily driven by the extensive usage of ethyl methacrylate in advanced coatings and adhesives, particularly in the automotive and construction sectors.

Additionally, robust industrial infrastructure and increasing investments in manufacturing facilities further bolster regional demand. In Europe, the market is experiencing steady growth due to rising environmental regulations promoting low-VOC coatings, enhancing the use of ethyl methacrylate in protective applications.

Meanwhile, the Asia Pacific region is witnessing a surge in demand, driven by expanding industrial production and rapid urbanization, contributing to the growing adoption of ethyl methacrylate-based products.

The Middle East & Africa and Latin America regions exhibit moderate growth, with increasing investments in industrial projects and construction activities. The rising focus on infrastructure development and coating applications in these regions is expected to provide incremental growth opportunities for ethyl methacrylate producers in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Evonik stands as an offering of a diverse range of specialty monomers under its VISIOMER® brand. The company has been instrumental in advancing sustainable production methods, notably through the development of the LiMA (Leading in Methacrylates) process. This innovative technology emphasizes efficient resource utilization and reduced environmental impact, positioning Evonik at the forefront of eco-friendly methacrylate production.

Suzhou Hechuang Chemical Co., Ltd. specializes in the production of high-purity EMA, boasting a purity level of 99.0%. The company’s commitment to quality is evident in its adherence to stringent manufacturing standards. In April 2024, Hechuang Chem achieved ISCC PLUS certification, underscoring its dedication to sustainable and responsible chemical production practices.

Wuhan 3B Scientific Corporation offers a range of fine chemicals, including EMA, catering primarily to research and development sectors. The company’s portfolio supports various scientific applications, reflecting its role in supplying essential chemicals for academic and industrial research.

Combi-Blocks Inc. is a research-based manufacturer and global supplier of laboratory reagents, including EMA. The company provides a broad spectrum of chemical compounds, serving the needs of the scientific community. Combi-Blocks’ extensive catalog supports diverse research initiatives across multiple disciplines.

Top Key Players in the Market

- Evonik

- Hechuang Chem

- Wuhan 3B Scientific

- Combi-Blocks

Recent Developments

- In January 2025, Bide Pharmatech, a Chinese company specializing in organic reagents and drug intermediates, announced plans to acquire Combi-Blocks, a U.S.-based supplier of laboratory reagents. The acquisition deal is valued at approximately USD 215 million.

- In January 2025, Evonik launched Smart Effects, a new business line formed by merging its Silica and Silanes divisions. This strategic move aims to enhance innovation and sustainability across industries such as automotive, electronics, consumer health, and construction.

Report Scope

Report Features Description Market Value (2024) USD 236.6 Million Forecast Revenue (2034) USD 371.0 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Upto 99%, Above 99%), By Application (Coatings, Adhesives and Sealants, Plastics and Polymers, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Evonik, Hechuang Chem, Wuhan 3B Scientific, Combi-Blocks Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Evonik

- Hechuang Chem

- Wuhan 3B Scientific

- Combi-Blocks