Global Coatings Market Size, Share, And Business Benefits By Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Fluoropolyner, Others), By Technology (Solvent-based, Water-based, Powder Coatings, Radiation Curable Coatings), By End-use (Architectural (Residential(New construction, Remodel and Repaint), Non-residential (Industrial, Commercial)), OEM (General industrial, Automotive OEM, Wood, Coil, Packaging, Aerospace, Others), Specialty (Automotive Refinish, Marine, Industrial Maintenance and Protective)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147311

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

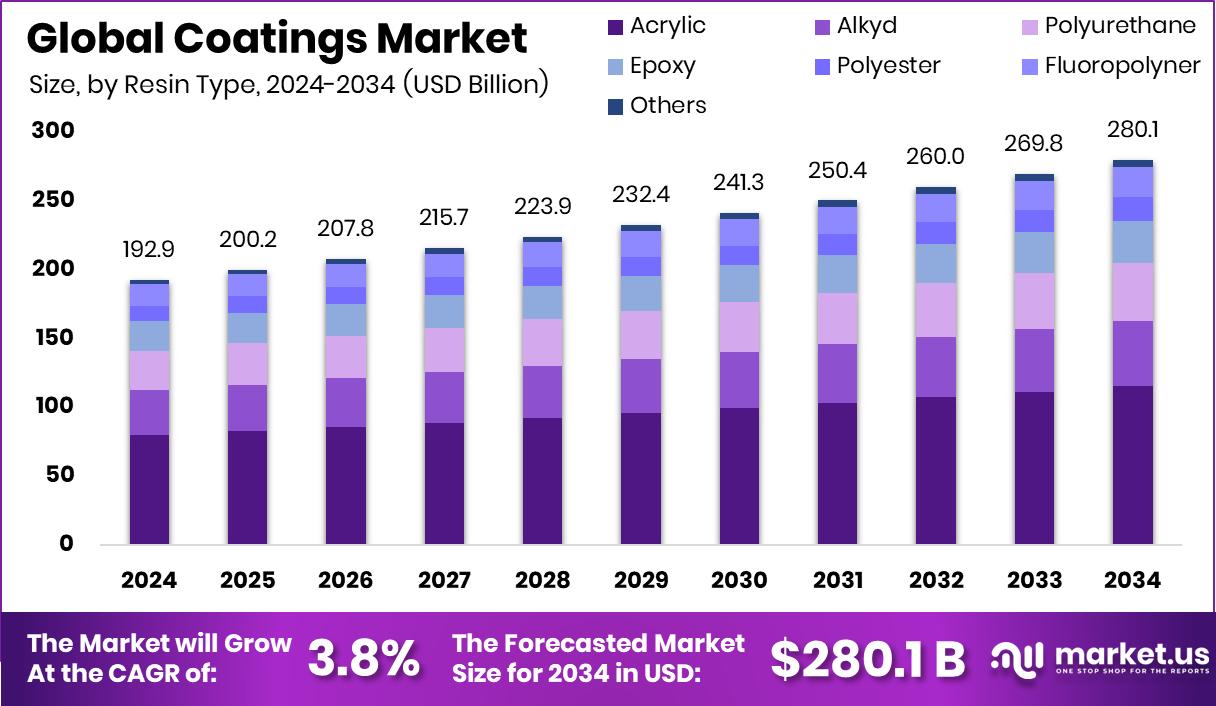

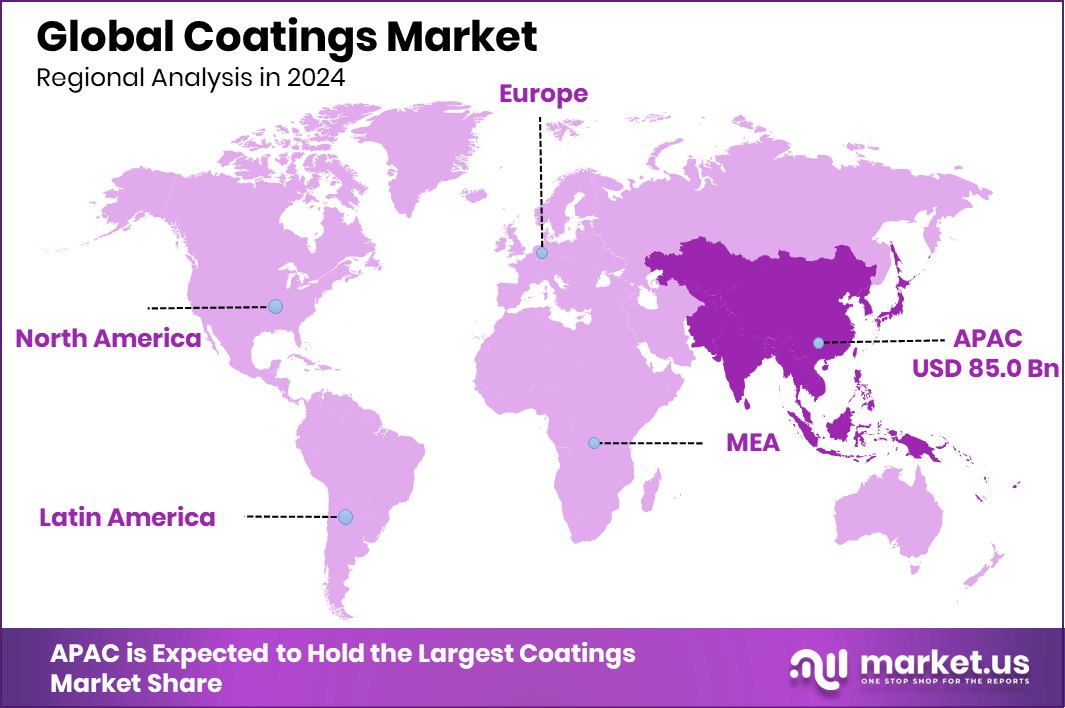

Global Coatings Market is expected to be worth around USD 280.1 billion by 2034, up from USD 192.9 billion in 2024, and grow at a CAGR of 3.8% from 2025 to 2034. Strong industrial growth in Asia-Pacific helped achieve 44.1% market share, USD 85.0 Bn.

Coatings refer to layers of substances applied to surfaces to protect them, enhance their appearance, or add specific functional properties. These substances can range from paints and varnishes to more sophisticated coatings designed for industrial applications, such as preventing corrosion, enhancing durability, or even providing antibacterial properties.

The coatings market encompasses the production and distribution of these various types of coatings. It serves a vast array of industries, including automotive, aerospace, construction, and consumer goods. The market’s growth is driven by the increasing demand for durable and aesthetically pleasing finishes in both residential and commercial constructions, as well as in manufacturing consumer products.

There is a substantial opportunity in the development of sustainable and eco-friendly coatings. Governments and the private sector are increasingly funding projects that focus on reducing the environmental impact of coating processes.

For example, the Government of Canada, through its Strategic Innovation Fund, is supporting a $100 million project with MDS Coating Technologies Corporation to expand environmentally friendly nano-coating manufacturing for aerospace applications. The Province of Prince Edward Island provided an additional $7 million loan for this initiative.

Moreover, the French government, via the France 2030 plan and ADEME, supported Ecoat, a sustainable coatings company, as part of a €21 million funding round. This funding aims to scale up the production of bio-based binders for coatings, targeting a capacity of 30,000 tons at Ecoat’s Roussillon plant. Such investments highlight the market’s shift towards sustainable development and the growing economic opportunities in green innovation within the coatings industry.

Key Takeaways

- Global Coatings Market is expected to be worth around USD 280.1 billion by 2034, up from USD 192.9 billion in 2024, and grow at a CAGR of 3.8% from 2025 to 2034.

- Acrylic resins captured 41.2% share, dominating the Coatings Market due to superior durability.

- Solvent-based coatings held a 46.9% market share, driven by high performance and versatility benefits.

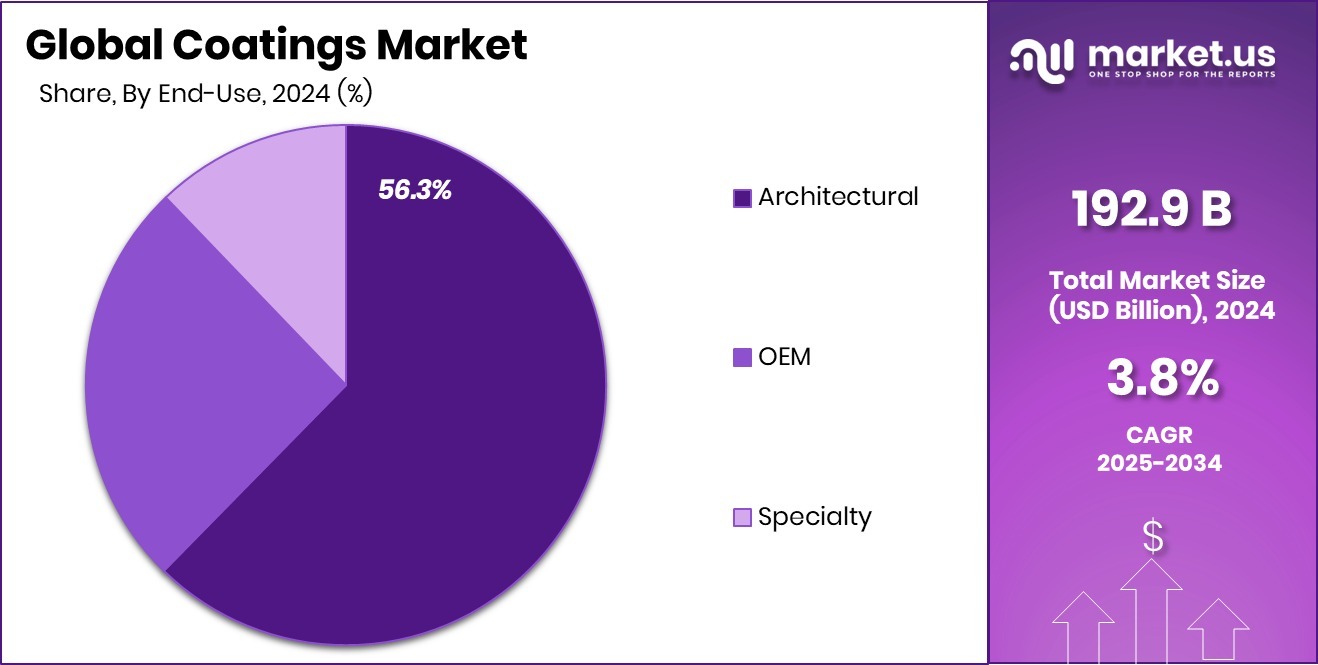

- Architectural coatings dominated with a 56.3% share, fueled by growing construction and renovation activities globally.

- Asia-Pacific’s growing construction sector boosted the Coatings Market value to USD 85.0 Bn, 44.1%.

By Resin Type Analysis

Acrylic coatings captured a strong 41.2% share by resin type globally.

In 2024, Acrylic held a dominant market position in the By Resin Type segment of the Coatings Market, with a 41.2% share. The strong market presence of acrylic coatings was mainly driven by their versatile characteristics, including excellent durability, UV resistance, and cost-effectiveness.

Acrylic resins found widespread use across both interior and exterior applications, making them a preferred choice in architectural and industrial projects. Their ease of formulation into both water-based and solvent-based systems further enhanced their adaptability across different environmental conditions.

In addition, growing trends in residential remodeling and commercial infrastructure upgrades reinforced the demand for high-quality acrylic coatings that offer superior aesthetic appeal and long-lasting protection.

By Technology Analysis

Solvent-based technology led the coatings market, holding 46.9% market share overall.

In the same year, Solvent-based coatings led the By Technology segment, commanding a 46.9% share. Solvent-based coatings continued to be favored for their outstanding performance in providing a tough, resilient finish that could withstand harsh environments.

These coatings offered superior adhesion, chemical resistance, and mechanical properties compared to alternatives, which made them essential for industries like automotive, marine, and heavy equipment manufacturing.

Despite increasing regulatory pressures regarding VOC emissions, the operational advantages of solvent-based coatings, such as faster drying times and the ability to perform well in varying climatic conditions, kept their demand resilient.

Their strong position reflected the market’s ongoing need for highly durable coating solutions that could ensure longevity and protection even under the most demanding operational environments.

By End-use Analysis

Architectural applications dominated coatings end-use, accounting for a leading 56.3% share.

Additionally, Architectural coatings dominated the by-end-use segment, accounting for 56.3% of the market. The segment’s dominance was fueled by robust construction activity, driven by urbanization trends, population growth, and the rising importance of enhancing building aesthetics and durability.

Architectural coatings were heavily utilized in both new construction and renovation projects, covering a wide range of applications such as walls, ceilings, facades, and decorative finishes. Consumers increasingly sought coatings that could offer superior protection against weathering, moisture, and pollution, further expanding the demand.

Moreover, as sustainability became a growing priority, there was an increasing inclination towards low-VOC and environment-friendly architectural coatings, helping this segment not only maintain but expand its market lead during 2024.

Key Market Segments

By Resin Type

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Fluoropolyner

- Others

By Technology

- Solvent-based

- Water-based

- Powder Coatings

- Radiation Curable Coatings

By End-use

- Architectural

- Residential

- New construction

- Remodel and Repaint

- Non-residential

- Industrial

- Commercial

- Residential

- OEM

- General industrial

- Automotive OEM

- Wood

- Coil

- Packaging

- Aerospace

- Others

- Specialty

- Automotive Refinish

- Marine

- Industrial Maintenance and Protective

Driving Factors

Rising Construction Activities Driving Coatings Market Growth

One of the biggest driving factors for the coatings market is the strong growth in construction activities worldwide. As more residential buildings, offices, malls, and commercial complexes are being built, the demand for coatings is rising sharply.

Coatings are essential not only to improve the appearance of structures but also to protect them from damage caused by weather, water, chemicals, and pollution. Urbanization, population growth, and government investments in smart cities and housing projects are pushing construction activities higher every year.

As a result, the need for high-performance architectural coatings is expanding steadily. Both developed and emerging economies are seeing this trend, which is creating huge opportunities for companies offering advanced and eco-friendly coating solutions.

Restraining Factors

Strict Environmental Rules Restrict Coatings Market Growth

One of the major restraining factors for the coatings market is the presence of strict environmental regulations. Many coatings, especially solvent-based ones, release harmful volatile organic compounds (VOCs) into the air, which can cause pollution and health problems.

Governments across the world are making stricter rules to control VOC emissions and promote eco-friendly products. Companies now have to spend more money on research and development to create safer, low-VOC coatings.

This increases production costs and affects profit margins. Smaller companies, in particular, face difficulties in meeting these strict standards. As a result, compliance with environmental laws is creating challenges for market growth, slowing down the expansion of traditional coating technologies, and pushing companies toward costly greener alternatives.

Growth Opportunity

Growing Demand for Eco-Friendly Coatings Solutions

One of the biggest growth opportunities in the coatings market is the rising demand for eco-friendly coatings. Customers and governments are becoming more aware of the need to protect the environment. As a result, there is a growing shift towards coatings that have low or zero volatile organic compounds (VOCs).

Water-based coatings, bio-based resins, and sustainable formulations are gaining strong popularity across construction, automotive, and industrial sectors. Companies that focus on developing green, durable, and high-performance products have a major chance to expand their market share.

With stricter environmental laws and customer preference for healthier choices, eco-friendly coatings are no longer optional — they are becoming a must. This shift opens exciting new doors for innovation and business growth.

Latest Trends

Rising Popularity of Smart and Functional Coatings

A major trend shaping the coatings market is the growing popularity of smart and functional coatings. These advanced coatings are designed to do more than just protect surfaces — they can also offer self-healing, anti-bacterial, anti-corrosion, or temperature-responsive features.

Industries like automotive, electronics, construction, and healthcare are showing strong interest in these smart coatings because they add extra value to products. For example, self-healing paints can automatically repair small scratches, saving maintenance costs.

Anti-bacterial coatings are in high demand for hospitals and public spaces. As technology improves, smart coatings are becoming more affordable and available, opening up new possibilities. This trend is pushing the coatings industry toward more innovation and specialty product development to meet future needs.

Regional Analysis

In 2024, Asia-Pacific led the Coatings Market, capturing 44.1% share, USD 85.0 Bn.

In 2024, Asia-Pacific dominated the global coatings market, accounting for 44.1% of the total share and reaching a valuation of USD 85.0 billion. The strong market position was supported by rapid urbanization, large-scale construction projects, and robust industrial development across key economies like China, India, and Southeast Asian countries.

North America followed with steady growth, driven by demand in automotive refinishing, construction remodeling, and increasing adoption of sustainable coatings technologies. Europe maintained a significant market presence, supported by ongoing investments in eco-friendly coatings, strict regulatory standards, and growing refurbishment activities in the construction sector.

Meanwhile, the Middle East & Africa region showed moderate growth, fueled by infrastructure expansion initiatives, particularly in the Gulf countries. Latin America also experienced gradual growth, with emerging demand across residential and commercial construction sectors, although economic challenges slightly limited faster expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, The Sherwin-Williams Company continued to strengthen its position as a leading force in the global coatings market. The company’s wide product range, including architectural paints, protective coatings, and industrial finishes, kept it highly competitive. Strategic investments in expanding manufacturing capabilities and enhancing distribution networks helped Sherwin-Williams meet the growing demand, particularly in North America and the Asia-Pacific regions.

PPG Industries Inc. also demonstrated strong performance in 2024 by leveraging its diverse portfolio across automotive, aerospace, and industrial coatings. PPG’s focus on innovation, including smart coatings and high-performance solutions, helped the company capture new opportunities across developed and emerging markets. Their continuous acquisition strategy and R&D investments enabled them to expand their technological edge, particularly in sustainable and functional coating solutions that resonated with shifting market demands.

Meanwhile, Nippon Paint Holdings Co., Ltd. showed notable growth, especially across the Asia-Pacific region, where its brand strength and market presence remained dominant. Nippon Paint’s emphasis on customer-centric product development, combined with aggressive regional expansion strategies, allowed it to solidify its leadership in fast-growing construction and infrastructure sectors. The company’s commitment to offering energy-saving and environmentally responsible coatings also positioned it favorably amidst tightening environmental regulations.

Top Key Players in the Market

- BASF SE

- Akzo Nobel N.V.

- Axalta Coating Systems

- Beckers Group

- Jotun

- Hempel A/S

- The Sherwin-Williams Company

- PPG Industries Inc.

- Nippon Paint Holdings Co. Ltd

- Asian Paints Ltd

- Kansai Paint Co., Ltd.

- RPM International Inc.

- BASF SE

- DAW SE

- Brillux

- Other Key Players

Recent Developments

- In February 2025, Axalta acquired three distributors in Europe: Colorificio Brianza Car and Brianza Car 3 in Italy, and CPS Carrosserie Peinture Système in France. These additions became part of the Axalta Axcess network, enhancing direct-to-customer sales and distribution across Europe.

- In September 2024, BASF introduced clearcoats made from recycled waste tires using its ChemCycling® technology. These products, under the Glasurit® Eco Balance and R-M® eSense brands, aim to reduce CO₂ emissions and support a circular economy.

Report Scope

Report Features Description Market Value (2024) USD 192.9 Billion Forecast Revenue (2034) USD 280.1 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Fluoropolyner, Others), By Technology (Solvent-based, Water-based, Powder Coatings, Radiation Curable Coatings), By End-use (Architectural (Residential(New construction, Remodel and Repaint), Non-residential (Industrial, Commercial)), OEM (General industrial, Automotive OEM, Wood, Coil, Packaging, Aerospace, Others), Specialty (Automotive Refinish, Marine, Industrial Maintenance and Protective)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Akzo Nobel N.V., Axalta Coating Systems, Beckers Group, Jotun, Hempel A/S, The Sherwin-Williams Company, PPG Industries Inc., Nippon Paint Holdings Co. Ltd, Asian Paints Ltd, Kansai Paint Co., Ltd., RPM International Inc., BASF SE, DAW SE, Brillux, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Akzo Nobel N.V.

- Axalta Coating Systems

- Beckers Group

- Jotun

- Hempel A/S

- The Sherwin-Williams Company

- PPG Industries Inc.

- Nippon Paint Holdings Co. Ltd

- Asian Paints Ltd

- Kansai Paint Co., Ltd.

- RPM International Inc.

- BASF SE

- DAW SE

- Brillux

- Other Key Players