Global Plasticizers Market Size, Share, And Business Benefits By Type (Phthalate Plasticizers (Diisodecyl phthalate (DIDP), Diisononyl phthalate (DINP), Diisobutyl phthalate (DIBP), Dipropyl Heptyl phthalate (DPHP), Dioctyl phthalate (DOP), Others), Non-Phthalate Plasticizers (Adipates, Trimellitates, Epoxies, Benzoates, Terephthalates, Others)), By Application (Flooring and Wall Covering, Wire and Cable, Coatings, Toys, Footwear, Film and Sheet, Medical Devices, Others), By End-use (Building and Construction, Automotive and Transportation, Electrical and Electronics, Consumer Goods, Textile, Packaging, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147131

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

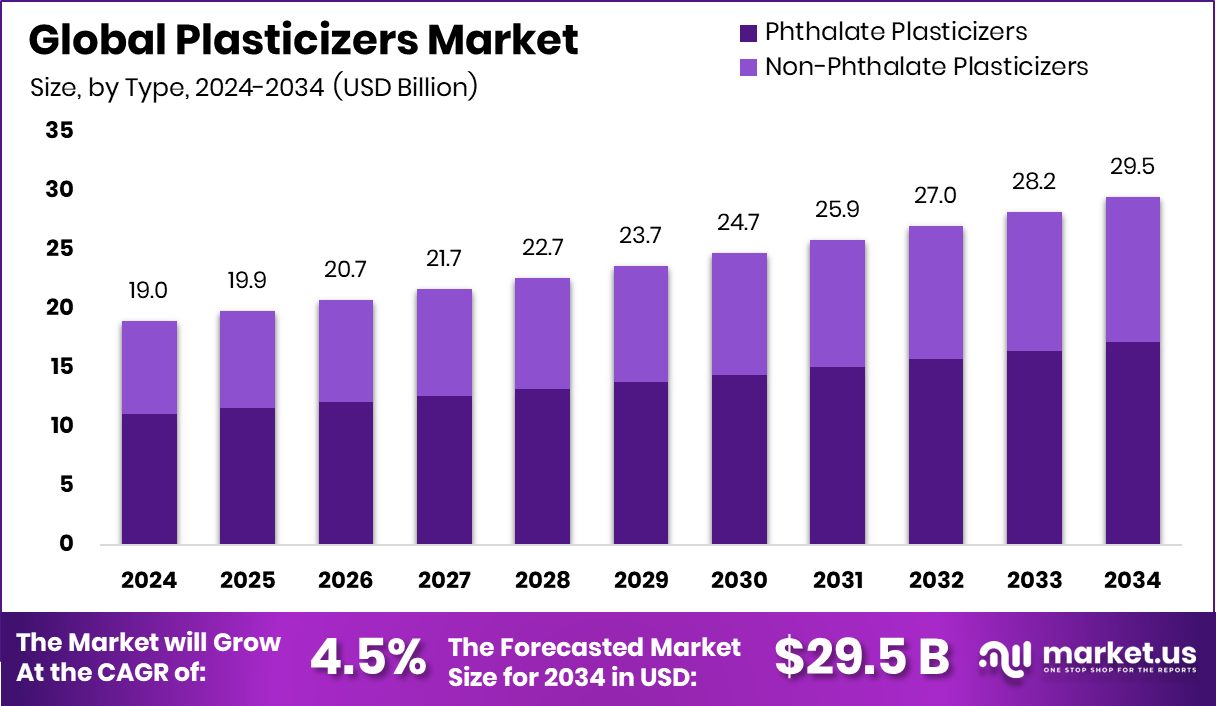

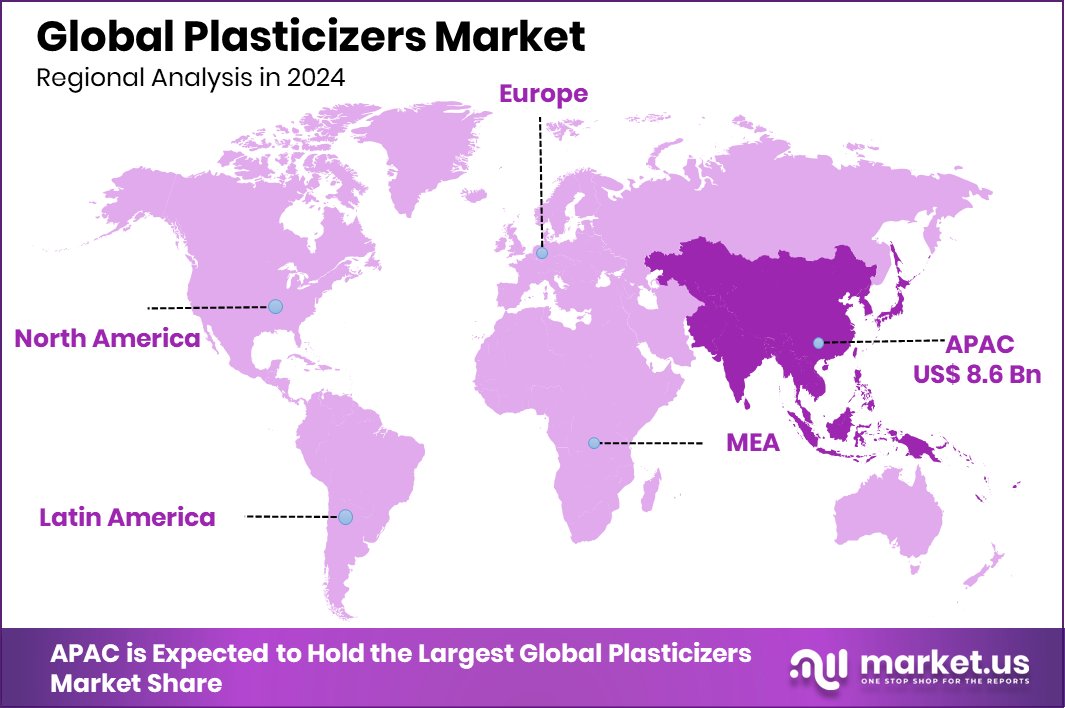

Global Plasticizers Market is expected to be worth around USD 29.5 billion by 2034, up from USD 19.0 billion in 2024, and grow at a CAGR of 4.5% from 2025 to 2034. Strong construction growth pushed Asia-Pacific’s Plasticizers Market to 45.3%, worth USD 8.6 Bn.

Plasticizers are chemical additives used to make materials, especially plastics like PVC, softer, flexible, and easier to handle. They work by embedding themselves between polymer chains, reducing intermolecular forces and increasing mobility. Without plasticizers, many plastics would be too rigid for practical uses. Today, plasticizers are widely used in products like cables, flooring, medical devices, and packaging materials to improve performance and durability.

The plasticizers market refers to the global trade, production, and consumption of plasticizer chemicals across industries. Demand is driven by sectors such as construction, automotive, healthcare, and consumer goods. Applications range from flexible PVC pipes and wires to synthetic leather and adhesives. With industrial growth and urbanization, the market has expanded significantly and continues to evolve with a shift toward eco-friendly and non-toxic plasticizers.

The key growth factor for the plasticizers market is the booming construction industry. Flexible PVC, essential for wiring, roofing, flooring, and wall coverings, heavily relies on plasticizers. Urban infrastructure development and housing projects in emerging economies are pushing the demand upward, making construction the largest consumer of plasticizers globally.

Rising demand for lightweight vehicles is a major driver for plasticizers. Automakers prefer flexible, lightweight, and durable materials to improve fuel efficiency. As a result, the use of plasticizers in automotive interiors, seals, and trims is expanding steadily, fueling the global need for advanced plasticizer formulations.

Key Takeaways

- Global Plasticizers Market is expected to be worth around USD 29.5 billion by 2034, up from USD 19.0 billion in 2024, and grow at a CAGR of 4.5% from 2025 to 2034.

- Phthalate plasticizers dominate the plasticizers market, capturing a strong 58.3% share due to versatile applications.

- Flooring and wall covering applications account for a 28.4% share, driven by rising infrastructure and renovation activities.

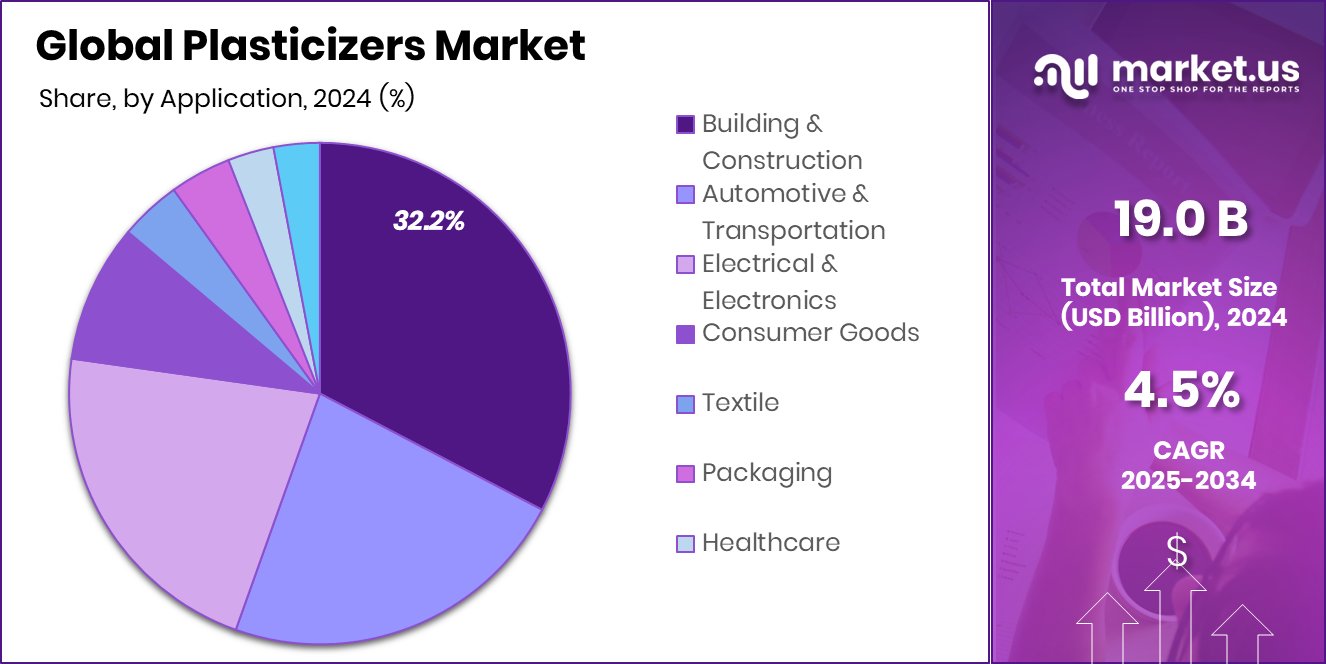

- The building and construction sector leads the plasticizers market with a 32.2% share, supporting large-scale urbanization projects worldwide.

- Asia-Pacific’s Plasticizers Market reached USD 8.6 Bn, capturing 45.3% global market share.

By Type Analysis

Phthalate Plasticizers dominate the Plasticizers Market with a 58.3% share in 2024 globally.

In 2024, Phthalate Plasticizers held a dominant market position in By Type segment of Plasticizers Market, with a 58.3% share. This leadership is largely attributed to their widespread usage in flexible PVC applications such as cables, flooring, and synthetic leather products. Phthalate plasticizers are preferred because of their excellent compatibility with polymers, cost-effectiveness, and ability to deliver superior performance characteristics like flexibility, durability, and low volatility.

Their dominance continues despite the rising environmental concerns, mainly due to their entrenched role in the construction and automotive industries, where high-performance requirements are crucial. However, the market is gradually witnessing a growing interest in alternative solutions, especially non-phthalate and bio-based plasticizers, spurred by regulatory pressures and consumer awareness.

Nonetheless, in 2024, Phthalate Plasticizers retained strong demand, particularly in emerging economies where infrastructure development is booming and regulations are relatively moderate. The 58.3% share reflects their critical importance in maintaining the cost-to-performance balance in major end-use industries.

Moving forward, companies focused on enhancing phthalate-based formulations for improved safety profiles may sustain their leadership in this segment while simultaneously exploring greener alternatives for future growth.

By Application Analysis

Flooring and Wall Covering applications accounted for 28.4% of the total Plasticizers Market demand.

In 2024, Flooring and Wall Covering held a dominant market position in the By Application segment of Plasticizers Market, with a 28.4% share. This strong foothold is driven by the high demand for flexible PVC materials in residential, commercial, and industrial construction activities.

Plasticizers play a vital role in enhancing the flexibility, durability, and longevity of flooring and wall covering products, making them more suitable for heavy foot traffic areas and varied environmental conditions. As urbanization expands and renovation activities increase worldwide, especially across Asia-Pacific and Middle Eastern countries, the need for aesthetically appealing and resilient floor and wall solutions continues to rise.

The 28.4% share indicates the critical importance of plasticizers in modern construction materials, where performance and cost-efficiency are essential. Moreover, the growing trend toward modular homes and smart buildings has further fueled the adoption of plasticizer-based flooring systems.

By End-use Analysis

The building and Construction sector led the Plasticizers Market with 32.2% end-use consumption share.

In 2024, Building and Construction held a dominant market position in the By End-use segment of Plasticizers Market, with a 32.2% share. This leadership stems from the extensive use of plasticizers in construction materials like pipes, cables, flooring, roofing membranes, and wall coverings.

Plasticizers are essential for improving flexibility, strength, and weather resistance in PVC-based construction products, making them highly valuable in modern infrastructure projects. Rapid urbanization, rising investments in smart cities, and increasing demand for affordable housing have significantly boosted plasticizer consumption in the building sector.

The 32.2% share underlines the sector’s reliance on high-performance, durable materials capable of meeting safety and energy efficiency standards. Furthermore, growing renovation and remodeling activities across developed and developing regions are sustaining steady demand for plasticizer-based products in residential and commercial buildings.

Key Market Segments

By Type

- Phthalate Plasticizers

- Diisodecyl phthalate (DIDP)

- Diisononyl phthalate (DINP)

- Diisobutyl phthalate (DIBP)

- Dipropyl Heptyl phthalate (DPHP)

- Dioctyl phthalate (DOP)

- Others

- Non-Phthalate Plasticizers

- Adipates

- Trimellitates

- Epoxies

- Benzoates

- Terephthalates

- Others

By Application

- Flooring and Wall Covering

- Wire and Cable

- Coatings

- Toys

- Footwear

- Film and Sheet

- Medical Devices

- Others

By End-use

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Consumer Goods

- Textile

- Packaging

- Healthcare

- Others

Driving Factors

Rising Construction Activities Boost Plasticizers Demand Globally

One of the top driving factors for the plasticizers market is the strong growth in construction activities around the world. Plasticizers are widely used in making flexible PVC, which is essential for products like flooring, roofing, pipes, and wall coverings. With rapid urbanization, there is a huge demand for affordable housing, modern office spaces, and better infrastructure.

Countries in Asia-Pacific, the Middle East, and Africa are leading the construction boom. This growing need for durable and flexible materials is pushing builders and manufacturers to use more plasticizers. As governments invest in smart cities and green buildings, the requirement for plasticizers in construction materials will continue rising steadily in the coming years.

Restraining Factors

Strict Environmental Rules Limit Plasticizers Market Growth

One major restraining factor for the plasticizers market is the tightening of environmental regulations across the world. Many plasticizers, especially phthalate-based types, have been linked to health and environmental concerns. Governments in Europe, North America, and parts of Asia are setting strict rules to limit or ban harmful plasticizers in consumer goods, medical devices, and children’s toys.

This creates challenges for manufacturers who now need to invest in safer, eco-friendly alternatives, which often cost more. The additional testing, certification, and regulatory approval processes also slow down product launches. As awareness about chemical safety grows among consumers, pressure on the plasticizers market to shift toward green solutions is becoming stronger, slightly restricting its traditional growth path.

Growth Opportunity

Rising Demand For Bio-Based Plasticizers Increases

A big growth opportunity for the plasticizers market is the rising demand for bio-based plasticizers. As governments and consumers push for safer and eco-friendly products, companies are focusing more on plasticizers made from natural and renewable sources. Bio-based plasticizers, like those from vegetable oils or other plant materials, are gaining popularity in industries such as packaging, medical, and consumer goods.

These alternatives not only reduce environmental impact but also meet strict health and safety standards. Many industries are willing to invest in green materials to improve their brand image and meet regulations. This growing shift towards sustainable solutions offers plasticizer manufacturers a strong new market to explore and expand over the next few years.

Latest Trends

Shift Towards Eco-Friendly Plasticizers Gains Momentum

A significant trend in the plasticizers market is the growing shift towards eco-friendly alternatives. Traditional plasticizers, particularly phthalates, have raised environmental and health concerns, prompting industries to seek safer options. Eco-friendly plasticizers, derived from renewable resources like vegetable oils, offer reduced toxicity and are biodegradable.

These alternatives are increasingly used in applications such as packaging, automotive interiors, and medical devices. The demand for sustainable products, coupled with stringent environmental regulations, is driving this transition. As a result, manufacturers are investing in research and development to enhance the performance and cost-effectiveness of bio-based plasticizers.

Regional Analysis

In 2024, Asia-Pacific dominated the Plasticizers Market with a 45.3% share, USD 8.6 Bn.

In 2024, Asia-Pacific held a dominant position in the Plasticizers Market, capturing 45.3% share valued at USD 8.6 billion. This strong leadership is mainly driven by rapid industrialization, expanding construction activities, and growing automotive production across countries like China, India, and Southeast Asia. The region’s demand for flexible PVC products in infrastructure and consumer goods continues to boost plasticizer consumption.

North America followed with steady growth, supported by high demand from automotive interiors and renovation projects. Europe maintained a significant presence, backed by sustainability initiatives and the gradual adoption of bio-based plasticizers in packaging and construction materials. Meanwhile, the Middle East & Africa region showed moderate growth due to ongoing infrastructure development and urban expansion in countries like Saudi Arabia and the UAE.

Latin America displayed a stable outlook, driven by building and construction activities in Brazil and Mexico. Overall, Asia-Pacific’s dominance remains strong in 2024, positioning it as the major revenue contributor to the global plasticizers market, with a solid base of industrial and residential applications pushing future growth forward.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global plasticizers market saw significant contributions from key players such as BASF SE, ExxonMobil, and Evonik Industries AG, each leveraging their unique strengths to address evolving market demands.

BASF SE reported sales of €65.3 billion in 2024, with its Chemicals and Materials segments playing a pivotal role. The company’s commitment to innovation and sustainability is evident in its development of alternative raw materials for plasticizers, aiming to meet the growing demand for eco-friendly solutions. BASF’s strategic focus on enhancing product performance while reducing environmental impact positions it favorably in the market.

ExxonMobil announced full-year 2024 earnings of $33.7 billion, with significant investments in advanced recycling technologies. The company allocated over $200 million to expand its recycling operations in Texas, aiming to process more than 1 billion pounds of plastic waste annually by 2027. This initiative underscores ExxonMobil’s dedication to sustainability and its proactive approach to addressing plastic waste challenges.

Evonik Industries AG achieved a net income of €222 million in 2024, with a 4% increase in sales volumes. The company expanded its production capacities for INA-based plasticizers, such as ELATUR® CH and ELATUR® DINCD, to meet rising demand. Evonik’s emphasis on high-quality, sustainable plasticizers and its commitment to scientific excellence reinforce its strong position in the market.

Top Key Players in the Market

- BASF SE

- ExxonMobil

- Evonik Industries AG

- UPC Technology Corporation

- Eastman Chemical Company

- LG Chem

- Aekyung Chemical Co Ltd

- Lanxess AG

- Avient Corporation

- Shandong Hongxin Chemical Co., Ltd.

- Nan Ya Plastics

- DIC Corporation

- Kao Corporation

- KLJ Group

- Mitsubishi Chemical Group Corporation

- Other Key Players

Recent Developments

- In March 2025, BASF signed a long-term agreement with Braven Environmental to supply PyChem®, a pyrolysis oil derived from mixed plastic waste. This feedstock will be used in BASF’s ChemCycling® process at the Port Arthur, Texas facility, replacing fossil resources and contributing to the production of Ccycled® plasticizers.

- In November 2024, ExxonMobil announced a $200 million investment to expand its advanced recycling operations at its Baytown and Beaumont facilities in Texas. The expansion is expected to add 350 million pounds per year of recycling capacity by 2026, contributing to the company’s goal of processing 1 billion pounds of plastic waste annually by 2027.

Report Scope

Report Features Description Market Value (2024) USD 19.0 Billion Forecast Revenue (2034) USD 29.5 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Phthalate Plasticizers (Diisodecyl phthalate (DIDP), Diisononyl phthalate (DINP), Diisobutyl phthalate (DIBP), Dipropyl Heptyl phthalate (DPHP), Dioctyl phthalate (DOP), Others), Non-Phthalate Plasticizers (Adipates, Trimellitates, Epoxies, Benzoates, Terephthalates, Others)), By Application (Flooring and Wall Covering, Wire and Cable, Coatings, Toys, Footwear, Film and Sheet, Medical Devices, Others), By End-use (Building and Construction, Automotive and Transportation, Electrical and Electronics, Consumer Goods, Textile, Packaging, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, ExxonMobil, Evonik Industries AG, UPC Technology Corporation, Eastman Chemical Company, LG Chem, Aekyung Chemical Co, Ltd, Lanxess AG, Avient Corporation, Shandong Hongxin Chemical Co., Ltd., Nan Ya Plastics, DIC Corporation, Kao Corporation, KLJ Group, Mitsubishi Chemical Group Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- ExxonMobil

- Evonik Industries AG

- UPC Technology Corporation

- Eastman Chemical Company

- LG Chem

- Aekyung Chemical Co Ltd

- Lanxess AG

- Avient Corporation

- Shandong Hongxin Chemical Co., Ltd.

- Nan Ya Plastics

- DIC Corporation

- Kao Corporation

- KLJ Group

- Mitsubishi Chemical Group Corporation

- Other Key Players