Global Glycol Ethers Market By Type(E-series, Methyl Glycol Ether, Ethyl Glycol Ether, Butyl Glycol Butyl Ether, Others), By P-series( Propylene Glycol Monomethyl Ether (PM), Propylene Glycol Methyl Ether Acetate (PMA), Dipropylene Glycol Monomethyl Ether (DPM), Tripropylene Glycol Monomethyl Ether (TPM), Propylene Glycol n-Butyl Ether (PnB), Dipropylene Glycol nButyl Ether (DPnB), Dipropylene Glycol Methyl Ether Acetate (DPMA), Others), By Purity(Upto 98%, Above 99%), By Application(Inks and Dies, Solvent, Anti-icing, Hydraulic and Brake Fluid, Chemical Intermediates, Others), By End Use Industry(Paints and Coatings, Printing, Pharmaceuticals, Cosmetics and Personal Care, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124089

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

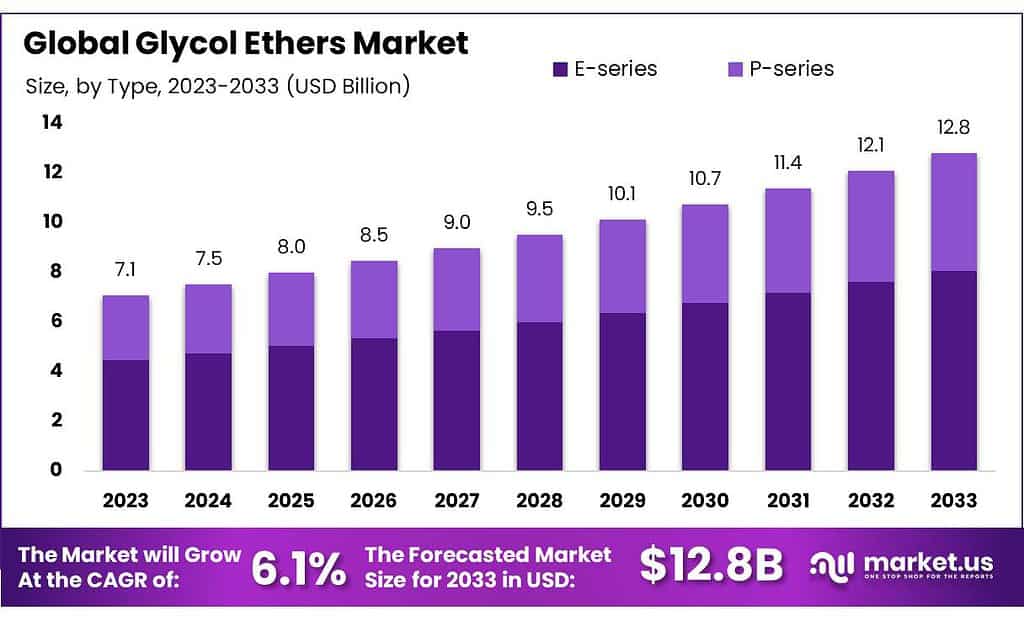

The global Glycol Ethers Market size is expected to be worth around USD 12.8 billion by 2033, from USD 7.1 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

The Glycol Ethers Market is a dynamic global industry centered around the production, distribution, and sale of glycol ethers, a type of solvent derived from alkyl ethers of ethylene glycol or propylene glycol. These solvents are prized for their ability to dissolve both water-soluble and hydrophobic substances, making them versatile and highly effective in various applications. They are commonly used in industries such as paints and coatings, pharmaceuticals, printing, and cosmetics, and are also found in products like brake fluid and cleaning products.

In the United States, the market is particularly robust, driven by a strong industrial base that leads to significant consumption in sectors like paints and coatings, and cleaning products. The U.S. contributes approximately 29% to the global market, supported by the availability of shale gas which provides a stable and cost-effective supply of ethylene oxide, a key raw material for producing glycol ethers. This advantage helps sustain the U.S.’s leading position in the global market.

Regulatory frameworks also play a critical role in shaping the industry. In regions like Europe and the U.S., stringent environmental regulations such as REACH and EPA standards mandate the move towards more sustainable and less toxic glycol ether products. These regulations are designed to minimize environmental impact and promote safer industrial practices, influencing market dynamics significantly.

Technological innovations and strategic partnerships are also crucial for market evolution. For example, collaborations like that between Saudi Arabian Oil Company (Aramco) and China Petroleum and Chemical Corporation highlight strategic efforts to enhance market presence and expand technological capabilities.

Moreover, there is a growing emphasis on developing bio-based glycol ethers, which offer a sustainable and environmentally friendly alternative to traditional solvents. These initiatives are steering the market towards more sustainable solutions, ensuring the industry’s adaptation to global demands for safer and greener products.

By Type

The E-series glycol ethers hold a dominant position in the market, capturing more than a 63.4% share. This group includes ethylene glycol ethers such as ethylene glycol monomethyl ether (methyl glycol ether), ethylene glycol monoethyl ether (ethyl glycol ether), and ethylene glycol monobutyl ether (butyl glycol ether).

These solvents are widely appreciated for their excellent solvency and coalescing abilities, which make them ideal for use in paints, coatings, and inks. Their lower toxicity compared to other glycol ethers makes them preferable in applications that require direct contact with humans, such as in cosmetics and pharmaceuticals.

This specific ether is utilized primarily in the production of paints and as a solvent in various industrial processes. Its effective solvent properties make it suitable for formulations where a quick evaporation rate is desired.

Known for its excellent solvency characteristics, ethyl glycol ether is used in a variety of applications, including as a solvent in paints, cleaning formulations, and dyeing processes. Its balance of hydrophobic and hydrophilic properties allows for versatility in both water-based and solvent-based systems.

Butyl glycol ether finds extensive use in the coatings industry due to its slow evaporation rate, which ensures better film formation during the drying process of paints and coatings. It is also used in cleaning products and as a solvent in chemical syntheses.

By P-series

Propylene Glycol Monomethyl Ether (PM): Dominating its segment, PM is extensively utilized in the paints and coatings industry due to its excellent solvency and low toxicity. It helps improve the performance and application properties of paint formulations.

Propylene Glycol Methyl Ether Acetate (PMA): PMA is valued for its strong solvent power and slow evaporation rate, making it ideal for high-quality coatings and inks. Its ability to dissolve both water-soluble and hydrophobic substances makes it a versatile choice in the production of surface coatings.

Dipropylene Glycol Monomethyl Ether (DPM): Known for its balanced solvency and evaporation rate, DPM is widely used in a variety of applications including industrial cleaners, paints, and coatings. It provides good performance in formulations requiring a moderate evaporation speed.

Tripropylene Glycol Monomethyl Ether (TPM): TPM finds its use primarily in industrial and commercial cleaning solutions. Its low toxicity and good environmental profile, combined with effective solvency, make it a preferred ingredient in eco-friendly cleaning products.

Propylene Glycol n-Butyl Ether (PnB) and Dipropylene Glycol n-Butyl Ether (DPnB): These ethers are utilized in applications requiring a higher boiling point and slower evaporation rate. Common uses include specialty coatings and cleaners, where extended contact time with surfaces is needed for effective cleaning or application.

Dipropylene Glycol Methyl Ether Acetate (DPMA): This solvent is particularly effective in high-solids coatings, where it helps improve the overall performance and appearance of the final product. DPMA is favored in automotive and industrial coatings for its ability to enhance film integrity and appearance.

By Purity

In 2023, the Glycol Ethers Market by purity showcased a significant trend in customer preference towards higher purity levels. Glycol ethers with a purity of up to 98% captured a dominant market position, accounting for more than 67.4% of the market share. This segment includes a broad range of glycol ether compounds widely utilized across various industries for their effective solvent properties, balancing cost with performance efficiency.

Glycol ethers of up to 98% purity are favored particularly in large-scale industrial applications where high volumes are required, and the slight variance in purity does not critically affect the performance of the end products. These applications typically include industrial cleaners, paint strippers, and other similar products where cost-effectiveness is prioritized alongside functional solvent capabilities.

On the other hand, glycol ethers with a purity above 99% represent a smaller, more specialized segment. These high-purity glycol ethers are essential in applications demanding strict control over impurities to ensure performance and quality, such as in pharmaceuticals, precision cleaning, and certain high-end electronics and coatings applications. The demand in this segment is driven by industries where the highest levels of purity are crucial for maintaining the integrity and functionality of sophisticated chemical formulations.

Despite the smaller market share, the above 99% purity segment is critical for applications that cannot compromise on quality and performance. These high-purity glycol ethers typically command a premium in the market, reflecting their enhanced manufacturing processes and the stringent requirements they meet for specialized industrial applications.

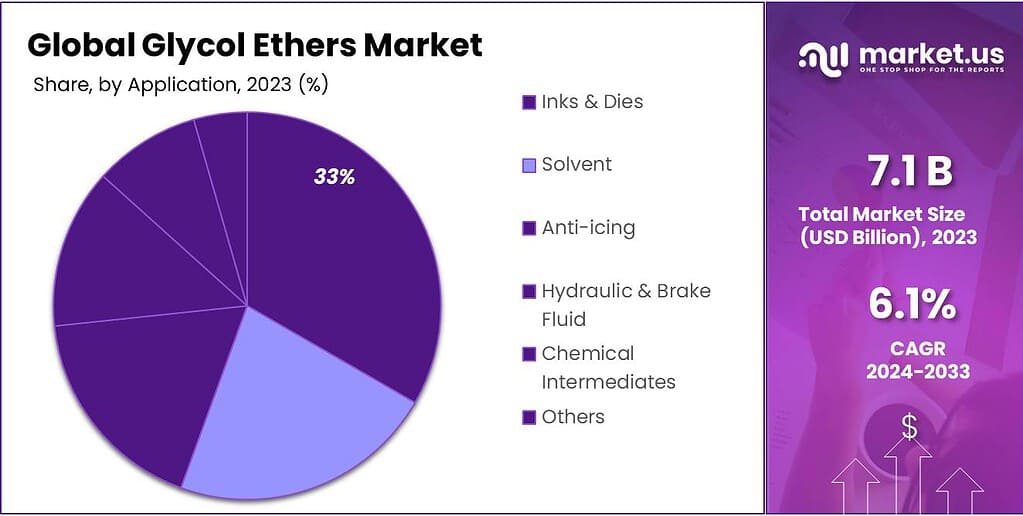

By Application

Inks & Dyes held a dominant market position, capturing more than a 33.5% share. This segment benefits significantly from the solvency properties of glycol ethers, which are crucial in achieving the desired consistency and performance in ink formulations. Glycol ethers help stabilize the formulation, improving flow properties, and enhancing the application of inks and dyes on various substrates.

Glycol ethers are widely used as solvents across multiple industries due to their ability to dissolve both water-soluble and hydrophobic substances effectively. This segment leverages glycol ethers for applications in paints, coatings, and cleaning products, where their evaporation rate and compatibility with other chemical components are valued.

In the anti-icing segment, glycol ethers are used primarily in aviation and automotive industries to prevent the formation of ice on surfaces such as windows and wings of aircraft and vehicle windshields. Their low freezing points and ability to lower the freezing point of water make them ideal for deicing formulations.

Glycol ethers play a crucial role in the formulation of hydraulic and brake fluids, offering high performance in both high and low temperatures, which is essential for the reliable operation of hydraulic and braking systems in vehicles.

As chemical intermediates, glycol ethers are involved in the synthesis of various chemical products, contributing to the production of solvents, plasticizers, and other critical industrial chemicals. Their reactivity and stability under different chemical conditions make them valuable for complex chemical processes.

By End Use Industry

Paints and Coatings This sector held a dominant market position, capturing more than a 36.3% share. Glycol ethers are extensively used in paints and coatings due to their excellent solvent properties, which help in improving the application and drying characteristics of coatings. They are particularly valued for their ability to enhance the performance of water-based paints, making them an essential component for the industry.

Printing In the printing industry, glycol ethers are utilized for their solvent capabilities, particularly in formulations that require quick drying and stable viscosity. They play a crucial role in ensuring high-quality printing on various substrates, including paper and plastics, contributing to consistent print clarity and color definition.

Pharmaceuticals Glycol ethers find applications in the pharmaceutical sector as solvents in the manufacture of drugs. Their controlled evaporation rate and compatibility with other substances make them ideal for use in the production of medicinal formulations.

Cosmetics & Personal Care In cosmetics and personal care, glycol ethers are used due to their solvency properties, which are important in formulating products like skin creams, lotions, and perfumes. They help in stabilizing the formulations and enhancing the solubility of various ingredients.

Key Market Segments

By Type

- E-series

- Methyl Glycol Ether

- Ethyl Glycol Ether

- Butyl Glycol Butyl Ether

- Others

By P-series

- Propylene Glycol Monomethyl Ether (PM)

- Propylene Glycol Methyl Ether Acetate (PMA)

- Dipropylene Glycol Monomethyl Ether (DPM)

- Tripropylene Glycol Monomethyl Ether (TPM)

- Propylene Glycol n-Butyl Ether (PnB)

- Dipropylene Glycol nButyl Ether (DPnB)

- Dipropylene Glycol Methyl Ether Acetate (DPMA)

- Others

By Purity

- Upto 98%

- Above 99%

By Application

- Inks & Dies

- Solvent

- Anti-icing

- Hydraulic & Brake Fluid

- Chemical Intermediates

- Others

By End Use Industry

- Paints and Coatings

- Printing

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

Drivers

Growth in the Personal Care and Cosmetics Industry

A significant driving factor for the Glycol Ethers market is the robust growth observed in the personal care and cosmetics industry. This sector relies heavily on glycol ethers for their exceptional solvent properties, which are crucial for the formulation of a wide range of beauty and personal care products. Glycol ethers are used extensively in products such as hair care items, skincare solutions, bath products, and various cleanliness products.

In recent years, the personal care and cosmetics industry has seen substantial growth. For instance, the beauty industry’s revenue is projected to exceed $120 billion by 2025, highlighting the increasing consumer demand for beauty and personal care products. This surge in demand directly impacts the glycol ethers market, as these chemicals are integral to the production of high-quality, effective cosmetic products.

The global market for glycol ethers benefits from this trend, particularly in regions like North America and Asia-Pacific. North America was the largest market for glycol ethers in 2022, driven by high consumer awareness and the preference for non-toxic, biodegradable products in personal care. Meanwhile, the Asia-Pacific region is expected to be the fastest-growing market, fueled by rapid economic development, increasing consumer spending, and expanding personal care sectors in countries like China and India.

Moreover, regulatory bodies in regions such as Europe and the United States enforce stringent standards on cosmetic formulations, pushing manufacturers towards safer and environmentally friendly ingredients. Glycol ethers, known for their low toxicity and effective solvent properties, are increasingly favored in compliance with these regulations, further driving their demand.

Strategic partnerships and technological advancements also play a crucial role in this market. Major companies in the glycol ethers sector are forming alliances to strengthen their market position and innovate sustainable product solutions. For example, Dow Chemicals and Haldor Topsoe have partnered to develop circular plastics from waste, underscoring the industry’s move toward sustainability.

Restraints

Stringent Environmental Regulations

A significant restraining factor for the Glycol Ethers market is the stringent environmental regulations imposed by various governmental and regulatory bodies around the world. These regulations are aimed at reducing the environmental and health impacts of glycol ethers, particularly due to their volatile organic compounds (VOC) content and potential toxicity.

Environmental Impact: Glycol ethers, especially the E-series, are known for their high volatility and capacity to form ground-level ozone, contributing to air pollution and posing health risks. The European Union’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations and the United States Environmental Protection Agency (EPA) have implemented strict guidelines to control the production, use, and disposal of glycol ethers. These regulations mandate rigorous testing and reporting of chemical safety, increasing compliance costs for manufacturers.

Market Dynamics: Compliance with these environmental regulations often requires significant investment in cleaner production technologies, process modifications, and continuous monitoring, which can be cost-prohibitive for many companies. For example, adhering to the EPA’s National Emission Standards for Hazardous Air Pollutants (NESHAP) involves substantial expenditures in upgrading equipment and implementing advanced emission control systems. This financial burden can deter smaller companies from entering the market or expanding their operations.

Impact on Production and Pricing: The regulatory requirements also lead to increased production costs, which can result in higher prices for glycol ether products. This price increase can make glycol ethers less competitive compared to alternative solvents that are not as heavily regulated. Consequently, industries may shift to using less expensive and less regulated solvents, further restraining market growth.

Shift Towards Alternatives: In response to these regulatory pressures, there is a growing shift towards the development and use of alternative solvents that are less harmful to the environment and human health. Bio-based glycol ethers and other green solvents are being developed, but their adoption is still limited by higher production costs and lower availability compared to traditional glycol ethers. The ongoing need to balance environmental compliance with economic viability remains a significant challenge for the industry.

Opportunity

Expansion in the Personal Care and Cosmetics Industry

A significant growth opportunity for the Glycol Ethers market lies in its expanding use in the personal care and cosmetics industry. Glycol ethers are integral in the formulation of various beauty and personal care products due to their excellent solvent properties, which enhance the consistency and effectiveness of these products. This trend is driven by several factors, reflecting both consumer preferences and industry dynamics.

The global personal care and cosmetics industry is experiencing robust growth. For example, the beauty industry’s revenue is projected to exceed $120 billion by 2025, indicating a strong consumer demand for a wide range of beauty and personal care products. This increasing demand directly impacts the glycol ethers market, as these chemicals are essential in producing high-quality, effective cosmetics and personal care items.

Regions such as North America and Asia-Pacific are pivotal in this market expansion. In North America, the glycol ethers market benefits from high consumer awareness and the preference for non-toxic, biodegradable products. This region was the largest market for glycol ethers in 2022, driven by their extensive use in formulations that require direct skin contact, such as lotions, creams, and other skincare products. Meanwhile, the Asia-Pacific region is expected to be the fastest-growing market, fueled by rapid economic development, increasing consumer spending, and the expanding personal care sectors in countries like China and India.

Regulatory bodies in Europe and the United States also influence this growth. Stringent standards on cosmetic formulations push manufacturers towards safer and environmentally friendly ingredients. Glycol ethers, known for their low toxicity and effective solvent properties, are increasingly favored in compliance with these regulations, further driving their demand.

Strategic partnerships and technological advancements play a crucial role in the market’s evolution. Major companies in the glycol ethers sector are forming alliances to strengthen their market position and innovate sustainable product solutions. For instance, partnerships between large chemical companies are focusing on developing bio-based glycol ethers, which offer a sustainable and environmentally friendly alternative to traditional solvents.

Trends

Rising Demand from the Automotive and Cosmetics Industries

A significant trend in the glycol ethers market is the increased demand driven by the automotive and cosmetics industries. This demand is propelled by the unique properties of glycol ethers, such as their ability to dissolve other substances effectively and their compatibility with various manufacturing processes.

Automotive Industry: In the automotive sector, glycol ethers are extensively utilized in the production of paints and coatings. These applications benefit from glycol ethers’ properties that enhance paint quality and durability, which are crucial for protecting automotive parts against moisture, abrasion, and temperature. As consumer expectations rise for vehicle appearance and longevity, so too does the demand for high-quality coatings, directly boosting the glycol ethers market.

Cosmetics Industry: The cosmetics industry also significantly influences glycol ether demand. Glycol ethers are used as solvents for active ingredients in various skincare and beauty products. Their solvency power and low toxicity make them ideal for formulations requiring a smooth application and stability over time. The growing consumer inclination towards high-quality cosmetic products, which include attributes like long-lasting wear and luxurious textures, supports the expanded use of glycol ethers in this sector.

These trends underline the glycol ethers’ role in meeting the demands of evolving market needs in both the automotive and cosmetic fields, highlighting their critical position in industrial applications and pointing towards continued growth in these sectors. As industries increasingly focus on product quality and environmental sustainability, glycol ethers are likely to remain in high demand.

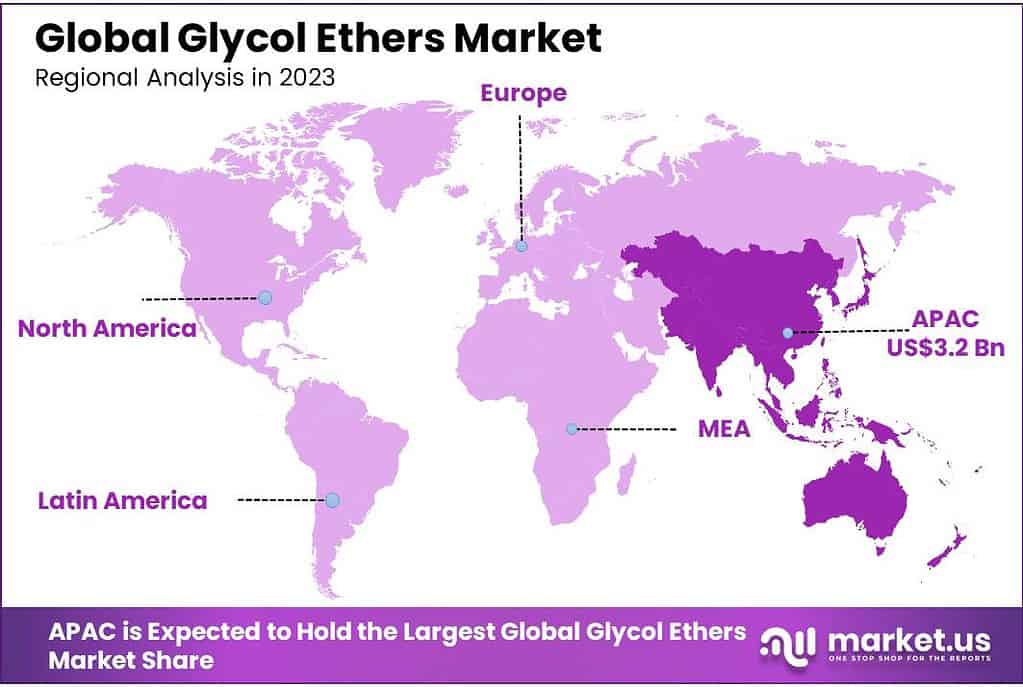

Regional Analysis

Asia Pacific: Dominating the market with a 41.5% share and valued at USD 3.2 billion, the Asia Pacific region leads due to its robust industrial base and expanding applications in paints, coatings, and personal care products. Countries such as China, India, Japan, and South Korea are major contributors, with China’s rapid industrialization and construction boom driving significant demand. The region’s growth is further supported by favorable government initiatives and increasing investments in infrastructure development.

North America: The North American market is substantial, driven by high consumer awareness and stringent environmental regulations that favor the use of glycol ethers in safer, environmentally friendly applications. The United States and Canada are key players, with the region experiencing steady growth due to advancements in chemical manufacturing technologies and the significant use of glycol ethers in pharmaceuticals, personal care products, and industrial applications.

Europe: Europe holds a significant share of the Glycol Ethers market, supported by the strong automotive and construction sectors. Germany, the UK, and France are leading countries within this region. Stringent regulations regarding VOC emissions drive innovation and the adoption of glycol ethers in environmentally friendly formulations. The market is characterized by a high demand for high-performance industrial solvents and cleaning agents.

Middle East & Africa: This region shows moderate growth potential, driven by the expanding construction sector and increasing investments in infrastructure projects. The market is supported by a rising demand for paints and coatings, particularly in the Gulf Cooperation Council (GCC) countries.

Latin America: The Latin American market is growing steadily, with Brazil and Mexico being significant contributors. The region’s growth is fueled by the automotive and construction industries, along with increasing industrial activities that demand high-quality solvents and chemicals.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Glycol Ethers market is characterized by the presence of several key players who significantly influence the industry’s dynamics through their extensive product portfolios, innovative capabilities, and strategic initiatives. Leading companies such as BASF SE, Eastman Chemicals Company, and Dow Chemical Company dominate the market with their advanced manufacturing processes and broad distribution networks.

BASF SE, a global leader, leverages its strong research and development capabilities to introduce innovative products, thereby maintaining its competitive edge. Eastman Chemicals Company and The Dow Chemical Company also play crucial roles in driving market growth through continuous product development and strategic collaborations.

Other notable players include INEOS, Huntsman Corporation, and Sasol, which have a substantial market presence due to their diversified product lines and focus on sustainability. Companies like India Glycols Limited and Jiangsu Yida Chemical cater to regional demands and expand their global footprint through partnerships and mergers.

The presence of companies such as Royal Dutch Shell and SABIC highlights the integration of upstream and downstream operations, enhancing supply chain efficiency. Additionally, firms like Henan GP Chemical and Kemipex are pivotal in catering to niche market segments, emphasizing high-quality and specialized glycol ether products.

Innovation and strategic expansion are common themes among these key players. For instance, Sadara Chemical and Nippon Nyukazai are investing in technological advancements to improve product performance and environmental sustainability. Companies like LyondellBasell and Solvay SA are focusing on expanding their production capacities to meet increasing demand. Overall, the competitive landscape of the Glycol Ethers market is shaped by the efforts of these leading companies to innovate, expand, and strategically position themselves in the global market.

Market Key Players

- BASF SE

- Eastman Chemicals Company

- FBC Chemical

- Hannong chemicals

- Henan GP Chemical

- Huntsman corporation

- India Glycols Limited

- INEOS

- Jangsu Yida Chemical

- Kemipex

- KN Neochem

- Lyondellbasell

- Nippon Nyukazai

- Oxiteno

- Recochem

- Royal Dutch Shell

- SABIC

- Sadara Chemical

- Sasol

- Solvay SA

- The Dow Chemical Company

Recent Development

In 2023 BASF SE, A typical medium-sized chemical manufacturing plant might need to invest around $5 million over five years to upgrade its facilities and processes to meet these stringent standards.

September 1, 2023, Eastman raised the prices of Eastman™ DB Solvent, Eastman™ EB Solvent, and Eastman™ DTB Solvent by USD 0.05 per pound (USD 0.11 per kilogram) across North America and Latin America.

Report Scope

Report Features Description Market Value (2023) US$ 7.1 Bn Forecast Revenue (2033) US$ 12.8 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Flavor (Plain/Original, Fruits, Chocolate, and Others), By Product Type (Smooth Peanut Butter and Crunchy Peanut Butter), By Application (Snacks & Cookies, Desserts & Ice-creams, Spreads & Dips, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Eastman Chemicals Company, FBC Chemical, Hannong chemicals, Henan GP Chemical, Huntsman corporation, India Glycols Limited, INEOS, Jangsu Yida Chemical, Kemipex, KN Neochem, Lyondellbasell, Nippon Nyukazai, Oxiteno, Recochem, Royal Dutch Shell, SABIC, Sadara Chemical, Sasol, Solvay SA, The Dow Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Glycol Ethers Market?Glycol Ethers Market size is expected to be worth around USD 12.8 billion by 2033, from USD 7.1 billion in 2023

What CAGR is projected for the Glycol Ethers Market?The Glycol Ethers Market is expected to grow at 6.1% CAGR (2024-2033).List the key industry players of the Global Glycol Ethers Market?BASF SE, Eastman Chemicals Company, FBC Chemical, Hannong chemicals, Henan GP Chemical, Huntsman corporation, India Glycols Limited, INEOS, Jangsu Yida Chemical, Kemipex, KN Neochem, Lyondellbasell, Nippon Nyukazai, Oxiteno, Recochem, Royal Dutch Shell, SABIC, Sadara Chemical, Sasol, Solvay SA, The Dow Chemical Company

-

-

- BASF SE

- Eastman Chemicals Company

- FBC Chemical

- Hannong chemicals

- Henan GP Chemical

- Huntsman corporation

- India Glycols Limited

- INEOS

- Jangsu Yida Chemical

- Kemipex

- KN Neochem

- Lyondellbasell

- Nippon Nyukazai

- Oxiteno

- Recochem

- Royal Dutch Shell

- SABIC

- Sadara Chemical

- Sasol

- Solvay SA

- The Dow Chemical Company