Global Mobile Hydraulic Equipment Market Size, Share, And Business Benefits By Product (Pumps, Valves, Transmission, Motors, Cylinders, Accumulators, Others), By Application (Construction Vehicles, Agriculture Vehicles, Forestry Machinery, Others), By End User (Construction, Material handling, Oil and gas, Mining, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140775

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

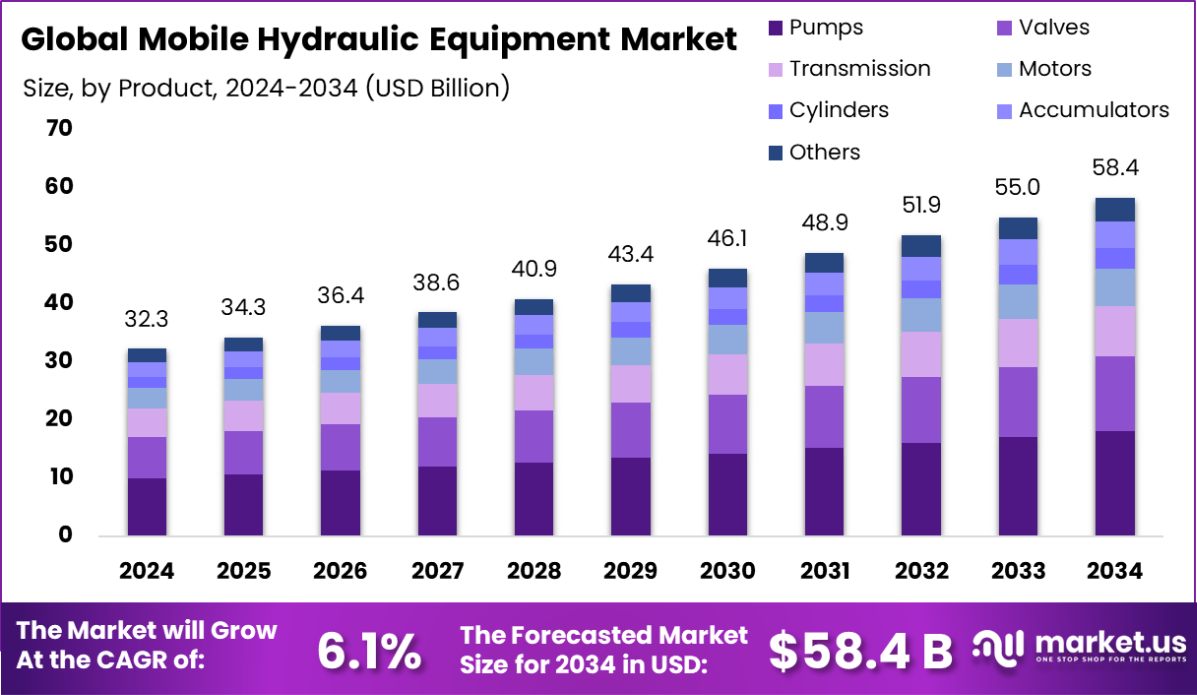

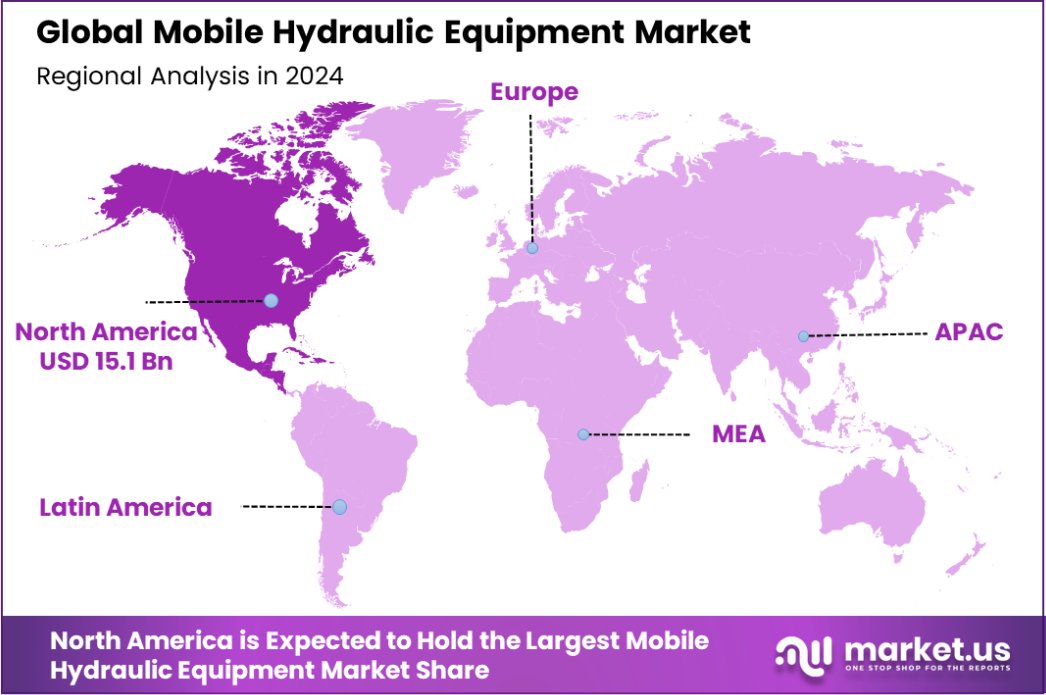

The Global Mobile Hydraulic Equipment Market is expected to be worth around USD 58.4 billion by 2034, up from USD 32.3 billion in 2024, and grow at a CAGR of 6.1% from 2025 to 2034. North America holds 46.8% of the Mobile Hydraulic Equipment Market, valued at USD 15.1 billion.

Mobile hydraulic equipment refers to machinery and tools that utilize hydraulic power to perform various tasks. This equipment relies on a hydraulic system with a fluid-filled hydraulic circuit. The power is generated through the motion and pressure of the fluid, allowing for the operation of heavy machinery such as excavators, backhoes, and hydraulic cranes. These systems are praised for their power density and precise control, making them indispensable in construction, agriculture, and industrial applications.

The mobile hydraulic equipment market comprises the sales and development of hydraulic machinery and systems used in mobile applications. This market serves a broad range of industries, including construction, mining, agriculture, and transportation. Market growth is driven by the increasing demand for efficient and robust machinery capable of performing complex tasks in various operational environments.

One significant growth factor in the mobile hydraulic equipment market is technological innovation. Advances in hydraulic technology, such as electro-hydraulic systems and improved fluid conveyance, enhance the efficiency and functionality of hydraulic equipment, leading to broader applications and market expansion.

The demand for mobile hydraulic equipment is primarily fueled by the global expansion of the construction and mining sectors. As these industries grow, the need for powerful and reliable machinery that can operate in challenging environments increases, directly boosting the demand for advanced hydraulic systems.

There is a substantial opportunity in the integration of automation and data analytics with hydraulic systems. By incorporating smart technologies that enable predictive maintenance and operational efficiency, manufacturers can offer more sophisticated, reliable, and safer hydraulic equipment. This innovation not only attracts new customers but also opens up avenues for market expansion in sectors that are increasingly relying on data-driven technologies for operational decisions.

According to Equipment Times, Volvo Construction Equipment saw a significant growth rate of 28% post-COVID-19. Meanwhile, the Indian government has announced ambitious plans, allocating 5 lakh crore annually for road projects, with a total of 70 lakh crore worth of projects in the pipeline. These developments are expected to significantly boost the Mobile Hydraulic Equipment Market.

Key Takeaways

- The Global Mobile Hydraulic Equipment Market is expected to be worth around USD 58.4 billion by 2034, up from USD 32.3 billion in 2024, and grow at a CAGR of 6.1% from 2025 to 2034.

- Pumps command a 31.2% share in the mobile hydraulic equipment market, highlighting their critical role.

- Construction vehicles dominate the application segment with a 41.2% market share, underscoring their widespread usage.

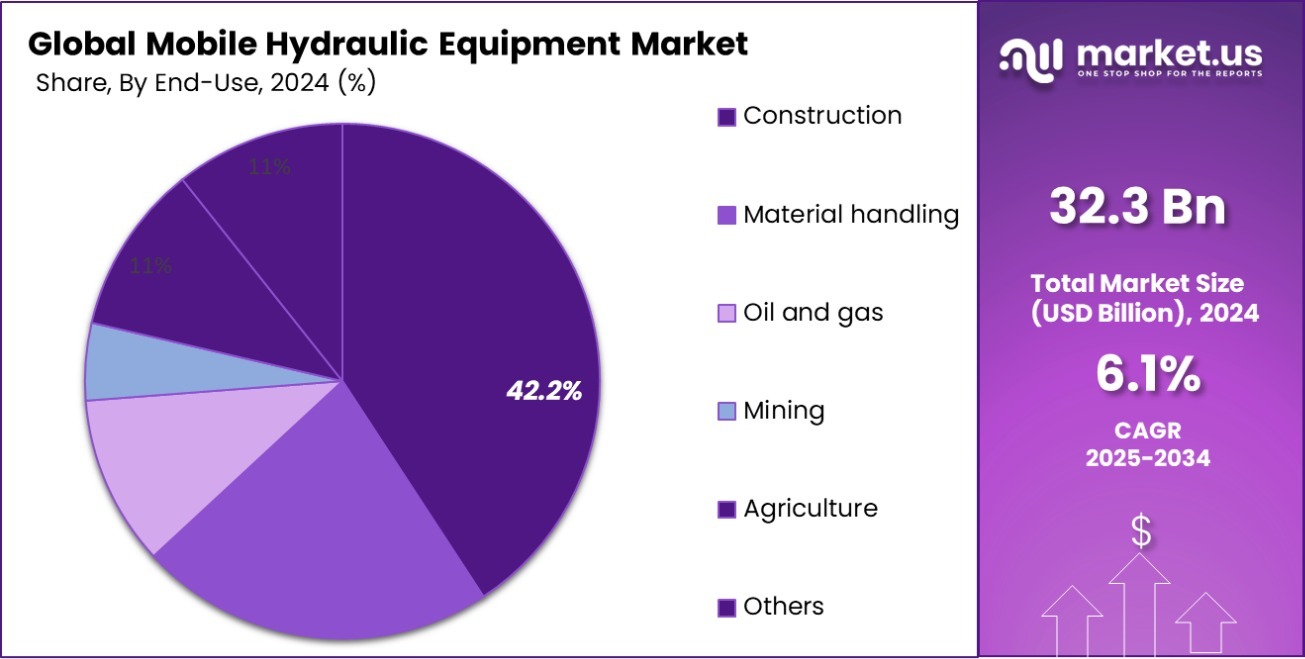

- The construction sector leads as the primary end-user, holding a 42.2% stake in the market.

- In North America, the Mobile Hydraulic Equipment Market holds 46.8%, valued at USD 15.1 billion.

By Product Analysis

Pumps lead with a 31.2% share in the Mobile Hydraulic Equipment Market.

In 2024, pumps held a dominant market position in the By Product segment of the Mobile Hydraulic Equipment Market, commanding a substantial 31.2% share. This significant market share underscores the pivotal role that hydraulic pumps play as essential components in various mobile hydraulic systems.

These pumps are crucial for converting mechanical power into hydraulic energy, which in turn drives the operation of machinery in industries such as construction, mining, and agriculture. The high demand for these pumps is primarily driven by their efficiency and reliability in transferring fluids under high pressure across different machinery, which is essential for the operation of excavators, loaders, and other heavy equipment.

The dominance of pumps in the market can also be attributed to ongoing innovations aimed at enhancing their performance and energy efficiency, reducing environmental impact, and extending operational life spans without compromising output.

As industries continue to seek more sustainable and cost-effective solutions, the strategic focus on developing pumps that offer greater hydraulic efficiency and compatibility with various fluids is likely to keep them at the forefront of the market demand in the mobile hydraulic equipment sector.

By Application Analysis

Construction vehicles dominate, holding 41.2% of Mobile Hydraulic Equipment applications.

In 2024, Construction Vehicles held a dominant market position in the By Application segment of the Mobile Hydraulic Equipment Market, with a notable 41.2% share. This substantial market share reflects the crucial reliance of the construction industry on hydraulic equipment to perform a variety of essential tasks. Construction vehicles such as excavators, backhoes, and bulldozers depend heavily on hydraulic systems for enhanced maneuverability, lifting capabilities, and overall operational efficiency.

The prominence of construction vehicles in the mobile hydraulic equipment market is driven by global urbanization and infrastructure development projects. As cities expand and infrastructure needs increase, the demand for robust and efficient construction machinery continues to rise. Hydraulic systems are preferred for their ability to deliver powerful performance and precise control, essential for the complex and demanding tasks required in construction sites.

Furthermore, the integration of new technologies such as GPS and IoT in hydraulic construction vehicles is enhancing their appeal by increasing efficiency and reducing operational costs. This trend is expected to maintain the strong position of construction vehicles in the mobile hydraulic equipment market, as they continue to be indispensable in the face of growing construction activities worldwide.

By End User Analysis

Construction leads end-user segments with 42.2% in Mobile Hydraulic Equipment.

In 2024, the Construction sector held a dominant market position in the By End User segment of the Mobile Hydraulic Equipment Market, commanding a substantial 42.2% share. This leading position underscores the critical role of mobile hydraulic equipment in the construction industry, where such tools are integral to operations ranging from earthmoving to lifting and material handling. The robust demand within this sector is primarily driven by global infrastructure growth, including the development of commercial buildings, residential areas, and public infrastructure projects.

The construction industry’s preference for mobile hydraulic equipment stems from the need for highly reliable and efficient machinery capable of performing in diverse and challenging environments. Hydraulic equipment offers unmatched precision and power, essential for tasks that require fine control and significant force, such as in excavation and crane operation.

Looking ahead, the demand in the construction sector is anticipated to grow further, propelled by increased investments in urban development and renewal projects around the world. Additionally, advancements in hydraulic technology, aiming for greater energy efficiency and sustainability, are expected to enhance the deployment of these systems, thereby sustaining their significant market share in the construction industry.

Key Market Segments

By Product

- Pumps

- Valves

- Transmission

- Motors

- Cylinders

- Accumulators

- Others

By Application

- Construction Vehicles

- Agriculture Vehicles

- Forestry Machinery

- Others

By End User

- Construction

- Material Handling

- Oil and gas

- Mining

- Agriculture

- Others

Driving Factors

Rapid Infrastructure Development Boosts Demand

As global economies expand, so too does the need for robust infrastructure development, which is a primary driving factor for the Mobile Hydraulic Equipment Market. The construction of roads, bridges, and urban structures necessitates heavy machinery that relies on hydraulic technology for efficient and precise operations. Hydraulic equipment, known for its power and reliability, is indispensable in these sectors.

The surge in infrastructure projects worldwide, especially in emerging economies, directly correlates with increased demand for mobile hydraulic equipment. This trend is further supported by government investments and public-private partnerships aiming to enhance national infrastructure, thereby propelling the market growth of mobile hydraulic systems.

Restraining Factors

High Maintenance Costs Limit Market Growth

One significant restraining factor in the Mobile Hydraulic Equipment Market is the high maintenance cost associated with hydraulic systems. These systems require regular upkeep to ensure optimal performance, which can involve expensive repairs and the frequent replacement of key components like seals, hoses, and fluids.

This necessity for ongoing maintenance can be a substantial financial burden for operators, particularly in sectors like construction and mining where equipment must endure harsh conditions. Additionally, the complexity of repairing advanced hydraulic systems requires skilled technicians, adding to operational costs. These factors can deter potential buyers, especially small and medium-sized enterprises, from investing in new hydraulic equipment, ultimately limiting market growth.

Growth Opportunity

Integration of IoT Enhances Equipment Efficiency

A significant growth opportunity in the Mobile Hydraulic Equipment Market is the integration of Internet of Things (IoT) technologies. By embedding sensors and connectivity features into hydraulic equipment, manufacturers can offer systems that not only perform better but also provide valuable data on usage, performance, and maintenance needs. This technological enhancement allows for real-time monitoring and predictive maintenance, reducing downtime and extending the lifespan of the machinery.

The ability to anticipate failures and optimize operations appeals strongly to industries seeking to minimize costs and maximize efficiency. As businesses increasingly favor smart technologies for their potential to improve productivity and operational insights, the adoption of IoT-integrated hydraulic equipment is poised to expand, driving further growth in the market.

Latest Trends

Electrification of Hydraulic Systems Gains Momentum

A prevailing trend in the Mobile Hydraulic Equipment Market is the electrification of hydraulic systems. This shift towards electrically powered hydraulics is primarily driven by the increasing emphasis on environmental sustainability and energy efficiency. Electric hydraulic systems offer several advantages over traditional hydraulic systems, including reduced emissions, lower noise levels, and enhanced control precision.

These features make electric hydraulics particularly attractive in urban and indoor environments where noise and pollution regulations are more stringent. As industries continue to adopt green practices and technology, the demand for electric hydraulic equipment is expected to rise, reflecting a broader industry move towards electrification. This trend is not only shaping current market dynamics but also paving the way for future innovations in hydraulic technology.

Regional Analysis

In North America, the Mobile Hydraulic Equipment Market holds a 46.8% share, valued at USD 15.1 billion.

In the Mobile Hydraulic Equipment Market, regional dynamics vary, reflecting different industrial and infrastructural development stages. North America dominates the market with a 46.8% share, valued at USD 15.1 billion, driven by robust construction activities and substantial investments in infrastructure development, particularly in the United States and Canada.

Europe follows, benefiting from advanced manufacturing capabilities and stringent environmental regulations that drive the demand for efficient and eco-friendly hydraulic equipment. The region’s focus on renewable energy projects also contributes to this demand, supporting a sophisticated market for mobile hydraulic equipment.

The Asia Pacific region is witnessing rapid growth due to increasing urbanization and industrialization, especially in China and India. Investments in public infrastructure and an expanding manufacturing sector are pivotal in driving the hydraulic equipment market forward.

The Middle East & Africa region, though smaller in comparison, is experiencing growth due to infrastructure projects and oil exploration activities, particularly in the Gulf Cooperation Council countries.

Latin America, while currently the smallest segment, shows potential for growth driven by a recovery in the construction sector and several ongoing infrastructure projects aimed at stimulating economic recovery, particularly in countries like Brazil and Mexico.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the global Mobile Hydraulic Equipment Market, the landscape in 2024 is highly competitive with several key players driving innovation and growth. Bucher Hydraulics is renowned for its precision-engineered hydraulic components, which cater to a wide range of mobile applications. Their focus on tailored solutions and sustainability aligns well with the increasing demand for efficient and environmentally friendly equipment.

Caterpillar Inc. continues to be a dominant force, leveraging its vast network and extensive portfolio to meet the diverse needs of the construction, mining, and agriculture sectors. The company’s commitment to integrating advanced technologies such as AI and IoT into their equipment positions them well for future growth and customer retention.

CNH Industrial N.V. stands out for its agricultural and construction machinery. The company’s strategic acquisitions and partnerships have broadened its technological capabilities, enhancing its product offerings and international reach.

Daikin Industries Ltd., traditionally strong in air conditioning systems, has made significant inroads into the hydraulic sector through innovative cooling solutions for hydraulic equipment, addressing the critical need for overheating prevention in heavy machinery.

Doosan Infracore Co., Ltd. focuses on expanding its presence in emerging markets, capitalizing on the growing demand for infrastructure development. Their machines are designed with robust features tailored to challenging environments, which is critical for their global expansion strategy.

Eaton Corp. Plc emphasizes energy-efficient solutions and has been at the forefront of electro-hydraulic innovations, which align with global trends towards sustainability.

Emerson Electric Co., known for its automation solutions, is enhancing the functionality and connectivity of hydraulic equipment, improving diagnostic capabilities and operational efficiency, which is key for maintaining competitiveness in a tech-driven market.

Top Key Players in the Market

- Bucher Hydraulics

- Caterpillar Inc.

- CNH Industrial N.V.

- Daikin Industries Ltd.

- Doosan Infracore Co., Ltd.

- Eaton Corp. Plc

- Emerson Electric Co.

- Haulotte Group

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- JCB Ltd.

- JWF Technologies

- Kawasaki Heavy Industries Ltd

- Kobelco Construction Machinery Co., Ltd.

- Komatsu Ltd.

- L&T Construction Equipment Limited

- Linde Hydraulics

- Mahindra Construction Equipment

- Parker-Hannifin Corp.

- Robert Bosch GmbH

- Sany Group

- Sany Heavy Industry Co., Ltd.

- Siemens AG

- Sumitomo Heavy Industries Construction Crane Co., Ltd.

- Trident Hydraulic

- United Rentals, Inc.

- Volvo Construction Equipment

- WEBER-HYDRAULIK GmbH

- Wipro Enterprises (P) Ltd.

Recent Developments

- In 2024, Mahindra Construction Equipment introduced new RoadMaster and EarthMaster BSV construction equipment at BAUMA CONEXPO 2024 in December 2024.

- In 2024, JCB started construction of a new $500 million manufacturing plant in the USA in June 2024.

Report Scope

Report Features Description Market Value (2024) USD 32.3 Billion Forecast Revenue (2034) USD 58.4 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Pumps, Valves, Transmission, Motors, Cylinders, Accumulators, Others), By Application (Construction Vehicles, Agriculture Vehicles, Forestry Machinery, Others), By End User (Construction, Material handling, Oil and gas, Mining, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bucher Hydraulics, Caterpillar Inc., CNH Industrial N.V., Daikin Industries Ltd., Doosan Infracore Co., Ltd., Eaton Corp. Plc, Emerson Electric Co., Haulotte Group, Hitachi Construction Machinery Co., Ltd., Hyundai Construction Equipment Co., Ltd., JCB Ltd., JWF Technologies, Kawasaki Heavy Industries Ltd, Kobelco Construction Machinery Co., Ltd., Komatsu Ltd., L&T Construction Equipment Limited, Linde Hydraulics, Mahindra Construction Equipment, Parker-Hannifin Corp., Robert Bosch GmbH, Sany Group, Sany Heavy Industry Co., Ltd., Siemens AG, Sumitomo Heavy Industries Construction Crane Co., Ltd., Trident Hydraulic, United Rentals, Inc., Volvo Construction Equipment, WEBER-HYDRAULIK GmbH, Wipro Enterprises (P) Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Hydraulic Equipment MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Hydraulic Equipment MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bucher Hydraulics

- Caterpillar Inc.

- CNH Industrial N.V.

- Daikin Industries Ltd.

- Doosan Infracore Co., Ltd.

- Eaton Corp. Plc

- Emerson Electric Co.

- Haulotte Group

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- JCB Ltd.

- JWF Technologies

- Kawasaki Heavy Industries Ltd

- Kobelco Construction Machinery Co., Ltd.

- Komatsu Ltd.

- L&T Construction Equipment Limited

- Linde Hydraulics

- Mahindra Construction Equipment

- Parker-Hannifin Corp.

- Robert Bosch GmbH

- Sany Group

- Sany Heavy Industry Co., Ltd.

- Siemens AG

- Sumitomo Heavy Industries Construction Crane Co., Ltd.

- Trident Hydraulic

- United Rentals, Inc.

- Volvo Construction Equipment

- WEBER-HYDRAULIK GmbH

- Wipro Enterprises (P) Ltd.