Global Air Compressor Market By Type (Positive Displacement, Reciprocating, Rotary, Dynamic Displacement), By Design (Stationary, Portable), By Operating Mode (Electric, Internal Combustion Engine), By Technology (Oil-Injected, Oil-Free), By Coolant Type (Air-cooled, Water-cooled), By Power Range (Up to 50 KW, 51-250 KW, 251-500 KW, Above 500 KW), By Pressure Range (Up to 20 Bar, 21-100 Bar, Above 100 Bar), By End-use (Chemical And Petrochemical, Healthcare And Medical, Metals And Mining, Oil And Gas, Automotive And Transportation, Food And Beverage, Energy And Power, Building And Construction), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2024

- Report ID: 44624

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

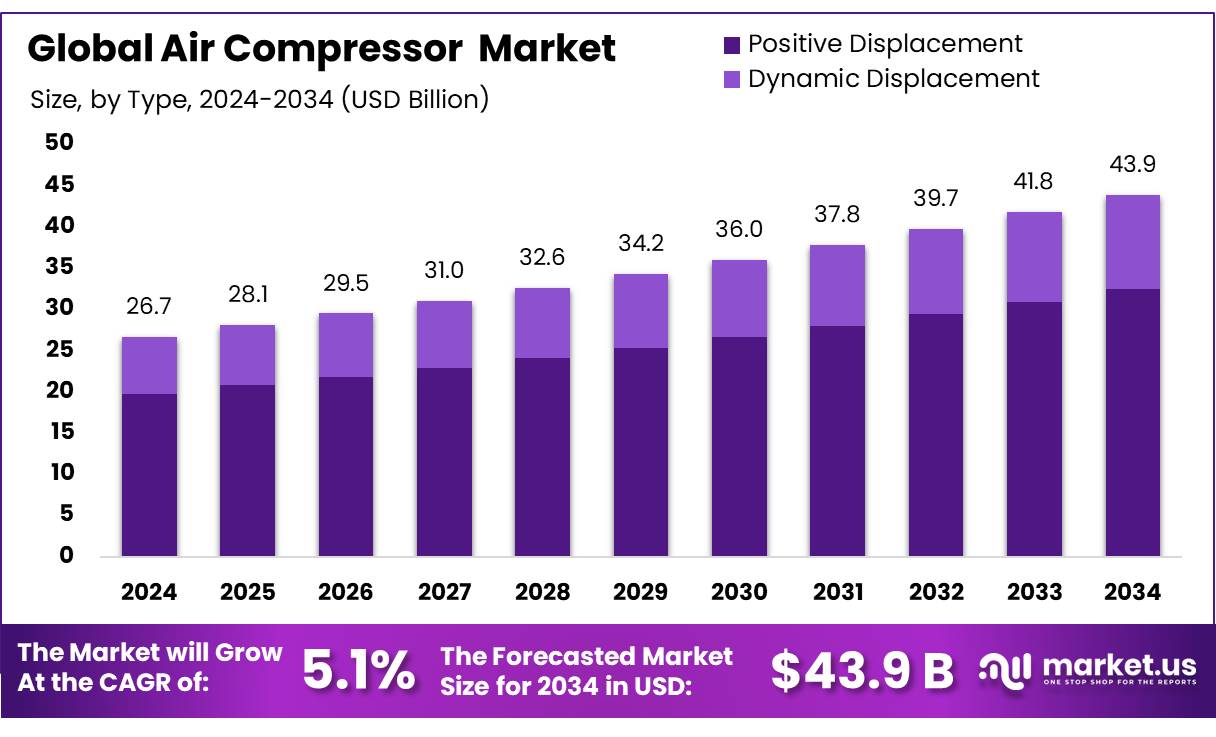

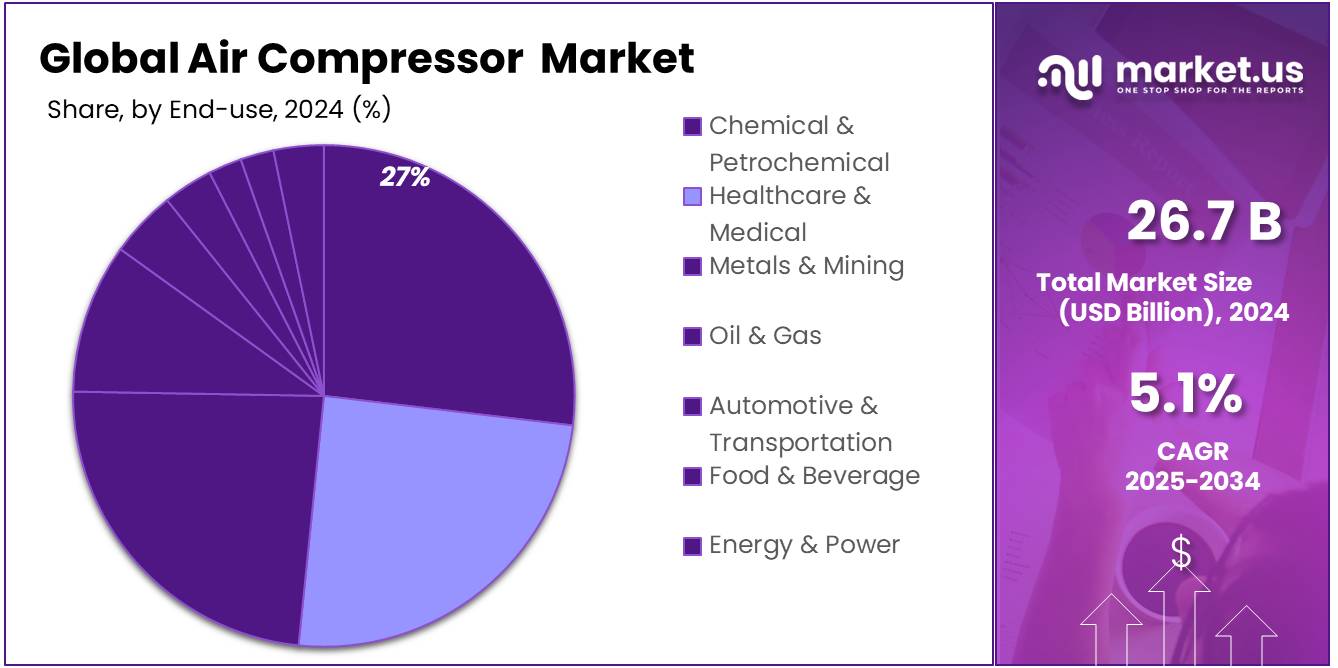

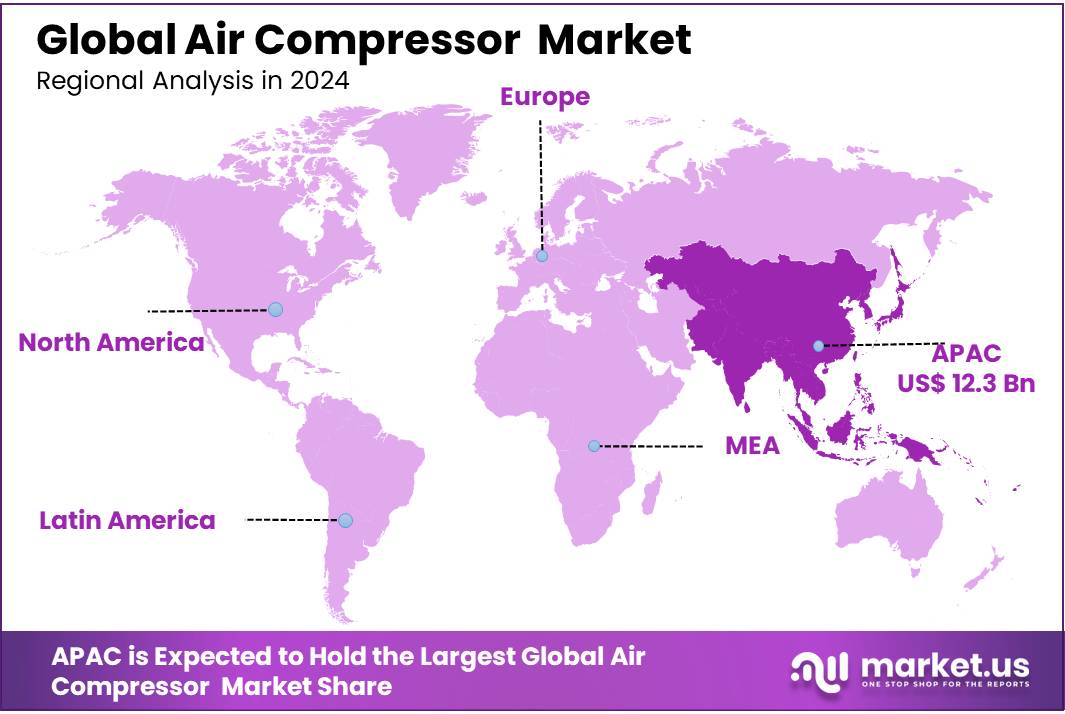

The Global Air Compressor Market size is expected to be worth around USD 43.9 Billion by 2034, from USD 26.7 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. Asia Pacific dominated a 46.30% market share in 2024 and held USD 12.3 Billion in revenue from the Air Compressor Market.

The global air compressor market has experienced robust growth due to the rising need for compressed air in various industrial sectors like automotive, construction, and manufacturing. Air compressors, essential for converting power into stored energy in the form of compressed air, are widely used across different industries. Key market leaders such as Atlas Copco, Ingersoll Rand, and Kaeser Compressors dominate the sector with their advanced technology and extensive distribution networks.

Market competition is increasing with new companies introducing innovative, economical, and more energy-efficient air compressors. North America and Europe are significant players, with North America holding about 35% of the market share and Europe around 30% in 2023, driven by high compressor usage in industrial and infrastructure projects.

Factors such as the demand for energy-efficient solutions and increasing industrial automation are propelling the air compressor market forward. Industries are integrating automated machinery that depends on compressed air, enhancing efficiency. The International Energy Agency predicts that by 2040, enhancements in industrial energy efficiency could decrease global energy demand by 12%, boosting the need for efficient air compressors.

This importance is underscored by recent policy initiatives in key markets such as India. The Indian Bureau of Energy Efficiency (BEE) has projected that through the implementation of new energy efficiency policies, there will be a cumulative avoidance of 18.2 TWh of electricity demand by 2030.

These policies are not just operational game changers but are also significant contributors to environmental conservation, with an expected reduction of 15 million metric tons of CO₂ emissions within the same timeframe.

Despite their widespread use, air compressors typically achieve only a 10% to 30% conversion of input power into effective output, with the vast majority of energy lost to heat, friction, and noise. This inefficiency presents a substantial opportunity for market players.

Key Takeaways

- Air Compressor Market size is expected to be worth around USD 43.9 Billion by 2034, from USD 26.7 Billion in 2024, growing at a CAGR of 5.1%.

- Positive Displacement segment held a dominant position in the Air Compressor Market, capturing more than a 74.60% share.

- Stationary segment held a dominant market position in the Air Compressor Market, capturing more than a 64.30% share.

- Electric segment held a dominant market position in the Air Compressor Market, capturing more than a 78.30% share.

- Oil-Free segment held a dominant market position in the Air Compressor Market, capturing more than a 67.10% share.

- Air-cooled segment held a dominant market position in the Air Compressor Market, capturing more than a 57.40% share.

- 51-250 KW power range segment held a dominant market position in the Air Compressor Market, capturing more than a 38.30% share.

- Chemical & Petrochemical segment held a dominant market position in the Air Compressor Market, capturing more than a 27.80% share.

- Asia Pacific (APAC) emerges as the dominating region, holding a substantial 46.30% share, with a market valuation of approximately USD 12.3 billion.

By Type

In 2024, the Positive Displacement segment held a dominant position in the Air Compressor Market, capturing more than a 74.60% share. This category, characterized by its reliable and consistent performance, encompasses various types such as reciprocating, rotary, screw, and scroll compressors. Each type is preferred for specific applications due to its unique operational advantages. For instance, screw compressors are widely appreciated for their efficiency in continuous duty applications, while scroll compressors are favored in medical and HVAC applications due to their quieter operation and lower maintenance needs.

Moving to the Dynamic Displacement segment, which includes centrifugal and axial compressors, it has carved out a niche in industries where high-flow rates are required, such as in large industrial operations and power plants. Despite its smaller market share compared to Positive Displacement, this segment is critical for applications demanding large volumes of compressed air.

By Design

In 2024, the Stationary segment held a dominant market position in the Air Compressor Market, capturing more than a 64.30% share. This type of compressor is primarily chosen for its robust performance in industrial settings where large volumes of air are required continuously. Commonly found in manufacturing plants, automotive assembly lines, and large construction sites, stationary compressors are valued for their high efficiency and capacity to operate for extended periods without significant maintenance.

On the other hand, the Portable segment, although smaller in market share, plays a crucial role in providing flexibility and mobility for various applications. These compressors are particularly popular in construction, home use, and other applications where the compressor needs to be moved between different sites or locations within a site.

By Operating Mode

In 2024, the Electric segment held a dominant market position in the Air Compressor Market, capturing more than a 78.30% share. Electric air compressors are preferred for their cost-effectiveness and minimal environmental impact, making them suitable for indoor and urban environments where noise and emissions regulations are stringent. They are widely used across various sectors, including manufacturing, healthcare, and food processing, where reliable and clean air supply is critical.

The Internal Combustion Engine segment, while smaller in market share, remains indispensable in scenarios where electricity is scarce or unavailable. These compressors are commonly deployed in construction sites, oil rigs, and remote mining operations where they provide a robust power source for heavy-duty tasks.

By Technology

In 2024, the Oil-Free segment held a dominant market position in the Air Compressor Market, capturing more than a 67.10% share. Oil-free compressors are highly sought after for applications that demand the highest levels of air purity, such as in pharmaceuticals, food and beverage processing, and electronics manufacturing. These compressors eliminate the risk of oil contamination in the compressed air supply, ensuring compliance with stringent health and safety standards.By Coolant Type

In 2024, the Air-cooled segment held a dominant market position in the Air Compressor Market, capturing more than a 57.40% share. This type of cooling system is preferred for its simplicity and cost-effectiveness, making it ideal for a wide range of applications, particularly in settings where water resources are limited or water-cooling infrastructure is impractical. Air-cooled compressors are commonly used in automotive, construction, and small manufacturing facilities due to their ease of installation and lower maintenance requirements compared to their water-cooled counterparts.

The air-cooled compressor market is expected to continue its growth, driven by innovations that improve cooling efficiency and equipment longevity. These advancements are anticipated to make air-cooled compressors even more appealing to industries that require reliable and economical solutions for their compressed air needs.

By Power Range

In 2024, the 51-250 KW power range segment held a dominant market position in the Air Compressor Market, capturing more than a 38.30% share. This segment appeals to a broad spectrum of industries due to its balance between power and efficiency, making it ideal for medium-scale industrial applications. Compressors in this power range are widely utilized in manufacturing, mining, and construction sectors, where they provide a robust performance for tools and machinery without the extensive energy costs associated with higher power units.

Compressors up to 50 KW, though less powerful, are crucial in smaller operations and workshops where space and energy consumption are significant considerations. The 251-500 KW and above 500 KW segments cater to heavy industrial uses that require significant compressed air output, such as in large manufacturing plants and the oil and gas industry.

The 51-250 KW segment is expected to maintain its prominence, driven by ongoing industrial expansion and the increasing adoption of technologically advanced compressors that offer greater energy efficiency and lower environmental impact. These factors are likely to enhance the segment’s appeal, particularly in industries focused on optimizing operational efficiency and reducing carbon footprints.

By Pressure Range

In 2024, the “Up to 20 Bar” pressure range segment held a dominant position in the Air Compressor Market, capturing more than a 53.40% share. This segment primarily caters to general manufacturing, automotive workshops, and construction applications where moderate pressure is sufficient for tasks like powering pneumatic tools, material handling, and spray painting operations. The widespread use of these compressors across various industries underscores their versatility and broad appeal.

Moving to the “21-100 Bar” range, this segment serves more specialized industrial applications that require higher pressure levels, such as energy exploration and production, heavy manufacturing, and certain chemical processes. Though smaller in market share compared to the “Up to 20 Bar” segment, the demand in this category is driven by industries that need high-performance compressors for more intense and continuous operations.

Lastly, the “Above 100 Bar” segment, while the smallest, is critical for extremely high-pressure applications found in sectors like aerospace, deep-sea exploration, and high-precision manufacturing. This segment’s compressors are highly specialized, supporting some of the most challenging and critical operations, requiring robust and reliable equipment that can handle intense pressures without compromise.

By End-use

In 2024, the Chemical & Petrochemical segment held a dominant market position in the Air Compressor Market, capturing more than a 27.80% share. This segment’s significant demand for air compressors is driven by the need for highly reliable and clean compressed air used in various critical processes including product handling, fluid pumping, and process air applications. The compressors in this sector must meet stringent air purity standards to prevent contamination and ensure safe operating conditions.

Healthcare & Medical and Food & Beverage also rely heavily on oil-free compressors to avoid contamination risks, emphasizing the importance of air quality in their operations. In sectors like Metals & Mining, and Oil & Gas, air compressors are vital for machinery operation and process automation, driving the need for robust and high-power units.

Key Market Segments

By Type

- Positive Displacement

- Reciprocating

- Rotary

- Screw

- Scroll

- Others

- Dynamic Displacement

- Centrifugal

- Axial

By Design

- Stationary

- Portable

By Operating Mode

- Electric

- Internal Combustion Engine

By Technology

- Oil-Injected

- Oil-Free

By Coolant Type

- Air-cooled

- Water-cooled

By Power Range

- Up to 50 KW

- 51-250 KW

- 251-500 KW

- Above 500 KW

By Pressure Range

- Up to 20 Bar

- 21-100 Bar

- Above 100 Bar

By End-use

- Chemical & Petrochemical

- Healthcare & Medical

- Metals & Mining

- Oil & Gas

- Automotive & Transportation

- Food & Beverage

- Energy & Power

- Building & Construction

- Others

Drivers

Increasing Demand in the Food & Beverage Industry

The air compressor market is the growing demand from the Food & Beverage industry. As the global population continues to grow, there is a corresponding increase in food production needs, which requires more extensive and reliable processing and packaging facilities. Air compressors play a crucial role in various stages of food production, from processing to packaging, ensuring that operations are both efficient and safe.

The Food & Beverage industry relies heavily on clean, oil-free compressed air to avoid contamination and meet stringent hygiene standards. According to data from the Food and Agriculture Organization (FAO), the global volume of food production must increase by approximately 70% by 2050 to meet the rising demand from a projected world population of 9.1 billion. This statistic underlines the critical role that technologies like air compressors will play in scaling up production capacities without compromising food safety or quality.

Moreover, air compressors are integral in the automation of food processing plants. Automated packaging systems, for instance, use compressed air to efficiently seal, label, and pack products, which helps to maintain the integrity and prolong the shelf life of food items. This automation is essential for ensuring high standards of food safety and operational efficiency, reducing the risk of contamination and waste during the packaging process.

Government initiatives also support the expansion of this sector by implementing regulations that encourage the adoption of energy-efficient and environmentally friendly technologies. For example, the U.S. Department of Energy (DOE) has various programs aimed at improving energy efficiency in industrial processes, including incentives for adopting energy-efficient air compressor systems. These programs not only support environmental sustainability but also reduce operational costs for food and beverage manufacturers, making investments in advanced air compressor systems more attractive.

Restraint

High Maintenance Costs and Energy Consumption

Air compressors, especially the more powerful and complex models, require regular maintenance to ensure efficient operation and prevent breakdowns. This maintenance includes periodic checks, replacements of filters and seals, and oil changes in oil-injected models. The costs associated with these maintenance activities can accumulate, making it a considerable expense for businesses.

For instance, the energy consumption of air compressors can account for up to 30% of a manufacturing plant’s total electricity bill, according to the U.S. Department of Energy. This significant energy use not only affects operational costs but also impacts the environmental footprint of the businesses using these systems.

The Food & Beverage industry, which must adhere to strict hygiene and safety standards, often requires specialized, oil-free compressors that are more expensive to maintain than their oil-injected counterparts. The need for uncontaminated air in food processing and packaging increases the demand for these advanced compressors, which in turn raises maintenance challenges and costs.

Governmental and regulatory bodies have been actively working to address these issues by setting standards and regulations that encourage the adoption of energy-efficient technologies. For example, the Energy Efficiency Directive by the European Union mandates improvements in overall energy performance, including that of industrial equipment like air compressors. While these regulations aim to reduce the environmental impact and improve energy efficiency, they also require companies to invest in newer, often more expensive technology.

Furthermore, initiatives like the Better Plants program led by the U.S. Department of Energy partner with manufacturers to improve energy efficiency. They provide resources and support to help plants reduce energy use, water consumption, and greenhouse gas emissions. Such initiatives are beneficial, but they also reflect the need for ongoing investment in new technologies, which can be a financial strain for some companies in the Food & Beverage sector.

Despite these challenges, the push towards more sustainable and energy-efficient operations creates opportunities for innovation in the air compressor market. Manufacturers are continually developing more reliable and energy-efficient models that promise lower lifetime costs and reduced environmental impact. However, the initial high cost of acquisition and the need for regular, costly maintenance remain significant barriers for many potential users, especially in cost-sensitive industries.

Opportunities

Sustainable Practices and Technological Innovations

The global food production sector is a massive consumer of industrial equipment, including air compressors, which are essential for a variety of processes from packaging to product handling. According to a report by the Food and Agriculture Organization (FAO), the food industry must upscale production significantly to feed the projected global population of nearly 10 billion by 2050. This necessitates not only an increase in food production but also an adoption of technologies that can make production more efficient and less harmful to the environment.

Modern air compressors that feature advanced energy-saving technologies such as variable speed drives (VSD) offer a considerable reduction in energy use. VSDs allow compressors to operate only at required speeds, significantly cutting energy consumption and associated costs. For instance, the integration of VSD technology can reduce energy usage by up to 35%, a substantial saving that can help mitigate the overall environmental impact of production facilities.

Additionally, regulatory bodies and governments are increasingly supporting initiatives that promote energy efficiency. In the United States, the Environmental Protection Agency (EPA) has implemented several regulations that encourage the adoption of energy-efficient appliances, including industrial machinery. These regulations are not only pushing industries towards greener alternatives but also opening up market opportunities for companies that produce and distribute energy-efficient compressors.

The push towards sustainability is further supported by consumer preferences. Today’s consumers are more environmentally conscious and prefer products manufactured in an eco-friendly manner. This shift in consumer behavior is prompting companies in the Food & Beverage sector to invest in green technologies, including energy-efficient air compressors, to meet market demand and maintain a competitive edge.

Moreover, technological advancements such as the Internet of Things (IoT) are making it possible to optimize compressor operations through real-time monitoring and predictive maintenance, thereby reducing downtime and maintenance costs. These technological integrations not only improve the operational efficiency of air compressors but also extend their lifespan, offering additional cost savings over time.

Latest Trends

Integration of IoT and AI in Air Compressors

In the realm of food production, air compressors play a critical role in numerous processes such as packaging, product handling, and maintaining controlled environments for food storage. The integration of IoT in air compressors allows for real-time monitoring and control, which enhances efficiency and ensures reliability. For example, IoT-enabled compressors can automatically adjust their operations based on the real-time demand and operational conditions, significantly reducing energy consumption and operational costs.

AI further complements this by providing predictive analytics, which helps in anticipating maintenance needs and potential system failures before they occur. This predictive maintenance can lead to fewer unplanned downtimes and extended equipment lifespans, ensuring continuous production lines, which is crucial in high-demand industries like food processing.

According to a report by the United Nations Industrial Development Organization (UNIDO), the adoption of smart manufacturing technologies can enhance production efficiency by up to 30% in industries where they are implemented. This significant improvement in efficiency is a strong incentive for companies, especially given the increasing global food demand projected by the Food and Agriculture Organization (FAO), which estimates that food production must increase by approximately 70% by 2050 to feed the growing population.

Government initiatives also support this trend. For instance, the European Union’s Horizon 2020 program actively funds research and innovation projects that include the development and integration of smart technologies in industrial applications, including those in the Food & Beverage sector. These initiatives not only foster the adoption of advanced technologies but also promote sustainability by encouraging the use of energy-efficient systems.

The integration of IoT and AI technologies into air compressors also addresses the growing environmental concerns related to industrial energy consumption and emissions. By optimizing compressor operations, these technologies can significantly reduce the carbon footprint of manufacturing processes, aligning with global efforts to combat climate change and meet stringent regulatory standards for environmental protection.

Consumer trends also play a role in this shift towards smart manufacturing. There is a growing demand among consumers for transparency in manufacturing processes and a preference for products made using sustainable practices. IoT and AI technologies can help manufacturers provide this transparency and meet consumer expectations by ensuring efficient, reliable, and environmentally friendly operations.

Regional Analysis

Asia Pacific (APAC) emerges as the dominating region, holding a substantial 46.30% share, with a market valuation of approximately USD 12.3 billion. This dominance is driven by rapid industrialization and expansion of manufacturing capacities in countries like China, India, and Japan. The region benefits from robust growth in sectors such as automotive, electronics, and construction, all of which extensively utilize air compressors for various applications.

North America also represents a significant portion of the market, propelled by advanced manufacturing practices and a strong presence of industries that prioritize energy-efficient technologies. This region is also seeing a surge in oil and gas exploration activities, which further boosts the demand for air compressors.

Europe, while mature, continues to innovate in compressor technology, focusing on energy-efficient and environmentally friendly products. This aligns with the region’s stringent environmental regulations, which drive the adoption of advanced air compressors.

The Middle East & Africa (MEA) and Latin America are expected to witness moderate growth. In MEA, the growth is primarily driven by the oil and gas sector, whereas in Latin America, the expansion is supported by the recovery of industrial activities and growth in manufacturing sectors post-economic downturns.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The air compressor market is highly competitive, with several key players contributing to its dynamic nature. Among the leading companies, Atlas Copco AB stands out for its extensive range of efficient and reliable air compressors, serving various sectors including manufacturing, construction, and mining. Similarly, Ingersoll Rand Inc. offers innovative compressed air solutions that emphasize energy efficiency and sustainability, aligning with global trends towards environmentally conscious manufacturing practices.

Other significant players such as Hitachi, Ltd., Mitsubishi Heavy Industries, Ltd., and Kaeser Kompressoren, Inc. are noted for their technological advancements and strong market presence across diverse regions. These companies have been instrumental in driving product innovation, particularly in the development of oil-free and variable speed compressors that reduce operational costs and carbon footprints. Additionally, companies like Doosan Group and Siemens AG play crucial roles in the market, with advanced compressor technologies that cater to heavy industries and energy sectors, enhancing their global competitiveness.

Top Key Players

- Atlas Copco AB

- Camfil

- Hitachi, Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Kaeser Kompressoren, Inc.

- FS-Curtis

- Ingersoll Rand Inc.

- Doosan Group

- KOBELCO COMPRESSORS CORPORATION

- Elliott Group

- Kirloskar Pneumatic Co Ltd

- Danfoss

- Baker Hughes Company

- Sulzer Ltd.

- Siemens AG

- BOGE KOMPRESSOREN

- Other Key Players

Recent Developments

- In June 2023, Kaeser Kompressoren acquired a compressor distribution company to expand its reach in the European market. This acquisition aims to increase their service and sales network by 20% across the region.

- In April 2023, Hitachi has recently launched a new series of energy-efficient air compressors that reduce electricity consumption by 15%. These models are designed for manufacturing industries looking to cut energy costs.

- In January 2023, Elgi Equipments Limited introduced a revolutionary oil-free compressor that offers a 10% higher air output compared to conventional models. This product targets sectors that require high purity air, like pharmaceuticals and food processing.

Report Scope

Report Features Description Market Value (2024) USD 26.7 Billion Forecast Revenue (2034) USD 43.9 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Positive Displacement, Reciprocating, Rotary, Dynamic Displacement), By Design (Stationary, Portable), By Operating Mode (Electric, Internal Combustion Engine), By Technology (Oil-Injected, Oil-Free), By Coolant Type (Air-cooled, Water-cooled), By Power Range (Up to 50 KW, 51-250 KW, 251-500 KW, Above 500 KW), By Pressure Range (Up to 20 Bar, 21-100 Bar, Above 100 Bar), By End-use (Chemical And Petrochemical, Healthcare And Medical, Metals And Mining, Oil And Gas, Automotive And Transportation, Food And Beverage, Energy And Power, Building And Construction) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Atlas Copco AB, Camfil, Hitachi, Ltd., Mitsubishi Heavy Industries, Ltd., Kaeser Kompressoren, Inc. , FS-Curtis, Ingersoll Rand Inc., Doosan Group, KOBELCO COMPRESSORS CORPORATION, Elliott Group, Kirloskar Pneumatic Co Ltd, Danfoss, Baker Hughes Company, Sulzer Ltd., Siemens AG, BOGE KOMPRESSOREN, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Atlas Copco AB

- Camfil

- Hitachi, Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Kaeser Kompressoren, Inc.

- FS-Curtis

- Ingersoll Rand Inc.

- Doosan Group

- KOBELCO COMPRESSORS CORPORATION

- Elliott Group

- Kirloskar Pneumatic Co Ltd

- Danfoss

- Baker Hughes Company

- Sulzer Ltd.

- Siemens AG

- BOGE KOMPRESSOREN

- Other Key Players