Europe Steel Piling Market by Product Type (Sheet Piles, Pipe Pile, H-Pile, and Others), By Material Type (Hot-rolled Steel Piling, and Cold-formed Steel Piling), By Application (Buildings And Construction, Infrastructure, Marine Construction, and Other Applications) By Countries and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2025

- Report ID: 140756

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

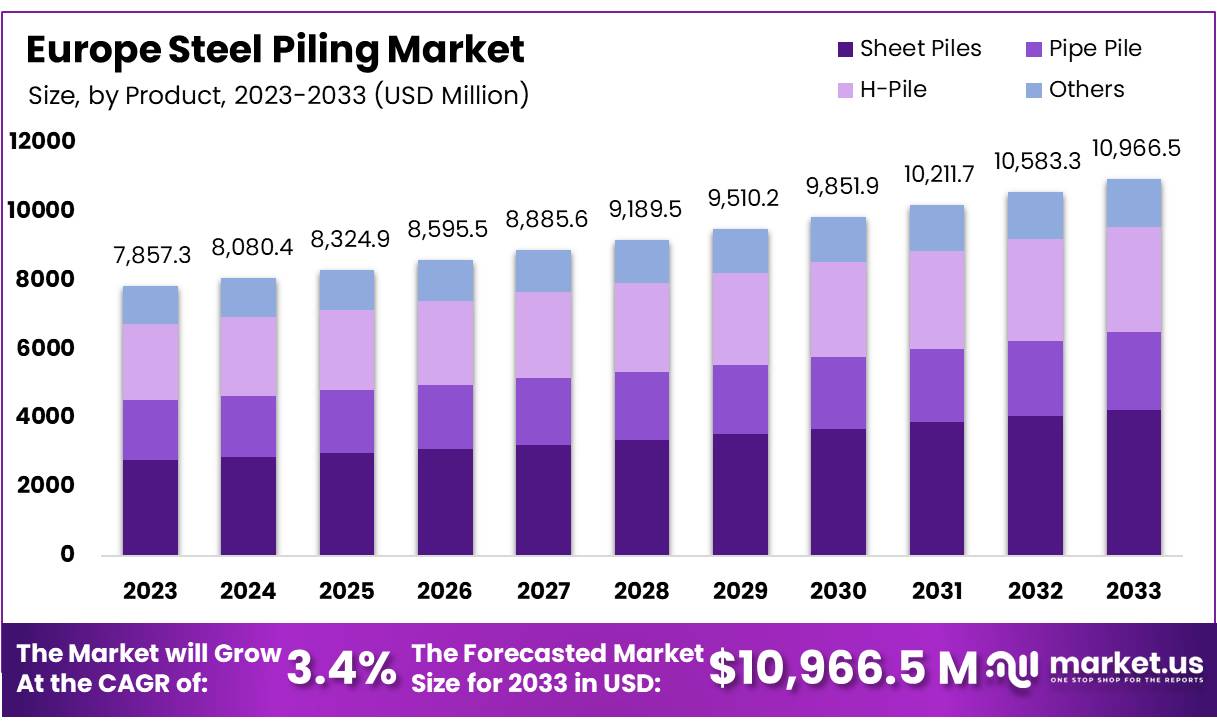

Europe Steel Piling Market size is expected to be worth around USD 10,966.5 Million by 2033, from USD 7,857.3 Million in 2023, growing at a CAGR of 3.45% during the forecast period from 2024 to 2033.

In the construction industry, steel piles have become essential for ensuring stability and structural integrity across a range of projects. These structural components, composed of steel, are driven into the ground to support structures such as buildings, bridges, and other infrastructure. Their adaptability, durability, and significant load-bearing capacity render them a preferred choice for numerous construction applications.

Several factors are driving growth in the European steel piling market. The increasing demand for infrastructure development across the region is a primary driver. Europe’s emphasis on urban redevelopment, expansion of transportation networks, and the need for enhanced coastal defenses are fueling the demand for robust foundation solutions.

Additionally, the push for sustainability and the adoption of eco-friendly construction practices are encouraging the use of steel piles due to their recyclability and long service life. Steel piles can be manufactured from recycled materials and are removable, contributing to their environmental appeal.

Key Takeaways

- The Europe Steel Piling Market was valued at USD 7,857.3 Million in 2023.

- The Europe Steel Piling Market is projected to reach USD 10,966.5 Million by 2033.

- Among steel piling products, the sheet pile type held the majority of the revenue share at 35.3%.

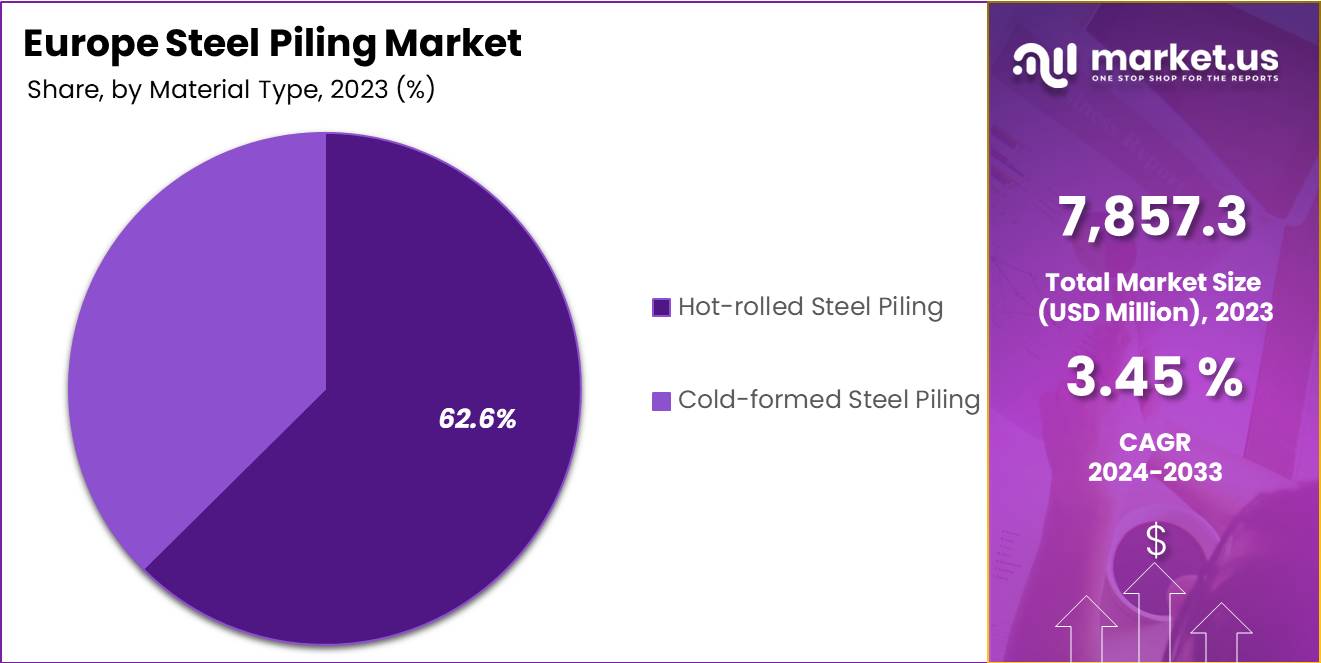

- Based on material type, hot-rolled steel piling accounted for the largest market share with 62.6%.

- Among applications, infrastructure accounted for the majority of the Steel Piling market share with 37.4%.

Product Type Analysis

Sheet Piles Held The Major Share Owing To Its Effective Usage And Versatility

The European steel piling market is segmented based on type into sheet piles, pipe piles, h-piles, and others. Among these, the sheet piles type held the majority of revenue share in 2023, with a market share of 35.3%. Sheet piles are highly versatile and effective for both temporary and permanent structures. They are commonly used in the construction of retaining walls, land reclamation, and flood defense systems. Their ability to be driven into almost any type of soil and their effectiveness in water-retaining structures make them a preferred choice for a variety of construction projects.

Moreover, there is a wide availability of different sizes and profiles of sheet piles across Europe, which allows for flexibility in design and application, catering to the specific needs of various construction projects. Steel sheet piles are environmentally friendly as they are often manufactured from recycled steel and are fully recyclable at the end of their lifecycle. This aligns with the increasing environmental regulations and the push for sustainable construction practices across Europe.

Material Type Analysis

Hot-rolled Steel Dominated the European Steel Piling Market

Based on products, the market is segmented into hot-rolled steel piling and cold-formed steel piling. Among these products, hot-rolled steel piling accounted for the majority of the market share with 62.6%. This dominance can be traced back to several intrinsic advantages of the hot-rolling process and the attributes of the products it yields. Firstly, structural integrity plays a pivotal role. Hot-rolled steel piles are produced at high temperatures, which allows the steel to be shaped and sized without any loss of strength.

This process alters the grain structure, enhancing the toughness and durability of the piles. These characteristics are essential for applications where structural stability and longevity are critical, such as foundational supports for buildings and bridges. Furthermore, the economical scale of production associated with hot-rolled steel piling contributes to its market dominance. The process is generally more economical for large-scale production runs, offering lower per-unit costs compared to cold-formed alternatives. This cost efficiency makes hot-rolled steel piling a more attractive option for large projects with stringent budget considerations.

Installation efficiency also enhances the appeal of hot-rolled steel piling. These piles are typically easier to splice and can be driven into hard ground conditions more effectively than their cold-formed counterparts. The ability to withstand rigorous driving forces without deformation is a critical factor in their widespread use in geotechnical challenging environments.

Application Analysis

Owing to the Critical Structural Support of Steel Piles, It Is Majorly Used in Infrastructure Sector

The steel piling market in Europe was further categorized based on applications such as buildings & construction, infrastructure, marine construction, and other applications. Among these, infrastructure accounted for the largest market share of 37.4% as of 2023. This significant share is primarily driven by the critical role that steel piling plays in infrastructure projects, which encompass a wide range of substantial and essential constructions such as bridges, roads, tunnels, and transportation systems. Infrastructure projects often require deep foundational support that can bear heavy loads and withstand harsh environmental conditions.

Steel piles, particularly those used in infrastructure, are designed to provide the necessary stability and strength for such demanding applications. Their capacity to handle the structural loads of large-scale infrastructure projects makes them indispensable in this sector. Infrastructure projects are investments meant to last decades, and the durability of steel piling ensures the longevity of these constructions. Steel piles are resistant to decay, pests, and environmental factors such as corrosion, especially when treated or coated, which makes them ideal for use in environments exposed to water, such as bridges and waterfronts. The combination of these factors—structural necessities, durability, economic benefits, technological advancements, and supportive policies—culminates in the preeminent role of steel piling in the infrastructure sector, underpinning its dominant market share in this category.

Key Market Segments

By Product Type

- Sheet Piles

- Pipe Pile

- H-Pile

- Others

By Material Type

- Hot-rolled Steel Piling

- Cold-formed Steel Piling

By Application

- Buildings & Construction

- Infrastructure

- Roads and highways

- Bridges

- Other Infrastructures

- Marine Construction

- Ports and harbors

- Waterways and canals

- Other Marine Constructions

- Other Applications

Drivers

Infrastructure Development and Renovation Is Anticipated to Boost Europe’s Market Growth

Much of Europe’s infrastructure, including bridges, roads, and railways, is aging and requires extensive renovation to meet current safety and efficiency standards. This renovation often involves the replacement of old piling with new, high-quality steel piling that can ensure the structural integrity and longevity of these critical assets. The ongoing need to upgrade infrastructure not only secures immediate demand for steel piling but also supports long-term market growth as governments allocate substantial budgets to these projects.

- The European Commission has selected 134 transport projects to receive over €7 billion in EU grants through the Connecting Europe Facility (CEF), the EU’s strategic investment instrument for infrastructure. This allocation marks the largest call under the current CEF Transport program.

In response to economic slowdowns, European governments have launched infrastructure initiatives as part of broader economic stimulus measures. These projects often receive significant funding, both from national budgets and European Union (EU) grants, aimed at enhancing regional connectivity and economic stability. Such financial backing not only drives the construction of new infrastructure but also the rehabilitation of existing facilities, thereby boosting the steel piling market. Overall, the synergy between infrastructure development, renovation efforts, regulatory frameworks, technological advancements, and economic policies is set to substantially elevate the demand for steel piling in Europe, thus catalyzing market growth.

Restraints

Fluctuating Steel Prices May Hinder Market Growth to A Certain Extent

Fluctuating steel prices represent a significant challenge that may hinder the growth of the steel piling market in Europe to a certain extent. Steel, as the primary raw material for piling products, has a pricing dynamic influenced by a multitude of global economic factors including supply chain disruptions, changes in demand in major markets, trade policies, and geopolitical events. These fluctuations can lead to uncertainty and potential volatility in the steel piling market.

Volatile steel prices complicate budgeting and financial planning for both manufacturers and consumers of steel piles. Projects that rely on steel piling often have fixed budgets and timelines; significant variations in material costs can lead to project delays, increased costs, or even the need to reevaluate project feasibility. This unpredictability can deter new investments and delay ongoing projects, directly impacting the growth of the steel piling market. Fluctuating prices can strain the supply chain. Suppliers may hesitate to stockpile material in a volatile market, leading to shortages and delays when prices are high.

Conversely, oversupply can occur when market participants anticipate a price increase that does not materialize, leading to increased holding costs and reduced profitability for suppliers and manufacturers. While the demand for steel piling is supported by robust infrastructure development, fluctuating steel prices pose a significant risk that can hinder market growth. The ability of market participants to manage these price risks through strategic sourcing, hedging, or contractual adjustments will be crucial in mitigating the impact of price volatility on the steel piling market.

Opportunity

Adoption of Green and Sustainable Construction Practices Creates Lucrative Opportunities in the Market

The adoption of green and sustainable construction practices presents lucrative opportunities for growth in the steel piling market, particularly within the context of increasing environmental concerns and regulatory pressures to minimize ecological footprints. As Europe intensifies its focus on sustainability, steel piling is well-positioned to capitalize on these emerging trends due to its inherent environmental benefits and adaptability to innovative construction methodologies. Steel is highly recyclable, with the ability to be reused without degradation of its properties. The life cycle of steel piles can be extended beyond their initial project, through either direct reuse in new construction or recycling into new steel products. This aligns with circular economy principles, reducing waste and the need for raw materials, which enhances the sustainability credentials of projects utilizing steel piling.

Many regions in Europe are implementing stringent green building standards that require the use of materials and processes with lower environmental impacts. Steel piling can help projects achieve higher ratings under these standards due to its durability, recyclability, and efficiency. For example, the use of steel piles in foundations can contribute to LEED or BREEAM certification points, making it an attractive option for developers aiming to meet these criteria. The shift towards green and sustainable construction practices is not just reshaping industry standards but also opening new avenues for growth and innovation in the steel piling market. Companies that embrace these practices can enhance their market positioning, meet regulatory requirements, and contribute to a more sustainable future.

Trends

Increased Use of Recycled Steel Is Influencing the Market

The increased use of recycled steel is significantly influencing the steel piling market, aligning with broader environmental goals and sustainability practices. This shift towards recycled materials is driven by the need to reduce carbon footprints, conserve natural resources, and respond to regulatory and societal pressures for more sustainable construction practices. The use of recycled steel dramatically reduces the demand for virgin iron ore, decreasing the environmental degradation associated with mining. Furthermore, recycling steel consumes less energy and produces fewer carbon emissions compared to the production of new steel from raw materials. These environmental benefits are pivotal in meeting the construction industry’s sustainability targets and complying with international environmental standards such as ISO 14001.

The increased use of recycled steel is reshaping the steel piling market by offering environmental, economic, and supply chain benefits. This trend not only supports sustainable construction initiatives but also creates competitive advantages for companies in the market, promoting broader adoption and innovation in steel piling applications.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impacted the Growth of the Steel Piling Market In Europe

Geopolitical conflicts and sanctions have led to disruptions in the supply of raw materials and finished steel products. Countries heavily reliant on imports from affected regions have experienced shortages, delays, and increased costs. These disruptions have particularly impacted the availability of specific types of steel piling products, forcing companies to seek alternative suppliers and adjust their procurement strategies, often at a higher cost. The instability caused by geopolitical tensions has contributed to significant fluctuations in steel prices.

Uncertainty regarding future supply conditions and the imposition of tariffs and trade barriers have led to speculative trading and price hikes. For the steel piling industry, this volatility complicates budgeting and financial planning, making it challenging for companies to price their projects competitively. The uncertainties generated by geopolitical tensions have led to a cautious approach from investors and stakeholders, resulting in delayed decisions on infrastructure and construction projects. This hesitancy affects the demand for steel piling, as new projects are postponed and the expansion of existing projects is slowed.

Key Countries Covered

- Europe

- Germany

- France

- K.

- Italy

- Spain

- Russia & CIS

- Denmark

- Sweden

- Norway

- Finland

- Rest of Europe

Market Players In the Europe Steel Piling Industry Are Developing Through Various Strategies

Companies are continuously improving the technical specifications of steel piling products to enhance performance under diverse environmental conditions and load requirements. This includes the development of lighter, stronger, and more corrosion-resistant steel grades. Companies are continuously improving the technical specifications of steel piling products to enhance performance under diverse environmental conditions and load requirements. This includes the development of lighter, stronger, and more corrosion-resistant steel grades.

Major companies are forming joint ventures with local firms allowing companies to leverage local market knowledge and networks, facilitating smoother entry into new markets. Moreover, they are acquiring smaller players or complementary businesses that can quickly enhance product lines, technological capabilities, and market share.

Market Key Players

Companies are expanding their operational footprint to new geographic regions to tap into emerging markets. This often involves setting up new manufacturing facilities or distribution channels in strategically important locations. There is a growing emphasis on reducing the environmental impact of production processes and products. This includes increasing the use of recycled materials and investing in energy-efficient technologies.

The following are some of the major players in the industry

- ArcelorMittal

- Nippon Steel Corporation

- ThyssenKrupp AG

- JFE Steel Corporation

- Nucor Corporation

- Salzgitter AG

- SSAB AB

- Tata Steel Europe

- Meever & Meever

- Vítkovice Steel

- SteelWall ISH GmbH

- Other Key Players

Recent Development

- In April 2024, a novel design approach for reinforcing and upgrading existing flood protection systems with steel sheet piles can result in savings of up to 40%.

- In September 2022, Union contractors Beaver Construction and Goettle both received contracts for piling work at the Nucor Steel site in Mason County, West Virginia.

Report Scope

Report Features Description Market Value (2023) USD 7,857.3 Mn Forecast Revenue (2033) USD 10,966.5 Mn CAGR (2024-2033) 3.45% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sheet Piles, Pipe Piles, H-Pile, and Others), By Material Type (Hot-rolled Steel Piling, Cold-formed Steel Piling), By Application (Buildings & Construction, Infrastructure, Marine Construction, and Other Applications) Country Analysis Europe – Germany, France, U.K., Italy, Spain, Russia & CIS, Denmark, Sweden, Norway, Finland, and Rest of Europe Competitive Landscape ArcelorMittal, Nippon Steel Corporation, ThyssenKrupp AG, JFE Steel Corporation, Nucor Corporation, Salzgitter AG, SSAB AB, Tata Steel Europe, Meever & Meever, Vítkovice Steel, SteelWall ISH GmbH, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF)

-

-

- ArcelorMittal

- Nippon Steel Corporation

- ThyssenKrupp AG

- JFE Steel Corporation

- Nucor Corporation

- Salzgitter AG

- SSAB AB

- Tata Steel Europe

- Meever & Meever

- Vítkovice Steel

- SteelWall ISH GmbH

- Other Key Players