Coated Steel Market Report By Product Type (Fluoropolymers, Polyurethanes, Polyester, Plastisol, Siliconized Polyester, Others), By Process (Coil, Extrusion, Hot Dip Galvanizing), By Form (Liquid, Powder), By End-Use (Building & Construction, Automotive, Consumer Goods & Appliances, Protective and Marine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121231

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

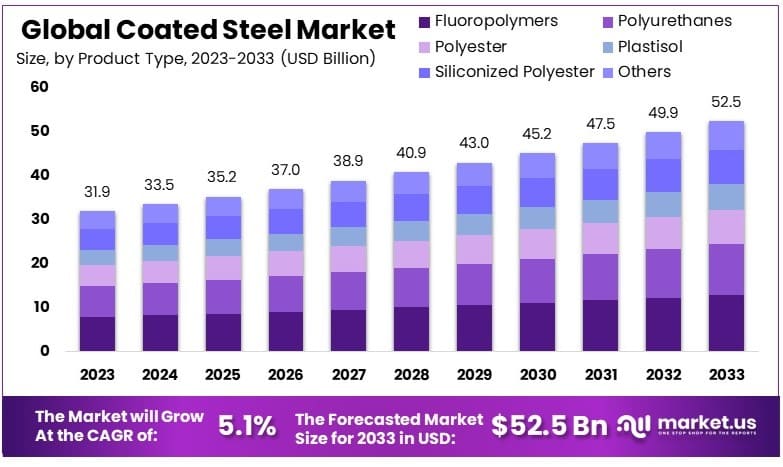

The Global Coated Steel Market size is expected to be worth around USD 52.5 Billion by 2033, from USD 31.9 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The coated steel market focuses on the production and application of steel coated with protective or decorative layers, such as zinc, paint, or polymers. This market caters to construction, automotive, appliances, and packaging industries.

The demand is driven by the need for corrosion-resistant, durable, and aesthetically appealing materials. Key players include steel manufacturers and coating technology companies. Technological advancements in coating methods and the rise of eco-friendly coatings are significant trends. The coated steel market is essential for enhancing the longevity and performance of steel products across various industries.

The Coated Steel market is set to experience robust growth, driven by the rapid urbanization and substantial infrastructure investment needs. By 2050, it is projected that 70% of the global population will reside in cities, up from the current 55%. This urban expansion necessitates extensive construction and infrastructure development, significantly boosting the demand for coated steel.

The global infrastructure investment gap highlights this opportunity. The Global Infrastructure Outlook estimates that the world requires $94 trillion in infrastructure investment by 2040. However, the current investment trend stands at $79 trillion, leaving a substantial $15 trillion gap. This shortfall underscores the urgent need for increased spending on infrastructure projects, which in turn fuels the coated steel market.

Moreover, infrastructure spending as a percentage of GDP varies significantly across countries. The United States ranks 13th globally, investing 2.4% of its GDP in infrastructure. This is relatively low compared to countries like China, which invests 5.1%, Indonesia at 4.1%, and Australia at 3.6%. To bridge the infrastructure gap and support urban growth, an increase in investment is anticipated, further driving demand for coated steel.

Coated steel’s durability, corrosion resistance, and aesthetic appeal make it a preferred material in construction and infrastructure projects. Its applications range from buildings and bridges to roads and railways, ensuring its critical role in future developments.

In conclusion, the coated steel market is poised for significant growth, driven by rapid urbanization and the pressing need for infrastructure investment. The substantial global infrastructure investment gap and the anticipated rise in urban populations underscore the critical role of coated steel in meeting future construction and infrastructure demands.

Key Takeaways

- Market Value: The Coated Steel Market is projected to grow from USD 31.9 billion in 2023 to USD 52.5 billion by 2033, at a CAGR of 5.1%.

- Product Type Analysis: Fluoropolymers dominate with 24.6%, due to their superior properties and wide-ranging applications.

- Process Analysis: Coil coating leads with 45.2%, favored for its efficiency and high-quality output.

- Form Analysis: Liquid form dominates with 72.6%, preferred for its versatility and ease of application.

- End-Use Analysis: Building & construction leads with 42.9%, driven by high demand for durable and corrosion-resistant materials.

- Dominant Region: APAC leads with 38.7% market share, fueled by extensive industrial and construction activities.

- High Growth Region: North America holds a 25.4% market share, supported by advancements in manufacturing and infrastructure projects.

- Analyst Viewpoint: The Coated Steel Market is thriving due to its critical role in various demanding applications, from construction to automotive manufacturing. The dominance of fluoropolymer and coil coating technologies highlights the industry’s focus on durability and efficiency. The market is highly competitive with a focus on innovation in coating technologies to meet environmental standards and performance requirements.

Driving Factors

Urbanization and Infrastructure Development Drives Market Growth

The rapid urbanization and infrastructure development across the globe are driving the demand for coated steel. Coated steel is widely used in residential and commercial constrution, bridges, and transportation infrastructure. The corrosion resistance and durability of coated steel make it an ideal choice for these applications. For instance, galvanized steel is commonly used in reinforced concrete structures, ensuring long-lasting protection against environmental factors. The global construction sector is expected to grow at a CAGR of 5.4% from 2021 to 2026, significantly boosting the coated steel market. Urbanization increases the need for robust and long-lasting materials, further accelerating demand.

Additionally, infrastructure projects like roads, railways, and airports require extensive use of coated steel due to its strength and longevity. Emerging economies in Asia-Pacific, such as China and India, are investing heavily in infrastructure development, contributing to the coated steel market’s expansion. As cities expand and new construction projects emerge, the coated steel market is set to benefit from the heightened activity in the construction and infrastructure sectors.

Automotive Industry Growth Drives Market Expansion

The automotive industry is a significant consumer of coated steel products, primarily for body panels, structural steel, and various automotive parts. As the demand for vehicles continues to rise, particularly in emerging economies, the need for coated steel increases correspondingly. Coated steel offers superior corrosion resistance, enhancing the longevity and aesthetic appeal of vehicles.

Moreover, the shift towards electric vehicles (EVs) also contributes to the demand for coated steel. EVs require lightweight yet durable materials, making coated steel an ideal choice. The growing automotive sector in countries like China, India, and Brazil further stimulates market growth. Coated steel’s ability to withstand harsh environmental conditions makes it essential for automotive manufacturers aiming to produce long-lasting and high-quality vehicles. The intertwined growth of the automotive industry and the coated steel market highlights the importance of coated steel in vehicle manufacturing and longevity.

Renewable Energy Sector Expansion Drives Market Growth

The global transition towards renewable energy sources, such as solar and wind power, has created a substantial demand for coated steel. Solar panel mounting structures and wind turbines often utilize coated steel for its strength and resistance to environmental conditions. The growing investment in renewable energy projects worldwide is expected to drive the coated steel market.

In addition, government initiatives and policies promoting renewable energy further boost the demand for coated steel. Countries like the United States, Germany, and China are investing heavily in renewable energy infrastructure, which requires robust and durable materials like coated steel. The synergy between renewable energy projects and the need for durable construction materials ensures the coated steel market’s growth. As the renewable energy sector expands, the demand for coated steel will continue to rise, driven by the need for reliable and long-lasting infrastructure solutions.

Restraining Factors

Environmental Concerns and Regulations Restrain Market Growth

The coated steel manufacturing process involves various chemicals and coatings, some of which have environmental implications. Stringent environmental regulations and concerns over the ecological impact of certain coating materials can restrain market growth. Manufacturers face challenges in complying with evolving regulations, leading to increased production costs and potential supply disruptions.

For instance, the European Union’s REACH regulation imposes strict controls on the use of hazardous substances, affecting the coated steel industry. Compliance with such regulations often requires investing in environmentally friendly technologies, which can be costly and time-consuming. These additional costs can reduce the profitability of manufacturers and slow market expansion.

Raw Material Price Volatility Restrains Market Growth

The coated steel market heavily depends on the availability and pricing of raw materials such as iron ore, coal, zinc, aluminum, and chromium. Price fluctuations and supply disruptions of these raw materials can significantly impact production costs and profitability. For example, the price of iron ore increased by over 70% in 2021, causing cost pressures on coated steel manufacturers.

Volatile prices make it difficult for manufacturers to maintain stable production costs, thereby restraining market growth. Additionally, supply chain disruptions, like those seen during the COVID-19 pandemic, further exacerbate these challenges. As a result, manufacturers may struggle to meet demand, leading to potential market stagnation.

Product Type Analysis

Fluoropolymers dominate with 24.6% due to their superior properties and widespread applications.

In the Coated Steel Market, the product type segment includes various types of coatings such as fluoropolymers, polyurethanes, polyester, plastisol, siliconized polyester, and others. Among these, fluoropolymers are the dominant sub-segment, holding a market share of 24.6%. Fluoropolymers are known for their exceptional resistance to chemicals, UV radiation, and extreme weather conditions. These properties make them ideal for use in harsh environments, including industrial applications and infrastructure projects. The durability and low maintenance requirements of fluoropolymer coatings contribute significantly to their popularity, driving demand in the coated steel market.

Fluoropolymers’ resistance to corrosion and their ability to maintain their properties over a wide temperature range make them suitable for various applications, including building exteriors, industrial facilities, and automotive components. This versatility is a key factor in their dominance in the coated steel market. Additionally, advancements in fluoropolymer technology have led to the development of more efficient and environmentally friendly coatings, further boosting their market share.

Polyurethanes, another significant sub-segment, are widely used for their flexibility, durability, and aesthetic appeal. They are commonly applied in automotive parts, consumer goods, and construction materials. The demand for polyurethane coatings is driven by their ability to provide a smooth finish and resistance to abrasion, chemicals, and weathering. However, they hold a smaller market share compared to fluoropolymers due to their relatively lower performance in extreme conditions.

Polyester coatings are also important in the market, known for their cost-effectiveness and good overall performance. They are extensively used in the construction industry, particularly for roofing and siding materials. Despite their widespread use, polyester coatings are less durable than fluoropolymers and polyurethanes, which limits their market share.

Plastisol coatings are used for their excellent adhesion and flexibility. They are commonly applied in consumer goods, automotive parts, and building materials. Their use is somewhat limited by their lower resistance to UV radiation and chemicals compared to fluoropolymers and polyurethanes.

Siliconized polyester coatings offer a balance between cost and performance, providing good durability and aesthetic qualities. They are used in various applications, including metal roofing and siding. However, their market share is smaller due to competition from more durable coatings like fluoropolymers.

The “others” category includes various specialty coatings used in niche applications. While these coatings have unique properties that make them suitable for specific uses, their overall market share is relatively small compared to the dominant sub-segments.

Process Analysis

Coil dominates with 45.2% due to its efficiency and high-quality output.

The coated steel market can be segmented by the process used to apply the coating, including coil, extrusion, and hot dip galvanizing. Among these, the coil coating process is the dominant sub-segment, with a market share of 45.2%. Coil coating is a highly automated process that involves applying a coating to a continuous strip of metal before it is fabricated into end products. This method is known for its efficiency, high-quality output, and ability to produce uniform coatings.

The coil coating process is favored in the industry due to its ability to handle large volumes and produce coated steel with consistent thickness and appearance. It is widely used in the building and construction sector for products such as roofing, siding, and panels. The automotive industry also utilizes coil-coated steel for body panels and structural components, benefiting from the process’s precision and quality control.

Extrusion coating is another significant sub-segment, where the coating material is applied to the steel substrate through an extrusion process. This method is commonly used for applications that require thick coatings and complex shapes. While extrusion coating offers advantages in specific applications, it is less efficient than coil coating for large-scale production, which limits its market share.

Hot dip galvanizing involves immersing steel in molten zinc to form a protective coating. This process is known for its excellent corrosion resistance and durability, making it ideal for outdoor and marine applications. However, hot dip galvanizing is generally more labor-intensive and less automated than coil coating, which reduces its overall market share despite its significant use in infrastructure projects.

Form Analysis

Liquid dominates with 72.6% due to its versatility and ease of application.

The coated steel market can also be segmented by the form of the coating, including liquid and powder. Liquid coatings are the dominant sub-segment, with a market share of 72.6%. Liquid coatings are highly versatile and can be applied using various methods such as spraying, brushing, and dipping. This flexibility makes them suitable for a wide range of applications, from large industrial projects to small consumer goods.

Liquid coatings offer several advantages, including ease of application, excellent adhesion, and the ability to form smooth, even layers. These properties make them ideal for use in the building and construction industry, automotive sector, and consumer goods manufacturing. The high market share of liquid coatings is also attributed to their ability to provide superior protection against corrosion and environmental factors.

Powder coatings, on the other hand, are applied as a free-flowing, dry powder and then cured under heat to form a hard, durable finish. While powder coatings offer benefits such as reduced environmental impact and lower application costs, they are less versatile than liquid coatings in terms of application methods and surface finish options. Consequently, powder coatings hold a smaller market share compared to liquid coatings.

End-Use Analysis

Building & Construction dominates with 42.9% due to high demand for durable materials.

The coated steel market can be segmented by end-use industries, including building and construction, automotive, consumer goods and appliances, protective and marine, and others. Among these, the building and construction industry is the dominant sub-segment, with a market share of 42.9%. The demand for durable, corrosion-resistant materials in the construction of residential and commercial buildings, infrastructure projects, and industrial facilities drives the growth of the coated steel market in this sector.

Coated steel is widely used in roofing materials, siding, structural components, and architectural applications due to its strength, durability, and low maintenance requirements. The construction industry’s ongoing expansion, particularly in emerging economies, contributes to the high demand for coated steel. Additionally, the trend towards sustainable and energy-efficient building materials further boosts the market for coated steel products in the construction sector.

The automotive industry is another significant end-use segment, driven by the need for high-quality, corrosion-resistant materials for vehicle manufacturing. Coated steel is used in body panels, structural components, and various automotive parts, contributing to the overall performance and longevity of vehicles. The growth of the automotive sector, particularly in developing regions, supports the demand for coated steel.

Consumer goods and appliances represent a smaller but important segment, where coated steel is used in the manufacture of household appliances, furniture, and other consumer products. The demand for aesthetically pleasing, durable materials in this sector drives the market for coated steel.

The protective and marine segment includes applications in marine environments, oil and gas, and other industries requiring high corrosion resistance. While this segment is smaller than the building and construction and automotive sectors, it plays a crucial role in specific applications where the performance of coated steel is critical.

Key Market Segments

By Product Type

- Fluoropolymers

- Polyurethanes

- Polyester

- Plastisol

- Siliconized Polyester

- Others

By Process

- Coil

- Extrusion

- Hot Dip Galvanizing

By Form

- Liquid

- Powder

By End-Use

- Building & Construction

- Automotive

- Consumer Goods & Appliances

- Protective and Marine

- Others

Growth Opportunities

Innovative Coating Technologies Offer Growth Opportunity

The development of advanced coating technologies presents growth opportunities for the coated steel market. Innovative coatings with improved corrosion resistance, self-healing properties, and enhanced durability can expand the applications of coated steel in various industries.

For example, self-healing coatings have the ability to repair minor scratches and damages, prolonging the lifespan of coated steel products. This innovation not only enhances the product’s value but also reduces maintenance costs for end-users. The market for advanced coatings is expected to grow at a CAGR of 5.6% from 2023 to 2033, driven by the increasing demand for high-performance materials in construction, automotive, and industrial sectors.

Sustainability and Recycling Initiatives Offer Growth Opportunity

As sustainability becomes a global priority, there is an increasing focus on recycling and reusing steel products. Coated steel can be recycled multiple times without compromising its properties, making it an environmentally friendly choice.

Manufacturers can capitalize on this trend by promoting the sustainability benefits of coated steel and incorporating recycled materials into their production processes. The global push towards a circular economy is expected to boost the demand for sustainable materials. In 2020, the recycling rate for steel in the U.S. was over 88%, highlighting the potential for growth in the coated steel market through sustainability initiatives.

Trending Factors

Lightweight and High-strength Coated Steel Are Trending Factors

The demand for lightweight and high-strength coated steel is increasing, particularly in the automotive industry, where fuel efficiency and emissions reduction are crucial considerations. Manufacturers are developing advanced coated steel products that offer superior strength-to-weight ratios, enabling weight reduction while maintaining structural integrity.

This trend is driven by the need to produce lighter vehicles that consume less fuel and emit fewer pollutants. The global automotive lightweight materials market is projected to grow at high CAGR from 2023 to 2033, underscoring the significance of lightweight coated steel in this sector.

Smart Coatings and Intelligent Monitoring Are Trending Factors

The integration of smart coatings and intelligent monitoring systems is an emerging trend in the coated steel market. These coatings can detect and monitor corrosion, temperature, and other environmental factors, providing real-time data for predictive maintenance and optimized asset management.

Smart coatings enhance the durability and functionality of coated steel products, making them more attractive for high-tech applications.

Regional Analysis

APAC Dominates with 38.7% Market Share

The Asia-Pacific (APAC) region dominates the coated steel market with a 38.7% market share. This dominance is driven by rapid industrialization and urbanization, particularly in China and India. These countries have large construction and automotive industries, which are major consumers of coated steel. Additionally, government infrastructure projects and investments in renewable energy contribute to the high demand. The presence of major manufacturers and low production costs also support the market’s growth in this region.

The characteristics of the APAC region significantly impact the coated steel market’s performance. The fast-paced economic development and increasing disposable income in countries like China, India, and South Korea boost construction activities and vehicle production. The region’s large population and growing urban areas create a sustained demand for housing and infrastructure, which in turn drives the coated steel market. Moreover, the expansion of manufacturing facilities and export-oriented policies further enhance the market dynamics.

North America holds a 25.4% market share. The market is driven by advanced automotive and construction industries. The region benefits from high investments in infrastructure and technological advancements. The market is expected to grow at a CAGR of 4.8% from 2021 to 2026.

Europe has a 22.3% market share. Strong industrial base, automotive sector, and focus on sustainable building materials drive the market. Germany, France, and the UK are key contributors. The market is projected to grow at a CAGR of 5.1% from 2021 to 2026.

Middle East & Africa account for 8.9% market share. Infrastructure development and growing construction activities in countries like UAE and Saudi Arabia drive demand. The market is anticipated to grow at a CAGR of 5.7% from 2021 to 2026.

Latin America holds a 4.7% market share. Brazil and Mexico are leading contributors due to their construction and automotive industries. The market is expected to grow at a CAGR of 4.3% from 2021 to 2026.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Coated Steel Market is shaped by key players such as ArcelorMittal, Baosteel Metal Products Co., Ltd, DONGKUKSTEEL MILL CO., LTD., KOBE STEEL, LTD., JSW Steel, Coated Products Limited, SEVERSTAL, BlueScope Steel Limited, ThyssenKrupp Steel Europe, NIPPON STEEL CORPORATION, J. K. Steel Strips LLP, United States Steel Corporation, NLMK, and NSAIL. These companies hold significant market influence due to their strategic positioning, technological advancements, and extensive distribution networks.

ArcelorMittal leads with its global presence and diverse product portfolio, offering high-performance coated steel products. Baosteel Metal Products Co., Ltd excels in innovation and cost-efficiency, driven by advanced manufacturing processes. DONGKUKSTEEL MILL CO., LTD., and KOBE STEEL, LTD. are prominent in the APAC region, leveraging regional demand and technological prowess.

JSW Steel and BlueScope Steel Limited focus on sustainability and eco-friendly coatings, aligning with global environmental trends. SEVERSTAL and ThyssenKrupp Steel Europe are key players in Europe, with strong R&D capabilities and a broad customer base. NIPPON STEEL CORPORATION emphasizes quality and reliability, catering to high-end market segments.

J. K. Steel Strips LLP, United States Steel Corporation, NLMK, and NSAIL are critical to their respective regions, contributing to market growth through innovation and strategic expansions. Collectively, these companies drive the market with competitive strategies, continuous product development, and robust supply chains.

Their efforts in enhancing product quality, expanding production capacities, and adopting sustainable practices ensure a dynamic and competitive market landscape. Each player’s strategic initiatives, such as mergers, acquisitions, and collaborations, further bolster their market positions and influence the overall growth trajectory of the coated steel market.

Market Key Players

- ArcelorMittal

- Baosteel Metal Products Co., Ltd

- DONGKUKSTEEL MILL CO., LTD.

- KOBE STEEL, LTD.

- JSW Steel, Coated Products Limited

- SEVERSTAL

- BlueScope Steel Limited

- ThyssenKrupp Steel Europe

- NIPPON STEEL CORPORATION

- J. K. Steel Strips LLP

- United States Steel Corporation

- NLMK

- NSAIL

Recent Developments

- June 2024: India’s JSW Steel to Invest $60 Million to Expand Coated Alloy Steel Product Capacity JSW Steel plans to invest $60 million to expand its coated alloy steel product capacity, enhancing its market presence in the industry.

- January 2024: Tata Bluescope Steel Introduces Shelter for All Tata Bluescope Steel has launched Shelter for All, a vision aimed at providing color-coated steel solutions for affordable housing and sustainable development.

- March 2024: Consumption of Painted Steel May Grow to 300,000 Tons in 2024 Forecast The consumption of painted steel is expected to reach 300,000 tons in 2024, driven by growing demand for color-coated steel products.

Report Scope

Report Features Description Market Value (2023) USD 31.9 Billion Forecast Revenue (2033) USD 52.5 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fluoropolymers, Polyurethanes, Polyester, Plastisol, Siliconized Polyester, Others), By Process (Coil, Extrusion, Hot Dip Galvanizing), By Form (Liquid, Powder), By End-Use (Building & Construction, Automotive, Consumer Goods & Appliances, Protective and Marine, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ArcelorMittal, Baosteel Metal Products Co., Ltd, DONGKUKSTEEL MILL CO., LTD., KOBE STEEL, LTD., JSW Steel, Coated Products Limited, SEVERSTAL, BlueScope Steel Limited, ThyssenKrupp Steel Europe, NIPPON STEEL CORPORATION, J. K. Steel Strips LLP, United States Steel Corporation, NLMK, NSAIL Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size for coated steel by 2033?The market is expected to reach USD 52.5 billion by 2033, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Which industries are the primary consumers of coated steel?Coated steel finds extensive applications in the construction, automotive, appliances, and packaging industries.

Which regions dominate the coated steel market, and what are the key growth opportunities?The Asia-Pacific region leads the market with 38.7% market share, driven by rapid industrialization and urbanization. Growth opportunities include innovative coating technologies and sustainability initiatives.

Who are the key players in the coated steel market, and what recent developments have occurred?Key players include ArcelorMittal, Baosteel Metal Products Co., Ltd, JSW Steel, and others. Recent developments include investments in capacity expansion and the introduction of sustainable solutions.

Which product types and processes dominate the coated steel market?Fluoropolymers are the dominant product type, while coil coating is the leading process, favored for its efficiency and high-quality output.

-

-

- ArcelorMittal

- Baosteel Metal Products Co., Ltd

- DONGKUKSTEEL MILL CO., LTD.

- KOBE STEEL, LTD.

- JSW Steel, Coated Products Limited

- SEVERSTAL

- BlueScope Steel Limited

- ThyssenKrupp Steel Europe

- NIPPON STEEL CORPORATION

- J. K. Steel Strips LLP

- United States Steel Corporation

- NLMK

- NSAIL