Global Structural Steel Market By Type (Heavy Structural Steel, Light Structural Steel, Rebar), By Application (Residential, Non-Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 20419

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

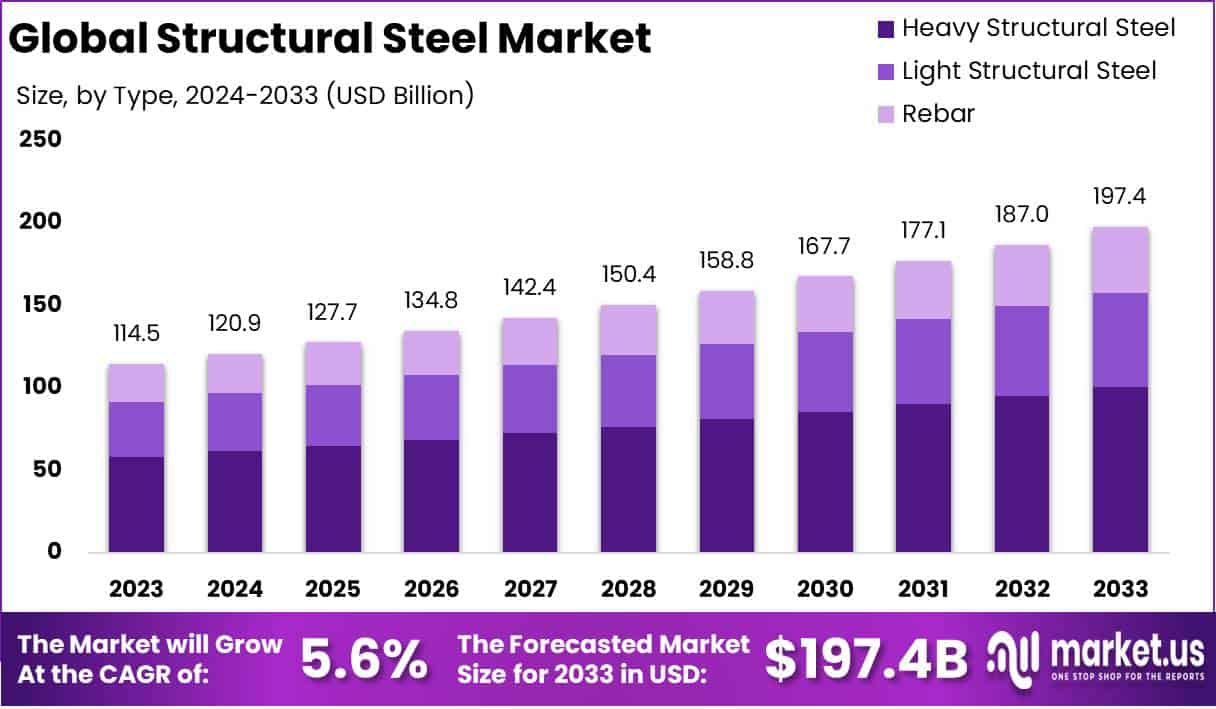

The Global Structural Steel Market size is expected to be worth around USD 197.4 Billion by 2033, from USD 114.5 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Structural steel refers to steel products designed for use in construction, offering high strength, durability, and versatility. It is primarily used in the framework of buildings, bridges, and other infrastructure, ensuring load-bearing capacity and structural integrity.

As a key material in modern construction, structural steel is preferred for its ability to withstand stress and support large-scale architectural designs. The structural steel market encompasses the production, distribution, and application of structural steel products across various sectors, including residential, non-residential, and industrial construction.

It represents a crucial component of the global construction industry, with applications ranging from high-rise buildings to transportation infrastructure and energy projects. As construction activities increase worldwide, particularly in developing regions, the market for structural steel is set for sustained growth.

Growth factors in the structural steel market include expanding urbanization, government infrastructure investments, and a rising focus on sustainable construction practices. The shift towards high-rise buildings, smart cities, and renewable energy facilities requires substantial use of structural steel due to its strength-to-weight ratio, cost-effectiveness, and compliance with building codes.

The Structural steel is robust, driven by the need for infrastructure upgrades in developed markets like North America and Europe, as well as rapid infrastructure expansion in Asia-Pacific and the Middle East. Growing investments in transport, healthcare, and energy projects further amplify this demand, underscoring structural steel’s pivotal role in economic development.

The structural steel market are largely linked to sustainability trends, particularly the adoption of green steel production methods. With global initiatives to reduce carbon emissions, demand for low-carbon and recyclable steel is expected to rise.

Additionally, advancements in manufacturing technologies, such as Building Information Modeling (BIM) and robotics, are enhancing structural steel’s value proposition by improving precision, reducing waste, and supporting faster project completion. These developments not only boost market competitiveness but also position structural steel as a key enabler of sustainable urban development.

According to United States Steel Corporation, Nippon Steel Corporation, Japan’s largest steelmaker, will acquire U.S. Steel in an all-cash transaction valued at $14.9 billion, with a $55.00 per share purchase price representing a 40% premium over U.S. Steel’s closing stock on December 15, 2023.

This acquisition, unanimously approved by both boards, enhances competitive advantages in low-cost iron ore, mini-mill steelmaking, and finishing capabilities.

According to ScienceDirect, structural steel is 100% recyclable and ranks among the most reused materials globally, making it a highly sustainable choice for construction. With a carbon content between 0.1% and 0.3%, this iron-carbon alloy is essential for infrastructure development due to its strength and versatility.

According to Monroe Engineering, structural steel is 1,000 times stronger than iron and among the world’s most recycled materials, reflecting its critical role in sustainable infrastructure development.

The sector, employing over 2 million globally, continues to expand due to increasing demand for resilient and adaptable construction solutions. Notably, steel’s elasticity surpasses that of rubber, further driving its versatility across various industrial applications.

Key Takeaways

- The global structural steel market is projected to grow from USD 114.5 billion in 2023 to USD 197.4 billion by 2033, with a CAGR of 5.6% from 2024 to 2033, driven by rising infrastructure and construction projects globally.

- Heavy Structural Steel dominates the type segment with a 51.1% share in 2023, due to its application in high-load-bearing structures like bridges and industrial facilities.

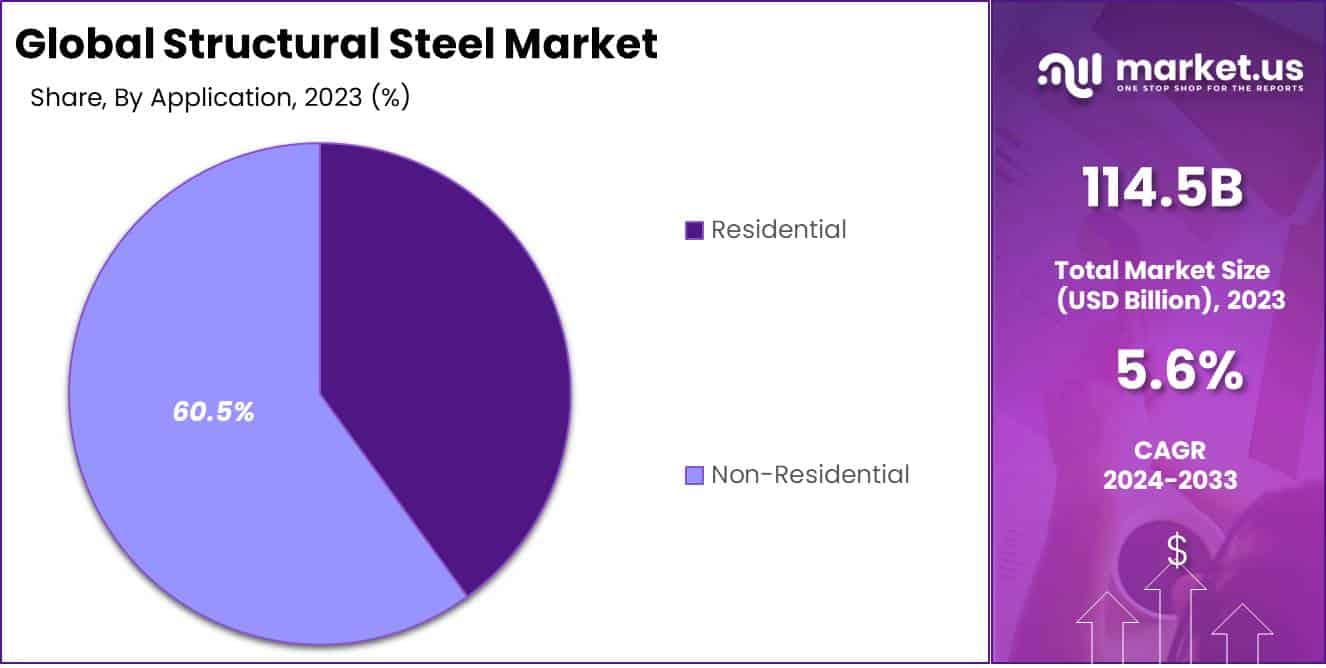

- The Non-Residential sector leads the application segment, capturing a 60.5% share in 2023, driven by commercial, industrial, and public infrastructure projects.

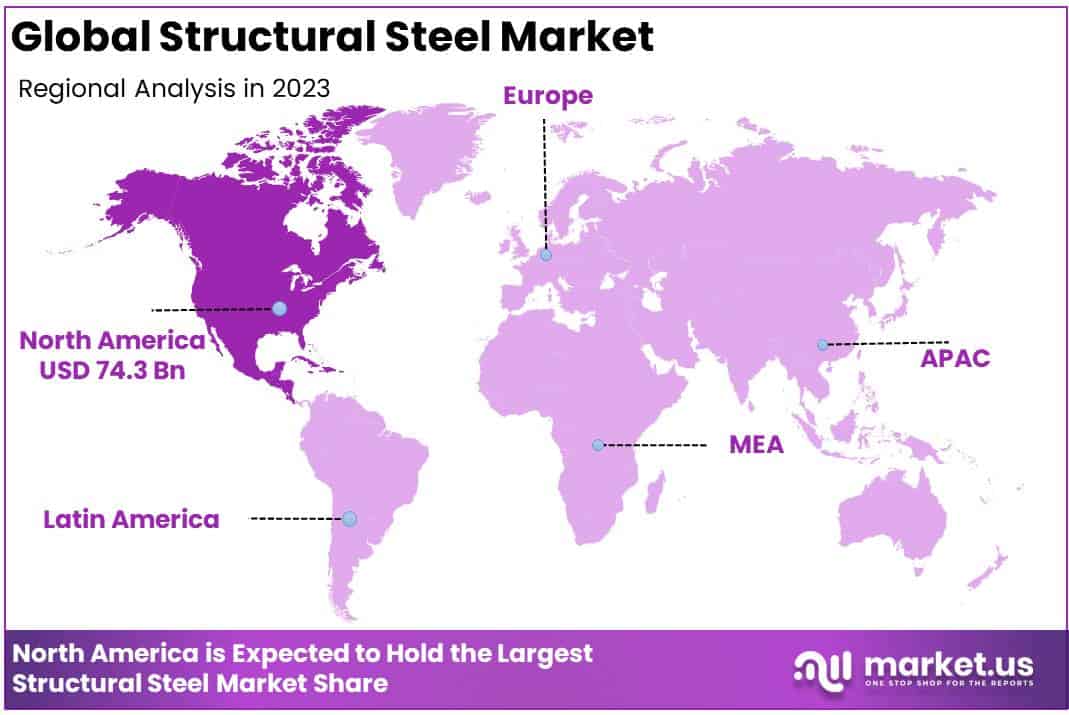

- North America holds the largest regional share at 64.9% in 2023, driven by government infrastructure investments, urban development, and robust residential construction.

By Type Analysis

Heavy Structural Steel Leads Structural Steel Market with 51.1% Share in 2023

In 2023, Heavy Structural Steel held a dominant position in the type segment of the global structural steel market, capturing more than a 51.1% share. This segment’s prominence is largely attributed to its extensive use in high-load-bearing infrastructure projects, such as bridges, industrial facilities, and large commercial buildings.

The demand for heavy structural steel is further driven by government investments in infrastructure renewal, particularly in North America and Asia Pacific, where large-scale urban development and transport infrastructure projects are prevalent. Its superior strength and durability make it indispensable in construction that requires high structural integrity.

Meanwhile, Light Structural Steel represents a significant segment, used predominantly in residential and smaller commercial constructions. This type’s lightweight nature and cost-effectiveness make it ideal for rapid construction projects and modular structures.

While it accounted for a smaller share compared to heavy structural steel, it is witnessing growing adoption due to increasing demand for faster, less labor-intensive building solutions, particularly in emerging markets of the Asia Pacific region.

As a result, this segment is expected to register steady growth, propelled by urbanization trends and the expansion of the real estate sector. The Rebar segment also plays a critical role in the market, driven by its vital use in reinforcing concrete in both residential and non-residential construction.

Rebar demand is notably strong in regions like North America and Europe, where infrastructure rehabilitation and renovation projects are widespread. With the surge in construction activities in developing economies, this segment is anticipated to grow steadily over the coming years.

By Application Analysis

Non-Residential Leads Structural Steel Market with 60.5% Share in 2023

In 2023, the Non-Residential sector held a dominant position in the application segment of the global structural steel market, capturing more than a 60.5% share. This segment’s leadership is fueled by high demand from large-scale infrastructure projects, such as commercial buildings, industrial facilities, and public infrastructure including bridges, airports, and stadiums.

The rise in government spending on infrastructure renewal, particularly in North America and Asia Pacific, is a key driver of this segment’s growth. Additionally, rapid industrialization, urban development, and the construction of energy-efficient commercial spaces contribute to sustained demand for structural steel in non-residential applications.

The Residential segment, while representing a smaller share, is experiencing notable growth driven by increasing urbanization and a surge in housing demand, especially in emerging markets of Asia Pacific and Latin America.

Structural steel’s attributes, including flexibility, safety, and faster construction timelines, make it an appealing choice in residential building projects, particularly for multi-story structures and high-density housing.

The trend toward prefabricated steel structures is further boosting the residential application of structural steel, which is expected to expand steadily in line with urban population growth and the push for affordable housing solutions.

Key Market Segments

By Type

- Heavy Structural Steel

- Light Structural Steel

- Rebar

By Application

- Residential

- Non-Residential

Driver

Expanding Construction Industry

The global construction industry’s rapid expansion, especially in emerging economies, remains a primary driver for the structural steel market. Rising urbanization and increasing infrastructure investments, particularly in Asia-Pacific and the Middle East, are propelling demand. Countries like India and China are leading in infrastructure development, accounting for substantial consumption of structural steel.

For instance, the Indian government plans to invest USD 1.4 trillion in infrastructure over the next five years, targeting smart cities, roads, and railways. Such initiatives drive the need for robust materials like structural steel due to its high strength-to-weight ratio, cost-effectiveness, and sustainability.

Moreover, the shift towards high-rise buildings and complex infrastructure projects globally reinforces structural steel’s pivotal role in construction. Its ability to meet stringent building codes, withstand seismic activities, and offer design flexibility makes it indispensable for modern urban projects.

In developed regions like North America and Europe, efforts to renovate aging infrastructure and build sustainable structures also contribute significantly. These factors combined create a substantial demand pull, positioning the construction sector as a fundamental growth pillar for the structural steel market through 2024.

Restraint

Volatility in Raw Material Prices

The structural steel market faces significant challenges from the volatility of raw material prices, particularly iron ore and scrap metal. Fluctuations in global steel prices, driven by geopolitical tensions, changing trade policies, and supply chain disruptions, have a direct impact on production costs.

In 2023, for example, iron ore prices experienced a 30% surge due to constrained supplies from major exporters like Brazil and Australia, impacting steel manufacturing costs. Such unpredictability can strain profit margins for steel manufacturers, forcing them to adjust pricing or reduce production rates.

The increased cost burden can also lead to hesitancy among construction companies to use structural steel in projects, as developers seek cost-effective alternatives. This scenario is particularly evident in emerging markets where budget constraints are more pronounced.

In addition, stricter environmental regulations on mining and steel production further contribute to cost pressures, as companies are compelled to invest in cleaner technologies. This dynamic, if persistent, could slow the market’s growth trajectory and demand stabilization efforts to maintain competitive pricing.

Opportunity

Adoption of Green Steel Technologies

The structural steel market is witnessing growing opportunities through the adoption of green steel solutions, driven by sustainability demands across industries. Green steel produced with reduced carbon emissions using renewable energy sources aligns with global efforts to achieve carbon neutrality by 2050.

For instance, Europe’s stringent regulations on carbon emissions and the European Green Deal are encouraging manufacturers to invest in low-carbon steel production processes.

Companies like ArcelorMittal and SSAB are advancing green steel technologies, including the use of hydrogen instead of coal in steel production, which significantly lowers CO2 emissions.

The adoption of green steel is gaining momentum in sectors such as automotive, construction, and infrastructure, all of which are under pressure to meet stringent sustainability targets. By offering an eco-friendly alternative, the structural steel market can cater to clients prioritizing sustainable construction practices, thereby unlocking new revenue streams.

As industries increasingly emphasize Environmental, Social, and Governance (ESG) criteria, green steel solutions could become a key differentiator, driving market growth and helping manufacturers secure government subsidies and partnerships for sustainable projects.

Trends

Integration of Advanced Manufacturing Techniques

Technological advancements in steel fabrication are emerging as a significant trend that enhances efficiency and drives market growth. Innovations such as Building Information Modeling (BIM), automation, and robotic welding have streamlined production processes, reducing waste, labor costs, and project timelines.

For instance, the use of BIM allows for precise planning and visualization of structural components, minimizing errors and optimizing material usage. This approach not only reduces costs but also contributes to sustainable construction practices by ensuring minimal waste.

Moreover, robotics and automated welding systems enhance the quality and precision of steel fabrication, making it more suitable for complex architectural designs. These technologies improve overall productivity, enabling faster project execution and reducing downtime.

This trend is particularly strong in developed markets like North America and Europe, where technology adoption is high, but it is also gaining traction in emerging economies as they strive to modernize their infrastructure. By increasing operational efficiency, these technological advancements enhance the competitiveness of structural steel, making it an attractive choice for construction projects globally.

Regional Analysis

Structural Steel Market North America Leads with 64.9% Market Share in 2023

The structural steel market exhibits notable regional variations, with North America leading the industry, commanding a 64.9% share in 2023, equating to approximately USD 74.3 billion. This strong market position is primarily driven by significant investments in infrastructure renewal, urban development, and industrial construction projects.

The U.S. remains the central growth engine within North America, supported by major government initiatives such as the Infrastructure Investment and Jobs Act. The act has stimulated demand across various sectors, including increased residential construction and commercial development.

In the Asia-Pacific region, rapid urbanization, infrastructure expansion, and residential sector growth have accelerated demand for structural steel. China and India emerge as key players, benefiting from large-scale infrastructure projects and expanding steel production capabilities.

The region is projected to experience the fastest growth, spurred by government-backed infrastructure initiatives and manufacturing sector expansion.

Europe also holds a substantial share of the structural steel market, underpinned by investments in sustainable construction, energy-efficient buildings, and transportation infrastructure.

The European Union’s emphasis on carbon emission reduction has encouraged the adoption of advanced, eco-friendly steel production technologies, with Germany, the UK, and France leading the region’s market growth.

In the Middle East & Africa, demand for structural steel is bolstered by large-scale infrastructure projects, especially in countries like the UAE, Saudi Arabia, and South Africa. The market growth here is driven by increased investment in commercial infrastructure, oil and gas projects, and residential development.

Latin America, while experiencing moderate growth, sees demand driven by infrastructure modernization and industrial construction, particularly in Brazil and Mexico. However, market dynamics in the region can be impacted by economic fluctuations and regulatory challenges.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global structural steel market is poised for robust growth, driven by increasing construction activities, rapid urbanization, and infrastructure development projects worldwide. Leading industry players are strategically reinforcing their market positions through expansions, technological innovations, and a strong focus on sustainability.

ArcelorMittal, the market leader, emphasizes low-carbon production and substantial investments in research and development (R&D) to maintain its competitive advantage. Similarly, Nippon Steel Corporation aims to enhance its production capacity and diversify its product offerings through strategic mergers and acquisitions, particularly in emerging markets.

Tata Steel is focusing on digital transformation and sustainable practices, including the use of green hydrogen, while also pursuing opportunities in downstream products to drive growth. South Korean giants POSCO and Hyundai Steel are investing heavily in eco-friendly production technologies, aligning with global decarbonization trends.

In the U.S., United States Steel Corporation and Nucor Corporation are capitalizing on government infrastructure investments and promoting recycled steel production to cater to domestic demand. Meanwhile, JSW Steel Limited and JFE Steel Corporation are expanding capacities in Asia-Pacific, which is witnessing rapid infrastructure growth.

Thyssenkrupp AG is concentrating on innovative solutions, particularly for automotive and construction sectors, fueling demand for specialized structural steel products. Other key players are focusing on strategic collaborations, advanced manufacturing processes, and sustainable initiatives to meet evolving market demands.

In this competitive landscape, sustained growth will hinge on strategic differentiation, sustainability, and technological innovation.

Top Key Players in the Market

- ArcelorMittal

- Nippon Steel Corporation

- Tata Steel

- POSCO

- Hyundai Steel

- United States Steel Corporation

- JSW Steel Limited

- JFE Steel Corporation

- Nucor Corporation

- Thyssenkrupp AG

- Other Key Players

Recent Developments

- In 2023, Nippon Steel Corporation, Japan’s largest steelmaker, and United States Steel Corporation (U.S. Steel), a key U.S. steel producer, announced a definitive agreement for NSC to acquire U.S. Steel. The deal involves an all-cash transaction of $55.00 per share, totaling approximately $14.1 billion in equity value and an overall enterprise value of $14.9 billion, including debt. The offer represents a 40% premium on U.S. Steel’s December 15, 2023, closing stock price. Both companies’ Boards of Directors have unanimously approved the transaction.

- In 2024, Tata Steel partnered with Tenova, an Italian engineering company, to install an electric arc furnace at Tata’s Port Talbot plant in Wales. The £1.25 billion project includes £500 million in support from the UK government. This initiative aims to reduce carbon emissions by 90% at the site by 2027, marking a significant move from traditional blast furnace methods.

- In 2024, ClarkDietrich, the largest cold-formed steel framing manufacturer in North America, introduced a new line of low embodied carbon (LEC) steel framing products. This new product line includes ProSTUD® metal drywall framing, structural steel, clips and connectors, and floor framing, designed to enable architects and engineers to create more sustainable buildings.

- In 2024, Arlington Capital Partners announced the formation of Keel Holdings, LLC through a merger of its portfolio company Pegasus Steel with newly acquired Metal Trades, LLC and Merrill Technologies Group. Keel will focus on manufacturing complex structures for priority programs within the U.S. Navy, Army, and Air Force, positioning itself as a leading defense manufacturer.

- In 2024, thyssenkrupp finalized the sale of thyssenkrupp Electrical Steel India Private Ltd. to a consortium comprising JSW Steel Limited and JFE Steel Corporation. The sale, valued at approximately 440 million euros, is part of thyssenkrupp’s strategy to streamline its Steel division. The main facility, located in Nashik, employs around 500 people. The transaction is anticipated to close within the next few months, expanding the presence of JSW and JFE in the electrical steel market in India.

Report Scope

Report Features Description Market Value (2023) USD 114.5 Bn Forecast Revenue (2033) USD 197.4 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Heavy Structural Steel, Light Structural Steel, Rebar), By Application(Residential, Non-Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ArcelorMittal, Nippon Steel Corporation, Tata Steel, POSCO, Hyundai Steel, United States Steel Corporation, JSW Steel Limited, JFE Steel Corporation, Nucor Corporation, Thyssenkrupp AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ArcelorMittal

- Baogang Group

- Evraz Plc

- Gerdau S.A.

- JSW Steel

- POSCO

- Nippon Steel Corp.

- Tata Steel

- SAIL

- Other Key Players