Global Commercial Refrigeration Equipment Market Report By Product (Transportation Refrigeration Equipment, Refrigerators & Freezers, Beverage Refrigeration, Display Showcases, Ice Merchandisers & Ice Vending Equipment, Other Products), By Application (Food Service, Food & Beverage Retail, Other Applications), By System Type, By Capacity, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 24745

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

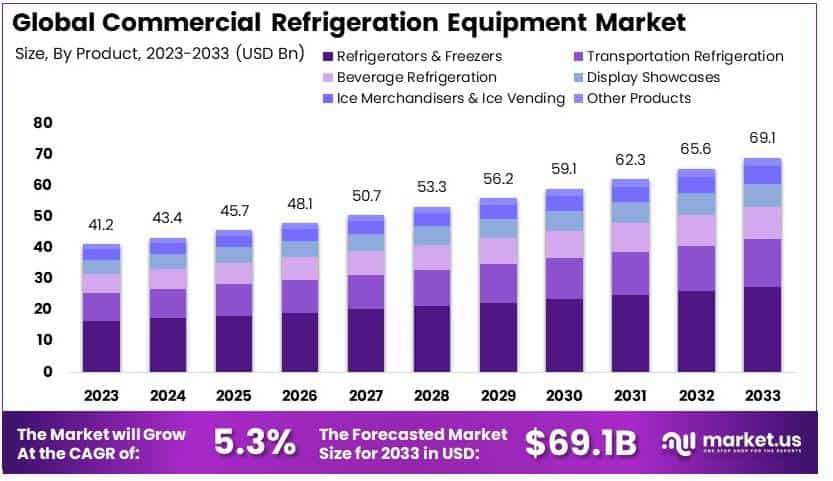

The Global Commercial Refrigeration Equipment Market size is expected to be worth around USD 69.1 Billion by 2033, from USD 41.2 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Commercial refrigeration equipment refers to appliances used to cool or freeze products for commercial purposes. This includes refrigerators, freezers, and cold storage units typically used in supermarkets, restaurants, and other food service industries. These systems help keep food and beverages fresh, ensuring quality and safety.

The commercial refrigeration equipment market includes the production and sale of cooling and freezing systems for the food and beverage industry, retail, and healthcare sectors. The market is expanding as industries focus on reducing energy consumption and improving refrigeration efficiency.

The commercial refrigeration equipment market is essential to industries such as food retail, hospitality, and healthcare. Walk-in coolers and freezers are widely used in restaurants and supermarkets, providing large storage capacities for perishables.

The key growth drivers in the commercial refrigeration equipment market are the increasing global demand for frozen and refrigerated foods, particularly in emerging markets, and stricter energy efficiency regulations. For example, in the UK, frozen food sales increased by 15.6% in value in 2023, reflecting growing consumer demand.

The rising need for cold storage in the healthcare industry, especially for vaccines and medicines, also presents new opportunities. Additionally, technological advances, such as improved insulation and smart refrigeration systems, are creating opportunities for manufacturers to offer more energy-efficient solutions, driving growth in the market.

On a broader scale, improving energy efficiency in commercial refrigeration can significantly contribute to global climate goals. The International Energy Agency (IEA) states that improving energy efficiency could cut 11 gigatons of CO2 emissions by 2030, which is crucial to achieving climate targets.

For instance, the U.S. Department of Energy (DOE) has introduced new energy standards for walk-in coolers and freezers, which are expected to save businesses over $4.9 billion in energy costs by 2050. This highlights the dual impact of reducing environmental footprints while enhancing profitability at a local level.

Government regulations are a significant force in shaping the commercial refrigeration market. The U.S. has allocated $86 billion for energy efficiency initiatives under the Inflation Reduction Act, which includes funding for upgrading refrigeration systems.

In the European Union, policies are aimed at reducing energy consumption by 11.7% by 2030, further incentivizing businesses to adopt energy-efficient equipment. Regulations such as the DOE’s energy standards for refrigeration equipment push manufacturers to continuously innovate, ensuring the market moves towards more sustainable solutions.

Key Takeaways

- The Commercial Refrigeration Equipment Market was valued at USD 41.2 billion in 2023 and is expected to reach USD 69.1 billion by 2033, with a CAGR of 5.3%.

- In 2023, Refrigerators & Freezers dominated the product segment, due to widespread use in food storage and retail.

- In 2023, Food Service led the application segment with 33.0%, driven by the demand for refrigeration in the hospitality sector.

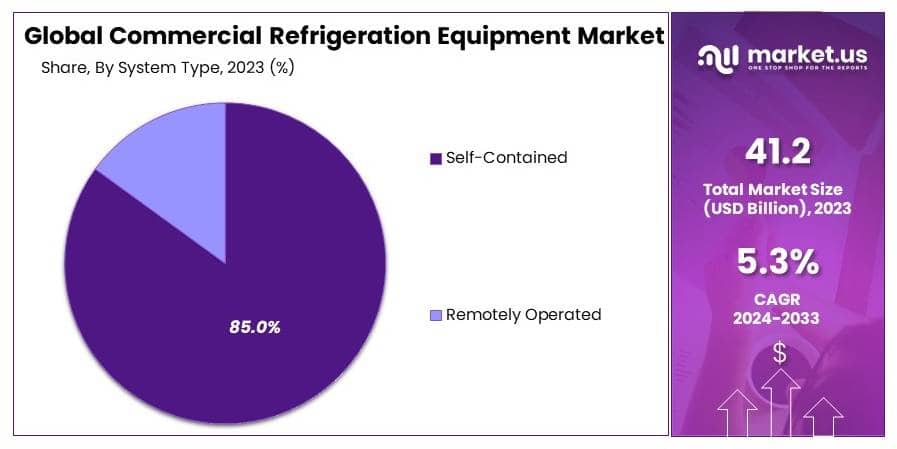

- In 2023, Self-Contained systems held 85%, offering easy installation and maintenance for commercial purposes.

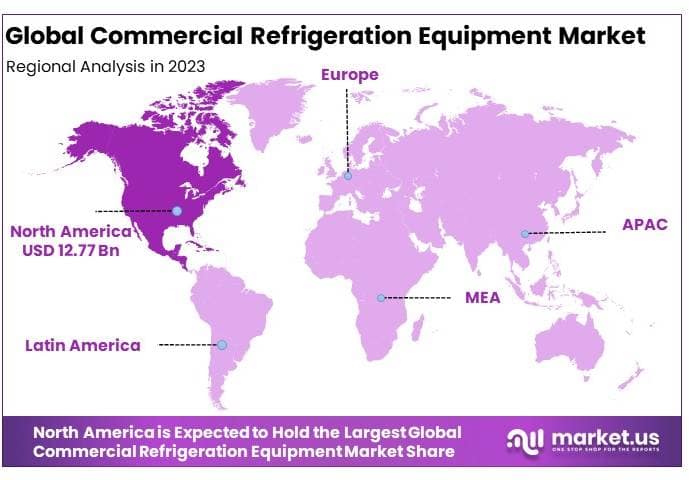

- In 2023, North America dominated with 31.0%, supported by the established foodservice industry and technological advancements.

Product Analysis

Refrigerators & freezers dominate due to their essential role in preserving perishable foods across various industries.

In the commercial refrigeration equipment market, the product segment includes several categories such as transportation refrigeration equipment, refrigerators and freezers, beverage coolers, display showcases, ice merchandisers, and vending equipment, among others.

Among these, refrigerators and freezers hold the largest share due to their critical role in food safety and preservation across various sectors including food service, retail, and healthcare. These devices are designed to meet stringent regulatory standards for temperature control, ensuring that perishables such as food, medicines, and other items are stored safely, thus reducing spoilage and extending shelf life.

Transportation refrigeration equipment is crucial for maintaining the cold chain during the transport of perishables, ensuring products reach consumers in optimal condition. This sub-segment is driven by the growth in international food trade and advancements in logistics and supply chain management.

Beverage refrigeration equipment is essential in venues that serve drinks, such as bars and restaurants, ensuring beverages are served at the correct temperature. The innovation in this area focuses on energy efficiency and improving the aesthetic appeal to enhance customer experience.

Display showcases are used extensively in retail environments to present perishable merchandise attractively while maintaining proper temperature control. These units are vital in promoting impulse purchases of food products.

Ice merchandisers and vending equipment are key for convenience stores and food service venues that need to provide ice in outdoor or self-service contexts, supporting revenue generation through user convenience.

Application Analysis

Food service dominates the application segment, accounting for 33.0% of the market in 2023.

Commercial refrigeration equipment is essential across various applications, with the food service industry as the leading segment. This dominance is attributed to the critical need for refrigeration in restaurants, cafes, and catering services to comply with food safety regulations and prevent spoilage.

Refrigeration equipment in food service settings not only ensures the safety and quality of food but also aids in the efficient operation of these establishments by facilitating the proper storage and handling of large volumes of food products.

Food and beverage retail, another significant application, utilizes commercial refrigeration for the storage and display of perishable goods. Supermarkets, convenience stores, and specialty food shops rely on advanced refrigeration solutions to extend the freshness of their offerings, enhancing customer satisfaction and minimizing waste.

Other applications include medical facilities and pharmaceutical storage, where precision cooling is necessary to preserve the integrity of medications and vaccines. The demand in this sub-segment is driven by stringent health and safety regulations.

System Type Analysis

Self-contained systems dominate the system type segment with an 85% market share in 2023, favored for their ease of installation and maintenance.

In commercial refrigeration, system types are categorized mainly into self-contained and remotely operated systems. Self-contained units are the predominant choice in the market, primarily because they are easier to install and maintain.

These units are compact and stand-alone, ideal for businesses with limited space that require flexible, easy-to-move solutions. Their plug-and-play nature reduces upfront costs and complexity, making them particularly attractive for small to medium-sized businesses.

Remotely operated systems, although less common, are employed in larger establishments or where multiple cooling points are centralized through one system. This setup is more energy-efficient and suitable for businesses with larger refrigeration needs, such as big supermarkets or food processing facilities.

Capacity Analysis

Refrigeration units with a capacity of 50 Cu.Ft. – 100 Cu.Ft. dominate the market, meeting the majority of medium-scale storage requirements efficiently.

Capacity in commercial refrigeration equipment is a crucial consideration that impacts the suitability and efficiency of these systems in various settings. Units with a capacity of 50 to 100 cubic feet are the most prevalent, balancing space efficiency with adequate storage capacity to meet the needs of a wide range of commercial applications, from restaurants to retail stores.

Units with a capacity of less than 50 cubic feet cater to smaller businesses or specialized needs where space is limited, such as in self-service kiosks, small cafes, or specialty boutiques. These compact units are designed for minimal footprint while still providing essential cooling functions.

On the other end, units with a capacity of more than 100 cubic feet are designed for large-scale operations that require substantial storage space, such as wholesale food distributors and large commercial kitchens. This segment is characterized by high-performance models that can handle significant cooling demands and operate efficiently under constant use.

Key Market Segments

By Product

- Transportation Refrigeration Equipment

- Refrigerators & Freezers

- Beverage Refrigeration

- Display Showcases

- Ice Merchandisers & Ice Vending Equipment

- Other Products

By Application

- Food Service

- Food & Beverage Retail

- Other Applications

By System Type

- Self-Contained

- Remotely Operated

By Capacity

- Less than 50 Cu. Ft.

- 50 to 100 Cu. Ft.

- More than 100 Cu. Ft.

Drivers

Increasing Demand for Frozen and Chilled Food Drives Market Growth

The commercial refrigeration equipment market is experiencing significant growth due to several key factors, including the rising demand for frozen and chilled food, the growing adoption of energy-efficient solutions, and the expansion of the retail sector.

As consumer preferences shift toward convenience, there is increasing demand for frozen and refrigerated food products. This trend drives the need for advanced refrigeration systems to preserve food quality and extend shelf life.

Energy efficiency is also playing a critical role, as businesses aim to reduce operational costs and comply with environmental standards. The development of energy-efficient refrigeration units not only helps reduce electricity consumption but also lowers greenhouse gas emissions, making them more attractive to eco-conscious consumers and businesses.

Additionally, the expansion of the retail sector, including supermarkets, hypermarkets, and convenience stores, is creating a higher demand for refrigeration equipment to store perishable goods. Cold chain logistics, driven by the growing demand for fresh produce, pharmaceuticals, and frozen products, further boosts the market as businesses seek reliable refrigeration solutions.

Restraints

High Initial Costs Restrain Market Growth

One of the major challenges for businesses is the significant upfront investment required for modern refrigeration equipment. The high cost of purchasing and installing these systems can deter smaller businesses, especially in developing regions, from adopting advanced solutions.

In addition to financial barriers, the industry is subject to stringent environmental regulations aimed at reducing harmful emissions from refrigerants. Compliance with these regulations often requires costly upgrades to refrigeration systems, adding to the financial burden for businesses.

Fluctuating energy prices also pose a challenge, as refrigeration equipment is energy-intensive. Rising energy costs can significantly increase operational expenses, making it more difficult for businesses to maintain profitability.

Maintenance and operational costs further complicate the situation, as refrigeration equipment requires regular servicing to ensure efficiency and avoid breakdowns. These factors collectively restrain the growth of the market, especially for cost-sensitive businesses.

Opportunity

Technological Advancements in Refrigeration Systems Provide Opportunities

As refrigeration technology continues to advance, there is a significant opportunity for manufacturers to introduce innovative solutions. These advancements, such as smart refrigeration systems and IoT integration, allow for real-time monitoring and improved energy management, which is highly valued by businesses looking to optimize operations.

Emerging markets also present vast opportunities for market players. As these regions experience economic growth and urbanization, the demand for commercial refrigeration equipment is rising. The expanding middle class and the growth of the retail and food service industries in these areas create a fertile market for refrigeration products.

Sustainability is another key area of opportunity. With the growing emphasis on reducing carbon footprints, businesses are increasingly interested in green refrigeration technologies that use natural refrigerants and energy-efficient systems.

The expanding food and beverage industry also drives demand for refrigeration equipment, providing additional growth potential for market players. These opportunities are expected to propel the market forward in the coming years.

Challenges

Global Supply Chain Disruptions Challenge Market Growth

Recent global events have caused significant disruptions in the supply chain, affecting the availability of critical components and delaying the production of refrigeration equipment. These disruptions pose a serious challenge to manufacturers, leading to increased lead times and higher costs for end-users.

The market is also highly competitive, with numerous players offering similar products. This intense competition forces manufacturers to continuously innovate while maintaining competitive pricing, which can pressure profit margins.

Balancing cost efficiency with sustainability further complicates the situation. While businesses are increasingly focused on adopting environmentally friendly solutions, the transition to green technologies often comes at a higher cost, making it difficult for companies to strike the right balance.

Rapid technological changes also present a challenge. Keeping up with advancements in refrigeration technology requires ongoing investment in research and development, which can be difficult for smaller companies. These challenges collectively create obstacles to the steady growth of the market.

Growth Factors

Rise in Supermarkets and Hypermarkets Is Growth Factor

The rapid expansion of large retail outlets, such as supermarkets and hypermarkets, is boosting demand for refrigeration equipment to store fresh produce, dairy, and frozen products.

As consumer preferences shift toward convenience, the demand for ready-to-cook food and pre-packaged food products is growing. This trend requires advanced refrigeration systems to ensure food safety and quality.

The globalization of the food supply chain also plays a crucial role in driving the market. As food products are transported over long distances, reliable refrigeration solutions are essential to maintain freshness and prevent spoilage.

The growth of the pharmaceutical and healthcare sector is another important factor. The increasing need for refrigeration equipment to store temperature-sensitive medical products, such as vaccines and medications, further drives the demand for advanced refrigeration systems.

Emerging Trends

Smart Refrigeration Systems Are Latest Trending Factor

Several trends are shaping the commercial refrigeration equipment market, including the rise of smart refrigeration systems, the use of natural refrigerants, and the growth of modular refrigeration units. Smart refrigeration systems, enabled by IoT and automation technologies, are becoming increasingly popular.

The use of natural refrigerants is also a growing trend as businesses seek to reduce their environmental impact. Natural refrigerants, such as ammonia and CO2, are considered eco-friendly alternatives to traditional refrigerants, and their adoption is being encouraged by regulatory bodies.

Modular refrigeration units are another trend gaining traction. These units offer flexibility, as they can be easily expanded or modified to meet changing business needs. Automation and IoT integration in refrigeration systems are also trending, enabling more efficient maintenance and energy management.

Regional Analysis

North America Dominates with 31.0% Market Share

North America leads the Commercial Refrigeration Equipment Market with a 31.0% share, valued at USD 12.77 billion. This dominance is driven by the strong demand from supermarkets, foodservice chains, and convenience stores. The region’s focus on energy-efficient refrigeration technologies and strict food safety regulations also boosts the market.

The large presence of fast-food chains and hypermarkets, combined with growing consumer demand for frozen and chilled foods, creates a strong need for advanced refrigeration equipment. Additionally, North America’s emphasis on reducing energy consumption through eco-friendly solutions drives innovation in this market. Key players in the industry are also investing in smart refrigeration technologies.

North America’s market dominance is expected to grow due to continued investments in sustainable and intelligent refrigeration systems. As the region tightens regulations on energy use and emissions, companies are likely to adopt more environmentally friendly equipment, ensuring steady market expansion.

Regional Mentions:

- Europe: Europe holds a significant share in the commercial refrigeration market, driven by stringent environmental regulations and a strong focus on reducing energy consumption. The region’s growth is supported by innovations in sustainable refrigeration technologies.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the commercial refrigeration market due to the expanding foodservice industry and retail sector. Countries like China and India are driving demand for energy-efficient refrigeration solutions.

- Middle East & Africa: The Middle East and Africa are seeing steady market growth, driven by the expansion of the hospitality industry and the rising demand for cold storage in food retail and healthcare.

- Latin America: Latin America’s market is growing due to the development of the food and beverage industry, with increased demand for refrigeration equipment in supermarkets and restaurants. Economic recovery in the region supports the steady market rise.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Commercial Refrigeration Equipment Market is led by key players such as AB Electrolux, Carrier, and Daikin Industries Ltd. The demand is driven by the growth in supermarkets, foodservice, and cold storage facilities. The need for energy-efficient and sustainable refrigeration systems also fuels market expansion.

Major players provide a wide range of products, including refrigerators, freezers, display cases, and cold storage solutions. These products serve industries like retail, foodservice, and healthcare, with a focus on temperature control and energy efficiency.

Companies emphasize strategic partnerships and long-term contracts with retailers and foodservice providers. Market positioning is enhanced by offering tailored solutions for different industries and ensuring product reliability. Service and maintenance agreements also contribute to customer retention.

Key players have strong operations in North America, Europe, and Asia Pacific. The Middle East and Latin America are emerging markets for refrigeration equipment as retail and foodservice industries expand.

Innovation centers around energy-efficient systems, smart controls, and eco-friendly refrigerants. Companies invest in R&D to meet environmental regulations and offer advanced cooling technologies.

The competitive edge lies in energy-efficient, sustainable, and smart refrigeration systems. Leading players stand out by providing reliable products, global distribution, and after-sales services, positioning them well for continued growth in the market.

Top Key Players in the Market

- AB Electrolux

- Carrier

- Daikin Industries Ltd.

- Dover Corporation

- Hussmann Corporation

- UNITED TECHNOLOGIES CORPORATION

- Johnson Controls International Plc

- AHT Cooling Systems GmbH

- Carrier Corporation

- Standex International Corporation

- GEA Group AG

- Lennox International Inc.

- Emerson Electric Co.

- Fujimak Corporation

- Haier Electronics Group Co., Ltd

- DAIKIN Industries, Ltd.

- Excellence Industries

- Imbera

- Zero Zone Inc.

- Ojeda USA Inc.

- Other Key Players

Recent Developments

- Sollatek and Soracom: In April 2024, Sollatek selected Soracom to provide IoT connectivity for its advanced commercial refrigeration systems. The collaboration aims to enhance energy efficiency, reduce maintenance costs, and offer real-time monitoring for refrigeration units.

- EU R290 Regulation: In April 2024, the European Union officially enforced the 500-gram charge limit for propane (R290) in commercial refrigeration systems. This regulation promotes safety and sustainability by supporting the use of natural refrigerants, aligning with the EU’s broader environmental goals.

- Lennox: In May 2024, Lennox rolled out HVAC systems using R-454B, a low-GWP refrigerant with a global warming potential 78% lower than traditional refrigerants. This early transition covers residential and commercial products, offering both sustainability and performance benefits.

- Blue Star: In April 2024, Blue Star launched a new range of energy-efficient deep freezers with capacities ranging from 60 to 600 liters. These freezers, designed for extreme temperatures, cater to sectors such as hospitality and frozen food, focusing on energy savings.

Report Scope

Report Features Description Market Value (2023) USD 41.2 Billlion Forecast Revenue (2033) USD 69.1 Billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Transportation Refrigeration Equipment, Refrigerators & Freezers, Beverage Refrigeration, Display Showcases, Ice Merchandisers & Ice Vending Equipment, Other Products), By Application (Food Service, Food & Beverage Retail, Other Applications), By System Type (Self-Contained, Remotely Operated), By Capacity (Less than 50 Cu. Ft., 50 to 100 Cu. Ft., More than 100 Cu. Ft.) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AB Electrolux, Carrier, Daikin Industries Ltd., Dover Corporation, Hussmann Corporation, UNITED TECHNOLOGIES CORPORATION, Johnson Controls International Plc, AHT Cooling Systems GmbH, Carrier Corporation, Standex International Corporation, GEA Group AG, Lennox International Inc., Emerson Electric Co., Fujimak Corporation, Haier Electronics Group Co., Ltd, DAIKIN Industries, Ltd., Excellence Industries, Imbera, Zero Zone Inc., Ojeda Usa Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Refrigeration Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Commercial Refrigeration Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AB Electrolux

- Carrier

- Daikin Industries Ltd.

- Dover Corporation

- Hussmann Corporation

- UNITED TECHNOLOGIES CORPORATION

- Johnson Controls International Plc

- AHT Cooling Systems GmbH

- Carrier Corporation

- Standex International Corporation

- GEA Group AG

- Lennox International Inc.

- Emerson Electric Co.

- Fujimak Corporation

- Haier Electronics Group Co., Ltd

- DAIKIN Industries, Ltd.

- Excellence Industries

- Imbera

- Zero Zone Inc.

- Ojeda Usa Inc.

- Other Key Players