Global Carbon Monoxide Market By Purity(More than 99%, Below 99%), By Grade(Commercial Grade, Electronic Grade), By Application(Metal Fabrication, Chemicals, Pharmaceuticals, Electronics, Ore Processing and Extraction, Others) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 129177

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

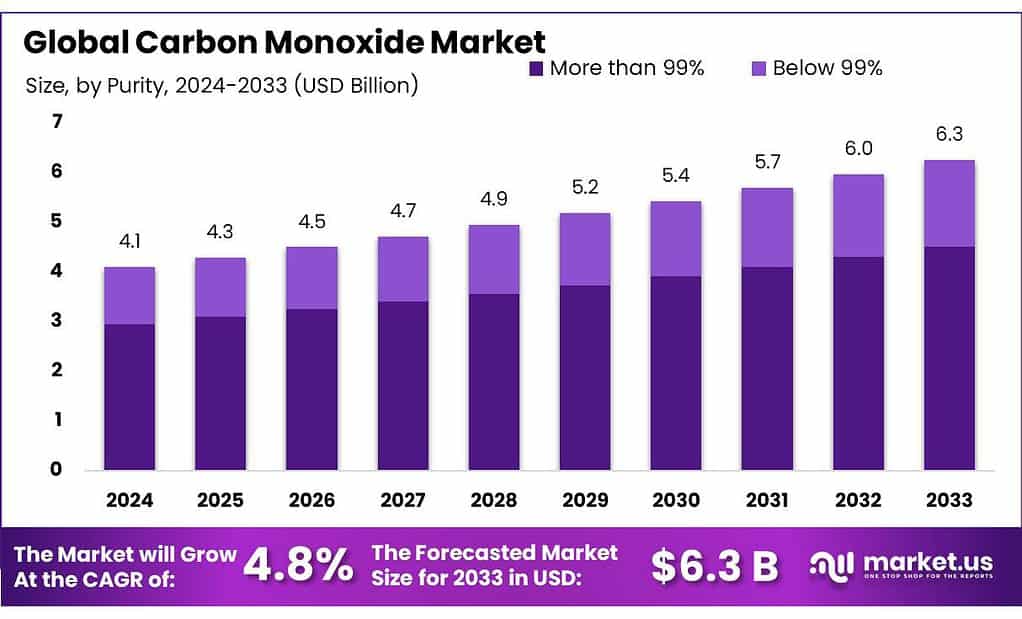

The global Carbon Monoxide Market size is expected to be worth around USD 6.3 billion by 2033, from USD 4.1 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

The carbon monoxide market encompasses the production, distribution, and use of carbon monoxide (CO), a colorless and odorless gas crucial for various industries. CO serves primarily as a chemical feedstock, particularly in the synthesis of methanol and acetic acid.

The market is projected to grow significantly, with methanol production alone expected to reach around USD 60 billion by 2026. Government regulations, such as the Clean Air Act in the United States, focus on reducing carbon emissions and managing air quality, directly impacting CO usage and production. This regulatory framework encourages CO capture and utilization innovations, pushing companies to adopt cleaner methods.

International trade dynamics also play a vital role in the carbon monoxide market. Recent data from the U.S. Department of Commerce indicates that U.S. carbon monoxide exports rose by 15% from 2020 to 2022, reflecting a growing demand for CO in global markets, particularly in Canada and Mexico. Additionally, government initiatives to promote sustainable practices are gaining momentum. The European Union is investing €5 billion in carbon capture and storage (CCS) technologies, aiming to support projects that capture and reuse CO. This investment addresses environmental concerns and opens new opportunities for CO utilization.

Private sector investments are rising, with companies like Linde and Air Products heavily investing in green technologies for CO applications. In 2022, Air Products partnered with Nestle to produce sustainable fuels, highlighting CO’s potential in cleaner energy solutions. Furthermore, recent mergers, such as Messer Group’s acquisition of Graham Corporation in 2021, showcase the strategic importance of CO, as firms seek to enhance production efficiencies and expand their market reach. Overall, the carbon monoxide market is positioned for growth, driven by increasing demand, regulatory support, and ongoing innovations.

Key Takeaways

- The global carbon monoxide market is projected to grow from USD 4.1 billion in 2023 to USD 6.3 billion by 2033, at a 4.8% CAGR.

- Carbon monoxide with more than 99% purity dominated the market in 2023, capturing 72.1% of the total market due to its use in chemical processes.

- Asia-Pacific led the global carbon monoxide market in 2023, capturing 42% market share, driven by robust industrial growth in China, India, and Japan.

- Commercial-grade carbon monoxide captured 82.4% of the market share in 2023, used predominantly in chemical and metallurgical industries.

- In 2023, metal fabrication held the largest application share, accounting for 43.2% of total market demand due to its role in metallurgy.

By Purity

In 2023, more than 99% purity carbon monoxide held a dominant market position, capturing more than a 72.1% share of the total market. This high-purity CO is crucial for various applications, particularly in the chemical industry, where it is used as a feedstock for producing methanol and acetic acid. Industries demand this level of purity to ensure optimal performance and efficiency in chemical processes.

Conversely, carbon monoxide with a purity below 99% accounted for the remaining market share. While this segment is smaller, it serves specific applications where ultra-high purity is not essential. This includes some metallurgical processes and lower-grade chemical synthesis.

The preference for more than 99% purity is driven by strict quality requirements in many end-use industries. As companies increasingly focus on product quality and sustainability, the demand for high-purity carbon monoxide is expected to continue rising. Overall, the carbon monoxide market shows a clear trend toward higher purity levels, reflecting the industry’s need for cleaner and more efficient production processes.

By Grade

In 2023, commercial-grade carbon monoxide held a dominant market position, capturing more than 82.4% of the total market share. This grade of CO is widely used in various industrial applications, including the production of chemicals like methanol and acetic acid. Its broad applicability in sectors such as metallurgy and chemical manufacturing drives its high demand.

On the other hand, electronic-grade carbon monoxide accounted for the remaining market share. This higher-purity grade is essential for specialized applications in the electronics industry, particularly in the production of semiconductors and other high-tech components. The requirements for electronic grade CO are stringent, as impurities can significantly impact performance and reliability.

The strong preference for commercial-grade CO is primarily due to its versatility and cost-effectiveness. As industries continue to expand, the demand for commercial-grade carbon monoxide is expected to grow, while electronic-grade CO will remain important for niche applications. Overall, the carbon monoxide market is characterized by a clear distinction between these two grades, each serving vital roles in their respective fields.

By Application

In 2023, metal fabrication held a dominant market position, capturing more than 43.2% of the total market share. Carbon monoxide is widely used in this sector for processes such as reducing metal ores and producing various alloys. Its ability to serve as a reducing agent makes it essential in the metal production process.

The chemicals sector followed closely, utilizing carbon monoxide for synthesizing important chemicals like methanol and acetic acid. This application is critical as it drives the overall demand for CO, contributing significantly to market growth.

In the pharmaceutical industry, carbon monoxide plays a key role in the production of certain drugs and compounds. Although this segment represents a smaller share, its importance cannot be overlooked due to the increasing focus on pharmaceutical innovation.

The electronics sector also utilizes carbon monoxide, particularly in the manufacturing of semiconductors and other high-tech components. The demand for electronic-grade carbon monoxide is rising as technology advances.

Additionally, the ore processing and extraction segment benefits from carbon monoxide’s properties in metal recovery processes. This application, while smaller in scale, supports the overall market by providing essential materials for various industries.

Key Market Segments

By Purity

- More than 99%

- Below 99%

By Grade

- Commercial Grade

- Electronic Grade

By Application

- Metal Fabrication

- Chemicals

- Pharmaceuticals

- Electronics

- Ore Processing and Extraction

- Others

Drivers

Increasing Demand in Chemical Production

One of the major driving factors for the carbon monoxide market is the rising demand for chemical production, particularly in the synthesis of methanol and acetic acid. As industries look for efficient and cost-effective solutions, carbon monoxide has become an essential feedstock.

The global methanol market, a key application for carbon monoxide, is projected to reach approximately USD 60 billion by 2026, growing at a compound annual growth rate (CAGR) of 7%. This growth is fueled by methanol’s increasing use in various applications, including formaldehyde production and fuel blending.

Additionally, acetic acid production, another significant application, is expected to expand as well. The acetic acid market is anticipated to grow to about USD 22 billion by 2025, driven by demand in sectors like textiles, food preservation, and pharmaceuticals. The substantial volumes of carbon monoxide required for these chemical processes underpin the overall growth of the carbon monoxide market.

Government initiatives aimed at reducing carbon emissions also support this demand. For instance, many countries are implementing regulations to encourage cleaner production methods. The European Union has set ambitious targets for reducing greenhouse gas emissions, promoting the adoption of technologies that utilize carbon monoxide effectively. The EU’s Carbon Capture and Storage (CCS) initiatives, with an investment of €5 billion, aim to support projects that capture and reuse CO, thereby enhancing its market potential.

Moreover, the chemical industry’s push toward sustainability and circular economy practices is leading to innovations in carbon monoxide applications. Companies are increasingly focusing on producing bio-based chemicals, which often rely on carbon monoxide as a feedstock. As the demand for eco-friendly products rises, carbon monoxide’s role in sustainable chemical manufacturing becomes more critical.

The international trade of carbon monoxide also plays a significant role in driving market growth. According to the U.S. Department of Commerce, U.S. carbon monoxide exports increased by 15% from 2020 to 2022, highlighting the growing global demand for CO in various applications. Major export destinations include Canada and Mexico, where carbon monoxide is utilized for chemical synthesis and manufacturing processes.

Restraints

Safety Concerns and Regulatory Challenges

One major restraining factor for the carbon monoxide market is the significant safety concerns and regulatory challenges associated with its production and use. Carbon monoxide is a toxic gas, and exposure can lead to serious health issues, including headaches, dizziness, and even fatal poisoning. According to the Centers for Disease Control and Prevention (CDC), an estimated 400 people die each year in the United States from unintentional CO poisoning, emphasizing the risks involved.

Due to its toxicity, regulatory bodies impose strict guidelines on carbon monoxide handling, storage, and transportation. For example, the Occupational Safety and Health Administration (OSHA) has established permissible exposure limits for carbon monoxide in the workplace, set at 50 parts per million (ppm) over an 8-hour workday. Such regulations necessitate substantial investments in safety measures and monitoring systems for companies dealing with CO, which can increase operational costs and limit market participation.

Furthermore, the Environmental Protection Agency (EPA) regulates CO emissions to protect air quality. The Clean Air Act requires states to implement plans to reduce CO emissions from industrial sources, leading to compliance costs that can be prohibitive for smaller operators. This regulatory environment can create barriers to entry for new companies, restricting market growth.

Additionally, increasing awareness of health and environmental risks associated with carbon monoxide has led to heightened scrutiny from both regulatory agencies and the public. Reports indicate that some communities are pushing for stricter regulations on CO emissions from industrial sources, driven by concerns about air quality and public health. This trend may result in more stringent local and national policies, which could further limit the operational scope for carbon monoxide producers.

The global focus on sustainability and reducing carbon footprints also presents challenges for the carbon monoxide market. As industries shift towards greener alternatives and renewable resources, reliance on fossil fuel-derived chemicals, including those involving carbon monoxide, may decrease. For instance, the European Union’s Green Deal aims to make Europe climate-neutral by 2050, which includes efforts to reduce emissions from all sectors. This transition could adversely affect the demand for carbon monoxide in various applications.

Opportunities

Expansion in Carbon Capture and Utilization Technologies

A significant growth opportunity for the carbon monoxide market lies in the expansion of carbon capture and utilization (CCU) technologies. As the global emphasis on reducing carbon emissions intensifies, CCU offers a promising pathway to not only capture carbon dioxide but also convert it into valuable products, including carbon monoxide. The International Energy Agency (IEA) projects that the global market for carbon capture technologies could reach USD 100 billion by 2030, driven by both regulatory pressures and corporate sustainability goals.

Carbon monoxide plays a critical role in the synthesis of chemicals and fuels from captured carbon dioxide. For instance, CO can be used in the production of methanol, which is increasingly recognized as a versatile building block for various chemicals and fuels. The methanol market is expected to grow to approximately USD 60 billion by 2026, with rising demand for cleaner energy solutions. This trend underscores the potential for CO derived from captured carbon emissions to meet the increasing needs of the chemical industry.

Government initiatives are also fueling the growth of CCU technologies. In the United States, the Department of Energy (DOE) has allocated significant funding to support research and development in carbon capture technologies, including a USD 35 million investment in various pilot projects. Similarly, the European Union has pledged to invest €5 billion in carbon capture and storage (CCS) technologies as part of its Green Deal. These initiatives not only promote technological advancements but also create a conducive environment for the commercialization of carbon monoxide derived from captured CO2.

Moreover, advancements in catalytic processes that convert CO2 into CO are gaining traction. Technologies that enhance the efficiency of this conversion are under active development, with some pilot projects demonstrating conversion efficiencies exceeding 60%. This not only enhances the economic viability of utilizing captured CO2 but also aligns with global decarbonization efforts.

Another area of growth is the increasing adoption of methanol as a clean fuel alternative. Methanol can be derived from renewable resources and is viewed as a key component in the transition to sustainable transportation. The global methanol market, supported by increasing interest in methanol-powered vehicles, is projected to grow significantly. This creates a direct pathway for carbon monoxide to contribute to cleaner fuel solutions, reinforcing its role in the energy transition.

Latest Trends

Increasing Focus on Green Hydrogen Production

One of the most significant trends in the carbon monoxide market is the increasing focus on green hydrogen production. As industries strive to reduce carbon emissions and transition to cleaner energy sources, hydrogen has emerged as a key player. The global hydrogen market is projected to grow substantially, with the green hydrogen segment expected to reach approximately USD 200 billion by 2030. This shift is driven by the need for sustainable alternatives to fossil fuels and the decarbonization of various sectors, including transportation and manufacturing.

Carbon monoxide plays an essential role in the production of hydrogen, particularly through processes such as steam methane reforming and the gasification of biomass. In these processes, CO can be converted into hydrogen and carbon dioxide. With increasing investments in hydrogen production technologies, the demand for carbon monoxide as a feedstock is also expected to rise. For instance, the International Energy Agency (IEA) anticipates that hydrogen production will need to triple by 2030 to meet climate goals, creating a corresponding need for CO.

Government initiatives are further supporting this trend. In Europe, the European Commission has set a target to produce 10 million tons of green hydrogen by 2030 as part of its hydrogen strategy. This initiative is backed by substantial investments, including €430 billion allocated to hydrogen-related projects, aiming to decarbonize industries and enhance energy security. Such ambitious targets indicate a growing recognition of hydrogen’s role in achieving climate goals, which directly impacts the carbon monoxide market.

Moreover, technological advancements in hydrogen production are facilitating more efficient and sustainable processes. For instance, innovative methods that integrate carbon capture with hydrogen production are gaining attention. By capturing the CO2 generated during hydrogen production and reusing it, these technologies can create a closed-loop system that significantly reduces emissions. Some pilot projects have demonstrated the potential for capturing over 90% of CO2 emissions, highlighting the feasibility of low-emission hydrogen production.

The automotive sector is also showing increasing interest in hydrogen fuel cell vehicles (FCVs). These vehicles utilize hydrogen to produce electricity, emitting only water vapor as a byproduct. With major automotive companies investing heavily in hydrogen technology, the market for hydrogen-powered vehicles is expected to grow rapidly. According to the Hydrogen Council, the number of hydrogen fuel cell vehicles could reach 2 million by 2030, creating additional demand for carbon monoxide as part of the hydrogen production process.

Regional Analysis

The global carbon monoxide market exhibits distinct regional trends, with Asia Pacific (APAC) leading in both production and consumption. The region accounts for approximately 42% of the total market share, driven by a burgeoning industrial sector and rising demand from key industries such as chemicals, electronics, and metallurgy. APAC’s carbon monoxide market was valued at USD 1.7 billion in 2023, supported by significant growth in China, India, and Japan. China’s robust manufacturing infrastructure and increasing use of carbon monoxide in syngas production contribute substantially to the region’s dominance.

North America follows closely, with the region’s advanced petrochemical and automotive industries creating strong demand for carbon monoxide. The market here is supported by the presence of key players and technological advancements, particularly in the U.S., which dominates the North American market. The region’s market is bolstered by increasing investments in chemical processing and fuel synthesis applications.

Europe holds a significant portion of the carbon monoxide market as well, with major contributions from Germany, France, and the UK. The region’s focus on sustainability and green chemistry applications has spurred the growth of carbon monoxide usage, particularly in renewable energy sectors and clean fuel technologies.

The Middle East & Africa region is emerging as a key player due to increasing industrial activities and petrochemical expansion, particularly in countries like Saudi Arabia and the UAE. Latin America, though a smaller market, shows steady growth driven by the chemical and metallurgical sectors in Brazil and Mexico, indicating potential for future market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The carbon monoxide market is highly competitive, with several key players dominating both regional and global markets. Major multinational corporations such as Air Liquide, Linde plc, and Praxair Inc. lead the industry due to their extensive product portfolios, strong global presence, and advanced technological capabilities in gas processing and distribution.

These companies benefit from economies of scale, allowing them to cater to diverse industries such as chemicals, metallurgy, and electronics, while continuing to invest in innovation and infrastructure. Air Products and Chemicals, Inc. and Messer Group GmbH are also prominent players, leveraging their expertise in industrial gases to meet rising demand in sectors like petrochemicals and energy.

In addition to global giants, the market also features a range of regional and specialized players such as American Gas Products, ATCO Atmospheric and Specialty Gases Pvt. Ltd., and Ningbo DSW International Co., Ltd. These companies often focus on niche markets or provide specialty gases for specific industrial applications.

Celanese Corporation, LyondellBasell Industries N.V., and Sipchem are key contributors to the market from a chemical manufacturing standpoint, utilizing carbon monoxide in their production processes. Furthermore, firms like Shanghai Chemical Industry Park Development Co., Ltd. and Yingde Gases Group Company highlight the growing importance of Asia, particularly China, in the carbon monoxide market. Smaller companies such as Middlesex Gases & Technologies, Inc. and Sri Venkateswara Carbonic Gases (P) Ltd. maintain a strong regional presence, catering to localized industries with tailored solutions.

Top Key Players

- Air Liquide

- Air Products and Chemicals, Inc.

- American Gas Products

- ATCO Atmospheric and Specialty Gases Pvt. Ltd.

- Axcel Gases

- Broner Glove & Safety Company

- Celanese Corporation

- Glencore plc

- Linde plc

- Lundin Energy

- LyondellBasell Industries N.V.

- MESA Specialty Gases & Equipment

- Messer Group GmbH

- Middlesex Gases & Technologies, Inc.

- Ningbo DSW International Co., Ltd.

- Praxair Inc.

- Shanghai Chemical Industry Park Development Co., Ltd.

- SIAD

- Sipchem

- Sri Venkateswara Carbonic Gases (P) Ltd.

- Tosoh

- Yingde Gases Group Company

Recent Developments

For instance, Air Liquide invested over USD 250 million to build a gas production unit in Idaho, supporting the semiconductor industry, and expanded its nitrogen production in Singapore.

In 2023 Air Products and Chemicals, Inc. announced the construction of two new world-scale carbon monoxide production facilities in Texas to further strengthen its pipeline capacity.

Report Scope

Report Features Description Market Value (2023) US$ 4.1 Bn Forecast Revenue (2033) US$ 6.3 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Purity(More than 99%, Below 99%), By Grade(Commercial Grade, Electronic Grade), By Application(Metal Fabrication, Chemicals, Pharmaceuticals, Electronics, Ore Processing and Extraction, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Air Liquide, Air Products and Chemicals, Inc., American Gas Products, ATCO Atmospheric and Specialty Gases Pvt. Ltd., Axcel Gases, Broner Glove & Safety Company, Celanese Corporation, Glencore plc, Linde plc, Lundin Energy, LyondellBasell Industries N.V., MESA Specialty Gases & Equipment, Messer Group GmbH, Middlesex Gases & Technologies, Inc., Ningbo DSW International Co., Ltd., Praxair Inc., Shanghai Chemical Industry Park Development Co., Ltd., SIAD, Sipchem, Sri Venkateswara Carbonic Gases (P) Ltd., Tosoh, Yingde Gases Group Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Liquide

- Air Products and Chemicals, Inc.

- American Gas Products

- ATCO Atmospheric and Specialty Gases Pvt. Ltd.

- Axcel Gases

- Broner Glove & Safety Company

- Celanese Corporation

- Glencore plc

- Linde plc

- Lundin Energy

- LyondellBasell Industries N.V.

- MESA Specialty Gases & Equipment

- Messer Group GmbH

- Middlesex Gases & Technologies, Inc.

- Ningbo DSW International Co., Ltd.

- Praxair Inc.

- Shanghai Chemical Industry Park Development Co., Ltd.

- SIAD

- Sipchem

- Sri Venkateswara Carbonic Gases (P) Ltd.

- Tosoh

- Yingde Gases Group Company